11 Safe Stocks for Superior Gains

Finding safe stocks with the potential to deliver outsized gains can be challenging, but this list of names is certainly a good place to start.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Achieving outsized gains in the stock market is no easy task. Oftentimes, it requires holding unproven smaller capitalization stocks or those that exhibit heightened volatility, such as many tech names. These types of securities are certainly not for everyone. Thankfully, home runs can also be generated from less risky holdings, or "safe stocks," if you know where to find them.

To locate safe stocks that also offer worthwhile capital gains, we screened Value Line's database of nearly 6,000 equities, and focused only on those ranked 1 (Highest) for Safety.

Value Line's proprietary Safety rank measures the total risk of each stock on a scale of 1 to 5. The 1s are the least risky, while the 5s are the riskiest. The rank marries two of Value Line's other metrics – a company's Financial Strength grade and its corresponding stock's Price Stability score.

Financial Strength is a measure of the company's financial condition, and is reported on a scale of A++ (highest) to C (lowest). Larger companies with strong balance sheets and significant cash flows get the highest grades.

A stock's Price Stability score is based on a ranking of the standard deviation (a measure of volatility) of weekly percent changes in the price of a stock over the last five years, and is reported on a scale of 100 (Highest) to 5 (Lowest), in increments of 5. At present, only 136 stocks garner a top Safety rank. For the most part, these are some of the largest, most financially sound and stable companies that Value Line tracks.

For the gains portion of the screen, we looked at Value Line's 18-month appreciation potential. This unique measurement is a purely quantitative estimate. As the name suggests, it seeks to predict a stock's price over an 18-month horizon (from today) in terms of a range.

In addition to the high and low values of the range, the percentage difference between the current stock price and the midpoint of the range is provided. The percentage may be thought of as the most likely potential profit. The larger the percentage, the greater the possible price appreciation.

The quantitative formula behind the 18-month range includes a number of variables, such as in-house analyst estimates and per-share sales, earnings, cash flow and book value results. Currently, the median 18-month appreciation for the stocks in Value Line's universe is 12%. For our screen, we focused on only those stocks whose prices are expected to increase by at least 25%, or more than double the median.

Read on as we explore 11 safe stocks that are expected to deliver sizable gains within the next 18 months. These stocks, as a group, should fit nicely in most equity portfolios – particularly those that employ a rather conservative strategy.

Data is as of July 21. Stocks are listed in reverse order of the expected 18-month appreciation, and then alphabetically.

Abbott Laboratories

- Market value: $211.4 billion

- Expected 18-month appreciation: 25%

Abbott Laboratories' (ABT, $118.98) appearance on this list of safe stocks is of little surprise. The designer and manufacturer of a wide range of healthcare products boasts an impressive balance sheet and a history of market-beating returns.

The Illinois-headquartered corporation, which employs 109,000 individuals, has roughly $17.5 billion in long-term debt, which is only 33% of total capital (long-term debt plus shareholders' equity). Cash assets exceed $8.3 billion and ABT generates ample cash flow to fund operations, service the debt and increase its dividend. On the latter note, following its spinoff of AbbVie (ABBV), its pharmaceuticals division, Abbott has increased its payout every year since 2013.

Along with a top-tier Financial Strength, ABT stock has been an excellent and steady performer. It has easily outpaced the broader market over the past five years. Looking ahead, that trend may well persist.

For the current year, Value Line estimates that revenues will reach $42.0 billion in fiscal 2021, compared to 2020's tally of $34.6 billion. The sizable top-line advance is largely based on sales of Abbott's COVID-19 testing-related products. Management indicated that these offerings generated $2.2 billion in sales during the March quarter, with Abbott's popular rapid tests comprising about 85% of the total.

Value Line expects earnings of $5.10 per share for the full year. That is a dime better than management's guidance of "at least $5.00 per share," which was issued following the release of ABT's first-quarter financial results.

Abbott stock is now trading around $119 per share. That is roughly 10% below its 52-week high, which was reached in mid-February. We think that the investment community is assuming that Abbott's business will slowdown some once the pandemic subsides. While this scenario, according to Value Line, would certainly result in lower sales of some of ABT's diagnostic products, the impact should be partially mitigated by improvement in other areas of the business that were previously weighed down by pandemic-related disruptions, most notably in Abbott's Established Pharmaceuticals division.

All told, according to Value Line's proprietary metrics, Abbott Labs offers excellent risk-adjusted returns over the next 18 months.

