7 Dow Stocks That Didn't Survive the Decade

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The Dow Jones Industrial Average had a heck of a good run over the past decade, even as membership in this bastion of just 30 blue-chip stocks changed dramatically.

On a price basis alone, the large-cap average has gained more than 160% since the last day of trading in 2009. Include dividends – all Dow stocks are dividend payers – and the industrial average has delivered a total return in excess of 230%. Indeed, the Dow has generated a 10-year annualized total return of 10.5%.

It's not unusual for the folks at S&P Dow Jones Indices, which operates the index, to make changes to the Dow. As a price-weighted average, it's necessary that the Dow stocks with the highest prices not get too far away from those with the lowest prices, lest those low-priced stocks become immaterial to the Dow's performance.

The keepers of the index also make changes to ensure the Dow comprises a diverse portfolio of stocks that reflect both the U.S. equity market and the U.S. economy.

To that last point, the average went into overdrive to better reflect the dynamic forces shaping the market and the economy. Seven Dow stocks were removed from the average over the past 10 years. In almost every case, the Dow's editors ditched a more sluggish, older-economy company in favor of a name that's riding secular changes in the global economy.

Here are the seven Dow stocks kicked to the curb over the past decade.

Data is as of Nov. 19 unless otherwise indicated. Dow Jones data from S&P Dow Jones Indices.

Kraft Foods

- Year removed: 2012

The processed-food giant then known as Kraft Foods was added to the Dow Jones Industrial Average in 2008, taking the place of insurer American International Group (AIG). AIG was decimated by the financial crisis to the point that the federal government doled out an $85 billion loan, in exchange for a 79.9% stake, to keep the systemically important financial institution afloat.

Kraft wouldn't be a Dow stock for very long, however.

In 2012, its fate was sealed when management decided to split the firm into two separate businesses: an international snacks company and a North American food company. Kraft Foods, the grocery company, had too low a market value to be a good fit for the Dow. Meanwhile, the snacks company known as Mondelez (MDLZ) was and remains a primarily international company. Dow stocks must be predominantly domestically focused.

Kraft – which eventually merged with H.J. Heinz to become what's currently known as Kraft Heinz (KHC) – was replaced in the average by UnitedHealth Group (UNH). Replacing an old-economy food company with a health-insurance behemoth makes the Dow better reflect the U.S. economy.

Alcoa

- Year removed: 2013

Aluminum giant Alcoa (AA) was removed from the Dow Jones Industrial Average in 2013 after a 54-year run in the blue-chip index. S&P Dow Jones Indices attributed the move to Alcoa's sagging stock price – hurt by a global aluminum slump – and a desire to add diversity to the average.

Alcoa was a poky, old-economy stock that didn't really clock the dynamism of the U.S. economy in the 21st century, but there was something elegiac about its exclusion. Alcoa was always the first Dow component to announce quarterly results. As such, Alcoa was considered to be the company that kicked off earnings season every three months.

Alcoa's place in the Dow was taken over by Nike (NKE), a global lifestyle brand more in tune with today's economy than a stuffy old materials sector stock.

Bank of America

- Year removed: 2013

- Bank of America (BAC) was a Dow component for only about five years when it was pulled from the industrial average in 2013. The financial crisis, which punished its business and share price, was to blame.

Again, the Dow Jones Industrial Average is a price-weighted index, which means anytime a company's share price gets too low, it basically becomes immaterial. Bank of America fell below $3 a share in intraday trading in early 2009.

BAC was embroiled in lawsuits stemming from the crisis and its acquisition of subprime lender Countrywide. In the aftermath of the crisis, Bank of America would pay more than $76 billion in penalties and fines.

The sprawling money-center bank eventually was replaced in the Dow by investment bank Goldman Sachs (GS).

