Best Dividend Stocks to Buy for Dependable Dividend Growth

How do you find the best dividend stocks to buy? Income investors know there's no substitute for regular dividend increases over the long haul.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Buy-and-hold dividend growth investors know something about the best dividend stocks to buy that less experienced yield-hunters don't: it pays to be patient when you're investing for income.

Shares in companies that raise their payouts like clockwork decade after decade can produce superior total returns (price change plus dividends) over the long run, even if they sport apparently ho-hum yields to begin with.

That's partly because regular dividend increases lift the yield on an investor's original cost basis. Stick around long enough, and the modest yield you received on your initial investment can hit double digits one day.

Companies with long histories of annual dividend growth also offer some peace of mind. After all, any company that manages to raise its dividend year after year – through recession, war, market crashes and more – is demonstrating both its financial resilience and its commitment to returning cash to shareholders.

What can dividend growth stocks do for long-term returns?

"The S&P 500 Dividend Aristocrats exhibits both capital growth and dividend income characteristics," writes Rupert Watts, head of factors and dividends product management at S&P Global. "Over the long term, the S&P 500 Dividend Aristocrats exhibited higher returns with lower volatility compared with the S&P 500, resulting in higher risk-adjusted returns."

Put another way, dividend growers not only go along for the ride in bull markets, but they also tend to hold up better in market drawdowns.

Case in point: The S&P 500 Dividend Aristocrats Index lost 6.2% on a total return basis (price change plus dividends) in 2022 – better than the S&P 500's 18.1% decline.

And dividends are an important element of overall returns, say Argus Research Director of Portfolio Strategies John Eade and Director of Research Jim Kelleher.

Citing data from Ned Davis Research, the two note that the average annual return of stocks within the S&P 500 between 1972 and 2010 was 7.3%, but the average annual return for companies that initiated or raised their dividends was 9.6%.

Which sectors are showing the strongest dividend growth trends for 2026?

Dividend growth was slow but steady in Q4 2025, says Howard Silverblatt, senior index analyst at S&P Dow Jones Indices. "Q1 2026 is expected to be a very busy positive period for dividend increases, as overall earnings and sales have posted record levels, with 2026 expected to post more dividend payment records."

It's early in the year, but historical trends suggest that financial and industrial stocks will show the strongest dividend growth trends for 2026.

According to Silverblatt's research, the financial and industrial sectors tied for the most dividend hikes in 2025, at 67 apiece. These sectors led in 2024, too, with financial stocks in the S&P 500 raising their dividends 61 times and industrials increasing their payouts 64 times.

How do you find the best dividend stocks to buy?

If you're looking to add dependable dividend growers to your portfolio, you can start by checking out the S&P 500 Dividend Aristocrats, an index of 69 companies in the S&P 500 index that have raised their payouts annually for at least 25 consecutive years.

Although they're scattered across pretty much every sector of the market, they do all share one thing in common: a commitment to reliable and long-term dividend growth.

S&P made three additions to the Dividend Aristocrats in January 2025: Erie Indemnity (ERIE), Eversource Energy (ES) and FactSet Research Systems (FDS) were tapped for inclusion thanks to their long records of annual dividend increases.

What are the top-rated dividend growth ETFs?

Alternatively, investors can gain exposure to every stock in the S&P 500 Dividend Aristocrats index via the ProShares S&P 500 Dividend Aristocrats ETF (NOBL). The exchanged-traded fund with $11.3 billion in assets under management has an expense ratio of 0.35%.

Other top-rated dividend growth ETFs include the Vanguard Dividend Appreciation ETF (VIG), the iShares Core Dividend Growth ETF (DGRO) and the SPDR S&P Dividend ETF (SDY).

Have a look at all the stocks in S&P 500 Dividend Aristocrats index in the table below – and be sure to keep scrolling for more information on each and every one of these dividend stalwarts.

Companies are listed by the number of years they've consecutively raised their dividends, from lowest to highest. The index of Dividend Aristocrats is maintained by S&P Dow Jones Indices. Dividend history based on company information and S&P data. Dividend-growth streaks include the current year if the company announced a dividend hike as of December 3, 2025.

