The Best and Worst Presidents (According to the Stock Market)

Which U.S. presidents oversaw the best and worst stock market performances? Just for grins, let's see what a 'stock market Mount Rushmore' might look like.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Mount Rushmore features massive 60-foot-tall busts of celebrated presidents George Washington, Thomas Jefferson, Theodore Roosevelt and Abraham Lincoln, each chosen for their respective roles in preserving or expanding the Republic.

But if you were to make a Mount Rushmore for presidents based on stock market performance, none of these men would make the cut. There really was no stock market to speak of during the Washington, Jefferson and Lincoln administrations, and Teddy Roosevelt ranks as one of the worst presidents for stock-market performance of the past 130 years — though he was not the worst.

Just for grins, let's consider what a "stock market Mount Rushmore" might look like. While we're at it, we'll rank every president that we can realistically include based on the available data – and that data includes a few caveats below.

How we calculated presidential stock market returns

The following is a ranking of every president since Benjamin Harrison (who, sneak preview, didn't do very well) by stock market performance, in order from worst to best.

The data is as of February 11, 2026, and includes President Donald Trump's second term. Returns data are price only (not including dividends), which tends to favor more recent presidents. Over the past half-century, dividends have become a smaller portion of total returns due to their unfavorable tax treatment.

Data is not adjusted for inflation. This will tend to reward presidents of inflationary times (Richard Nixon, Jimmy Carter, Gerald Ford, etc.) and punish presidents of disinflationary or deflationary times (Franklin Delano Roosevelt, George W. Bush, Barack Obama, etc.).

Presidents from Herbert Hoover to the present are ranked using the S&P 500 stock index, whereas earlier presidents were ranked using the Dow Jones Industrial Average due to data availability.

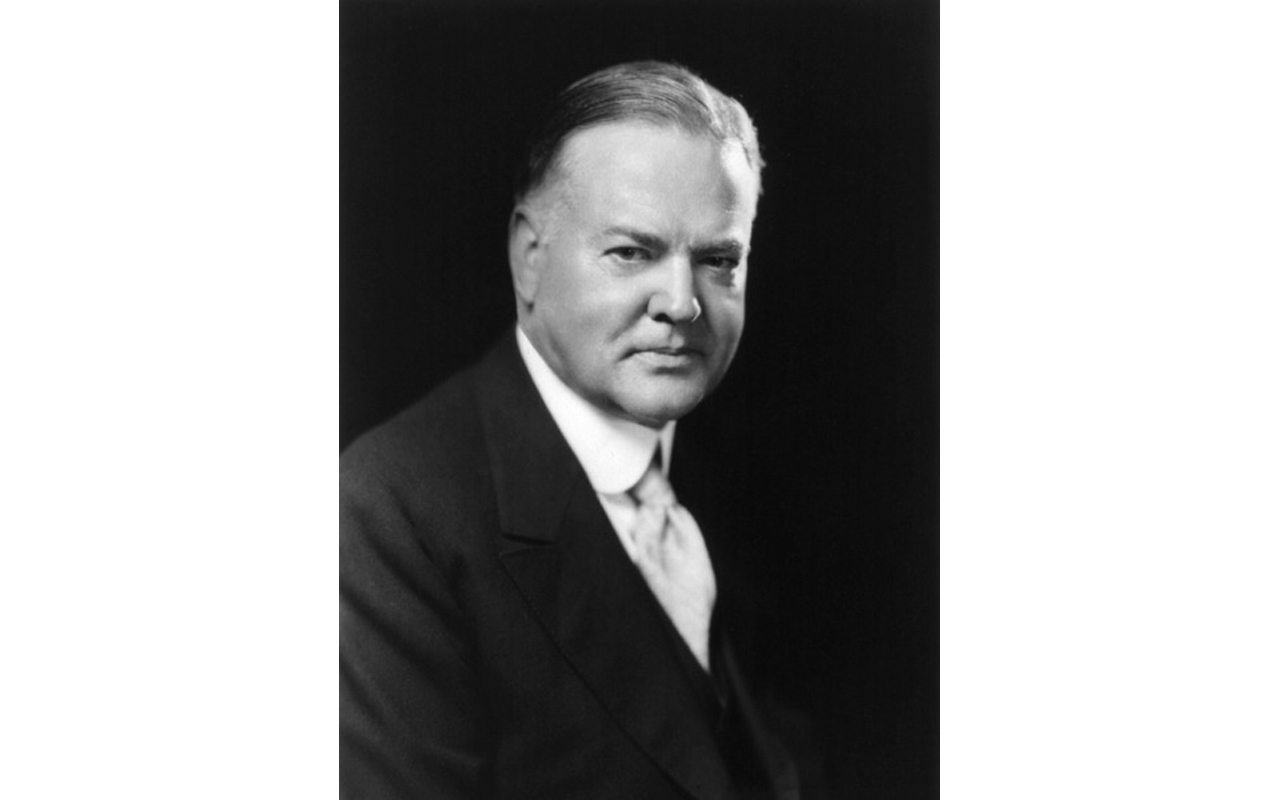

Herbert Hoover

- President: March 4, 1929 to March 4, 1933

- Stock market return: -30.8% per year

Someone has to be in last place, and that particular shame belongs to Herbert Hoover. Hoover occupies the bottom rung with a truly abysmal 77.1% cumulative loss and 30.8% annualized compound loss.

In case you need a history refresher, Hoover took office just months before the 1929 stock market crash that ushered in the worst bear market in U.S. history.

That's rotten luck, but don't feel too sorry for Hoover. He played his part in bringing about the whole mess. More than a thousand economists signed a letter warning him not to sign the Smoot-Hawley Tariff Act into law — yet he did it anyway. This helped to turn what might have been a garden-variety recession into the Great Depression.

That's on you, Hoover.

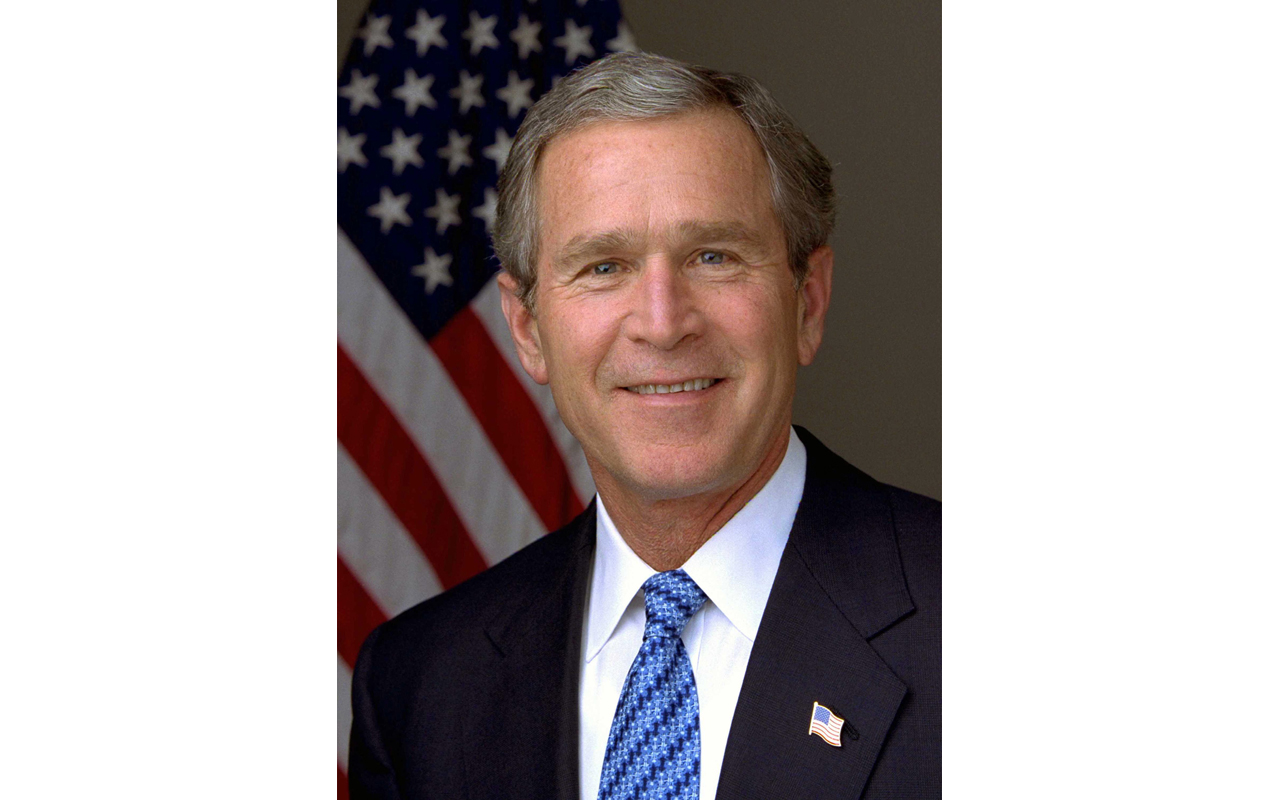

George W. Bush

- President: January 20, 2001 to January 20, 2009

- Stock market return: -5.6% per year

In second-to-last place is George W. Bush, with annualized losses of 5.6%. Poor Dubya had the misfortune of taking office just as the dot-com boom of the 1990s went bust and shortly before the September 11, 2001, terror attacks helped to push the economy deeper into recession. If that weren't bad enough, the 2008 mortgage and banking crisis happened at the tail end of his presidency.

Sandwiched between two of the worst bear markets in U.S. history, Dubya never had a chance.

There were some good market years, of course. Stocks rallied from 2003 to a peak in 2007, briefly surpassing their Clinton-era dot-com highs. These gains were attributable, at least in part, to Bush's tax and regulatory reforms, which deserve credit.

However, Bush also will be remembered for an expensive and controversial war in Iraq and for throwing fiscal restraint out the window with some of the largest budget deficits in history.

