Nvidia (NVDA) released its fiscal 2026 second-quarter earnings report after the close Wednesday, August 27.

Nvidia earnings are one of Wall Street's most anticipated events, thanks to accelerating demand for all things artificial intelligence (AI).

Nvidia reported earnings of $1.05 per share, up 54% year over year and ahead of a Wall Street forecast of $1.01. Revenue was $46.7 billion, up 56% annually and just ahead of a consensus estimate of $46.0 billion.

The Kiplinger team reported live on Nvidia's second-quarter earnings report, bringing you the news and our expert analysis of what the results could mean for you and your portfolio. Scroll for the updates.

10 Major AI Companies You Should Know | Here's the Truth About Using AI to Plan Your Retirement | AI Goes To School

What time is Nvidia's earnings release?

Nvidia will release its fiscal second-quarter earnings report after the stock market closes on Wednesday, August 27. The results typically come through around 4:20 pm to 4:30 pm Eastern Standard Time.

The release of Nvidia's earnings report will be followed by a conference call, which will begin at 5 pm EST.

- Karee Venema

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021, and oversees a wide range of investing coverage, including content focused on equities, fixed income, mutual funds, ETFs, macroeconomics and more.

Nvidia's next-gen efforts, robotics updates and competition are top of mind for analysts

Jamie Meyers, senior analyst at Laffer Tengler Investments, is upbeat ahead of Nvidia's earnings announcement.

"We've seen strong demand intra-quarter, along with companies like OpenAI complaining about cloud capacity and chip availability," Meyers notes. "Moreover, with a resumption of China H20 shipments, we expect the loss of revenue – at $8 billion last quarter – from China sales will be significantly less or mostly eliminated."

Meyers also expects management to comment on both sovereign and Blackwell Ultra ramps. "As such, we believe earnings will skew to the upside," he adds.

For the earnings call, Meyers wants to learn more about next-generation efforts, including those for robotics. To this end, Nvidia has inked partnerships with firms like Siemens and Schneider Electric.

He also wants to see updates about software and AI tools, such as the NeMo framework (for building generative AI models), new Omniverse libraries and the Cosmos world foundation models (for robotics).

Finally, Meyers is looking to hear more about any impacts from rivals. "We are monitoring whether the hyperscalers' own chips will cut into Nvidia's demand, though we don't see evidence of that yet."

- Tom Taulli

Tom Taulli has been developing software since the 1980s. He sold his applications to a variety of publications. In college, he started his first company, which focused on the development of e-learning systems. He would go on to create other companies as well, including Hypermart.net that was sold to InfoSpace in 1996. Along the way, Tom has written columns for online publications such as Bloomberg, Forbes, Barron's and Kiplinger. He has also written a variety of books, including Artificial Intelligence Basics: A Non-Technical Introduction.

Does Nvidia pay a dividend?

Nvidia pays a small quarterly dividend of 1 cent per share, which works out to 4 cents per share annually.

Based on the chipmaker's current share price, this equates to a dividend yield of 0.02%. This is well below the S&P 500's current dividend yield of 1.2%.

In fiscal 2025, Nvidia paid roughly $834 billion in dividends. It also bought back $33.7 billion in stock.

- Karee Venema

Related: The Kiplinger Dividend 15: Our Favorite Dividend-Paying Stocks

A possible Ruben ramp delay and U.S. revenue sharing – what Gabelli Funds' Makino is watching in Nvidia's earnings

Even though expectations for Nvidia’s upcoming earnings report are high, the company is likely not to disappoint. This is the view from Ryuta Makino, research analyst at Gabelli Funds.

"The question currently is on the Blackwell ramp and any update on the H20 re-ramp, given that the export license restrictions have been lifted in China," Makino says. "There may be questions on the 15% revenue share with the government and how that may impact ultimate end-demand."

Another story he's looking for is on the Rubin ramp, which is expected in 2026. Makino notes that "there are some rumors that it may be delayed or the ramp will be slower than initial expectations."

Makino is also watching for competitive issues. Some of the developments to keep an eye on include Advanced Micro Devices' (AMD) upcoming GPU lineup and Broadcom’s (AVGO) ASICs. Additionally, some Chinese firms are taking market share from the Nvidia H20.

"On the networking side, we're hearing more about Arista Networks' (ANET) strength against NVLink,” he says. “So, it would be interesting to hear about the strength of Nvidia's networking as well."