The S&P 500 Dividend Aristocrats

Company | Ticker | Sector | Years of dividend growth |

|---|---|---|---|

FactSet Research Systems | FDS | Financials | 26 |

Fastenal | FAST | Industrials | 26 |

Eversource Energy | ES | Utilities | 27 |

C.H. Robinson Worldwide | CHRW | Industrials | 28 |

J.M. Smucker | SJM | Consumer staples | 28 |

Cardinal Health | CAH | Health care | 29 |

Church & Dwight | CHD | Consumer staples | 29 |

International Business Machines | IBM | Information technology | 30 |

Albemarle | ALB | Materials | 30 |

Realty Income | O | Real estate | 30 |

Caterpillar | CAT | Industrials | 31 |

Essex Property Trust | ESS | Real estate | 31 |

NextEra Energy | NEE | Utilities | 31 |

Expeditors International of Washington | EXPD | Industrials | 31 |

Brown & Brown | BRO | Financials | 32 |

A.O. Smith | AOS | Industrials | 32 |

Chubb | CB | Financials | 32 |

Linde | LIN | Materials | 32 |

West Pharmaceutical Services | WST | Health care | 32 |

Roper Technologies | ROP | Information technology | 33 |

Ecolab | ECL | Materials | 33 |

General Dynamics | GD | Industrials | 34 |

Erie Indemnity | ERIE | Financials | 35 |

Chevron | CVX | Energy | 38 |

T. Rowe Price | TROW | Financials | 39 |

McCormick & Co. | MKC | Consumer staples | 40 |

Atmos Energy | ATO | Utilities | 42 |

Brown-Forman | BF.B | Consumer staples | 42 |

Amcor | AMCR | Materials | 42 |

Exxon Mobil | XOM | Energy | 43 |

Cintas | CTAS | Industrials | 43 |

Air Products & Chemicals | APD | Materials | 43 |

Aflac | AFL | Financials | 43 |

Franklin Resources | BEN | Financials | 45 |

Clorox | CLX | Consumer staples | 47 |

Sherwin-Williams | SHW | Materials | 48 |

McDonald's | MCD | Consumer discretionary | 49 |

Pentair | PNR | Industrials | 49 |

Medtronic | MDT | Health care | 49 |

Automatic Data Processing | ADP | Industrials | 51 |

Lowe's | LOW | Consumer discretionary | 51 |

Consolidated Edison | ED | Utilities | 51 |

Walmart | WMT | Consumer staples | 52 |

Archer-Daniels-Midland | ADM | Consumer staples | 52 |

S&P Global | SPGI | Financials | 52 |

Nucor | NUE | Materials | 53 |

Kimberly-Clark | KMB | Consumer staples | 53 |

Abbott Laboratories | ABT | Health care | 53 |

Becton Dickinson | BDX | Health care | 54 |

AbbVie | ABBV | Health care | 54 |

Illinois Tool Works | ITW | Industrials | 54 |

PepsiCo | PEP | Consumer staples | 54 |

W.W. Grainger | GWW | Industrials | 55 |

PPG Industries | PPG | Materials | 55 |

Target | TGT | Consumer staples | 55 |

Sysco | SYY | Consumer staples | 57 |

Stanley Black & Decker | SWK | Industrials | 57 |

Federal Realty Investment Trust | FRT | Real Estate | 58 |

Hormel Foods | HRL | Consumer staples | 60 |

Nordson | NDSN | Industrials | 62 |

Kenvue | KVUE | Consumer staples | 62 |

Colgate-Palmolive | CL | Consumer staples | 63 |

Coca-Cola | KO | Consumer staples | 63 |

Johnson & Johnson | JNJ | Health care | 64 |

Cincinnati Financial | CINF | Financials | 65 |

Genuine Parts | GPC | Consumer discretionary | 69 |

Procter & Gamble | PG | Consumer staples | 69 |

Emerson Electric | EMR | Industrials | 70 |

Dover | DOV | Industrials | 70 |

FactSet Research Systems

- Consecutive annual dividend increases: 26

FactSet Research Systems (FDS) was added to the Aristocrats in January 2025. The financial data and portfolio analytics company boasts 45 consecutive years of revenue growth and 27 consecutive years of adjusted earnings growth as a public company.

Fastenal

- Consecutive annual dividend increases: 26

Fastenal (FAST) was added to the Dividend Aristocrats in January 2024, replacing Walgreens Boots Alliance.

Most recently, in April 2025, the company declared a quarterly cash dividend of 44 cents per share, up from 33 cents.

Fastenal generated more than $680 million in levered free cash flow in fiscal 2024, and that was after paying out $917 million in dividends.

Eversource Energy

- Consecutive annual dividend increases: 27

Eversource Energy (ES) was added to the Dividend Aristocrats in January 2025. The utility provides energy to about 4 million customers in Connecticut, Massachusetts and New Hampshire.

Over the past 10 years, the company's dividend boasts a compound annual growth rate of more than 6%. With ample free cash flow, ES should extend its streak of dividend hikes to 28 years.

C.H. Robinson Worldwide

- Consecutive annual dividend increases: 28

C.H. Robinson Worldwide (CHRW) provides freight transportation and logistics services to industries around the globe. It also delivers reliable increases to its dividend each and every year.

The company joined the Dividend Aristocrats on February 1, 2023, by dint of its 25-year streak of payout hikes. The most recent increase was announced in November 2025 – a 1-cent bump in the disbursement to 63 cents per share quarterly.

CHRW disburses nearly $300 million annually in dividends.

J.M. Smucker

- Consecutive annual dividend increases: 28

J.M. Smucker (SJM) is a well-known consumer staples stock thanks to the company's wide range of popular brands. Folgers and Dunkin' coffee, Jif peanut butter and Smucker's eponymous jams and jellies represent just a few of its offerings.

Perhaps less well known is that SJM is an equity income machine, having increased its dividend annually for 28 years, per S&P. Thanks to that track record, the stock was added to the Dividend Aristocrats on February 1, 2023.

Smucker last increased its dividend in July 2025, by 2% to $1.10 per share per quarter.

Cardinal Health

- Consecutive annual dividend increases: 29

A steady stream of acquisitions helped wholesale drug and medical device distributor Cardinal Health (CAH) become the giant that it is today. Its most recent acquisition – a $1.9 billion all-cash deal for Solaris Health – closed in late 2025.

Like the rest of the medical device industry, CAH faced challenges during the pandemic as patients put off elective surgeries. But the company still managed to generate ample free cash flow and the dividend increases such cash flow supports.

Indeed, Cardinal Health has upped the ante on its annual payout for 29 years and counting. The Aristocrat last raised its disbursement in May 2025, declaring an incremental increase in the quarterly dividend to 51.07 cents per share from 50.56 cents per share.

Church & Dwight

- Consecutive annual dividend increases: 29

Consumer staples company Church & Dwight (CHD) might not ring a bell with many retail investors, but they're certainly familiar with many of its wares. Arm & Hammer, OxiClean and Waterpik are just a few examples among dozens of its household brands.

Church & Dwight was founded in 1846 and is today the leading producer of baking soda in the U.S. Its stock was added to the S&P 500 at the end of 2015.

CHD, which has paid a consecutive quarterly dividend for 124 years, last raised its payout in January 2025 – a 4% bump to 29.5 cents per share.

International Business Machines

- Consecutive annual dividend increases: 30

International Business Machines (IBM), a component of the Dow Jones Industrial Average, isn't quite as illustrious as it once was. The company's revenue has been in steady decline for the better part of a decade, hurt by its also-ran status in critical growth areas such as social, mobile, analytics and the cloud infrastructure business.

And yet through all its slips and stumbles, Big Blue has been a dividend stalwart, gaining membership to the Dividend Aristocrats in January 2021.

In April 2025, IBM raised the quarterly dividend by a penny to $1.68 per share, marking its 30th consecutive year of increases. IBM has paid consecutive quarterly dividends since 1916. Importantly, the company has the resources to keep the growth streak alive, which is a characteristic you expect to see among the best dividend stocks.

Albemarle

- Consecutive annual dividend increases: 30

Albemarle (ALB), which manufactures specialty chemicals such as lithium, most recently hiked its dividend in July 2025 to 40.5 cents per share quarterly.

Albemarle's products work entirely behind the scenes, but its chemicals go to work in a number of industries, from clean-fuel technologies to pharmaceuticals to fire safety. The fact that it's a lithium stock is at the heart of the bull case.

Realty Income

- Consecutive annual dividend increases: 30

Realty Income (O) is a real estate investment trust (REIT) that investors can rely on for steady income, but there's another aspect to this stock that might suit certain income investors: Realty Income is a rare breed of monthly dividend stocks.

Known as The Monthly Dividend Company, Realty Income invests in diversified commercial real estate, with a portfolio of more than 15,450 properties across all U.S. states, the U.K. and six other countries in Europe. The company's tenants, which operate across scores of industries, include Walgreens, 7-Eleven, FedEx (FDX) and Dollar General (DG).

Realty Income typically generates predictable cash flow thanks to the long-term nature of its leases. The company has delivered compound average annual dividend growth of 4.2% since 1994.

Caterpillar

- Consecutive annual dividend increases: 31

Caterpillar (CAT), the world's largest maker of heavy construction and mining equipment, was added to the Dividend Aristocrats in January 2019.

CAT has paid a regular dividend without fail since 1933, and has lifted its payout every year for 30 years. Most recently, the company raised the dividend in June 2025, by 7% to $1.51 per share per quarter.