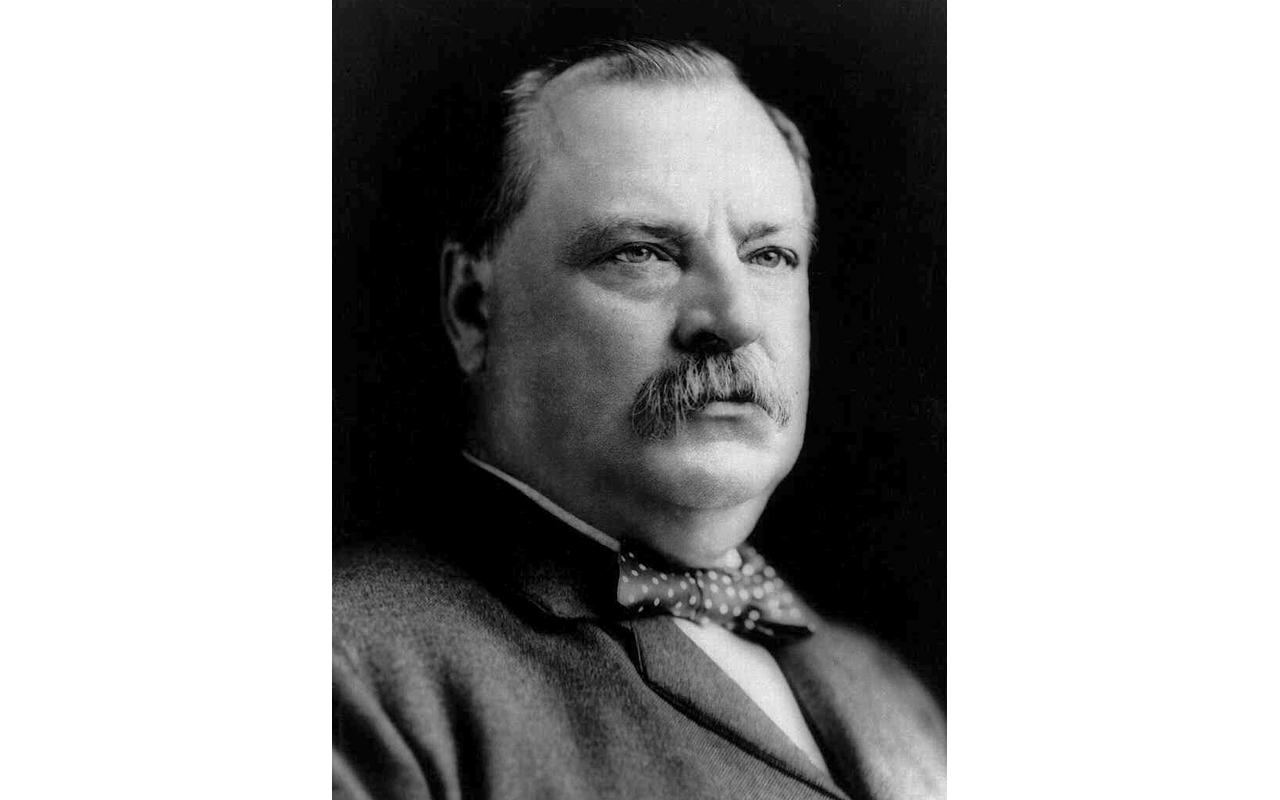

Grover Cleveland

- President: March 4, 1893 to March 4, 1897

- Stock market return: -4.9% per year

For the third-worst president in terms of stock market returns, we must return to the late 1800s and the second presidency of Grover Cleveland.

Most of the poorer-performing presidents had their share of mistakes that helped contribute to the lousy market returns of their presidency. Cleveland, on the other hand, was just unlucky.

By any historical account, he was a responsible president who ran an honest and fiscally sound administration that believed in free trade and sound money. He was respected by voters and by his peers in Washington. But then the Panic of 1893 hit the banking system and led to a deep depression. The fallout was so bad, it led to a grassroots revolt and a total realignment of the Democratic Party.

After Cleveland fell from grace, the mantle of leadership eventually shifted to Teddy Roosevelt, Woodrow Wilson and William Jennings Bryan, in what is known as the Progressive Era. That, among other things, gave us the Federal Reserve.

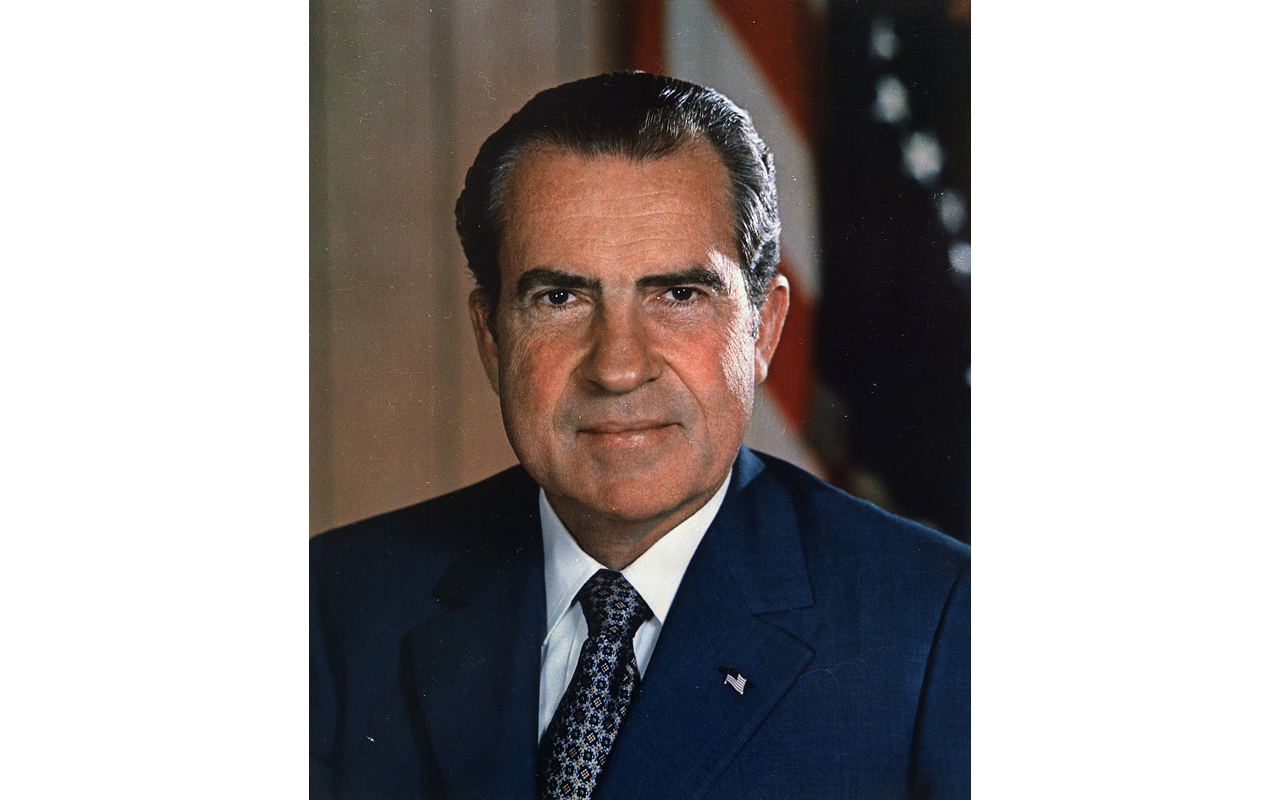

Richard Nixon

- President: January 20, 1969 to August 9, 1974

- Stock market return: -3.9% per year

Stocks didn't perform well during the presidency of Richard Nixon, losing 3.9% per year. It's worth remembering that these losses were in nominal terms. Considering the high inflation prevalent during his time in office, real losses would look a lot worse.

"Tricky Dick" generally is considered to be one of the most intelligent men to ever occupy the White House. Alas, following the Watergate scandal, he also was widely considered to be one of the most paranoid and corrupt. Facing certain impeachment, Nixon was forced to resign early in his second term.

But while Nixon's presidency is most associated with Watergate, the Vietnam War and sweating profusely while on stage, market historians would point out that the most significant event for stock investors was Nixon's closing of the gold window. That ended the dollar's convertibility to gold and essentially killed the Bretton Woods system.

This helped to usher in the high inflation of the 1970s, which contributed to one of the worst bear markets in history in 1973-74, and for good measure, wrecked the bond market.

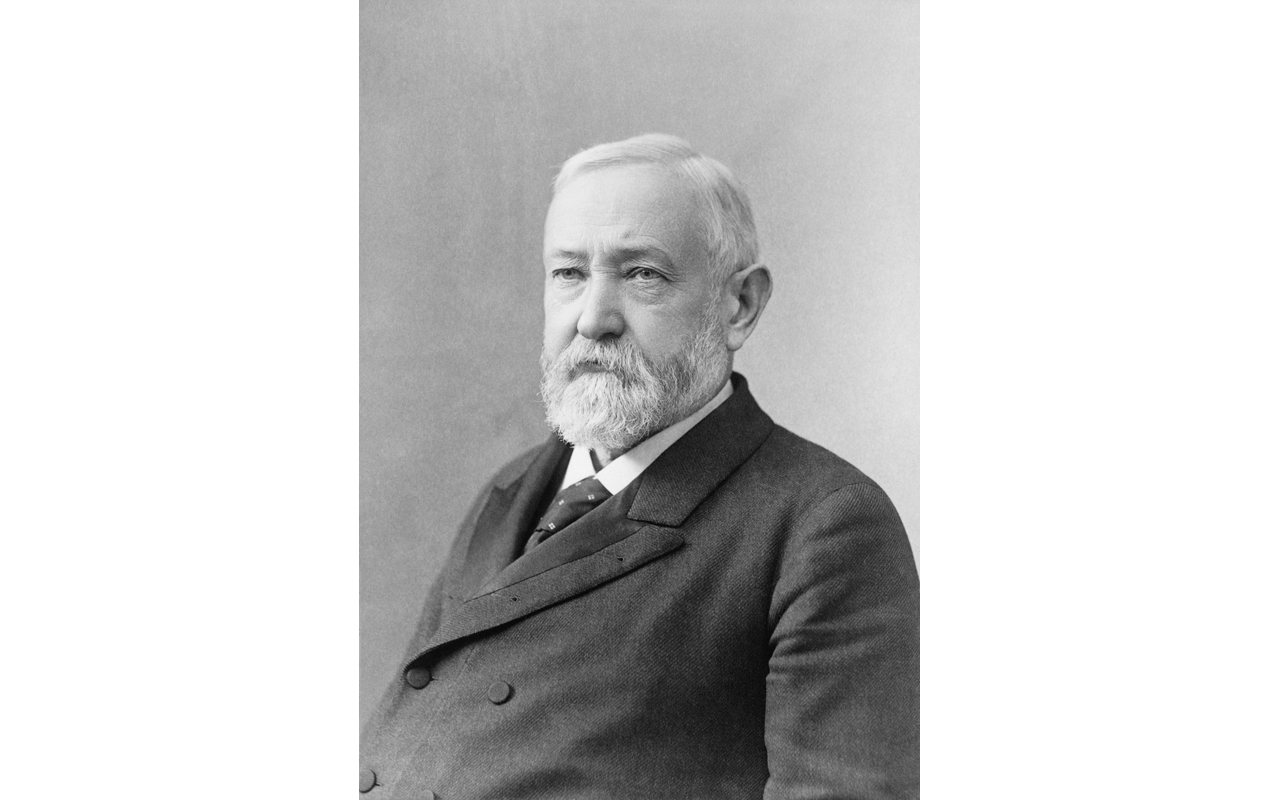

Benjamin Harrison

- President: March 4, 1889 to March 4, 1893

- Stock market return: -1.4% per year

Most Americans know very little about President Benjamin Harrison, a one-term president whose time in the White House fell between Grover Cleveland's two non-consecutive terms. History buffs might note that he was the grandson of President William Henry Harrison, making them the only grandfather-grandson pair to have held the White House.

Harrison, a protectionist, was a proponent of high tariffs and used the revenue to boost federal spending. He has the distinction — or perhaps shame? — of being the first president to preside over a federal budget of more than $1 billion. His administration also passed the Sherman Antitrust Act, which is the foundation of U.S. competitiveness regulation.

There was no defining recession or calamity in Harrison's presidency, though the market losses of 1.4% per year under his watch are generally attributed to the effects of the unpopular McKinley Tariff, signed into law by President Harrison.

