If You'd Put $1,000 Into Adobe Stock 20 Years Ago, Here's What You'd Have Today

Adobe stock has led the S&P 500 by a wide margin over the past couple of decades... but that lead is slipping.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Adobe (ADBE) stock was supposed to get a big boost by adding AI to its offerings, and yet so far the transformational technology has only put shares under pressure.

The result? Although truly long-time shareholders are still sitting on market-beating returns, ADBE isn't the same buy-and-hold beast of yore.

While Magnificent 7 stocks such as Nvidia (NVDA) and Microsoft (MSFT) helped the tech-heavy Nasdaq Composite gain 25% over the past 52 weeks, ADBE is down a painful 30%.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

It gets worse. Shares lost more than a quarter of their value last year. And while ADBE popped 77% in 2023, it lost more than 40% in 2022. Yikes.

If it's any consolation to restive shareholders, many steps forward and a few steps back is sort of par for the course for volatile ADBE stock.

Much of the recent underperformance can be attributed to competition in generative AI. For years, the company enjoyed a near monopoly in its niche. Its Creative Suite – which includes the likes of Photoshop, Premiere Pro for video editing and Dreamweaver for website design, among others – really had no peer.

But times change. The emergence of Microsoft's (MSFT) Azure and other cloud-based competitors have taken a bite out of Creative Cloud.

True, Adobe's suite of products still commands a market share of more than 60%, but there's no question the company – and its shareholders – have been feeling the heat.

Indeed, ADBE now lags the broader market on an annualized total return basis by more than 20 percentage points over the past three- and five-year periods.

The bottom line on Adobe stock

It wasn't supposed to be like this. After all, Adobe's hot 2023 run was a lot more like what longtime shareholders have come to expect from the large-cap stock.