Check Point Software Technologies

- Market value: $16.4 billion

- Expected 18-month appreciation: 25%

Check Point Software Technologies (CHKP, $123.22), a developer of internet security solutions, boasts a pristine balance sheet. The Israel-headquartered corporation has zero long-term debt on its ledger and nearly $2 billion in cash. Coupled with a history of excellent stock price stability and Check Point is a strong choice as far as safe stocks go.

It also operates in a high-growth sector of the economy. The cybersecurity industry comprises companies that monitor, detect, prevent and eliminate threats to computer systems, servers and networks of all sizes.

Over the past several years, the demand for these services has exploded as businesses continue to conduct more of their operations online, and in response to several high-profile data breaches at large corporations and government agencies.

The coronavirus has also been a boon to the industry. The virus outbreak required companies across the globe to put work-from-home orders in place. Management teams have striven to update their network security structures to protect against increasingly sophisticated attacks, as data travels between homes, as well as offices.

A crisis situation spells opportunity for crime, and hackers have certainly used COVID-19-related applications and files to bait users into downloading viruses and ransomware. Even as the vaccine rollout progresses and when it is completed, we posit that many companies will continue to have employees work from home, which should be favorable for cybersecurity spending for years to come.

According to Value Line's estimates, Check Point will be a beneficiary from the increased spending. Value Line's figures point to high-single-digit revenue and earnings gains over the next several years. As for the stock, it has badly lagged the broader market over the past year but, according to Value Line's 18-month measurement, it should make up a good chunk of the lost ground.

Clorox

- Market value: $22.2 billion

- Expected 18-month appreciation: 25%

Following a huge run up in the early part of the pandemic, the shares of Clorox (CLX, $178.84) have stopped to catch their breath. Throughout much of 2020, the manufacturer of a broad range of cleaning products and household goods experienced tremendous demand for its offerings.

In fact, in the December quarter, Clorox recorded double-digit sales growth in all 10 of its business categories. Pandemic-induced stocking and increased home consumption were the main factors behind the stellar results.

The consumer staples stock reached an all-time high price of $239.87 on Aug. 3, 2020, but is now trading far below that mark. Perhaps a return to that lofty level is in the cards.

Clorox earns Value Line's top rank for Safety, thanks to a stable stock, solid balance sheet and impressive cash flow generation. In fact, for 2021, Value Line estimates that cash flow per share will reach $9.30. If it gets near the mark, Clorox should easily be able to fund operations, expand its business and buy back some stock.

In addition, management recently announced that the quarterly dividend will increase by 4.5% to $1.16 per share. The dividend is for shareholders of record on July 28 and is payable on Aug. 13.

CLX is scheduled to report fiscal fourth-quarter results in early August, for the year ended June 30. Even though Value Line is forecasting disappointing comparisons for the period, the strength shown during the front half of fiscal 2021 – thanks to higher consumer demand and consumption – likely boosted full-year results. All told, the top and bottom lines probably climbed a respective 8% and 4% in fiscal 2021. Sales and earnings may climb at a more modest clip in fiscal 2022.

Clorox stock is now trading about 20% below its 52-week high. That sizable correction, in Value Line's view, has created a good entry point for conservative investors looking for safe stocks. A dividend yield north of 2.5% is another plus.

NextEra Energy

- Market value: $148.8 billion

- Expected 18-month appreciation: 25%

Electric utilities are not generally thought of as vehicles for significant capital gains, but that is a possibility with a position in NextEra Energy (NEE, $75.88).

Formerly known as FPL Group, NextEra is a holding company for Florida Power & Light Company and Gulf Power, which provides electricity to more than 5.6 million customers in eastern, southern and northwestern Florida.

The company also runs NextEra Energy Resources, an unregulated power generator with nuclear, gas and renewable assets. Lastly, it has a 57.2% stake in NextEra Energy Partners (NEP), a limited partnership that owns and manages clean energy projects in the U.S.

NextEra's balance sheet does include $46.1 billion in long-term debt and only $1.5 billion in cash. This unfavorable debt-to-cash ratio, according to Value Line, is offset by the utility's immense size, consistent operations, excellent management execution and high score for Price Stability.

Looking ahead, Value Line expects NextEra to remain a fine performer on the financial front. The service area's economy is healthy and Florida's population is expected to continue to increase over the years ahead. That is more potential customers for the electric utility business.

NextEra should also benefit from the addition of more renewable energy projects. Value Line is presently estimating earnings of $2.65 per share this year, which would represent a 26% advance over 2020's tally. It also projects that the bottom line will reach $3.50 per share out five years.

