10 Things You Must Know About Bull Markets

It's easy to look smart when most stocks are gaining day after day, but how much do you really know about the workings of bull markets?

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

There’s a saying on Wall Street: Don’t confuse brains with a bull market.

After all, when most stocks are gaining day after day, it’s easy to look smart. Indeed, the market has been in bull mode for so much of the last decade-plus, that it's hard to remember what challenging investing looks like.

Technical analysts differ on the definition of a bull market, but by one measure the S&P 500 confirmed it was in a bull on January 19, 2024, when it closed above its previous record close set back on January 3, 2022.

For the record, the S&P 500's longest bull market in history began in March 2009 and ended abruptly in March 2020, clobbered by coronavirus fears. The ensuing bear market cut fast and deep, but bottomed out in late March. About a month after its nadir, the market returned to bull-market territory and just kept chugging along.

Justified or not, those of us who have stuck around in stocks are probably feeling pretty brainy these days. Still, there’s plenty more to know about extended runs in stocks.

Read on to learn 10 things you must know about bull markets.

1. Why is it called a bull market?

There are several theories. Some say it's because the New York Stock Exchange is built on land that was used by the Dutch in the 17th century to auction off cattle. Another popular explanation is that rising markets were once fueled by fast-talking brokers with exaggerated claims about stocks (thus the phrase, "a line of bull").

As much as the "line of bull" story rings true, the most widely accepted theory is that the actions of bulls and bears, when attacking an opponent, reflect market movements. Bulls thrust upward, while bears swipe downward.

2. When stocks are officially in a bull market

There are many misconceptions about bull markets. No, we're not in a bull market just because the pundits on TV say we are. Neither is it a bull market when a major stock market index — such as the Dow Jones Industrial Average, S&P 500 or Nasdaq Composite — hits a new record high.

Rather, market trackers at S&P Dow Jones Indices define a bull market as a 20% rise in the S&P 500 from its previous low. By that measure — a 20% gain off the low —the current bull market began on January 19, 2024.

Note that by that measure, a bull market comes to an end when the S&P 500 falls 20% from its peak.

But other market analysis and research houses view bull markets differently. For instance, Sam Stovall, chief investment strategist at investment research firm CFRA, told Kiplinger's Personal Finance that he defines a bull market as a gain of at least 20% too – but the market also must go six months without falling beneath the previous low.

Other market participants will say that you can't truly confirm a bull market until you exceed the previous all-time highs. By that measure, the bull market started on March 23, 2020, but wasn't confirmed until Aug. 18, 2020, when the S&P 500 eclipsed its previous high set on Feb. 19, 2020.

Regardless, by most strategists' definitions, we're in a new bull market.

3. How long the average bull market lasts

As much as investors would like the answer to this question to be "forever," bull markets tend to run for just under four years.

The average bull market duration, since 1932, is 3.8 years, according to market research firm InvesTech Research. As noted above, the longest bull market in history ran for 11 years, from 2009 to 2020.

4. How common bull markets are

Not including our current uptrend (because some strategists want further confirmation), there have been 26 bull markets since 1928, according to Ned Davis Research, which uses its own set of signals to determine bull and bear markets. We have seen the same number of bear markets over that time frame.

