10 Best Stocks You've Never Heard Of

The market is peppered with undiscovered gems boasting stable fundamentals and cheap valuations. Here are 10 of the best stocks flying under the radar.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

An important advantage retail investors have over institutional buyers when seeking out the best stocks to buy is the ability to find undiscovered gems, which are generally too small for fund managers to hold. Institutions invest billions of dollars at a time and are thus reluctant to buy thinly traded equities that become volatile when big blocks trade. The price of low-volume stocks spikes when institutions start purchasing blocks and plummets when blocks are sold. The end result is high transactional costs and eroding trading profits.

Surprisingly there are many more companies uncovered by Wall Street analysts than there are ones researched by the pros. A Multex study from a few years ago found that only about one-third of the approximately 8,900 U.S. exchange-traded stocks are covered by analysts; two-thirds have no research coverage at all.

This lack of coverage may have nothing to do with the quality of the company or its growth prospects. The biggest factor determining Wall Street coverage is the company's potential to generate investment banking fees. Small stocks rarely sell public debt or equity. Since these are poor candidates for investment banking fees, Wall Street firms have little incentive to provide research coverage.

With the major stock market indices down double-digits so far in 2022, this could be a great time for investors to seek out the best stocks to buy among hidden gems. Neglected equities are sometimes undervalued and can begin to generate outsized returns once they land on investors' radar. There is even a name for this phenomenon: the "neglected firm effect." One study looking at well-covered S&P 500 stocks versus neglected ones over a nine-year period found that the neglected stocks generated 16.4% average annual returns versus returns of only 9.4% for the broadly covered stocks.

Here are 10 of the best stocks that have been virtually ignored by Wall Street. Many have characteristics that make them recession-resistant, most are bargained-priced and several pay rich dividends.

Data is as of Oct. 17. Dividend yields are calculated by annualizing the most recent payout and dividing by the share price.