- Tom Taulli

Hedge funds bought Nvidia in Q2

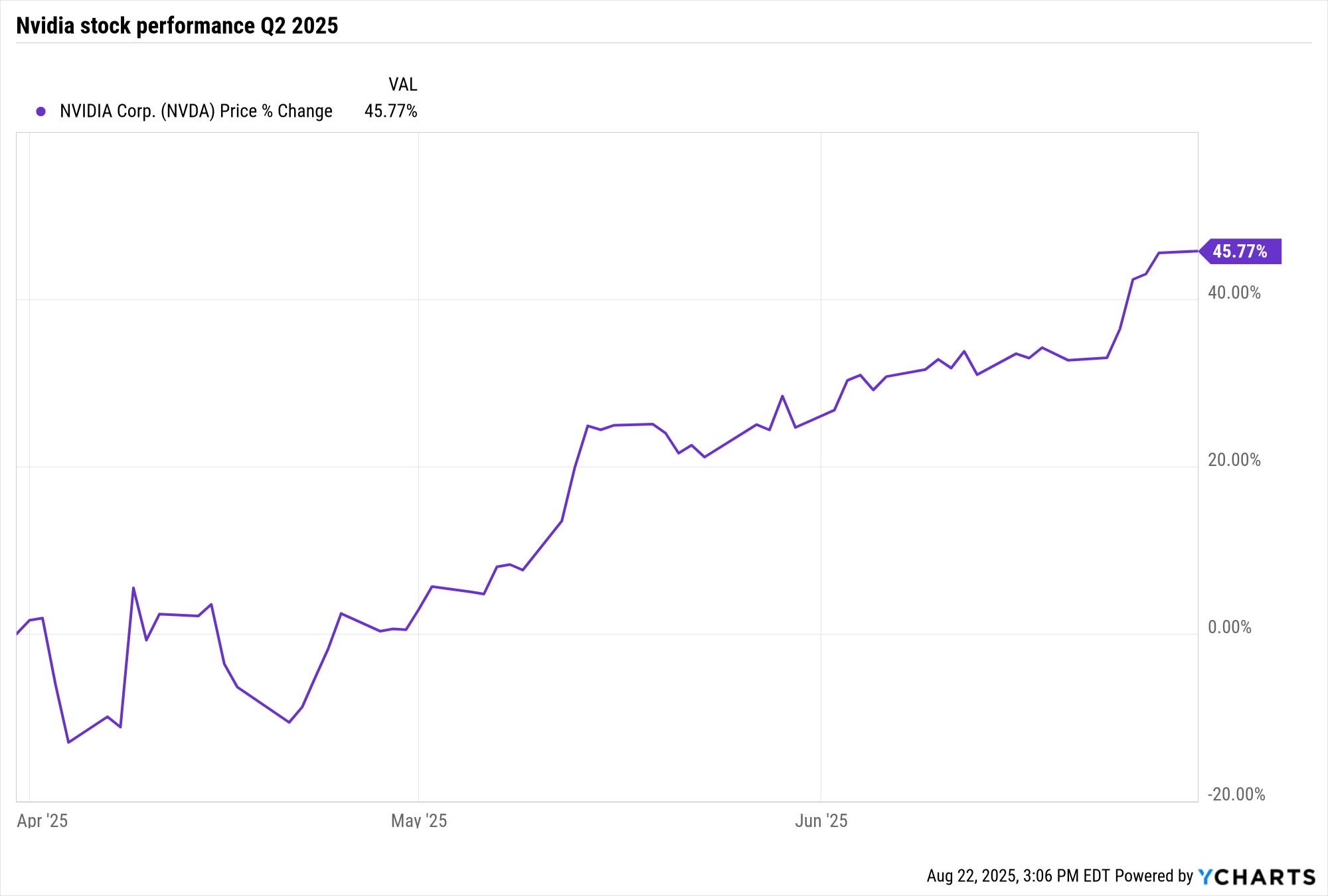

Nvidia shares plunged at the start of the second quarter as uncertainty over President Donald Trump's tariff policies spooked investors. The chipmaker quickly recovered, though, with NVDA ending the quarter up nearly 46%.

During this April 1 through June 30 time frame, hedge funds were net buyers of Nvidia stock in the second quarter.

According to WhaleWisdom, 82 hedge funds initiated new NVDA positions over the three-month period and 389 reduced their stakes. This compares to 44 hedge funds that closed out of their Nvidia stakes entirely and 264 that reduced their positions.

The net change in hedge fund share ownership amounted to 113 million shares.

- Karee Venema

Stifel raises Nvidia's price target ahead of earnings

Stifel analyst Ruben Roy raised his price target on Nvidia stock to $212 from $202 ahead of earnings, calling the shares "attractively valued" due to the company's AI pole position.

The analyst believes the resumption of H20 shipments in July and accelerating demand for GB300 infrastructure will lead to a beat-and-raise scenario for Nvidia on Wednesday.

"Our supply chain discussions continue to point to expectations for ramping GB300 orders into year-end even as sustained GB200 demand continues," Roy writes in a note to clients.

In the near term, the analyst expects investors to be focused on "hyperscaler demand and sustainability of infrastructure investment, particularly in lieu of recent concerns regarding an 'AI bubble' and reports of an underwhelming GPT-5 launch."

Roy also believes impacts related to Chinese export restrictions and possible margin pressure from early GB300 ramps are also things investors are watching.

Overall, the analyst continues to believe "that NVDA’s leadership positioning in AI infrastructure remains unchallenged, and we expect GB300 specifications to remain best-in-class as inference and reasoning complexity continues to increase."

- Karee Venema

Nvidia stock trades lower at the start of earnings week

Nvidia stock is trading modestly lower ahead of Monday's opening bell, down 0.2% at last check.

Still, shares are up 32.6% for the year to date through the August 22 close, making NVDA the best Dow Jones stock of 2025 at this point.

The main indexes are also poised for a lower open on Monday, with futures on the blue chip Dow Jones Industrial Average, broader S&P 500 and tech-heavy Nasdaq all in the red following Friday's Fed-fueled rally.

- Karee Venema

Beyond export bans: Nvidia's bid to keep China in its orbit

For Nvidia's upcoming earnings call, the company's positioning and strategy in China will certainly be a big topic. There is even buzz that the tech giant is developing a new chip for the market, according to a report from Reuters.

"This chip is currently being called the B30A and is based on Nvidia's next-generation Blackwell architecture," says Simeon Bochev, CEO and co-founder at Compute Exchange. "It would outperform the H20, which is the most powerful chip that Nvidia is allowed to sell to China under the current U.S. chip export restrictions, while maintaining regulatory limits."

Bochev considers this important for the U.S. to maintain global AI dominance. He thinks that export bans ultimately fail. After all, a country like China has the financial and engineering resources to build its own homegrown GPUs.

Regardless, the B30A may be bullish for Nvidia. "It could generate a new engine of growth for the company in China," says Ray Wang, research director of Semiconductors, Supply Chain, & Emerging Tech at Futurum Equities. "This is given the potential for higher pricing and sales volumes, as well as the likely significant demand of Chinese companies."

Still, there are potential regulatory headwinds to consider.

"While the B30A is reportedly designed to comply with U.S. export restrictions, approval can't be guaranteed," Bochev notes. "There are deep-seated fears in Washington, D.C., about the national security risks of giving China access to advanced U.S. AI technology, especially chips that can be used in the military, for surveillance, or other strategic purposes."