Hewlett-Packard

- Year removed: 2013

- Hewlett-Packard's business had been circling the drain for years before 2013. HP had once been one of Silicon Valley's most innovative companies, but the world largely passed it by in the 21st century. The sclerotic company was increasingly dependent on selling low-margin PC workstations and printers. Ink cartridge replacements alone couldn't sustain the growth investors expect from technology companies.

HP had been added to the Dow in 1997, a time when irrational exuberance was fueling the bubble in tech stocks. By 2013, it was a disaster. In a sort of last straw, Hewlett-Packard made one of the worst acquisitions of all time in 2011, spending $61 billion on British software company Autonomy. Less than a year later, the company would have to take a write off of $8.8 billion to reflect the fact that HP had grossly overpaid for the asset. The once-illustrious tech company's market cap fell from $61 billion pre-merger to $25 billion after the deal flopped.

Visa (V), the payments processor (and vibrant, relevant tech company) took HP's place in the average. A couple years later, in 2015, HP split into two companies: HP Inc. (HPQ) and Hewlett Packard Enterprise (HPE).

AT&T

- Year removed: 2015

- AT&T (T) has been added to and dropped from the Dow many times in its long corporate history. The telecommunications giant was first added in 1916. It was then dropped in 1928, added again in 1939 … and dropped in 2004. The following year, SBC Communications, a Dow stock, changed its name to AT&T after it acquired the original AT&T.

AT&T found itself back in the Dow in 2005 but it wouldn't stay for all that long. The landscape had changed dramatically by 2015. At that point, the wireless business was saturated and then some. T was attempting to sort out a strategy to make itself a content producer, not just a distributor. And with Verizon (VZ), the Dow already had a giant telecommunications company as a member.

AT&T's sluggish stock had traded sideways for years prior to 2015. It hardly participated in the big run-up in share prices in the early phase of the bull market.

There's little wonder why the keepers of the Dow would kick out AT&T and replace it with Apple (AAPL).

