10 Solid Social Distancing Stocks to Buy

Many of us probably weren't even aware of the concept of social distancing until the past couple of months.

Many of us probably weren't even aware of the concept of social distancing until the past couple of months. Sadly, it has been necessarily used so often during the coronavirus outbreak, we'd all be blasphemously rich if we got a dollar every time it was mentioned.

Social distancing, of course, is the practice of keeping physical distance from other people – typically to slow down a pandemic like the current COVID-19 coronavirus outbreak – through measures such as schools suspending classes, offices having employees work from home and people avoiding mass gatherings. And, as opportunities arise from almost any sea change, a few "social distancing stocks" stand to benefit from this trend.

Many global economies will pay dearly to stop this coronavirus. That puts us, as investors, in uncharted territory. Warren Buffett says to be greedy when others are fearful, but it's difficult to do that when all stocks look like losing propositions.

That said, with the S&P 500 down almost 30% (including dividends) in the past month, the time to sell has likely passed for most investors. You could go to cash to ride out the coronavirus and the recession that's likely to follow. However, during the recession of 2008, many people got out of the markets and never got back in. So if you want to stay in, it might be worth hitching your wagon to stocks that stand to benefit from the new social rules.

Here are 10 social distancing stocks to buy. All of them are at least set up to outperform for as long as social distancing is necessary – and some of them could be worthwhile holdings for much longer after that.

Data is as of March 16. Analyst opinion data from The Wall Street Journal.

Netflix

- Market value: $131.1 billion

- Analysts' opinion: 25 Strong Buy, 2 Buy, 10 Hold, 1 Sell, 3 Strong Sell

Sometimes, the best ideas are the most obvious ones. And Netflix (NFLX, $298.84) is a pretty obvious first-to-mind company when it comes to social distancing stocks to buy.

Over the next two weeks (at least), many of the country's schools will be closed, leaving a bunch of kids with very little to do except run around outside by themselves or stay indoors and watch television.

NFLX stock started the year on a precarious perch. For one, growth was slowing at home, in part thanks to launches from the likes of Apple (AAPL) and Disney (DIS). NFLX reported its fourth-quarter results in January, revealing that it added 420,000 subscribers in the U.S. and 128,000 in Canada. That compares to roughly 8.2 million net additions across the rest of the world. So, the U.S. and Canada contributed just 6.3% of the 8.8 million net new global subscribers during the final three months of 2019.

Fear not. In February, a report from Nielsen came out that showed people spent 19% of their TV viewing time in the final three months of 2019 streaming movies and TV shows. That was up from 10% a year earlier. Netflix and Alphabet's (GOOGL) YouTube were the top two services, with 31% and 21% market share, respectively.

With the sheer amount of streaming time going up, combined with the need to practice social distancing, investors can expect Netflix to bring forward more content to meet the needs of housebound children and adults, leading to additional domestic subscribers. The company could benefit from similar trends abroad.

Spotify

- Market value: $21.7 billion

- Analysts' opinion: 16 Strong Buy, 1 Buy, 7 Hold, 1 Sell, 2 Strong Sell

Like Netflix, Spotify (SPOT, $117.64) is a pure-play streaming service. Of course, it's not part of a big conglomerate like YouTube, Apple Music or Amazon Music. That means it lives or dies from its paid and ad-supported subscriptions.

Interestingly, as people have been forced to stay home, they're creating coronavirus-inspired playlists for their friends and colleagues to listen to while under quarantine or self-isolating. That alone could bring thousands of new potential customers to Spotify who hadn't considered the audio streaming service before.

Also, consider that over the past year, Spotify has spent approximately $582 million on podcast acquisitions. As a result, it now has more than 700,000 podcasts to listen to. A lot of adults who are suddenly working from home are going to have a lot more freedom to listen to the podcasts they want.

Spotify is in the early stages of monetizing podcasts.

"It's fair to say that we're just very early in the monetization of podcasts overall," CEO Daniel Elk said during the company's fourth-quarter conference call. "And as it relates to third-party content, (as in) content that we've just licensed and put on the service, right now, all monetization is their own, and we're not participating in that."