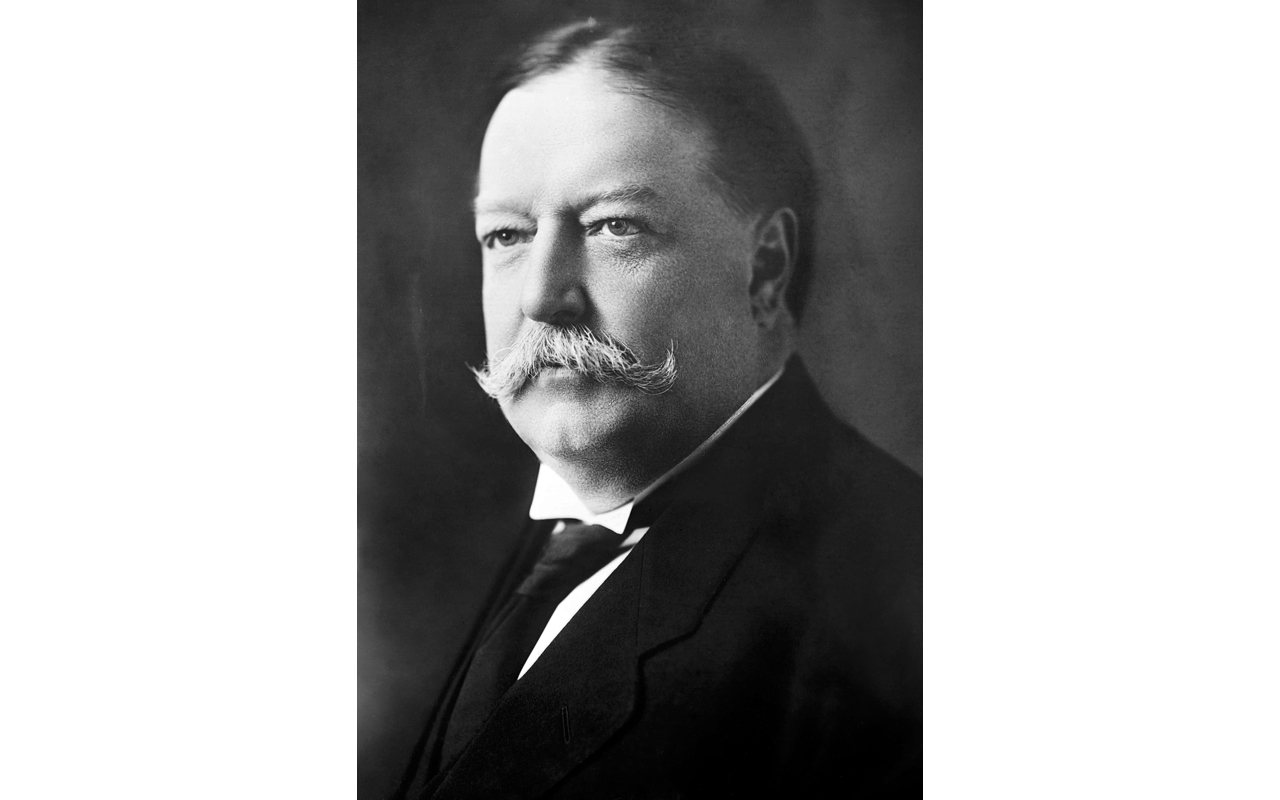

William Howard Taft

- President: March 4, 1909 to March 4, 1913

- Stock market return: -0.1% per year

The market didn't do much of anything under President William Howard Taft's watch, losing 0.1% per year.

Taft has the distinction of being the only man to serve both as president and, later, as chief justice of the Supreme Court. Otherwise, there's not much to say about him. He was a one-term president who sported a luxuriant mustache that made him look a little like a James Bond villain.

He also was the unfortunate victim of Teddy Roosevelt's ego. Roosevelt split the Republican vote by running as a third-party candidate, thus paving the way for Woodrow Wilson's win.

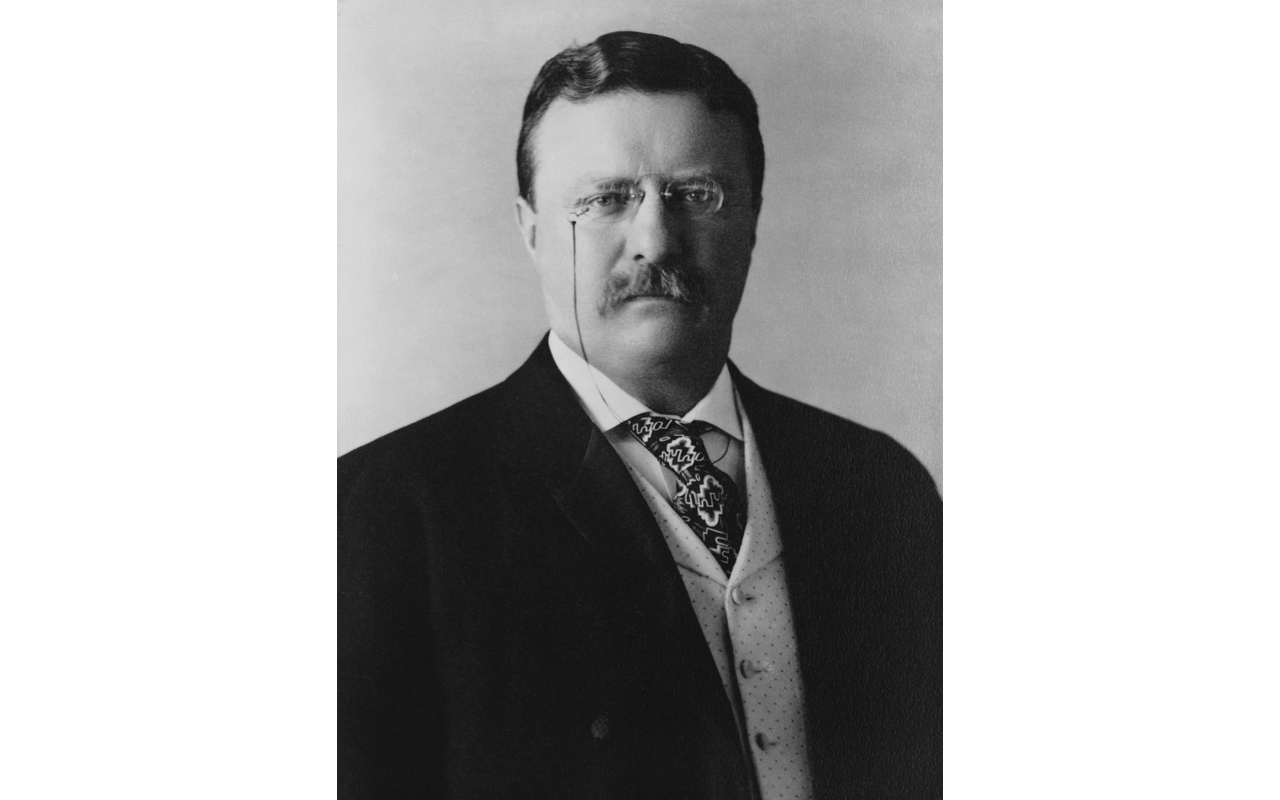

Theodore Roosevelt

- President: September 14, 1901 to March 4, 1909

- Stock market return: 2.2% per year

Teddy Roosevelt was never supposed to be president. The Republican Party considered him a loose cannon and tried to neutralize him by making him vice president. That was fine until President McKinley was assassinated, and the job fell to Roosevelt by default.

Roosevelt is one of America's more colorful and controversial presidents. He is fondly remembered as being a rugged cowboy and Rough Rider, as well as for his wartime exploits. He's also the only president from the 1900s to grace Mount Rushmore. He was a walking, breathing symbol of America's manifest destiny.

Alas, he also had a reputation for being something of a bully and had an ego that was proportionate to his bust on Mount Rushmore. He was best known for expanding the power of the government to aggressively break up industrial monopolies, which, in part, explains the rather lackluster market returns of 2.2% per year under his presidency.

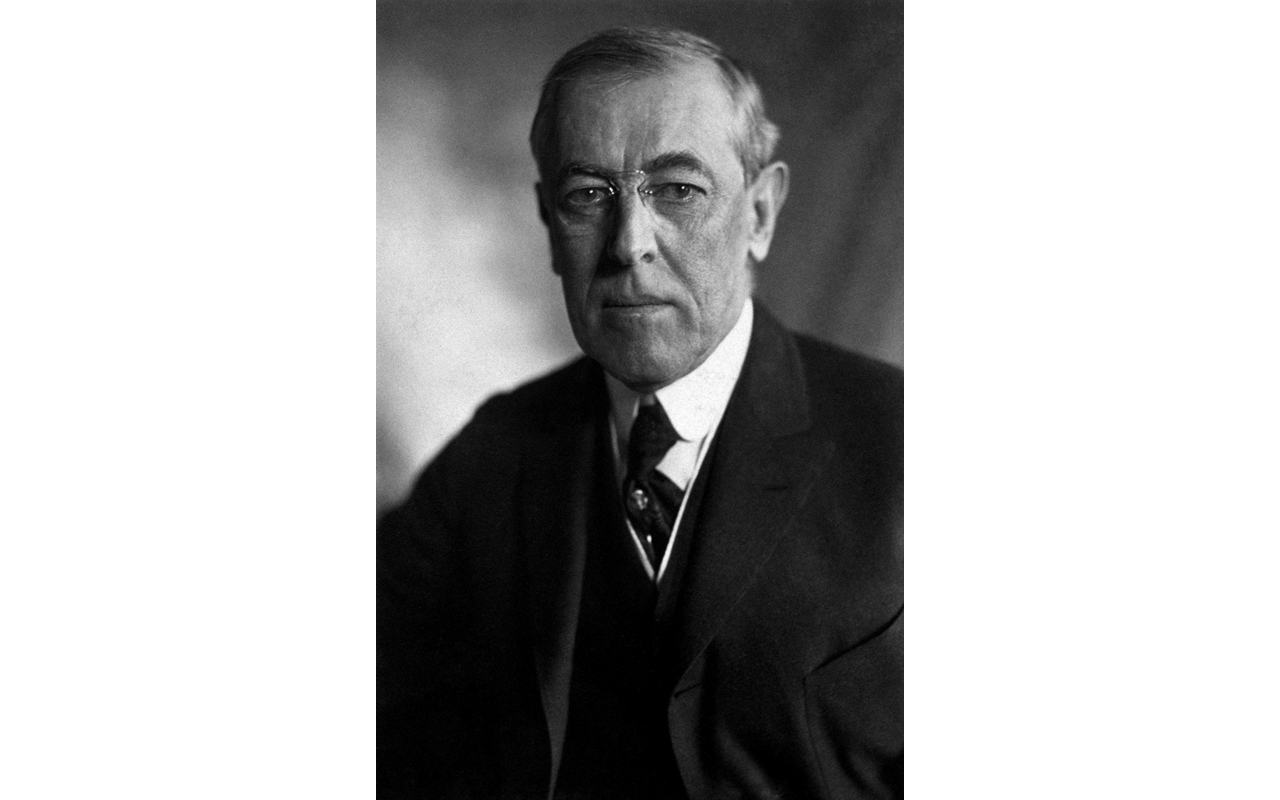

Woodrow Wilson

- President: March 4, 1913 to March 4, 1921

- Stock market return: 3.1% per year

President Woodrow Wilson is probably best-known for serving as president during World War I.

But for economic historians, he will forever live in infamy as the president who reinstituted federal income taxes and created an income-tax division within the Bureau of Internal Revenue (which eventually became the Internal Revenue Service).

He also introduced the Federal Reserve system, making him one of the most influential presidents in modern history.

Prior to the Fed's founding and its emergence as a "lender of last resort" to banks suffering short-term liquidity crunches, America's financial system was extremely susceptible to bank runs and financial crises.

For all its perceived faults, the Fed has brought a degree of stability to our system that was previously and sorely absent.

