2019 Midyear Investing Outlook: Where to Put Your Money Now

Tariff tantrums and rising labor costs are weighing down this aging bull market.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

One-third of the way into 2019, the U.S. stock market looked more resilient than ever. The bull had snapped back from a devastating correction like a bovine half its age. Assuaging worries of a looming recession, the economy grew at a robust 3.2% in the first quarter. Instead of earnings dipping into negative territory, as analysts had expected, corporate America ended the first quarter slightly in the black.

Perhaps most important, the Federal Reserve Board pivoted from telegraphing as many as three rate hikes in 2019 to zero rate hikes. Stocks hit a new high on April 30, delivering an early 2019 return of 18.3%, including dividends—nearly two years’ worth of the long-term average gain for stocks in just four months. As strategist David Kelly of JP Morgan Funds noted, in the vernacular of NASA astronauts, all systems were “go.”

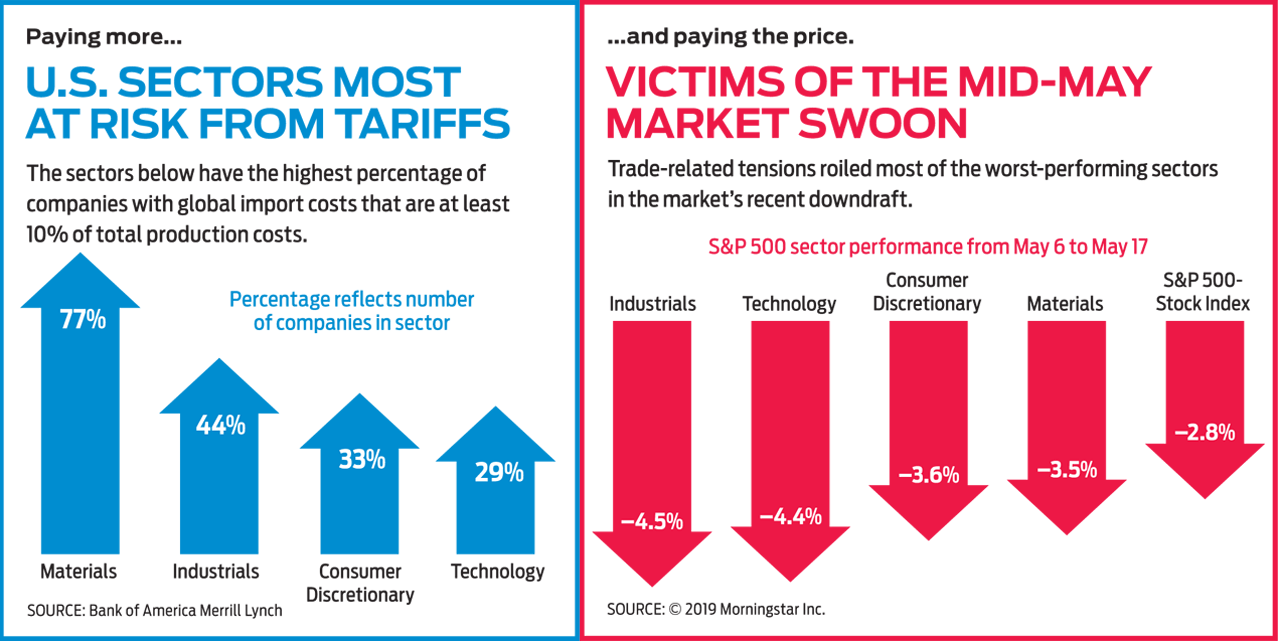

Then President Trump tweeted about trade. To steal Kelly’s metaphor, he might as well have tweeted, “Houston, we have a problem.” Stock prices sank 4.5% in six trading days as the trade war with China escalated. Stocks have been volatile since, and the downdraft served as a swift reminder that substantial risks are building in this aged bull market and in an economic expansion that in July becomes the longest one ever.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

In January, we said that Standard & Poor’s 500-stock index could reach 2950 to 3000 in 2019, with no guarantees that the highs would come at year-end. We got to 2946 on April 30. Although we’re not ruling out violent swings up or down, we now think that the year will end with the S&P 500 somewhere closer to 2850, as earnings continue to increase, but modestly, and investors express a smaller appetite for risk by keeping price-earnings ratios in check. That would put the Dow Jones industrial average between roughly 26,000 and 27,000—let’s say a little bit over 26,500. If we’re correct, the S&P 500 would end the calendar year with a price gain of about 14%, but not far from its recent close at about 2860. (Prices, returns and other data are as of May 17, unless otherwise noted.)