- Tom Taulli

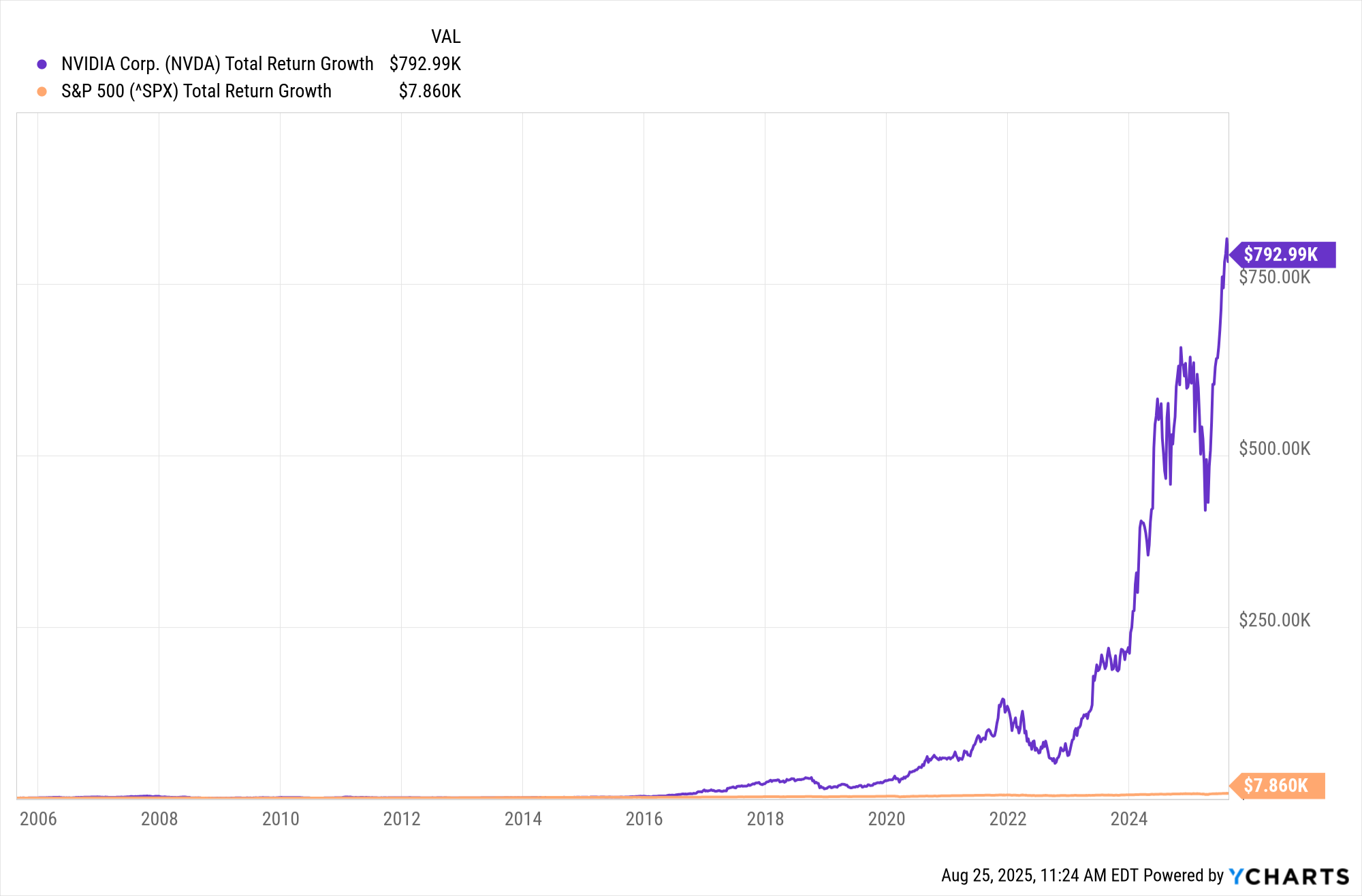

What would you have if you invested $1,000 in Nvidia 20 years ago?

Nvidia's share price has gone through some notable ups and downs over its 26 years as a publicly traded company, but its long-term trend has always been up and to the right.

Indeed, Nvidia has been one of the best stocks to own over that time frame and created more than $309 billion in shareholder value between January 1999 and December 2020, according to an analysis by Hendrik Bessembinder, a finance professor at the W.P. Carey School of Business at Arizona State University.

Over the past two decades, Nvidia stock generated an annualized total return of 39.7%. The S&P 500, with dividends reinvested, returned an annualized 10.8% over the same period.

In dollar terms, a $1,000 investment in Nvidia 20 years ago would be worth roughly $793,000 today. That same amount invested in the S&P 500 would theoretically be worth $7,900.

As Nvidia goes, so goes the market

Nvidia stock has made some notable post-earnings moves in the past two years. Here's a quick rundown of NVDA's single-session returns the day after the chipmaker reported earnings:

- Q1 Fiscal 2026 (reported May 28, 2025): +3.3%

- Q4 Fiscal 2025 (reported February 26, 2025): -8.5%

- Q3 Fiscal 2025 (reported November 20, 2024): +0.5%

- Q2 Fiscal 2025 (reported August 28, 2024): -6.4%

- Q1 Fiscal 2025 (reported May 22, 2024): +9.3%

- Q4 Fiscal 2024 (reported February 21, 2024): +16.4%

- Q3 Fiscal 2024 (reported November 21, 2023): +0.8%

- Q2 Fiscal 2024 (reported August 23, 2023): +3.2%

This works out to an average post-earnings move of 6.1%. But even a below-average move could impact the broader market, says Jay Woods, chief global strategist at Freedom Capital Markets.

This is because, at $4.34 trillion, Nvidia is "the largest market capitalized firm in the world," and "holds the highest weighting of any stock."

Indeed, Nvidia has a 7.6% weighting in the S&P 500 and accounts for 14.4% of the Nasdaq-100. But in the price-weighted Dow, NVDA, last seen at $181 per share, is ranked 19th out of 30.

- Karee Venema

UBS sees more upside ahead for Nvidia stock

Late last week, UBS Global Research analyst Timothy Arcuri raised his price target on Nvidia stock to $205 from $175, representing implied upside of more than 13% to current levels, on revised earnings estimates.