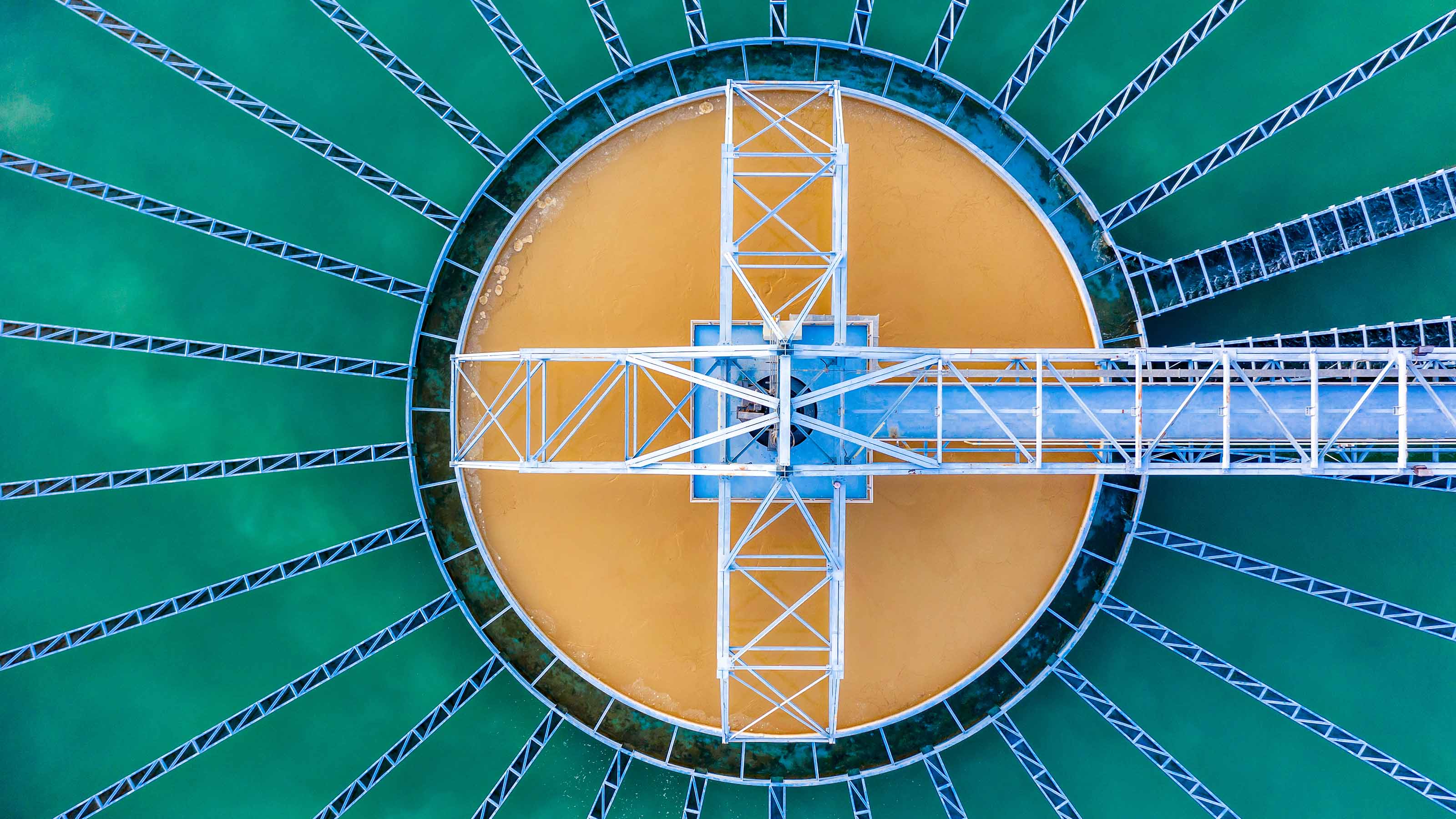

Global Water Resources

- Sector: Utilities

- Market value: $284.3 million

- Dividend yield: 2.5%

- Wall Street analysts: 2

Global Water Resources (GWRS, $11.91) is an Arizona water utility that is benefitting from robust population growth in the greater Phoenix and Tucson markets. The latest census data shows Arizona as the ninth fastest-growing U.S. state, based on a 12% population gain between 2010 and 2020. The company's largest service area is the Phoenix suburb of Maricopa, which experienced 34% growth over the past decade.

Environmental, social and governance (ESG) investors like the company's focus on "total water management." GWRS owns water, wastewater and recycled water operations across each of its core markets that enable it to both conserve water and maximize economic and social value. Operations include 55,814 active service connections and 25 water systems that recycle more than 1.0 billion gallons of water annually.

The company's revenues rose 7.6% year-over-year to $21.7 million during the first six months of 2022, reflecting a rising number of active service connections. Adjusted EBITDA (earnings before interest, taxes, depreciation and amortization) grew 26.7% and earnings per share (EPS) improved 69.7%.

Recent events bode well for this utility's future EPS growth, including the acquisition of a Pima County water utility that adds 3,300 active new accounts. What's more, the company's first rate increase since 2014 is expected to add $2.2 million to revenues, while proceeds of a $15.5 million stock offering will provide GWRS with funds to use for acquisitions and new projects.

Another positive catalyst for GWRS stock is the mid-September initiation of coverage by analysts at Janney with a Buy rating and $17 price target.

Plus, Global Water is on this list of best stocks in part because it pays monthly dividends that have grown four years in a row and presently yield 2.5%. The company typically raises its dividend in November, so new investors may be able to lock in a near-term dividend hike.

Since most of its infrastructure is relatively new, Global Water has higher depreciation and amortization impacting EPS than other water utilities. This reduces the company's earnings per share and makes its price-to-earnings-based valuation look rich. Valuation looks more reasonable based on price-to-cash flow and PEG (price earnings growth) metrics. GWRS trades at 12 times cash flow, a 45% discount to its five-year average. Plus, its PEG sits at 0.7. PEG ratios below 1.0 are generally considered cheap.

Tiptree

- Sector: Financial services

- Market value: $412.5 million

- Dividend yield: 1.4%

- Wall Street analysts: 0

Tiptree (TIPT, $11.36) administers and underwrites specialty insurance products that include commercial and personal lines, credit insurance and collateral protection, as well as warranty and service contract insurance. These products are marketed through independent insurance agents, finance companies, auto dealers and brokers. In addition to these products, the company also has mortgage loan and maritime shipping segments.

TIPT has spent 2022 monetizing the value of some of its assets. The company sold a 24% stake in Fortegra, its specialty insurance unit, to Warburg Pincus for $200 million and recently sold two of its dry bulk ships for $46 million (a 50% premium to book value) as part of initial steps toward exiting the shipping business entirely.

The fastest-growing part of Tiptree's business is Fortegra, which has delivered 30% annual premium growth and 29% yearly adjusted net income gains over the past five years. Fortegra is an A-rated insurer, enjoys a 95% agent retention rate and is continuing to grow via new programs, policy renewals and expansion into multi-billion-dollar European markets.

