If You'd Put $1,000 Into Walmart Stock 20 Years Ago, Here's What You'd Have Today

Walmart stock has beaten the broader market by a slim margin over the past couple of decades.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

When it comes to blue chip stocks that pay dividends and play defense, Walmart's (WMT) reputation is pretty tough to beat.

Indeed, Walmart is indisputably one of the best dividend stocks for dependable dividend growth.

This member of the S&P 500 Dividend Aristocrats has increased its payout annually for more than half a century. For those reasons and more, Walmart ranks as one of analysts' top-ranked Dow Jones stocks.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Walmart's defensive characteristics certainly came in handy in 2022, as you can see in the chart below.

The S&P 500 generated a total return (price change plus dividends) of -18.1%, a historically bad result.

On the other hand, Walmart's total return came to -0.5% – or essentially flat – to beat the broader market by more than 17 percentage points.

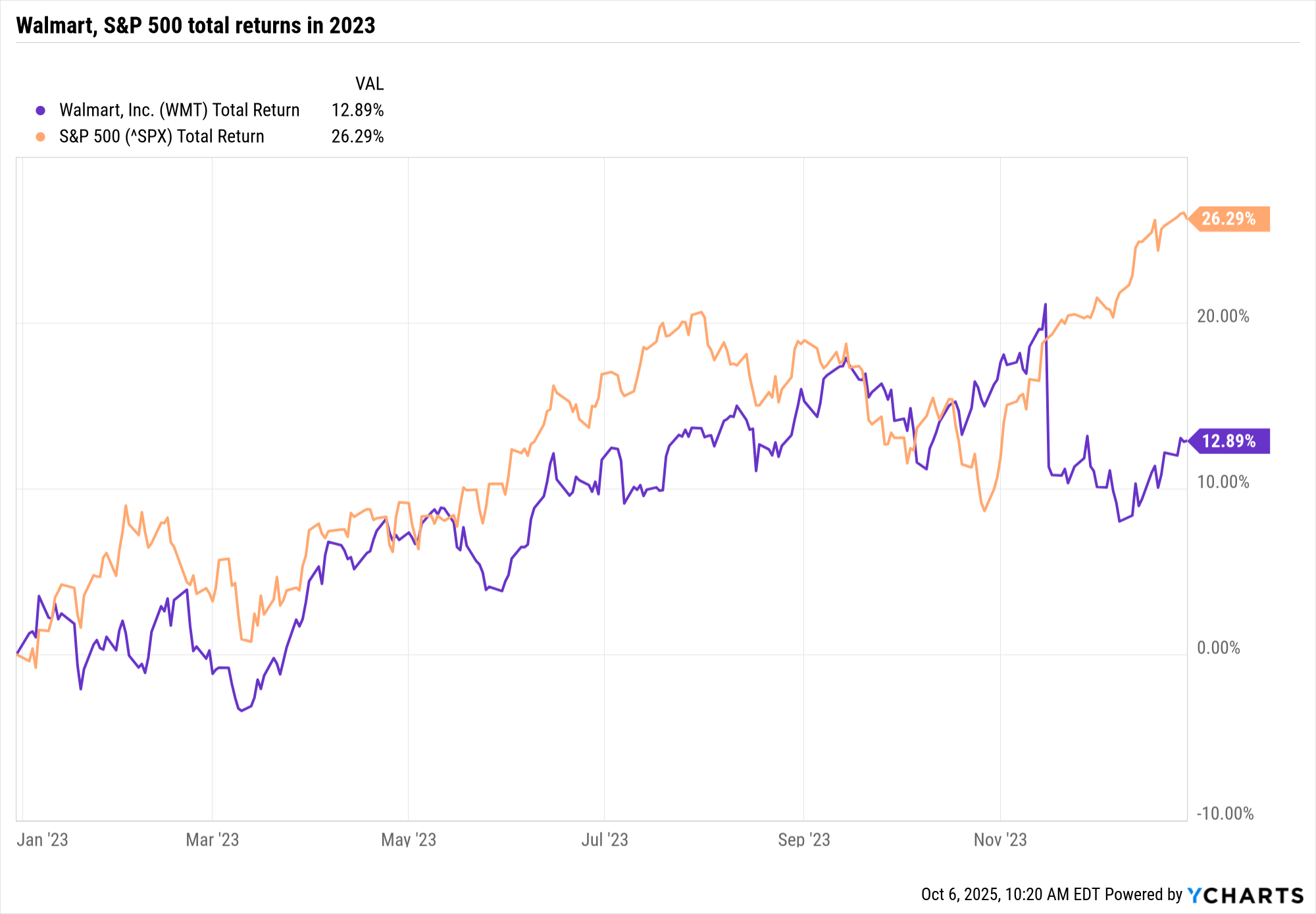

The other side of WMT's defensive coin can be seen in its performance during 2023's remarkable rally. While the S&P 500 returned more than 26%, Walmart returned less than 13%.