For Nvidia's fiscal Q2 print, Arcuri is expecting revenue in the $46 billion range and is anticipating the company to guide for fiscal Q3 revenue of $54 billion to $55 billion, excluding China. If China is included, the forecast could be for $57 billion in revenue.

He also believes data center revenue stayed strong, though Nvidia's gaming segment is facing tough comparisons following an impressive first quarter.

"On China, there is likely some re-usable H20 inventory that had been written down, but we believe NVDA did place new Hopper wafer orders upon receipt of H20 license news and we still believe it is working on a Blackwell version as the U.S. government likely (in our view) raises the ceiling of what is allowed to ship into China as part of its rare earth deal efforts," Arcuri adds.

The analyst sees "overall demand signals as strong as ever" and expects "NVDA's commentary to reflect this very strong backdrop."

- Karee Venema

Snowflake reports on Wednesday too

Snowflake (SNOW) is also slated to unveil earnings after Wednesday's close. Analysts expect the AI cloud platform provider to report fiscal 2026 second-quarter earnings of 27 cents per share, up 50% year over year. Revenue is forecast to arrive at $1.1 billion (+25.2% YoY).

Ahead of the event, BofA Securities analyst Brad Sills upgraded SNOW to Buy from Neutral (the equivalent of Hold). He also hiked his price target to $240 from $220, representing implied upside of 23% to current levels.

Sills points to proprietary data sources that signal momentum in Snowflake's data warehouse and emerging Cortex AI, as well as its Snowpark developer businesses.

"While we believe that Q2 earnings will be a catalyst for the stock given multiple positive data points [including solid web activity and channel feedback], our call is for outperformance over the long term given incremental traction with products addressing a significantly larger addressable AI market for software of $155 billion," Sills says.

He adds that with Snowflake shares are trading at "a reasonable" 1.5 times free cash flow adjusted for growth, lower than its broader large-cap peer group.

- Karee Venema

Nvidia says its newest "robot brain" is available

Nvidia announced Monday that its newest "robot brain," Jetson AGX Thor, is now "generally available" to purchase, with the price for the developer kit and production modules starting at $3,499.

The company said that the new computers are "designed to power millions of robots across industries including manufacturing, logistics, transportation, healthcare, agriculture and retail."

"With unmatched performance and energy efficiency, and the ability to run multiple generative AI models at the edge, Jetson Thor is the ultimate supercomputer to drive the age of physical AI and general robotics," said Nvidia CEO Jensen Huang.

According to Nvidia, the Jetson AGX Thor enables robots to have "real-time, intelligent interactions with people and the physical world."

Huang has previously said that outside of AI, robotics represents the company's biggest area for potential growth.

In its fiscal first quarter, Nvidia reported revenue of $567 million in its Automotive and Robotics segment, up 72% year over year.

- Karee Venema

Nvidia remains a top pick at Jefferies ahead of earnings

Jefferies analyst Blayne Curtis is joining the chorus of Wall Street pros that expect Nvidia to report a fiscal Q2 beat Wednesday evening.

"Readthroughs from ODMs suggest the Blackwell ramp is progressing, albeit maybe not as fast as the bull case exiting Computex, with the B300 layering in October," Curtis says.

The analyst notes that revenue expectations for a roughly $2 billion beat in both the July and October quarters are "doable," but adds that they may not be a layup as Street estimates create a high bar.

Curtis thinks networking growth will show upside, but doesn't expect "NVDA to add in much, if any, China sales, as there seems to be a deal in place for the licenses."

He remains confident in Nvidia for the long term and has the company as a "top pick."

- Karee Venema

A VC's take on Nvidia's upcoming earnings report

Anthony Georgiades is co-founder and general partner at Innovating Capital, a venture fund that focuses on cybersecurity, enterprise infrastructure and Web3. Over the past decade, he has invested in 46 companies and achieved 10 successful exits, including Strata (a multi-cloud enterprise identity platform) and Cohesity (a leader in next-generation data management).

Along the way, he has seen the impact of Nvidia on his investments, specifically in terms of the growing demand for GPUs.

"The company's dominance in the AI ecosystem is unparalleled, powering over 80% of AI training and deployment GPUs globally and supplying the chips behind three-quarters of the world's top supercomputers," Georgiades says. "The launch of the Blackwell Ultra architecture shows how quickly they're pushing the innovation cycle, and their expansion beyond chips into software, simulation, robotics and AI infrastructure makes them more than just a semiconductor company. They're building the entire stack."

Yet this does not mean that Nvidia is without risks. In fact, there are some notable ones, such as the supply constraints.

Nvidia's "reliance on Taiwan Semiconductor Manufacturing Company (TSMC) and exposure to geopolitical risks in Asia add fragility," he says. "China is a wildcard, as export restrictions and rising local competitors are real threats. Structurally, the environmental and energy intensity of AI workloads could become a bottleneck if regulation or infrastructure can't keep up. NVIDIA is leading the AI wave, but the risks are systemic, not just competitive."

Georgiades thinks that Nvidia's upcoming earnings report will be a critical litmus test for whether the company can keep justifying its growth trajectory. Still, he remains upbeat.

"The company is embedding itself deeper into AI infrastructure with $500 billion in planned global buildouts," Georgiades notes. "The moat created by CUDA, its developer ecosystem, and its pace of innovation gives it staying power. So while the stock may look expensive, it reflects how central Nvidia has become to the AI economy. The risk isn't that Nvidia is overvalued in the short term, but that the entire AI cycle slows faster than investors expect."

- Tom Taulli

I, Robot … says Nvidia

A key part of the long-term growth story for Nvidia is robotics. It's perhaps the biggest opportunity for AI.

Ahead of its earnings report this week, Nvidia is already teasing some of its latest offerings. As we previously, the company announced a robotics chip module called the Jetson AGX Thor, or the "robot brain." It will start shipping next month and have a price tag of $3,499.

"At a high level, the Jetson AGX Thor is a Developer Kit using the Blackwell GPU," says Vaclav Vincalek, founder and chief technology officer of Hiswai.com. "It is targeted at companies developing robots equipped with cameras and various sensors. It provides high-throughput, low-latency data ingestion and processing."

