The 25 Biggest U.S. IPOs of All Time

The biggest IPOS in U.S. history include a major chipmaker, a ride-hailing firm and a handful of global telecoms.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Initial public offerings (IPOs) are the process companies use to tap the public stock markets for capital. These offerings usually involve early stage businesses that are looking for fresh fuel for growth; many are small opportunities, but the biggest IPOs can create mammoth returns for investors.

Consider if you invested $10,000 in the IPO of Amazon.com (AMZN) back in 1997. The e-commerce company's per-share offering price was $18. There have been multiple stock splits over the years, so if you held onto your original investment, you would now own 133,200 AMZN shares. What's more, the value of your investment would be roughly $26.6 million. That's more than enough for most folks to retire on.

But IPOs aren't guaranteed tickets to riches, as notable dot-com implosions Pets.com and Webvan proved. However, whenever there is a chance to snag high returns — even with the hottest upcoming IPOs — there are always lots of risks lurking.

Public offerings are not only relegated to startup companies. Some of the biggest IPOs come from multi-billion dollar organizations that have been around for decades. These will often lead to huge deals.

Among the most popular deals so far in 2025, the IPO of AI infrastructure provider CoreWeave (CRWV) raised roughly $1.5 billion for the company and valued it at approximately $23 billion.

But what are the biggest IPOs in U.S. history? Here, we take a look at the largest 25 public offerings ever to grace U.S. markets. (Data is courtesy of Renaissance Capital, unless otherwise noted.)

China Mobile Limited

- IPO date: October 22, 1997

- Amount raised in IPO: $4 billion

- Offer price: $11.50

In 1997, a financial crisis in Asia impacted countries including South Korea, Indonesia and Thailand. There were widespread worries about the ability to finance debt obligations, especially for real estate, and volatility with foreign currencies.

Despite this, China Mobile Limited was able to pull off its public, raising $4 billion in Hong Kong and New York — making it one of the biggest IPOs ever. This was part of China's government policy to privatize some of its massive asset holdings.

Investors saw this as a lucrative opportunity to get exposure to China's growth potential. Many of these assets were actually from cellular customers and from higher-income regions of the country, like Guangdong.

China Mobile has since expanded into various new businesses. Some include cloud computing and the IoT (Internet-of-Things). There are currently 985 million mobile customers and 286 million wireline broadband customers.

By the summer of 2021, the company would delist from the New York Stock Exchange (NYSE) because of stricter federal regulations, though shares are still traded on other global exchanges, including in Hong Kong and Shanghai.

Banco Santander Brasil

- IPO date: October 6, 2009

- Amount raised in IPO: $4 billion

- Offer price: $13.50

The Banco Santander Brasil (SAN) offering was a spinoff of Banco Santander, the largest bank in Spain, but it got off to a rocky start. Investors were still hesitant to invest in banks back in 2009 because of the collapse of Lehman Brothers the previous year.

Santander was the third largest bank in Brazil at the time in terms of the asset base, representing roughly 10.2% of the market. The bank had bulked up with aggressive acquisitions. In the first half of 2009, the bank posted $1.25 billion in profits.

The financial firm set aside a portion of the proceeds raised from one of the biggest IPOs ever to open roughly 600 branches over a five-year period. Less than half of the Brazilian population did not have a checking account at that time.

But since the public offering, the financial stock has been a disappointment for investors since the public offering. SAN's American depositary shares (ADS) have since lost more than half of their value.

Blackstone Group

- IPO date: June 21, 2007

- Amount raised in IPO: $4.1 billion

- Offer price: $31.00

A key to the success for the Blackstone Group (BX), a private equity firm, has been its ability to anticipate major market cycles. So it should surprise nobody that Blackstone's IPO was impeccably timed.

Blackstone went public near the peak of the private-equity boom, and a year before the financial crisis took hold.

The IPO was a big-time payday for the firm's co-founders, with CEO Stephen Schwarzman snagging $677 million, and Peter Peterson pulling in a cool $1.9 billion. They founded the company in 1985 by contributing $400,000 in capital.

Blackstone Group has continued to be dominant in the private equity world. It would go on to expand into other investment categories like insurance, credit and infrastructure. In July 2023, the firm announced that it reached $1 trillion in assets under management.