As for 2024, WMT beat the broader market by nearly 50 percentage points, helped by resiliency in the labor market and consumer spending.

Happily for long-term shareholders, WMT stock's outperformance over the past 52 weeks has helped it turn in market-beating returns on a 20-year basis.

That's a change in fortune. WMT stock was a long-time laggard following a torrid run in the 1990s, hurt by the market's preference for growth over value, as well as worries about the future of bricks-and-mortar retail.

The bottom line on Walmart stock

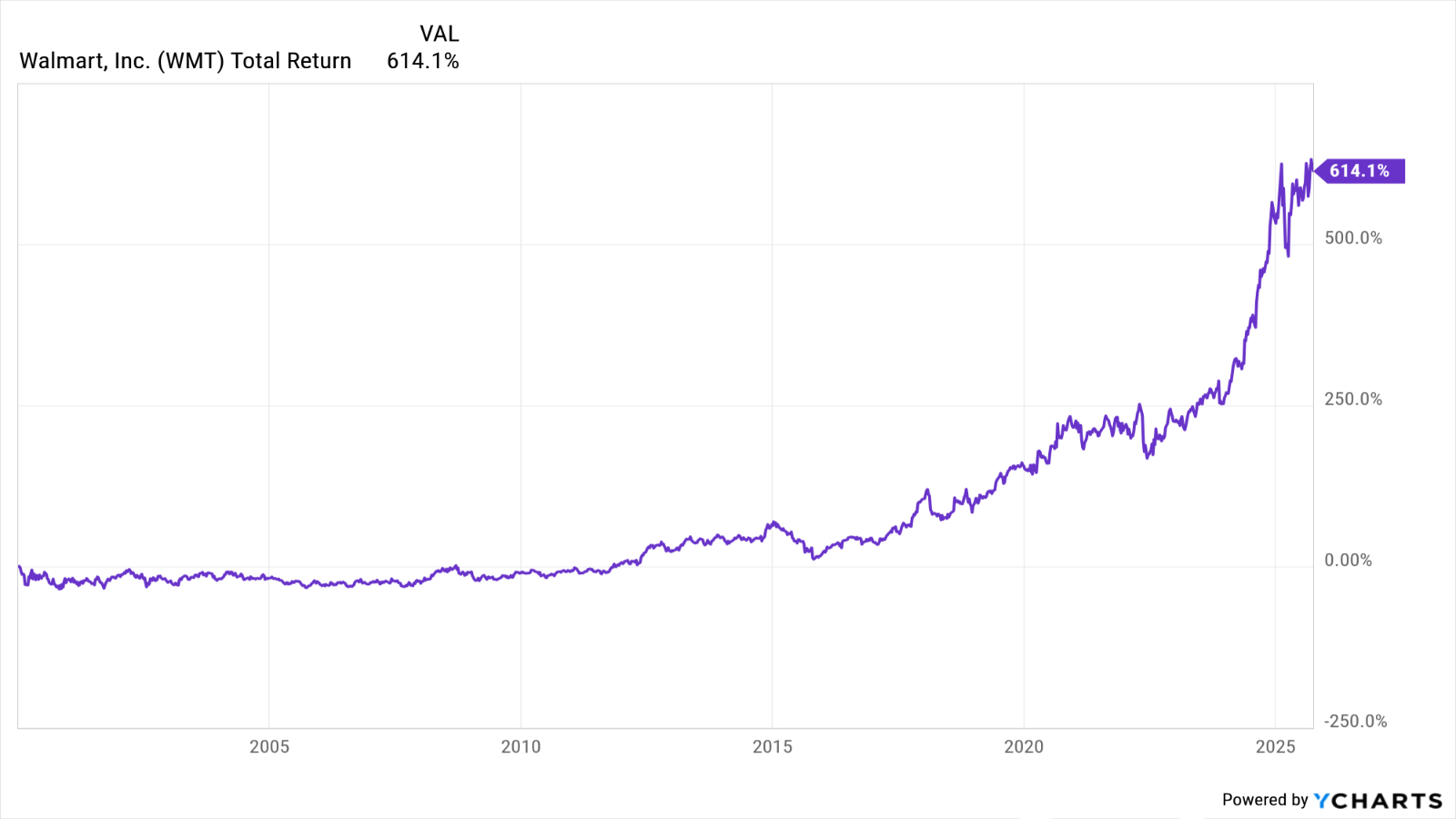

Walmart stock was actually one of the best stocks of the 30 years between 1990 and 2020, but as you can see in the chart below, WMT basically traded sideways for the first decade-plus of the 21st century.

Walmart shares went nowhere for a long time, but then that's not necessarily unusual given how far and fast they appreciated during the bubblicious 90s.

Between the beginning of 1997 and the end of 1999, WMT gained more than 500% on a price basis. The broader market didn't quite double over the same span.

