The Vinyl Rule of Retirement: Plan for Two Sides in Your Next Act

Follow the vinyl rule, because "Life is what happens when you're busy making other plans."

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Bust out the record collection. Not only might it be worth something, but there’s also a valuable retirement lesson in there, too.

Since the launch of Record Store Day in 2008, vinyl has made a serious comeback. How big? In 2022, vinyl outsold CDs for the first time since 1987, racking up more than $1 billion in sales. A key reason why records are hip once again is cultural nostalgia.

And that's not the only thing people are nostalgic for these days. An overwhelming number of workers would happily rewind to the era of pensions. According to a recent Nuveen and TIAA Institute survey, 93% of 401(k) plan participants said it’s important to have the option to convert their savings into guaranteed monthly income. Two-thirds said that option would make them feel more confident about retirement.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The survey highlights one of the biggest challenges in retirement: figuring out how to turn your savings into a steady income stream, so you can enjoy life today without losing sleep about tomorrow.

Because, much like a vinyl record, retirement for most has two distinct sides. It starts with high energy, then flips to something slower — each with its own rhythm, needs and funding decisions.

To understand what retirement really looks like, and why it’s not one continuous groove, consider the vinyl rule of retirement: plan to make the most of the active, high-energy early years while preparing for the slower, care-focused side that comes next.

Side A: The active, adventurous retirement years

The top aspirations for people contemplating retirement are to "pursue new hobbies" and "find new adventures," according to an Allianz survey. For many, that happens during the first decade.

"This is when people check off the bucket-list items they’ve been dreaming about their whole lives," says Jacob Martin, CFP® and financial adviser at Keeler & Nadler Family Wealth. "I often see clients move to a new city, travel the world and generally make the most of their physical health while they still can."

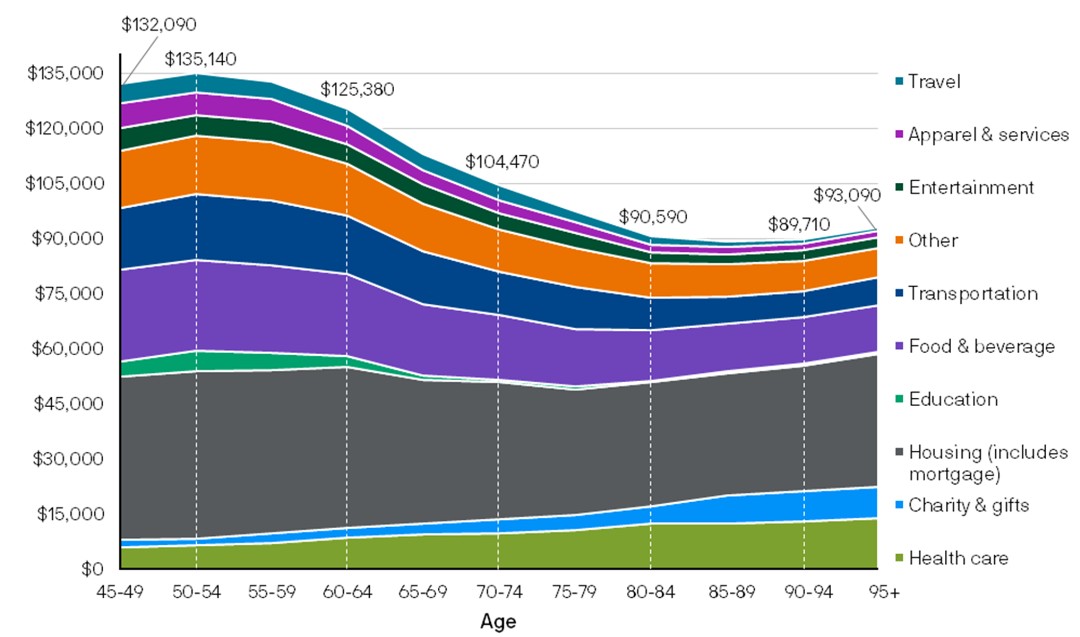

Spending tends to reflect that burst of activity. JP Morgan research shows that Americans with $1-3 million in investable assets typically hit their peak spending years in midlife and into early retirement, but often see a dip before spending rises again later in life due to health care needs.

The chart below illustrates the annual spending by age in households with investable wealth ranging from $1 to $3 million.

That’s why Martin encourages clients to embrace this early phase. "Some retirees hold back, thinking they’ll spend more later. But this is the decade to really live. Spending more from 65 to 75 often works just fine since costs usually drop later."

His recommendation? "Set up a regular withdrawal from your investments, like a paycheck, to create a sense of consistent cash flow so you feel confident spending on the things you care about."

Ralph White, principal and financial planner at Arrivity Financial Planning, suggests creating separate pools of money for different goals. The first pool is a traditional retirement portfolio invested in a diversified mix of stocks, bonds and two years’ worth of cash reserves for steady spending needs.

