Five Ways Retirees Can Keep Perspective Through Market Jitters

Market volatility is a recurring event with historical precedents (the dot-com bubble, global financial crisis and pandemic), each followed by recovery. Here's how people who are near or in retirement can navigate economic uncertainty.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

If you've been watching the news lately — or even just checking your 401(k) balance — it's normal to feel uneasy.

We're seeing tariff battles flaring up, conflicts overseas dragging on, inflation gnawing at purchasing power, even murmurs of another world war. I've had more than a few clients call me recently and ask, "Is this the beginning of the end?"

You're not wrong to feel concerned. But you're also not without options — or context.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The Kiplinger Building Wealth program handpicks financial advisers and business owners from around the world to share retirement, estate planning and tax strategies to preserve and grow your wealth. These experts, who never pay for inclusion on the site, include professional wealth managers, fiduciary financial planners, CPAs and lawyers. Most of them have certifications including CFP®, ChFC®, IAR, AIF®, CDFA® and more, and their stellar records can be checked through the SEC or FINRA.

We've been here before

Since 1996, we have been helping clients through:

The dot-com bubble and crash (1995-2002). Fueled by excitement about internet-based business, technology was soaring in the late 1990s — companies with little to no revenue received sky-high valuations.

The Nasdaq reached its peak in March 2000, rising above 5,000. By 2002, the Nasdaq crashed nearly 80%, erasing trillions of dollars in market value. Many companies went bankrupt, and investor confidence in technology was shaken for years.

This highlighted the danger of speculative investing and the importance of fundamentals.

The global financial crisis (2007-2009). Fueled by the housing market collapse, subprime mortgage defaults spread into the broader financial systems. The S&P 500 lost more than 50% of its value from its 2007 peak to the 2009 trough.

Panic led to widespread selling and government bailouts — reinforcing the need for diversification and risk management.

The COVID-19 pandemic crash and recovery (2020). The world endured severe economic uncertainty amid global lockdowns, halted travel and business closures. The S&P 500 fell more than 30% in just a few weeks (February to March 2020).

Massive fiscal stimulus and near zero interest rates fueled a rapid V-shaped recovery, with markets reaching all-time highs by late 2020.

Many adjustments are still impacted today, by way of monetary policy, work culture, e-commerce and new adoption of technology.

Each time, the world felt a little off its axis, and that's hard to forget.

But here's the key takeaway: Every time, we recovered — not immediately, not painlessly, but consistently. From 2009 to 2021, the S&P 500 returned nearly 16% per year, on average. Those who stayed the course were rewarded.

What's different — and what's not

No two crises are identical. Today's landscape brings its own mix of challenges:

- Global instability. Conflicts in Eastern Europe, the Middle East, and the South China Sea aren't just headlines; they're market movers.

- Economic friction. Trade tensions and interest rate hikes have created real pressure on growth.

- Domestic tension. From labor strikes to political paralysis, the U.S. feels as if it's holding its breath.

What's not different: Underneath all this, we still have a resilient economy. Companies are innovating. Consumers are spending. AI, biotech, and clean energy aren't just buzzwords — they're building the next economic cycle.

If you're near or in retirement, read this twice

When markets turn volatile, the instinct to do something is strong. But reacting emotionally can be the costliest move you make.

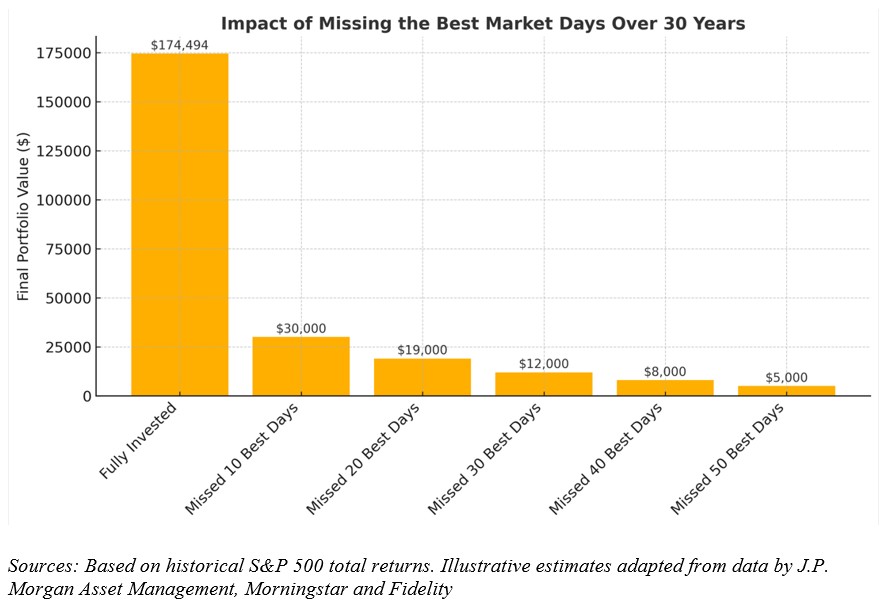

Time and again, some of the best market days come right after the worst. To illustrate this, the graphic below shows the impact of missing the best market days in the last 30 years.

