7 Great Growth ETFs to Get Your Portfolio Going

These growth ETFs provide exposure to the higher-risk investing style while mitigating some of the headaches associated with it.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

While 2021 began as the year of value, growth stocks and growth exchange-traded funds (ETFs) have been making their way back into favor in recent weeks.

Growth investing is one that continues to capture many investors' attention. While there are no hard and fast rules for the style, incorporating growth stocks into your portfolio involves finding names that are expanding faster than their sector peers or broader market averages.

Typically, these stocks are smaller in terms of market cap, but they don't have to be. Measures of revenue growth or predicted gains to earnings per share (EPS) are often the chief metrics that growth investors focus on.

Capital gains are another factor investors in growth stocks and growth ETFs keep an eye on, as dividends are often nonexistent for many names within the category. Many growth firms tend to retain whatever earnings they have and plow them back into building the business.

There are certainly drawbacks to growth investing. For one, you never really know when the bus is going to run out of gas. It is not uncommon for growth stocks to eventually start to slow down and mature, but some do this more quickly than others and this loss of momentum can rapidly hamper your returns.

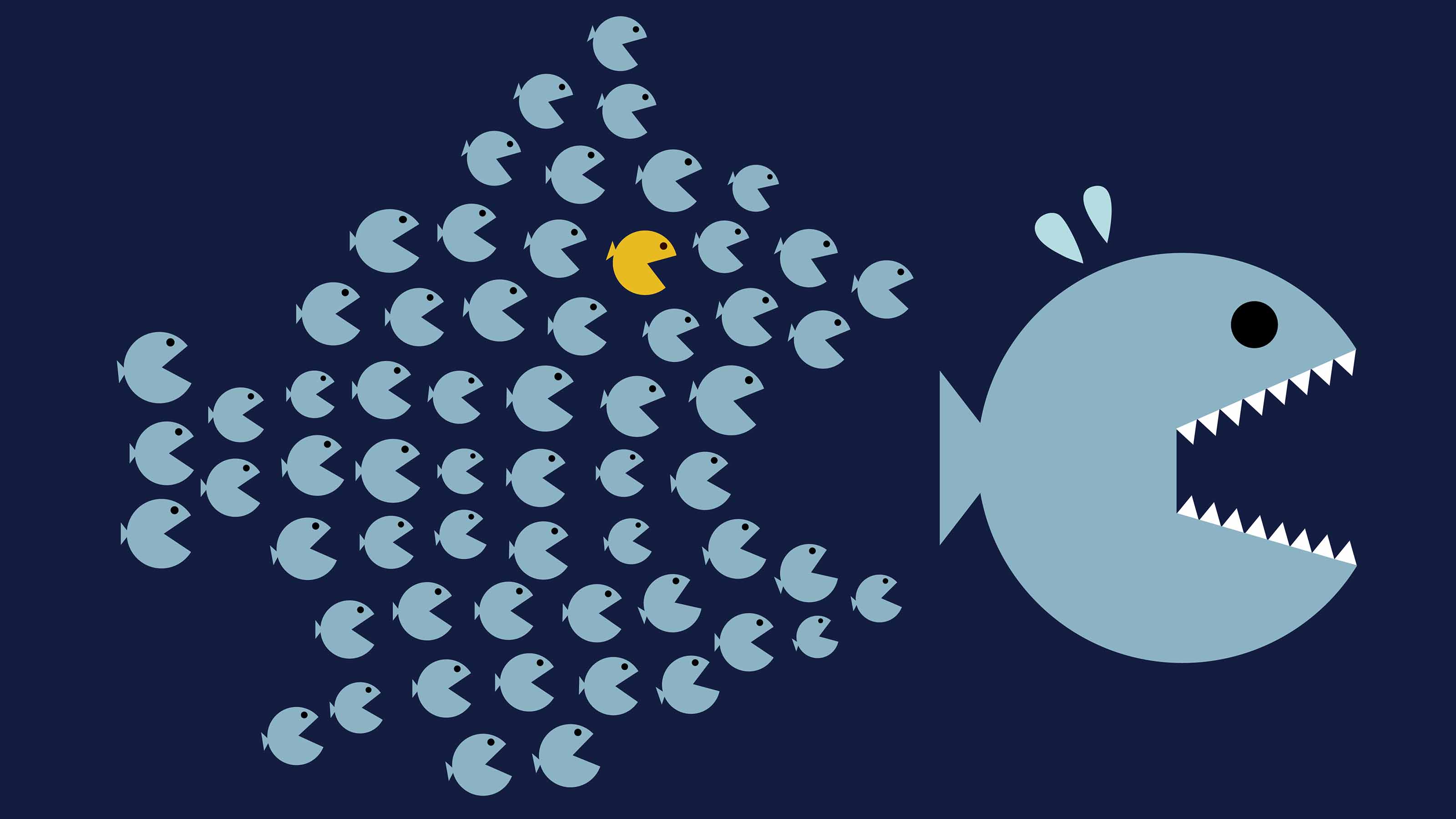

One way to protect investments against these sharp drops is to adopt a broad approach. Growth ETFs provide immediate diversification by spreading out risk across dozens or even hundreds of stocks, mitigating some of the headaches that accompany this investing style.