Then, do something similar for your active retirement years. "Since this is such a finite period of time, I don't want market downturns to impact this because you can’t get this time back," he says. "I recommend setting aside funds that are available specifically for travel or other fun activities, ideally in a separate savings or conservatively invested brokerage account."

The flip: easing into the next chapter

Eventually, the tempo slows. There’s a gradual shift in retirement, moving from adventure and activity to a quieter, more reflective rhythm. This transition can stem from changes in health, evolving priorities or the reality of a shrinking budget.

According to Martin, this "slower phase" tends to emerge between ages 75 and 85. "This is when I start to see health become a limiting factor," he says. “Big trips and active pursuits become harder to manage. Even if outside care isn’t yet needed, spending tends to drop and bottom out around age 80.”

That shift is rooted in biology as much as lifestyle. For example, research indicates that after age 30, strength declines by 10% to 15% per decade until around age 70, when the loss accelerates to 25% to 40% per decade.

That means even daily routines may require more energy or assistance, nudging retirees toward lower-intensity activities, like river cruises instead of hiking tours, or evenings out over long-haul adventures.

This transition doesn’t have to catch you off guard. Planning for “the flip” means making sure your assets can go the distance, especially with inflation eroding your spending power over time.

One key move is thinking carefully about when to claim Social Security, says Bill Shafransky, CFP® and senior wealth adviser at Moneco Advisors. "Taking your benefit before full retirement age results in a permanently lower monthly payment," he says. "That smaller base means future cost-of-living adjustments (COLAs) will also be smaller, which can add up over time."

Still, none of this means the music stops.

Side B: slower, quieter — but still rich with meaning

Just like flipping a record, the later years of retirement offer a different tempo — slower, softer, more reflective. But they’re not any less meaningful or even less expensive.

In fact, spending can rise again during this stage, largely due to increased health care and potential caregiving needs. A 65-year-old retiring in 2025 can expect to spend an average of $172,500 on health care over the course of retirement, estimates Fidelity.

It explains why two in three workers (66%) say they’re worried about their health as they age. And for good reason: Genworth’s 2024 Cost of Care Survey pegs the national median annual cost of assisted living at $70,800.

Not everyone will require long-term care, and there are different ways to fund it. However, Martin advises people to consider long-term care insurance to help cover later-life expenses. "If you’ve planned for healthcare needs on the back end," he says, "you can feel more comfortable spending freely during your earlier, more active retirement years."

Shafransky sees this as a blind spot for many clients. "What I find interesting is how optimistic some pre-retirees are about the latter years," he says. "They think, 'That won’t happen to me.' But even if long-term care insurance isn’t the right fit, it’s essential to have a financial strategy for a worst-case scenario."

Thriving on "Side B" isn’t just about finances, as non-financial preparation can also make a big difference in your quality of life. Research indicates that people with a sense of purpose experience less cognitive decline. Regular volunteering is linked to slower biological aging, and staying mentally and socially engaged can help stave off depression, loneliness and memory loss.

And, of course, regular exercise remains one of the most effective ways to age well.

Still, these are years worth looking forward to, as older adults tend to be happier than their younger counterparts. Research shows that with age comes greater emotional resilience and contentment, as older adults tend to live more in the present, appreciating time rather than constantly planning for what’s next.

It goes to show the vinyl record resurgence may also signify the value of being "old school" like that. As John Lennon (who had a custom record player installed in his Rolls-Royce) famously said: "Life is what happens when you’re busy making other plans."

Read More Retirement Rules

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Jacob Schroeder is a financial writer covering topics related to personal finance and retirement. Over the course of a decade in the financial services industry, he has written materials to educate people on saving, investing and life in retirement.

With the love of telling a good story, his work has appeared in publications including Yahoo Finance, Wealth Management magazine, The Detroit News and, as a short-story writer, various literary journals. He is also the creator of the finance newsletter The Root of All (https://rootofall.substack.com/), exploring how money shapes the world around us. Drawing from research and personal experiences, he relates lessons that readers can apply to make more informed financial decisions and live happier lives.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Quiz: Do You Know How to Avoid the 'Medigap Trap?'

Quiz: Do You Know How to Avoid the 'Medigap Trap?'Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.We are 62 and finally retired after decades of hard work. I see the lakehouse as an investment in our happiness.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

5 Ronald Reagan Quotes Retirees Should Live By

5 Ronald Reagan Quotes Retirees Should Live ByThe Nation's 40th President's wit and wisdom can help retirees navigate their financial and personal journey with confidence.

-

We're 78 and Want to Use Our 2026 RMD to Treat Our Kids and Grandkids to a Vacation. How Should We Approach This?

We're 78 and Want to Use Our 2026 RMD to Treat Our Kids and Grandkids to a Vacation. How Should We Approach This?An extended family vacation can be a fun and bonding experience if planned well. Here are tips from travel experts.

-

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs In

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs InRoth conversions are all the rage, but what works well for one household can cause financial strain for another. This is what you should consider before moving ahead.