Stock Market Today: Nasdaq Closes in Correction Territory

After a choppy trading session for stocks, all three major benchmarks ended the day in the red.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

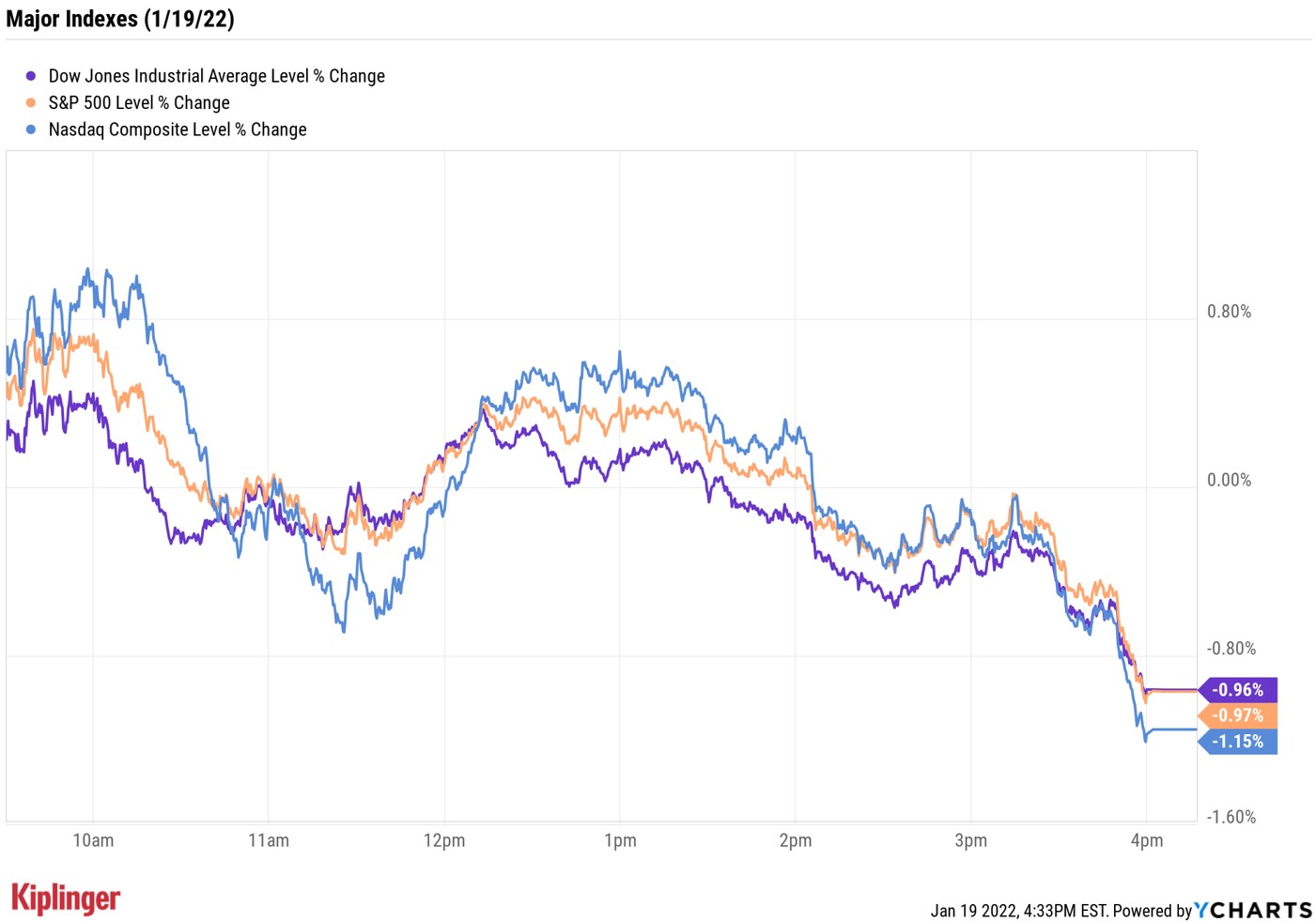

The stock market kept investors on edge today, with the major benchmarks bouncing back and forth between positive and negative territory.

Bank stocks remained in focus following the latest round of fourth-quarter earnings reports, though today's reactions were mixed.

State Street (STT, -7.1%) was a notable decliner as lower-than-expected servicing fees revenues overshadowed higher-than-anticipated profit and revenue, while U.S. Bancorp (USB, -7.8%) slid after posting disappointing earnings and net interest income.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Bank of America (BAC, +0.4%), on the other hand, edged higher after its top- and bottom-line beats, while Wall Street also welcomed the financial firm's forecast of growth in noninterest expenses – which include employee salaries – to be roughly flat in 2022. (Goldman Sachs took a beating yesterday for noting that rising compensation costs were taking a bite.)

