If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

MMM stock has been a pit of despair for truly long-term shareholders.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

The good news for long-suffering 3M (MMM) shareholders is that the stock is beating the broader market over the past year, and Wall Street is collectively bullish on MMM for the first time in 15 years.

The bad news is that shares in this once-illustrious blue chip stock have been a dismal buy-and-hold bet.

That might come as a shock. Few multinational industrial conglomerates enjoy 3M's household recognition. The inventor of masking tape, Scotch Tape and Post-it Notes likely resonates with consumers in ways that peers such as PPG Industries (PPG) or Illinois Tool Works (ITW) do not.

Article continues belowFrom just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

3M also carries a certain gravitas thanks to its distinguished history. Founded in the early 20th century as the Minnesota Mining and Manufacturing Company, MMM grew into an innovation powerhouse. Today, the company produces everything from personal protective equipment and adhesives to electronic displays and advanced materials.

It's hard to believe now, but this old economy conglomerate was once considered snazzy, if not exactly sexy. 3M has long plowed money into research and development, and it still encourages employees to spend 15% of their time on their own initiatives.

When 3M was added to the Dow Jones Industrial Average in 1976, it was due in part to its contemporary technological prowess. For a diversified industrial manufacturer, it was kind of an exciting company.

Alas, the 21st century hasn't been nearly as good to 3M or its shareholders. While analysts haven't been this upbeat about MMM's prospects in ages, anyone who held on through what has been a lost decade has a lot of catching up to do.

Several factors have weighed on 3M through the years. Stagnant revenue growth was a headwind, but the massive overhang came from years of lawsuits about "forever chemicals" (PFAS) and claims that its Combat Arms earplugs led to hearing loss.

MMM emerged from its lengthy litigation nightmare in 2024 and decided to get leaner. The market applauded when it spun off its health care business, Solventum (SOLV), in April 2024; however, the resulting loss of revenue and free cash flow forced the company to cut its dividend.

That stung the equity-income crowd. 3M had been one of the best dividend stocks for dependable growth, having increased its payout for 64 consecutive years. Following the cut, it's no longer a member of the S&P 500 Dividend Aristocrats.

The bottom line on MMM stock?

This period of turmoil led to serious underperformance. MMM currently trails the S&P 500's annualized total return (price change plus dividends) over every standardized time frame beyond 52 weeks.

Throughout its entire life as a public company, MMM generated an annualized return of 9.7%, lagging the broader market by about a percentage point. It also lags the S&P 500 by wide margins in the past three-, five-, 10-, and 15-year periods.

Which brings us to what $1,000 invested in MMM stock 20 years ago would be worth today. The answer: not nearly enough.