CAT also added $20 billion to its current stock buyback program, which was launched in 2022 with no expiration date.

Essex Property Trust

- Consecutive annual dividend increases: 31

Essex Property Trust (ESS), which was added to the Dividend Aristocrats in 2020, is a REIT that invests in apartments primarily on the West Coast.

ESS went public in 1994 and has been hiking its payout ever since. The most recent increase came in February 2025, when the REIT lifted the quarterly dividend to $2.57 per share.

Thanks to its steady and generous stream of dividend hikes, Essex boasts a 10-year compound annual dividend growth rate of nearly 7%.

NextEra Energy

- Consecutive annual dividend increases: 31

NextEra Energy (NEE) is a relatively recent addition to the Aristocrats. The utility stock was added to the elite group of dividend growers in January 2021.

The company has two principal businesses: Florida Power & Light (FPL) is Florida's largest electric utility, while NextEra Energy Resources is a major player in wind and solar energy. Analysts like this combination of a successful regulated utility with a faster-growing renewables business.

The company last raised its dividend in February 2025, by 10% to 56.65 cents per share per quarter.

Expeditors International of Washington

- Consecutive annual dividend increases: 31

Expeditors International of Washington (EXPD) was added to the Aristocrats in January 2020. The logistics company last raised its semiannual dividend in May 2025, to 77 cents a share from 73 cents a share.

The transportation company went through a rough few years. Trade tensions between the U.S. and China during the first Trump administration greatly hurt EXPD. And then COVID-19 disrupted airfreight tonnage volumes and ocean container shipments. But things have stabilized.

Through it all, EXPD remained committed to its semiannual dividend, which it has hiked every year for more than a quarter-century. A consistently low payout ratio should help ensure that Expeditors has ample resources to keep the streak alive and maintain its place on a list of the best dividend stocks.

Brown & Brown

- Consecutive annual dividend increases: 32

Brown & Brown (BRO), which offers insurance brokerage services to both businesses and consumers, has been in operation since 1939, but its stock wasn't added to the S&P 500 until 2021.

Happily for long-term dividend growth investors, BRO's inclusion in the main benchmark for U.S. equity performance also opened the door to the Dividend Aristocrats. Brown & Brown was added to the elite list of equity income stalwarts in 2022, thanks to its three-decade streak of annual dividend increases.

BRO's most recent hike was announced in October 2025 – a 10% increase in the quarterly distribution to 16.5 cents per share.

A.O. Smith

- Consecutive annual dividend increases: 32

A.O. Smith (AOS), a manufacturer of commercial and residential water heaters, is a relatively recent addition to the Dividend Aristocrats, entering the club in 2018. In October 2025, it announced a 6% raise in its quarterly payout to 36 cents per share. That marked a 32nd consecutive year of dividend hikes for the industrial stock.

As a result, the 10-year compound annual growth rate of AOS' dividend now stands at more than 18%.

With ample free cash flow and a below-average payout ratio, investors can count on AOS to keep the dividend increases coming.

Chubb

- Consecutive annual dividend increases: 32

Chubb (CB) was added to the Dividend Aristocrats in January 2019. The insurance company in May announced its 32nd consecutive year of dividend growth, raising the quarterly payout to 97 cents per share from 91 cents.

As the world's largest publicly traded property and casualty insurance company, Chubb boasts operations in 54 countries and territories. It's not the most exciting topic for dinner conversation, but it's a profitable business that supports a longstanding dividend.

Linde

- Consecutive annual dividend increases: 32

Linde (LIN) became a Dividend Aristocrat in late 2018 after it completed its merger with Praxair, which itself was added to the illustrious list of the S&P 500's best dividend stocks to buy for income growth in January 2018. The $90 billion tie-up of Linde and Praxair created the world's largest industrial gasses company.

Praxair raised its dividend for 25 consecutive years before its merger, and the combined company continues to be a steady dividend payer. Prior to the merger, Linde, now headquartered in Dublin, raised its dividend every year since 2014.

Linde's most recent hike came in February 2025 – an 8% bump in the quarterly payout to $1.50 per share.

With ample free cash flow after debt-service payments, Linde should have plenty of firepower to keep its dividend-growth streak alive.

Roper Technologies

- Consecutive annual dividend increases: 33

Roper Technologies (ROP) – an industrial company whose businesses include medical and scientific imaging, RF technology and software, and energy systems and controls, among others – has been an equity income machine for more than three decades.

The most recent hike was declared in November 2025, when Roper lifted the quarterly payout by 10% to 91 cents per share.

A combination of acquisitions, organic growth and stronger margins have helped Roper juice its dividend without stretching its profits. And while the yield might not look like much, patient investors have come to appreciate what ROP's steady dividend increases have done for their returns.

West Pharmaceutical Services

- Consecutive annual dividend increases: 32

West Pharmaceutical Services (WST) was added to the Dividend Aristocrats in January 2021 in recognition of its long history of annual increases.

WST operates in a critical sector of the health care supply chain, manufacturing packaging components and delivery systems for injectable drugs and other medical products. Bulls note that demand for COVID-19 vaccines is boosting demand for the firm's products. Meanwhile, the biopharmaceutical industry's robust pipeline should support longer-term growth.

The firm last raised the dividend in October 2024 – a 5.3% increase in the quarterly payout to 21 cents per share. Ample free cash flow and a low payout ratio should reassure shareholders that the annual dividend increases will keep coming.