While the world has continued to have its share of crises in the decades following the Federal Reserve's creation, it's difficult to imagine what our system would look like today without a central bank.

That's great, but it's still hard not to curse Wilson every time Tax Day comes around and tax returns are due to the IRS.

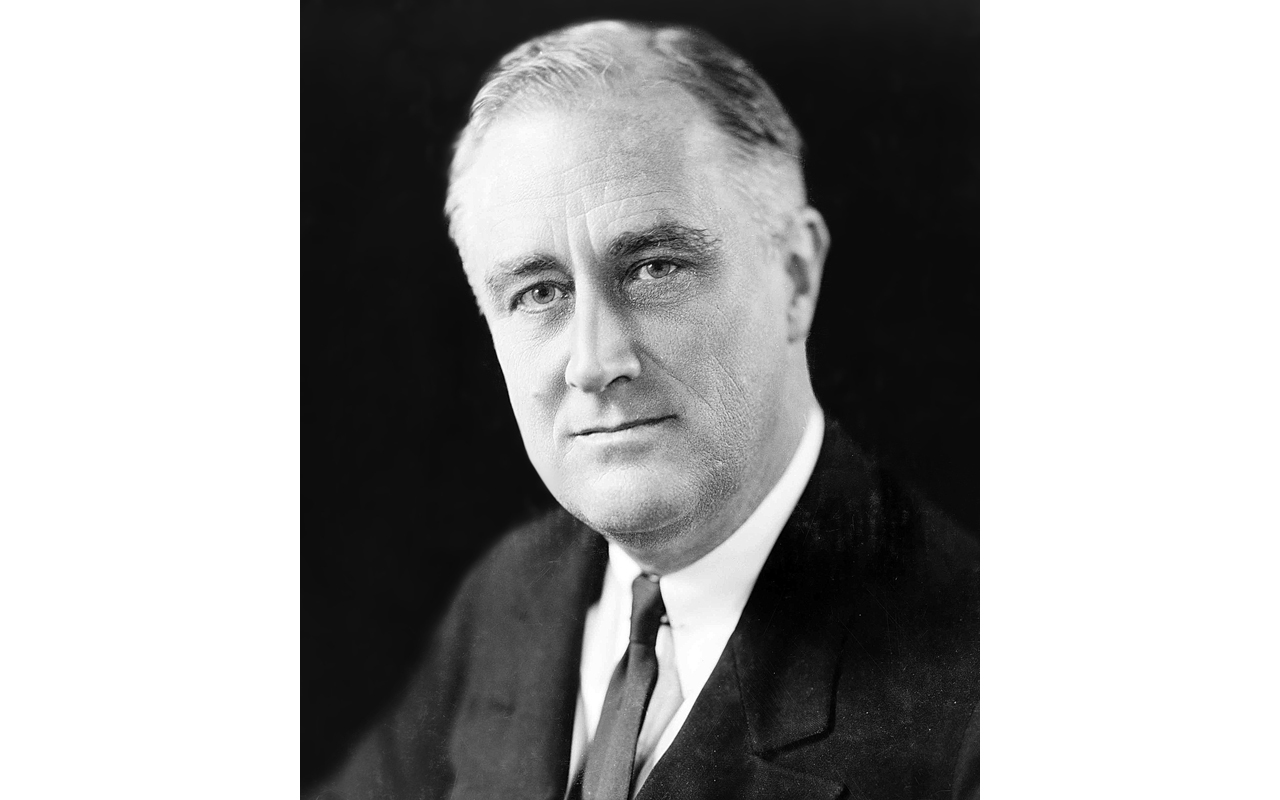

Franklin Delano Roosevelt

- President: March 4, 1933-April 12, 1945

- Stock market return: 6.2% per year

Franklin Delano Roosevelt was the longest-serving president in U.S. history, having been elected to four terms and serving for slightly more than 12 years before dying in office.

He's remembered as the president who steered the country through the Great Depression and stood up to Nazi Germany and Imperial Japan.

More controversially, he's also remembered as the president who gave us the New Deal and the massively expanded role of the federal government that came with it.

In Roosevelt's defense, the economy was already broken when he took office. Hoover's poor management of the early years of the Great Depression had left a real mess to clean up.

However, many economists would argue that Roosevelt's heavy-handed approach to regulation slowed down the recovery and caused the effects of the Depression to linger far longer than they should have.

That's open to debate, of course. But it might explain why stock returns were a relatively modest 6.2% per year despite having a low starting point following the 1929 crash and bear market.

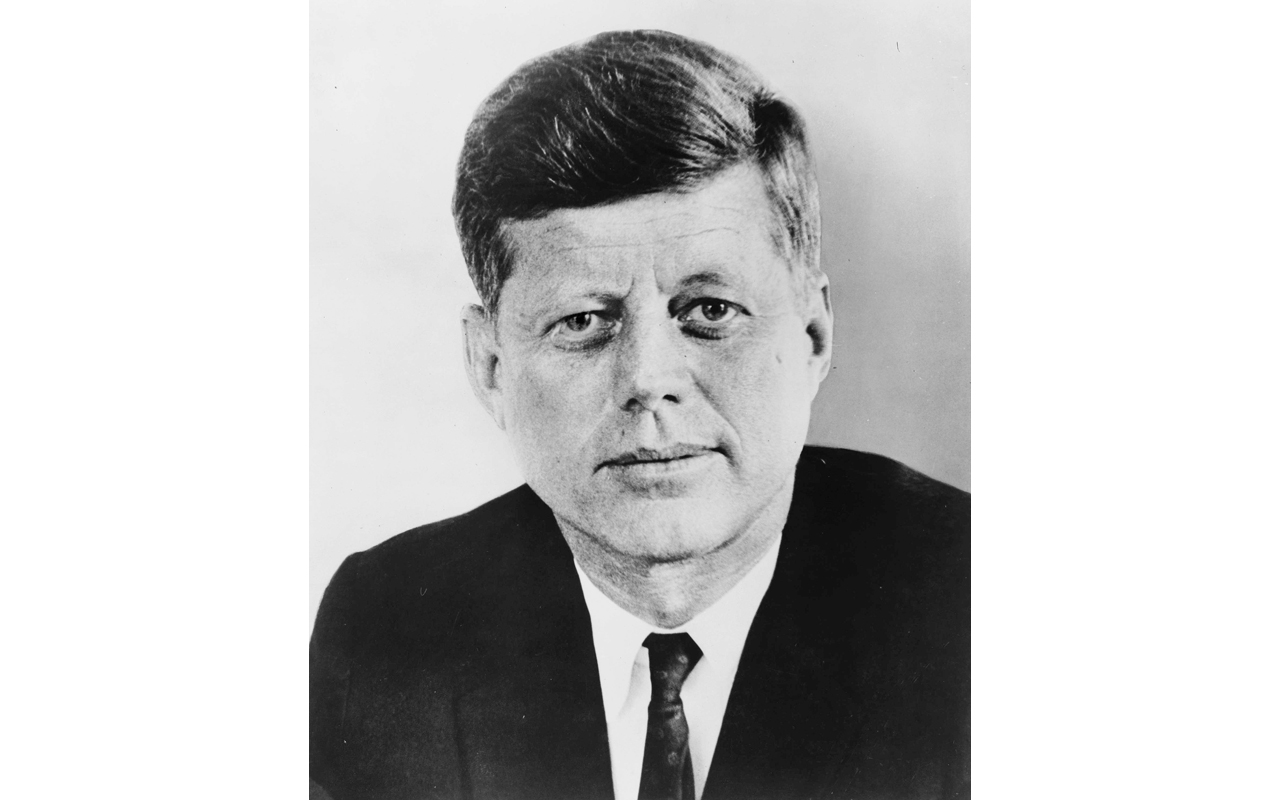

John F. Kennedy

- President: January 20, 1961 to November 22, 1963

- Stock market return: 6.5% per year

John F. Kennedy was president for less than three years before he was tragically assassinated in office.

But he's fondly remembered by most Americans as the president who inspired the nation to fly to the moon.

He also was famous for his handling of the Cuban Missile Crisis and for presiding over a particularly frosty segment of the Cold War.

Market historians also would point out that Kennedy advocated lower personal and corporate income taxes and generally promoted pro-growth policies.

Kennedy believed that lower tax rates would paradoxically lead to higher tax revenues due to higher overall economic activity. This sentiment would later be called the "Laffer Curve" after Art Laffer popularized the concept while serving in Ronald Reagan's administration.

A bear market early in Kennedy's term knocked down his average, but stocks still managed to return a respectable 6.5% per year during his time in office.

Jimmy Carter

- President: January 20, 1977 to January 20, 1981

- Stock market return: 6.9% per year

President Jimmy Carter gets blamed for a lot of things that probably weren't his fault. His presidency was marked by economic "malaise," in his words, characterized by low growth, high inflation and an economy that was highly susceptible to commodity price shocks. And sweaters …

Carter will always be remembered as the president that turned the heater down in the White House, setting an example for energy conservation. By the time Carter took office, the U.S. economy was deindustrializing, and the regulatory framework that had been in place since the Great Depression was really starting to look stale.

Carter made early attempts to deregulate and rethink the regulatory state, which is commendable, but he lacked the gravitas and the ideological zeal to pull off anything like the Reagan Revolution that would follow him.

Nevertheless, the stock market did manage to return 6.9% per year during his presidency. Not too shabby.

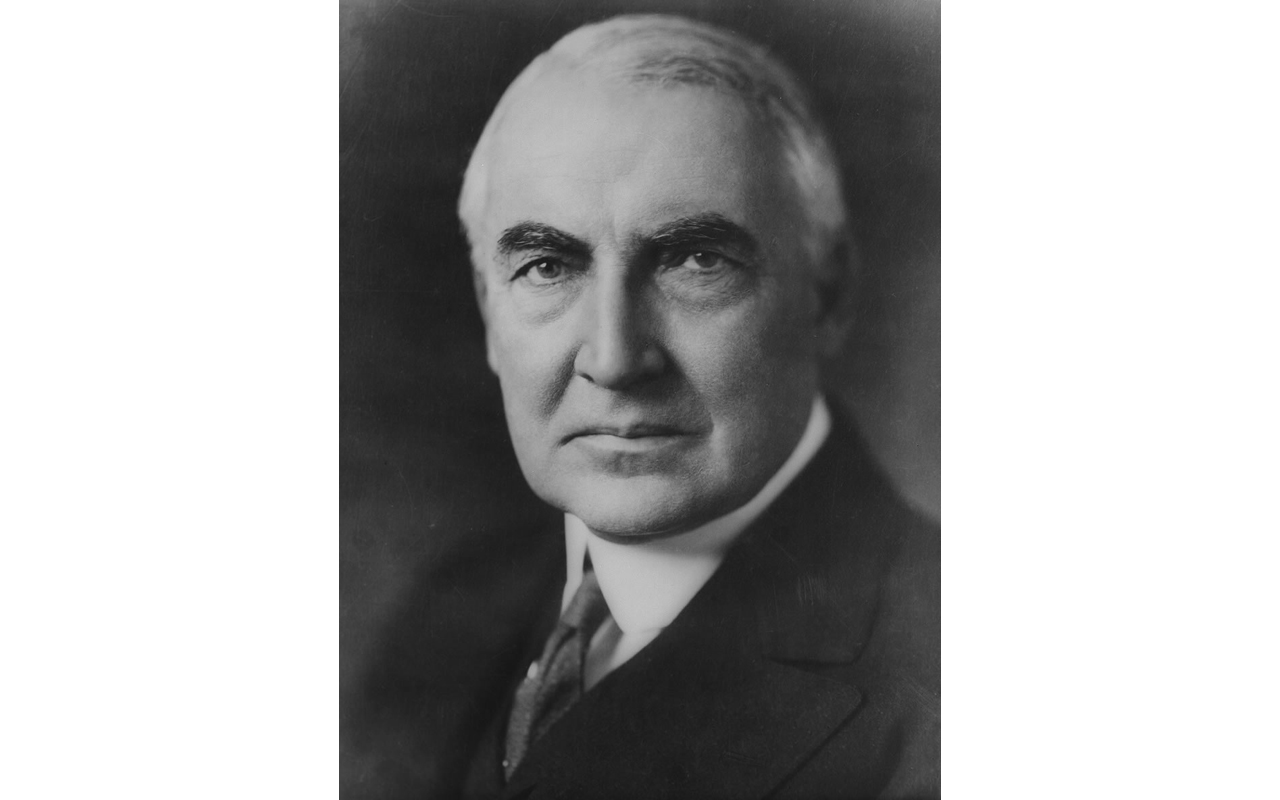

Warren G. Harding

- President: March 4, 1921 to August 2, 1923

- Stock market return: 6.9% per year

President Warren G. Harding is generally considered to be one of the worst presidents in U.S. history.