The system includes 128 gigabytes of memory, a monitor, a keyboard, mouse ports and network connectivity. It can process more than 7.5 times the AI computing power than the prior model.

However, when it comes to commercialization, robotics is still in the nascent stages.

"What the industry needs is a ChatGPT moment," says Muddu Sudhakar, a co-founder and investor of tech startups. "But with the Jetson AGX Thor, this could help get there. It's affordable and powerful. In other words, the system can be a way to help unleash innovation in robotics."

- Tom Taulli

When is Nvidia's earnings call?

Nvidia will host its earnings call on Wednesday, August 27, beginning at 5 pm Eastern Standard Time.

Ahead of its earnings call, Nvidia will release its fiscal second-quarter earnings report after the stock market closes. The results are typically posted between 4:20 pm to 4:30 pm EST.

- Karee Venema

Where does Wall Street stand on Nvidia stock?

Wall Street is overwhelmingly bullish on Nvidia stock. Of the 67 analysts covering NVDA who are tracked by S&P Global Market Intelligence, 49 say it's a Strong Buy, 11 have it at Buy, six call it a Hold and one has it at Strong Sell.

This works out to a consensus Strong Buy recommendation and makes Nvidia one of the top-rated Dow stocks.

Analysts' price targets currently range from a low of $100 to a high of $270. The average target price of $194.22 represents implied upside of 7.1% to current levels.

William Blair analyst Sebastien Naji is one of those with an Outperform (Buy) rating on Nvidia.

"Despite increased competition, Nvidia should retain its leadership in AI for several years to come (underpinned by industry-leading hardware, an unparalleled supply chain, and the broadly used CUDA-based software stack), which will allow it to capture a majority of AI infrastructure investments," Naji says.

As for Nvidia's earnings, Naji expects "another beat-and-raise quarter powered by volume deployments of Blackwell GPUs and NVL72 racks."

While the analyst says the second quarter is unlikely to have any revenue contributions from China, he expects to see H20 revenue included in forward guidance.

- Karee Venema

AI likely fueled Marvell Technology's top and bottom lines, too

Marvell Technology (MRVL) is another chipmaker on this week's earnings calendar. The company designs and manufactures semiconductors for data infrastructure, including AI and cloud computing, and it will disclose its fiscal 2026 second-quarter results after Thursday's close.

Wall Street is expecting impressive growth. As a group, analysts expect Marvell earnings to more than double year over year to 67 cents per share, while revenue is projected to rise 58% to $2.0 billion.

"We expect fiscal second-quarter results at or above consensus and fiscal third-quarter guidance at least at consensus before auto ethernet divestiture effects," says B. Riley Securities analyst Craig A. Ellis.

The analyst notes that focus will be centered on AI growth in Marvell's data center segment, with artificial intelligence now the majority of mix.

"We believe [Marvell's] AI Infrastructure event [from earlier this summer] validated momentum and MRVL's long-term growth trajectory, showing deep custom silicon visibility with customer engagement breadth, significantly exceeding prior disclosures," Ellis adds.

The analyst has a Buy rating on Marvell and a $115 price target, representing implied upside of 54% to current levels.

- Karee Venema

Nvidia stock closes higher ahead Tuesday

Nvidia shares gained 1.1% on Tuesday, bringing their year-to-date gain to 35.4%. This makes NVDA to top-performing Dow Jones stock for 2025, but today, it was the seventh-best of the 30 blue chips.

Aircraft maker Boeing (BA), meanwhile, was the best Dow stock on Tuesday, rising 3.5% on reports the U.S. government is considering taking equity stakes in defense stocks.

As for the main indexes, the Dow Jones Industrial Average added 0.3%, the S&P 500 rose 0.4% and the Nasdaq Composite tacked on 0.4%.

Read more: President Trump Makes Markets Move Again: Stock Market Today

NVDA is up in pre-market trading

Nvidia (NVDA), scheduled to report its fiscal 2026 second-quarter earnings after the closing bell, was up 0.6% in pre-market trading as of 7:25 a.m. Eastern Standard Time.

The semiconductor stock last changed hands at $182.91, just shy of the 52-week high of $184.48 and the all-time closing high of $183.16 it reached on August 12.

NVDA is up 39% over the trailing 12 months, 34% year to date, and 3.6% for the past month vs 16%, 10%, and 0.9% for the S&P 500 and is now trading at nearly 42 times forward earnings estimates.

People are starting to talk about a bubble, and Louis Navellier of Navellier & Associates says the repercussions of an earnings miss would be of far greater magnitude than another big revenue beat for the AI revolutionary.

According to Navellier, "The downside of any disappointments is probably greater than the upside of an even stronger outlook that is already priced into the world's most valuable stock."

But NVDA stock is still recovering in valuation terms from the double impact of the DeepSeek revelation in January and President Donald Trump's "Liberation Day" tariffs announcement in April.

Indeed, on January 6, NVDA stock closed at $149.43 and 50.59 times forward earnings.

Wall Street expects Nvidia to report earnings of $1.01 per share, up from 68 cents a year ago, on revenue growth of 53% to $46 billion.

– David Dittman

Nvidia stock slips at the open

Nvidia opened lower and was down more than 1% about 15 minutes into Wednesday's trading session. In fact it was No. 30 among the 30 Dow Jones stocks early on the day it's scheduled to release fiscal 2026 second-quarter earnings.

Expectations for Nvidia ratcheted even higher in pre-market trading after software maker Okta (OKTA, +3.1%) reported its own expectations-beating quarterly results.

Okta is making a name for itself in competition against the likes of Microsoft (MSFT, -0.3%) by offering a platform-neutral solution to what its CEO describes as the "identity quagmire" wrought by the AI Revolution.

Management reported earnings of 91 cents per share vs a FactSet-compiled consensus forecast of 84 cents. Revenue was up 13% year over year to $728 million against a $711 million estimate.

Okta guided to fiscal third-quarter revenue of $728 million to $730 million, better than FactSet's $721 million forecast. Management also raised its full-year revenue guidance to $2.875 billion to $2.885 billion from $2.85 billion to $2.86 billion.

