20 of Wall Street’s Newest Dividend Stocks

Many companies have cut or killed their cash distributions in 2020, but these new dividend stocks have either started or kept up freshly initiated payouts.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

To say that 2020 has been full of surprises would be the understatement of the year.

Companies that might have seemed safe prior to the pandemic, such as conservative real estate investment trusts (REITs), were suddenly found to be risky when their tenants could no longer pay the rent. And flashy tech stocks – which in a more normal world might have seemed risky – suddenly found themselves selling mission-critical services.

Yet as upside down as the world is right now, some things really haven't changed, and that includes the appreciation investors have for reliable dividend stocks. The consistent payment of a dividend was, is, and likely always will be a sign of quality. Thus, new dividend stocks have, in a sense, finally made it.

"Few things better mark a quality company than the payment of a dividend," says John Del Vecchio, forensic accountant and co-manager of the AdvisorShares Ranger Equity Bear ETF (HDGE). "Earnings and even sales can be manipulated by an unscrupulous management team. But in order to pay the dividend, they have to have actual cash in the bank."

"Initiating a new dividend is often a sign that a company has matured into a stable and more durable business and one that's a lot less likely to disappoint," Del Vecchio added.

The data seems to support this. A study by Ned Davis Research found that the S&P 500 returned 7.70% per year between 1972 and 2017. But a portfolio consisting of only the dividend-paying stocks in the S&P 500 returned 9.25% per year over the same period, soundly beating the index. Non-payers generated paltry returns of just 2.61%.

Yes, the COVID-19 pandemic has been particularly hard on dividend payers and has forced many to slash their payouts or eliminate them altogether. But at the same time, plenty of companies are surviving and thriving in this environment enough to initiate a dividend or continue a recently initiated dividend.

Today, we're going to look at 20 new dividend stocks. While every pick isn't necessarily a recommendation – this is merely a list of recent dividend initiators – you can certainly use it as a starting point for further research.

Data is as of July 23. Dividend yields are calculated by annualizing the most recent payout and dividing by the share price.

Rexnord

- Market value: $3.6 billion

- Dividend yield: 1.1%

- First regular dividend: 2020

First up is Rexnord (RXN, $30.27). This company might have only initiated its dividend this year, but it has a long history in the American Midwest dating back to 1891. Originally started as a maker of industrial chain belts, RXN today manufactures advanced process and motion control and water management products.

Through its process and motion controls businesses, Rexnord is a manufacturing company that builds the machinery other manufacturing companies need to produce their own wares. And its water management products focus on water safety and drainage control. It's a unique and highly specialized collection of businesses.

With most of the world still in recession, Rexnord might have a few lean quarters in front of it. But if the larger trend of manufacturing returning from China to the U.S. continues to build steam, Rexnord should have a very bright future.

RXN joined this list of new dividend stocks this year with an 8-cent-per-share payout in March. It currently yields just more than 1%.

Provident Bancorp

- Market value: $156.2 million

- Dividend yield: 1.5%

- First regular dividend: 2020

Provident Bancorp (PVBC, $8.02) is the parent company of Provident Bank, a small bank based in Amesbury, Massachusetts. Provident is small, with only eight offices in Massachusetts and New Hampshire. Yet the firm is the 10th-oldest financial institution in America and has a history dating back to 1828.

Despite the bank's pedigree, it has a short history as a public company. Its privately held holding company brought the bank public in 2015.

Provident's history as a dividend payer is even shorter. The bank paid its first dividend in May of this year and also initiated a stock repurchase plan.

Initiating a dividend at a time when much of the economy was shut down and many small businesses were having a hard time paying their loans was a bold move. And to be fair, the bank made the announcement on March 12, before the extent of the coronavirus disruptions was fully understood.

We probably shouldn't expect much in the way of dividend hikes over the next several quarters, and the share buybacks are likely on ice for a while, or at least until the economy is a little healthier. But PVBC seems to be sticking with the program, and has announced a dividend to be paid Aug. 13. Shares are down 36% year-to-date; value investors might want to give this one a deeper look.