With the easy gains behind us this year, we think you’ll do best by scouting stocks that can eke out reliable earnings growth in a low-growth economy and looking to dividends to bolster returns. We favor large-company stocks over small, and we think investors can find good candidates in a number of market sectors and in overseas markets—but you’ll have to be discerning and selective within each category. In the second half of 2019, investors will have to stay defensive, while also taking advantage of tactical opportunities as they arise. “When you get this kind of sideways market, there are always opportunities,” says Brian Nick, chief investment strategist at investment firm Nuveen. (See our interview with Brian Nick.)

Tariff tantrum

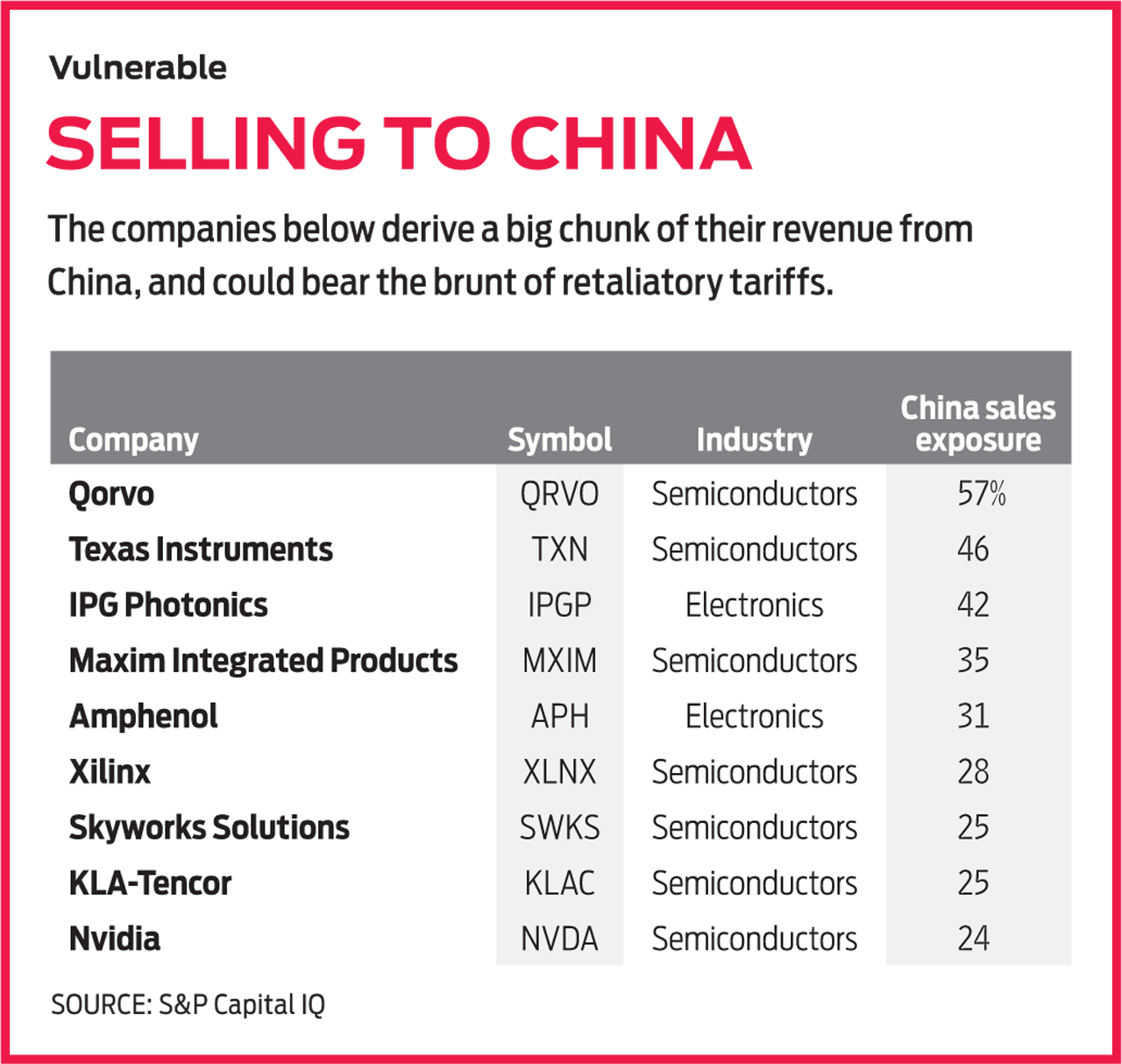

A trade war with China isn’t the only hurdle for stocks, but it’s the biggest one. In May, the Trump administration raised tariffs on $200 billion worth of Chinese goods from 10% to 25% and began the process to impose tariffs of up to 25% on the remainder of Chinese imports, valued at roughly $300 billion. China retaliated with tariffs set to take effect in June on about $60 billion worth of imports from the U.S. Companies paying tariffs on goods they import from China can either pass the cost on to their customers or absorb it, sacrificing profit margins instead. Those selling to China directly risk revenue shortfalls if tariffs (or boycotts) are imposed there. The levies put pressure on both economies by boosting inflation and dampening consumer and business spending overall.

The stakes are high enough that most experts expect a deal. “The consequences of letting tariffs stay in place, and of adding new tariffs, could have significant impacts on the U.S. and Chinese economies,” says Paul Christopher, head of global market strategy for Wells Fargo Investment Institute. “Neither side can stand that kind of slowdown.” The costs go beyond the calculus of imports, exports and gross domestic product. “For the economy, more brinkmanship means a continued gradual erosion of confidence,” says economist Ethan Harris of Bank of America Merrill Lynch.