Chinese chipmaker Cambricon Technologies also reported stellar numbers, posting a company-record first-half profit on momentum created by the introduction of DeepSeek in January.

Cambricon – a Huawei Technologies competitor on the Chinese AI market – was up as much as 10.2% on the Shanghai Stock Exchange and closed higher by 3.2%.

China is working to fill gaps in its supply chain in the absence of clarity about the availability of Nvidia products in the domestic market. Its success underscores the global pace and potential of AI development.

– David Dittman

NVDA rising with "plenty of runway" for the AI revolution

Nvidia rose all the way from the bottom of the stack of Dow Jones stocks into positive territory before noon today, but the stock remains a little bouncy ahead of its post-closing-bell earnings announcement.

Meanwhile, regarding questions about a bubble for NVDA stock and/or the AI revolution, a team of Wedbush analysts including Seth Basham, Dan Ives and Matt Bryson sees "plenty of runway ahead" for "a golden age of productivity and economic growth."

"Throughout history," the Wedbush team writes, "boom-and-bust stock market cycles have emerged alongside periods of innovation. New technologies can deliver massive productivity gains and economic growth such as in the 1920s, but they can also spark speculative excess."

This is not that: "While some investors fear that a stock market bubble is forming due to lofty valuations and unachievable expectations for artificial intelligence (AI), we disagree."

According to Wedbush, "The potential for AI to drive productivity and economic growth dwarfs past technologies."

The bottom line is "earnings forecasts likely materially underestimate the benefit of AI in the years to come, making stocks reasonably valued."

Indeed, Wedbush says we're still in the early stages of the AI Revolution – or the "4th Industrial Revolution."

Analysts do anticipate corrections along the way. But, "fueled by AI-led innovation, interest rate cuts and tax incentives, we believe that this bull market can endure."

Bryson rates NVDA stock Outperform (or "Buy") with a 12-month target price of $210, up from $175 as of August 21.

– David Dittman

Hyperscalers the beating heart of the AI revolution

Well – in the sense that all the earnings beats Nvidia has put together on its way to becoming the most valuable company in the history of the world are a function of capital expenditures by companies such as Alphabet (GOOGL), Amazon.com (AMZN), Meta Platforms (META), and Microsoft (MSFT) – yes, hyperscalers are the heart of the artificial intelligence revolution.

(And, of course, Nvidia – maybe more specifically CEO Jensen Huang – is the brains behind their respective ever-expanding (for now) AI operations.)

As Louis Navellier of Navellier & Associates suggests, "With all the data center spending announced by the AI giants, NVDA's numbers will be strong." So how much capex are we talking about with the Big Four?

Alphabet is tracking to $85 billion in 2025, up from a prior estimate of $75 billion on strong demand for its cloud products and services.

Amazon reported second-quarter capex of $31.4 billion and said the figure is "reasonably representative of our quarterly capital investment rate for the back half of this year," suggesting $118.5 billion in full-year spend.

Meta expects to spend $66 billion to $72 billion during its fiscal 2025, up from prior guidance of $64 billion to $72 billion.

Microsoft reported $88.7 billion for the 12 months through June, the end of its fiscal 2025, up from its $80 billion forecast. MSFT management said spending would slow in fiscal 2026, with first-quarter capex down 50% year over year to $30 billion.

The Big Four have guided to aggregate capex of as much as $364 billion for their respective fiscal years, up from estimates of approximately $325 billion.

Navellier sees ever-rising demand on the horizon: "There is no doubt that bigger companies will want their proprietary data managed onsite, adding further to demand." He also adds, parenthetically, a potentially good problem for chipmakers to have: The AI giants could face difficulties getting their orders filled.

"At this point, it's not a question of demand, but more of being able to ship and meet demand." Navellier notes that customers are already turning to Advanced Micro Devices (AMD) to backstop the ability to get orders filled.

Nvidia will also benefit from the Trump administration loosening restrictions on transactions with China. "It will be the most closely watched earnings announcement of the year," Navellier concludes.

– David Dittman

Nvidia eases on down into earnings

Nvidia closed Wednesday's regular trading session down 17 cents, or 0.09%. So the leader of the AI revolution remains perched to reach new highs post-earnings – or take the whole market down with it.

So much attention – here and elsewhere – is on capex and how much the Big Four hyperscalers are spending to build out their AI capacity.

Peter Berezin of BCA is looking at something else. "Investors will be scrutinizing Nvidia’s earnings report tonight for signs of cracks in the massive, ongoing AI capex boom," Berezin writes. "I understand the temptation to do so, but I am not certain that capex is the best metric to focus on."

As Berezin explains, hyperscaler capex temporarily peaked in the fourth quarter of 2022, "AFTER the stock market had already bottomed during that year."

Going back to the dot-com era, telecom capex started sliding in early 2001 "as the recession was beginning."

According to Berezin, "Capex is generally a coincident-to-lagging indicator. If you focus on capex as an indicator of where the stock market is going, you will find yourself behind the curve.

Instead, focus on free cash flow, "a leading indicator not just for capital spending but for the stock market as well."

Hyperscaler free cash flow peaked in the third quarter of 2021 "before stocks started to fall. And telecom free cash flow peaked in the fourth quarter of 1999, "before the dot-com bust."

He warns "hyperscaler free cash flow is ALREADY trending lower," a sign of rising risk AI stocks are nearing peaks.

Regarding Nvidia, the magnitude of its upside surprises has steadily fallen over the past seven quarters. "I have no idea what tonight will bring," he concludes, "but the evidence suggests that market expectations are increasingly catching up to reality."

– David Dittman

Nvidia's Huang says "the AI race is on"

Nvidia reported fiscal 2026 second-quarter revenue of $46.7 billion, up 6% quarter over quarter and 56% year over year, and earnings of $1.05 per share, up 30% sequentially and 54% annually. Wall Street forecast revenue growth of 53% to $46 billion and EPS of $1.01.

Nvidia stock was down more than 4% within minutes of its announcement but has already rebounded.