HBT Financial

- Market value: $156.2 million

- Dividend yield: 1.5%

- First regular dividend: 2020

HBT Financial (HBT, $8.02) is a bank holding company with controlling interests in Heartland Bank and Trust Company and the State Bank of Lincoln. The century-old bank, founded in 1920, is based in Bloomington, Illinois. HBT's subsidiaries have 64 locations scattered across Illinois and provide the basic services you'd expect from a community bank.

Yet despite its long history, HBT is brand-spanking new as a public company. The company executed its initial public offering (IPO) in December 2019. And the bank wasted little time in starting up payouts, initiating a cash distribution early in 2020 to join this list of new dividend stocks.

As with banks in general (and smaller banks in particular), HBT really got beaten up in the COVID-19 bear market. And it has really yet to recover. Shares are down about 35% year-to-date and yield 7.4%.

While there is a lot of uncertainty right now in the banking word due to the pandemic and the potentially slow recovery in consumer spending, the financial system has thus far remained strong and is well supported by the Federal Reserve. If you're a patient value investor, this sector definitely is worth a deeper dive.

SBA Communications

- Market value: $33.3 billion

- Dividend yield: 0.6%

- First regular dividend: 2019

Next up is cellular tower REIT SBA Communications (SBAC, $298.68), which paid out its first dividend in September 2019.

SBA is a leading independent owner and operator of wireless communications infrastructure including towers, distributed antenna systems and small cells. It's active in 14 countries, with the largest being the United States, Brazil and Canada.

SBA was founded in 1989 but converted to the REIT structure in 2017. This is important and means that, while modest today, SBA's dividend should continue to grow for years to come. To legally avoid federal income tax, REITs are required by law to distribute at least 90% of their profits.

Furthermore, while many REITs are facing unprecedented challenges because of forced closures and decreased foot traffic, life has never been better for cell tower landlords. That shouldn't change anytime soon.

SBA initiated its dividend last August and has already hiked it once. Expect more of the same going forward.

CURO Group Holdings

- Market value: $307.6 million

- Dividend yield: 2.9%

- First regular dividend: 2020

The quarantine-related lockdowns hit working-class Americans a lot harder than white-collar professionals. While many office employees can continue to do their jobs from home, blue-collar and service workers generally can't.

This has created both opportunities and risk for non-traditional financial companies like CURO Group Holdings (CURO, $7.54).

CURO is non-bank lender serving what it calls "underbanked" consumers in the United States, Canada and United Kingdom. Its services include short-term loans, check cashing, prepaid debit cards and pawn-based lending.

Naturally, CURO's customers tend to be people with low credit. If you're a high-income earner with a country club membership, you're not likely to need a payday loan. It remains to be seen exactly how strapped for cash CURO's clients will be once the temporary unemployment benefits stemming from virus relief start to get phased out. But at the same time, it's possible that record numbers of people will need CURO's services as we continue to see economic fallout.

In any event, CURO's shares are down by more than half from their 52-week highs and yield 2.9% on a dividend that the company began paying in March of this year.

But just because CURO has joined the ranks of 2020's new dividend stocks doesn't necessarily make it a buy right away. At least two shareholder-rights firms are investigating the company over allegations that CURO misled investors about the negative effect of business changes in 2018, so you'll want to wait for the smoke to clear.

