Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Small-company stocks are notoriously volatile. And these days, large-company stocks seem expensive. So for Goldilocks-style investors, medium-size companies can seem just right.

After all, the firms in the middle range of the stock market have survived the risky small-company stage "and still have a long runway for future growth. They are in a sweet spot," says Stephen Grant, manager of the Value Line Mid Cap Focused Fund, which has notched a 10-year average annual return of 12.8%, edging the 12.0% return of the large-company S&P 500 index over the same period.

Before you invest in midsize companies, consider their parameters. There's surprising variation in what counts as a medium-size company. Generally, investors gauge a company's size by the value of its outstanding shares, or market capitalization. The stocks in the middle range are called mid caps.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Stocks in the S&P 400, one of the most-cited indexes of mid-cap companies, have an average market cap of $6.8 billion, but the index lists stocks with values running from $1.7 billion to nearly $18 billion. FTSE Russell, which produces broader indexes, defines mid caps as the 800 companies below the 200 largest in the Russell 1000 index. Companies in the Russell Midcap index range in size from $3 billion to about $65 billion, with an average market cap of $23 billion.

Investors have to be choosy with stocks in this range. The history of mid caps' performance serves as a caution against blanket bullishness, says Zach Johnson, chief investment officer for Stack Financial Management. Large-cap stocks have, on average, outpaced mid-cap stocks in nine of the past 10 years. The S&P 400's 16.4% return in 2023, although strong by historical standards, lagged the index of larger companies; the S&P 500 index returned 26.3%.

That's one reason the S&P 400 was trading at an average price multiple of just 14.4 times its companies' expected earnings over the next 12 months, compared with a price-to-earnings (P/E) ratio of 19.5 for the S&P 500.

Bargain hunters need to be selective and patient, Johnson says. He expects midsize valuations will start to close the gap relative to their larger brethren, and that promises relative outperformance, "but you just never know when" it will happen, he says. He advises mid-cap investors to focus on firms with good businesses and strong balance sheets. "The fundamentals of finance matter in the end," he says.

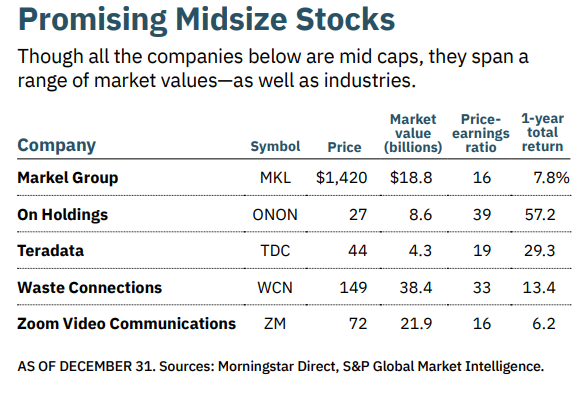

Below, we've listed five promising companies within the broader mid-cap range. Prices and other data are as of December 31, unless otherwise noted.

Markel Group

Markel Group (MKL), a Richmond, Virginia-based insurer, is a "mini Berkshire Hathaway," says Bruce Kennedy, a portfolio manager for the DF Dent Midcap Growth fund, a member of the Kiplinger 25, the list of our favorite no-load mutual funds.

Like Berkshire, the company uses cash from its operations to buy stable (if not flashy) companies. Among Markel's holdings are Costa Farms, one of the nation's largest houseplant growers, and Ellicott Dredges, the oldest manufacturer of ships that can suck up sand and dirt from the bottoms of waterways.

Another Berkshire parallel: Markel has more cash in reserve than it owes in debt. The financial stock has grown steadily for decades. It traded at $12 in 1987, and it closed out 2023 at $1,420, giving it an annualized growth rate of about 14% and a market value of $18.8 billion.