In the first six months of 2022, TIPT grew revenues 11.8% and adjusted net income 12.0%. Meanwhile, its insurance business generated 21.4% revenue gains and 49.1% adjusted net income growth.

A sum of the parts analysis published by Tiptree values the Fortegra business at $19.85 per share, while its remaining segments are valued at $6.27 per share. This puts their combined value at $26.12 per share, which is more than twice the current share price.

Despite this year's strong financial performance, TIPT shares are down more than 25% in 2022. This means interested investors can scoop up one of the best stocks they've never heard of at a discount.

Chico's FAS

- Sector: Consumer discretionary

- Market value: $635.5 million

- Dividend yield: N/A

- Wall Street analysts: 1

Under a new management team, women's apparel retailer Chico's FAS (CHS, $5.08) is implementing a turnaround driven by customer engagement, distinctive brands and digital platforms that have accelerated sales growth and multiplied market share opportunities.

Its three clothing brands (Chico's, White House Black Market and Soma) are sold in 1,258 company-owned stores nationwide. The company's targeted demographic is affluent women, whose spending habits tend to be more recession-resistant. Thanks to this focus, Chico's FAS was able to achieve high double-digit same-store growth for two of its three brands during the June quarter while most other apparel retailers recorded declines.

By 2024, the company anticipates hitting $2.5 billion of revenues (vs. $1.8 billion in 2021) and delivering 15% annual EPS growth.

June quarter results showed sales up 18.4% year-over-year, gross margins 300 basis points higher (a basis point = 0.01%). and 62% EPS growth. These results were among the best for any specialty apparel retailer. In addition, Chico's FAS has over $172 million of cash and $86 million of trailing 12-month free cash flow to invest in its brands, pay down debt and boost return to investors via share repurchases..

Despite beating estimates and raising full-year 2022 guidance by nearly 20%, CHS shares dropped 15% following the announcement of June earnings. CHS stock is down roughly 10% year-to-date. But that makes this retailer one of the best stocks in terms of valuation, trading at less than a 6 times forward earnings – or roughly half the P/E multiple of its peers.

Associated Capital Group

- Sector: Financial services

- Market value: $886.6 million

- Dividend yield: 0.5%

- Wall Street analysts: 0

Associated Capital Group (AC, $40.28) provides alternative asset management services through a wholly-owned business, Gabelli & Co. Investment Advisors. Legendary value investor Mario Gabelli owns roughly 85% of the company.

The firm makes investments based on its proprietary "Private Market Value" model and by identifying catalysts that may drive value. In addition to alternative investing, the company makes direct investments in firms through a private equity business and special purpose acquisition companies (SPACs).

AC has over $1.8 billion of assets under management and is a specialist in merger arbitrage, which involves buying stock in companies when deals are announced and at a discount to the deal terms. These strategies have powered 7.4% average annual returns and positive results in 35 of the last 37 years.

The company's assets under management have risen by $21 million in 2022 as a result of $157 million of fund inflows, partially offset by market depreciation of $64 million and a $72 million negative impact from currency fluctuations.

While the broader stock and bond markets struggled in the first half of 2022, merger and acquisition demand has remained robust, delivering in Q2 its eighth consecutive quarter of over $1 trillion of activity. The company's merger arbitrage business is also benefiting from rising interest rates, which can make deal spreads widen to compensate arbitrage investors for the time value of their money.

Due to a drop in the market value of its public and partnership investments, Associated Capital Group recorded net losses during the first half of 2022 that caused book value per share to decline 4% year-over-year to $40.30. The stock has also struggled, down roughly 6% for the year-to-date in 2022.

Associated Capital pays an annualized dividend of 20 cents per share that has held steady for six years and currently yields 0.6%. Since its spin-off seven years ago, the company has returned over $155 million to investors through share repurchases and paid nearly $30 million of dividends.

Ebix

- Sector: Technology

- Market value: $577.9 million

- Dividend yield: 1.6%

- Wall Street analysts: 1

Ebix (EBIX, $18.70) is a global fintech powerhouse that provides software that manages transactions between brokers and insurance companies. The company runs over 40 million life insurance quotes annually and processes in excess of $60 billion in annuity premiums per year. Through its various SaaS (software-as-a-service) platforms, it provides services to millions of clients globally across the banking, insurance and healthcare industries. It serves customers across six continents and more than 69 countries.