Overall, the financial sector (-1.7%) was one of the biggest laggards on the Street today, second only to consumer discretionary (-1.8%).

"Prior to last Friday, when the first round of earnings started to hit, the Financial Select Sector SPDR ETF was up 9.5% [from its December lows] while the S&P Regional Banking ETF was up 17%," says Michael Reinking, senior market strategist for the New York Stock Exchange. "This made the bar very high for this group coming into the reporting season."

After a choppy intraday session, the Dow Jones Industrial Average (-1% at 35,028), S&P 500 Index (-1% at 4,532) and the Nasdaq Composite (-1.2% at 14,340) all ended the day in the red – the last of the three closing in official correction territory (a drop of 10% or more from a peak).

Other news in the stock market today:

- The small-cap Russell 2000 gave back 1.6% to land at 2,062.

- U.S. crude oil futures surged 1.8% to settle at $86.96 per barrel, their loftiest settlement in more than seven years.

- Gold futures jumped 1.7% to finish at $1,843.20 an ounce.

- Bitcoin slipped 0.4% to $41,638.31. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Procter & Gamble (PG, +3.4%) reported fiscal second-quarter earnings of $1.66 per share and revenue of $20.95 billion, beating analysts' consensus estimates for earnings of $1.65 per share and revenue of $20.34 billion. The company credited price increases for its strong quarter and said more are slated to take effect this quarter. "We reiterate our Buy, viewing PG's best-in-class supply chain and dominant pricing power as a significant competitive advantage during this difficult operating environment," says CFRA Research analyst Arun Sundaram. "While PG is facing higher costs, it is translating into broad-based market share gains, which could prove to be much stickier than recent inflation trends."

- SoFi Technologies (SOFI) surged 13.7% after the San Francisco-based fintech firm received approval from both the the Office of the Comptroller of the Currency (OCC) and the Federal Reserve to become a bank holding company. SOFI plans to close on its acquisition of California communitiy lender Golden Pacific Bancorp in February, at which point it can operate SoFi Bank, its bank subsidiary. "We're initiating coverage of SoFi with an Outperform [Buy] rating and a $20 price target, which represents ~60% upside [to Tuesday's close]," wrote Wedbush analyst David Chiaverini in a note. "The company is a one-stop shop for financial services and this is a significant competitive advantage over neobank competitors who tend to focus on niche offerings rather than the full financial picture; plus its streamlined product offering makes it well-positioned versus legacy consumer finance providers including traditional banks who are viewed by younger cohorts as being outdated, not fee-friendly, and have friction in the cross-selling process given business segments tend to operate in silos."

How Investors Can Find Zen

There have been plenty of Wall Street experts sounding the alarm that the recent bout of volatility could continue in the near term.

And for many in the market, these choppy waters could have them struggling to remain calm – but all hope is not lost.

One way for investors to find zen amid the uncertainty is by letting someone else – namely skilled, seasonal managers – guide them and their portfolios.

For 401(k) investors, we've recently culled the most popular mutual fund options for retirement savers, including those from top brokerage firms like T. Rowe Price, Fidelity, Vanguard and American Funds.

We also have our running list of the best low-fee mutual funds investors can buy. Several of our picks have changed over the last year to account for the changing dynamics of both the market and the economy, but one thing has stayed the same: Our Kiplinger 25 is made up of our favorite low-cost funds managed by tenured stock pickers. Check them out.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Americans, Even With Higher Incomes, Are Feeling the Squeeze

Americans, Even With Higher Incomes, Are Feeling the SqueezeA 50-year mortgage probably isn’t the answer, but there are other ways to alleviate the continuing sting of high prices

-

Hiding the Truth From Your Financial Adviser Can Cost You

Hiding the Truth From Your Financial Adviser Can Cost YouHiding assets or debt from a financial adviser damages the relationship as well as your finances. If you're not being fully transparent, it's time to ask why.

-

How to Manage a Disagreement With Your Financial Adviser

How to Manage a Disagreement With Your Financial AdviserKnowing how to deal with a disagreement can improve both your finances and your relationship with your planner.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Adds 211 Points as Greenland Tensions Ease: Stock Market Today

Nasdaq Adds 211 Points as Greenland Tensions Ease: Stock Market TodayWall Street continues to cheer easing geopolitical tensions and President Trump's assurances that there will be no new tariffs on Europe.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

Dow Dives 870 Points on Overseas Affairs: Stock Market Today

Dow Dives 870 Points on Overseas Affairs: Stock Market TodayFiscal policy in the Far East and foreign policy in the near west send markets all over the world into a selling frenzy.

-

How the Stock Market Performed in the First Year of Trump's Second Term

How the Stock Market Performed in the First Year of Trump's Second TermSix months after President Donald Trump's inauguration, take a look at how the stock market has performed.