Failure to reach a deal, resulting in a full-fledged trade war, could lead to a global recession and bear market, say analysts at BofA Merrill, although the firm’s current thinking is that a deal will be struck after a tense period of jousting and a correction that lops as much as 10% off U.S. stock prices.

Investors are hyper-focused on trade risks, but it’s also important to consider the upside of a resolution. A deal or interim agreement will likely include a guarantee that China will purchase enough U.S. goods to shrink our trade deficit with China by half, or roughly $200 billion, says Well Fargo’s chief stock strategist, Audrey Kaplan. “We could see abrupt price appreciation in companies that would be selling more to China,” she says.

The good news for now is that proposed tariffs are delayed on imported autos and parts, and tariffs on steel and aluminum from Canada and Mexico have been lifted. Regardless of the outcome with China, investors should steel themselves for volatility with every turn in the negotiations. Within those sectors most affected by trade tensions, businesses with the most at stake include automakers, electrical equipment and machinery companies, textile producers, computer electronics firms, and some chemical and commodity producers, according to Morgan Stanley research.

The Fed trumps trade

In our January outlook, we said the biggest risks to the market were trade tensions and higher interest rates. We’ve witnessed the havoc that disappointments on the trade front can wreak, but the interest-rate outlook has turned decidedly more positive. “The underpinnings of the stock market are solid, and the key factor shaping my view is the Fed and its change in stance,” says Kristina Hooper, chief global investment strategist at Invesco.

An accommodative central bank will support a U.S. economy that should continue to grow, but at a slower pace.