A major contributor to the firm's recent sales growth is its India-based EbixCash business, which offers prepaid Visa (V) and Mastercard (MA) gift cards. The Indian gift card market is valued at more than $39 billion and forecast to grow over 19% annually over the next five years. Ebix plans to sell a stake in EbixCash via an initial public offering (IPO) while retaining majority ownership.

A negative short seller report in June questioned the financials of EbixCash and resulted in a nearly 50% drop in Ebix's share price. Although the company published a point-by-point rebuttal of the short seller's claims, the damage was already done and EBIX shares remain down over 40% in 2022.

While the company has yet to return to its pre-COVID levels of growth in businesses such as travel and foreign exchange, Ebix delivered strong June quarter results with revenues up 6% on a constant currency basis and EPS rising 23%. Revenues grew in nine of the company's 10 geographies and, excluding the prepaid card business, were up 32%. The one analyst covering Ebix looks for better than 24% annual EPS gains this year and next.

The biggest risk factor with Ebix is high debt, which is the result of its aggressive acquisition strategy. Debt currently comprises nearly 50% of capital. However, the company plans to use a portion of the proceeds from the EbixCash IPO to dramatically reduce debt, which should help the share price.

At present EBIX stock trades at 8 times earnings, a 59% discount to IT industry peers and 40% below its historic average. EBIX also pays a modest 30 cents-per-share annual dividend, which has held steady for seven years and currently yields 1.7%.

Cass Information Systems

- Sector: Industrials

- Market value: $536.9 million

- Dividend yield: 2.9%

- Wall Street analysts: 0

Payment processor Cass Information Systems (CASS, $39.31) is one of the best stocks to benefit from inflation and rising interest rates. The company's main business involves processing payments for freight and other corporate expenses. Its fees are determined by the number of transactions processed and the amount per transaction. When energy and other corporate expenses rise, CASS earns higher fees per transaction, which increases the company's funds float that's earning interest from its Cass Commercial Bank subsidiary.

Cass dispenses more than $80 billion of payments annually on behalf of its customers and manages an average funds float of $1.1 billion. It is supported by Cass Commercial Bank, which holds over $2 billion of assets.

The company's transportation and facility dollar volume has increased five quarters in a row. It is supported by a more than 40% increase in Cass' financial fee revenues over that same time frame.

The company provides freight auditing and payment processing services for numerous Fortune 500 companies, including PepsiCo (PEP), Caterpillar (CAT), Emerson Electric (EMR), and Lowe's (LOW). It is also recognized as the industry leader in freight audit and payment processing.

Cass achieved record results in the June quarter, with transportation dollar volume up 28% to $11.4 billion and EPS rising 29% to 62 cents per share. Return on equity (ROE) also rose 16.5%.

The company has paid dividends every year since 1934 and increased its payout 20 years in a row. At present, the company pays an $1.12 per share annual dividend that yields 2.9%.

Despite record revenues and EPS in 2022, CASS shares trade at 16 times earnings, which is a 27% discount to other fintech stocks

Ascend Wellness Holdings

- Sector: Healthcare

- Market value: $331.3 million

- Dividend yield: N/A

- Wall Street analysts: 0

Ascend Wellness Holdings (AAWH, $1.76) is a vertically integrated cannabis grower and retailer operating 22 dispensaries across six states and five cultivation facilities. Company-owned stores are located in prime urban and suburban locations characterized by high barriers to entry such as Chicago's trendy River North neighborhood, Boston's Faneuil Hall district, the Paramus suburb of New Jersey and Collinsville near St. Louis.

The states where Ascend Wellness operates stores (Illinois, Michigan, New Jersey, Massachusetts, Ohio and Pennsylvania) are four of the nation's top markets for recreational cannabis and two of the top markets for medical cannabis.

AAWH is further distinguished from competitors by its well-established in-house brands – Simply Herb, Ozone and its premium brand Ozone Reserve. Each product line includes edible, vape, flower, pre-rolled and concentrate forms of cannabis. Owning its own cultivation and processing facilities allows Ascend Wellness to control product quality and also capture more links of the value chain.

Legal cannabis sales are forecast to nearly double in the U.S. over the next five years and reach $46 billion by 2026. At present 18 U.S. states and the District of Columbia allow sales of recreational cannabis and 38 states permit sales of medical cannabis. These numbers are likely to rise as a result of pending legislation in multiple states and favorable support from 68% of U.S. voters.

