30 Blue-Chip Stocks With the Best Analyst Ratings

Volatile markets might keep you up at night, but long-term investors would do well to remember that they're also a chance to get high-quality stocks at bargain prices.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Volatile markets might keep you up at night, but long-term investors would do well to remember that they're also a chance to get high-quality stocks at bargain prices. Hey, any time blue-chip stocks go on sale, investors should be ready to pounce.

Wall Street analysts certainly think that way. The blue-chip Dow Jones Industrial Average fell more than 4% in the first quarter of 2018. The broader Standard & Poor's 500-stock index lost nearly 3%, while the technology-heavy Nasdaq Composite declined 2%. And the general retreat in share prices has analysts licking their chops over all the great buys to be found.

From financial services to the energy sector to tech stocks, brand-name companies with massive market values look like rock-solid buys, analysts say. To see which blue-chip stocks they love the most, we turned to data from S&P Global Market Intelligence.

S&P Global Market Intelligence surveys analysts' ratings on stocks and scores them on a five-point scale, where 1.0 equals "Strong Buy" and 5.0 means "Strong Sell." Any score of 2.0 or lower means that analysts, on average, rate the stock a buy. The closer the score gets to 1.0, the better.

After screening the S&P 500 for large-cap, blue-chip stocks with the best analyst scores, we came up with 30 companies. These are the buy-rated blue chips that Wall Street analysts love the most.

Data is as of April 4, 2018. Companies are listed by strength of analysts' buy recommendations, from lowest to highest. Dividend yields are calculated by annualizing the most recent quarterly payout and dividing by the share price. Analysts' ratings provided by S&P Global Market Intelligence. Click on ticker-symbol links in each slide for current share prices and more.

#30: Apple

- Market value: $870.6 billion

- Dividend yield: 1.5%

- Analysts' average recommendation: 2.0

Analysts cooled somewhat on Apple (AAPL, $171.61) after it posted weaker-than-expected sales of iPhone 8 and iPhone X during the holiday shopping season, but Wall Street's average view is still solidly bullish. Although the current crop of iPhones might not be runaway hits, the gadget remains wildly popular and gives Apple a powerful long-term edge.

Analysts at Canaccord Genuity note that there are currently 635 million iPhones in use around the globe. "This impressive installed base should drive strong iPhone replacement sales and earnings, as well as cash flow generation to fund strong long-term capital returns," say the analysts, who rate shares at "Buy."

#29: Accenture

- Market value: $96.4 billion

- Dividend yield: 1.6%

- Analysts' average recommendation: 1.97

Consulting services firm Accenture (ACN, $149.97) has been investing heavily in acquisitions in order to compete better with International Business Machines (IBM) and Cognizant (CTSH) in digital and cloud services, and it appears to be paying off. Revenue grew 15.2% in the quarter ended Feb. 28, its fastest rate in five years.

Accenture easily topped the Street's profit and sales estimates in the most recent quarter, but a drop in operating margins spooked investors, sparking a selloff. On average, however, analysts remain confident the stock is a buy. William Blair Equity Research rates ACN at "Outperform" (equivalent of buy), citing the company's strategic outlook.

"We are confident in Accenture's ability to grow future revenue given the company is always investing in the next wave of technology and services (such as blockchain and artificial intelligence)," William Blair analysts note.

#28: Gilead Sciences

- Market value: $98.3 billion

- Dividend yield: 3.1%

- Analysts' average recommendation: 1.97

After tumbling about 20% over the past two years, analysts on average view Gilead Sciences (GILD, $75.40) as a beaten-up biotechnology stock to buy.

Gilead is something of a victim of its own success. Sovaldi, its blockbuster treatment for hepatitis C, effectively cured so many sufferers that demand plunged. Sales for the antiviral medication and other hepatitis C treatments such as Harvoni declined to $9.1 billion in 2017 from $14.8 billion a year earlier.

The company's overall revenue is expected to decline more than 18% this year before stabilizing in 2019, analysts estimate, helped by new treatments for HIV such as Bictarvy.

Analysts at William Blair Equity Research have an "Outperform" rating on the stock, pointing to the ongoing strength of its HIV medications, as well as the recent acquisition of Kite Pharma, which gives Gilead exposure to cell therapies.

