The 12 Best Low-Volatility Stocks of the Market Crash

When stocks go from setting all-time highs to tumbling 20% into a bear market in only three weeks, there are precious few places for equity investors to hide.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

When stocks go from setting all-time highs to tumbling 20% into a bear market in only three weeks, there are precious few places for equity investors to hide. But that doesn't mean defensive, low-volatility stocks aren't doing their jobs.

Investment professionals helping people construct a diversified portfolio always harp on the need for stocks that will hold up better in hard times. Well, hard times are here, and so it's time to see exactly how much defense the top performing defensive stocks are actually providing.

We screened the S&P 500 for stocks in classically defensive sectors: consumer staples, utilities, health care and real estate. Next we limited ourselves to low-volatility stocks with a "beta" of less than 1.0. Beta is a measure of volatility that indicates how closely a stock's price movement correlates with a benchmark.

For example, the S&P 500 has a beta of 1.0. Any stock that has a beta less than 1.0 can be said to be less volatile than the broader market. What this means in practice is that low-beta stocks tend to lag the broader market when stocks are going up, but – critically – they also hold up better when the S&P 500 is in decline.

Recent market carnage means it's time for defensive, low-beta stocks to shine. Even if they lose value in a selloff, they should lose less value than the broader market. And if they have above-average dividends that further soften losses, all the better.

Have a look at the 12 best-performing low-volatility stocks in this market crash so far.

Prices and other data are as of March 11. Data is courtesy of S&P Global Market Intelligence and YCharts. Dividend yields are calculated by annualizing the most recent payout and dividing by the share price.

J. M. Smucker

- Market value: $12.0 billion

- Dividend yield: 3.3%

- % change (Feb. 19 to March 11): -4.6%

- Beta: 0.33

Consumer staples are usually a port in a market storm, and we're seeing some of them hold up quite well – especially the packaged food makers. J. M. Smucker (SJM, $105.59), for instance, was off almost 5% from the Feb. 19 market top to March 11, but that's far better than the S&P 500's 19% dive over the same span.

Consumers buy staples such as food, toothpaste, toilet paper and soap regardless of economic conditions, although they do sometimes trade down for cheaper store brands. Smucker's brands include Folgers coffee, Jif peanut butter and Smucker's jam. With so many Americans preparing to hole up in their homes for extended periods of time, it's only natural that they would stock up on long-lived edibles.

That's what makes low-volatility stocks such as SJM so valuable right now.

Merck

- Market value: $201.0 billion

- Dividend yield: 3.1%

- % change (Feb. 19 to March 11): -3.4%

- Beta: 0.69

Health-care stocks are another classically defensive sector, the thinking being that consumers spend on their health in both good times and bad. Merck (MRK, $79.25), a component of the Dow Jones Industrial Average, has suffered limited losses as it brings its considerable firepower to the pandemic fight.

The gargantuan pharmaceutical company is just one of many pharmaceutical companies and biotechnology firms scrambling to develop vaccines and treatments for COVID-19.

Looking a little farther down the road, MRK also has plans of spinning off its women's health, biosimilars and legacy products into a new company so it can focus on its core growth products, likely by mid-2021.

Wall Street analysts see more upside ahead. Of the 20 analysts covering this low-vol stock who are tracked by S&P Global Market Intelligence, 11 rate the stock at Strong Buy, four say Buy and five call it a Hold.

Extra Space Storage

- Market value: $13.5 billion

- Dividend yield: 3.4%

- % change (Feb. 19 to March 11): -2.9%

- Beta: 0.31

Real estate investment trusts (REITs) are another tried-and-true way to play defense when the outlook is dim.

"U.S. REITs have outperformed the S&P 500 by more than 7% annually in late-cycle periods since 1991 and have offered meaningful downside protection in recessions," according to global investment manager Cohen & Steers.

Real estate benefits from relatively stable, lease-based cash flows and above-average dividend yields, the investment firm notes. "Furthermore, REITs sell space not goods, so they are less likely to be affected by short-term shocks to the global supply chain."

Although housing and gambling REITs could get smacked around, a company like Extra Space Storage (EXR, $104.40) should hold up relatively well. EXR owns or operates 1,817 self-storage stores in 40 states, Washington, D.C., and Puerto Rico.

The healthy dividend yield of 3%-plus also gives shares some buoyancy. Better still, that dividend has nearly doubled since 2015, though the most recent hike was fairly modest at just less than 5%, to its current 90 cents per share. And at a beta of around 0.3, EXR is among the most stable of these low-volatility stocks.