Over the past half decade, a position in NextEra would have resulted in a capital gain of nearly 200%. Although the stock has traded sideways over the past few months, Value Line estimates that the issue will recommence its upward charge within the next 18 months.

Novo Nordisk

- Market value: $203.7 billion

- Expected 18-month appreciation: 25%

Novo Nordisk (NVO, $88.81) is a major producer of insulin and diabetes-care products, as well as treatments for coagulation disorders and hormone replacement therapy products. The Denmark-based enterprise has an envious financial position, with little long-term debt and ample cash assets. As a major provider of essential healthcare products, cash flows are significant and its stock is highly rated for Price Stability.

Novo Nordisk's Diabetes Care business continues to show solid growth trends. At constant exchange rates, sales for the division were up 9% in the first quarter to just over $4.3 billion. Most of the gains were driven by non-insulins used to control blood sugar. Related sales increased 23% to $1.8 billion, led by NVO's drug diabetes Ozempic, which saw growth of 40% to $1.1 billion.

Meanwhile, sales of Rybelsus – a newer diabetes offering – more than tripled to $115 million. These products now account for 22.8% of the diabetes care market, up from 18.9% a year earlier. The company's obesity drug Saxenda also continues to do well and Value Line is bullish in regard to NVO's pipeline.

In April, Ozempic was approved in China for treating patients with insufficiently controlled Type II diabetes and for reducing the risk of major cardiovascular events in diabetics with heart disease. Management expects to launch the product in the second half of this year.

In NVO's Biopharm segment, Sogroya was recently approved in Europe for the treatment of adults with hormone deficiency. Altogether, the company remains on track for record profits this year.

This large pharmaceuticals giant would likely make a fine holding in conservative portfolios with exposure to safe stocks. A large capital gain also appears likely within 18 months.

McCormick & Company

- Market value: $22.9 billion

- Expected 18-month appreciation: 30%

Leading spices and seasoning manufacturer McCormick & Company (MKC, $85.56) has consistently benefitted from the strong brand loyalty built over its long history, which dates back to 1889.

In fact, the company exceeded annual sales of $5.5 billion in 2020 and Value Line estimates that it will topple $6.0 billion this fiscal year, which ends Nov. 30, 2021. Although its balance sheet does include $4.7 billion in debt and just $290 million in cash, McCormick's excellent track record, ample cash flows and stable stock leads it to be awarded Value Line's top Safety rank.

After advancing nicely in calendar 2020, the stock has lagged the broader market so far this year. According to Value Line, the investment community has not been willing to jump aboard when the company is facing a stretch of difficult quarterly comparisons.

This includes MKC's fiscal second quarter ended May 31, with adjusted earnings per share arriving at 60 cents. This figure bested consensus estimates, but fell short of the prior-year tally, which benefited from more people eating at home during the early stages of the COVID-19 pandemic. McCormick also will have to deal with higher operating costs, with the prices of ingredients, fuel and transportation on the rise.

Management recently raised its full-year adjusted per-share net guidance to a range of $3.00 to $3.05. Value Line followed suit, with its estimate now at the high end of the provided bracket.

Although there is no denying that McCormick, like most of its food processing peers, will probably witness a pullback in demand as more vaccinated people eat outside the home, we think the company will retain some of the customers gained at the beginning of the pandemic.

In fact, May-period sales for MKC's Consumer segment fell only 2%, after climbing 26% in the prior-year same period. Meanwhile, Flavor Solutions sales were up 39% year-over-year over the three-month period, with growth expected to continue thanks to restaurants and other foodservice customers.

On the cost side, management believes that it will be able to mitigate some of the inflationary pressures by raising prices on products and through continued cost-cutting measures under its Comprehensive Continuous Improvement program, which commenced more than a half-decade ago.

In sum, high-quality McCormick remains an appealing option for those with an 18-month investment horizon seeking out safe stocks.

NewMarket

- Market value: $3.3 billion

- Expected 18-month appreciation: 30%

The shares of NewMarket (NEU, $306.34) have performed poorly of late. Over the past 12 months, the stock has declined about 25% in value. For comparison, the S&P 500 Index is up 33% over the same time frame.

Although the company remains nicely profitable, margins and net income have declined due to higher raw material expenses. In fact, oil has been the main culprit, which is heavily used in NewMarket's core Petroleum Additives business (99% of total sales). This division produces numerous products including lubricants, engine oil and fuel additives under the HiTEC, GREENBURN, TecGARD, BioTEC and MMT brands.