#27: Eli Lilly

- Market value: $81.9 billion

- Dividend yield: 2.9%

- Analysts' average recommendation: 1.95

- Eli Lilly (LLY, $78.60) fell off a "patent cliff" in the first few years of the current decade when it lost exclusive rights to blockbuster drugs such as antipsychotic treatment Zyprexa and the antidepressant drug Cymbalta.

But the worst of the patent losses are fading, bullish analysts say, and the launch of new blockbusters should fuel long-term growth. Trulicity, a new diabetes drug, and Taltz, which is used to treat psoriasis, posted strong sales gains in Lilly's fourth quarter, which helped offset declining sales of Humalog, its best-selling drug for diabetes.

Analysts at Zacks rate LLY shares at "Buy," noting that the company's wide range of therapeutic treatments provides support in the face of generic competition.

#26: Costco Wholesale

- Market value: $81.4 billion

- Dividend yield: 1.1%

- Analysts' average recommendation: 1.93

Analysts mostly shrugged off Costco Wholesale's (COST, $185.52) disappointing second-quarter earnings report in early March. Although the wholesale club posted profits and sales below Wall Street's estimates, the Street still loves Costco's momentum in physical and digital retail, as well as its unique demographics.

Analysts at Cowen & Co., which rates shares at "Outperform," note that the average Costco shopper is only 43 with an average household income of $73,000. The average total population shopper is 46 with average household income of just $57,000, Cowen notes.

Analysts at Stifel call Costco a “best-in-class retailer,” and the company's strong 7.7% comparable-store sales growth in February indicates that's still the case. Stifel has a "Buy" rating on COST shares.

#25: Starbucks

- Market value: $82.7 billion

- Dividend yield: 2.1%

- Analysts' average recommendation: 1.91

- Starbucks (SBUX, $58.83) has taken a couple of lumps lately. For instance, analysts at Wedbush Securities downgraded Starbucks stock to "Neutral" (equivalent of hold) from "Outperform" at the end of March, citing worries about sales growth in both the U.S. and China. Around the same time came a California judge's ruling that coffee cups must come with cancer warnings in the Golden State.

However, despite these recent setbacks, analysts on average still believe SBUX is worth buying, and expect solid revenue and profit growth for the coffee chain.

Analysts expect sales to improve almost 11% this year, according to data from Thomson Reuters. Earnings per share are forecast to increase 21% to $2.49 a share. And analysts at Wells Fargo Securities, who rate shares at "Outperform," note that sales of Starbucks packaged coffee are outdoing the competition.

#24: BlackRock

- Market value: $86.8 billion

- Dividend yield: 2.1%

- Analysts' average recommendation: 1.88

Vanguard might be nipping at its heels, but BlackRock (BLK, $536.31) remains the world's largest asset manager with a commanding share of the market for exchanged-traded funds (ETFs). That bodes well for future growth. BlackRock currently has $6.3 trillion in assets under management, but the real action comes from the expanding popularity of passive investments.

Best known for its iShares suite of exchange-traded funds, BlackRock's $1.38 trillion in ETF assets gives it nearly 40% of the market, according to Morningstar. Second-place Vanguard has $872 billion in ETF assets, good for about 25% of that market.

"Given the company's strong fundamentals and good growth prospects, adding the stock to your portfolio seems a wise idea now," Zacks Equity Research says.

#23: Merck

- Market value: $147.1 billion

- Dividend yield: 3.6%

- Analysts' average recommendation: 1.87

Analysts who are bullish on Merck (MRK, $54.54) note the strength of a host of its blockbuster drugs.

Cancer-drug Keytruda, for example, is a runaway hit, having been approved for advanced melanoma, non-small cell lung cancer, head and neck cancer, classical Hodgkin lymphoma and bladder cancer. The pharmaceutical giant is seeking additional approvals for Keytruda for a wide range of other cancers. Bulls also point to strength in Januvia for diabetes, and Gardasil, a human papillomavirus vaccine.

Analysts at Credit Suisse say Merck needs to find additional products to drive revenue growth. However, the strength of Merck's Keytruda and immune-oncology franchise keeps Credit Suisse firmly in the buy camp with a rating of "Outperform."

#22: Cisco Systems

- Market value: $198.4 billion

- Dividend yield: 3%

- Analysts' average recommendation: 1.86

Analysts think Cisco Systems (CSCO, $41.20) is a bargain-basement buy. Goldman Sachs recently added the networking giant to its "Conviction Buy" list, which is the firm's highest recommendation.