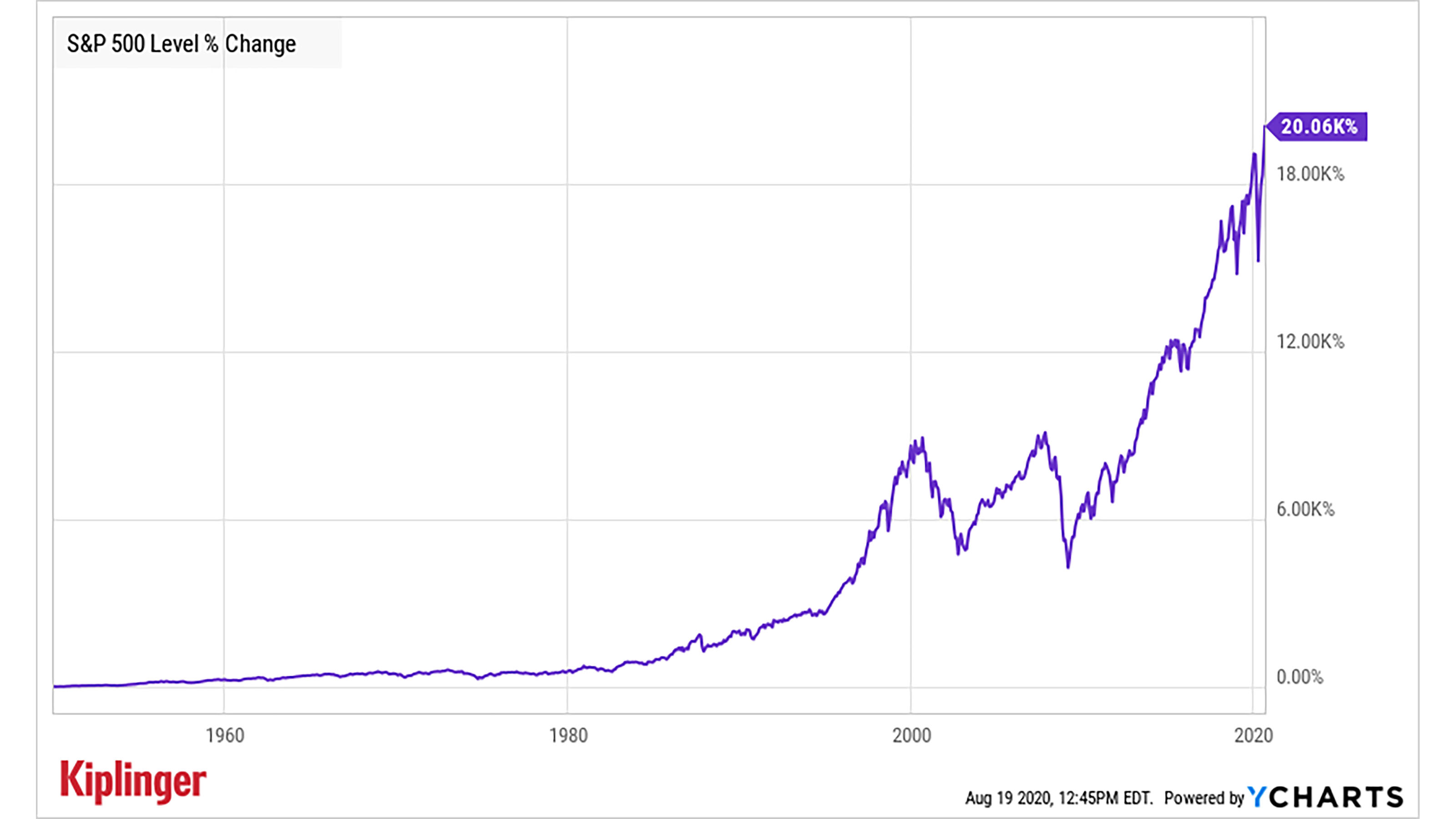

On average, stocks gain 112% during a bull market. That's against an average loss of 36% during a bear market. And, of course, stocks have only gone up over the long term.

5. The types of stocks that do best in a bull market

It depends.

Typically, over the course of a bull market, different types of stocks will lead the pack. In a young bull market (early in an economic expansion), the cyclical sectors that are most sensitive to interest rates and economic growth do best, including financials, consumer discretionary (companies that provide nonessential goods or services) and industrials.

Later, tech stocks tend to lead mid-cycle, and commodity-linked sectors, including energy and materials, often outperform at the end stages of the economic cycle.

But this isn't your typical bull market. As we'll see below, tech stocks are outperforming and financials are lagging. Remember that a diversified portfolio will probably own all or most of these stocks, but the proportions will likely change over time.

