Stock Market Today: Stocks Swing Lower as Government Shutdown Nears

The main benchmarks erased some if not all of their early morning gains, putting the lid on a tough month and quarter.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Stocks jumped at the open as an encouraging reading on inflation sent Treasury yields lower. The main benchmarks lost steam as the session wore on, however, as brinkmanship in Washington D.C. has the U.S. government all but likely to shut down over the weekend.

Ahead of the opening bell, the Bureau of Economic Analysis said its August personal consumption and expenditures (PCE) index, the Fed's preferred measure of inflation that tracks consumer spending, was up 0.4% month-over-month and 3.5% year-over-year – both figures higher than what was seen in July.

Still, the monthly increase (0.1%) and annual increase (3.9%) in core PCE, which excludes volatile food and energy prices, were each lower than July's figures. Additionally, the year-over-year core PCE reading was the lowest in two years.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"The inflation news was rather positive," says Edward Moya, senior market strategist at currency data provider OANDA. " When you combine today's PCE and consumer data with yesterday's downward revised personal consumption numbers, one should expect that economic activity will slow down quicker in the fourth quarter."

The data boosted expectations the Federal Reserve will keep interest rates steady at both its November and December meetings, even as the central bank at its most recent gathering projected one more potential rate hike this year.

According to CME Group, futures traders are pricing in an 86% chance for a pause at the next Fed meeting, up from 73% one week ago. The probability the central bank will keep the federal funds rate unchanged at its current range of 5.25% to 5.5% in December rose to 64% from last week's reading of 58%.

Shutdown looms as short-term spending measure fails

Lowered expectations for future rate hikes sent Treasury yields retreating and stocks soaring out of the gate, though sentiment fizzled into the weekend as investors worried over a looming government shutdown. The deadline to pass funding legislation is Saturday at midnight. This afternoon, House Speaker Kevin McCarthy failed to find support to pass even a stopgap spending measure.

Shutdowns historically have not been all that bearish on stocks. However, one complication could be that a data dependent Fed will find itself flying blind. Economic data will not be tabulated during a shutdown, says Carol Schleif, chief investment officer at BMO Family Office. This "ironically could cause them to err on the side of holding steady, instead of increasing rates, until they get clearer data sets," Schleif adds.

Nike shines after earnings

After being up more than 1% this morning, the Nasdaq Composite finished up 0.1% at 13,219. The S&P 500 ended 0.3% lower at 4,288. The Dow Jones Industrial Average underperformed its peers, shedding 0.5% to 33,507, though two of its components – Nike (NKE) and Walgreens Boots Alliance (WBA) – were among the day's best stocks.

Nike, for its part, jumped 6.7% after the athletic apparel maker reported higher-than-expected fiscal first-quarter earnings of 94 cents per share. The company also said inventory levels were down 10%. Revenue of $12.9 billion fell short of analysts' estimates. The big earnings beat sent fellow shoe stocks Adidas (ADDYY, +6.1%) and ON Holding (ONON, +6.1%) soaring.

Walgreens Boots Alliance (WBA), meanwhile, was the best Dow Jones stock today. Shares of the pharmacy chain popped 6.4% after a Bloomberg report indicated the company is considering Tim Wentworth, a former Cigna (CI) executive, as its next CEO. Earlier this month, Rosalind Brewer announced she was stepping down as head of Walgreens.

All three main benchmarks finished the month and quarter with substantial losses.

Related content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

How the Stock Market Performed in the First Year of Trump's Second Term

How the Stock Market Performed in the First Year of Trump's Second TermSix months after President Donald Trump's inauguration, take a look at how the stock market has performed.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

Stocks End Volatile Year on a Down Note: Stock Market Today

Stocks End Volatile Year on a Down Note: Stock Market TodayAfter nearing bear-market territory in the spring, the main market indexes closed out the year with impressive gains.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

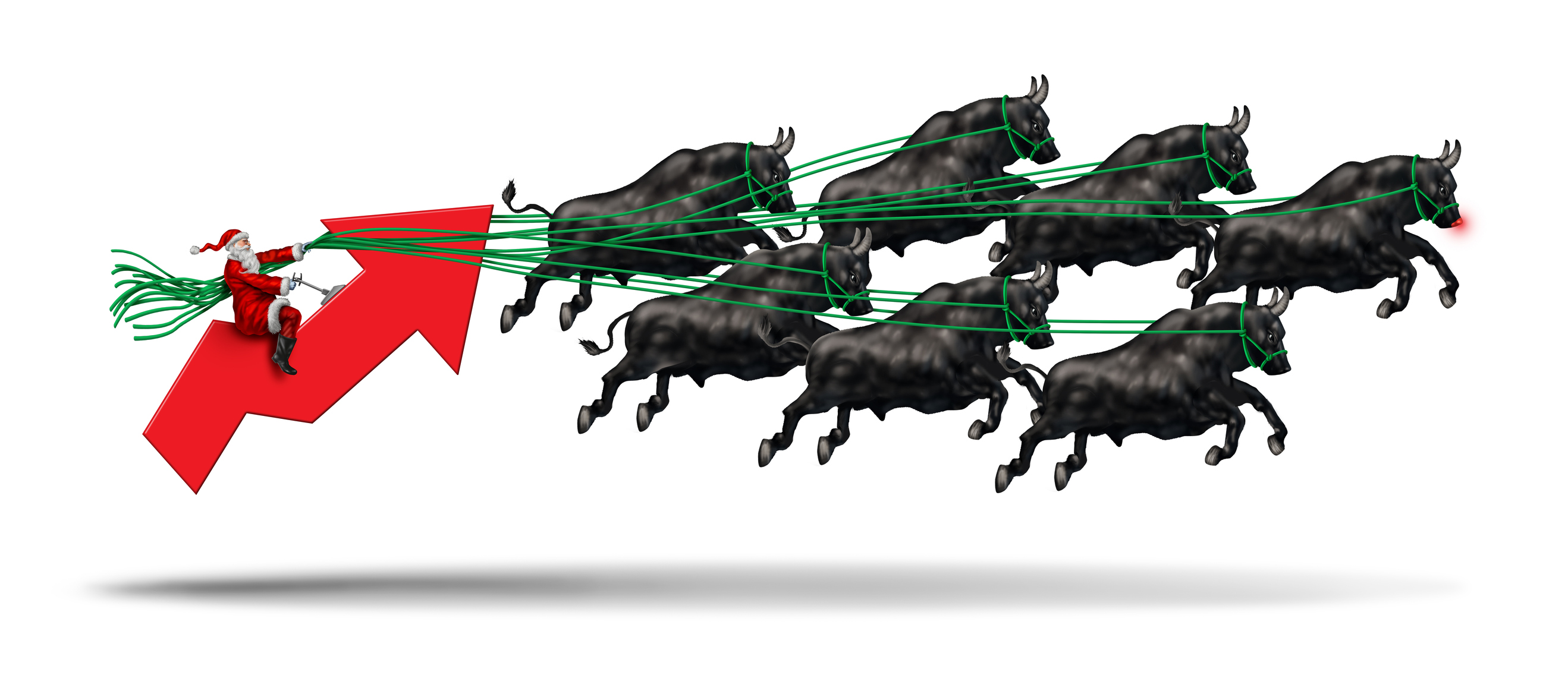

The Santa Claus Rally Officially Begins: Stock Market Today

The Santa Claus Rally Officially Begins: Stock Market TodayThe Santa Claus Rally is officially on as of Wednesday's closing bell, and initial returns are positive.