Analysts are bullish on CSCO in part because it raised its quarterly dividend and share repurchase program in response to corporate tax cuts. Goldman also likes Cisco's growth prospects. Cisco makes the routers and switches that form the backbone of the internet, and capital spending by telecommunications companies is "healthy and improving," analysts note.

Most importantly, Goldman likes how cheap Cisco stock looks. Between all the cash the company is generating – and all the cash it's returning to shareholders – analysts say CSCO trades at a "significant discount."

#21: PayPal

- Market value: $89.7 billion

- Dividend yield: N/A

- Analysts' average recommendation: 1.86

Shares in PayPal (PYPL, $74.78) took a hit in late March after analysts at Bernstein initiated coverage of the stock with a rating of only "Market Perform" (equivalent of hold). The analysts said they are neutral on the digital payments company because of "underappreciated business pressures surfacing for the leading online checkout button." Among the pressures? Increased competition and a dependency on eBay (EBAY).

Fair enough, but Bernstein's more cautious outlook remains the minority view on the Street.

Of 44 analysts surveyed by S&P Global Market Intelligence, 30 rate PYPL a buy, while 13 have it at hold. One analyst says it's a sell. All told, analysts believe the stock will outperform the Standard & Poor's 500-stock index by a solid margin over the next 12 months or so.

#20: Kraft Heinz

- Market value: $74.8 billion

- Dividend yield: 4%

- Analysts' average recommendation: 1.83

- Kraft Heinz (KHC, $61.38) is having a rough year. In February, the packaged food giant offered up a double-whammy of bad news. The company missed Wall Street's fourth-quarter earnings and revenue estimates and offered a disappointing 2018 outlook. To top it off, Berkshire Hathaway (BRK.B) Chairman Warren Buffett announced his retirement from the Kraft Heinz board. Berkshire holds a 26.8% stake in the company.

KHC stock is down more than 20% for the year-to-date, but analysts on average still say it's a future winner. Stifel analysts point out that Buffett's retirement from the board in no way reflects his commitment to the company. He's 87, after all, and has said he wants travel less. Stifel rates shares at "Buy," citing "Kraft Heinz's robust earnings growth outlook and the potential for the business to continue (to make acquisitions)."

#19: McDonald's

- Market value: $128.5 billion

- Dividend yield: 2.6%

- Analysts' average recommendation: 1.79

Analysts by and large see value in McDonald's (MCD, $161.73) stock even if its new value menu hasn't lived up to the hype. Credit Suisse notes that MCD's $1/$2/$3 Dollar Menu launched in early January didn't perform up to expectations, and a Big Mac trio promotion wasn't as successful as hoped for this year.

Nevertheless, like much of the Street, Credit Suisse, which rates shares at "Outperform," remains bullish on the fast food chain.

CS analysts think any slowdown in sales is temporary. They expect better results from the new $1/$2/$3 Dollar Menu as customers become more aware of its offerings, and say franchisees are very excited about the national launch of fresh beef hamburgers slated for May. Of the 34 analysts surveyed by S&P Global Market Intelligence, 24 have it at the equivalent of buy, while 10 say it's a hold.

#18: Abbott Laboratories

- Market value: $103.8 billion

- Dividend yield: 1.8%

- Analysts' average recommendation: 1.77

Diversified health-care giant Abbott Laboratories (ABT, $59.46) is expected to deliver revenue growth of nearly 13% this year, according to Thomson Reuters, and earnings-per-share growth of 14%. Longer-term, analysts believe ABT will deliver average annual profit growth of nearly 12% for the next half-decade.

Analysts at Zacks Equity Research point to Abbott's successful strategy of growth through mergers and acquisitions. "The company continues to benefit from the recently completed acquisition of St. Jude Medical, which offers it an industry-leading pipeline across cardiovascular, neuromodulation, diabetes and vision care," Zacks says. The analysts also are upbeat about Abbott's successful acquisition of Alere, a diagnostics company.

#17: Chevron

- Market value: $218.9 billion

- Dividend yield: 3.9%

- Analysts' average recommendation: 1.77

- Chevron's (CVX, $114.48) stock tumbled in February after the integrated oil giant posted disappointing fourth-quarter earnings, and shares have yet to fully recover.

That does, however, have a number of analysts calling CVX a bargain. Of the 26 analysts surveyed by S&P Global Market Intelligence, 19 have it at the equivalent of buy, vs. seven who call it a hold.

