If You'd Put $1,000 Into Nvidia Stock 20 Years Ago, Here's What You'd Have Today

Anyone shocked by Nvidia stock's wild ride should know that volatility has always been the price of admission to this long-time market beater.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Nvidia (NVDA) cemented its place as the market's favorite bet on artificial intelligence (AI) three years ago and it shows no signs of letting up.

Indeed, the company has become so important to investors that Nvidia's earnings report helps set the tone for trading for the broader market.

To recap: OpenAI's ChaptGPT kicked off the AI frenzy at the end of 2022. Seemingly insatiable demand on the part of AI hyperscalers for Nvidia's graphics processing units (GPUs) propelled NVDA stock past $1 trillion in market capitalization midway through 2023.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

It took only about eight months for yet another blowout quarterly earnings report to push Nvidia stock past the $2 trillion mark.

Cut to early 2024 when Nvidia's over-the-top first-quarter earnings – plus a NVDA stock split and a dividend hike – pushed its market cap past $3 trillion.

As of this writing, Nvidia, which replaced Intel (INTC) in the Dow Jones Industrial Average in late 2024, is the world's largest publicly traded company. Indeed, it became the first company to top $4 trillion in market cap in July 2025. Four months later, Nvidia briefly exceeded $5 trillion in market cap before shares eased back.

But then, long-time shareholders should be used to such outsized rewards and risks by now.

That's because volatility has always been the price of admission to this long-time market beater. True, Nvidia, a highly cyclical semiconductor stock, has vastly outperformed the broader market since going public at the end of the last century.

Quite naturally, it has done so with several vertiginous ups and downs along the way.

After losing half its value in 2022, NVDA stock more than tripled on a price basis in 2023, vs a gain of 24% for the S&P 500.

And as for 2024? Nvidia stock gained more than 170% vs a 25% rise in the broader market. The stock once again led the broader market in 2025, albeit by "only" 21 percentage points.

Nvidia's market-beating ways go much farther back than most folks might know, however. In fact, few stocks have done more for investors over the past few decades than Nvidia.

From its initial public offering at $12 a share in January 1999 through December 2020, NVDA stock created $309.4 billion in shareholder wealth, according to an analysis by Hendrik Bessembinder, a finance professor at the W.P. Carey School of Business at Arizona State University.

Indeed, per Bessembinder's findings, which account for a stock's increase in market value adjusted for cash flows in and out of the business and other factors, Nvidia was one of the 30 best stocks over that 30-year time frame.

Looked at another way, over its life as a publicly traded company, Nvidia stock generated an annualized total return of 37.1%. The S&P 500, with dividends reinvested, returned an annualized 10.8% over the same period.

Importantly, most of the shareholder wealth generated by Nvidia came over just the past few years. That's because back in the day, the primary market for Nvidia's chips consisted of PC and console video game enthusiasts.

Happily for Nvidia, it just so happens that the company's powerful GPUs and related intellectual property are indispensable to the fields of artificial intelligence, professional visualization, cryptocurrency mining and more.

As noted above, NVDA processors are in demand for use in data centers – and especially data centers that power generative AI. Indeed, the company is struggling to keep up with orders from hyperscalers such as Microsoft (MSFT), Meta Platforms (META), Amazon.com (AMZN) and Alphabet (GOOGL).

Few blue chip stocks offer so much exposure to so many emerging endeavors, which helps explain NVDA stock's amazing returns over the longer haul. AI has been NVDA's afterburner.

But as remarkable as the company's business may be, it doesn't quite get to the heart of what NVDA stock has meant to long-term shareholders and their brokerage statements. For that, consider the following facts about Nvidia stock.

The bottom line on Nvidia stock?