You don't need to be reckless, but you do need a plan grounded in discipline.

Five moves that make sense right now

1. Review your income plan. Make sure you've got 12 to 24 months of essential living expenses in something liquid — high-quality bonds or cash equivalents. This reduces the need to sell investments in a down market.

Looking for expert tips to grow and preserve your wealth? Sign up for Building Wealth, our free, twice-weekly newsletter.

2. Use a bucket approach. You can separate short-term needs from longer-term investments. It will help you stay invested for growth without sacrificing sleep.

3. Rebalance, don't retreat. Market dips often create opportunities. Rebalancing your portfolio can lock in gains, reduce risk and position you for the rebound.

4. Be intentional about taxes. Volatility opens the door for tax-loss harvesting or even converting some traditional IRA dollars to Roth IRAs. QCDs, for those age 70½ and older, are another great tool.

5. Plan for longevity. Many of us are living well into our 90s. That means a 65-year-old retiree still has a 25-to-30-year investment horizon. You'll likely need some growth exposure to maintain purchasing power over time.

Final thoughts

It's not about predicting the next 12 months. It's about preparing for the next 20 years.

Resilience isn't just an economic concept — it's a mindset. Things are uncertain right now. But history favors those who stay focused, stay calm and stay committed to their plans.

Sources: Bloomberg, Morningstar, JP Morgan Guide to the Markets (2024), Federal Reserve Economic Data.

Securities and advisory services offered through Commonwealth Financial Network®, member FINRA/SIPC, a Registered Investment Adviser. Fixed insurance products and services are separate from and not offered through Commonwealth Financial Network. Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®. CERTIFIED FINANCIAL PLANNER™ in the U.S., which it awards to individuals who successfully complete CFP Board's initial and ongoing certification requirements.

Related Content

- Three Keys to Logical Investing When Markets Are Volatile

- Three Financial Planning Strategies for When Markets Fall

- Retirement Income Strategies for the Long Haul

- Diversification: An Investment Adviser's Guide to Why You Need It and How to Achieve It

- Finances Aside, What Does a Happy Retirement Look Like?

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dennis D. Coughlin, CFP, AIF, co-founded CG Capital with Christopher C. Giambrone in 1999. He has been in practice since 1996 and works with individuals nearing retirement and those whom have already retired. Proud of his humble upbringing, Dennis shares his advice with the same core principles that he was raised with. When not in the office, you will find him with his family enjoying the outdoors.

-

Timeless Trips for Solo Travelers

Timeless Trips for Solo TravelersHow to find a getaway that suits your style.

-

A Top Vanguard ETF Pick Outperforms on International Strength

A Top Vanguard ETF Pick Outperforms on International StrengthA weakening dollar and lower interest rates lifted international stocks, which was good news for one of our favorite exchange-traded funds.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

A Top Vanguard ETF Pick Outperforms on International Strength

A Top Vanguard ETF Pick Outperforms on International StrengthA weakening dollar and lower interest rates lifted international stocks, which was good news for one of our favorite exchange-traded funds.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

We're 64 With $4.3 Million. I Want to Retire Now and Pay for Health Insurance Until We Get Medicare. My Wife Says We Should Work. Who's Right?

We're 64 With $4.3 Million. I Want to Retire Now and Pay for Health Insurance Until We Get Medicare. My Wife Says We Should Work. Who's Right?I want to retire now and pay for health insurance until we get Medicare. My wife says we should work 10 more months. Who's right?

-

Missed Your RMD? 4 Ways to Avoid Doing That Again (and Skip the IRS Penalties), From a Financial Planner

Missed Your RMD? 4 Ways to Avoid Doing That Again (and Skip the IRS Penalties), From a Financial PlannerIf you miss your RMDs, you could face a hefty fine. Here are four ways to stay on top of your payments — and on the right side of the IRS.

-

What Really Happens in the First 30 Days After Someone Dies (and Where Families Get Stuck)

What Really Happens in the First 30 Days After Someone Dies (and Where Families Get Stuck)The administrative requirements following a death move quickly. This is how to ensure your loved ones won't be plunged into chaos during a time of distress.

-

AI-Powered Investing in 2026: How Algorithms Will Shape Your Portfolio

AI-Powered Investing in 2026: How Algorithms Will Shape Your PortfolioAI is becoming a standard investing tool, as it helps cut through the noise, personalize portfolios and manage risk. That said, human oversight remains essential. Here's how it all works.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

Good Stock Picking Gives This Primecap Odyssey Fund a Lift

Good Stock Picking Gives This Primecap Odyssey Fund a LiftOutsize exposure to an outperforming tech stock and a pair of drugmakers have boosted recent returns for the Primecap Odyssey Growth Fund.