His presidency was marked by scandal; prior to Watergate, the Teapot Dome bribery scandal was probably the biggest in U.S. history.

Harding was also known to be a serial philanderer who preferred pursuing mistresses to governing the country.

That said, while Harding didn't accomplish much as president, he was in the middle of the pack when it came to stock market performance. Stocks returned 6.9% annually during his presidency.

Harding died in office from a heart attack and was followed by Calvin Coolidge, who would go on to preside over one of the greatest economic expansions in U.S. history.

Lyndon B. Johnson

- President: November 22, 1963 to January 20, 1969

- Stock market return: 7.7% per year

President Lyndon B. Johnson, better remembered as "LBJ," took over the presidency following John F. Kennedy's assassination. His time in office was turbulent, marked by an escalation of the Vietnam War and widespread social unrest.

LBJ was one of only four presidents who, while eligible to seek re-election, chose not to.

While his handling of the war cast his presidency in a negative light, Johnson also launched the Medicare and Medicaid programs, which decades later still provide basic health coverage to retired and to lower-income Americans.

Due, in part, to the cost of the Vietnam War, inflation started to trend higher during Johnson's presidency, eventually accelerating into the punishing stagflation that plagued the presidencies of Nixon, Ford and Carter.

Under his watch, the market still returned a respectable 7.7% per year.

Harry Truman

- President: April 12, 1945 to January 20, 1953

- Stock market return: 8.1% per year

Harry Truman is perhaps most famous for being the president that ended World War II and as the only world leader to use nuclear weapons in war, dropping atomic bombs on Hiroshima and Nagasaki.

He also managed the earliest years of the Cold War and implemented the Marshall Plan, which poured billions of dollars into rebuilding Western Europe after World War II.

Truman had the good fortune to preside over the beginnings of the post-war surge in prosperity.

The war and the rebuilding that followed it supercharged the U.S. economy and finally shook it out of the Great Depression.

By the time Truman left office, the American economy was booming.

Stocks averaged an 8.1% annual returns during Truman's presidency.

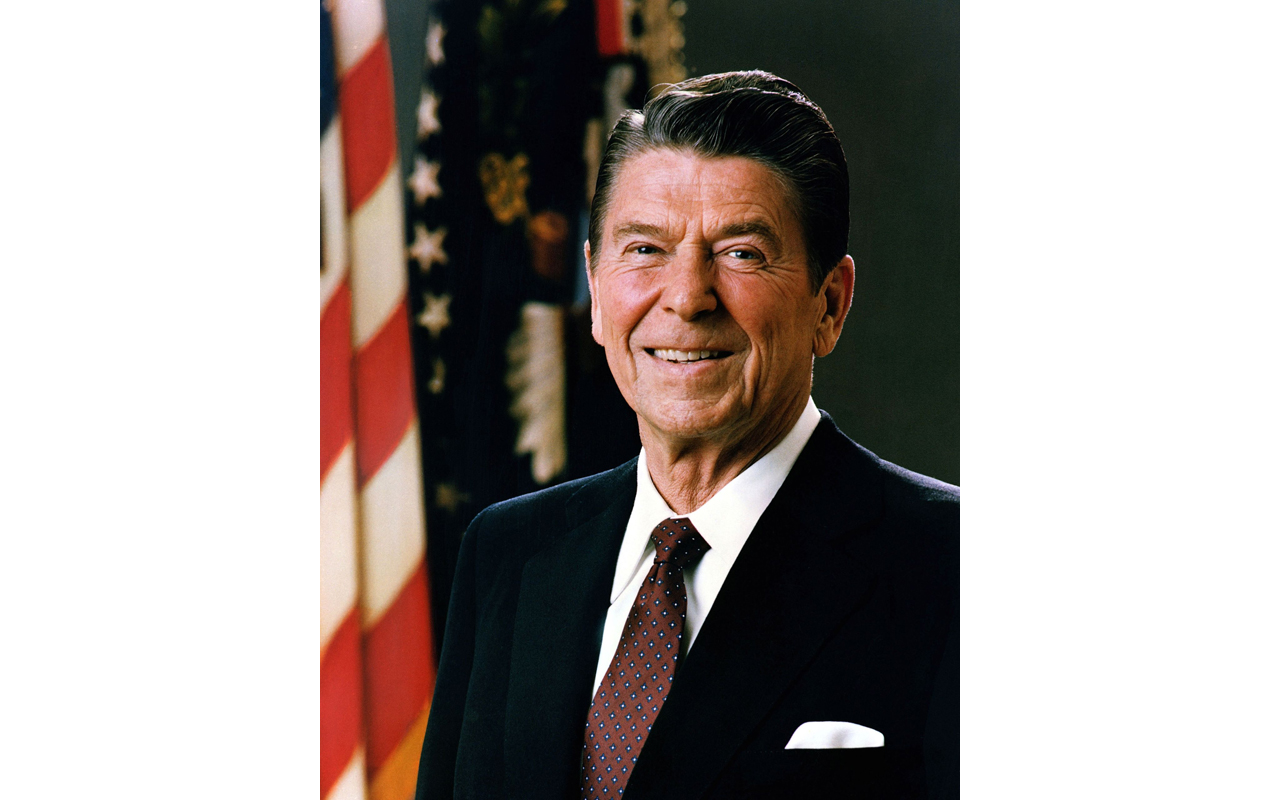

Ronald Reagan

- President: January 20, 1981 to January 20, 1989

- Stock market return: 10.2% per year

Perhaps no person more embodies the decade of the 1980s than President Ronald Reagan. The final stages of the Cold War, the Decade of Greed, Gordon Gekko from the movie Wall Street — this was the Reagan Era.

Reagan took office at a time when America was ripe for change, and his "Reaganomics" consisted of tax cuts, deregulation and a general shift toward pro-business policies.

The Reagan years also coincided with the beginning of one of the greatest bull markets in history.

Very early in Reagan's presidency, Fed Chairman Paul Volker broke the back of inflation by running an exceptionally tight monetary policy.

This led to a nasty recession early in Reagan's first term, but by the end of that term, the economy was firing on all cylinders and didn't slow down until George H.W. Bush's term.

Tax cuts, deregulation and falling inflation contributed to the impressive 10.2% annualized returns over the course of Reagan's presidency.

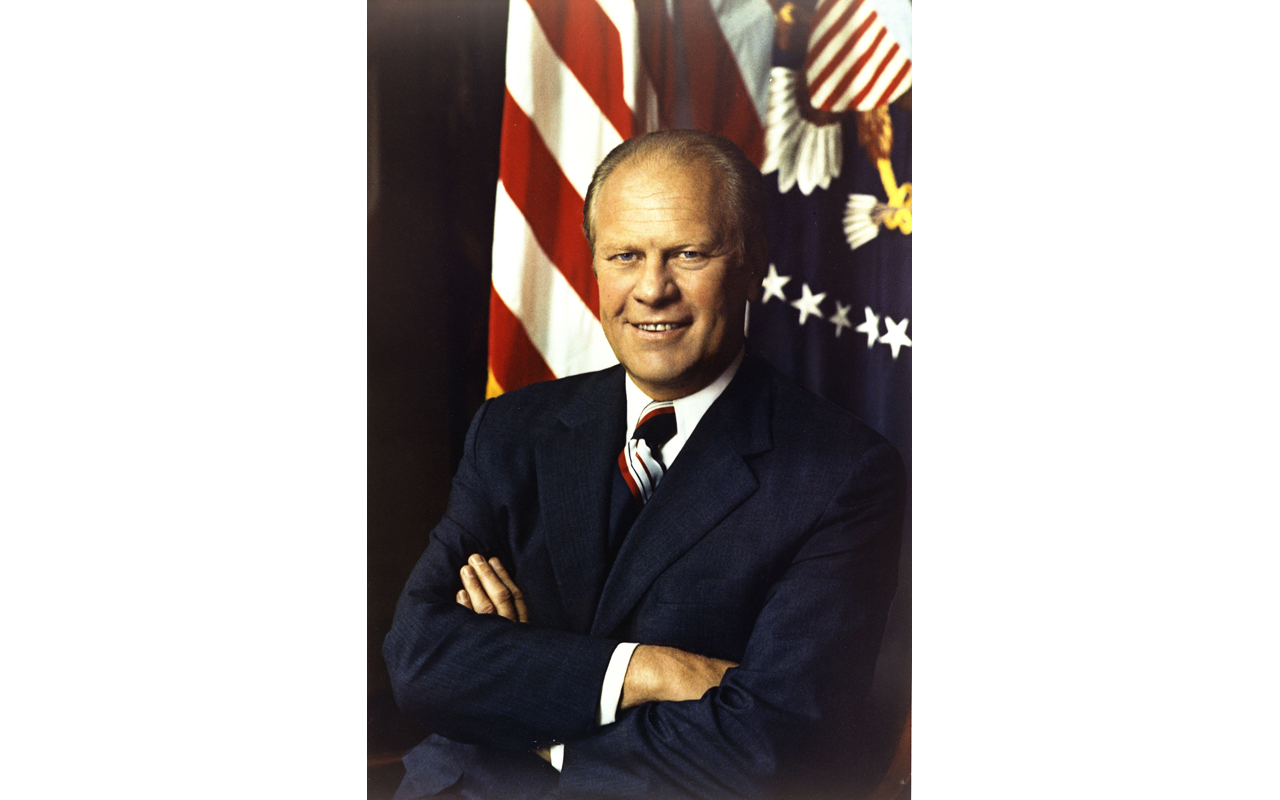

Gerald Ford

- President: August 9, 1974 to January 20, 1977

- Stock market return: 10.8% per year

Gerald Ford holds the distinction of being the only American president to have never been elected to the office of president or vice president.

He became vice president after the resignation of Spiro Agnew, and later became president following the departure of the scandal-plagued Richard Nixon.

Ford never got much respect as president. He inherited a nasty economy from Nixon, characterized by sluggish growth and high inflation, and he lacked the imagination or charisma to do much about it.

Yet, Ford is an interesting case study in how timing is everything when it comes to investing.

He took office just as the brutal 1973-74 bear market was nearing its end. That bear market saw the Dow and S&P 500 lose nearly half their respective values.