Markel's overall revenues have grown steadily. And though profits have been affected by dropping valuations of the bonds it holds to fund insurance payoffs, the company is on a pace to report $113 per share in profits for 2023. Analysts expect earnings to grow by an average of about 7% a year over the next three years. The stock was recently trading at 16 times expected 2024 earnings. At that valuation, Kennedy described the investment as "a grinder" that he's happy to own. It won't be a top or bottom performer, he says, but will grind out gains for the long term.

On Holding

Zurich-based On Holding (ONON) makes distinctive athletic shoes, such as running shoes with soles made of light, flexible honeycombed tubes. Runners apparently love them, and as a result, so do many investors and analysts. "It is a great brand with a huge market opportunity that continues to take share from competitors," says David Baron, portfolio manager of the mid-cap heavy Baron Focused Growth Fund.

On, which trades on the New York Stock Exchange, increased its global sales by more than sevenfold between 2019 and 2023 to reach $2.1 billion. The stock returned nearly 60% in 2023, closing the year at $27, giving it a market capitalization of $8.6 billion.

Baron said he was a buyer in late 2023 at prices in the mid $20s because of the company's rapid growth and lucrative profit margins. On's global sales reach and low-debt balance sheet insulate it from the vagaries of the U.S. economy, he adds.

"I'm even more bullish on the stock now than I was six or seven months ago," says Baron. He expects the company's sales to be turbocharged in late 2024, when the Swiss Olympic team wears its On-created uniforms.

Sixteen of the 20 analysts who follow the stock, trading at a P/E ratio of 39, rate it a Buy. Morgan Stanley's Alex Straton calls On one of the most attractive companies in the sports-apparel niche, in part because it has been able to increase sales without much discounting. The company's tennis shoes – named "the Roger," after investor and brand representative Roger Federer – retail for $199.

Teradata

Teradata (TDC) is a cloud-computing firm that helps companies analyze and make the best use of their data. The tech stock has had a bumpy ride over the past five years, closing out December at $44 a share – close to its price at year-end 2018.

With a market capitalization of just $4.3 billion, it's one of the smaller mid-cap companies. But it is the single biggest holding in the Heartland Mid Cap Value fund. The fund's lead manager, Colin McWey, is betting the stock is more of a bargain than indicated by its P/E of nearly 19.

Recurring revenues from Teradata's cloud-computing services snowballed by more than 60% in 2023. McWey expects the rapid growth to continue, pushing the company's total revenues ahead by more than 10% a year. Teradata's stock price in relation to revenues doesn't reflect that potential, he says: "Teradata trades at a recurring-revenue multiple that implies no growth."

Eight of the 11 Wall Street analysts who follow the company are similarly bullish. Analysts have, on average, set a target price of $62 for the shares over the next 18 months, implying they see room for gains of more than 40%.

Waste Connections

Investors who focus on Wall Street's darlings can miss out on profitable opportunities, says Value Line's Grant. "The glamour stocks are the ones that people tend to overpay for," he says. That's one reason he sees opportunity in the definitively unglamorous Waste Connections (WCN), the third-largest hauler and recycler of non-hazardous trash in the U.S.

The company is headquartered in Canada but trades on the New York Stock Exchange – at a relatively lofty P/E of 33, reflecting a "growthy" outlook. Grant says his single most important criterion for choosing a stock is whether the company has a 10-year history of increasing earnings per share, and Waste Connections checks that box. It reported earnings of $1.58 per share in 2013, and it is expected to report $3.42 in 2023. Its 10-year compound annual earnings growth rate is in excess of 8%.

Of the 22 Wall Street analysts who follow Waste Connections, 17 rate the stock a Buy. The analysts at Truist Securities like the way that trash hauling is insulated against the ups and downs of the economic cycle. The stock is "an attractive place to park capital amid current macro uncertainty," they say. Trading at $149 per share, the company has a market capitalization just north of $38 billion. Truist's analysts have set a target price for the company of $160 in 2024.

Zoom Video Communications

The application we all used to talk with one another during the COVID shutdowns took a beating when we could connect in real life again. At the end of 2023, Zoom Video Communications' (ZM) stock was trading at $72, a long way off from its October 2020 peak of $568. The recent price translates into a market capitalization of $21.9 billion.