On the bullish side sit analysts at JPMorgan, who told clients that Chevron stock's swoon below $115 a share offers a "favorable" entry point. JPMorgan cited the company's "balanced long-term story around production growth" and return of capital to shareholders, among other factors, for its optimistic view.

#16: Booking Holdings

- Market value: $100 billion

- Dividend yield: N/A%

- Analysts' average recommendation: 1.76

If the name Booking Holdings (BKNG, $2,071.01) seems unfamiliar, it's because until recently the company was known as The Priceline Group, trading under the stock symbol PCLN. The popular reservation website for hotels, flights and rental cars changed its name in February to better reflect its portfolio of brands. As popular as the Priceline site might be, the company's Booking.com property is actually the company's largest business.

By any name, this stock still smells as sweet to Wall Street analysts, whose average view is bullish. Stifel analysts, who have a "Buy" recommendation on the stock, write: "We expect continued penetration of both international and domestic markets over the long term as Booking's share of total global bookings is currently in the single digits, leaving ample runway for growth."

#15: Honeywell

- Market value: $108.4 billion

- Dividend yield: 2%

- Analysts' average recommendation: 1.75

A global trade war is the last thing a multinational industrial conglomerate like Honeywell (HON, $144.84) needs, but analysts by and large remain bullish on the stock.

One area of strength the Street points to is the company's aerospace division. Zacks Equity Research notes that Honeywell "forecasts new civilian-use single engine helicopter shipments of 4,000 to 4,200 over the next five years on the back of strong global economic conditions, potential positive impact of the U.S. tax reform and lower volatility in oil and gas-related markets."

Analysts surveyed by Thomson Reuters expect Honeywell's earnings per share to increase more than 12% in 2018 on revenue growth of almost 5%. The Street projects longer-term earnings expansion to average 10% annually for the next five years.

#14: Home Depot

- Market value: $205.3 billion

- Dividend yield: 2.4%

- Analysts' average recommendation: 1.71

- Home Depot (HD, $177.44) probably isn't having the greatest spring, analysts say, but that doesn't mean investors should abandon the stock.

Analysts at Stifel, who rate shares at "Buy," won't be surprised if sales come in soft this season. After all, a cold, rainy March in much of the country means "spring never sprung," they write. But Stifel continues to be bullish on HD, as well as the underlying economic environment. "While weather can have a one quarter impact on results, we consider weather to be a trading factor, not an investment factor," Stifel analysts write.

The rest of the Street tends to agree. According to S&P Global Market Intelligence, 25 analysts have HD stock at buy. Nine say it's a hold. Meanwhile, not a single analyst covering the nation's largest home improvement retailer thinks the stock is a sell.

#13: Schlumberger

- Market value: $89.8 billion

- Dividend yield: 3.1%

- Analysts' average recommendation: 1.70

It's been rough several years for oil-field services companies like Schlumberger (SLB, $64.81), ever since prices for crude collapsed in 2014. But analysts see brighter times ahead. Morgan Stanley analysts say the offshore drilling industry is undergoing a slow but steady recovery, and that bodes well for firms like Schlumberger.

SunTrust Robinson Humphrey raised its rating on SLB to "Buy" from "Hold" in early April, citing its advantages as the largest, most diversified oilfield-services company in terms of product and geographic reach. Of the 37 analysts surveyed by S&P Global Market Intelligence, 28 have SLB at the equivalent of buy, eight say it's a hold and one calls it a sell.

#12: Microsoft

- Market value: $710.9 billion

- Dividend yield: 1.9%

- Analysts' average recommendation: 1.69

- Microsoft (MSFT, $92.33) is a blue-chip buy in most analysts' eyes, and some of them just positively gush about the software giant's potential. Indeed, the folks at Canaccord Genuity think Microsoft can reach a market value of a trillion dollars in just a couple of years. "If you believe, as we do, that it is reasonable to expect Microsoft to appreciate between 10% to 20% annually for the next five years, you get to the Big T as early as the (fourth quarter of) 2019, or more like sometime in early 2020," says Canaccord, which rates MSFT at "Buy."

Canaccord points to accelerating growth in Microsoft's cloud-based products such as Office 365 and Azure, as well as contributions from the Xbox gaming franchise as reasons to be optimistic.

On average, analysts agree that MSFT stock has a bright future. Of the 36 researchers polled by S&P Global Market Intelligence, 29 say shares are the equivalent of buy, while six say Microsoft is a hold.