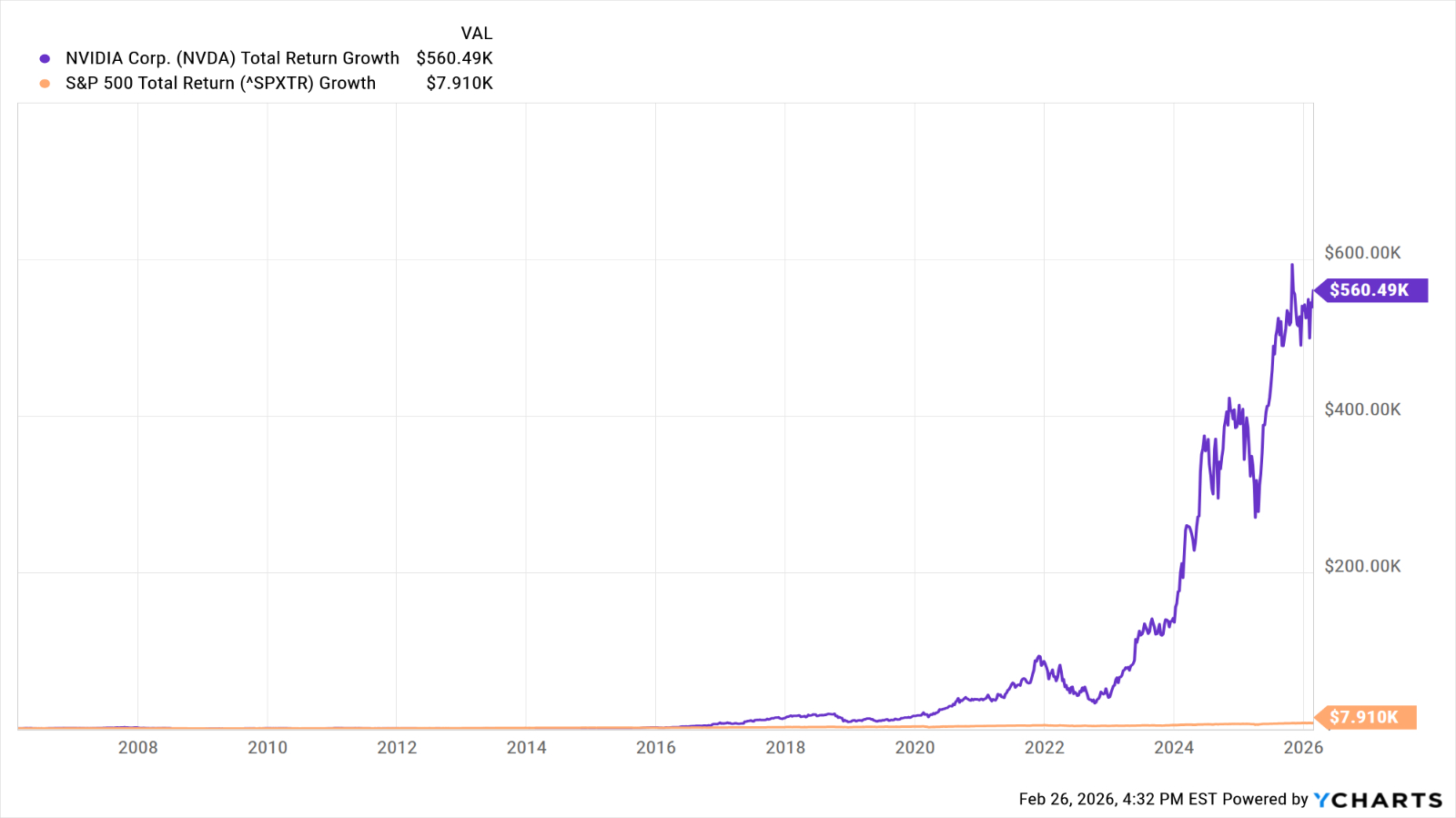

Over the past two decades, Nvidia stock generated an annualized total return (price change plus dividends) of 37.2%. The S&P 500, by comparison, generated an annualized total return of 10.9% over the same span.

What does that mean in dollar terms? Have a look at the above chart and you'll see that if you invested $1,000 in Nvidia stock 20 years ago, it would today be worth more than $560,000. The same amount invested in an S&P 500 index fund would theoretically be worth not quite $8,000 today.

As for adding to NVDA at current levels, the Street remains bullish even after the stock's incredible run. Indeed, NVDA rates as a top Dow Jones stock to buy.

Of the 63 analysts issuing opinions on Nvidia stock surveyed by S&P Global Market Intelligence, 49 rate it at Strong Buy, 11 say Buy, two call it a Hold and one has it at Strong Sell.

That works out to a rare consensus recommendation of Strong Buy. Indeed, Nvidia ranks among analysts' top S&P 500 stocks to buy now.

Speaking for the bulls, Oppenheimer analyst Rick Schafer says the AI build-out is still in its early days.

