Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

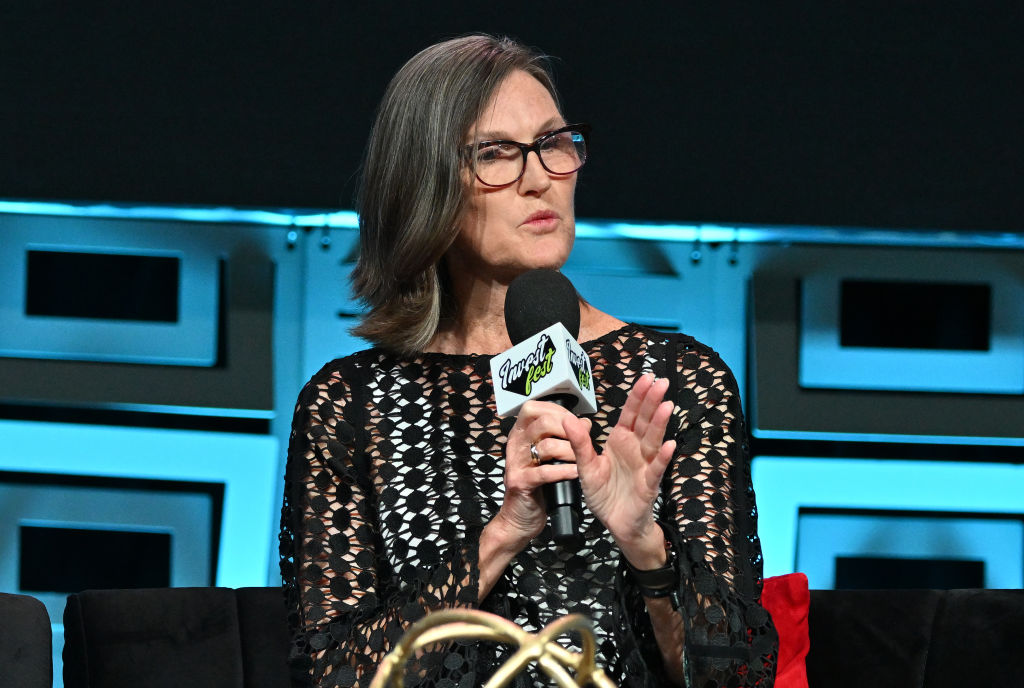

Cathie Wood is the chief executive and chief investing officer of ARK Invest, whose exchange-traded funds have notched some of the best and worst returns in the market in recent years.

The firm’s flagship fund, ARK Innovation (ARKK), was an early investor in hot technology companies such as Tesla, Nvidia and Salesforce. It returned a blistering 153% in 2020, putting it in the top 1% of similar funds. Investors poured money in, making the fund the nation’s largest actively managed ETF, with nearly $28 billion under management in early 2021. But rising interest rates are kryptonite to the high-growth stocks Wood favors, and Innovation lost 23% and 67% in 2021 and 2022, respectively. That put it at the very bottom of its category and sparked a mass exodus by investors.

ARK’s fortunes reversed again in 2023 as inflation and interest rates moderated. Now with assets of only about $8 billion, Innovation gained more than 35% in 2023 through November 30, and it is once again in the top 1% of its category. ARK also manages or subadvises 12 other ETFs, with exposure to themes including robotics, genetics, space exploration and financial technology. Five of the funds, launched in November with another firm, are based on cryptocurrency futures contracts or crypto-related stocks. And ARK is hoping for regulatory approval to launch an ETF that holds cryptocurrencies directly.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

We caught up with Wood in November 2023 to see what is top of mind for her now.

KIPLINGER: What trends are you focusing on for 2024?

WOOD: We are probably going to focus on the convergence among the 14 technologies around which we have centered our investments. One of the most important convergences taking place in technology combines robotics, energy and artificial intelligence. That is going to create revenue opportunities that are going to scale so quickly that people won’t believe the numbers. Robo-taxis, we believe, will generate $8 trillion to $10 trillion in global annual revenue in 10 years. The biggest autonomous vehicle provider we believe in — and our conviction has only increased on this — is Tesla. I have two Teslas, a Model 3 and a Model Y. They are effectively robots collecting data for Tesla to help evolve their robo-taxi software. Tesla now has 5 million robots roaming around collecting proprietary data of real-world driving.

We think Tesla is involved in the most important and biggest artificial intelligence project in the world. Another convergence we think is going to transform healthcare is the convergence of AI and genetics. It is unlocking the code to life, health, disease and death. Companies like CRISPR Therapeutics AG are combining AI with gene-editing and therapy tools to diagnose and treat disease in its very early stages, or even before something evolves into a disease. The United Kingdom has approved CRISPR Therapeutics’ gene-editing therapy for sickle cell disease. The Food and Drug Administration (FDA) is scheduled to decide on whether doctors in the U.S. can use it.

KIPLINGER: Where do you see opportunities in the financial technology sector?

WOOD: We’re very focused on fintech. Which companies are going to be the winners in the digital wallet — which includes services that enable chat, sending money to one another, commerce, and crypto activity? We are looking for the winners in the developed world along the lines of WeChat in China.

One of the most important fintech developments is the rise of digital assets, which many people call crypto. Bitcoin is a digital asset. Its volatility has obscured its long-term returns. Despite five drawdowns greater than 75% since its inception in 2009, bitcoin has delivered positive annualized returns over three-, four and five-year time horizons.

