If You'd Put $1,000 Into Walmart Stock 20 Years Ago, Here's What You'd Have Today

Walmart stock has beaten the broader market by a slim margin over the past couple of decades.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

When it comes to blue chip stocks that pay dividends and play defense, Walmart's (WMT) reputation is pretty tough to beat.

Indeed, Walmart is indisputably one of the best dividend stocks for dependable dividend growth.

This member of the S&P 500 Dividend Aristocrats has increased its payout annually for more than half a century. For those reasons and more, Walmart ranks as one of analysts' top-ranked Dow Jones stocks.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Walmart's defensive characteristics certainly came in handy in 2022, as you can see in the chart below.

The S&P 500 generated a total return (price change plus dividends) of -18.1%, a historically bad result.

On the other hand, Walmart's total return came to -0.5% – or essentially flat – to beat the broader market by more than 17 percentage points.

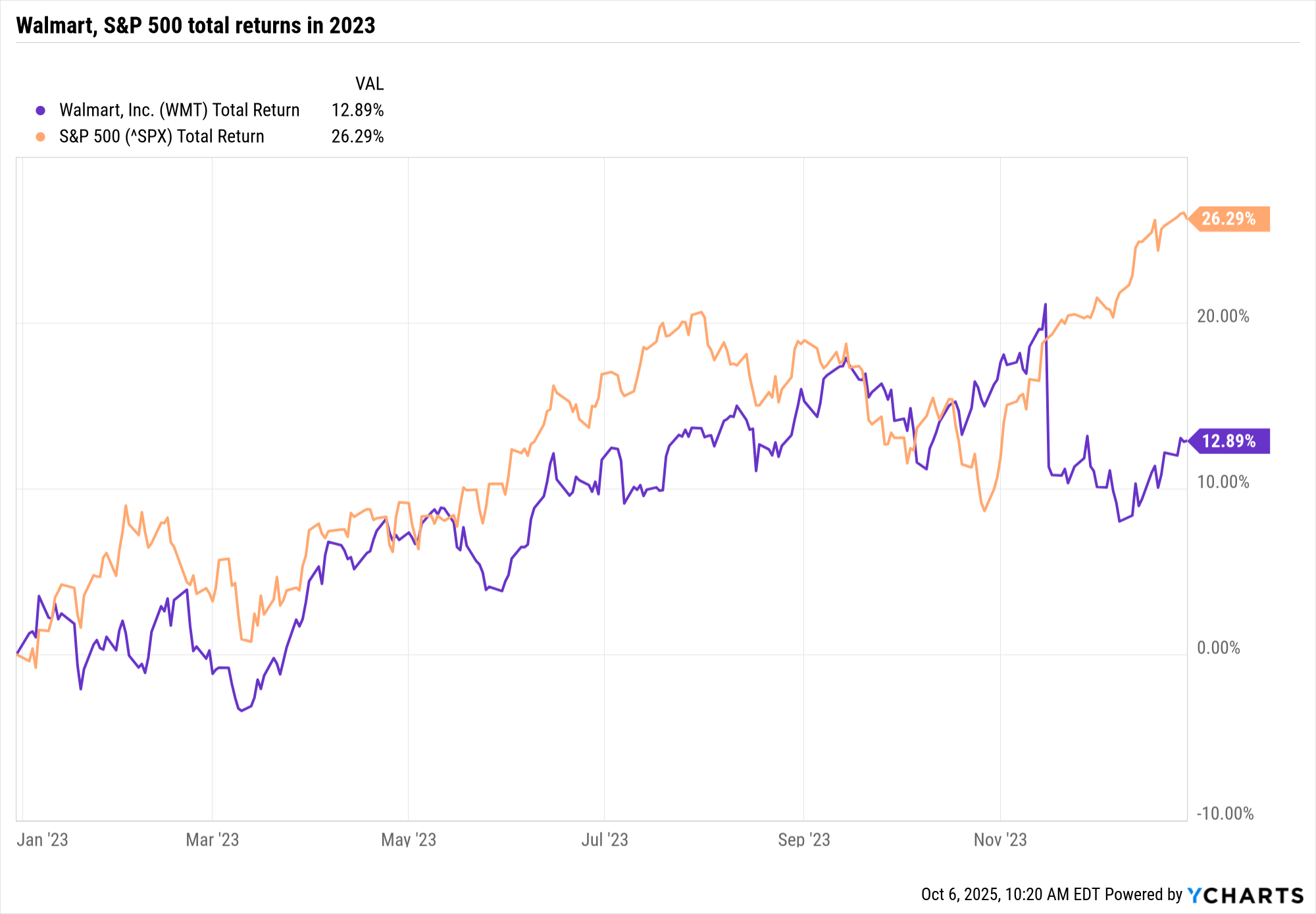

The other side of WMT's defensive coin can be seen in its performance during 2023's remarkable rally. While the S&P 500 returned more than 26%, Walmart returned less than 13%.