Coming off of a low base like that, the market was in position to deliver solid returns even in a lousy economy, and that's what happened. During Ford's tenure, the S&P 500 delivered solid 10.8% annualized returns.

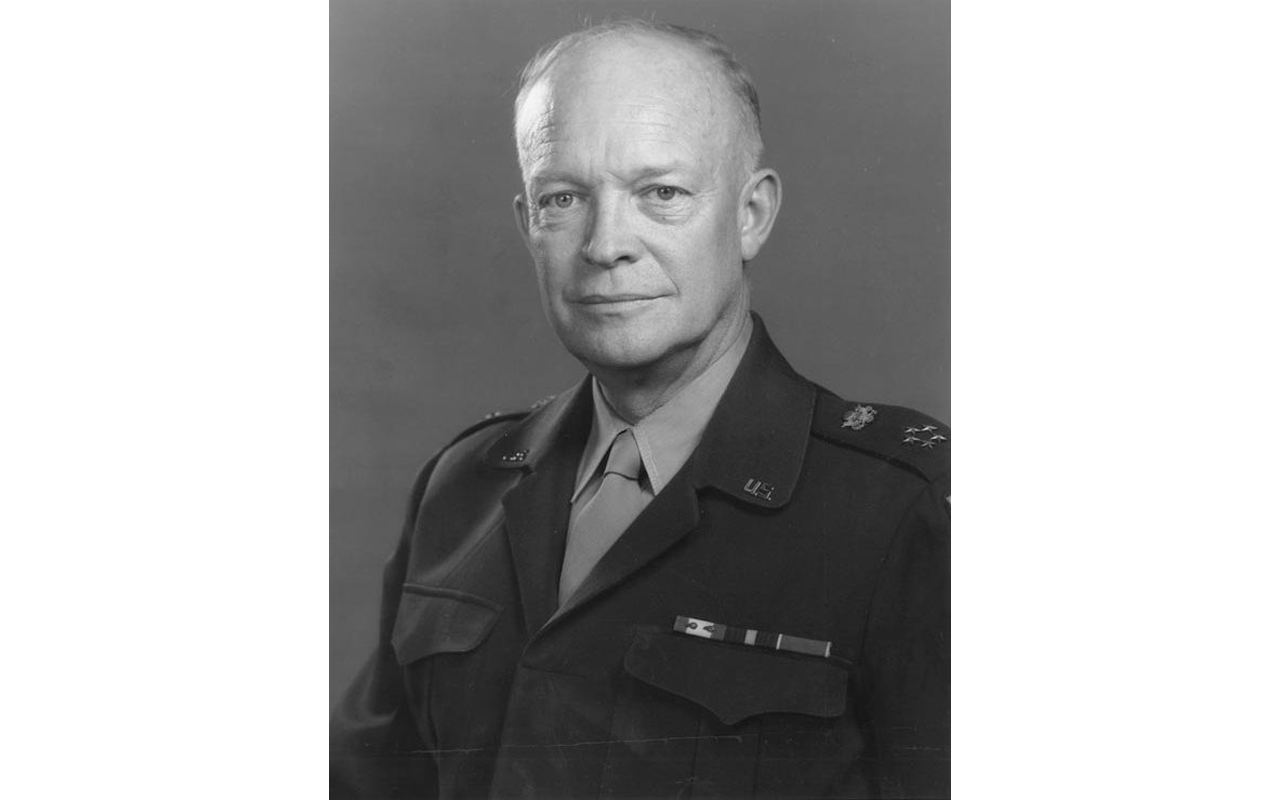

Dwight D. Eisenhower

- President: January 20, 1953 to January 20, 1961

- Stock market return: 10.9% per year

Dwight D. Eisenhower had a certain prestige that few presidents before or after could ever hope to match. As the supreme commander of the Allies in World War II, he was accustomed to being in charge.

He also happened to preside over an almost idyllic period in American history in the prosperous 1950s.

The United States emerged from the war as the only major world power without significant damage to rebuild, yet that didn't stop Eisenhower from embarking on one of the most ambitious infrastructure projects in American history in the Interstate Highway System.

America, in the 1950s, was the world's economic, political and military superpower, so it is perhaps unsurprising that this decade was a strong one in the stock market. Under Eisenhower, the S&P 500 saw annual returns of 10.9%.

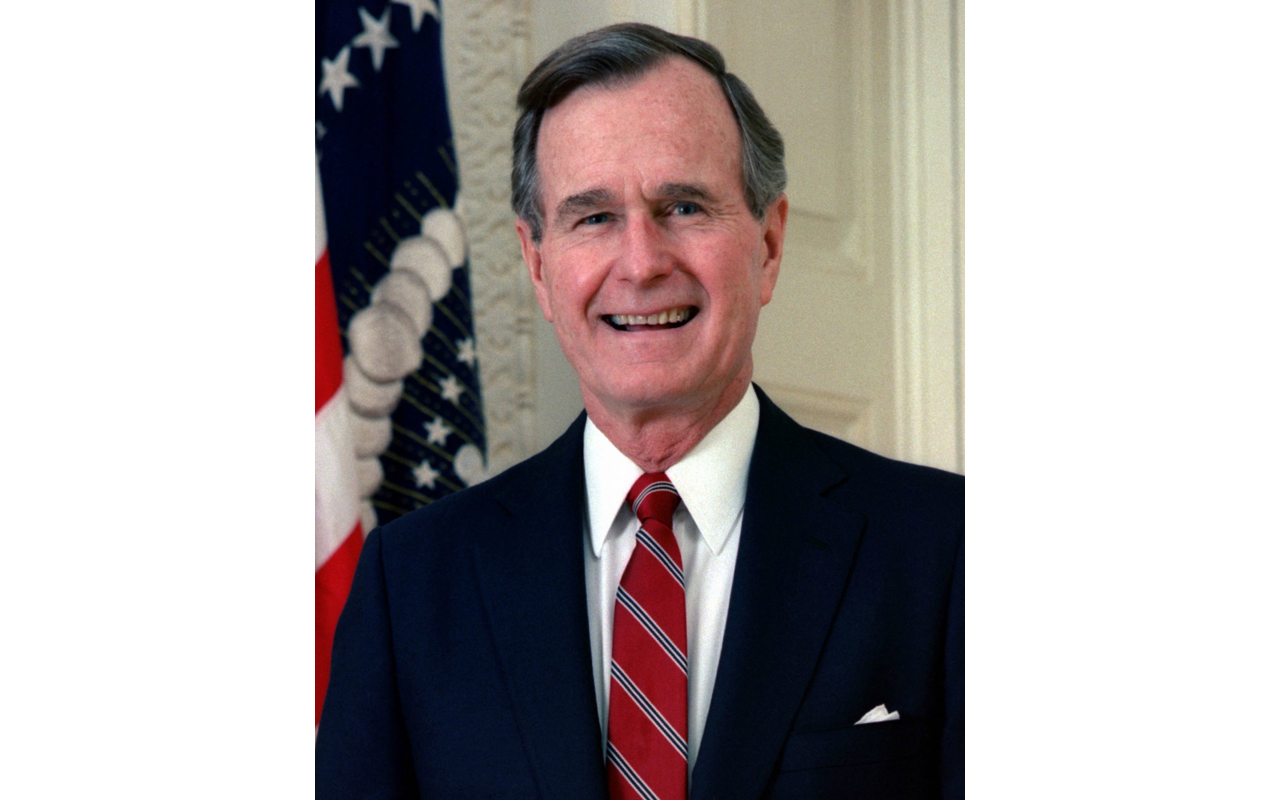

George H.W. Bush

- President: January 20, 1989 to January 20, 1993

- Stock market return: 11.0% per year

The elder George Bush had a more difficult time at the ballot box than his son. George W. managed to secure two terms, whereas George H.W. lost his re-election bid to Bill Clinton.

Yet, when it comes to stock market performance, the elder Bush utterly trounced the younger. Under George H.W. Bush, stocks returned an impressive 11% per year. Under Dubya, they lost nearly 6% per year.

George H.W. Bush inherited an economic boom and soaring political stature from his predecessor, Ronald Reagan. The late Reagan years and early Bush years saw the collapse of the Berlin Wall and the fall of the Soviet Union. Bush also successfully repelled Saddam Hussein's invasion of Kuwait in the Gulf War.

Unfortunately for Bush, the end of the Cold War brought with it a decline in defense spending that helped to create the worst recession in more than a decade in the early 1990s. This — and the emergence of a third-party candidate in Ross Perot — handed the 1992 election to Bill Clinton.

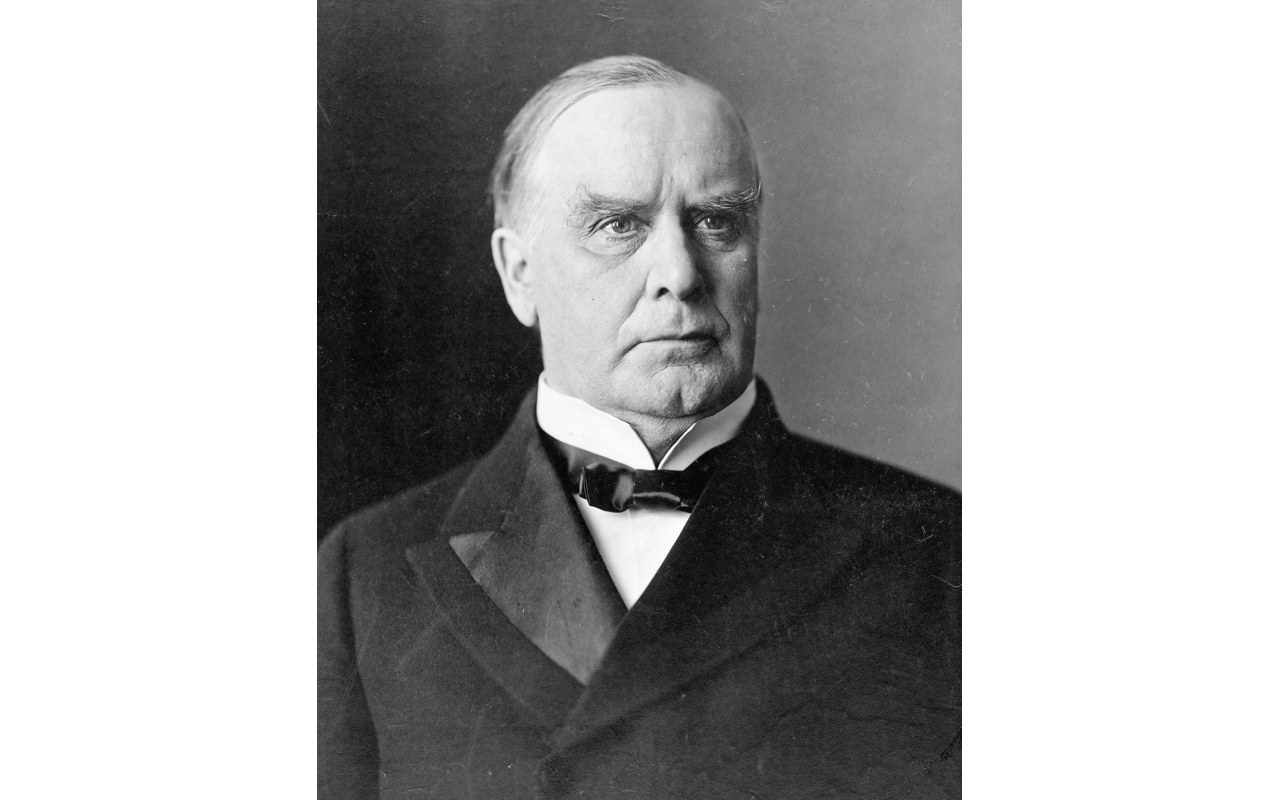

William McKinley

- President: March 4, 1897 to September 14, 1901

- Stock market return: 11.3% per year

William McKinley is an exception on many counts.