Walmart

- Market value: $324.6 billion

- Dividend yield: 1.9%

- % change (Feb. 19 to March 11): -2.8%

- Beta: 0.43

- Walmart (WMT, $114.43) – the ultimate big-box, one-stop-shopping retailer – should benefit from customers stocking up on perishable and non-perishable goods, medication, health-care accessories and many other things housebound Americans need during the pandemic.

Oppenheimer analyst Rupesh Parikh, who rates the stock at Perform (the equivalent of Hold), notes that Walmart historically tends to outperform during recessionary periods. With a five-year beta of 0.43, according to S&P Global Market Intelligence, it has a fairly loose correlation with the S&P 500.

A discount retailer with a wide geographic footprint and vast portfolio of consumer staples isn't immune from the effects of the pandemic. But for now, investors think it offers some downside protection – and so far, it has.

Public Storage

- Market value: $38.5 billion

- Dividend yield: 3.6%

- % change (Feb. 19 to March 11): -0.8%

- Beta: 0.19

- Public Storage (PSA, $220.44) is benefitting from the same dynamics that are propping up Extra Space Storage. The company, which is also a REIT, acquires, develops, owns and operates self-storage facilities. As of Dec. 31, PSA had interests in 2,483 self-storage facilities located in 38 states.

The company's status as a REIT and healthy dividend payer amid the pandemic has given it a lift, as well as the fact that public-storage companies are something of a recessionary play – when people are forced to downsize their homes, they often keep their other possessions locked away in storage. Its low beta of just around 0.2 is attractive as well.

Nonetheless, analysts aren't as hot on Public Storage as they are other low-volatility stocks at the moment. Analysts' average recommendation stands at Hold: Ten analysts call it a Hold, two say Sell and two say Strong Sell, while just a pair of pros call PSA shares a Strong Buy.

Eli Lilly

- Market value: $139.9 billion

- Dividend yield: 2.1%

- % change (Feb. 19 to March 11): -0.6%

- Beta: 0.36

- Eli Lilly (LLY, $140.02) is another big pharmaceutical company that's joined the crowded race to develop vaccines and treatments for COVID-19. And in a way, it's personal. LLY confirmed on March 10 that one of its Indianapolis-based employees tested positive for the virus.

Like Walmart and the other low-volatility stocks on this list, Eli Lilly has a fairly weak correlation with the broader market. It tends to underperform the S&P 500 when stocks are rising and outperforms when the market is declining.

Analysts are bullish on the name. Of the 18 analysts surveyed by S&P Global Market Intelligence, five rate the stock at Strong Buy, four say Buy and nine have it at Hold.

Goldman Sachs on March 11 upgraded Eli Lilly to Conviction Buy (strong buy) from Buy, citing its high growth potential. "LLY's growth profile is among the strongest in US large cap biopharma, driven by exposure to high growth categories (i.e., GLPs for diabetes) and a number of new product cycles," the analyst firm writes.