6. Best-performing sector in the current bull market

There's really no agreement on when a bull market "officially" begins. Some say it's when the market rises 20% off the bear-market bottom, while others contend it's not a bull until the market regains its prior peak.

But ever since the market took off in 2023, it's been led by the Magnificent 7 stocks. The group is made up of mega-cap stocks Apple (AAPL), Alphabet (GOOGL), Microsoft (MSFT), Amazon.com (AMZN), Meta Platforms (META), Tesla (TSLA) and Nvidia (NVDA).

In 2023, the Magnificent 7 stocks logged an impressive average return of 111%, compared to a 24% return for the broader S&P 500.

7. Stocks leading the rally

For the 52 weeks ended January 19, the best performing stocks in the S&P 500 included Nvidia, Meta Platforms and Royal Caribbean (RCL).

8. Bull markets can fuel unstainable businesses

All the great bubbles started out as bull markets. From the Dutch tulip bulb mania of 1636-37 to the Nifty Fifty blue-chip stocks that collapsed in 1973 to the dot-com darlings that popped the turn-of-the-century tech bubble, spectacular rises and breathtaking falls prove that irrational euphoria and a herd mentality can catapult any market into oblivion.

To learn about the occasionally catastrophic combination of human nature and financial markets, read Manias, Panics and Crashes: A History of Financial Crises, by Charles P. Kindleberger. The newest edition of the classic book was updated by economist Robert Z. Aliber and released in 2015.

9. What a secular bull market is

A secular bull market is an advance usually measured by the decade instead of by the year, occasionally punctuated by shorter bear markets.

Secular bull markets include the run from 1982 through 2000 that saw prices for stocks in the S&P 500 rise more than 1,200%, despite bear markets in 1987 and 1990. The 1949-1966 secular bull withstood a nearly 30% drop in 1962. The average gain for secular bulls approaches 500%.

10. What kills a bull market

A rising inflation, higher interest rates and recession can all contribute to the death of a bull market. But timing is everything.

The stock market anticipates a recession, typically peaking six to nine months in advance of the onset of one. Making things even trickier, stocks sometimes anticipate recessions that never materialize. Also, stocks tend to perform well in the early days of higher rates and rising inflation; they signal a strengthening economy, after all.

Eventually, however, higher rates choke off growth as inflation erodes the value of investment returns.

Related Content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Anne Kates Smith brings Wall Street to Main Street, with decades of experience covering investments and personal finance for real people trying to navigate fast-changing markets, preserve financial security or plan for the future. She oversees the magazine's investing coverage, authors Kiplinger’s biannual stock-market outlooks and writes the "Your Mind and Your Money" column, a take on behavioral finance and how investors can get out of their own way. Smith began her journalism career as a writer and columnist for USA Today. Prior to joining Kiplinger, she was a senior editor at U.S. News & World Report and a contributing columnist for TheStreet. Smith is a graduate of St. John's College in Annapolis, Md., the third-oldest college in America.

-

Over 65? Here's What the New $6K 'Senior Deduction' Means for Medicare IRMAA Costs

Over 65? Here's What the New $6K 'Senior Deduction' Means for Medicare IRMAA CostsTax Breaks A new deduction for people over age 65 has some thinking about Medicare premiums and MAGI strategy.

-

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.Tax Law Here's how taxpayers can amend their already-filed income tax returns amid a potentially looming legal battle on Capitol Hill.

-

5 Investing Rules You Can Steal From Millennials

5 Investing Rules You Can Steal From MillennialsMillennials are reshaping the investing landscape. See how the tech-savvy generation is approaching capital markets – and the strategies you can take from them.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

Dow Hits New High Ahead of January Jobs Report: Stock Market Today

Dow Hits New High Ahead of January Jobs Report: Stock Market TodayA weak reading on December retail sales was in focus ahead of Wednesday's delayed labor market data.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.