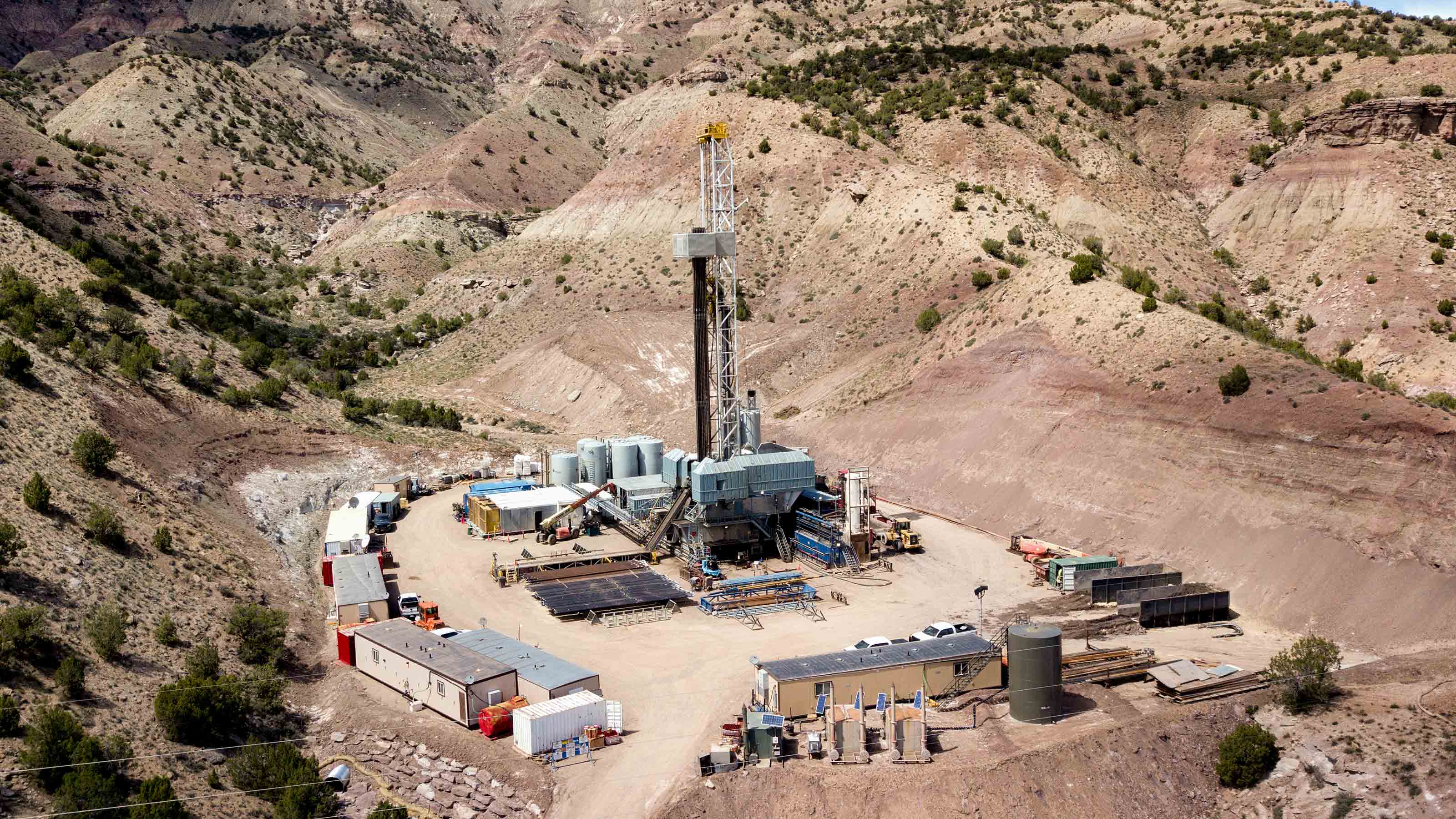

Cactus

- Market value: $1.7 billion

- Dividend yield: 1.6%

- First regular dividend: 2019

Oil and gas has been a graveyard for investor capital in recent years, and income investors in particular have been particularly beaten up. Many energy firms have been forced to suspend or cut dividends this year as the industry grapples with structural oversupply and a dearth or demand due to virus quarantines and reduced travel.

And it's not just exploration and production companies suffering. Oilfield services companies and suppliers have also really struggled this year.

