10 Things You Should Know About Bonds

Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor.

Donna LeValley

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

When it comes to bond investing, there's a lot more to know than the current interest rate on Treasuries.

Bonds have two primary roles: income – whether taxable or tax-free – and portfolio diversification. Much of the time, when stocks or other investments struggle, bonds hold their value.

Read on to learn some key concepts every bond investor should know.

1. It's all about interest rates

The Federal Reserve has raised interest rates by more than 5 percentage points over the past two years. Why is this important to investors in bonds?

Bond prices certainly are linked to interest rates, but inversely. When interest rates overall are on the rise, older, lower-yielding bonds become devalued. Conversely, falling rates raise the value of older issues with higher coupon rates.

So remember this like it's your mantra:

- When interest rates rise, bond prices fall.

- When interest rates fall, bond prices rise.

Rinse, wash, repeat.

2. What does 'duration' mean?

To dispel with some misconceptions, "duration" is not a rough estimate of how long it will take to reach your investing goal. Neither is it the number of years a bond issuer has gone without a negative credit event. And it doesn't refer to the number of years before the borrower has to return your principal.

Rather, it’s a measure of a bond’s interest rate sensitivity. As a general rule, for every 1% increase or decrease in interest rates, a bond's price will change approximately 1% in the opposite direction for every year of duration.

Duration – roughly related to a bond’s maturity, or the average maturity of the bonds in a fund’s portfolio – tells you approximately how much the price of a bond, or a fund’s net asset value, would fall or rise depending on the direction of interest rates. A duration of 5.5, for example, implies that a fund’s share price would fall roughly 5.5% if market rates rise one percentage point over a 12-month period.

3. What's the single biggest risk to bond returns?

A rising stock market that attracts investment assets at the expense of bonds or a growing government budget deficit can hurt returns on bonds, but nothing cripples them like the "I" word.

Indeed, nothing is as pernicious to a lender than inflation, which represents a double-whammy for bondholders.

After all, inflation both devalues the real worth of future interest payments and usually results in higher interest rates that detract from a bond’s current market value.

Recession talk makes bond investors nervous for good reason. Corporate bonds are at increased risk of default when the economy is contracting. It turn, that keeps a lid on bond prices.