The company's revenues more than doubled from $144 million in 2020 to $332 million in 2021. During the first six months of 2022, revenues grew 22% year-over-year to $182.6 million. While AAWH is not yet profitable on a GAAP basis, adjusted EBITDA (earnings before interest, taxes, depreciation and amortization) is steadily rising, and grew from $30.8 million in 2020 to $79.4 million in 2021. In the first six months of 2022, adjusted EBITDA hit $37.3 million, up 3.1% from the year prior.

Future growth will come from new stores and acquisitions, which are supported by $141 million of balance sheet cash and access to another $275 million of funding.

The marijuana stock's lack of Wall Street coverage is reflected in its valuation. AAWH shares are down approximately 80% year-to-date in 2022 and trade below a six times forward enterprise value/ EBITDA – a 50% discount to industry peers.

Still, AAWH is one of the best stocks for insider buying. The company's three independent directors together acquired approximately 60,000 shares in July and the company's founder and co-founders together purchased 50,000 shares.

Diamond Hill Investment Group

- Sector: Financial services

- Market value: $510.6 million

- Dividend yield: 3.6%

- Wall Street analysts: 0

Diamond Hill Investment Group (DHIL, $166.66) is an active fund manager with $25.8 billion of assets under management. The firm's investment approach is value-based and focused on U.S. and international equities, fixed income and alternative assets. Large-cap domestic stocks represent roughly 67% of Diamond Hill's portfolio. The company generates earnings from both investment advisory and mutual fund administration fees.

Like most fund managers, DHIL has been hit by fund outflows and market losses this year, which contributed to a 17% decline in assets under management during the first six months of 2022. Unlike other managers, however, Diamond Hill has remained profitable, generating earnings of $4.27 per share in the first half of 2022, thanks in part to a big rise in operating margins.

The resiliency of Diamond Hill's results will enable the company to continue paying a sizable dividend while also rewarding investors via share repurchases. The firm returned $80 million to investors in 2021 via dividends and share repurchases and another $31 million was returned during the first six months of 2022.

Diamond Hill has a 14-year history of paying big special dividends and also began distributing a regular cash dividend in 2021. Special dividends have increased steadily in recent years, up from $8 in 2018 to $19 in 2021. Meanwhile, the regular cash dividend grew 50% in 2022 to $6.00 annualized. Even if the special dividend is halved in 2022, investors would still realize a phenomenal 8.9% yield on DHIL shares.

Dividends are supported by a liquid balance sheet that shows cash totaling $177.7 million ($56.07 per share) or roughly one-third of DHIL's recent share price.

DHIL stock is down 14% year-to-date in 2022 to trade at less than a 10 times earnings – a nearly 10% discount to financial sector peers and 15% below the company's five-year average P/E multiple. In other words, investors can get one of the best stocks at a discount right now.

Hovnanian Enterprises

- Sector: Consumer discretionary

- Market value: $208.4 million

- Dividend yield: N/A

- Wall Street analysts: 0

Homebuilder Hovnanian Enterprises (HOV, $36.63) is one of the best stocks for valuation right now, trading at 1.2 times earnings, a more than 89% discount to its industry peers. Hovnanian is among the top 15 homebuilders in the U.S., with operations in high-growth metro areas of the West, Southwest and Mid-Atlantic and a focus on first-time homebuyers.

Recession fears bottoming the housing market doubtless contribute to the stock's weak valuation – though this ignores many positive aspects of Hovnanian's story. For example, while home buyers are stepping back amid rising mortgage rates and home prices, the supply of available homes still remains extremely tight. Freddie Mac estimates that the U.S. housing supply is roughly 4 million units short of demand. In addition, Hovnanian is better positioned than most builders since the company operates in Western and Southern states (Arizona, Florida, Georgia, Texas and South Carolina) that rank among the fastest-growing in the country.

Another factor working in HOV's favor is its conservative positioning. Its current $1.6 billion housing inventory is less than half that of Great Recession (2008-2010) levels and the company has begun selling some vacant lots to free up cash for debt reduction.

During the first nine months of fiscal 2022, the company's home sale revenues grew to $1.97 billion (3,939 homes) from $1.89 billion (4,501 homes) one year ago. Additionally, homebuilding gross margins improved by 400 basis points. The company also ended the July quarter with a contract backlog of $1.79 billion, up 4% from the year earlier. Generally, contract backlog is a good predictor of revenues realized over the next 12 months.

