The Pros' Investment Strategies for Today's Market

Fundamentals, fixed income and gold are just some of the investment strategies Wall Street's top minds are using to navigate the current market environment.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Wall Street's most prevalent investment strategies looking out toward the rest of 2023 look much, much different than they did this time a year ago.

Around this time last year, the S&P 500 had just entered a bear market, putting an end to the 2020-2022 bull run.

Additionally, the Federal Reserve was on the cusp of instigating the third of what would become 10 rate hikes between the start of 2022 and today. But no one knew back then just how far or fast these hikes would go, leaving investors to balance on a precarious perch of uncertainty amid a world that was still trying to find its footing in the wake of COVID-19.

Today, the situation is hardly any more certain, but for different reasons. The Russia-Ukraine war has led to tremendous hardship and global uncertainty. And yet the S&P 500 is up by more than 13% year-to-date and the Nasdaq Composite Index has climbed nearly 30% since January. Spending is on the rise in the U.S. and the unemployment rate has remained low. Inflation, however, remains elevated with at least one more rate hike penciled in for July.

Meanwhile, the word "recession" is getting bandied about in the media, with experts arguing over the possibility of 2023 bringing one upon the U.S. – if it hasn't already begun.

How, then, should investors go about their business in this evolving environment?

We've asked several fund managers and other industry experts just that – and in turn, they've shared some of the investment strategies they like for the rest of 2023. Read on to see what they have to say.

Stay the course

- Provided by: Roger Aliaga-Diaz

- Position(s): Global head of portfolio construction at Vanguard

"As we approach mid-year, the current market environment continues to be as uncertain as it was at the beginning of the year," Aliaga-Diaz says. While he believes interest rates are reaching a peak and that the Fed will "prevail in its fight against inflation," he says the battle may be won at the expense of a "mild recession later this year."

Given that, he tells investors to not let continued uncertainty tempt you into making changes to your long-term investment strategies.

"Research shows that making large changes to your asset allocation to capitalize on short-term market movements is difficult to consistently get right," Aliaga-Diaz says. "The best and worst days for the markets are often clustered close together and maintaining discipline in periods of heightened uncertainty and volatility is crucial."

Focus on what companies can control

- Provided by: Karina Funk

- Position(s): Chartered financial analyst, chair of Sustainable Investing at Brown Advisory and portfolio manager of the Brown Advisory Sustainable Growth Fund

"When macroeconomic surprises hit, the equity market tends to be very inefficient, and this creates opportunities that we seek to exploit," Funk says. "As active managers with a long-term investment horizon, we seek to take advantage of short-term dislocations by allocating capital to new and/or existing names that may be trading at a discount relative to our view of their fundamental strengths, downside risk, and forward upside potential."

For example, inflation plus a wind-down of historic COVID demand for vaccine containment solutions caused West Pharmaceutical Services (WST) to miss its earnings expectations at the end of 2022. And yet her team, still believing in the company's leadership and value proposition, added to their allocation during the drop. Since then, it's proven to be even stronger and faster-growing than pre-COVID, she says.

"Current macroeconomic uncertainty, led by changes in monetary policy and inflation, is likely to continue in the second half of the year," Funk says. "While we can and do run scenario analyses of how some of these risks may affect our portfolio holdings or candidates, our focus as bottom-up fundamental managers is to invest in companies that have a lot more that is within their control than outside of it."

For example, rather than just trying to predict how inflation will affect input costs, she also targets companies with demonstrated pricing power and inelastic demand, such as a life sciences firm that provides critical solutions for part of life-saving treatments.

"In terms of sustainable investing, the more compelling the customer value proposition, the more a company can navigate an uncertain macroeconomic environment," she says.

An example of this is the need for energy efficiency with the increasingly complex processor loads of artificial intelligence, like Monolithic Power's (MPWR) chips, which "provide precise power that reduces wasted energy," she says.