Spotify reported podcast consumption increased by 200% during the fourth quarter. Overall, monthly active users (MAUs) grew 31% year-over-year to 271 million, and subscribers hit 124 million, a gain of 29% year-over-year. The number of people staying home over the next few weeks might bolster its growth even more.

Electronic Arts

- Market value: $25.7 billion

- Analysts' opinion: 18 Strong Buy, 4 Buy, 10 Hold, 0 Sell, 0 Strong Sell

You'll find a few video game companies among the more attractive social distancing stocks. If you're a sports fan and like gaming, Electronic Arts (EA, $88.67) has you covered at a time when live events have gone up in smoke.

Thanks to Madden 20, FIFA 20 and NHL 20, your yearning for professional live sports on TV won't be nearly as acute. Add-in Star Wars: Jedi Fallen Order and its Apex Legends and Battlefield franchises, and there's plenty to keep even the most avid sports fan busy.

JPMorgan analyst Alexia Quadrani reiterated her overweight rating on Electronic Arts' stock March 11, writing to clients that that both it and Activision Blizzard (ATVI) could be "unique beneficiaries of COVID-19."

In the third quarter, Electronic Arts reported digital net bookings over the trailing 12 months of $4.1 billion, 15% higher than a year earlier. The quarter included the launch of the aforementioned Star Wars game. That helped generate record cash flow of $1.9 billion over those same 12 months.

Thanks to Apex Legends, FIFA Ultimate Teams and Madden Ultimate Teams, its live services net bookings grew by 27% to a record $993 million over the trailing 12 months. This is significant because it is extra content EA is selling within the games themselves.

Except for the cancellation of some of its live events, the coronavirus should act as a growth accelerator in at least the weeks ahead – and perhaps put EA stock among longer-term stocks to buy if even more people pick up video gaming as a more serious hobby.