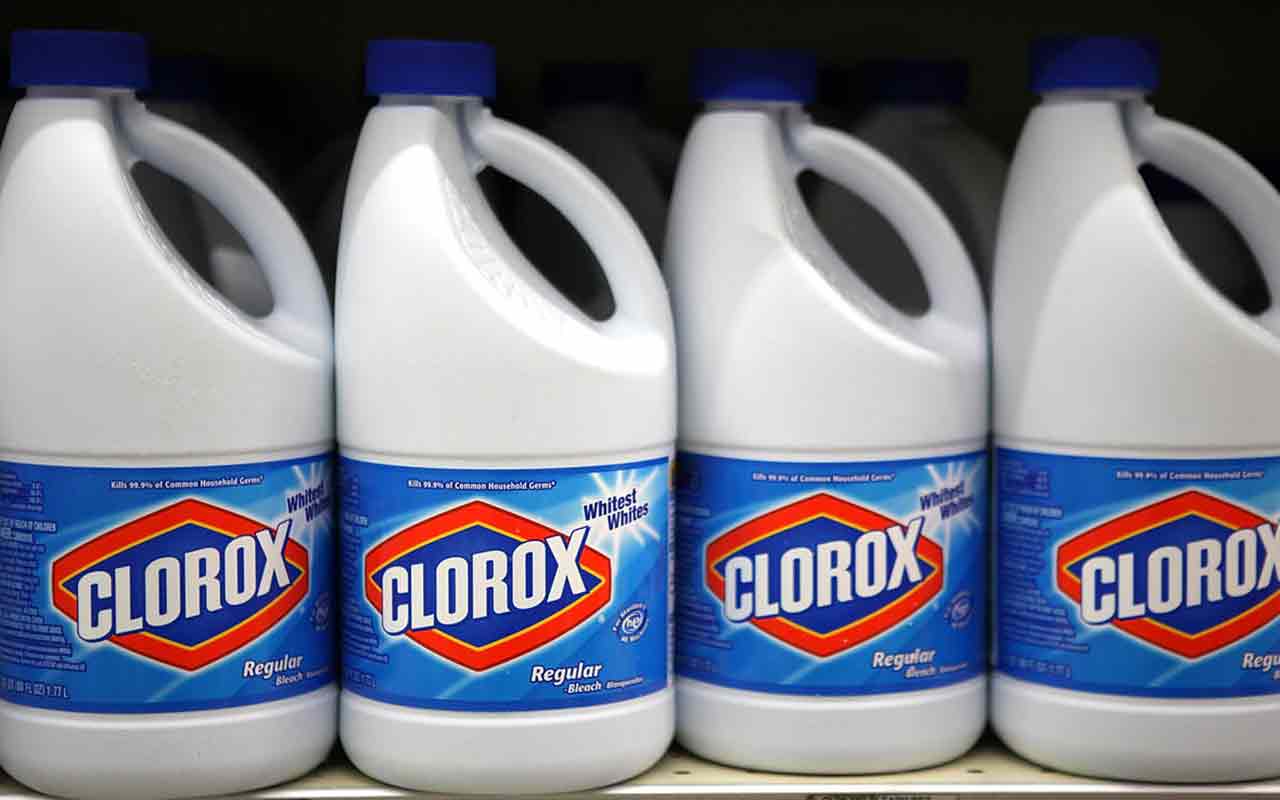

Clorox

- Market value: $21.2 billion

- Dividend yield: 2.5%

- % change (Feb. 19 to March 11): 2.8%

- Beta: 0.34

- Clorox (CLX, $169.40) – which we listed among the best stocks to ride out the coronavirus scare – is the first of our low-volatility stocks to be in the green during the big drawdown.

The reasons are fairly clear: Clorox is a consumer staples company that specializes in disinfectant products, be they wipes, sprays, liquid or gels. With coronavirus on the loose, it's critically important to keep surfaces and other items clean. A decent yield helps, too.

The COVID-19 outbreak – which has bleach and other cleaning products flying off the shelves – has been Clorox's time to shine after a long period of underperformance. For the 52 weeks ended Feb. 19, CLX gained 5.5% vs. a jump of 22% for the S&P 500.

Current price action might make the stock a trade on the coronavirus, but analysts as a group with an average recommendation of Hold remain skeptical of it as a longer-term holding. Argus Research, however, upgraded shares to Buy from Hold on March 9, as sales of Clorox products should benefit from the coronavirus outbreak. Additionally, the company is adding to its inventory of disinfectants, Argus notes.

Digital Realty Trust

- Market value: $28.6 billion

- Dividend yield: 3.3%

- % change (Feb. 19 to March 11): 3.5%

- Beta: 0.48

- Digital Realty Trust (DLR, $137.00), a REIT with data centers on five continents, is another steady real estate play. It's among low-beta stocks that are less than half as volatile as the broader market. A healthy dividend yield and weak correlation to the S&P 500 helps tamp down volatility.

And, like the other REITs on this list, it's less likely to get slammed by coronavirus than real estate companies in the hotel and gambling industries.

GorillaTrades strategist Ken Berman noted on March 6 that DLR has substantial short interest – bets against the stock that, if they go wrong, force traders to buy the stock to close those bets. "(That) could be foreshadowing a strong rally," Berman said.

DLR is fairly well liked among Wall Street's pros. Over the past month, it has received five Buy ratings versus just one Hold.

Kroger

- Market value: $24.1 billion

- Dividend yield: 2.1%

- % change (Feb. 19 to March 11): 3.6%

- Beta: 0.57

- Kroger (KR, $30.59), the nation's largest supermarket operator, received a nice lift when it was disclosed on Feb. 14 that Warren Buffett's Berkshire Hathaway (BRK.B) bought a sizable stake. Kroger was among some of the stocks Buffett bought and sold during the fourth quarter – he picked up 18.9 million shares worth more than $549 million, so Berkshire now owns 2.4% of the grocery empire's shares outstanding.