But one energy-related company is bucking the trend of dividend cuts. Cactus (WHD, $22.40) actually initiated its first dividend late last year, with a December payment.

Cactus designs and manufactures wellheads and pressure control equipment primarily to "nonconventional" onshore developers. In other words, Cactus sells its wares to frackers.

Needless to say, fracking isn't the best business to be in these days, which is why Cactus' share price is down by 35%. The company has already announced layoffs and salary reductions, lowering its headcount by about 30%.

If there's any good news, it's that the stock has been on a steady upswing since March. And WHD has managed to keep its dividend intact so far, including its 90-cent distribution delivered on June 18.

Be careful investing in this new dividend stock given the terrible macro environment for its customers. And if you do buy Cactus, you should be prepared for the possibility of a dividend cut. But at current prices, it is at least worth exploring as a value play.

Victory Capital Holdings

- Market value: $1.3 billion

- Dividend yield: 1.1%

- First regular dividend: 2019

Financial stocks are well represented on this list of new dividend payers, which brings us to Victory Capital Holdings (VCTR, $19.07).

Victory manages about $127.7 billion in client assets. It also manages and distributes a suite of mutual funds as well as the VictoryShares family of ETFs.

Just a few months ago, this business would have seemed precarious. But with the major indices just a hair's breadth away from new all-time highs, life is looking pretty good for traditional asset managers whose revenues stem from the size of money under management. All else equal, a market move that sends stocks 20% higher equates to roughly 20% higher revenues.

This bull run that has been in place since late March might prove to be ephemeral. We frankly have no way to know if or when the next correction will strike. But until it does, traditional money managers like VCTR should enjoy this epic run.

Victory initiated its dividend last year, with its first payout in September 2019, and the shares currently yield 1.1%.

PennyMac Financial Services

- Market value: $3.5 billion

- Dividend yield: 1.1%

- First regular dividend: 2018

Mortgage REITs got hammered during the March bear market, and many suffered permanent damage to their portfolios. With millions of Americans forced to seek forbearance protection, many mortgage note holders were left holding the bag.

But for mortgage servicers, it was mostly business as usual. And that brings us to our next recent dividend initiator, PennyMac Financial Services (PFSI, $44.38).

PennyMac is the third-largest mortgage producer in the U.S. and the sixth-largest mortgage servicer. But while it writes and services a ton of mortgages, it doesn't actually carry them of its books. Substantially all of its mortgages are sold to Fannie Mae, Freddie Mac or Ginnie Mae.

Apart from its mortgage origination and servicing businesses, PennyMac is also the manager of the PennyMac Mortgage Investment Trust (PMT), a mortgage REIT.

PennyMac's shares stumbled in March, but the stock has recovered and then some, gaining 30% year-to-date to new all-time highs. PFSI's stock price has doubled over the past two years, and this new dividend stock is showing no sign of slowing down.

SmartFinancial

- Market value: $213.0 million

- Dividend yield: 1.4%

- First regular dividend: 2019

SmartFinancial (SMBK, $14.00) might sound like a cutting-edge fintech company, but it's actually a sleepy little regional bank. SmartFinancial is the bank holding company for SmartBank, which has 29 branch locations scattered across Tennessee, Alabama, Florida and Georgia.

As with many small-town community banks, SmartFinancial has been active in the mergers-and-acquisitions game, acquiring Foothills Bank and Southern Community Bank in 2018.

SmartFinancial reinitiated its dividend in 2019 after taking a 10-year hiatus. The bank eliminated its dividend following the financial crisis and only restarted it last year.

Like most banks, SmartFinancial got hit hard in the March selloff and is still down nearly 40% from its 52-week highs. Low interest rates and the potential for loan defaults will be ongoing risks for this sector, but that would seem to be more than accounted for at today's prices.