Here are 7 growth ETFs that act as one-stop shops for those looking to capitalize on growth investing. A few of these selections deal primarily with the broader growth style of investing, while a few home in on specific explosive trends.

Data is as of July 20. Dividend yields represent the trailing 12-month yield, which is a standard measure for equity funds.

Vanguard Growth ETF

- Assets under management: $79 billion

- Dividend yield: 0.57%

- Expenses: 0.04%, or $4 annually for every $10,000 invested

Vanguard funds are synonymous with low-cost indexing. Founder John Bogle did invent the entire concept of index funds after all. So, the investment manager is often a great place to visit first, no matter what style or sector you're looking to add to your portfolio. It's no different when it comes to growth investing.

Here, we get the $79 billion Vanguard Growth ETF (VUG, $290.99).

VUG tracks the CRSP U.S. Large Cap Growth Index, which focuses its attention on the large-cap segment of the U.S. market. CRSP – which is affiliated with the University of Chicago Booth School of Business – applies various screens looking at future long-term earnings growth, sales metrics, current investment-to-assets ratio and return on assets to determine which stocks can be considered for the index.

This works out to be about 290 stocks. Top holdings include names such as Amazon.com (AMZN) and Microsoft (MSFT). Tech stocks make up about half of the fund, with consumer discretionary making up another fourth or so. That sort of sector mix is to be expected given that these industries are often full of growth stocks.

That sector makeup hasn't really affected VUG's returns throughout its history. Over the last 10 years, the ETF has managed to produce a 17.5% annual total return. Given the fund's paltry dividend yield, much of that return has come from capital gains. This makes VUG a wonderful addition to a taxable portfolio to take advantage of lower long-term capital gains taxes.

And for those looking for a low-cost fund, VUG is one of the best growth ETFs you'll find. Its expense ratio is just 0.04%, meaning you'll have a cheap, easy way to add a swath of growth stocks to your portfolio.

iShares Russell 2000 Growth ETF

- Assets under management: $11.7 billion

- Dividend yield: 0.32%

- Expenses: 0.24%

It takes a lot to move the needle for a mega-cap stock. We're talking tens of billions of dollars' worth of additional revenue or earnings to make a difference to the bottom line. But for smaller stocks, achieving double-digit revenue or earnings expansion is much easier, and many people equate small-cap stocks with growth.

And the power of thinking small can do wonders for your portfolio.

The iShares Russell 2000 Growth ETF (IWO, $296.62), for instance, put out a massive 34% return in 2020. The Russell 2000 is arguably the benchmark for small-cap U.S. stocks. IWO takes this the power of small caps a step further and applies various screens to the parent index to focus only on those meeting growth criteria. This drops the number of holdings down to 1,173 different small-cap stocks.

This screening process has resulted in some impressive relative strength. IWO outperformed the regular iShares Russell 2000 ETF (IWM) by 15 percentage points in 2020. The growth ETF also managed to surpass the value version of the Russell 2000 – the iShares Russell 2000 Value ETF (IWN) – by nearly 30 percentage points over the 12-month period.

While growth took a break at the start of 2021, it's finally starting to reassert itself. And IWO, which costs a mere 0.24% in annual expenses, could be the best way to get the most bang for your buck while participating in that revival.

Invesco S&P 500 Pure Growth ETF

- Assets under management: $2.8 billion

- Dividend yield: 0.16%

- Expenses: 0.35%

A few years ago, the smart-beta revolution took hold in the world of ETFs. The basic principle is to improve upon the standard bread-and-butter market-cap weighted indexes. By screening for various factors and other metrics, index sponsors can craft a framework for stronger returns.

Truth be told, a lot of smart-beta does fall flat. But when it comes to growth ETFs, smart-beta occasionally comes up with a winner ... and that includes the Invesco S&P 500 Pure Growth ETF (RPG, $185.74).