As for KR outperforming the broader market during the great COVID-19 selloff, that's due to its large footprint as a retailer of consumer staples such as food and cleaning supplies.

The company has roughly 2,760 retail food stores operating under such banners as Dillons, Ralph's, Harris Teeter and its namesake Kroger, as well as 1,537 gas stations. All told, it's one of the five largest retailers in the world. Anxious consumers looking to stock up could very well cause a spike in sales this quarter.

Campbell Soup

- Market value: $15.2 billion

- Dividend yield: 2.8%

- % change (Feb. 19 to March 11): 5.6%

- Beta: 0.49

Shares in Campbell Soup (CPB, $50.47) popped 10% on March 3 after CEO Mark Clouse went on a press tour talking up the growing demand for CPB's products, driven by COVID-19. Campbell Soup is ramping up demand as worried customers stockpile soup.

The packaged-foods company is also working to prevent supply chain disruptions for its wide portfolio of products. In addition to its eponymous soups, CPB brands include Goldfish crackers, Pepperidge Farm cookies and Swanson frozen meals. Clouse notes that only about 10% of Campbell's products are sourced outside of the U.S., and less than 2% comes from China.

Campbell Soup is having its hero moment along with other low-vol stocks, but it remains to be seen how long it can last. CPB has been a long-time market laggard, and by a wide margin at that. For three years ended Feb. 19, the stock lost more than 19% while the S&P 500 gained 43%. Analysts' average recommendation remains at Hold.

Gilead Sciences

- Market value: $93.3 billion

- Dividend yield: 3.7%

- % change (Feb. 19 to March 11): 9.4%

- Beta: 0.99

The best-performing stocks in the S&P 500 since the selloff began are two biotechnology names working on drugs for coronavirus.

- Gilead Sciences (GILD, $73.30) gained more than 9% as the S&P 500 tanked 19% because it's working feverishly to address the pandemic.

Gilead is already testing a coronavirus drug in Wuhan province, China, where the outbreak originated. Remdesivir, an antiviral drug developed by Gilead to treat Ebola and SARS, is undergoing crash human trials, and it's being used to treat some patients on an emergency basis. RBC Capital Markets writes that initial trial results could be available as early as April.

"We expect (GILD) to continue to be viewed as defensive during this outbreak and acknowledge promising signals from the ongoing studies would indeed lead to upside not only for shares, but potentially some relief in the broader markets as well," RBC writes.

Just note that while Gilead technically makes the list of low-volatility stocks by virtue of a lower beta than the S&P 500, it's not by much – at 0.99, it's virtually every bit as volatile. But it has been headed in the more favorable direction: up.

Regeneron Pharmaceuticals

- Market value: $51.1 billion

- Dividend yield: N/A

- % change (Feb. 19 to March 11): 15.9%

- Beta: 0.80

- Regeneron Pharmaceuticals (REGN, $464.70) is the only equity on this list of low-volatility stocks that doesn't have a dividend. But it has been one of the best stocks of the past 10 years, and it has been the best S&P 500 stock since the bull market abruptly ended last month.

News that Regeneron was expanding its work on COVID-19 treatments helped the stock gain 32% in February alone. (Incidentally, REGN had a miserable 2019, falling as much as 27% at one point before finishing up less than 1%.)

Regeneron and partner Sanofi (SNY) are working with the U.S. Department of Health and Human Services to combat COVID-19. The firms are currently rushing to perform a clinical trial to test the effectiveness of their Kevzara rheumatoid arthritis drug against novel coronavirus.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dan Burrows is Kiplinger's senior investing writer, having joined the publication full time in 2016.

A long-time financial journalist, Dan is a veteran of MarketWatch, CBS MoneyWatch, SmartMoney, InvestorPlace, DailyFinance and other tier 1 national publications. He has written for The Wall Street Journal, Bloomberg and Consumer Reports and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among many other outlets. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange.

Once upon a time – before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily – Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing. He's also written for Esquire magazine's Dubious Achievements Awards.

In his current role at Kiplinger, Dan writes about markets and macroeconomics.

Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University.

Disclosure: Dan does not trade individual stocks or securities. He is eternally long the U.S equity market, primarily through tax-advantaged accounts.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

Dow Hits New High Ahead of January Jobs Report: Stock Market Today

Dow Hits New High Ahead of January Jobs Report: Stock Market TodayA weak reading on December retail sales was in focus ahead of Wednesday's delayed labor market data.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.