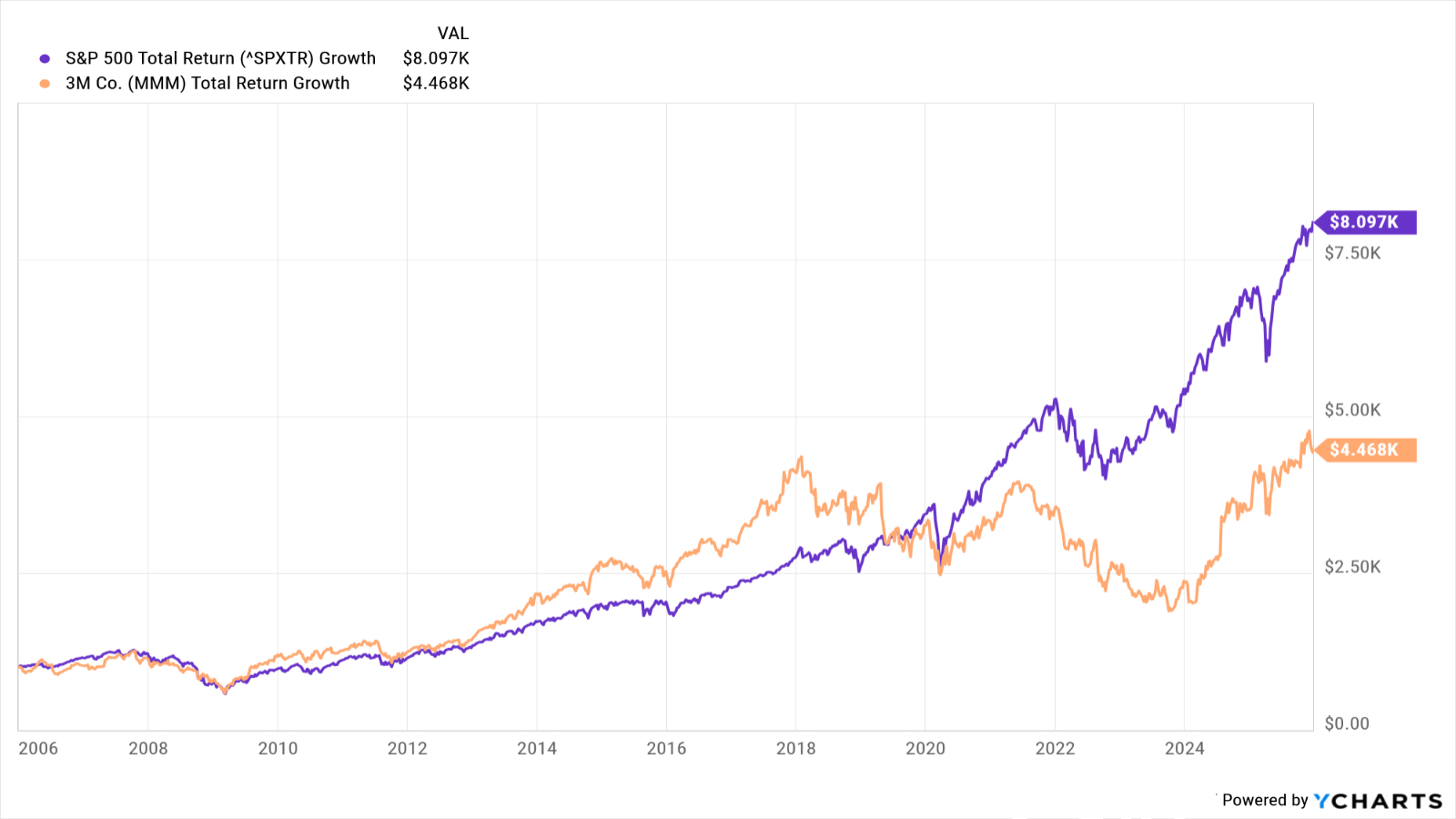

Have a look at the chart and you'll see that the industrial stock has been a black pit of opportunity cost.

If you had plunked down a thousand bucks two decades ago, it would today be worth about $4,500 — an annualized total return of 7.7%.

The same sum invested in the S&P 500 would theoretically be worth $8,000 today, or a 10.8% annualized return.

As for where MMM goes from here, the Street is more "constructive" than it has been in a very long time. Of the 17 analysts surveyed by S&P Global Market Intelligence, eight rate shares at Strong Buy, two say Buy, five have it at Hold and two say Sell. That works out to a consensus recommendation of Buy, albeit with mixed conviction.

It also happens to be the most bullish the Street has been on MMM since 2011.

Argus Research analyst Kristina Ruggeri, who rates the shares at Buy, cites the way the company is executing its turnaround strategy, among other factors.

"MMM is now making progress with aggressive steps to improve revenue and earnings, including cross-selling efforts and investments in the business," Ruggeri writes. "It is also undergoing a company-wide restructuring, making supply-chain improvements, and driving efficiencies in its manufacturing plants.

"In all, margins are widening meaningfully, and cash flow remains strong."

More Stocks of the Past 20 Years

- If You'd Put $1,000 Into Netflix Stock 20 Years Ago, Here's What You'd Have Today

- If You'd Put $1,000 Into Microsoft Stock 20 Years Ago, Here's What You'd Have Today

- If You'd Put $1,000 Into Apple Stock 20 Years Ago, Here's What You'd Have Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dan Burrows is Kiplinger's senior investing writer, having joined the publication full time in 2016.

A long-time financial journalist, Dan is a veteran of MarketWatch, CBS MoneyWatch, SmartMoney, InvestorPlace, DailyFinance and other tier 1 national publications. He has written for The Wall Street Journal, Bloomberg and Consumer Reports and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among many other outlets. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange.

Once upon a time – before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily – Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing. He's also written for Esquire magazine's Dubious Achievements Awards.

In his current role at Kiplinger, Dan writes about markets and macroeconomics.

Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University.

Disclosure: Dan does not trade individual stocks or securities. He is eternally long the U.S equity market, primarily through tax-advantaged accounts.