KIPLINGER: Your biggest ETF holds about 33 stocks. How do you decide which technologically disruptive firms will make money for investors?

WOOD: We have a three-step process. We start with research to size the market. Then we do an analysis of each stock. The third step is to score each stock on six factors: the company’s people; its moat, or barriers to entry in its industry; market share; execution, which in our world is not whether managers meet quarterly profit numbers but whether they are spending enough on research and development and are spending on the right things; the stock’s valuation; and, finally, risks, such as the risk of increased regulation.

KIPLINGER: How do you decide on the right price to buy?

WOOD: We’re very focused on valuation, but not today’s — the valuation in five years. To put a stock in our portfolio, we need a minimum expectation of a 15% compound annual rate of return over the next five years. We look for stocks that will meet that target based on revenue growth and increases in profitability.

KIPLINGER: How do you decide if it is time to take profits?

WOOD: This was a decision we had to make with Nvidia (NVDA) as it was moving into the $400-pershare range. As the projected five-year return dropped below 15%, we reduced our holdings. We saw so many other opportunities. AI is not just a hardware play, it’s also software, and we want to make sure that our portfolios are exposed to that. Companies that harness AI in thoughtful ways will increase their productivity dramatically. UiPath is a company whose software harnesses AI to help other companies increase the efficiency of their workflows. We added to our position in 2023; it’s now one of the top five stocks in our innovation fund.

KIPLINGER: Your funds have steered away from many of the most popular tech firms. Why?

WOOD: Our strength is to bring other sources of innovation into a portfolio at a very early stage. We’re not going to add much value if we invest in stocks people already know about.

We have a small holding in Microsoft. It has a lot going for it, but everybody knows it and owns it already. Also, we have been reducing holdings in Alphabet, Google’s parent. We don’t think it is in a good place. Chatbots are going to eat into its advertising model. We have also sold some Amazon. Soon we’re going to be able to say to AI: Go around the world to any website and find me the cheapest whatever item.

KIPLINGER: Do you have any advice for individual investors? What would you say to them about your funds’ volatility?

WOOD: While interest rates were going up in 2021 and 2022, long-term-oriented investments of all kinds, including long-term bonds and our strategy, were clobbered. During that time, we concentrated our holdings in our highest-conviction names, based on our scoring system. Because the markets are beginning to believe that we’re near the top in long-term interest rates, our strategies have had a very good year.

We think investors should ask themselves whether they have sufficiently incorporated disruptive innovation into their portfolio construction. We believe innovation should be considered as a strategic allocation with a five-year or longer time horizon. What I suggest to my family members is that they dollar-cost average. Invest $20 every two weeks or $50 a month into various strategies. Over time, that should be a winning proposition.

Note: This item first appeared in Kiplinger's Personal Finance Magazine, a monthly, trustworthy source of advice and guidance. Subscribe to help you make more money and keep more of the money you make.

Read more

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kim Clark is a veteran financial journalist who has worked at Fortune, U.S News & World Report and Money magazines. She was part of a team that won a Gerald Loeb award for coverage of elder finances, and she won the Education Writers Association's top magazine investigative prize for exposing insurance agents who used false claims about college financial aid to sell policies. As a Kiplinger Fellow at Ohio State University, she studied delivery of digital news and information. Most recently, she worked as a deputy director of the Education Writers Association, leading the training of higher education journalists around the country. She is also a prize-winning gardener, and in her spare time, picks up litter.

-

Supreme Court Strikes Down Trump Tariffs: What's Next for Consumers and Retailers?

Supreme Court Strikes Down Trump Tariffs: What's Next for Consumers and Retailers?Tax Law This landmark decision will reshape U.S. trade policy and could define the outer boundaries of presidential economic power for years to come.

-

Before You Go to Costco, Try This Grocery Strategy First

Before You Go to Costco, Try This Grocery Strategy FirstA simple shift in how you plan meals could help you spend and waste less.

-

10 Things to Know About Decluttering

10 Things to Know About DeclutteringYou’ve spent a lifetime amassing your stuff. Here’s how to get rid of it.

-

Why the Next Fed Chair Decision May Be the Most Consequential in Decades

Why the Next Fed Chair Decision May Be the Most Consequential in DecadesKevin Warsh, Trump's Federal Reserve chair nominee, faces a delicate balancing act, both political and economic.

-

Yes, Artificial Intelligence Stocks Are Booming

Yes, Artificial Intelligence Stocks Are BoomingIt's fair to ask about the latest tech boom, "Is it really different this time?"

-

A Value Focus Clips Returns for This Mairs & Power Growth Fund

A Value Focus Clips Returns for This Mairs & Power Growth FundRough years for UnitedHealth and Fiserv have weighed on returns for one of our favorite mutual funds.

-

Small-Cap Stocks Gain Momentum. That's Good News for This iShares ETF

Small-Cap Stocks Gain Momentum. That's Good News for This iShares ETFThe clouds appear to be parting for small-cap stocks, which bodes well for one of our favorite exchange-traded funds.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.

-

Should You Be Investing in Emerging Markets?

Should You Be Investing in Emerging Markets?Economic growth, earnings acceleration and bargain prices favor emerging markets stocks right now.

-

7 Hybrid Adviser Services, Reviewed

7 Hybrid Adviser Services, ReviewedThese hybrid adviser services aim for a sweet spot that combines digital investing with a human touch.

-

These Unloved Energy Stocks Are a Bargain

These Unloved Energy Stocks Are a BargainCleaned-up balance sheets and generous dividends make these dirt-cheap energy shares worth a look.