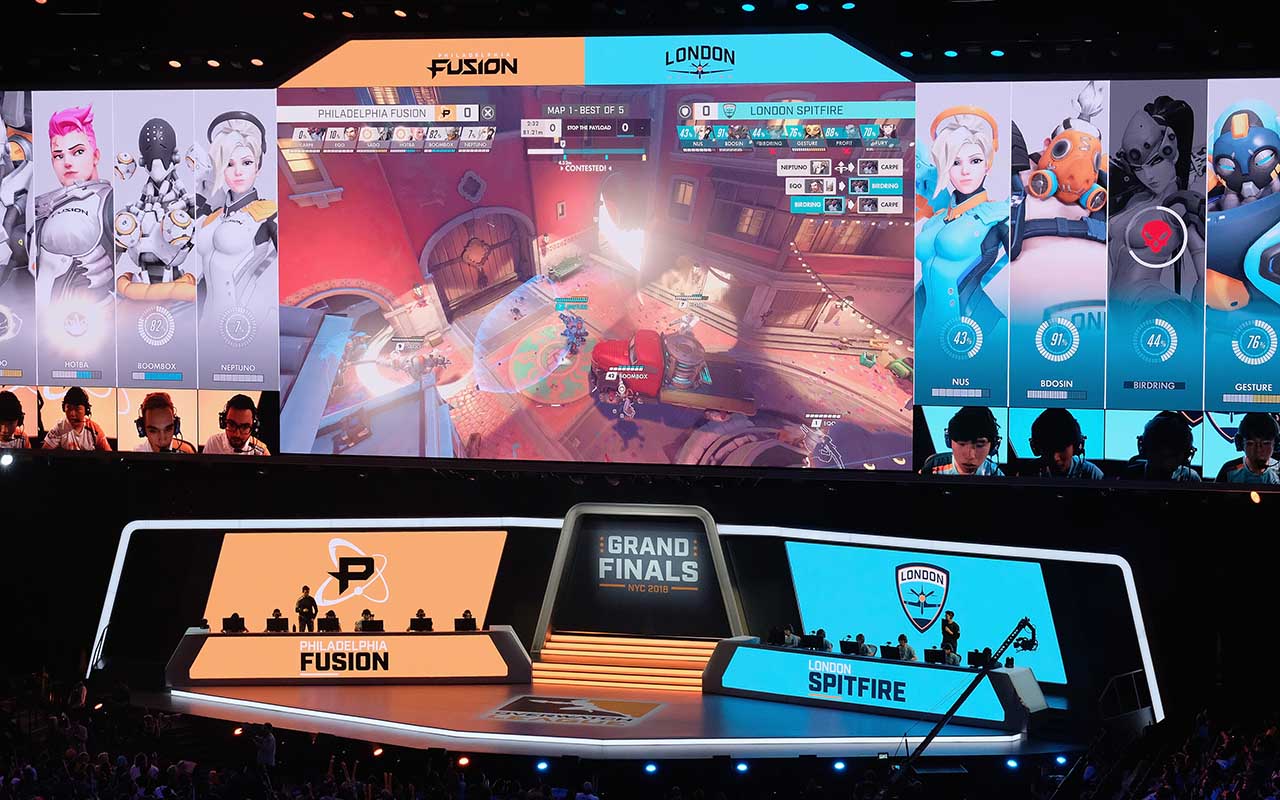

Huya

- Market value: $3.2 billion

- Analysts' opinion: 12 Strong Buy, 0 Overweight, 3 Hold, 0 Sell, 0 Strong Sell

The Washington Post reported on March 16 that more people have died from the coronavirus outside China than inside. Further, with the epidemic slowing in China, its government can go to work rebuilding its economy.

Not only is China the world's largest video game market, but it is the second-largest eSports market behind only the U.S.

While the devastation to China's economy as a result of the outbreak has been significant, Huya's (HUYA, $14.44) position as the No. 1 game streaming platform in that country makes it a very compelling stock.

In Huya's fourth quarter, it reported 64% year-over-year growth in revenues to $354 million. Even more impressive: It generated a non-GAAP net profit of $35 million, just shy of a 10% net margin. MAUs grew by 48% in the quarter, to 150.2 million, with 41% of them on mobile. In addition, Huya's total number of paying users increased by 5.9% to 5.1 million thanks to its mobile strategy and diversified content.

The number of people playing video games in China is expected to grow by 30% through 2023, to 891 million. Huya's competitive edge, along with a fast-growing user base, should help HUYA stock deliver for the next few years.

Global X Video Games & Esports ETF

- Assets under management: $57.9 million

- Expenses: 0.50%, or $50 annually on a $50,000 investment

- Analysts' opinion: N/A

Although the market's correction has hit stocks in all sectors and industries, including video games and eSports, the Global X Video Games & Esports ETF (HERO, $14.63) is a good place to invest if you believe companies such as Electronic Arts and Huya will benefit from social distancing measures but don't want to expose yourself to company-specific risk.

In existence for less than a year (it launched Oct. 25, 2019), HERO doesn't have a track record to speak of; nor does it have a lot of assets, with less than $60 million at the moment. But it provides access to what amounts to a 40-stock portfolio of social distancing stocks to buy that includes the likes of ATVI, EA, Take-Two Interactive (TTWO) and more. It's a very concentrated portfolio, too, with the top 10 holdings accounting for 58% of its portfolio.

The video game industry is expected to get a serious lift this year from Microsoft and Sony (SNE) introducing new Xbox and PlayStation consoles – the first major hardware upgrades since 2013. With considerably improved performance capabilities, playing video games on consoles will be better than ever.

While mobile gaming represents the biggest market share in video gaming at 46%, the console business still accounts for 30% of the global gaming markets (the rest is in PCs). Consoles might eventually disappear from the gaming marketplace, but makers of video games don't appear to be going anywhere.

Microsoft

- Market value: $1.0 trillion

- Analysts' opinion: 28 Strong Buy, 4 Buy, 2 Hold, 0 Sell, 0 Strong Sell

Ark Investment Management CEO Catherine Wood is one of Wall Street's most successful portfolio managers. She specializes in disruptive innovation investments. Recently, she discussed the coronavirus and how it will help accelerate innovation.

"During the worst financial crisis of our lifetimes, innovation gained more traction than most investors had expected. Companies offering faster, cheaper, more cost effective, and creative products and services gained significant share," Wood wrote on March 3. "Software-as-a-Service and online retail were prime beneficiaries during the (2008 Global Financial Crisis)."