Bonds are back

- Provided by: Steve Laipply

- Position(s): Global co-head of iShares Fixed Income at BlackRock

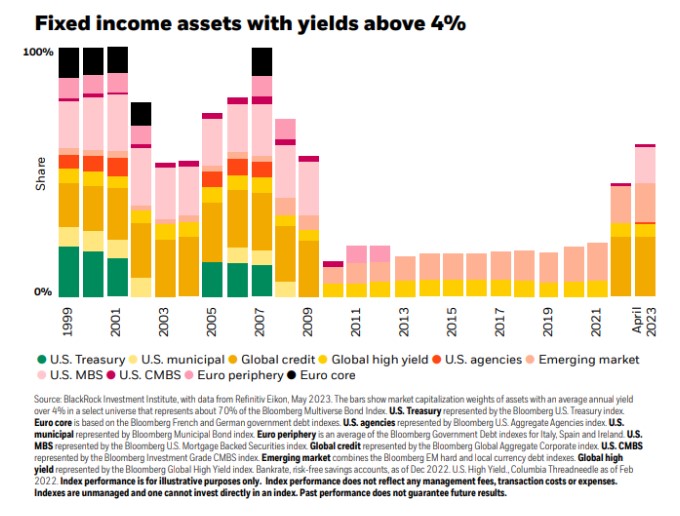

Bond yields are on the rise, with more than 60% of fixed-income sectors yielding 4% or more now. "The front end of the U.S. Treasury curve now yields more than high yield indices did at the end of 2020," Laipply says. "And not only has it been true that yields are back, but the notion of 'bonds as ballast' has begun to reappear after going missing in action during 2022."

He believes that many multi-asset portfolios are under-allocated to fixed income currently, especially given bonds can be a powerful diversifier to riskier assets. Investors should be reallocating to fixed income, he says.

"Given where yields now are, investors are able to reduce equity over-weights, increase credit quality, improve liquidity and lower overall portfolio risk," he says.

As an example, he says to consider stepping into higher quality, medium-term fixed income via funds like the iShares U.S. Treasury Bond ETF (GOVT), the iShares Core US Aggregate Bond ETF (AGG), the iShares MBS ETF (MBB) or the iShares 5-10 Year Investment Grade Corporate Bond ETF (IGIB).

"We believe the new regime of greater macro and market volatility is poised for a long stay and demands a new investment playbook," he says. "For those who have had to look elsewhere for income over the past decade, the great yield reset has transformed the strategic opportunity in fixed income."

Not just any bonds, but quality bonds

- Provided by: Ashok Bhatia

- Position(s): Deputy chief investment officer for fixed income at Neuberger Berman

Bonds may be more appealing in 2023, but not all bonds are to be trusted equally.

"As companies and individuals need to refinance debt into higher rates, or pay more to finance working capital, we expect that one-off issues in credit markets will continue," Bhatia says. Rather than a broad rise in default rates, he expects the risks to be idiosyncratic, or company-specific.

To invest in such an idiosyncratic environment, he says to "move up in quality, so higher rated credits within sectors and higher rated sectors in general." You should also reduce exposure to cyclical sectors and businesses with high capital needs or a lot of floating-rate debt because the adjustment to interest rates will impact these companies first. Finally, expand your allocations to securitized or non-corporate exposures where you can.

"In terms of investment strategies this would correspond to, it would be things like Core or Global Core fixed income type of strategies," Bhatia says.

He expects that as U.S. and European investors increase their fixed-income allocations over time, higher quality segments such as agency mortgages, high-quality-asset-backed securities and investment-grade corporate bonds will be "key beneficiaries of these flows."

Bank on banks

- Provided by: Miles Lewis

- Position(s): Portfolio manager at Royce Investment Partners

"In the wake of recent bank failures, the regional banking industry has seen a significant correction in market values and high volatility throughout the first half of 2023," Lewis says. "This challenging climate is creating highly promising long-term investment opportunities among select small-cap regional players."

Periods of high anxiety tend to be profitable entry points for banking stocks, he says, as was seen in the 2008 Financial Crisis. Many banks are trading below their tangible book value, but the "discounted valuations in most cases are not rooted in fundamentals, which for many banks remain solid, albeit with some near-term pressure on margins and returns."

Additionally, "fears about the long-term viability of the industry and near-term risks are greatly exaggerated." As an example, he points to concerns about office corporate real estate, noting that most regional and community banks don't have exposure to large downtown office buildings that are commonly cited as under distress.

"While smaller regional and community banks are likely to feel some impacts of pending regulation, the current focus of the regulators is on banks with greater than $100 billion in assets, which does not include the majority of U.S. banks," Lewis adds.

Deposit costs are elevated currently, but he says this is largely a function of the inverted yield curve and Fed rate hikes. "If history is a guide, then yield curves do not remain inverted forever – the average since 1970 is about 14 months - and the Fed typically cuts rates when the economy slows."

Finally, he says his recent conversations with dozens of bank CEOs confirm his views that "regional and community bank models are strong and will endure, despite mainstream narrative to the contrary."

Stay conservative

- Provided by: Bob Welch

- Position(s): Senior vice president and financial advisor at Wealth Enhancement Group

Despite stronger-than-expected returns on the Nasdaq and S&P 500 so far this year, Welch says that "if you look under the surface of the market, there is cause for concern."

He points to how Apple (AAPL), Microsoft (MSFT), Alphabet (GOOGL), Amazon (AMZN) and Nvidia (NVDA) account for roughly 80% of the S&P 500's year-to-date returns, saying that "it is not healthy when so few companies are responsible for such a large percentage of the return."

