How to Invest for Rising Data Integrity Risk

Amid a broad assault on venerable institutions, President Trump has targeted agencies responsible for data critical to markets. How should investors respond?

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

"How to invest for rising data-integrity risk..." What does that even mean?

If you're reading this story, you're probably an investor. And, if you're an investor, you're probably well aware of the Bureau of Labor Statistics (BLS) and the Securities and Exchange Commission (SEC) and what those agencies do, generally speaking.

So you probably have an opinion about questions of data integrity. At the same time, as a trader friend of mine, a pro, likes to say, "Price is the only thing that pays."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

And I have good news for you: You can express your opinion in the form of a hypothesis, test it in the market, perhaps even profit from it.

And, if there is an actionable market response to recent changes inside the executive branch and/or President Donald Trump's public statements about SEC reporting, here are some ways to play it.

Let's take a quick look at why markets are focused on questions of data integrity. Then we'll see how to invest for rising data-integrity risk.

Why questions around data integrity are rising right now

Data integrity was a bigger deal than it otherwise would have been when the Department of Labor's Bureau of Labor Statistics announced late on Friday, September 19, that it was delaying the release of results of its 2024 Consumer Expenditures Surveys "with no explanation," multiple financial media headlines noted.

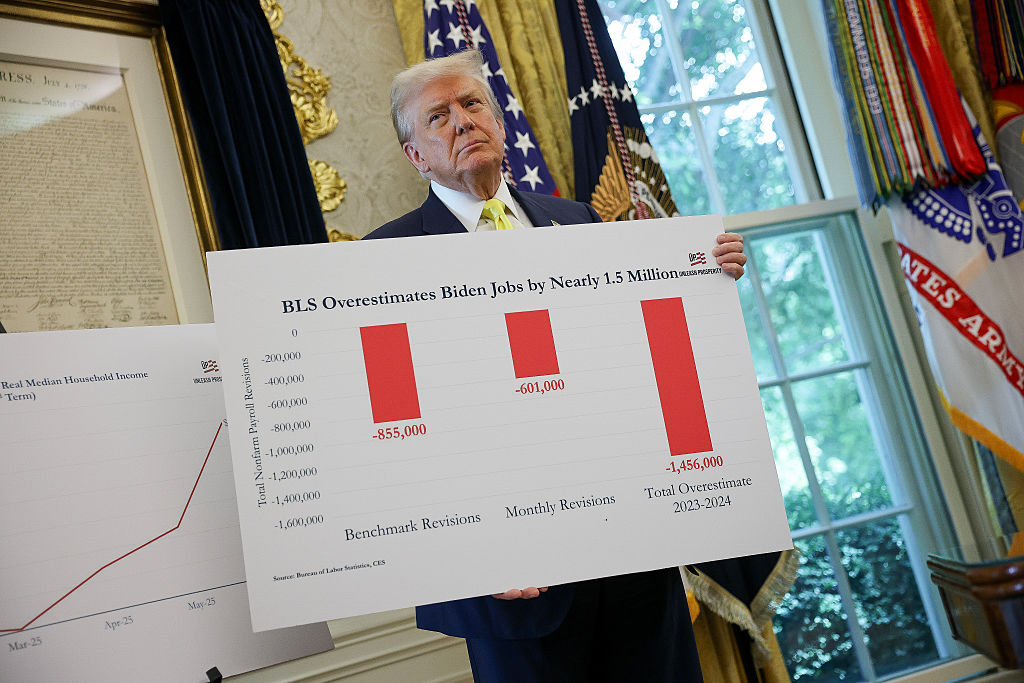

Markets have been unusually curious about what's happening inside the executive agency since August 1, when President Trump fired Commissioner Erika McEntarfer after the BLS reported weak jobs growth in July, including major downward revisions to May and June hiring numbers.

President Trump said on Truth Social that McEntarfer had "RIGGED" jobs figures "to make the Republicans, and ME, look bad" and removed the labor economist from her role running the BLS data-collection effort.

There was no similar social media reaction to the dismal August jobs report and a subsequent BLS annual update showing the U.S. economy created nearly a million fewer jobs from April 2024 through March 2025 than initially estimated.

However, on September 10, the Labor Department's Office of Inspector General opened an investigation into "the challenges that Bureau of Labor Statistics encounters collecting and reporting closely watched economic data."

The letter informing Acting Commissioner William J. Wiatrowski of the inquiry specifies changes to inflation-data collection efforts as well as employment situation surveys.

Alas, as the BLS revealed on Monday, September 22, the delayed release of the Consumer Expenditures report was due to a tabulation discrepancy traceable to a redesign of the questionnaire implemented in 2024 "to reduce respondent burden and improve data quality."

And, as labor economist Guy Berger notes, it's a "very reasonable and completely warranted" explanation. Of course, the BLS probably could have said the very same thing Friday afternoon.

It might have prevented some drama, even perhaps a bit of erosion of public confidence in the integrity of the data government agencies collect, process and disseminate.

And it's hard not to catch a cool drift from the White House, what legal scholars might even describe in "chilling effect" terms.