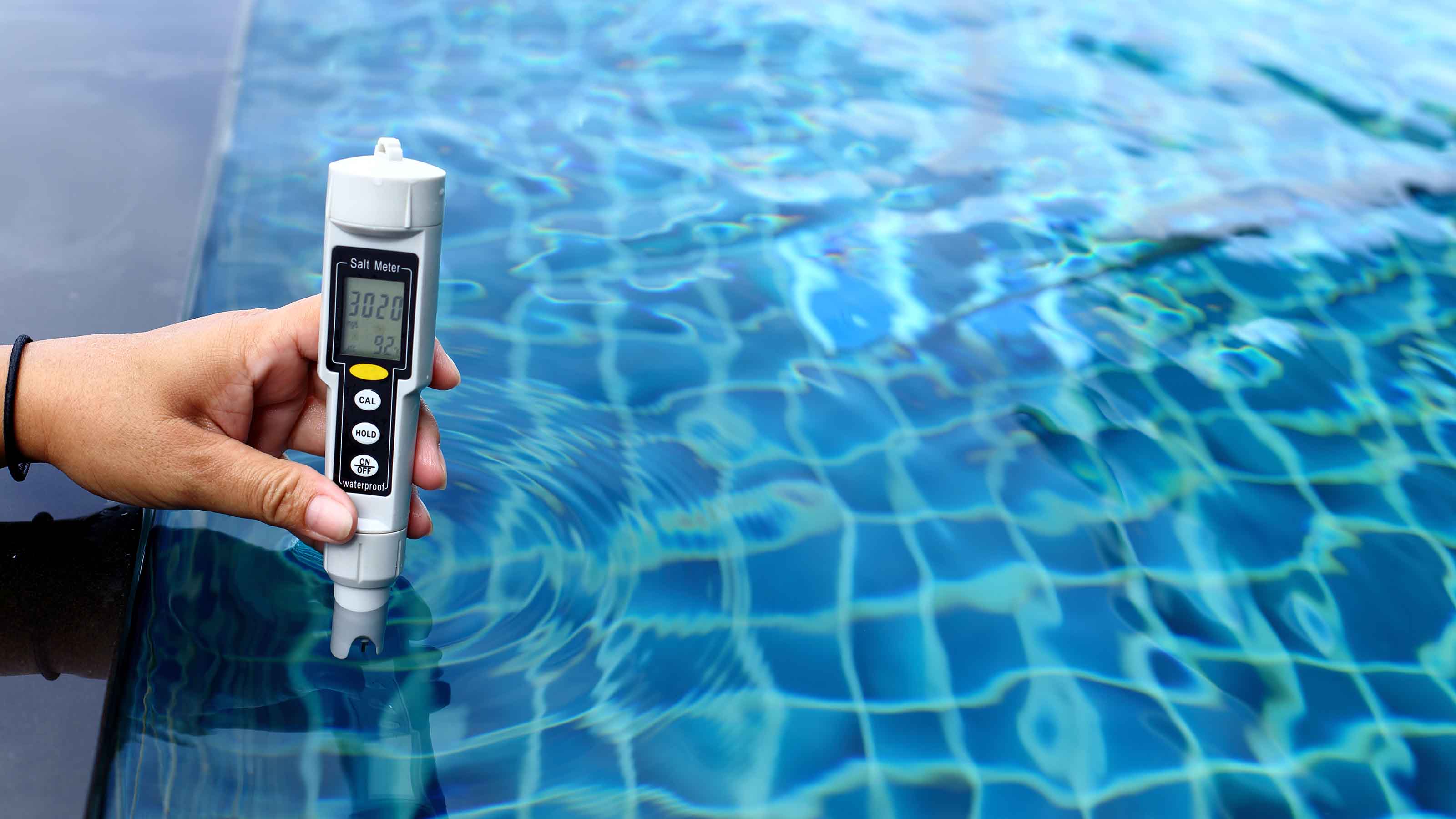

Ecolab

- Consecutive annual dividend increases: 33

Ecolab (ECL) provides water treatment and other industrial-scale maintenance services for several industries, including food, health care, and oil and gas. Practically speaking, its products help optimize everything from offshore oil production to electronics polishing to commercial laundries.

Ecolab's fortunes can wane as industrial needs fluctuate, though; for instance, when energy companies pare spending, ECL will feel the burn.

Over the long haul, however, this Dividend Aristocrat's shares have been a proven winner. That's thanks in no small part to 33 consecutive years of dividend increases. ECL's most recent hike came in December 2024, with a 14% increase in the quarterly payment to 65 cents per share.

General Dynamics

- Consecutive annual dividend increases: 34

Defense contractor General Dynamics (GD) was added to the elite list of best dividend stocks to buy for dividend growth in 2017.

Generous military spending has helped fuel this dividend stock's steady stream of cash returned to shareholders. Indeed, General Dynamics has upped its distribution for more than three decades now.

The last increase was announced in March 2025, when GD lifted the quarterly payout to $1.50 a share. With its below-average payout ratio, General Dynamics should have sufficient room for more dividend growth.

Erie Indemnity

- Consecutive annual dividend increases: 35

Property and casualty insurers can be reliable sources of income, not to mention rising payouts. That's the case with Erie Indemnity (ERIE), which was added to the Dividend Aristocrats in January 2025.

The company's dividend, which has risen annually without fail for more than three decades, boasts a 10-year compound annual growth rate of more than 7%.

Chevron

- Consecutive annual dividend increases: 38

Chevron (CVX) is an integrated oil giant that also has operations in natural gas and geothermal energy. It also happens to be the lone energy-sector name among the 30 Dow Jones stocks.

Analysts praise Chevron for having the strongest financial base in its peer group, a highly attractive portfolio of assets, and the "most straightforwardly positive risk/reward profile" of any stock in its sub-sector.

Perhaps most important for income investors, CVX has more than three decades of uninterrupted dividend growth under its belt, and management has said it will protect the payout at all costs. Chevron's last increase was announced in February 2025 with a 5% bump in the quarterly dividend to $1.71 per share.

T. Rowe Price

- Consecutive annual dividend increases: 39

Asset managers such as T. Rowe Price (TROW) have been losing market share to indexed funds of the type Vanguard offers, but the company still boasts a massive (and growing) $1.77 trillion in assets under management).

Strong performance from actively managed funds and the firm's focus on the growing retirement market are just two factors boosting AUM, analysts note.

T. Rowe Price has improved its dividend every year for 39 years, including a 2.4% increase to the payout announced in February 2025. Given its track record as one of the best dividend stocks, investors can expect a 40th consecutive dividend hike next year.

McCormick & Co.

- Consecutive annual dividend increases: 40

McCormick (MKC) – the maker of herbs, spices and other flavorings – has been bulking up with acquisitions over the years to drive sales growth, and the deals have been paying off.

The strategy should continue to provide support for McCormick's dividend, which has been paid without interruption since 1925 and raised annually for 40 years. MKC last declared an increase to its dividend in November 2025 – a 6.7% raise to the quarterly payment to 48 cents per share.

With ample free cash flow and a reasonable payout ratio, MKC has been able to generate a five-year compound annual dividend growth rate of 8%.

Atmos Energy

- Consecutive annual dividend increases: 42

Atmos Energy (ATO), which distributes and stores natural gas, was added to the Dividend Aristocrats in January 2020. The Dallas-headquartered firm serves more than 3 million distribution customers in more than 1,400 communities across nine states, with a large presence in Texas and Louisiana.

Analysts, who are mostly bullish on the name, point to ATO's strong fundamentals and increasing U.S. demand for natural gas. A robust balance sheet and potential for above-average earnings growth also recommend the stock.

Atmos clinched another year of dividend growth in November 2025 when it announced a 15% increase to $1 a share per quarter.

Brown-Forman

- Consecutive annual dividend increases: 42

Brown-Forman (BF.B) is one of the largest producers and distributors of alcohol in the world. Jack Daniel's Tennessee whiskey and Finlandia vodka are just two of its best-known brands, with the former helping drive long-term growth.

Unlike many of the best dividend stocks to buy on this list, you won't have a say in corporate matters with the publicly traded BF.B shares. They hold no voting power. And most of the voting-class A shares are held by the Brown family.