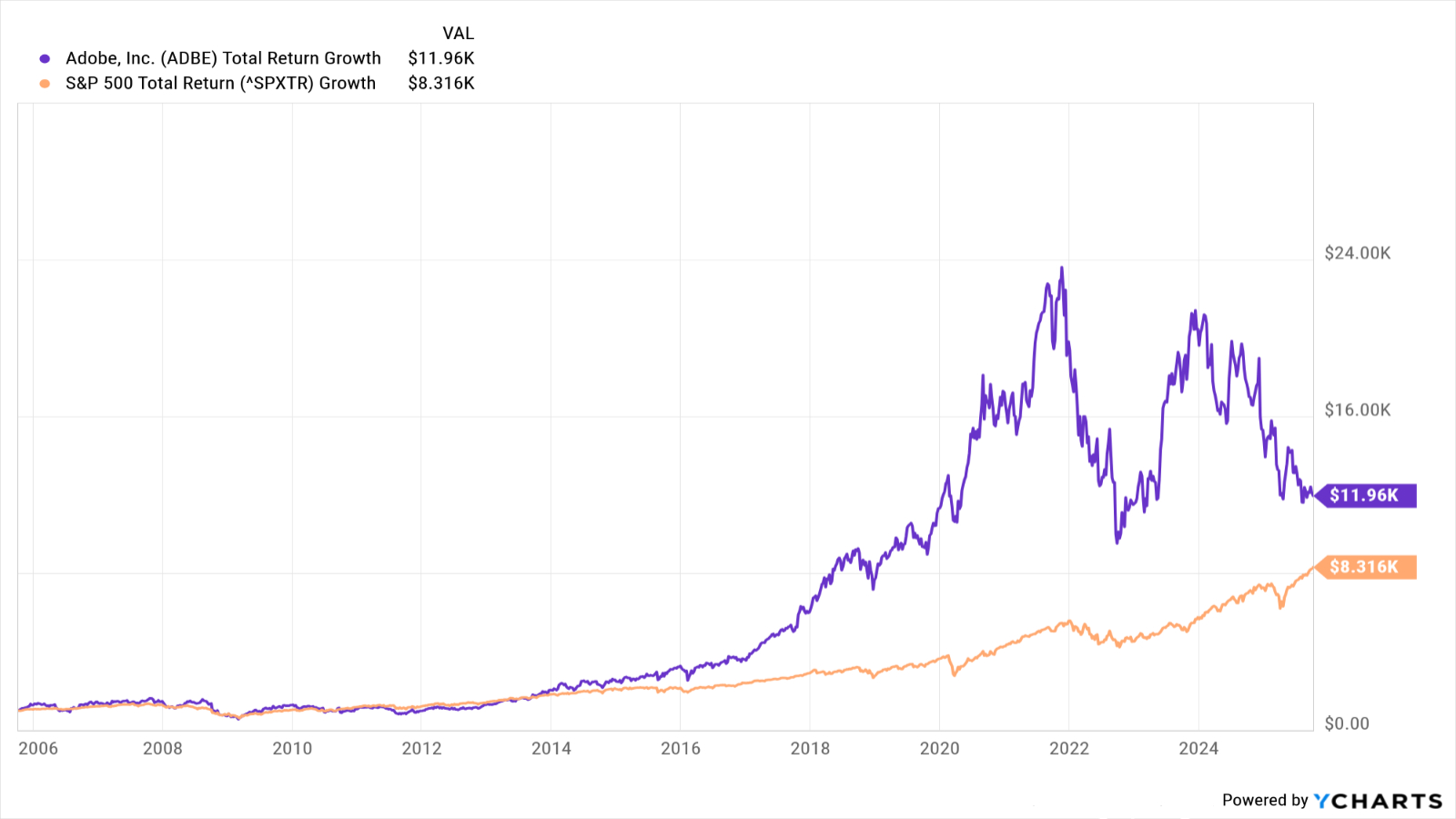

Have a look at the chart below and you'll see that a $1,000 investment in Adobe stock 20 years ago would today be worth nearly $12,000. The same money invested in the S&P 500 would theoretically have grown to about $8,300.

Although Adobe is maintaining its market-beating ways, the outperformance gap has narrowed alarmingly since shares peaked back in November 2021.

Happily for bulls, Wall Street believes ADBE can one-day reclaim its record high. Of the 40 analysts issuing opinions on Adobe stock surveyed by S&P Global Market Intelligence, 20 rate it at Strong Buy, five call it a Buy, 12 have it at Hold and three say it's a Strong Sell.

That works out to a consensus recommendation of Buy, with solid conviction.

More Stocks of the Past 20 Years

- If You'd Put $1,000 Into Nvidia Stock 20 Years Ago, Here's What You'd Have Today

- If You'd Put $1,000 Into Apple Stock 20 Years Ago, Here's What You'd Have Today

- If You'd Put $1,000 Into Amazon Stock 20 Years Ago, Here's What You'd Have Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dan Burrows is Kiplinger's senior investing writer, having joined the publication full time in 2016.

A long-time financial journalist, Dan is a veteran of MarketWatch, CBS MoneyWatch, SmartMoney, InvestorPlace, DailyFinance and other tier 1 national publications. He has written for The Wall Street Journal, Bloomberg and Consumer Reports and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among many other outlets. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange.

Once upon a time – before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily – Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing. He's also written for Esquire magazine's Dubious Achievements Awards.

In his current role at Kiplinger, Dan writes about markets and macroeconomics.

Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University.

Disclosure: Dan does not trade individual stocks or securities. He is eternally long the U.S equity market, primarily through tax-advantaged accounts.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

We're 64 with $4.3 million and can't agree on when to retire.

We're 64 with $4.3 million and can't agree on when to retire.I want to retire now and pay for health insurance until we get Medicare. My wife says we should work 10 more months. Who's right?

-

Missed an RMD? How to Avoid That (and the Penalty) Next Time

Missed an RMD? How to Avoid That (and the Penalty) Next TimeIf you miss your RMDs, you could face a hefty fine. Here are four ways to stay on top of your payments — and on the right side of the IRS.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

Missed Your RMD? 4 Ways to Avoid Doing That Again (and Skip the IRS Penalties), From a Financial Planner

Missed Your RMD? 4 Ways to Avoid Doing That Again (and Skip the IRS Penalties), From a Financial PlannerIf you miss your RMDs, you could face a hefty fine. Here are four ways to stay on top of your payments — and on the right side of the IRS.

-

What Really Happens in the First 30 Days After Someone Dies (and Where Families Get Stuck)

What Really Happens in the First 30 Days After Someone Dies (and Where Families Get Stuck)The administrative requirements following a death move quickly. This is how to ensure your loved ones won't be plunged into chaos during a time of distress.

-

AI-Powered Investing in 2026: How Algorithms Will Shape Your Portfolio

AI-Powered Investing in 2026: How Algorithms Will Shape Your PortfolioAI is becoming a standard investing tool, as it helps cut through the noise, personalize portfolios and manage risk. That said, human oversight remains essential. Here's how it all works.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

Good Stock Picking Gives This Primecap Odyssey Fund a Lift

Good Stock Picking Gives This Primecap Odyssey Fund a LiftOutsize exposure to an outperforming tech stock and a pair of drugmakers have boosted recent returns for the Primecap Odyssey Growth Fund.

-

More Tools to Build a Bond Ladder

More Tools to Build a Bond LadderVanguard aims to launch a line of target-maturity corporate bond ETFs.

-

A Newly Retired Couple With a Portfolio Full of Winners Faced a $50,000 Tax Bill: This Is the Strategy That Helped Save Them

A Newly Retired Couple With a Portfolio Full of Winners Faced a $50,000 Tax Bill: This Is the Strategy That Helped Save ThemLarge unrealized capital gains can create a serious tax headache for retirees with a successful portfolio. A tax-aware long-short strategy can help.