This, coupled with inflation and recession uncertainty, has led him to a more conservative asset allocation in his investment strategies.

"We are less bullish on the broad market, instead favoring sectors that are defensive in nature, namely healthcare and consumer staples," Welch says. "We also like stocks that grow their dividends over time."

Welch is also comfortable holding more cash now that money market funds are yielding close to 5%.

Favor quality, rotate overseas and go for gold

- Provided by: Allison Bonds

- Position(s): Head of private wealth management & independent wealth management, State Street Global Advisors

Stocks have kicked off 2023 with early gains, but Bonds cautions that market leadership has been narrow, with a small number of mega-cap tech stocks driving those gains.

"Full-year estimates for 2023 suggest U.S. earnings will be lower than where they were to start the year," she says. "In contrast, markets outside of the U.S., particularly Europe, present the potential for more positive earnings growth and attractive valuations relative to U.S. equities."

To hedge risks within the U.S., she suggests investment strategies that focus on companies with stable cash flows and strong balance sheets that are trading at favorable valuations.

"Several ETFs including the SPDR S&P Dividend ETF (SDY) and SPDR MSCI USA StrategicFactors ETF (QUS) provide diversified exposure to stocks with these traits," she says. "Outside of the U.S., we suggest allocating to the SPDR Portfolio Developed World ex-US ETF (SPDW) or the SPDR Portfolio Europe ETF (SPEU)."

Given the threat of a recession in the U.S. still looms, she'd also caution investors to diversify beyond stocks and bonds. "Investors might consider adding some gold exposure to their portfolio through an ETF such as SPDR Gold Shares (GLD) or SPDR Gold MiniShares Trust (GLDM), as the precious metal can serve as a hedge against both slowing economic growth and inflationary risks," she says.

Opportunities in machine learning and AI

- Provided by: Erin Scannell

- Position(s): Private wealth advisor at Ameriprise

Scannell also believes it's prudent to mitigate risks given the fact that leading economic indicators point to a recession. However, he also sees opportunities.

"Machine learning and artificial intelligence (AI) have exploded this year as ChatGPT and others have had exponential user growth," he says, adding that it took Facebook 10 months to get 1 million users and ChatCPT only five days.

"We believe the transformational technology has the potential to disrupt existing industries while at the same time creating new businesses, with most forecasts predicting a 20% to 30% growth rate moving forward," Scannell says.

To take advantage of this, he would overweight the following AI stocks as part of a diversified portfolio: Microsoft, Alphabet, Adobe (ADBE), Synopsys (SNPS), Nvidia and Taiwan Semiconductor (TSM).

When looking at investment strategies on a sector level, Scannell says he'd overweight the software industry, "where the technology is likely to play an increasingly instrumental role in the development of more effective, reliable and personalized software solutions" in the short-term.

Over the long term, he's overweight technology hardware, semiconductors, manufacturing and industrial firms, financial firms and healthcare.

Look beyond the U.S., private credit, and traditional energy

- Provided by: Jason Blackwell

- Position(s): Chartered financial analyst, chief investment strategist and principal at The Colony Group

The U.S. may be heading for a recession, but that doesn't mean the rest of the world is going down with us.

"There are many great companies that are domiciled outside the United States and other regions are in different phases of their economic cycle," Blackwell says, adding that he particularly likes emerging markets right now.

Liquidity also remains important. For that, he sees private credit as an area of opportunity among investment strategies.

"With regional banks needing to slow down the growth of their loan books, a number of businesses may need more creative forms of financing," he says.

Finally, Blackwell recommends keeping an "all of the above" approach to energy. "With the Inflation Reduction Act making it through the debt ceiling negotiations, there is a tremendous amount of incentive for companies to invest in sustainable projects," he says. "However, traditional energy will continue to have a major role in the economy for decades to come."

Rebalance between value and growth

- Provided by: Derek Pszenny

- Position(s): Accredited investment fiduciary, co-founder of Carolina Wealth Management

"Right now, there's a divergence between growth stocks and value stocks – growth stocks for the year are up 20%, while value stocks are flat or even down a little bit," Pszenny says.

This means that if you started the year with a portfolio that was 50% growth and 50% value, there'd be a statistical difference of nearly 10%, he says.

"Generally speaking, a 5% difference is considered statistically significant," Pszenny says. So at this point in the year, it is crucial investors look at the spread between large growth stocks and large value stocks, and rebalance as necessary."

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Coryanne Hicks is an investing and personal finance journalist specializing in women and millennial investors. Previously, she was a fully licensed financial professional at Fidelity Investments where she helped clients make more informed financial decisions every day. She has ghostwritten financial guidebooks for industry professionals and even a personal memoir. She is passionate about improving financial literacy and believes a little education can go a long way. You can connect with her on Twitter, Instagram or her website, CoryanneHicks.com.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.