After four rate hikes in 2018, for a total of nine starting in December 2015, the Fed is on hold, with a target for its benchmark interest rate of 2.25% to 2.50%. In September, central bankers were telegraphing three rate hikes in 2019; now, no hikes are on the horizon, and the next move might very well be in the other direction. The central bank also said it would slow the reduction of bond holdings on its balance sheet, another easing move. “If the Fed had stayed on autopilot, they’d have been on their way to hiking us into recession by mid 2020. The pivot put that off for at least a year,” says Jason Bloom, a global exchange-traded fund strategist at Invesco.

An accommodative central bank will support a U.S. economy that should continue to grow, but at a slower pace. Kiplinger expects gross domestic product growth to come in at 2.6% for the year, down from 2.9% in 2018, as the effects of tax cuts wane—slower than the first quarter’s robust 3.2% growth rate. As they have been since the 2009 start of this expansion, consumers will continue to be a bright spot, says Michael Ryan, chief investment officer, Americas, for UBS Global Wealth Management. “Household assets are near record highs, personal balance sheets are in the best shape in a couple of decades, personal income is showing positive growth and unemployment is at generational lows,” he says.

History shows that a looming presidential election should be good for the economy and, therefore, stocks. Since 1939, the market has experienced a loss only once in the year before a presidential election, according to Stock Trader’s Almanac. That was in 2015, when the price of the S&P 500 fell 0.7%. “I expect the administration to do everything it can to juice the economy. That doesn’t mean they’ll be successful,” says Hooper. “But I expect enough will be done to prevent a recession,” she says.

Stuckflation

The expansion’s continued longevity and the Fed’s laissez-faire stance on rates depend on inflation remaining contained. The Consumer Price Index has been mostly stable, at a modest 2% over the past 12 months. And the long-term outlook remains benign. “Stuckflation—our view that inflation will be suppressed for the foreseeable future—is a core part of our case for stocks,” says Katie Nixon, chief investment officer at Northern Trust Wealth Management. Technological improvements that increase productivity and an aging population, with more people past peak-spending years, are among the forces constraining inflation, says Nixon. But that doesn’t mean we won’t get occasional flare-ups, she says.

Expect inflation at year-end to reach a rate of 2.2%, up from 1.9% at the end of 2018. Oil prices, rising earlier in the year, are currently caught in a tug-of-war between worries about supply disruptions if unrest escalates in the Persian Gulf and the potential for falling demand if trade woes constrict China’s growth. If higher tariffs stay in place for long, it could nudge the inflation rate to 2.3% by year-end, according to Kiplinger forecasts. And if tariffs are imposed on all Chinese products, including a broad range of consumer items, inflation will run higher. In that case, say BofA economists, assuming the expense is borne by end users, the cost to consumers could reach $140 billion, equivalent to 1% of all consumer spending and essentially canceling out last year’s tax cut.

Tariffs aren’t the only wild card on the inflation front. With a 3.6% unemployment rate, the lowest since 1969 (when Peter, Paul and Mary’s Leaving on a Jet Plane was America’s sound track), inflation watchers are on the lookout for higher labor costs—and finding them. Wages are rising, so far at a moderate 3.2% annual rate, according to the government’s most recent report. Firms can pay higher wages without having to pass those costs on to customers or squeeze profit margins too tightly, as long as workers become more productive. “That’s the battle, productivity versus wages,” says Tony DeSpirito, lead portfolio manager of the BlackRock Equity Dividend fund. Productivity came through in a big way in the first quarter, rising at a robust 3.6% annual rate. The productivity rate for the past four quarters is the highest since 2010.

In order to sustain those productivity gains, keeping the economy humming and corporate profits healthy, business spending on buildings, industrial plants, equipment, technology and the like will have to continue to increase. That’s a tall order, says Mike Wilson, chief U.S. equity strategist at Morgan Stanley. A spending surge in 2018, fueled by tax cuts and repatriated overseas profits, means capital spending has gotten ahead of itself for the next few quarters, Wilson says, and he sees companies cutting back for now. He notes that in the first quarter, Amazon.com, Facebook, Alphabet and Microsoft all reported that they missed previously announced capital-spending targets.