Byline Bancorp

- Market value: $502.0 million

- Dividend yield: 0.9%

- First regular dividend: 2019

Let's add one final bank holding company to the list in Byline Bancorp (BY, $13.08). BY is the holding company for Byline Bank, a community bank with a history going back a century. Byline is a regional bank for the upper Midwest and has more than 50 branches throughout the Chicago and Milwaukee metro areas.

Like most of the other bank holding companies on this list, Byline is a small-cap stock with a market cap of under $500 million. And 2020 has been a tough one for smaller banks. Here's a familiar refrain: BY shares still are down a third from their 52-week high.

Low interest rates erode bank profit margins, so the earnings outlook doesn't look great in the immediate future. But again, buying a healthy bank at a 33% discount to its recent highs would seem like a decent long-term bet. At current prices, Byline yields a little less than 1%.

Signature Bank

- Market value: $6.0 billion

- Dividend yield: 2.0%

- First regular dividend: 2018

Smaller community banks have been major dividend initiators over the past few years, and most have managed to stay financially sound and healthy throughout the COVID-19 downturn. Let's add one more community bank to our list of recent dividend payers.

Signature Bank (SBNY, $111.58) is a regional bank with 32 private client offices mostly scattered around New York City. The bank also has offices in San Francisco, California, and Charlotte, North Carolina.

In the world of financial services, bigger is generally perceived as better. Yet Signature Bank has managed to carve out a profitable niche, targeting a smaller but wealthier clientele of business owners and senior managers.

Signature Bank has been in business since 2001 and publicly traded since 2004. SBNY joined this list of new dividend stocks in August 2018 when it paid out 56 cents per share, and it has maintained that payout ever since. At current prices, the dividend works out to a yield of 2%.

SBNY hasn't raised its dividend since initiating it two years ago, but future hikes are a very real possibility, given that the bank pays a conservative 22% of its profits as dividends.

Corteva

- Market value: $21.5 billion

- Dividend yield: 1.8%

- First regular dividend: 2019

Corteva (CTVA, $28.67) is the child of divorce. In a whirlwind romance, Dow Chemical and DuPont de Nemours briefly merged to become a powerhouse chemical producer in 2017. Alas, there wasn't much of a honeymoon. Just two years later, the company split into three new companies: commodity chemical maker Dow (DOW), specialty chemical maker DuPont (DD) and agricultural supplier Corteva.

If that was hard to follow, don't feel bad. It's questionable how much sense it made to make the world's largest chemical company only to immediately dismantle it. But at least in Corteva, we have a focused play on agricultural technology.

Corteva has two segments: Seed and Crop Protection. Its Seed segment does exactly what its name suggests, boosting farm productivity by making seeds with protection against weeds, pests and disease. The company's Crop Protection segment manufactures herbicides, pesticides and other farming products.

It's not a scintillating business. But it's critical to feeding a growing global population.

Corteva paid shareholders a dividend for the first time on Sept. 13, 2019; at current prices, it yields 1.89%.

Cowen

- Market value: $486.8 million

- Dividend yield: 0.9%

- First regular dividend: 2020

Cowen (COWN, $17.58) might not have the name recognition of a Goldman Sachs (GS) or a Morgan Stanley (MS), but it's in the same line of work. The company provides investment banking, research, sales and trading, prime brokerage and other services.

Founded in 1918 and based in New York, the company keeps a relatively low profile, at least by Wall Street standards.

The stock has been a wild ride, though. While COWN shares are close to three-year highs currently, they had lost two-thirds of their value in the depths of March – the same month it paid out its first dividend of 4 cents per share.

Taking a longer-term view, Cowen has been through a rough decade. At current prices, the stock has appreciated just 1%, in fairly volatile fashion.

It remains to be seen what the outlook for investment banks will look like as the world continues to reopen. While IPOs might be on ice for a while, we could see a surge in mergers and in debt offerings.

In any event, Cowen's shares have been surging higher since the March lows and don't appear to be losing their momentum. So, Mr. Market clearly believes the post-COVID world offers potential.