To start, most of the presidents that saw the highest stock returns were more recent presidents, whereas McKinley's first term started in the 1800s.

Further, most presidents from the late 1800s and early 1900s who favored protective tariffs tended to see lousy stock returns. McKinley was an exception on that count, as well, as he was a strong advocate of tariffs, yet enjoyed the fourth-highest stock returns of all presidents in history.

This was partly due to timing. McKinley came to power just as the depression that had wrecked Grover Cleveland's presidency was running its course.

McKinley's second term was cut short by an assassin's bullet, which led to Teddy Roosevelt assuming the presidency. But during his time in office, the Dow saw annualized returns of 11.3%.

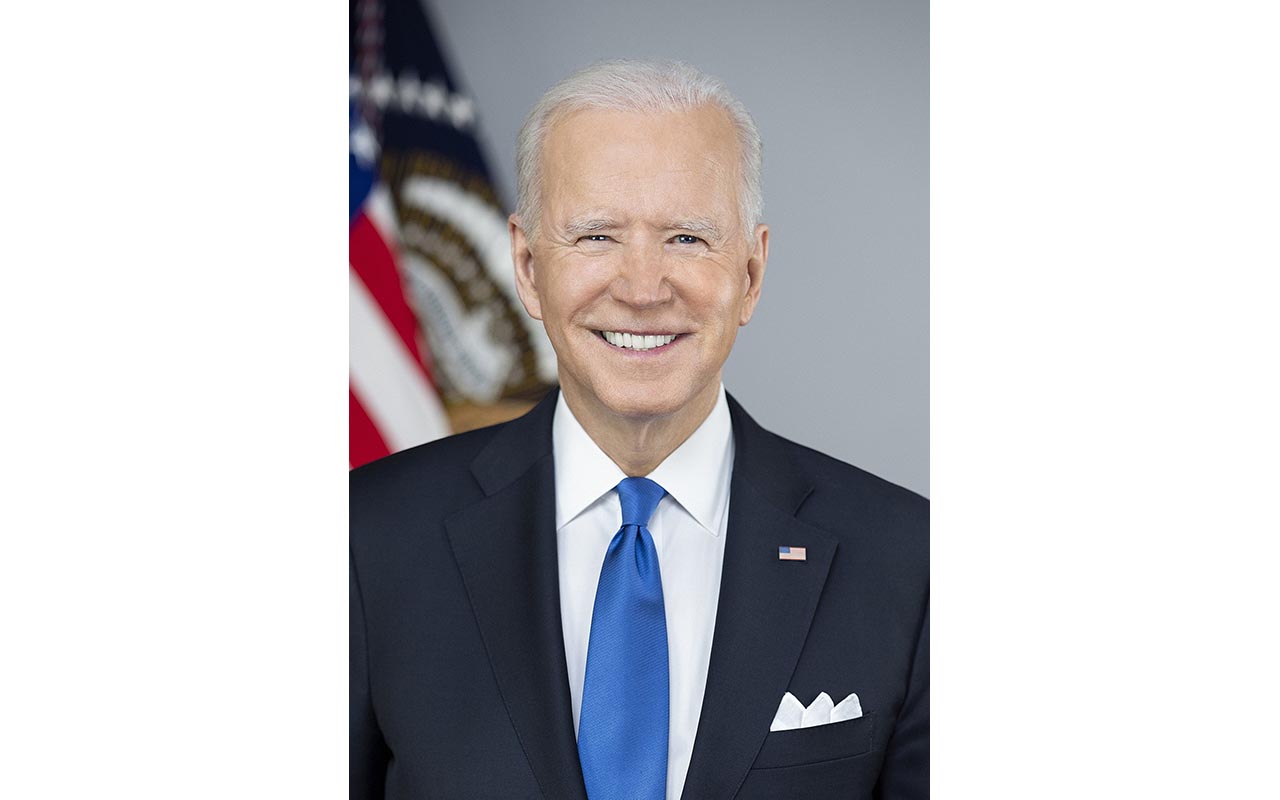

Joe Biden

- President: January 20, 2021 to January 20, 2025

- Stock market return: 11.9% per year

Joe Biden was tops after his first 100 days in office.

"Since January 20, if the stock market's performance is any indication, Wall Street appears to approve of President Biden's attempts to corral the COVID-19 virus and stimulate the economy," Sam Stovall, chief investment strategist for CFRA, said amid Biden's first 100 days.

He added that Biden's return through April 28, 2021, put him on pace for "the second strongest 100-day return of first-term presidential administrations since WWII, and well above the average of 1.9% since 1949."

"Only President Kennedy had a more joyous reception by Wall Street in 1961, but not by much," Stovall added. "The 21 new all-time highs recorded by the S&P 500 since January 20th of this year [2021] slightly exceeded President Kennedy's 20 count."

Late 2021 and 2022 were far less kind as the Federal Reserve's aggressive campaign of raising interest rates to battle high inflation weighed on investors' risk appetite.

However, markets resumed their red-hot ways in 2023 and in 2024, sparking a new bull market and sending the S&P 500 back into record-high territory.

As a result, the S&P 500's 11.9% annualized return in Biden's single term puts him near the top of the pack of the best U.S. presidents in terms of stock market performance.

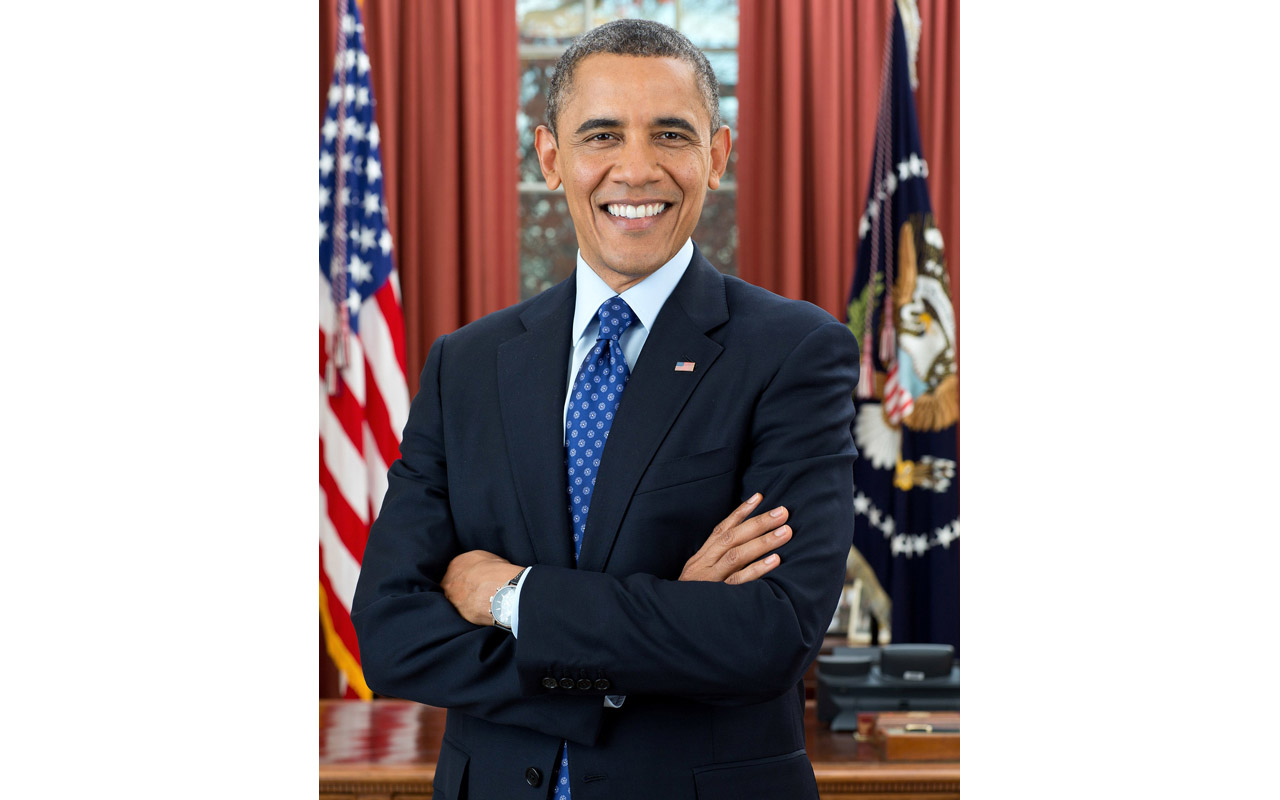

Barack Obama

- President: January 20, 2009 to January 20, 2017

- Stock market return: 12.8% per year

President Barack Obama took office at a particularly difficult time in American history.

The housing boom had recently gone bust, taking down the banking sector with it.

Obama was left with the thankless task of managing the aftermath of the crisis and putting the rules in place to make sure it wouldn't happen again.

Partly because of this, Obama was not known for being particularly business-friendly as president. Yet he can boast some of the most impressive stock market returns of any president in history with cumulative returns of 162.8% and annualized returns of 12.8%.

As was the case with Gerald Ford, it came down to timing. Obama had the good fortune of taking office right as the worst bear market since the Great Depression was nearing its end. There was nowhere for the market to go but up. That's fantastic timing.

All the same, nearly 13% annualized returns are pretty good and place Obama as the fourth-highest-returning president in history.

Donald Trump (second term)

- President: January 20, 2025 to present

- Stock market return in first full year: 13.3%

Tariffs were a thorn in the side of President Donald Trump's start to his second term as president. The S&P 500 was down nearly 17% for the year to date in early April 2025 as uncertainty about Trump's aggressive tariff policy sparked concerns about slowing economic growth and higher inflation.

Indeed, Trump's first 100 days in office marked the worst stock market return over this time frame since the start of Nixon's second term in 1972, according to CFRA Research.

But the stock market staged an impressive recovery, with the S&P 500 surging more than 39% from April 8, 2025, through February 11, 2026, as Trump paused or backed down from many of his massive retaliatory tariffs.

"With each policy retreat, investors became increasingly confident that Trump’s threats were merely negotiating tactics and unlikely to be implemented," says Mike Dickson, head of research at Horizon Investments.

And many on Wall Street expect stocks to keep climbing. "We remain sanguine about the outlook for the U.S. stock market," says Wedbush analyst Seth Basham, who adds that fundamental drivers such as earnings growth, inflation and favorable fiscal, regulatory and monetary policy remain positive despite lingering concerns related to artificial intelligence.

Note: To keep these apple-to-apple comparisons, we used the stock market return data from January 20, 2025, through January 20, 2026. Broadening the data out to February 11 brings the stock market return to 15.8%.

Donald Trump (first term)

- President: January 20, 2017 to January 20, 2021

- Stock market return: 13.6% per year

President Donald Trump's first term as president was far from calm, and you could say the same for the stock market during his tenure.

Equities barely managed to avoid bear-market territory in Q4 2018, then rallied for more than a year before suffering a dramatic (albeit quick) bear market in 2020.