Moreover, uncertainty about the trade situation—and after that, the upcoming presidential election—might also cause companies to curtail spending. Already, says Wilson, corporate profit margins are pinched from the capital spending spree, rising labor costs and the cost of carrying inventories that built up as companies spent their tax-cut windfall and scrambled to stock up ahead of tariffs imposed last year. “Since last September, we’ve seen the broadest disappointment in margins since the last recession, in virtually every industry,” he says. Consequently, Wilson believes that corporate earnings might come in worse than expected this year. His S&P 500 year-end target is 2750, down almost 4% from its mid May close.

Earnings count

Expectations were certainly low for the first quarter, with analysts forecasting earnings to fall by as much as 3% at one point. But it looks now as though corporate America will eke out a 1.4% earnings gain for the first quarter. Wall Street analysts expect earnings for S&P 500 companies to gain about 3% in 2019, compared with last year’s rocket-propelled 22.7% increase, reflecting lower tax rates. Analysts expect a nearly 12% increase in 2020, which seems optimistic to many strategists. “We see the potential for negative revisions as we move throughout the year,” says Nick, at Nuveen.

It’s important to note that with profits essentially flat so far this year, most of 2019’s early, meteoric gains were fueled by investors’ willingness to pay higher price-earnings ratios. The S&P 500 began the year trading at 14.4 times expected earnings for the next four quarters, peaked at 17.1 times and traded recently at 16.5 times. We don’t think P/Es are likely to rise much, if at all, from here, and they could contract. Without investor sentiment doing the heavy lifting on stock prices, earnings will count more than ever. Firms that disappoint are likely to be punished.

For example, shares in Deere & Co. fell 7.7% on the day the company reported earnings for the most recent quarter that missed analysts’ forecasts. Deere also said that full-year profits were likely to come in 8% lower than the company had previously indicated. The blame went to lower crop prices, bad weather that has delayed planting, and the trade war. In general, global firms struggled more than their domestically focused counterparts in the first quarter: Companies generating less than half their sales in the U.S. reported earnings declines of 12.8%, according to research firm Factset, while those with more than half of sales coming from the U.S. reported earnings growth of 6.2%.

What to buy now

Finding sectors with stronger growth prospects becomes more important in an economy growing only modestly, says Invesco’s Hooper, who cites the tech sector as a good example. But tech is a tricky bet right now due to trade tensions, with hardware firms and semiconductor manufacturers, in particular, square in the crosshairs. That’s one reason Hooper favors business-oriented tech companies that are focused on cloud computing, software and services. Others agree. Microsoft (symbol MSFT, $128), with its Azure cloud services unit, for example, is among the stocks on Morgan Stanley’s Fresh Money Buy List. Portfolio comanager Jim Golan at William Blair Large Cap Growth fund likes Accenture (ACN, $178). The giant global tech consultant helps companies shift operations to the cloud and will benefit over the longer term as businesses integrate 5G wireless technology into their operations. A good choice for fund investors is Fidelity Select Software and IT Services Portfolio (FSCSX). For a more diversified fund, explore Janus Henderson Global Technology (JAGTX).

Health care stocks have been roiled by political uncertainties swirling around potential drug-price regulation, threats to the Affordable Care Act and calls for the expansion of Medicare. “The election spooks people, but a handful of businesses are strong,” says Matt Benkendorf, chief investment officer at Vontobel Quality Growth, a money manager. An aging population acts as a moat around health care companies, he says, and they offer “stable and resilient underlying growth because they are not discretionary purchases.” He believes medical technology companies are attractive, including Becton, Dickinson (BDX, $228), Boston Scientific (BSX, $37) and Medtronic (MDT, $88). For a diversified health care portfolio, try Vanguard Health Care (VGHCX), a member of the Kiplinger 25, the list of our favorite no-load mutual funds. Or consider Invesco S&P 500 Equal Weight Health (RYH, $191), an exchange-traded fund that is a member of the Kiplinger ETF 20, the list of our favorite ETFs.