In anticipation of slowing 2023 home sales, Hovnanian is filling out its pipeline by partnering on build-for-rent initiatives with institutional investors. HOV began construction of a 200-home build-to-rent community last quarter, pre-sold at solid margins, and has signed letters of intent for two more such communities, numbering 350 more pre-sold homes for two new institutional investors.

Hovnanian recently increased its full-year 2022 guidance, now expecting revenues of $2.8 billion to $3.0 billion and EPS of $32.00 to $33.50. While it is difficult to predict how long macroeconomic headwinds will "cause some homebuyers to delay their purchase decision, we remain confident that rising rents, combined with low supply of homes for sale will ultimately drive increased demand for new homes," said Ara K. Hovnanian, CEO of Hovnanian, in the company's fiscal Q3 earnings report.

Preformed Line Products

- Sector: Industrials

- Market value: $367.8 million

- Dividend yield: 1.1%

- Wall Street analysts: 0

Preformed Line Products (PLPC, $74.44) is one of the best stocks to play the expanding worldwide electric power grid and 5G buildouts. This company makes cable anchoring and control hardware, fiber optic and copper splice closures, and high-speed cross-connect devices used by customers in the telecommunications, energy, utility and solar industries. PLPC operates in more than 140 countries worldwide.

Approximately two-thirds of the company's revenues come from utilities and the rest comes from telecom services providers. Recent demand is fueled by the grid expansion required to accommodate rising electrical demand and also by the urgent need to replace aging infrastructure; 70% of the U.S. power grid is more than 25 years old and well past its useful life.

PLPC has generated more than 10% annual sales growth and nearly 25% annual EPS gains over three years. During the first six months of 2022, the company's sales grew 20% and EPS soared 61.5%.

Its growth is supported by an exceptional balance sheet, with total debt at just 26% of equity. The company has maintained an 80 cents per share annual dividend for 20 consecutive years that currently yields 1.1%. Payout at 31% suggests a very safe dividend.

Despite favorable tailwinds and a record 2022 financial performance, PLPC shares trade at just 8 times earnings, a 50% discount to industrial sector peers and 40% below the stock's historic average P/E multiple. Some of this undervaluation may be due to the fact that PLPC is thinly traded. Insiders own about 33% of the stock and a lack of earnings calls or investor conferences makes the company a relative unknown on Wall Street.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Lisa currently serves as an equity research analyst for Singular Research covering small-cap healthcare, medical device and broadcast media stocks.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Why Wells Fargo's Revenue Miss Isn't Worrying Wall Street

Why Wells Fargo's Revenue Miss Isn't Worrying Wall StreetWells Fargo is one of the best S&P 500 stocks Wednesday even after the big bank's top-line miss. Here's what you need to know.

-

Constellation Energy Stock Soars on Its $26 Billion Buy. Here's Why Wall Street Likes the Deal

Constellation Energy Stock Soars on Its $26 Billion Buy. Here's Why Wall Street Likes the DealConstellation Energy is one of the best S&P 500 stocks Friday after the utility said it will buy Calpine in a cash-and-stock deal valued at $26 billion.

-

The 24 Cheapest Places To Retire in the US

The 24 Cheapest Places To Retire in the USWhen you're trying to balance a fixed income with an enjoyable retirement, the cost of living is a crucial factor to consider. Is your city the best?

-

What Scott Bessent's Treasury Secretary Nomination Means for Investors

What Scott Bessent's Treasury Secretary Nomination Means for InvestorsMarkets are reacting positively to Trump's nomination of Scott Bessent for Treasury secretary. Here's why.

-

TJX Stock: Wall Street Stays Bullish After Earnings

TJX Stock: Wall Street Stays Bullish After EarningsTJX stock is trading lower Wednesday despite the TJ Maxx owner's beat-and-raise quarter, but analysts aren't worried. Here's why.

-

Cisco Stock: Why Wall Street Is Bullish After Earnings

Cisco Stock: Why Wall Street Is Bullish After EarningsCisco stock is lower Thursday despite the tech giant's beat-and-raise quarter, but analysts aren't concerned. Here's what you need to know.

-

Apple Stock Slips After Earnings. Wall Street Isn't Worried

Apple Stock Slips After Earnings. Wall Street Isn't WorriedApple stock is trading lower Friday despite the iPhone maker beating expectations for its fiscal fourth quarter, but analysts are still bullish.

-

Tesla's Robotaxi Event: What Wall Street Expects

Tesla's Robotaxi Event: What Wall Street ExpectsTesla’s robotaxi event kicks off next week. Here’s what Wall Street expects to see and how analysts feel about the stock heading into the event.