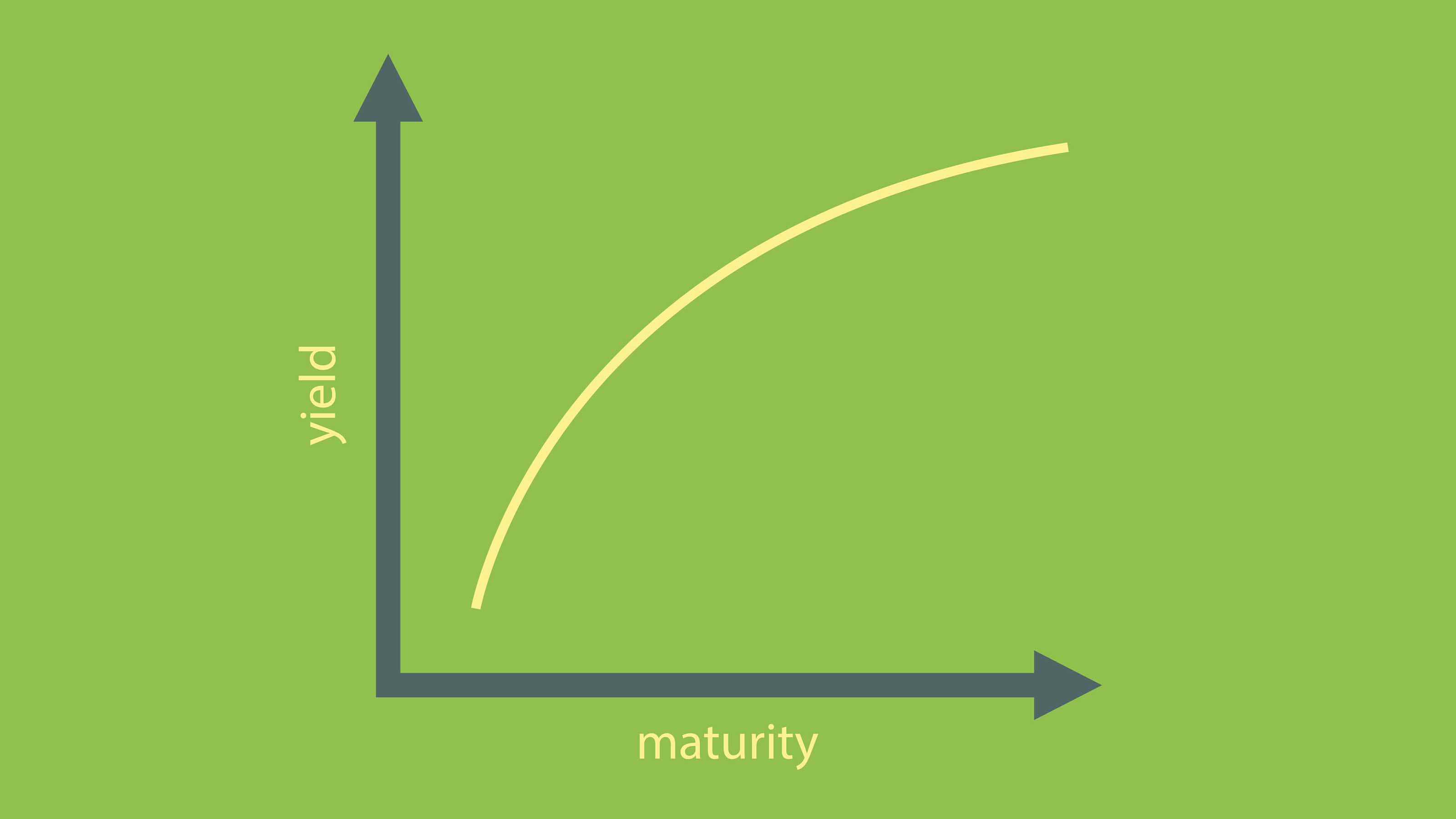

4. What is an inverted yield curve?

Nothing gets recession talk started like an inverted yield curve.

A wild and volatile bond market, also known as an upside-down bond market, isn't nearly as worrisome. It's also not good when Treasury securities pay higher interest rates than corporate bonds or mortgages with the same maturity.

But an inverted yield curve is worse. When short-term Treasury notes pay a higher interest rate than long-term government notes and bonds, there be monsters ahead.

Inverted yield curves are usually taken as a warning that the economy is slowing and might go into a recession. Longer-dated maturities typically yield more than shorter ones; when that relationship reverses, it could be because investors foresee lower interest rates as the economy slows along with borrowing demand.

However, there are exceptions, and an inverted yield curve doesn’t always spell disaster.

5. What is the highest rating a bond can have?

The two most important agencies that rate the creditworthiness of bond issues are Moody's and Standard & Poor's.

The highest credit score for borrowers – be they companies or countries – is AAA. Both agencies use the same designation when it comes to the very best, most reliable debtors.

AAA ratings are precious and hard to earn. The government of Canada gets one. Pharmaceutical giant Johnson & Johnson also has a AAA rating. Amazon, however, even with its massive war chest and firehouse of free cash flow, gets a rating of A1 from Moody's and S&P rates Amazon at AA-.

Famously, the U.S. lost its top-notch rating from Standard & Poor’s when the rating agency downgraded Uncle Sam to AA+ in August 2011, citing a high level of debt and weakened “effectiveness, stability and predictability of American policymaking” with regard to the debt load.

6. What is a bond's yield to maturity?

Don't mistake this for the interest rate on the bond when it is issued, or the interest rate the bond pays between now and the date it is scheduled to mature.

Yield to maturity is the total return, including a gain or loss in the bond’s price, that you can expect if you buy the bond today and keep it until it matures.

Rather, it's a total return calculation.

Although the word “yield” is in the phrase “yield to maturity,” the figure also includes the future gain or loss in the bond’s value to bring it back to par.

7. Where do bondholders rank in case of bankruptcy?

If a company goes out of business and liquidates, bondholders have the first claim on whatever cash becomes available in the bankruptcy.

Anyone who does not own securities but is owed money by the borrower becomes a general creditor. General creditors might include employees, contractors and suppliers. Stockholders are last in line.