Some value and growth indexes that actually contain the same stocks. RPG looks to counter that issue. The ETF uses various screens and assigns two scores to all the stocks in the S&P 500 Index – one for value and one for growth. The ratio between the value score and the growth score is then used to rank all the stocks in the index as either deep value, blend or deep growth. Only the deep growth-scoring stocks are included in RPG's portfolio.

The screens do make a huge difference in terms of the number of holdings. Thanks to its smart-beta twist, RPG only holds around 73 names. Top holdings include PayPal (PYPL), Nvidia (NVDA) and Generac (GNRC). Technology stocks make up the bulk of the ETF, coming in at roughly 40% of assets.

The tighter portfolio worked for RPG last year, as it managed to outperform both the S&P 500 Index and the S&P 500 Growth Index. That outperformance carries over since the ETF's inception in 2006. It's just a few basis points annually, but over time, small amounts do compound to greater long-term returns.

SPDR S&P Midcap 400 ETF Trust

- Assets under management: $20.8 billion

- Dividend yield: 0.94%

- Expenses: 0.23%

For more cautious investors, there may be a way to "have your cake and eat it too” when it comes to growth stocks – and that's by not focusing on strictly growth stocks in the first place.

Mid-caps offer much of the same potential as growth stocks, but with a little bit more safety. That's because mid-cap stocks are big enough to have real cash flows, sales, profits and maybe even a steady dividend. But they are also small enough to still be able to grow revenues and earnings at a relatively quick rate. As such, most mid-caps still fall within the realm of growth stocks.

For older investors wanting to grow their capital, but unable to take on the pure risk of growth stocks, mid-caps make for an attractive solution.

Now there is some trade-off here. You won't experience the same sort of huge increase watching a cloud stock go to the moon. But, you also won't feel the same sort of heartbreak when it hits a snag and crashes back down to earth.

When it comes funds featuring mid-cap stocks, the SPDR S&P Midcap 400 ETF Trust (MDY, $481.54) is still the big boy on the block.

The fund tracks the benchmark S&P 400 Midcap Index and has performed well since its inception in May 1995. That performance has been very "growthy" indeed, with the ETF's 12-month return at the end of June clocking in at 52.9%. Since its inception, the MDY has managed to produce average returns of about 12% per year.

With its swift trading volume, low expenses and ability to perform well over time, the MDY could be one of the best growth ETFs for more conservative investors.

To learn more about MDY, visit the State Street Global Advisors provider site.

iShares MSCI EAFE Growth ETF

- Assets under management: $10.5 billion

- Dividend yield: 1.2%

- Expenses: 0.39%

One of the biggest sins in investing has to be having a hometown bias. We tend to load up our portfolios with stocks from the nation we live in, with the idea being that they may be safer than international rivals.

But the truth be told, nearly half of the world's market cap lies outside the U.S. and that number is growing. And thanks to the expanding world economy, you're just as likely to drive a German car, watch shows on a TV made in Korea or eat food from a British corporation. To that end, it's not a terrible idea to have some international exposure to your portfolio and growth stocks are a great way to do that.

At nearly $11 billion in assets, the iShares MSCI EAFE Growth ETF (EFG, $106.47) is the largest and most liquid fund focusing on international growth stocks. The fund tracks the MSCI EAFE Growth Index, which captures the growthier-side of mid- and large-cap stocks in Europe, Australia, Asia and the Far East . Sadly, our neighbors to the north are not included. All in all, the ETF holds more than 460 different foreign equities.

Shockingly, technology isn't the biggest sector for the fund. That would be industrial stocks, which account for roughly 20% of assets. Rounding out the top three are healthcare stocks (16.3%) and consumer discretionary names (16.1%). Tech only makes about 15% of assets.

Returns for EFG have been mixed. But so has the return profile for all international stocks. However, there have been pockets of some very decent returns from the fund. For example, last year, the exchange-traded fund managed to produce an 18% gain. Over the last decade, the ETF has averaged a more modest return of 7.5% per year.

With investors painfully under-exposed to international equities, EFG makes any easy low-cost way to add exposure to global growth stocks.

Invesco QQQ

- Assets under management: $179.7 billion

- Dividend yield: 0.48%

- Expenses: 0.20%

Certain sectors are naturally more prone to having growth stocks in their mitts. Technology, healthcare and consumer discretionary tend to focus on fads, innovation and cutting-edge products moreso than say industrial manufacturers making ball-bearings. Investors looking to add a dose of growth stocks to their portfolios may want to focus their attention on these sectors.

And the Invesco QQQ (QQQ, $358.79) could be one of the easiest ways to do just that.

