If You'd Put $1,000 Into Procter & Gamble Stock 20 Years Ago, Here's What You'd Have Today

Procter & Gamble stock is a dependable dividend grower, but a disappointing long-term holding.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Procter & Gamble (PG) is about as blue as a blue chip stock can be. Sadly for long-term shareholders, this battleship of a defensive dividend-paying name has delivered underwhelming returns vs the broader market for a very long time.

Founded in the first half of the 19th century, P&G has grown into the world's largest consumer products company by market value, boasting a vast portfolio of billion-dollar brands. From Tide laundry detergent to Crest toothpaste to Pampers diapers, today, P&G sells its wares in more than 150 countries.

Yet even as Procter & Gamble expanded its dominance in the U.S. and spread around the globe, it never wavered in its commitment to returning cash to shareholders through dividends. P&G has paid uninterrupted dividends since 1891.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Even more impressively, P&G has increased its payout every year for nearly seven decades. As a member of the S&P 500 Dividend Aristocrats, Procter & Gamble has more than earned its reputation as one of the best dividend stocks to buy for dependable dividend growth.

Between its dividend increases and the fundamental nature of its business — sales of toothpaste and diapers tend to hold up in tough times — P&G stock is considered a classic defensive name.

This Buy-rated Dow Jones stock has been a component of the blue-chip benchmark since 1932.

There's no questioning the company's illustrious history. P&G stock's past performance, however, isn't quite as distinguished.

The bottom line on PG stock?

There's no way around it: P&G stock has been a market laggard for ages.

To be fair, over its lifetime as a publicly traded company, P&G has delivered market-matching results. With a total return (price change plus dividends) of 10.8%, it's essentially tied with the S&P 500 over the same span.

The problem is that if you look at time frames more relevant to shareholders alive today, Procter & Gamble stock is a bust.

It lags the broader market on an annualized total return basis in the past one-, three-, five-, 10-, 15- and 20-year periods – and by painfully wide margins, too.