As for 2024, WMT beat the broader market by nearly 50 percentage points, helped by resiliency in the labor market and consumer spending.

Happily for long-term shareholders, WMT stock's outperformance over the past 52 weeks has helped it turn in market-beating returns on a 20-year basis.

That's a change in fortune. WMT stock was a long-time laggard following a torrid run in the 1990s, hurt by the market's preference for growth over value, as well as worries about the future of bricks-and-mortar retail.

The bottom line on Walmart stock

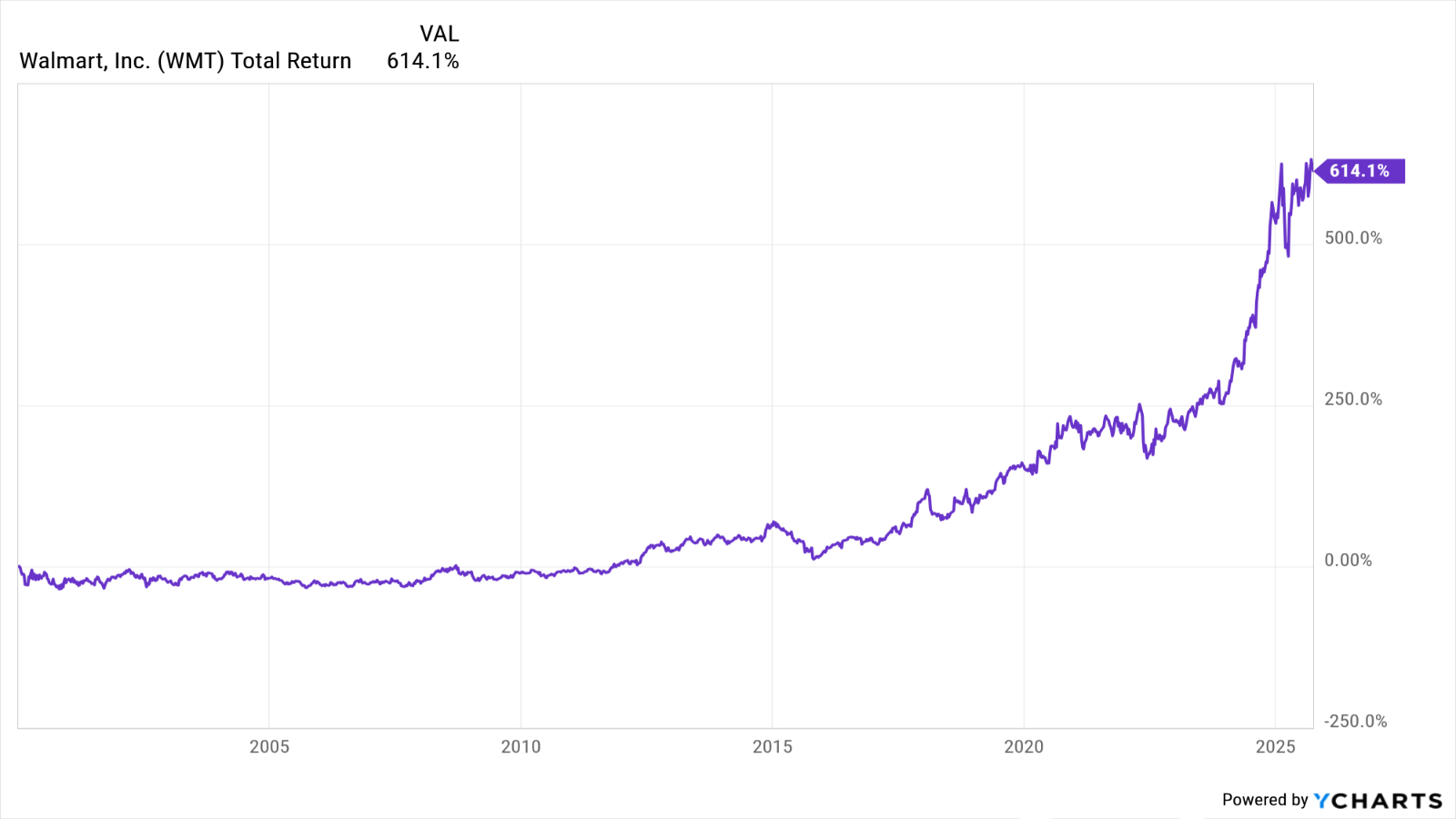

Walmart stock was actually one of the best stocks of the 30 years between 1990 and 2020, but as you can see in the chart below, WMT basically traded sideways for the first decade-plus of the 21st century.