Management highlighted Blackwell Data Center sequential revenue growth of 17% but also noted "no H20 sales to China-based customers in the second quarter." Gross margin for the quarter was 72.7%.

"Blackwell is the AI platform the world has been waiting for," CEO Jensen Huang said in his prepared remarks, "delivering an exceptional generational leap." Huang said production of Blackwell Ultra "is ramping at full speed, and demand is extraordinary."

Nvidia guided to third-quarter revenue of $54.0 billion, "plus or minus 2%," assuming zero H20 shipments to China. Margin will be 73.5%, plus or minus 50 basis points, and Nvidia reiterated a forecast to exit fiscal 2026 with non-GAAP gross margins in the mid-70% range.

"NVIDIA NVLink rack-scale computing is revolutionary," Huang concluded his press release remarks, "arriving just in time as reasoning AI models drive orders-of-magnitude increases in training and inference performance. The AI race is on, and Blackwell is the platform at its center."

– David Dittman

CFO Kress says let Nvidia compete globally

Nvidia's chief financial officer, Colette Kress, delivered a fluent and impressive presentation of Nvidia's fiscal 2026 second-quarter financial performance as well as its current operations and technical achievements during her prepared remarks at the top of the AI revolutionary's earnings conference call.

A straight-up appeal to authority is probably the highlight, though, as Kress called on the U.S. government to approve shipments of Nvidia's Blackwell technology to customers in China and open up a potential $2 billion to $5 billion market.

"Every licensed sale will benefit the U.S. economy and advance U.S. leadership," Kress explained. "We want to compete globally and win the support of every developer."

Sovereign AI revenue doubles

Kress also highlighted Nvidia's success with what CEO Jensen Huang described as "sovereign AI" during the company's fiscal 2026 first-quarter conference call.

As for the outlook, Kress noted $7 billion sequential revenue growth and reiterated Nvidia included no H20 shipments to China in its forecast.

The CFO said Nvidia is "accelerating investments to meet the magnitude of its growth opportunity" but continues to expect to end the fiscal year with mid-70% margins.

Huang highlights $3 to $4 trillion opportunity

"Over the next couple of years," CEO Jensen Huang said in his response to the first question during Nvidia's conference call, "we're going to scale into a $3 to $4 trillion AI infrastructure opportunity."

Huang highlighted advances in agentic AI models over the past year that have significantly increased computing power.

Nvidia's Blackwell system is built for this moment, Huang said, with its infrastructure enabling AI to adapt and solve problems for many different industries.

– David Dittman

Nvidia is getting more ubiquitous

If the federal government loosens up its restrictions, Nvidia is ready to ship H20 systems to China, according to CFO Colette Kress.

Meanwhile, CEO Jensen Huang, underscoring the complexity of what he said is the most difficult computer science problem in the history of the world, noted that Nvidia's system are in "every cloud" and are usable with every platform.

"The complexity is extraordinary," he said. "It's done at an extreme scale.

"If I can just add one more thing, we're in every cloud for a reason."

He concluded by highlighting that Nvidia's growth opportunity is supported by a holistic solution.

Huang says China is a $50 billion opportunity this year

Jensen Huang said China is a potential $50 billion market "this year" for Nvidia, emphasizing its position as the No. 2 computing country in the world, with AI researchers and robust tech infrastructure.

The CEO said it's important for the U.S. companies to be able to address the Chinese market and reiterated that Nvidia continues to lobby the federal government.

"The American tech stack should be the global standard," Huang said.

Did Nvidia do enough?

Nvidia recovered from its post-earnings announcement after-market lows but was off nearly 3% during the extended session.

CEO Jensen Huang and CFO Colette Kress continue to describe a major market opportunity in revolutionary terms, using "fourth industrial revolution" as context for what's happening with AI around the world.

Huang noted Nvidia's orders with existing large customers and suggested additional significant upside from other entities such as AI-native start-ups. He also noted enterprise SaaS as well as industrial demand.

"This year is a record-breaking year, and I expect next year to be a record-breaking year as we race toward artificial super-intelligence," Huang said. "The next several years we see really significant growth opportunities ahead."

– David Dittman

Argus lifts Nvidia price target after earnings

Wall Street has been quick to weigh in on Nvidia after the chipmaker's earnings event.

"Nvidia posted fiscal second-quarter revenue and non-GAAP earnings per share that topped Wall Street consensus estimates, and revenue that was above the high end of management's guidance," says Argus Research analyst Jim Kelleher. "The stock pulled back in the aftermarket, a move that reflected guidance that beat rather than demolished pre-reporting consensus estimates for fiscal Q3."

And following fiscal 2025, when Nvidia posted record revenue and profits, the company appears poised to build on this momentum, Kelleher adds. Nvidia "has unmatched positioning within transformational AI technology, which is segueing from generative AI to agentic, reasoning AI."

The analyst recommends that investors either establish or add to positions "in this preeminent vehicle for participation in the AI economy," given his belief that the shares have much more room to run.

Kelleher reiterated his Buy rating on Nvidia after earnings and lifted his price target to $220, representing implied upside of more than 20% to the stock's August 27 close.

- Karee Venema

AI startup CEOs: Why is Nvidia so important?

AI has been a major driver for the bull run in the stocks. And of course, one of the biggest beneficiaries has been Nvidia, whose market cap is $4.4 trillion.

Nvidia's earnings reports are among the most widely anticipated among publicly traded companies. But why? We turned to some of the biggest names in the AI startup world to get their takes on the chipmaker and what they watch for in Nvidia earnings.

Nic Adams, co-founder and CEO of 0rcus: Nvidia's gross margins, research and development spending, and data center revenue breakdown are worth monitoring. Gross margins reflect pricing power and efficiency. R&D spending indicates the company's commitment to maintaining its technological lead.

A detailed look at data center revenue, especially the mix between different GPU architectures and networking solutions, provides insight into the adoption rates of its latest products and the health of its core business beyond the headline numbers.