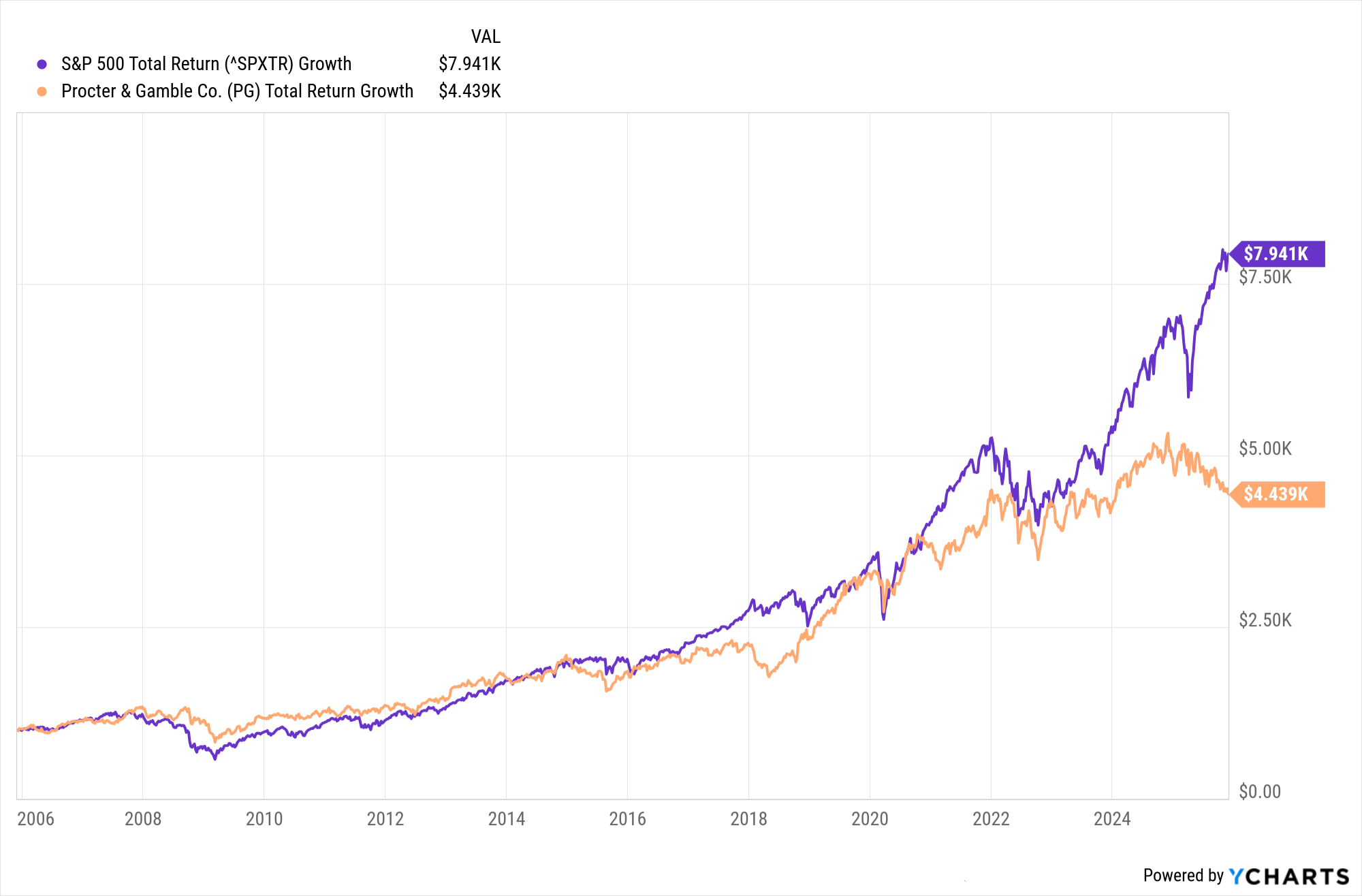

To get a sense of what this underperformance looks like on a brokerage statement, have a look at the above chart. It shows that if you put $1,000 into P&G stock 20 years ago, it would today be worth about $4,400. That's an annualized return of 7.8%.

The same thousand bucks invested in the S&P 500 would today be worth about $8,000 — or an annualized return of 10.9%.

Past performance is not a guarantee of future results, and Wall Street does mostly like P&G stock at current levels. Of the 24 analysts covering P&G surveyed by S&P Global Market Intelligence, 10 call it a Strong Buy, four rate it at Buy and 10 say Hold. That works out to a consensus recommendation of Buy — albeit with somewhat mixed conviction.

Speaking for the bulls, Argus Research analyst Taylor Conrad recommends buying shares on weakness.

"Despite higher raw material and distribution costs, the company continues to manage its margins with productivity initiatives," Conrad writes in a note to clients. "We also like P&G’s record of dividend growth and note that management’s 5% dividend hike in April showed confidence in future performance."

More Stocks of the Past 20 Years

- If You'd Put $1,000 Into Home Depot Stock 20 Years Ago, Here's What You'd Have Today

- If You'd Put $1,000 Into Coca-Cola Stock 20 Years Ago, Here's What You'd Have Today

- If You'd Put $1,000 Into Sherwin-Williams Stock 20 Years Ago, Here's What You'd Have Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dan Burrows is Kiplinger's senior investing writer, having joined the publication full time in 2016.

A long-time financial journalist, Dan is a veteran of MarketWatch, CBS MoneyWatch, SmartMoney, InvestorPlace, DailyFinance and other tier 1 national publications. He has written for The Wall Street Journal, Bloomberg and Consumer Reports and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among many other outlets. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange.

Once upon a time – before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily – Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing. He's also written for Esquire magazine's Dubious Achievements Awards.

In his current role at Kiplinger, Dan writes about markets and macroeconomics.

Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University.

Disclosure: Dan does not trade individual stocks or securities. He is eternally long the U.S equity market, primarily through tax-advantaged accounts.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Why Invest In Mutual Funds When ETFs Exist?

Why Invest In Mutual Funds When ETFs Exist?Exchange-traded funds are cheaper, more tax-efficient and more flexible. But don't put mutual funds out to pasture quite yet.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.