EBay

- Market value: $38.8 billion

- Dividend yield: 1.2%

- First regular dividend: 2019

Online auction and payments pioneer eBay (EBAY, $55.15) joined the ranks of new dividend stocks in early 2019 and has raised its payout in 2020, from 14 cents per share to 16 cents. More distribution growth is likely. At its current level, eBay is paying out only 27% of its profits in dividends.

At the current stock price, the dividend works out to a modest yield of 1.2%. That might not sound like much, but remember that most technology firms don't pay a dividend at all.

It might feel like eBay has been something of an also-ran in the e-commerce world it helped to create. Amazon.com and nimbler mobile apps capture most of the headlines, and its spun-off PayPal (PYPL) has made fintech headlines for years. But while eBay flies mostly under the radar, it's no slouch on the growth front. Revenues per share have nearly doubled since 2013, and the stock is up 53% in 2020.

As an older internet play, eBay may not be as exciting as the latest social media darling. But it has managed to survive for over two decades in the cutthroat world of e-commerce and has proven itself to be durable and shareholder-friendly.

Valvoline

- Market value: $3.9 billion

- Dividend yield: 2.2%

- First regular dividend: 2016

Valvoline (VVV, $21.07) is about as far from a trendy tech stock as you can get. It is one of America's oldest companies, with a history going back to 1866. And while we associate the brand with motor oil, Valvoline actually predates the invention of the automobile. In fact, its lubricant products helped to get the Industrial Revolution off the ground.

Yet despite its long history, Valvoline is a baby as a public company. It was spun off from Ashland (ASH) in 2016.

Valvoline paid its first dividend of 4.9 cents at the end of 2016, and it's already has juiced its dividend by 131% to a current 11.3 cents per share. Importantly, there's room for more; the company's dividend payout ratio is only 36%.

Valvoline might find waning demand for its lubricants and services due to the rise of electric vehicles over the next few decades. Electric vehicles have fewer moving parts and don't generally require regular oil changes. But even if a large percentage of new-car sales were electric vehicles starting today, the existing base of traditional gasoline-powered engines would be enough to keep VVV alive and kicking for a long time to come.

You shouldn't expect massive growth from an old-economy stock like Valvoline. But it should be a reliable dividend payer for the foreseeable future.

Constellation Brands

- Market value: $34.5 billion

- Dividend yield: 1.7%

- First regular dividend: 2015

Constellation Brands (STZ, $179.00) is the world's largest publicly traded wine producer. But beyond wine, the company is also a major beer producer. It markets under the Corona, Modelo and Pacifico Mexican brand names and has a large portfolio of craft beer brands, including Funky Buddha, Obregon Brewery and Ballast Point. Constellation also produces and sells an assortment of vodka, whiskey and tequila and other spirit brands.

Having the word "corona" in one of your most iconic products is an unfortunate coincidence in the age of COVID-19. But it hasn't seemed to slow down the company much, as the shares are essentially flat on the year.

STZ has been traded publicly since 1992 but only began paying a dividend in 2015. Since then, it has made up for lost time. Constellation has hiked its dividend by a cumulative 142%. Understandably, it hasn't topped up the payout yet in 2020.

Dollar General

- Market value: $48.2 billion

- Dividend yield: 0.8%

- First regular dividend: 2015

After months of virus lockdowns, the economy is looking rickety right now. And even as the economy continues to reopen, it might be years before we fully return to something resembling "normal," At this stage of the cycle, it's not a bad idea to look for recession-resistant companies that do well during hard times.

The COVID-19 experience has been disastrous for most brick-and-mortar retailers. But it has been smooth sailing for essential businesses like grocery and sundry stores. And with the economy likely to be slow for a while, consumers likely will trade down to cheaper alternatives such as dollar stores.

This brings us to Dollar General (DG, $191.65). Many working-class families depend on dollar stores for affordable packaged and processed foods, cleaning supplies, personal-care products, and basic groceries such as milk, eggs and bread.