#11: DowDuPont

- Market value: $148.1 billion

- Dividend yield: 2.4%

- Analysts' average recommendation: 1.69

Credit Suisse recently named DowDuPont (DWDP, $63.69) as one of its top stock picks for the next six to 12 months. Analysts are bullish on the its ability to further cut costs in the shorter-term, as well as the benefits of the company's plan to split into three separate publicly traded firms next year.

The spinoff of the agriculture division, which will focus on seeds and crop protection, will be called Corteva Agriscience. The materials division will retain the Dow name, while the spinoff of the specialty products division will be known as DuPont.

In the meantime, analysts expect earnings per share to jump 23% this year, according to data from Thomson Reuters. Revenue is forecast to increase 5.5%.

#10: Adobe Systems

- Market value: $110.8 billion

- Dividend yield: N/A

- Analysts' average recommendation: 1.68

To casual observers, Adobe Systems (ADBE, $225.05) is probably best-known for its Flash player, Acrobat portable document viewer or Photoshop image editing software, but the company is so much more. Indeed, when it comes to creative software for businesses and individuals, the company is absolutely dominant with a broad portfolio or products.

That's a huge selling point with analysts. "Adobe has established itself as the unchallenged leader in Creative software for both the Enterprise and Consumer markets," say Stifel analysts, who rate shares at "Buy." "We view Adobe as one of the most compelling investment cases."

As well they should. Wall Street expects Adobe to generate average profit growth of 26% a year for the next five years.

#9: Comcast

- Market value: $159.4 billion

- Dividend yield: 2.3%

- Analysts' average recommendation: 1.58

- Comcast (CMCSA, $34.32), the cable TV and broadband giant that also owns NBC Universal, is a deal right now, by some analysts' estimates. Buckingham Research Group recently told Barron's that the company is undervalued by almost $100 billion. Comcast's stock is depressed, in part because investors fear it will get into a bidding war with 21st Century Fox (FOXA) over Sky, the U.K.-based satellite TV operator, Barron's notes.

Even if those fears have any merit, bullish analysts think they're overblown -- and most analysts are indeed upbeat on Comcast's stock. The Street forecasts average annual earnings growth of 16.5% a year for the next half-decade. Of the 26 analysts issuing opinions to S&P Global Market Intelligence, 21 have CMCSA at buy. The remaining five rate it at hold.

#8: Alphabet

- Market value: $713.5 billion

- Dividend yield: N/A

- Analysts' average recommendation: 1.53

Google-parent Alphabet (GOOGL, $1,029.71) is tumbling along with the rest of the market so far this year, but that just means a good stock is getting cheaper by the day, analysts say. And the great majority of them remain steadfast in their view that this blue-chip technology stock deserves a place in your portfolio. Of the 45 analysts issuing opinions to S&P Global Market Intelligence, 38 rate GOOGL at the equivalent of buy, while seven have it at hold.

Although GOOGL is under duress at the moment, the long-term story remains intact. It owns commanding market share in the fast-growing digital advertising industry, for one thing. Alphabet also has artificial intelligence, machine learning and virtual reality in its sights, and it's already a major player in cloud-based services.

#7: Facebook

- Market value: $450.6 billion

- Dividend yield: N/A

- Analysts' average recommendation: 1.48

The case for buying Alphabet on the dip? The same goes for Facebook (FB, $155.10), analysts say. Bad press, concerns over user privacy and fears of regulation are punishing FB stock, so now is the time to pounce, Canaccord Genuity says. The firm's analysts say recent events will have "minimal mid-term impact on (Facebook's) business," and suspect the selloff "will prove to be an attractive entry point for FB stock."

Canaccord, which rates shares at "Buy," says Facebook already has privacy solutions in the works, its fundamentals remain strong, and shares look cheap at current depressed levels. Canaccord is hardly alone in its bullish view. With an average recommendation of 1.48, analysts are firmly in the buy camp when it comes to the social media giant.

#6: UnitedHealth Group

- Market value: $221.4 billion

- Dividend yield: 1.4%

- Analysts' average recommendation: 1.48

With roughly $215 billion in market value and more than $200 billion in annual sales, UnitedHealth Group (UNH, $228.79) is the largest publicly traded health insurance company by a wide margin. UNH's sheer size makes it a favorite of hedge funds, as well as Wall Street analysts.

Zacks Equity Research cites the company's Optum division, its international business and strong capital position as reasons to like the stock.