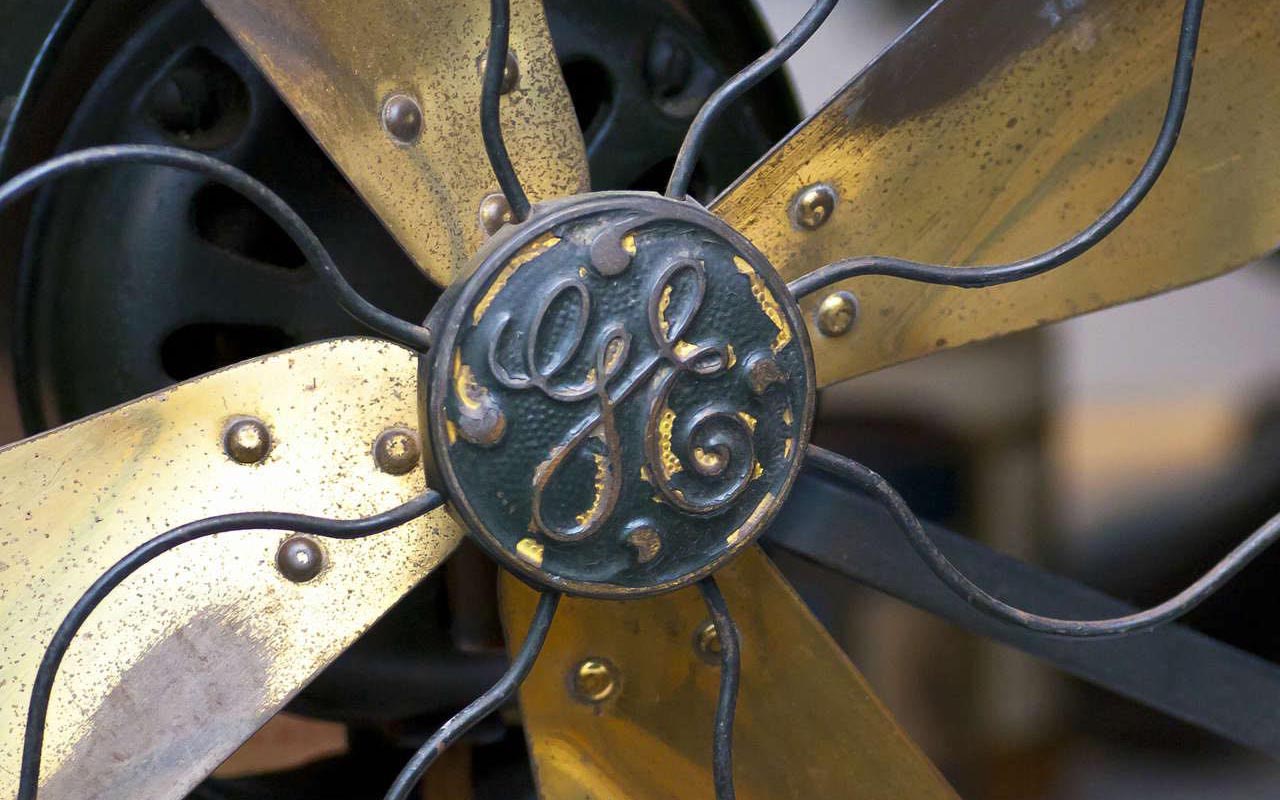

General Electric

- Year removed: 2018

- General Electric (GE), once the most valuable publicly traded company in the U.S. and a symbol of America's industrial might, was an original member of the Dow in 1896. It remained in the average continuously since 1907.

But the industrial conglomerate and financial leviathan quickly unraveled in the years after the financial crisis, which forced it to cut its longtime dividend in 2009.

General Electric eventually rid itself of the GE Capital financial division to prevent being labelled a systemically important financial institution and thus subject to increased oversight. Once upon a time, GE Capital was the company's main profit driver.

A series of poor deals left the company strapped for cash. GE was forced to sell once-proud divisions such as the railroad business. And it again pulled the rug out from under income investors, with a dividend cut in 2017.

Investors fled GE stock as if it had the plague. By the time General Electric got the boot and was replaced by Walgreens Boots Alliance (WBA) in June 2018, shares changed hands at around $13 a pop – far too low to have any material impact on the Dow. Months later, GE hacked its dividend once more, to a mere penny per share.

DuPont

- Year removed: 2019

Specialty chemicals company DuPont (DD) had been a Dow stock since 1935, but a major corporate makeover found the storied name left out of the average.

DuPont and chemicals competitor Dow Inc. (DOW) merged in late 2017 with the intention of later splitting off into three companies. The company that existed after the merger but before the split was called DowDuPont and took DuPont's place in the Dow industrials.

DowDuPont spun off its materials division as Dow Inc. in April 2019, then its agriculture business as Corteva (CTVA) in June. The remaining specialty products division was renamed DuPont.

Dow Inc. remained in the average, ending DuPont's tenure there. S&P Dow Jones Indices said the change would allow the DJIA to maintain its current exposure to the materials sector.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dan Burrows is Kiplinger's senior investing writer, having joined the publication full time in 2016.

A long-time financial journalist, Dan is a veteran of MarketWatch, CBS MoneyWatch, SmartMoney, InvestorPlace, DailyFinance and other tier 1 national publications. He has written for The Wall Street Journal, Bloomberg and Consumer Reports and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among many other outlets. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange.

Once upon a time – before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily – Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing. He's also written for Esquire magazine's Dubious Achievements Awards.

In his current role at Kiplinger, Dan writes about markets and macroeconomics.

Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University.

Disclosure: Dan does not trade individual stocks or securities. He is eternally long the U.S equity market, primarily through tax-advantaged accounts.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.

-

Dow Dives 870 Points on Overseas Affairs: Stock Market Today

Dow Dives 870 Points on Overseas Affairs: Stock Market TodayFiscal policy in the Far East and foreign policy in the near west send markets all over the world into a selling frenzy.