The "Cubes" track the Nasdaq-100 Index. As one of the first exchanges to embrace computer trading back in the 1980s, the Nasdaq has long been home to companies focused on innovation. As such, the vast bulk of the index is made up of tech, consumer discretionary and healthcare firms.

The Nasdaq-100 tracks the largest domestic and international non-financial companies listed on the Nasdaq Stock Market. Tech makes up nearly 50% of the index, while consumer discretionary makes up around 22% of assets and healthcare comes in at roughly 7%. Because of its mix, QQQ represents a who's who of growth stocks.

Top holdings include Apple (AAPL), Amazon.com and Adobe (ADBE). That puts it among the best large-cap growth ETFs around.

Performance-wise, the fund is hard to beat. Over the last 10 years, QQQ has managed to post a 21% annual total return. It's focus on the growthier aspects of the Nasdaq has it beating the regular Nasdaq Composite Index – which includes all the stocks on the exchange – by about 4 percentage points annually over that time frame.

Adding in the very swift trading volume, low bid-ask spreads and rock-bottom expenses, the QQQ could be one of the easiest ways to add a touch of growth to any portfolio.

ARK Innovation ETF

- Assets under management: $22.6 billion

- Dividend yield: 0.00%

- Expenses: 0.75%

Guru Cathie Wood takes a lot of heat for some of her, perhaps, overzealous price targets for stocks she loves – Tesla (TSLA) to $3,000, for instance. But the growth investor has been really spot-on with finding top-names in the world of science and technology. The nearly $23 billion Ark Innovation ETF (ARKK, $120.76) is her flagship fund.

Unlike the rest of the growth ETFs on this list, ARKK is an actively managed fund. That is, a human being rather than an index determines the holdings. In this case, Wood and her team focus their attention on "disruptive innovation." Basically, finding companies that use technology to completely change the traditional way we do things.

This can include healthcare, automation, fintech and renewable energy to name a few. Wood runs a concentrated fund, with just 35 to 55 holdings. This helps ARKK stay locked-in on their best ideas only.

Top holdings read like a list of growth stocks, including electric vehicle (EV) maker Tesla, streaming giant Roku (ROKU) and telehealth pioneer Teledoc Health (TDOC).

Wood's prowess in finding growth stocks has worked well over the years. ARKK has managed to produce a 48% annual return over the last five years and is up a whopping 87% in the last year.

However, nothing in life is free.

Given the fund's concentrated nature, ARKK is a volatile beast and prone to some big price swings. Year-to-date, the ETF is down about 6%. Secondly, while not a trader per se, Wood isn't afraid to drop stocks from the holdings or to add distressed names. Finally, the exchange-traded fund isn't cheap at 0.75% in annual expenses.

But for investors looking for a more active role with their growth stocks, ARKK could be one of the best choices around. Woods has proven herself to be a tactful manager and her long-term returns speak for themselves.

To learn more about ARKK, visit the ARK Innovation provider site.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

The 24 Cheapest Places To Retire in the US

The 24 Cheapest Places To Retire in the USWhen you're trying to balance a fixed income with an enjoyable retirement, the cost of living is a crucial factor to consider. Is your city the best?

-

5 Stocks to Sell or Avoid Now

5 Stocks to Sell or Avoid Nowstocks to sell In a difficult market like this, weak positions can get even weaker. Wall Street analysts believe these five stocks should be near the front of your sell list.

-

Best Stocks for Rising Interest Rates

Best Stocks for Rising Interest Ratesstocks The Federal Reserve has been aggressive in its rate hiking, and there's a chance it's not done yet. Here are eight of the best stocks for rising interest rates.

-

The Five Safest Vanguard Funds to Own in a Volatile Market

The Five Safest Vanguard Funds to Own in a Volatile Marketrecession The safest Vanguard funds can help prepare investors for market tumult but without high fees.

-

The 5 Best Inflation-Proof Stocks

The 5 Best Inflation-Proof Stocksstocks Higher prices have been a major headache for investors, but these best inflation-proof stocks could help ease the impact.

-

Bogleheads Stay the Course

Bogleheads Stay the CourseBears and market volatility don’t scare these die-hard Vanguard investors.

-

5 of the Best Preferred Stock ETFs for High and Stable Dividends

5 of the Best Preferred Stock ETFs for High and Stable DividendsETFs The best preferred stock ETFs allow you to reduce your risk by investing in baskets of preferred stocks.

-

What Happens When the Retirement Honeymoon Phase Is Over?

What Happens When the Retirement Honeymoon Phase Is Over?In the early days, all is fun and exciting, but after a while, it may seem to some like they’ve lost as much as they’ve gained. What then?