Walmart shares went nowhere for a long time, but then that's not necessarily unusual given how far and fast they appreciated during the bubblicious 90s.

Between the beginning of 1997 and the end of 1999, WMT gained more than 500% on a price basis. The broader market didn't quite double over the same span.

Also weighing on WMT during the first decade of the new century was the threat from e-commerce.

Walmart responded by becoming the second-largest e-commerce retailer in the U.S. after Amazon.com (AMZN) – albeit a distant second. Walmart got serious about its digital strategy sometime around 2006, but it took a while for what was regarded as "show-me" story to ultimately prove successful.

Whatever the causes, that lost decade on Walmart's stock chart really hurts its long-term results. Over the past 20 years, WMT stock has generated an annualized total return of 12.5% vs 11% for the S&P 500.

And even then, that one percentage point of outperformance emerged only recently. To get a sense of what this sort of ride looks like on a stock chart, see the image below.

The chart illustrates the fact that if you invested $1,000 in Walmart stock 20 years ago, today it would be worth about $10,500. The same thousand bucks invested in an S&P 500 ETF would be worth about $8,000 today.

For its entire history as a publicly traded company, WMT's annualized total return beats the broader market by 2.5 percentage points.

More Stocks of the Past 20 Years

- If You'd Put $1,000 Into Nvidia Stock 20 Years Ago, Here's What You'd Have Today

- If You'd Put $1,000 Into Sherwin-Williams Stock 20 Years Ago, Here's What You'd Have Today

- If You'd Put $1,000 Into Berkshire Hathaway Stock 20 Years Ago, Here's What You'd Have Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dan Burrows is Kiplinger's senior investing writer, having joined the publication full time in 2016.

A long-time financial journalist, Dan is a veteran of MarketWatch, CBS MoneyWatch, SmartMoney, InvestorPlace, DailyFinance and other tier 1 national publications. He has written for The Wall Street Journal, Bloomberg and Consumer Reports and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among many other outlets. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange.

Once upon a time – before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily – Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing. He's also written for Esquire magazine's Dubious Achievements Awards.

In his current role at Kiplinger, Dan writes about markets and macroeconomics.

Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University.

Disclosure: Dan does not trade individual stocks or securities. He is eternally long the U.S equity market, primarily through tax-advantaged accounts.

-

Why Some Michigan Tax Refunds Are Taking Longer Than Usual This Year

Why Some Michigan Tax Refunds Are Taking Longer Than Usual This YearState Taxes If your Michigan tax refund hasn’t arrived, you’re not alone. Here’s what "pending manual review" means and how to verify your identity if needed.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

Good Stock Picking Gives This Primecap Odyssey Fund a Lift

Good Stock Picking Gives This Primecap Odyssey Fund a LiftOutsize exposure to an outperforming tech stock and a pair of drugmakers have boosted recent returns for the Primecap Odyssey Growth Fund.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

Good Stock Picking Gives This Primecap Odyssey Fund a Lift

Good Stock Picking Gives This Primecap Odyssey Fund a LiftOutsize exposure to an outperforming tech stock and a pair of drugmakers have boosted recent returns for the Primecap Odyssey Growth Fund.

-

More Tools to Build a Bond Ladder

More Tools to Build a Bond LadderVanguard aims to launch a line of target-maturity corporate bond ETFs.

-

A Newly Retired Couple With a Portfolio Full of Winners Faced a $50,000 Tax Bill: This Is the Strategy That Helped Save Them

A Newly Retired Couple With a Portfolio Full of Winners Faced a $50,000 Tax Bill: This Is the Strategy That Helped Save ThemLarge unrealized capital gains can create a serious tax headache for retirees with a successful portfolio. A tax-aware long-short strategy can help.

-

5 Retirement Myths to Leave Behind (and How to Start Planning for the Reality)

5 Retirement Myths to Leave Behind (and How to Start Planning for the Reality)Separating facts from fiction is an important first step toward building a retirement plan that's grounded in reality and not based on incorrect assumptions.

-

I'm a Financial Adviser: Silence Is Golden, But It Hurts Your Heirs More Than You Think

I'm a Financial Adviser: Silence Is Golden, But It Hurts Your Heirs More Than You ThinkTalking to heirs about transferring wealth can be overwhelming, but avoiding it now can lead to conflict later. Here's how to start sharing your plans.

-

Dow Dives 521 Points as Goldman, AmEx Slide: Stock Market Today

Dow Dives 521 Points as Goldman, AmEx Slide: Stock Market TodayNews of Block's massive layoffs exacerbated AI worries across the financial sector.

-

The Merger Market is Heating Up. Here's How to Cash In

The Merger Market is Heating Up. Here's How to Cash InInvesting in takeover deals can be a low-volatility way to diversify your portfolio.