Analysts expect UnitedHealth's earnings to increase an average of 16% a year for the next five years, according to data from Thomson Reuters. If they're right, UNH should continue its winning ways.

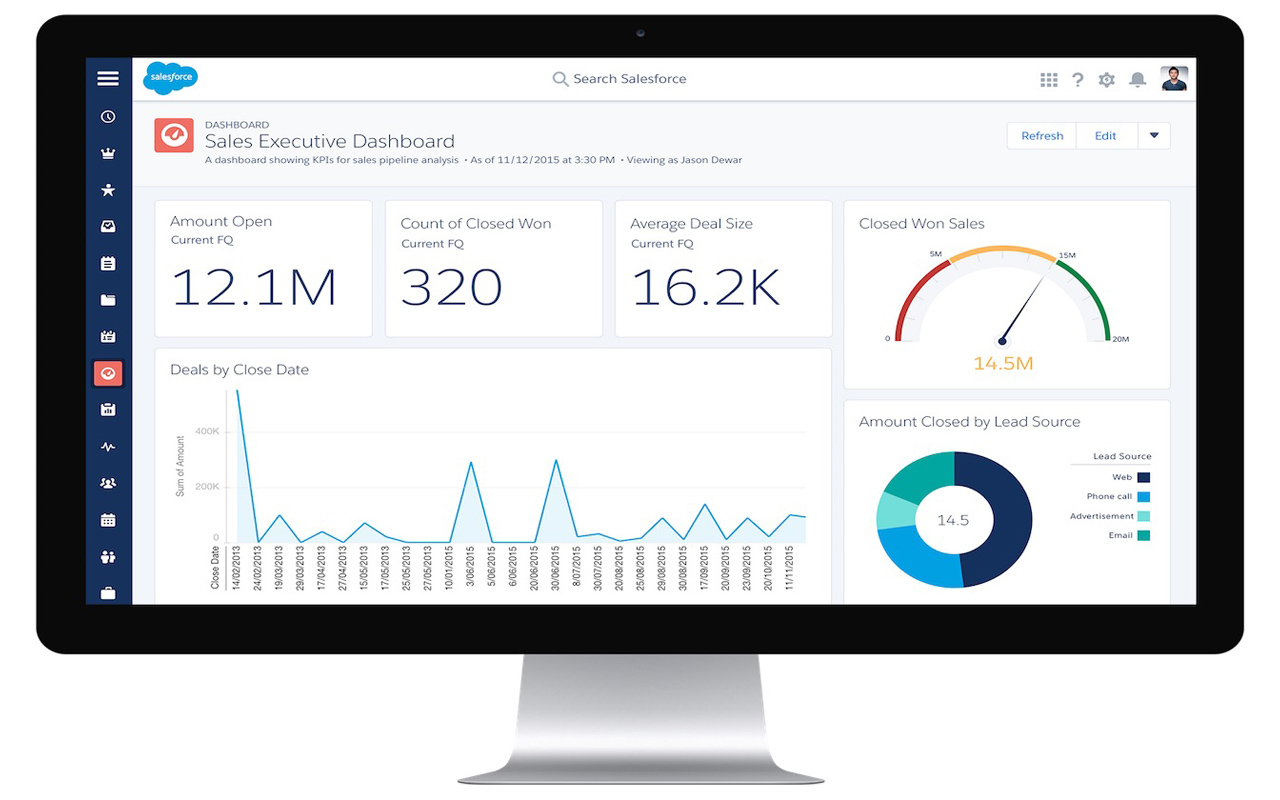

#5: Salesforce.com

- Market value: $87.5 billion

- Dividend yield: N/A

- Analysts' average recommendation: 1.43

- Salesforce.com (CRM, $119.48) was doing cloud-based computing before it was cool. The company sells subscriptions to web-based applications to help companies increase and manage their sales.

Analysts at Canaccord Genuity, who rate shares at "Buy," note that corporate demand for software upgrades is strong. And going forward, CRM will benefit from the application of artificial intelligence as an overlay on top of Salesforce's services.

The bottom line is that analysts think Salesforce is a profit-growth machine. The Street forecasts long-term profit growth to average 29% a year for the next five years, according to data from Thomson Reuters. Of 44 analysts issuing opinions to S&P Global Market Intelligence, 30 rate shares at "Buy," 10 say "Outperform," three call it a "Hold" and one says "Underperform" (sell, essentially).