Still, you can enjoy in the company's gains and dividends. That payout has been on the rise for 42 consecutive years and has been delivered without interruption for 81. Most recently, Brown-Forman last upped the quarterly ante in November 2025, by 2% to 23.1 cents per share.

Amcor

- Consecutive annual dividend increases: 42

Amcor (AMCR) is a pretty boring company. It designs, manufactures and sells various packaging products for every industry you can think of, including food, beverage, pharmaceutical, medical, home and personal care.

But sometimes boring can be beautiful, and that's the case with Amcor when it comes to reliable income. It was named to the list of payout-hiking dividend stocks at the start of 2020 after its June acquisition of Bemis. Bemis, which fell out of the S&P 500 index and thus the Aristocrats in 2014, rejoined by merit of its merger with Amcor.

The company last raised its dividend in November 2025, by 2% to 13 cents a share per quarter. Ample free cash flow and a reasonable payout ratio should help ensure that the annual dividend increases keep on coming.

Exxon Mobil

- Consecutive annual dividend increases: 43

Exxon Mobil (XOM) remains one of the world's largest energy companies and is the biggest oil company by market value in the U.S. However, it was removed from the blue-chip Dow Jones Industrial Average in August 2020.

This dividend stalwart and its various predecessors have strung together uninterrupted payouts since 1882. To its credit, XOM was one of the few energy companies that didn't cut or suspend its payout amid the pandemic-caused crash in oil prices.

That said, it did put a temporary pause on its dividend growth.

The blue chip's quarterly distribution remained unchanged in 2020 amid the COVID-19 crisis. Fortunately for shareholders, membership in the Dividend Aristocrats is based on consecutive increases to the annual payout; a 3.4% bump to the dividend in October 2022 to 91 cents per share per quarter ensured that XOM will have a higher annual payout than in 2021, and thus remain in the club.

As for Exxon's most recent hike, the energy giant raised its dividend for a 43rd consecutive year in October 2025 when it increased its payout by 4% to $1.03 per share quarterly.

Cintas

- Consecutive annual dividend increases: 43

Cintas (CTAS) is perhaps best-known for providing corporate uniforms, but the company also offers maintenance supplies, tile and carpet cleaning services and even compliance training.

As such, it's seen by some investors as a bet on jobs growth, and tends to move ahead of any pick-up in hiring during and economic recovery. Indeed, CTAS has worked pretty well as a proxy for employment in the past.

Regardless of how the labor market is doing, Cintas is a stalwart when it comes to being one of the best dividend stocks. The company has raised its payout every year since going public in 1983. However, those have been annual distributions up until this year, when the company switched to quarterly payouts.

Most recently, in July 2025, CTAS raised its quarterly dividend by 15.4% to 45 cents per share.

Air Products & Chemicals

- Consecutive annual dividend increases: 43

Air Products & Chemicals (APD) spent much of the early 2020s restructuring. Under pressure from investors, it started to shed some weight, including spinning off its Electronic Materials division and selling its Performance Materials business.

Air Products, which dates back to 1940, now is a slimmer company that has returned to focusing on its legacy industrial gases business. But it hasn't taken its eye off the dividend, which it has improved on an annual basis for 43 years in a row. That includes an upgrade in January 2025 to $1.79 a share.

Aflac

- Consecutive annual dividend increases: 43

Aflac (AFL) is a supplemental insurance company – popularized by the loud Aflac duck – with roots going back to 1955 that covers numerous workplace offerings, such as accident, short-term disability and life insurance.

Although the COVID-19 pandemic slammed the insurance industry, AFL stock returned to pre-crash levels by early 2021, helped by the market's confidence in its dividend. And with a conservative payout ratio and four straight decades of dividend growth, that confidence is indeed well placed.

Aflac last raised its payout in November 2025, upping the quarterly distribution by 5.2% to 61 cents per share. And in addition to regular dividend increases, Aflac buys back a lot of its own stock.

Franklin Resources

- Consecutive annual dividend increases: 45

The name Franklin Resources (BEN) might not be well-known among investors; however, along with its subsidiaries, it's called the more familiar Franklin Templeton investments. The global investment firm is one of the world's largest with $1.7 trillion in assets under management, and is known for its bond funds, among other offerings.

Mutual fund providers have come under pressure because customers are eschewing traditional stock pickers in favor of indexed investments. However, Franklin has fought back in recent years by launching its first suite of passive exchange-traded funds.

Meanwhile, the asset manager remains attractive as an income provider for investors looking for the best dividend stocks. It has raised its dividend annually since 1981.

Clorox

- Consecutive annual dividend increases: 48

Clorox (CLX), whose brands include its namesake bleaches and cleansers, Glad trash bags and Hidden Valley salad dressing, won't blow investors away with its long-term total returns.

Rather, this consumer staples giant is all about defense and dividends. And, indeed, the dependable and defensive nature of Clorox's business has allowed the company to raise its annual dividend for more than four decades. The most recent hike came in July 2025 with a 1.6% bump to $1.24 per share per quarter.

CLX boasts a reasonable payout ratio and ample free cash flow, which should ensure a 49th consecutive increase to the dividend in 2026.

Sherwin-Williams

- Consecutive annual dividend increases: 48

Thanks to its 2017 acquisition of Valspar, Sherwin-Williams (SHW) is one of the largest paints, coatings and home-improvement companies in the world.

Income investors certainly don't need to worry about Sherwin-Williams' steady and rising dividend stream. SHW has hiked its distribution every year since 1979. The most recent hike came in February 2025 with a 10.5% increase to the quarterly payment to 79 cents per share.

The company was added to the Dow Jones Industrial Average in November 2024.

McDonald's

- Consecutive annual dividend increases: 49

The world's largest hamburger chain also happens to be a dividend stalwart. Changing consumer tastes will always be a risk, but McDonald's (MCD) dividend dates back to 1976 and has gone up every year since. That's the power of being a consumer giant that has been able to adjust itself to changing consumer tastes without losing its core.

MCD last raised its dividend in October 2025, when it lifted the quarterly payout by 5% to $1.86 a share. That marked its 49th consecutive annual increase. The company's 10-year compound annual dividend growth rate stands at more than 7%. And over the past 20 years? The CAGR tops 14%.

Medtronic

- Consecutive annual dividend increases: 49

Medtronic (MDT), one of the world's largest makers of medical devices, is an income machine. Most recently, in May 2025, MDT lifted its quarterly payout by a penny to 71 cents per share.

Such increases are typical of the firm. Medtronic's dividend delivered a compound annual growth rate of almost 10% over the past decade. Ample growth in free cash flow helps ensure that the hikes keep coming. The company's fiscal 2024 free cash flow increased 14% to $5.2 billion.

All told, MDT returned $5.5 billion to shareholders in 2024, including $1.6 billion through net share repurchases in the fourth quarter.