Also weighing on WMT during the first decade of the new century was the threat from e-commerce.

Walmart responded by becoming the second-largest e-commerce retailer in the U.S. after Amazon.com (AMZN) – albeit a distant second. Walmart got serious about its digital strategy sometime around 2006, but it took a while for what was regarded as "show-me" story to ultimately prove successful.

Whatever the causes, that lost decade on Walmart's stock chart really hurts its long-term results. Over the past 20 years, WMT stock has generated an annualized total return of 12.5% vs 11% for the S&P 500.

And even then, that one percentage point of outperformance emerged only recently. To get a sense of what this sort of ride looks like on a stock chart, see the image below.

The chart illustrates the fact that if you invested $1,000 in Walmart stock 20 years ago, today it would be worth about $10,500. The same thousand bucks invested in an S&P 500 ETF would be worth about $8,000 today.

For its entire history as a publicly traded company, WMT's annualized total return beats the broader market by 2.5 percentage points.

More Stocks of the Past 20 Years

- If You'd Put $1,000 Into Nvidia Stock 20 Years Ago, Here's What You'd Have Today

- If You'd Put $1,000 Into Sherwin-Williams Stock 20 Years Ago, Here's What You'd Have Today

- If You'd Put $1,000 Into Berkshire Hathaway Stock 20 Years Ago, Here's What You'd Have Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dan Burrows is Kiplinger's senior investing writer, having joined the publication full time in 2016.

A long-time financial journalist, Dan is a veteran of MarketWatch, CBS MoneyWatch, SmartMoney, InvestorPlace, DailyFinance and other tier 1 national publications. He has written for The Wall Street Journal, Bloomberg and Consumer Reports and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among many other outlets. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange.

Once upon a time – before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily – Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing. He's also written for Esquire magazine's Dubious Achievements Awards.

In his current role at Kiplinger, Dan writes about markets and macroeconomics.

Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University.

Disclosure: Dan does not trade individual stocks or securities. He is eternally long the U.S equity market, primarily through tax-advantaged accounts.

-

5 Ronald Reagan Quotes Retirees Should Live By

5 Ronald Reagan Quotes Retirees Should Live ByThe Nation's 40th President's wit and wisdom can help retirees navigate their financial and personal journey with confidence.

-

How to Use 1031 Exchanges to Build Your Real Estate Empire

How to Use 1031 Exchanges to Build Your Real Estate EmpireSmall rental properties can be excellent investments, but you can use 1031 exchanges to transition to commercial real estate for bigger wealth-building.

-

Where's the Best Place to Save for a House Down Payment?

Where's the Best Place to Save for a House Down Payment?Learn how timing matters when it comes to choosing the right account.

-

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate Empire

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate EmpireSmall rental properties can be excellent investments, but you can use 1031 exchanges to transition to commercial real estate for bigger wealth-building.

-

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs In

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs InRoth conversions are all the rage, but what works well for one household can cause financial strain for another. This is what you should consider before moving ahead.

-

The 8 Stages of Retirement: An Expert Guide to Confidence, Flexibility and Fulfillment, From a Financial Planner

The 8 Stages of Retirement: An Expert Guide to Confidence, Flexibility and Fulfillment, From a Financial PlannerRetirement planning is less about hitting a "magic number" and more about an intentional journey — from understanding your relationship with money to preparing for your final legacy.

-

5 Mistakes to Avoid in the 5 Years Before You Retire, From a Financial Planner

5 Mistakes to Avoid in the 5 Years Before You Retire, From a Financial PlannerWhen retirement is in reach, financial planning gets serious — and there's a heightened risk of making serious mistakes, too. Here are five common slipups.

-

I'm a Financial Planner: This Retirement Strategy Helps Plot a Stress-Free Path to Cash Flow

I'm a Financial Planner: This Retirement Strategy Helps Plot a Stress-Free Path to Cash FlowDividing funds into a safety bucket, an income bucket and a growth bucket can help to cover immediate expenses, manage cash flow and promote growth.

-

Your Most Overlooked Retirement Investment: Luxuriating in Doing Nothing

Your Most Overlooked Retirement Investment: Luxuriating in Doing NothingWhen you take the time to rest and breathe, your brain starts to focus on what matters most in your new stage of life.

-

If the Markets Cause You Restless Nights, You Might Want to Consider This Safety Net

If the Markets Cause You Restless Nights, You Might Want to Consider This Safety NetIf you find market volatility too stressful, buying annuities that provide stability and protect your principal could help you rest easier. Here's what to consider.

-

When Markets Are Jumpy: A Financial Planner Explains How to Stay Grounded

When Markets Are Jumpy: A Financial Planner Explains How to Stay GroundedMarket turbulence makes even the most experienced investors nervous. Here are some tips for ignoring the panic and trusting your plan when things get volatile.