On the bright side, NewMarket's balance sheet is in fine shape and the company generates plenty of surplus cash flow. This year, for instance, Value Line expects NEU to generate cash flow of $33.20 per share, or $365 million.

The dividend outlay ought to amount to $7.80 a share in fiscal 2021, and capital expenditures will probably tally $7.25 per share. As a result, NewMarket will likely generate per-share free cash flow of around $18.60. At this time, it is unknown what the Virginia-based corporation intends to do with these funds. It's possible that management elects to repurchase shares, make an acquisition and/or pay a special dividend.

Moving back to operations, Value Line believes that raw materials costs will eventually normalize, but additional revenue opportunities for NewMarket appear sparse. The company's products are heavily used by internal combustion engines, which continue to become more efficient and require less fuel additives and lubricants per mile driven. Furthermore, the push toward producing more cleaner-burning hybrid and electric vehicles (EVs) has become a key priority of the Biden administration.

It is not all doom and gloom, however. While NewMarket's days as a fast-growing company are likely in the past, it still should have a sizable market for its products. That, coupled with the currently depressed stock price, and recovery potential out 18 months appears worthwhile.

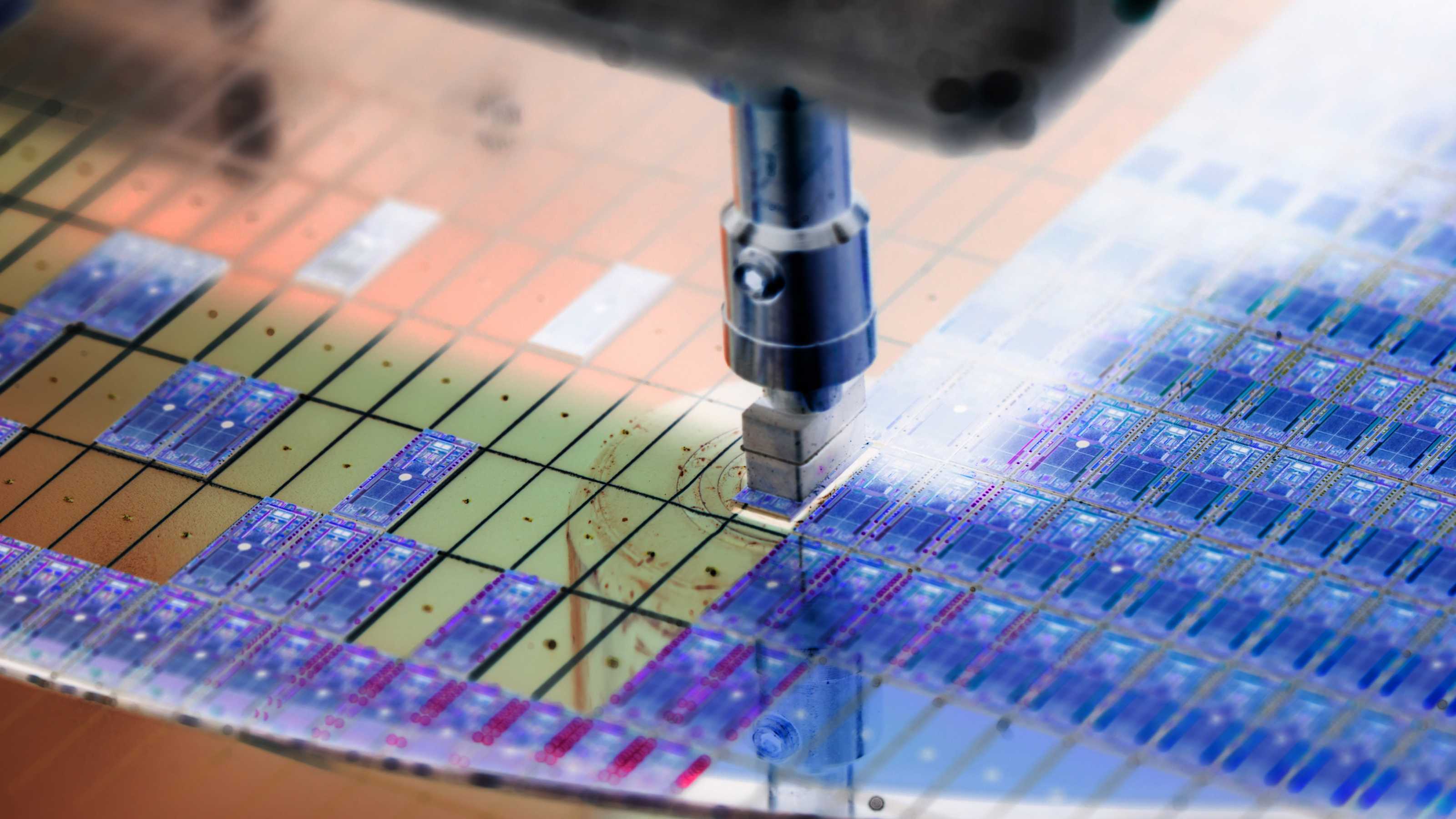

Taiwan Semiconductor

- Market value: $611.3 billion

- Expected 18-month appreciation: 30%

When looking for safe stocks, a good place to start is with a company that has nearly three times more cash than long-term debt. That is the case with Taiwan Semiconductor (TSM, $117.87).

This flexibility has also allowed management, on average, to increase the annual dividend payout by more than 20% over the past five years. In addition to shareholder-friendly activities supporting the stock price, Value Line is also bullish in regard to the company's business prospects.

According to Value Line's analysis, healthy revenue and earnings advances are on tap. Over the past several quarters, Taiwan Semiconductor has experienced strong demand for its High Performance Computing (HPC) products, which includes memory chips, especially from the automotive industry.

Indeed, there is currently a lack of new and pre-owned cars in the U.S. largely due to a shortage of semiconductors that are heavily utilized in autos. Value Line believes that this pent-up demand will take considerable time to be satiated, which augurs well for suppliers such as TSM. What's more, demand from the mobile phone sector should increase as the year moves on, following milder-than-normal seasonality in this segment earlier this year.

Looking longer term, Value Line is also optimistic. The company's immense size and balance-sheet strength give it a leg up on the competition and should enable it to withstand an industry downturn better than most. Increased economies of scale should also provide a boost to the bottom line during more prosperous times.