In the past year, Microsoft's (MSFT, $135.42) enterprise messaging platform, Teams, passed Slack Technologies' (WORK) Slack as the No. 1 workplace messaging app. It had 13 million daily users halfway through 2019. Six months later, that number grew to more than 20 million thanks to buy-in from many of America's largest companies.

As social distancing rules require more employees to work from home, Microsoft's momentum over the past year is going to make Microsoft Teams a natural choice, especially for large companies that aren't already using its product. Its Skype and Azure products will lend a hand, too.

Amazon.com

- Market value: $840.9 billion

- Analysts' opinion: 42 Strong Buy, 4 Buy, 4 Hold, 0 Sell, 0 Strong Sell

Much like Microsoft, Amazon.com (AMZN, $1,689.15) is holding up relatively well compared to the S&P 500. It's down a little less than 9% year-to-date, which is far better than the 25% decline in the S&P 500.

When you combine the world's largest e-commerce business with the largest provider of cloud infrastructure services and the third-largest digital ad platform in the U.S., you've got a trifecta of businesses that together are hard to beat. That's especially true in difficult times such as the ones we're currently experiencing.

As more people are embracing social distancing, online ordering will become even more prevalent than it already is. While there is the possibility of a global economic slowdown causing a recession, Amazon's share of U.S. e-commerce sales in 2019 was slightly more than 52%, a massive number. Outside the U.S., it held almost 6% of e-commerce sales for an overall global market share of 13.7%.

Amazon surely will feel the effects from a global recession, but not nearly as much as its competitors. This has played out once before: During the 2007-09 bear market, AMZN stock fell by 36%, while the S&P 500 lost 55% on a total return basis (price plus dividends).

If you're looking for a place to hide in these turbulent times, cash is your best bet. If you want to remain invested in the markets, Amazon is among the best social distancing stocks to buy to reduce your downside exposure.

Teladoc Health

- Market value: $8.5 billion

- Analysts' opinion: 12 Strong Buy, 0 Buy, 11 Hold, 0 Sell, 0 Strong Sell

- Teladoc Health (TDOC, $116.74), a leading global provider of virtual health care and telemedicine, issued a press release on March 13 stating that it had seen daily virtual medical visits spike by 50% as the traditional health-care system became stretched.

"The demand for virtual care visits has accelerated as several health plans have waived consumer cost sharing and public health officials at all levels of government have encouraged the public to take advantage of virtual care services," the company said. "These actions have driven many people to use telemedicine for the first time, with more than half of all the Teladoc Health visits this month being from first time users."

The coronavirus is forcing people to opt for virtual health care. Once the outbreak ends, you can be sure Teladoc's share of the total addressable U.S. market – estimated between $10 billion and $30 billion, depending on who you include in the number – will grow. That's going to be very good for business.

It's already been quite a year for Teladoc. TDOC shares are already up 39% year-to-date, running laps around almost every other company with a market value in excess of $2 billion. It's the sixth best stock year-to-date among more than 1,500 eligible companies, according to FinViz data.

That's something to write home about. But more importantly for prospective investors looking for social distancing stocks, it looks like the coronavirus will continue to improve Teladoc's fates, here in the U.S. and elsewhere.

- Market value: $416.2 billion

- Price-to-sales: 5.9

- Analysts' opinion: 39 Strong Buy, 4 Buy, 5 Hold, 0 Sell, 2 Strong Sell

The debate over which social media platform will gain the most new users from the coronavirus has already begun. eMarketer and Business Insider recently released a report discussing the biggest impacts of the coronavirus pandemic.

"The spread of coronavirus is likely to boost digital media consumption across the board as people spend more time at home and communicate in person less," the report states. "Social networks could be a major beneficiary, as people turn to these platforms to connect with friends and family who may be at a distance or to access news content."

- Facebook (FB, $146.01) is considered a platform for older people. In 2019, adults 75 or older accounted for almost 40% of the social media platform's users, up from 26% in 2018. It's likely to benefit from more older people joining the app to keep in touch with friends.

As for Facebook's Instagram platform, 72% of teenagers say they use the picture-based social media app to communicate with friends. That's significantly higher than the 51% who use Facebook.