MDT is able to steer generous sums of cash back to shareholders thanks to the ubiquity of its products. It holds more than 47,000 patents on products ranging from insulin pumps for diabetics to stents used by cardiac surgeons.

Look around a hospital or doctor's office – in the U.S. or in more than 160 other countries – and there's a good chance you'll see its products.

Pentair

- Consecutive annual dividend increases: 49

U.K.-based water-treatment company Pentair (PNR) whose divisions include Flow Technologies, Filtration & Process and Aquatic & Environmental Systems, is always looking to expand its capabilities.

In early January 2021, it closed on its acquisition of Rocean, a maker of countertop filtration systems for the home. Terms were undisclosed. That followed its 2019 acquisition of Aquion for $160 million in cash.

Pentair has raised its dividend annually for 49 straight years, most recently in February 2025. A modest payout ratio and consistently ample free cash flow helps ensure that Pentair will continue to be one of the best dividend stocks.

Automatic Data Processing

- Consecutive annual dividend increases: 51

Automatic Data Processing (ADP) is the world's largest payroll processing firm, responsible for paying nearly 40 million employees and serving more than 1 million clients across 140 countries.

Through good economic times and bad, one of ADP's great advantages is its "stickiness." After all, it's complicated and expensive for corporate customers to change payroll service providers.

That competitive advantage helps throw off consistent income and cash flow. In turn, ADP has become a dependable dividend payer – one that has provided an annual raise for shareholders since 1975.

ADP's most recent dividend increase came in November 2025 when it lifted the quarterly payout 10% to $1.70 per share. The company's 10-year compound annual dividend growth rate stands at more than 8%.

Lowe's

- Consecutive annual dividend increases: 51

When it comes to home improvement chains, Home Depot (HD), a member of the Dow Jones Industrial Average, gets all the glory. But rival Lowe's (LOW) is the superior dividend grower.

Lowe's has paid a cash distribution every quarter since going public in 1961, and that dividend has increased annually for half a century. Most recently, in May 2025, Lowe's lifted its quarterly payout by 4% to $1.20 per share. Home Depot is a longtime dividend payer, too, but its string of annual dividend increases dates back only to 2010.

Consolidated Edison

- Consecutive annual dividend increases: 51

Consolidated Edison (ED) is the largest utility company in New York State by number of customers. Founded in 1823, it provides electric, gas or steam services to roughly 3.5 million customers in New York City and Westchester County.

ConEd also happens to be North America's second-largest solar power provider, and is investing in electric vehicle charging programs and other green energy endeavors.

Like most utilities, Consolidated Edison is highly regulated but enjoys a fairly stable stream of revenues thanks to limited direct competition – but not a lot of growth.

The longtime Dividend Aristocrat has hiked its annual distribution without interruption for five decades. In January 2025, the utility raised its quarterly payout to 85 cents per share.

Walmart

- Consecutive annual dividend increases: 52

The world's largest company by revenue might not pay the biggest dividend, but it sure is consistent. Walmart (WMT) had been delivering meager penny-per-share increases to its quarterly dividend since 2014.

In February 2025, WMT announced a 13% increase to 94 cents per share.

And shareholders can count on the increases to keep coming. The discount retailer, which operates approximately 11,400 stores and e-commerce websites under 54 banners in 26 countries, is a cash machine.

WMT has generated average annual levered free cash flow of more than $13 billion over the past five years.

Archer-Daniels-Midland

- Consecutive annual dividend increases: 52

Archer-Daniels-Midland (ADM) processes ingredients for food and feed, including corn sweeteners, starches and emulsifiers such as lecithin. It also has a commodity trading business.

It's a truly global agricultural powerhouse, too, boasting customers in 200 countries served by more than 800 facilities.

Archer-Daniels-Midland has paid out dividends on an uninterrupted basis for more than 92 years. The most recent hike came in February 2025, when ADM increased the quarterly payout to 51 cents a share. The move extended the dividend stock's streak of annual raises to 52 years.

S&P Global

- Consecutive annual dividend increases: 52

Formerly known as McGraw Hill Financial, S&P Global (SPGI) is the company behind S&P Global Ratings, S&P Global Market Intelligence and S&P Global Platts.

Although most investors probably know it for its majority stake in S&P Dow Jones Indices – which maintains the benchmark S&P 500 index and the blue-chip Dow Jones Industrial Average – it's also a central player in corporate and financial analytics, information and research.

S&P Global has paid a dividend each year since 1937 and has increased its disbursement annually for more than half a century. Most recently, in January 2025, SPGI raised its quarterly payout by 5.5% to 96 cents a share.

Nucor

- Consecutive annual dividend increases: 53

Nucor (NUE) is the largest U.S. steelmaker, but it's perhaps even more well known for its almost unrivaled commitment to dividend growth.

As one of the best dividend stocks, Nucor has increased its dividend for 53 straight years, or every year since it began paying dividends in 1973.

The most recent increase came in December 2025 when NUE lifted the quarterly disbursement by a penny to 56 cents per share. Nucor returns close to $500 million in cash to shareholders in dividends alone, year in and year out.

Kimberly-Clark

- Consecutive annual dividend increases: 53

Kimberly-Clark's (KMB) well-known brands include Huggies diapers, Scott paper towels and Kleenex tissues.

Like other makers of consumer staples, Kimberly-Clark holds out the promise of delivering slow but steady growth along with a healthy dividend to drive total returns.

Kimberly-Clark has raised the annual payout for 53 consecutive years. In January 2025, the board of directors approved a 3.3% increase in the quarterly dividend to $1.26 per share.

Abbott Laboratories

- Consecutive annual dividend increases: 53

Abbott Laboratories (ABT) manufactures a wide variety of health care goods. Its portfolio includes branded generic drugs, medical devices, nutrition and diagnostic products.

Some of its best-known products include Similac infant formulas, Glucerna diabetes management products and i-Stat diagnostics devices.

Abbott Labs dates all the way back to 1888. It first paid a dividend in 1924 and its dividend growth streak is long-lived too, at more than a half-century and counting. The last payout hike came in December 2024 — a 7.3% increase to 59 cents per share quarterly.

Becton Dickinson

- Consecutive annual dividend increases: 54

Medical devices maker Becton Dickinson (BDX) has bulked up quite a bit over the past few years. In 2015, it acquired CareFusion, a complementary player in the same industry.

Then in 2017, it struck a $24 billion deal for fellow Dividend Aristocrat C.R. Bard, another medical products company with a strong position in treatments for infectious diseases.

As a result of all that M&A, BDX boasts a highly diversified portfolio of products – and the ample free cash flow needed to support continued dividend growth. BDX last raised its payout in November 2025 to $1.05 a share per quarter.

AbbVie

- Consecutive annual dividend increases: 54

AbbVie (ABBV) is one of the highest yielders on this list of the best payout-improving dividend stocks. The pharmaceutical company was spun off from fellow Dividend Aristocrat Abbott Laboratories in 2013.