Several market strategists believe financial services stocks are bargains, given strong balance sheets and an economy that plugs along. Financial Select Sector SPDR (XLF, $27) is a diversified Kip ETF 20 member that holds banks, insurers and asset managers.

Don’t be lured into small-company stocks by arguments that they’re immune from trade turmoil because most of their sales come from the U.S. Small caps tend to lag when economic growth is slowing, and they’re already struggling with higher costs. “Nowhere is the labor-cost issue more evident than with the small-cap cohort,” says Wilson, at Morgan Stanley. Surveys suggest that labor has not been this big an issue for 40 years, he says.

Bonds for ballast

Our interest-rate outlook can be summed up as “lower rates for a longer time”. Safety-seeking investors have pushed down yields on 10-year Treasuries to 2.4% and sent prices, which move in the opposite direction, higher. “Now is a good time to own bonds, even if you think rates will move modestly up,” says strategist Erik Ristuben, of Russell Investments. “It’s more likely that the 10-year Treasury hits 1.5% before it hits 3.5%,” he says.

Investors should be careful about dropping down in credit quality to reach for yield. Given the still-solid economic backdrop in the U.S. and the potential for juicy yields, Northern Trust’s Nixon still likes high-yield bonds. However, she warns, “you have to know what you own and be very cognizant of credit risk.” By contrast, think of a stake in U.S. Treasuries and other high-quality bonds, which often zig when stock prices zag, as portfolio insurance. “It will help you live to fight another day when stock markets become volatile,” says Nixon. (For more, see The Right Way to Add Bonds to Your Portfolio.)

Dividend stocks are another avenue for income-seeking investors to explore. Since 1930, dividends have accounted for more than 40% of the total return of S&P 500 stocks. (To find companies with the best prospects for raising their dividends, turn to The Outlook for Dividends.)

Finally, don’t ignore alternative investments, says Invesco’s Hooper, including real estate investment trusts. Two we like: American Tower (AMT, $202), yielding 1.8%, and Realty Income (O, $69), a member of the Kiplinger Dividend 15, yielding 3.9%.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Anne Kates Smith brings Wall Street to Main Street, with decades of experience covering investments and personal finance for real people trying to navigate fast-changing markets, preserve financial security or plan for the future. She oversees the magazine's investing coverage, authors Kiplinger’s biannual stock-market outlooks and writes the "Your Mind and Your Money" column, a take on behavioral finance and how investors can get out of their own way. Smith began her journalism career as a writer and columnist for USA Today. Prior to joining Kiplinger, she was a senior editor at U.S. News & World Report and a contributing columnist for TheStreet. Smith is a graduate of St. John's College in Annapolis, Md., the third-oldest college in America.

-

Are You Making These Savings Mistakes?

Are You Making These Savings Mistakes?Avoiding these common mistakes can help you build a foundation of wealth while not leaving thousands of dollars on the table.

-

I See the Freedom in My Friend's Late-Life Divorce

I See the Freedom in My Friend's Late-Life DivorceHaving gone through a divorce myself, I know it can bring financial and emotional peace in the long run.

-

Want to Divorce the IRS? This is How to Go About It (Legally)

Want to Divorce the IRS? This is How to Go About It (Legally)With some careful planning focused on the standard deduction, retirees who have large sums in tax-deferred accounts can avoid unpleasant tax bills and even part ways with the IRS for good.

-

Stocks Drop as Iran Worries Ramp Up: Stock Market Today

Stocks Drop as Iran Worries Ramp Up: Stock Market TodayPresident Trump said he will decide within the next 10 days whether or not the U.S. will launch military strikes against Iran.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Big Change Coming to the Federal Reserve

Big Change Coming to the Federal ReserveThe Lette A new chairman of the Federal Reserve has been named. What will this mean for the economy?

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

Job Growth Sizzled to Start the Year. Here's Why It's Unlikely to Impact Interest Rates

Job Growth Sizzled to Start the Year. Here's Why It's Unlikely to Impact Interest RatesThe January jobs report came in much stronger than expected and the unemployment rate ticked lower to start 2026, easing worries about a slowing labor market.