ARK Invest CEO Cathie Wood was buying shares in late 2023. "I'm pretty excited about the artificial intelligence products and services that Zoom is evolving," she says. One such service is automated meeting summaries. Zoom, which is a top-five holding in the ARK Innovation exchange-traded fund, has seen its profitability rebound recently. For the fiscal year ending January 31, Zoom is on pace to report $1.33 per share in earnings, up from just 34 cents in the previous year.

The company is attractively priced, trading at less than 16 times expected earnings for the next 12 months. Perhaps more important for growth-focused investors is the stock's PEG ratio, which is the P/E divided by the expected growth rate over the next three to five years. Zoom's PEG ratio was recently under 0.4; anything below 1 is generally viewed as a sign of strong growth.

Morningstar senior equity analyst Dan Romanoff believes there is plenty of room for the stock to rise. Noting that the company is debt-free and that demand for online meeting spaces continues to be robust, he has pegged Zoom's fair value at $89 per share, implying a 24% upside.

Note: This item first appeared in Kiplinger's Personal Finance Magazine, a monthly, trustworthy source of advice and guidance. Subscribe to help you make more money and keep more of the money you make here.

Related content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kim Clark is a veteran financial journalist who has worked at Fortune, U.S News & World Report and Money magazines. She was part of a team that won a Gerald Loeb award for coverage of elder finances, and she won the Education Writers Association's top magazine investigative prize for exposing insurance agents who used false claims about college financial aid to sell policies. As a Kiplinger Fellow at Ohio State University, she studied delivery of digital news and information. Most recently, she worked as a deputy director of the Education Writers Association, leading the training of higher education journalists around the country. She is also a prize-winning gardener, and in her spare time, picks up litter.

-

You Received a Life Insurance Payout. Here's How to Avoid an IRS Audit.

You Received a Life Insurance Payout. Here's How to Avoid an IRS Audit.You received a big check from your loved one's life insurance policy. Will the IRS be expecting a check from you now?

-

Supreme Court Strikes Down Trump Tariffs: What's Next for Consumers and Retailers?

Supreme Court Strikes Down Trump Tariffs: What's Next for Consumers and Retailers?Tax Law This landmark decision will reshape U.S. trade policy and could define the outer boundaries of presidential economic power for years to come.

-

Before You Go to Costco, Try This Grocery Strategy First

Before You Go to Costco, Try This Grocery Strategy FirstA simple shift in how you plan meals could help you spend and waste less.

-

Why the Next Fed Chair Decision May Be the Most Consequential in Decades

Why the Next Fed Chair Decision May Be the Most Consequential in DecadesKevin Warsh, Trump's Federal Reserve chair nominee, faces a delicate balancing act, both political and economic.

-

Yes, Artificial Intelligence Stocks Are Booming

Yes, Artificial Intelligence Stocks Are BoomingIt's fair to ask about the latest tech boom, "Is it really different this time?"

-

A Value Focus Clips Returns for This Mairs & Power Growth Fund

A Value Focus Clips Returns for This Mairs & Power Growth FundRough years for UnitedHealth and Fiserv have weighed on returns for one of our favorite mutual funds.

-

Small-Cap Stocks Gain Momentum. That's Good News for This iShares ETF

Small-Cap Stocks Gain Momentum. That's Good News for This iShares ETFThe clouds appear to be parting for small-cap stocks, which bodes well for one of our favorite exchange-traded funds.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.

-

Should You Be Investing in Emerging Markets?

Should You Be Investing in Emerging Markets?Economic growth, earnings acceleration and bargain prices favor emerging markets stocks right now.

-

7 Hybrid Adviser Services, Reviewed

7 Hybrid Adviser Services, ReviewedThese hybrid adviser services aim for a sweet spot that combines digital investing with a human touch.

-

These Unloved Energy Stocks Are a Bargain

These Unloved Energy Stocks Are a BargainCleaned-up balance sheets and generous dividends make these dirt-cheap energy shares worth a look.