"Nvidia has transformed from a graphics company to a premier leading full stack AI solutions platform company," notes the analyst, who rates NVDA at Outperform (the equivalent of Buy.) "Compute continues to chase demand. NVDA ubiquitous AI platform best positioned to win."

Just remember that NVDA is ultimately a chip company, and the semiconductor industry is cyclical. As exciting as the AI build-out may be, Nvidia's growth prospects could still one day change.

More Stocks of the Past 20 Years

- If You'd Put $1,000 Into Microsoft Stock 20 Years Ago, Here's What You'd Have Today

- If You'd Put $1,000 Into Apple Stock 20 Years Ago, Here's What You'd Have Today

- If You'd Put $1,000 Into Walmart Stock 20 Years Ago, Here's What You'd Have Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dan Burrows is Kiplinger's senior investing writer, having joined the publication full time in 2016.

A long-time financial journalist, Dan is a veteran of MarketWatch, CBS MoneyWatch, SmartMoney, InvestorPlace, DailyFinance and other tier 1 national publications. He has written for The Wall Street Journal, Bloomberg and Consumer Reports and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among many other outlets. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange.

Once upon a time – before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily – Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing. He's also written for Esquire magazine's Dubious Achievements Awards.

In his current role at Kiplinger, Dan writes about markets and macroeconomics.

Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University.

Disclosure: Dan does not trade individual stocks or securities. He is eternally long the U.S equity market, primarily through tax-advantaged accounts.

-

Big Nvidia Numbers Take Down the Nasdaq: Stock Market Today

Big Nvidia Numbers Take Down the Nasdaq: Stock Market TodayMarkets are struggling to make sense of what the AI revolution means across sectors and industries, and up and down the market-cap scale.

-

How Medicare Advantage Costs Taxpayers — and Retirees

How Medicare Advantage Costs Taxpayers — and RetireesWith private insurers set to receive $1.2 trillion in excess payments by 2036, retirees may soon face a reckoning over costs and coverage.

-

3 Smart Ways to Spend Your Retirement Tax Refund

3 Smart Ways to Spend Your Retirement Tax RefundRetirement Taxes With the new "senior bonus" hitting bank accounts this tax season, your retirement refund may be higher than usual. Here's how to reinvest those funds for a financially efficient 2026.

-

Big Nvidia Numbers Take Down the Nasdaq: Stock Market Today

Big Nvidia Numbers Take Down the Nasdaq: Stock Market TodayMarkets are struggling to make sense of what the AI revolution means across sectors and industries, and up and down the market-cap scale.

-

Trump's New Retirement Plan: What You Need to Know

Trump's New Retirement Plan: What You Need to KnowPresident Trump's State of the Union address touched upon several topics, including a new retirement plan for Americans. Here's how it might work.

-

Buy and Hold … or Buy and Hope? It's Time for a Better Retirement Planning Strategy

Buy and Hold … or Buy and Hope? It's Time for a Better Retirement Planning StrategyOnce you're retired, your focus should shift from maximum growth to strategic preservation and purposeful planning to help safeguard your wealth.

-

Your Legacy Is More Than Your Money: How to Plan for Values, Not Just Valuables

Your Legacy Is More Than Your Money: How to Plan for Values, Not Just ValuablesLegacy planning integrates your values and stories with legal and tax strategies to ensure your influence benefits loved ones and good causes after you're gone.

-

Will Real Estate and Private Equity Start to Shine Again in 2026?

Will Real Estate and Private Equity Start to Shine Again in 2026?Real estate, private equity and general partner stakes could benefit from future interest rate cuts. What are the risks and rewards of investing in each?

-

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market Today

Nasdaq Soars Ahead of Nvidia Earnings: Stock Market TodayWednesday's risk-on session was sparked by strong gains in tech stocks and several crypto-related names.

-

Health Care Stocks Have Sagged. Can You Bet on a Recovery?

Health Care Stocks Have Sagged. Can You Bet on a Recovery?The flagging health care sector has perked up a bit lately. Is it time to invest?

-

Your Retirement Age Is Just a Number: Today's Retirement Goal Is 'Work Optional'

Your Retirement Age Is Just a Number: Today's Retirement Goal Is 'Work Optional'Becoming "work optional" is about control — of your time, your choices and your future. This seven-step guide from a financial planner can help you get there.