Trump vs quarterly reporting

The prevailing environment also includes President Trump's suggestion of a major change to the timing and frequency of company reporting to the SEC.

Rather than public companies releasing quarterly reports, Trump suggests semi-annual submissions to the SEC and the market so managers can focus on running their companies and turn down the temperature on earnings season.

"This is exactly backward," writes Ritholtz Wealth Management Chairman and Chief Investment Officer Barry Ritholtz. "In the real world," he adds, "human behavior emphasizes what occurs less often – meaning doing something less frequently gives it an even greater significance than something that becomes routine or common."

Ritholtz suggests twice-a-year earnings reporting will "become overwhelmingly intense" and generate "such focus on it that any company that misses analysts' forecast will find their stock price shellacked."

Bottom line, according to Ritholtz, "This is counterproductive."

Trump's argument resembles one made by Berkshire Hathaway (BRK.B) Chairman and CEO Warren Buffett and JPMorgan Chase (JPM) CEO Jamie Dimon in a 2018 opinion piece for The Wall Street Journal. Buffett and Dimon made a somewhat different point: Public companies should curtail or stop offering earnings guidance.

As Buffett and Dimon wrote, "Our views on quarterly earnings forecasts should not be misconstrued as opposition to quarterly and annual reporting. Transparency about financial and operating results is an essential aspect of U.S. public markets, and we support being open with shareholders about actual financial and operational metrics."

They conclude that "U.S. public companies will continue to provide annual and quarterly reporting that offers a retrospective look at actual performance so that the public, including shareholders and other stakeholders, can reliably assess real progress."

Trump vs the Fed

The environment also includes the president's ongoing effort to impose his will on the Federal Reserve, with his attempt to fire Fed Governor Lisa Cook now a Supreme Court case.

At issue, from the market's perspective, is the ability of the world's most important central bank to conduct monetary policy and set interest rates independent of political influence.

Now that you know why data integrity is at risk, here are some potential ways to position your portfolio.

Short the dollar

If you think all of the change in Washington, D.C. undermines the U.S. role in the global economy, you can short the dollar.

The Invesco DB U.S. Dollar Index Bearish Fund (UDN) tracks the Deutsche Bank Short USD Currency Portfolio Index.

The index uses short U.S. Dollar Index (DXY) futures contracts to replicate being short the dollar against a basket of those six major world currencies.

UDN is a liquid and convenient way to bet against the buck and invest in rising data-integrity risk.

Long Europe

Another way to invest in rising data-integrity risk is to increase your overseas exposure.

Indeed, broad questions about the stability of U.S. institutions is one reason why investing abroad could pay off.

A basket of the best European stocks will do well when the euro is appreciating vs the dollar.

And the euro has appreciated 12.8% this year amid broad and lingering uncertainty about President Trump's tariffs.

Look for expatriates

Buying stocks of U.S.-based companies with significant overseas revenue can provide a "natural hedge" against U.S. dollar risk.

A weaker dollar makes it cheaper for multinational companies to convert foreign profits into U.S. currency. At the same time, a softer buck boosts the competitiveness of exporters' products.

A lot depends on hedging policies as well as geographic exposures. Still, big, familiar multinational companies such as Magnificent 7 stocks Apple (AAPL), Alphabet (GOOGL) and Microsoft (MSFT) generate significant revenue overseas.

Among the best large-cap stocks to buy are global oil and gas exploration and production outfits Chevron (CVX) and Exxon Mobil (XOM). Miners such as Newmont (NEM) and health care companies such as Johnson & Johnson (JNJ) also generate significant overseas revenue.

All are good candidates when it comes to how to invest for rising data-integrity risk.

Be a Gold Bug

Perhaps you think Trump's moves will lead to a historic sell-off where correlations go to one and people sell what they can, when they can.

How to invest for rising data-integrity risk is basically a moot question at this point. Holding physical gold is probably your best bet.

Indeed, as the U.S. dollar has declined from a two-year high in January, what's widely recognized as the world's first medium of exchange and its first investment has made new all-time high after new all-time high.

Low-cost gold ETFs with exposure to the physical metal are an efficient way to provide a hedge with potential upside.

Making America great again, again

Maybe you think too much is made of noisy monthly jobs reports and inflation numbers that not even the Federal Reserve prioritizes.

If you see a lot of sound and fury signifying nothing, from the president and/or market Cassandras, you can go long and/or stay long the U.S.

In fact, the U.S. Dollar Index has declined nearly 12% since hitting an intraday peak of 110.18 on January 13. It's down nearly 10% for the year to date.

Indeed, you might say what's happening in Washington, D.C. is already priced in and the risk now is to the upside.

Related content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

David Dittman is the former managing editor and chief investment strategist of Utility Forecaster, which was named one of "10 investment newsletters to read besides Buffett's" in 2015. A graduate of the University of California, San Diego, and the Villanova University School of Law, and a former stockbroker, David has been working in financial media for more than 20 years.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Why Invest In Mutual Funds When ETFs Exist?

Why Invest In Mutual Funds When ETFs Exist?Exchange-traded funds are cheaper, more tax-efficient and more flexible. But don't put mutual funds out to pasture quite yet.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.