The investment community has certainly taken notice of Taiwan Semiconductor, and the price-per-ADR (American depositary receipt) has advanced more than 70% over the past year. Value Line believes that the equity's valuation is quite rich, but will justifiably remain lofty over the near term. Thus, meaningful capital appreciation, especially on a risk-adjusted basis, appears quite likely.

Canadian National Railway

- Market value: $74.5 billion

- Expected 18-month appreciation: 35%

Canadian National Railway's (CNI, $104.22) financial strength may soon be tested. A few months ago, it agreed to purchase fellow railroad Kansas City Southern (KSU) for $325 per share – $200 a share in cash and 1.059 shares of CNI stock for each KSU share owned. The deal values Kansas City Southern at just under $34 billion. According to CNI's management, it can generate up to $1.0 billion annually in synergies and overall cost reductions following the merger.

The transaction recently hit a potential snag. On July 8, news was released that the Biden administration is looking for regulators to get more aggressive on consolidation and anti-competitive pricing in the railroad and shipping industries. All railroad stocks that Value Line tracks were down that day. Canadian National shares' drop was modest, but Kansas City lost nearly 8%, and continues to trade well below the potential purchase price.

In Value Line's view, there is still a very good chance that the merger is approved by regulators. Thus, purchasing shares of Kansas City Southern could lead to a decent profit, though the transaction is not expected to be completed until late 2022 or early 2023.

Value Line is also bullish in regard to Canadian National Railway's prospects. On its own, Canadian National operates Canada's largest railroad system, and as the global economy recovers from COVID-19, more goods will certainly be transported via the rails. Value Line projects healthy and steady revenue and earnings gains over the next several years. In addition, according to its 18-month metric, a sizable capital gain awaits.

The situation may prove even more favorable should the railroad be able to complete the purchase of Kansas City. Mergers in the railroad space are rare, and the addition would greatly expand Canadian National's size, market reach and profit potential.

Infosys

- Market value: $90.4 billion

- Expected 18-month appreciation: 65%

Infosys (INFY, $21.31) is another one of the safe stocks on this list that sports a debt-free balance sheet. As of June 30, the India-headquartered IT services provider also had more than $3.4 billion in cash assets. All told, according to Value Line, Infosys should continue to have little trouble funding operations, the semi-annual dividend and share buybacks.

The stock price has been on an upward trend for more than a year now. In fact, it is now trading just below its all-time high of $21.87, which was reached in mid-July.