Everyone else – including shareholders, bankers with delinquent loans to the business, and the company's suppliers – must get in line behind the bondholders.

8. What's the minimum order my broker will sell me?

It's a misconception that when you buy bonds from your broker, you must order in multiples of $1,000.

In fact, you can buy $25 “baby bond” units, and often those are better and more liquid than bonds with a face value of $1,000. The $25 units are simple to buy because they are listed just like stocks or ETF units.

9. When do low-rated, high-yield bonds do well?

High-yield bonds, also known as junk bonds, can have a legitimate place in a fixed income portfolio.

That's especially true when the economy is so strong that even weak companies are profitable and paying their debts.

Junk bonds are often seen as more related to stocks than to other bonds, and they tend to do better when the economy is growing swiftly and stocks are rising.

10. What's the deal with munis?

Municipal bonds are often known as tax-exempt bonds, but that doesn't mean you always escape income tax on the interest.

Some municipalities issue both tax-free and taxable bonds because some buyers, such as pension funds and foreign investors, would benefit from the higher yield but do not get anything from a tax exemption.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Anne Kates Smith brings Wall Street to Main Street, with decades of experience covering investments and personal finance for real people trying to navigate fast-changing markets, preserve financial security or plan for the future. She oversees the magazine's investing coverage, authors Kiplinger’s biannual stock-market outlooks and writes the "Your Mind and Your Money" column, a take on behavioral finance and how investors can get out of their own way. Smith began her journalism career as a writer and columnist for USA Today. Prior to joining Kiplinger, she was a senior editor at U.S. News & World Report and a contributing columnist for TheStreet. Smith is a graduate of St. John's College in Annapolis, Md., the third-oldest college in America.

- Donna LeValleyRetirement Writer

-

Over 65? Here's What the New $6K 'Senior Deduction' Means for Medicare IRMAA Costs

Over 65? Here's What the New $6K 'Senior Deduction' Means for Medicare IRMAA CostsTax Breaks A new deduction for people over age 65 has some thinking about Medicare premiums and MAGI strategy.

-

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.

U.S. Congress to End Emergency Tax Bill Over $6,000 Senior Deduction and Tip, Overtime Tax Breaks in D.C.Tax Law Here's how taxpayers can amend their already-filed income tax returns amid a potentially looming legal battle on Capitol Hill.

-

5 Investing Rules You Can Steal From Millennials

5 Investing Rules You Can Steal From MillennialsMillennials are reshaping the investing landscape. See how the tech-savvy generation is approaching capital markets – and the strategies you can take from them.

-

Big Change Coming to the Federal Reserve

Big Change Coming to the Federal ReserveThe Lette A new chairman of the Federal Reserve has been named. What will this mean for the economy?

-

What Fed Rate Cuts Mean For Fixed-Income Investors

What Fed Rate Cuts Mean For Fixed-Income InvestorsThe Fed's rate-cutting campaign has the fixed-income market set for an encore of Q4 2024.

-

The Most Tax-Friendly States for Investing in 2025 (Hint: There Are Two)

The Most Tax-Friendly States for Investing in 2025 (Hint: There Are Two)State Taxes Living in one of these places could lower your 2025 investment taxes — especially if you invest in real estate.

-

The Final Countdown for Retirees with Investment Income

The Final Countdown for Retirees with Investment IncomeRetirement Tax Don’t assume Social Security withholding is enough. Some retirement income may require a quarterly estimated tax payment by the September 15 deadline.

-

The 24 Cheapest Places To Retire in the US

The 24 Cheapest Places To Retire in the USWhen you're trying to balance a fixed income with an enjoyable retirement, the cost of living is a crucial factor to consider. Is your city the best?

-

Dividends Are in a Rut

Dividends Are in a RutDividends may be going through a rough patch, but income investors should exercise patience.

-

Bond Ratings and What They Mean

Bond Ratings and What They Meaninvesting Bond ratings measure the creditworthiness of your bond issuer. Understanding bond ratings can help you limit your risk and maximize your yield.

-

Bond Basics: Treasuries

Bond Basics: Treasuriesinvesting Understand the different types of U.S. treasuries and how they work.