#4: Visa

- Market value: $270.4 billion

- Dividend yield: 0.7%

- Analysts' average recommendation: 1.42

As the world's largest payments network, Visa (V, $119.81) is well-positioned to benefit from the growth of cashless transactions and digital mobile payments. Indeed, analysts polled by Thomson Reuters expect Visa's earnings to increase an average of 18% a year over the next half-decade.

But analysts aren't the only ones who are bullish on the name. In addition to being popular with hedge funds, Visa also happens to be one of Warren Buffett's favorite stocks. Berkshire Hathaway, of which the famed value investor is chairman and CEO, owns nearly 11 million shares in Visa worth more than $1.2 billion.

Analysts at Credit Suisse, who rate shares at "Outperform," like Visa's solid revenue growth and the potential for more stock buybacks thanks to corporate tax cuts.

#3: MasterCard

- Market value: $182.6 billion

- Dividend yield: 0.6%

- Analysts' average recommendation: 1.42

Like Visa, MasterCard (MA, $173.69) is payments processor beloved by both Wall Street analysts and Warren Buffett. Berkshire Hathaway holds nearly 5 million shares worth about $840 billion. MasterCard also happens to have some of the fastest dividend growth in the Berkshire portfolio.

Analysts at Credit Suisse, who rate shares at "Outperform," note that MasterCard is making major investments in safety and security, geographic expansion and technology. As a group, analysts expect MasterCard earnings to rise an average of 20% a year for the next five years, according to Thomson Reuters. In 2018 alone, earnings per share are forecast to increase 31%.

#2: Broadcom

- Market value: $102.6 billion

- Dividend yield: 2.9%

- Analysts' average recommendation: 1.37

The Trump administration might have blocked Broadcom (AVGO, $236.99) from acquiring rival Qualcomm (QCOM) in early March, but that didn't cool analysts' ardor for the chipmaker. The breakdown of the Street's recommendations from S&P Global Market Intelligence goes like this: 33 have buy-equivalent rankings, while just two say hold. Average it out and Broadcom has one of the highest recommendations of any blue-chip stock on the market.

Zacks Equity Research says all this bullishness stems in part from increased demand for networking products from cloud and data centers, growth in broadband video delivery and rising demand for storage.

Analysts polled by Thomson Reuters expect Broadcom's revenue to increase 20% this year.

#1: Amazon.com

- Market value: $682.9 billion

- Dividend yield: N/A

- Analysts' average recommendation: 1.37

If Facebook and Google are buys on weakness, you can bet that Amazon.com (AMZN, $1,410.57) is too. Indeed, when it comes to analysts' recommendations, the e-commerce leader is second to none. Partly that because of Amazon's willingness to constantly invest in its business and try new areas of growth. It's a strategy for continued success over the long haul.

True, Amazon has come under Twitter assault from the White House, but analysts don't fear any lasting damage. Strategists at GBH Insights, a market research firm, think this rocky patch for Amazon and other major tech stock stocks will pass.

The bottom line is that analysts think Amazon's earnings can grow at an average annual clip of 24% a year for the next half decade. Of 46 analysts tracked by S&P Global Market Intelligence, 44 give the stock a buy rating, and the remaining two have it at hold.

That's good enough for Wall Street's most optimistic view of any big, blue-chip stock.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dan Burrows is Kiplinger's senior investing writer, having joined the publication full time in 2016.

A long-time financial journalist, Dan is a veteran of MarketWatch, CBS MoneyWatch, SmartMoney, InvestorPlace, DailyFinance and other tier 1 national publications. He has written for The Wall Street Journal, Bloomberg and Consumer Reports and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among many other outlets. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange.

Once upon a time – before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily – Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing. He's also written for Esquire magazine's Dubious Achievements Awards.

In his current role at Kiplinger, Dan writes about markets and macroeconomics.

Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University.

Disclosure: Dan does not trade individual stocks or securities. He is eternally long the U.S equity market, primarily through tax-advantaged accounts.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.

-

Dow Dives 870 Points on Overseas Affairs: Stock Market Today

Dow Dives 870 Points on Overseas Affairs: Stock Market TodayFiscal policy in the Far East and foreign policy in the near west send markets all over the world into a selling frenzy.

-

Stocks Struggle for Gains to Start 2026: Stock Market Today

Stocks Struggle for Gains to Start 2026: Stock Market TodayIt's not quite the end of the world as we know it, but Warren Buffett is no longer the CEO of Berkshire Hathaway.