Kevin Surace, CEO of Appvance: Within Nvidia's earnings, investors should take a closer look at several things, including (1) adoption of open-source CUDA replacements (HIP, oneAPI, etc.), which could signal erosion of Nvidia's lock-in, (2) supply/demand imbalances, since shortages have kept pricing abnormally high, and (3) cloud vendor strategies, because if hyperscalers succeed with custom silicon, it reduces their dependence on Nvidia.

These are all leading indicators that tell us whether today's extraordinary growth is the beginning of a decades-long run, or a peak before the market normalizes.

Anurag Gurtu, CEO of Airrived: Nvidia's latest earnings again demonstrate just how central the company has become to the AI revolution.

But as impressive as the numbers are, my view is that investors, enterprises, and policymakers need to look beyond short-term revenue and ask harder questions about sustainability, competition, and concentration risk.

The biggest risk isn't just technical – it's systemic. We've allowed the global AI build-out to rest on one company's supply chain. If Nvidia stumbles, whether due to geopolitics, supply shortages, or regulatory pressures, the ripple effects will be enormous. Investors should recognize that Nvidia's dominance is both a strength and a vulnerability.

- Tom Taulli

Nvidia looks to AI agents to supercharge growth

AI agents are one of the hottest categories in tech. They leverage sophisticated models that engage in reasoning and planning to take actions. Ultimately, AI agents could become digital workers, such as with automating tedious and repetitive tasks.

On Nvidia's earnings call, Jensen Huang talked about this powerful technology:

"At the highest level of growth drivers would be the evolution, the introduction, if you will, of reasoning agentic AI. Where chatbots used to be one shot, you give it a prompt and it would generate the answer, now the AI does research. It thinks and does a plan, and it might use tools. And so it's called long thinking; and the longer it thinks, oftentimes, it produces better answers.”"

What this means is that there will be even more demand for Nvidia GPUs. According to Huang, the compute power for one-shot versus reasoning agentic AI models could be anywhere from 100X to 1,000X.

Regardless, the rise of agentic AI is already having an impact. Says Huang:

"As a result of agentic AI and vision language models, we now are seeing a breakthroughs in physical AI, in robotics, autonomous systems. So in the last year, AI has made tremendous progress and agentic systems, reasoning systems is completely revolutionary."

- Tom Taulli

AI still has plenty of room for growth

Nvidia stock is trading slightly lower mid-afternoon Thursday, even as fiscal second-quarter earnings and revenue numbers beat Wall Street's estimates and the third-quarter guidance also came in higher than expected.

"Unfortunately, it fell short of the whisper number," says Stephen Callahan, trading behavior specialist at Firstrade. "This was probably because they didn't include sales to China. The small selloff was probably a knee-jerk overreaction to missing the whisper number on the guidance."

Callahan adds that Nvidia is likely just being conservative with its guidance and "if they put a number out there now that includes China, they would be making it up."

Still, what Nvidia did guide for ($54 billion in revenue for fiscal Q3) is a good sign for the broader tech sector and AI. "There may be bumps in the road ahead, but overall, the AI sector has a lot of room to grow," Callahan says.

- Karee Venema

Nvidia and China: Takes from Gabelli and Freedom Capital Markets

Nvidia's latest earnings event underscored considerable anxiety about the impact of the Chinese market. Yet the quarter still delivered impressive numbers, highlighting the company's dominant position in AI infrastructure.

But as you dig into the report and earnings call, there were certainly some nuances:

John Belton, portfolio manager of Gabelli Growth Innovators ETF:

Jensen Huang has suggested China could be a $50 billion annualized revenue opportunity for Nvidia, which is clearly significant.

That said, I view it as more of a "nice to have." It's good for the U.S. if Nvidia is allowed to operate in China – and I believe they will be.

One reason they didn't beat by more in the July quarter is that they had no H20 sales to Chinese customers. That was a little unexpected, as many thought they'd be able to generate some revenue toward the tail end of the quarter once export licenses were reinstated.

On the guidance side, it was encouraging that management sized a $2 billion to $5 billion potential tailwind if they can sell existing inventory. Plugging that in suggests there would have been meaningful upside to Street numbers in the guide as well.

Now, there are headlines that they're in discussions with the U.S. about a new China-compliant Blackwell product, which could be an even bigger opportunity than the H20. So, China remains a major opportunity. It's a market they will be able to participate in, all the steps are progressing as they should, and the expectations miss feels more like a short-term issue I'm not overly focused on.

Paul Meeks, managing director at Freedom Capital Markets:

A lot of good news was already baked into the stock price. Investors are starting to get a little concerned because there's still no deal with China. That raises the question: How strong is the guidance really, given how much depends on that?

The Trump administration has pushed the dispute out another 90 days, so we won't get clarity anytime soon – it's still a couple of months away.

Ideally, the eventual resolution will be a big, comprehensive deal that covers tariffs with China, export controls on AI chips for Nvidia and Advanced Micro Devices (AMD), and even the future of TikTok's U.S. operations.

What we know is that Nvidia and AMD have voracious demand, not just from U.S. customers, but internationally – and from China, if they're allowed to ship. The real question is supply, and specifically, supply to China.

- Tom Taulli

Nvidia closes lower after earnings

Nvidia stock opened marginally higher Thursday, but quickly dropped into negative territory and stayed there through the remainder of the session.

When the closing bell rang, shares were off 0.7%, even as the broader market enjoyed modest gains.

Despite its post-earnings pullback, CFRA Research Angelo Zino lifted his price target on the chip stock to $210 from $206, and raised his earnings-per-share estimates for fiscal years 2026, 2027 and 2028.

"We come away optimistic about NVDA's growing addressable market and the sustainability of spending plans from hyperscalers, with levels moderating after the Big 4 virtually doubled capex spend the last two years," Zino writes. "Although we currently assume no revenue from China on the data center side for the October quarter, as it looks for geopolitical issues to subside, NVDA cited strong interest and the potential to ship $2 billion to $5 billion in H20."

Zino also believes U.S. approval of Blackwell chip sales in China "will unlock significantly higher revenue potential."

That's a wrap for us for Nvidia's fiscal second-quarter earnings event. Join us in November when we will live blog all the news on the company's fiscal Q3 print.

- Karee Venema