Including its time as part of Abbott, AbbVie has upped its annual distribution for 54 consecutive years.

The company's best-selling treatments include Humira: a rheumatoid arthritis drug that has been approved for numerous other ailments, and that appears is on pace to surpass Lipitor as the best-selling drug of all time. AbbVie also makes cancer drug Imbruvica, as well as testosterone replacement therapy AndroGel.

Illinois Tool Works

- Consecutive annual dividend increases: 54

Founded in 1912, Illinois Tool Works (ITW) makes construction products, car parts, restaurant equipment and more. While ITW sells many products under its namesake brand, it also operates businesses including Foster Refrigerators, ACME Packaging Systems and the Wolf Range Company.

In August 2025, Illinois Tool Works raised its quarterly dividend by 7% to $1.61 cents a share, bringing its streak of annual increases to 54 years. However, the company notes that excluding a period of government controls in 1971, that streak would stretch even farther.

PepsiCo

- Consecutive annual dividend increases: 54

Not too long ago, investors fretted over a long-term slide in sales of carbonated beverages, but that turned out not to be a secular trend after all. Indeed, market research forecasts the global market for fizzy drinks to produce a compound annual growth rate of 4.7% through 2028.

Besides, PepsiCo (PEP) has an ace up its sleeve with its snacks business. The company's Frito-Lay division is known for Doritos, Tostitos, Rold Gold pretzels, and numerous other brands. Meanwhile, demand for salty snacks remains solid.

The bottom line? PEP's business remains fundamentally strong, and that should keep its dividend-growth streak intact. PepsiCo declared its 54th straight annual increase in April 2025 with a 5% bump in the annnualized dividend to $5.69 per share.

W.W. Grainger

- Consecutive annual dividend increases: 55

W.W. Grainger (GWW) – which not only sells industrial equipment and tools, but provides other services such as helping companies manage inventory – is expected to generate steady if not spectacular sales growth for the next few years.

Happily for the income-minded, Grainger has achieved annual dividend growth for a half century and maintains a below-average payout ratio.

Additionally, GWW approved the repurchase of up to 5 million shares of the company's outstanding common stock, replacing the company's existing repurchase authorization.

PPG Industries

- Consecutive annual dividend increases: 55

PPG Industries (PPG) makes coatings and paints for numerous industries, including aerospace, architecture, automotive and packaging. Its sprawling operations employ roughly 47,000 people in more than 50 countries.

PPG has paid a dividend since 1899 and has raised it annually for 53 years. A below-average payout ratio and solid outlook for long-term earnings growth should keep the dividend increases coming. PPG's last raise came in July 2025 with a bump in the quarterly distribution to 71 cents per share from 68 cents per share.

Target

- Consecutive annual dividend increases: 55

Target (TGT) might be the No. 2 discount retail chain after Walmart in terms of revenue, but it doesn't take a back seat to the behemoth from Bentonville when it comes to dividends.

Target paid its first dividend in 1967, seven years ahead of Walmart, and has raised its payout annually since 1972.

With its well-below-average payout ratio, income investors can count on Target to keep hitting the mark for dividend growth. That has certainly been the case historically. Over the past decade, the company's dividend boasts a compound annual growth rate of nearly 12%.

Sysco

- Consecutive annual dividend increases: 57

Years of acquisitions have made Sysco (SYY) the food services and supply giant it is today. And the company's scale really came in handy during the pandemic, when it had to weather the closure of restaurants, bars and other food-service venues.

Happily for shareholders, the sudden and sharp downturn couldn't stop SYY from hiking its dividend for a 57th consecutive year. The company last raised its payout in April 2025 with 3 cents bump to 54 cents per share per quarter.

Stanley Black & Decker

- Consecutive annual dividend increases: 57

Power- and hand-toolmaker Stanley Black & Decker (SWK) has improved its cash distribution annually for more than half a century, including a 1 cent increase to 82 cents per share quarterly announced in July 2024.

SWK has bulked up through a series of deals over the past five years or so, including the acquisitions of Newell Tools, the Craftsman tool brand, IES Attachments, Nelson Fastener Systems and Consolidated Aerospace Manufacturing.

A low payout ratio and ample free cash flow should keep it SWK's dividend growth streak going.

Federal Realty Investment Trust

- Consecutive annual dividend increases: 58

Real estate investment trusts such as Federal Realty Investment Trust (FRT) are required to pay out at least 90% of their taxable earnings as dividends in exchange for certain tax benefits. Thus, REITs are well known as some of the best dividend stocks you can buy.

And few have been steadier than FRT, which owns retail and mixed-use real estate in several major metropolitan areas. Federal Realty Investment Trust has now hiked its payout every year for 58 years – the longest consecutive record in the REIT industry. Its latest increase – upping the quarterly dividend by 3 cents to $1.13 per share – was announced in August 2025.

Hormel Foods

- Consecutive annual dividend increases: 60

Hormel Foods (HRL) is best known for Spam, but it's also responsible for its namesake meats and chili, Skippy peanut butter, Dinty Moore stews and House of Tsang sauces, among other brands.

But it shouldn't go unnoticed that the packaged food company is about as reliable as they come when it comes to income investing, having raised its payout every year for more than five decades.

Indeed, in November 2025, Hormel announced its 60th consecutive dividend increase – a 1% raise to 29.25 cents per share quarterly. The packaged foods company is rightly proud to note that it has paid a regular dividend without interruption since becoming a public company in 1928.

Nordson

- Consecutive annual dividend increases: 62

Nordson's (NDSN) addition to the Dividend Aristocrats on February 1, 2023, boosted the industrial sector's representation in the equity income benchmark.

The company designs and manufactures systems that dispense, apply and control fluids like adhesives, coatings and sealants. As such, Nordson's customers are found in industries ranging from food packaging and biotechnology to aerospace and semiconductor manufacturing.

Although the yield on the payout might not wow investors, Nordson's epic streak of dividend increases certainly proves the company's commitment to returning cash to shareholders. S&P says the company has hiked its payout for 44 consecutive years. By Nordson's count, it has raised its dividend for 62 straight years.

Either way, Nordson became eligible for inclusion to the Dividend Aristocrats when it was added to the S&P 500 in February 2022.

The company last raised its dividend in August 2025 hiking the quarterly disbursement by 5% to 82 cents per share.

Kenvue

- Consecutive annual dividend increases: 62

Kenvue (KVUE) was added to the Dividend Aristocrats in August 2023 when it was spun off from fellow Aristocrat Johnson & Johnson (JNJ).

The former consumer health division of J&J's brand portfolio that includes Band-Aid, Benadryl, Zyrtec, Listerine and Tylenol.

The world’s largest pure-play consumer health company by revenue generated levered free cash flow of $1.6 billion in 2024.