Even then, Trump managed to finish his first term as one of the top presidents by market performance, which was fueled, in part, by his Tax Cuts and Jobs Act (TCJA). However, that performance also included a wild rally after Election Day 2020.

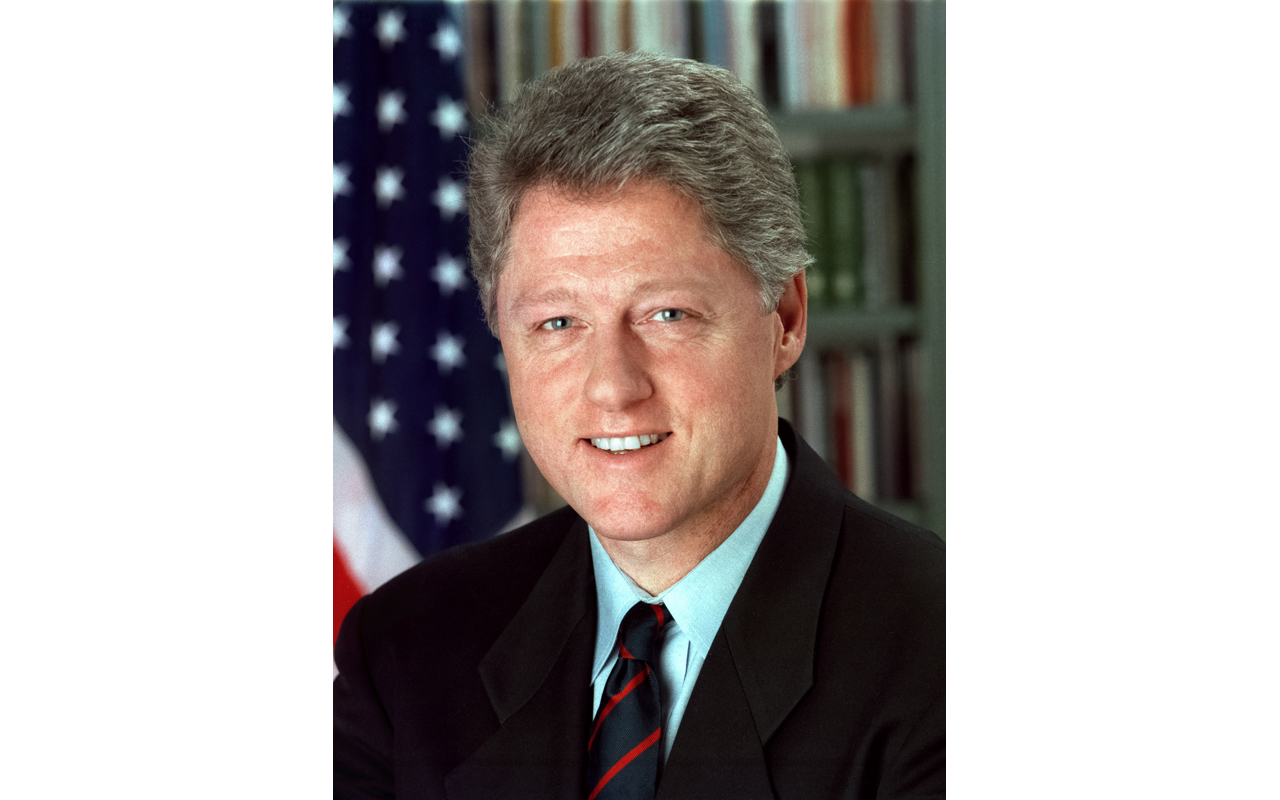

Bill Clinton

- President: January 20, 1993 to January 20, 2001

- Stock market return: 15.0% per year

The No. 2 spot goes to President Bill Clinton, who presided over one of the largest booms in American history in the 1990s: the "dot-com" boom.

This was lucky timing, of course. But to his credit, Clinton was considered one of the more business-friendly presidents by modern standards, particularly during the final six years of his presidency. More important, he was smart enough to embrace the technology revolution rather than stifle it.

The 1990s were an exciting time. With communism discredited after the fall of the USSR, the United States emerged as the world's only economic and political superpower. The emergence of the internet and a new breed of technology companies created a surge in prosperity and fundamentally reshaped the economy.

The S&P 500 soared nearly 210% during Clinton’s eight years, working out to annualized returns of 15.0%.

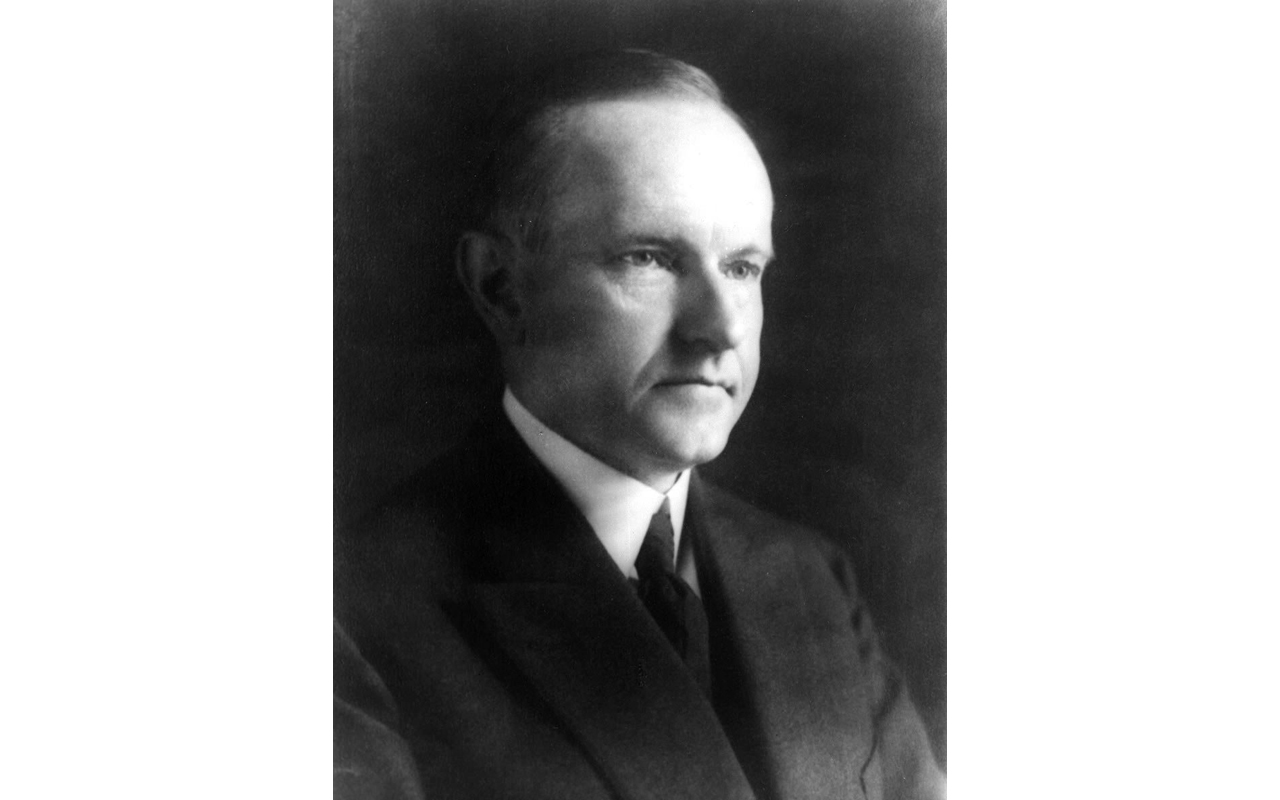

Calvin Coolidge

- President: August 2, 1923 to March 4, 1929

- Stock market return: 26.1% per year

At the top of the list is Calvin Coolidge: the man who presided over the boom years of the Roaring Twenties.

Coolidge — a hero among small-government conservatives for his modest, hands-off approach to government — famously said, "After all, the chief business of the American people is business. They are profoundly concerned with producing, buying, selling, investing and prospering in the world."

It was true then, and it's just as true today.

In Coolidge's five-and-a-half years in office, the Dow soared an incredible 266%, translating to compound annualized gains of 26.1% per year.

The cynic might point out that Coolidge was also extraordinarily lucky to have taken office just as the 1920s were starting to roar, and to have retired just as the whole thing was starting to fall apart.

His successor, Hoover, was left to deal with the consequences of the 1929 crash and the Great Depression that followed.

Related content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Charles Lewis Sizemore, CFA is the Chief Investment Officer of Sizemore Capital Management LLC, a registered investment advisor based in Dallas, Texas, where he specializes in dividend-focused portfolios and in building alternative allocations with minimal correlation to the stock market.

-

4 High-End Experiences Worth the Splurge After 50

4 High-End Experiences Worth the Splurge After 50These curated date ideas provide the perfect backdrop for couples ready to enjoy the very best that the world has to offer.

-

Health Care Stocks Have Sagged. Can You Bet on a Recovery?

Health Care Stocks Have Sagged. Can You Bet on a Recovery?The flagging health care sector has perked up a bit lately. Is it time to invest?

-

Costco's Auto Program: Can Membership Pricing Really Save You Money on a Car?

Costco's Auto Program: Can Membership Pricing Really Save You Money on a Car?Costco's Auto Program can simplify the car-buying process with prearranged pricing and member perks. Here's what to know before you use it.

-

Health Care Stocks Have Sagged. Can You Bet on a Recovery?

Health Care Stocks Have Sagged. Can You Bet on a Recovery?The flagging health care sector has perked up a bit lately. Is it time to invest?

-

Your Retirement Age Is Just a Number: Today's Retirement Goal Is 'Work Optional'

Your Retirement Age Is Just a Number: Today's Retirement Goal Is 'Work Optional'Becoming "work optional" is about control — of your time, your choices and your future. This seven-step guide from a financial planner can help you get there.

-

Have You Fallen Into the High-Earning Trap? This Is How to Escape

Have You Fallen Into the High-Earning Trap? This Is How to EscapeHigh income is a gift, but it can pull you into higher spending, undisciplined investing and overreliance on future earnings. These actionable steps will help you escape the trap.

-

I'm a Financial Adviser: These 3 Questions Can Help You Navigate a Noisy Year With Financial Clarity

I'm a Financial Adviser: These 3 Questions Can Help You Navigate a Noisy Year With Financial ClarityThe key is to resist focusing only on the markets. Instead, when making financial decisions, think about your values and what matters the most to you.

-

Dow Absorbs Disruptions, Adds 370 Points: Stock Market Today

Dow Absorbs Disruptions, Adds 370 Points: Stock Market TodayInvestors, traders and speculators will hear from President Donald Trump tonight, and then they'll listen to Nvidia CEO Jensen Huang tomorrow.

-

Private Capital Wants In on Your Retirement Account

Private Capital Wants In on Your Retirement AccountDoes offering private capital in 401(k)s represent an exciting new investment opportunity for "the little guy," or an opaque and expensive Wall Street product?

-

It's Time to Bust These 3 Long-Term Care Myths (and Face Some Uncomfortable Truths)

It's Time to Bust These 3 Long-Term Care Myths (and Face Some Uncomfortable Truths)None of us wants to think we'll need long-term care when we get older, but the odds are roughly even that we will. Which is all the more reason to understand the realities of LTC and how to pay for it.

-

Fix Your Mix: How to Derisk Your Portfolio Before Retirement

Fix Your Mix: How to Derisk Your Portfolio Before RetirementIn the run-up to retirement, your asset allocation needs to match your risk tolerance without eliminating potential for growth. Here's how to find the right mix.