Dollar General was founded in 1939 but only began paying a dividend in 2015. At current prices, it yields a little under 1%. There is a lot of competition in this space from other dollar stores and from large discounters such as Walmart (WMT). But if you believe that the economy might be depressed for a while, then Dollar General is worth considering.

Universal Display

- Market value: $7.4 billion

- Dividend yield: 0.4%

- First regular dividend: 2017

When you think of dividend payers, tech hardware companies generally aren't the first thing to come to mind. The cyclical nature of their business pushes them to hoard cash, and as a general rule, dividend investors have found the pickings slim in this space.

That's what makes Universal Display (OLED, $156.70) an unusual addition to this list of new dividend stocks.

Universal Display gets its distinctive trading symbol "OLED" from the products it makes: organic light-emitting diode (OLED) technologies used in flat-panel displays and lighting applications.

Universal Display has been publicly traded since 1996, but it didn't pay its first dividend until 2017. But it has been a dividend-raising monster ever since. The company made its first 3-cent-per-share payout in March 2017 and quickly doubled it in 2018. In 2019, it hiked its dividend by 67%, then by another 50% earlier this year.

Even with all that fuel behind the payout, OLED isn't exactly a high yielder. But if Universal Display continues to boost its dividend in such aggressive fashion, the yield will at least be respectable in the near-future. With a payout ratio of just 15%, more dividend growth is likely.

SLM

- Market value: $2.6 billion

- Dividend yield: 1.7%

- First regular dividend: 2019

You might not be familiar with SLM (SLM, $6.90), but you probably know it by its nickname: Sallie Mae.

SLM makes student loans. And contrary to popular belief, Sallie Mae is actually a private company. It isn't backed by Uncle Sam, though it used to be. The company was created as a government-sponsored enterprise in 1972 but transitioned to a private lender between 1997 and 2004.

Sallie Mae has become controversial. To its supporters, it has made higher education a reality for millions of Americans who would have never been able to afford it otherwise. To its detractors, the company has reduced an entire generation to debt slavery.

Sallie Mae suspended it in 2007 during the financial crisis. It then reinstated a dividend in 2011 only to kill it again three years later. SLM restarted its dividend yet again in March of last year, and it recently continued its streak of consecutive payouts with a dividend to be distributed Sept. 15.

Let's hope the third time is the charm.

Be careful with SLM stock. It has a history of dividend cuts, and its product is a political lightning rod. But shares also trade for a very modest 4 times earnings, so a good deal of risk would seem to already be priced in.

Equinix

- Market value: $65.2 billion

- Dividend yield: 1.4%

- First regular dividend: 2015

We'll finish this list with data center operator Equinix (EQIX, $736.69).

REITs haven't fared well during the COVID crisis, as landlords have had to deal with financially strapped tenants. Data center REITs are a major exception, however.

Just as fossil fuels were critical in getting the Industrial Revolution off the ground, data is what drives the new economy. And not just social media or cloud operators. Large enterprises, banks and governments are using more and more data every day, and data center operators such as Equinix are a way to play this trend.

Equinix has a sprawling empire of more than 200 data centers spread across 24 countries. Suffice it to say that Equinix is an important part of the infrastructure connecting the world.

EQIX paid out its first regular quarterly dividend of $1.69 in March 2015. The company has since grown the dividend 57% to $2.66.

This is not the highest-yielding REIT, of course, at just 1.5%. But it's a healthy company selling a critical service to the new economy.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Charles Lewis Sizemore, CFA is the Chief Investment Officer of Sizemore Capital Management LLC, a registered investment advisor based in Dallas, Texas, where he specializes in dividend-focused portfolios and in building alternative allocations with minimal correlation to the stock market.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

Dow Hits New High Ahead of January Jobs Report: Stock Market Today

Dow Hits New High Ahead of January Jobs Report: Stock Market TodayA weak reading on December retail sales was in focus ahead of Wednesday's delayed labor market data.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.