Although traditional print advertising and outdoor signs might decline due to fewer people on the streets, digital advertising likely will remain strong as brands seek to remain top-of-my mind with consumers. Facebook ad costs are falling while ad impressions are increasing, which means whatever happens during the coronavirus, FB stock ought to do just fine.

Zoom Video Communications

- Market value: $29.8 billion

- Analysts' opinion: 4 Strong Buy, 3 Buy, 13 Hold, 0 Underweight, 3 Strong Sell

Ark Investment Management analyst James Wang recently discussed the grand work-at-home experiment that is taking place around the world during the coronavirus outbreak. In unprecedented numbers, employees have been forced to telecommute.

One of the main beneficiaries of this phenomenon is Zoom Communications (ZM, $107.86), the California-based provider of remote conferencing services, including video and audio conferencing, chat and content sharing around the world.

"Video conferencing company Zoom has been one of the notable beneficiaries of this virus," Wang wrote in Ark's weekly innovation letter. "In recent weeks, usage and free trials have ticked up, with significant interest from China, a market that historically has shunned western SaaS products."

"During the past month, as the stock market has dropped, Zoom has gained 19%."

Zoom Video has been among the best social distancing stocks so far. ZM stock is up 58% year-to-date, which is nearly 85 percentage points better than the S&P 500. Sure, it isn't cheap at 44 times sales. But when you have a product that everyone's clamoring for, investors will pay more than they would for a run-of-the-mill stock.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Will has written professionally for investment and finance publications in both the U.S. and Canada since 2004. A native of Toronto, Canada, his sole objective is to help people become better and more informed investors. Fascinated by how companies make money, he's a keen student of business history. Married and now living in Halifax, Nova Scotia, he's also got an interest in equity and debt crowdfunding.

-

Stock Market Today: Stocks Slip Ahead of Big Earnings, Inflation Week

Stock Market Today: Stocks Slip Ahead of Big Earnings, Inflation WeekPerhaps uncertainty about tariffs, inflation, interest rates and economic growth can only be answered with earnings.

-

Ask the Editor — Tax Questions on "The One Big Beautiful Bill Act"

Ask the Editor — Tax Questions on "The One Big Beautiful Bill Act"Ask the Editor In this week's Ask the Editor Q&A, we answer tax questions from readers on the new tax law.

-

The 24 Cheapest Places To Retire in the US

The 24 Cheapest Places To Retire in the USWhen you're trying to balance a fixed income with an enjoyable retirement, cost of living is a crucial factor to consider.

-

Zoom AI Companion Efforts Fuel Earnings Beat, Stock Surge

Zoom AI Companion Efforts Fuel Earnings Beat, Stock SurgeZoom stock is rallying after the company reported solid earnings thanks to demand for its AI-powered collaboration tools. Here's what you need to know.

-

Why You Should Invest In Midsize Companies

Why You Should Invest In Midsize CompaniesMidsize companies promise a long runway for growth, with less volatility than smaller firms. Here are five to consider.

-

5 Stocks to Sell or Avoid Now

5 Stocks to Sell or Avoid Nowstocks to sell In a difficult market like this, weak positions can get even weaker. Wall Street analysts believe these five stocks should be near the front of your sell list.

-

Best Stocks for Rising Interest Rates

Best Stocks for Rising Interest Ratesstocks The Federal Reserve has been aggressive in its rate hiking, and there's a chance it's not done yet. Here are eight of the best stocks for rising interest rates.

-

The 5 Safest Vanguard Funds to Own in a Volatile Market

The 5 Safest Vanguard Funds to Own in a Volatile Marketrecession The safest Vanguard funds can help prepare investors for continued market tumult, but without high fees.

-

The 5 Best Inflation-Proof Stocks

The 5 Best Inflation-Proof Stocksstocks Higher prices have been a major headache for investors, but these best inflation-proof stocks could help ease the impact.

-

5 of the Best Preferred Stock ETFs for High and Stable Dividends

5 of the Best Preferred Stock ETFs for High and Stable DividendsETFs The best preferred stock ETFs allow you to reduce your risk by investing in baskets of preferred stocks.