Investors received some more good news earlier this month when Infosys reported its June-quarter financial results. For the three-month period, revenues came in at nearly $3.8 billion and earnings were 17 cents per ADR. Value Line's estimate was on the mark in regard to earnings, but Infosys' top line easily exceeded expectations, as stronger demand for the company's consulting, technology and outsourcing services persisted.

To mid-decade, Value Line thinks that product rollouts and enhanced artificial intelligence (AI) solutions ought to help sustain global IT services demand. Indeed, secular technological tailwinds are likely to play a major role in large deal wins for Infosys.

For instance, it recently agreed to team up with global energy giant BP to collaborate on a clean energy initiative to reduce emissions. Meanwhile, the company's commitment to product development, such as its recently unveiled Cobalt and Modernization platforms, as well as its conversational AI partnership with LivePerson, should nicely supplement a favorable operating environment.

Although the ADRs are now trading near their all-time high, Value Line believes that there is more room to run, given Infosys' excellent business prospects and reasonable valuation. A well-covered and secure dividend yield near 2% is a nice sweetener.

Canon

- Market value: $25.2 billion

- Expected 18-month appreciation: 85%

Value Line's 18-month measurement is extremely bullish in regard to Canon (CAJ, $24.05). The Tokyo-based manufacturer of electronic devices, including copiers, printers and cameras, trades on the New York Stock Exchange via ADRs. This security is issued by U.S. banks and each ADR is equal to one common share of Canon. A position in CAJ (and most other ADRs) does not subject the investor to foreign transaction taxes, and dividends are paid without foreign withholding.

Although the stock has struggled of late, its balance sheet is not to blame. As of March 31, Canon had long-term debt obligations of just $43 million, compared to cash assets of nearly $4.4 billion.

In fact, the stock is now trading slightly below book value per share (total assets – total liabilities, divided by shares outstanding), suggesting that the ADRs are materially undervalued. We think it is safe to assume that Value Line's 18-month measurement is keyed into this feature.

Later this month, Canon is scheduled to report financial results for its June period. For the quarter, Value Line thinks the company will put in a decent showing. Revenues probably expanded to $7.5 billion, aided by improvement in the global economy.

The coronavirus pandemic-related restrictions have been lifted in many areas worldwide, which likely bolstered demand for office equipment. An improvement in travel has also helped camera demand. Management has reduced administrative costs and spending on research and development (R&D), which likely allowed for a much improved year-over-year comparison. All told, we estimate that the company earned 20 cents per ADR, compared to a loss of 8 cents per share last year.

According to Value Line, the ADRs of Canon appear inexpensive. In addition to trading below book value, its current price-to-earnings (P/E) ratio is well below the broader market median. Add in expectations of rising revenues and profits, and similar to the other safe stocks on this list, CAJ appears poised to deliver a sizable capital gain.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

The 24 Cheapest Places To Retire in the US

The 24 Cheapest Places To Retire in the USWhen you're trying to balance a fixed income with an enjoyable retirement, the cost of living is a crucial factor to consider. Is your city the best?

-

5 Stocks to Sell or Avoid Now

5 Stocks to Sell or Avoid Nowstocks to sell In a difficult market like this, weak positions can get even weaker. Wall Street analysts believe these five stocks should be near the front of your sell list.

-

Best Dividend Stocks to Buy for Dependable Dividend Growth

Best Dividend Stocks to Buy for Dependable Dividend Growthdividend stocks How do you find the best dividend stocks to buy? Income investors know there's no substitute for regular dividend increases over the long haul.

-

Best Stocks for Rising Interest Rates

Best Stocks for Rising Interest Ratesstocks The Federal Reserve has been aggressive in its rate hiking, and there's a chance it's not done yet. Here are eight of the best stocks for rising interest rates.

-

The Five Safest Vanguard Funds to Own in a Volatile Market

The Five Safest Vanguard Funds to Own in a Volatile Marketrecession The safest Vanguard funds can help prepare investors for market tumult but without high fees.

-

The 5 Best Inflation-Proof Stocks

The 5 Best Inflation-Proof Stocksstocks Higher prices have been a major headache for investors, but these best inflation-proof stocks could help ease the impact.

-

5 of the Best Preferred Stock ETFs for High and Stable Dividends

5 of the Best Preferred Stock ETFs for High and Stable DividendsETFs The best preferred stock ETFs allow you to reduce your risk by investing in baskets of preferred stocks.

-

What Happens When the Retirement Honeymoon Phase Is Over?

What Happens When the Retirement Honeymoon Phase Is Over?In the early days, all is fun and exciting, but after a while, it may seem to some like they’ve lost as much as they’ve gained. What then?