Colgate-Palmolive

- Consecutive annual dividend increases: 63

Colgate-Palmolive (CL) sells a wide range of consumer staples brands including its namesake toothpaste and dish soap, as well as Speed Stick deodorant, Murphy cleaning products and Tom's of Maine personal-care products.

Demand for Colagte's products tends to remain stable in both good economic times and bad, and that drives the free cash flow need to maintain its dividend growth streak.

And what a streak it is. Colgate's dividend dates back more than a century, to 1895, and the company has increased it annually for 62 years. CL last raised its payment in March 2025 to 52 cents a share quarterly.

Coca-Cola

- Consecutive annual dividend increases: 63

Coca-Cola (KO) has long been known for quenching consumers' thirst, but it's equally effective at quenching investors' thirst for income. The company's dividend history stretches back to 1920, and the payout has swelled for 63 consecutive years.

Coca-Cola has worked hard to expand its offerings beyond traditional carbonated beverages, adding bottled water, fruit juices, sports drinks and teas to its product lineup.

In addition to the namesake Coca-Cola brand, KO also sports names such as Minute Maid, Powerade, Simply Orange and Vitaminwater.

Johnson & Johnson

- Consecutive annual dividend increases: 63

Johnson & Johnson (JNJ), founded in 1886 and public since 1944, is best known as a pharmaceutical giant after having spun off its consumer health division.

JNJ's diversification adds fortitude to this defensive dividend stock, and that helps income investors sleep better at night. The healthcare giant has increased its payout for three decades and counting.

The most recent hike came in April 2025 when JNJ increased the quarterly dividend by 4.8% to $1.30 per share.

Cincinnati Financial

- Consecutive annual dividend increases: 65

Property and casualty insurer Cincinnati Financial's (CINF) offerings include life insurance, annuities, umbrella insurance and a wide range of business insurance products.

Shares took a beating during the worst of the pandemic, but went on to beat the broader market handily over the next couple of years. And even when CINF stock was bottoming out, investors knew they could count on their dividends. Indeed, at 64 consecutive years and counting, Cincinnati Financial boasts one of the longest dividend growth streaks of any Dividend Aristocrat.

The P&C insurer most recently lifted its quarterly payout in January 2025 to 87 cents per share.

Genuine Parts

- Consecutive annual dividend increases: 69

Automotive and industrial replacement parts maker Genuine Parts (GPC) is best-known for the Napa brand. However, it also has deep roots in Mexico, where it operates under the AutoTodo brand, as well as Canada, where it operates as UAP.

Founded in 1928, Genuine Parts has long made returning cash to shareholders a priority.

The company has paid a cash dividend every year since going public in 1948, and has raised its payout for 69 consecutive years.

Emerson Electric

- Consecutive annual dividend increases: 70

Emerson Electric (EMR) makes a wide variety of industrial products, ranging from control valves to electrical fittings.

The company has paid dividends since 1956 and has boosted its annual payout for 70 consecutive years.

With a below-average payout ratio and plenty of free cash flow, investors can count on Emerson Electric to keep the dividend hikes coming.

Procter & Gamble

- Consecutive annual dividend increases: 69

With major brands such as Tide detergent, Pampers diapers and Gillette razors, Procter & Gamble (PG) is among the world's largest consumer products companies.

Although the economy ebbs and flows, demand for products such as toilet paper, toothpaste and soap tends to remain stable. That hardly makes P&G completely recession-proof, but it does make the grade as one of the best dividend stocks to buy because it's an equity income machine.

The Dow Jones Industrial Average component has paid shareholders a dividend since 1890, and has raised its payout for 69 years in a row.

Dover

- Consecutive annual dividend increases: 70

Dividend growth has long been a top priority for Dover (DOV). Indeed, 70 consecutive years of annual dividend increases is proof positive of the company's commitment to returning cash to shareholders.

The industrial conglomerate has its hands in all sorts of businesses, from Dover-branded pumps, lifts and even productivity tools for the energy business, to Anthony-branded commercial refrigerator and freezer doors. It's not an exciting business, but it can be a remunerative one.

Dover last raised its payout in August 2025, when it upped the quarterly outlay to 52 cents per share from 51.5 cents per share.

Related content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dan Burrows is Kiplinger's senior investing writer, having joined the publication full time in 2016.

A long-time financial journalist, Dan is a veteran of MarketWatch, CBS MoneyWatch, SmartMoney, InvestorPlace, DailyFinance and other tier 1 national publications. He has written for The Wall Street Journal, Bloomberg and Consumer Reports and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among many other outlets. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange.

Once upon a time – before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily – Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing. He's also written for Esquire magazine's Dubious Achievements Awards.

In his current role at Kiplinger, Dan writes about markets and macroeconomics.

Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University.

Disclosure: Dan does not trade individual stocks or securities. He is eternally long the U.S equity market, primarily through tax-advantaged accounts.

-

How Much It Costs to Host a Super Bowl Party in 2026

How Much It Costs to Host a Super Bowl Party in 2026Hosting a Super Bowl party in 2026 could cost you. Here's a breakdown of food, drink and entertainment costs — plus ways to save.

-

3 Reasons to Use a 5-Year CD As You Approach Retirement

3 Reasons to Use a 5-Year CD As You Approach RetirementA five-year CD can help you reach other milestones as you approach retirement.

-

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?

Your Adult Kids Are Doing Fine. Is It Time To Spend Some of Their Inheritance?If your kids are successful, do they need an inheritance? Ask yourself these four questions before passing down another dollar.

-

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)

The 4 Estate Planning Documents Every High-Net-Worth Family Needs (Not Just a Will)The key to successful estate planning for HNW families isn't just drafting these four documents, but ensuring they're current and immediately accessible.

-

Love and Legacy: What Couples Rarely Talk About (But Should)

Love and Legacy: What Couples Rarely Talk About (But Should)Couples who talk openly about finances, including estate planning, are more likely to head into retirement joyfully. How can you get the conversation going?

-

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate Assets

How to Get the Fair Value for Your Shares When You Are in the Minority Vote on a Sale of Substantially All Corporate AssetsWhen a sale of substantially all corporate assets is approved by majority vote, shareholders on the losing side of the vote should understand their rights.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to Chance

How to Add a Pet Trust to Your Estate Plan: Don't Leave Your Best Friend to ChanceAdding a pet trust to your estate plan can ensure your pets are properly looked after when you're no longer able to care for them. This is how to go about it.

-

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate Plan

Want to Avoid Leaving Chaos in Your Wake? Don't Leave Behind an Outdated Estate PlanAn outdated or incomplete estate plan could cause confusion for those handling your affairs at a difficult time. This guide highlights what to update and when.

-

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial Advice

I'm a Financial Adviser: This Is Why I Became an Advocate for Fee-Only Financial AdviceCan financial advisers who earn commissions on product sales give clients the best advice? For one professional, changing track was the clear choice.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.