Conoco

- IPO date: October 22, 1998

- Amount raised in IPO: $4.4 billion

- Offer price: $23.00

In 1875, Isaac Elder Blake founded Continental Oil and Transportation Company, which was focused on oil, kerosene and other chemical products. He sold Continental to Standard Oil in 1884, but it was spun off in 1911 as part of a monopoly breakup.

Over the years, the company bulked up via acquisitions and eventually changed its name to Conoco. DuPont eventually acquired the company during the go-go 1980s takeover era, taking advantage of shares that were depressed because of a plunge in oil prices. But the companies weren't a good fit, and Conoco was once again shed off, via an IPO.

The 1998 offering raised $4.4 billion — a record at the time that still keeps Conoco on this list of the biggest U.S. IPOs ever. When Conoco went public, it was the sixth-largest oil company in the U.S., boasting a network of 7,900 gas stations.

Conoco eventually merged with Phillips Petroleum in 2002 to form ConocoPhilips (COP). The company today has operations in 13 countries and has about 10,000 employees. Its total assets as of December 2024 are $122.8 billion.

DiDi Global

- IPO date: June 29, 2021

- Amount raised in IPO: $4.4 billion

- Offer price: $14.00

The IPO roadshow for Didi Global, the top ride-hailing app company in China, took only three days.

The CEO boasted about the company's growth potential, underscoring the fact that a sizable amount of the populations in the Chinese cities DiDi covered did not have cars. The company was also making substantial investments in artificial intelligence (AI) and electric vehicles (EVs).

Unfortunately, the investment would turn into a disaster — and quickly. Within 11 months of its debut as one of the biggest U.S. IPOs ever, Didi delisted its shares from the NYSE due to the Chinese government's crackdown on the company. Regulators had concerns about Didi's data security, ordering it to stop taking new customers and terminating some of its apps. The result was a nearly 13% decline in the company's top line.

By the time of the delisting, the company's market capitalization had plunged to around $11 billion from above $75 billion in July 2021.

Lineage

- IPO date: July 24, 2024

- Amount raised in IPO: $4.4 billion

- Offer price: $78.00

Lineage (LINE), which calls itself the world's largest global temperature-controlled warehouse REIT, debuted with the largest IPO since Arm in 2023 when it listed on the Nasdaq on July 24, 2024.

LINE's final initial offering price of $78 was at the high end of the company’s target range of $70 to $82, and management also boosted the number of shares on offer from 74 million to 56.9 million.

Shares opened at $82 on July 25 and traded as high as $89.85 on July 31, putting a market cap north of $20 billion on the stock.

Just the second REIT to go public since 2022, according to Renaissance Capital Management, LINE has had a tough go of it since then. In January, management announced major job cuts amid slowing demand and rising inflation concerns.

Demand for cold-storage services surged during the pandemic and figured prominently in Lineage's IPO decision but has cooled amid elevated inventories and higher prices.

LINE has lost more than 46% since its IPO vs a gain of more than 25% for the S&P 500 and now carries a market cap of less than $9 billion.

Coupang

- IPO date: March 11, 2021

- Amount raised in IPO: $4.6 billion

- Offer price: $35.00

When Bom Kim dropped out of the Harvard MBA program in 2010, he started Coupang (CPNG). He saw a huge opportunity to build an e-commerce platform in South Korea, Asia's fourth-largest economy by gross domestic product (GDP).

The focus was to create a marketplace like China's Alibaba Holdings (BABA) that would allow for an extensive product selection. But Kim also built a distribution network with warehouses and logistics systems, similar to Amazon.com.

The strategy worked. From 2018 to 2021, revenue soared to $12 billion from $900 billion. A major catalyst for the company's top line was the COVID-19 pandemic as consumers in lockdown had little choice but to use Coupang's service.

Unfortunately, in a story similar to many pandemic darlings, growth cooled as the world returned to normal, and CPNG shares came under pressure. By July 2024, the stock had lost more than 50% of its initial value.

CIT Group

- IPO date: July 2, 2002

- Amount raised in IPO: $4.6 billion

- Offer price: $23.00

Conglomerate Tyco bought top business lender CIT in 2001, then tried unsuccessfully to sell it back off in early 2002. Management then switched gears to spin it off with an IPO instead.

Wall Street wasn't very enthusiastic about the CIT Group deal, in part because Tyco CEO Dennis Kozlowski had abruptly resigned a month earlier over reports he was being investigated over dodging taxes.

The IPO priced below its original range, and the financial stock fell by 4% on its first day of trading. Still, the offering raised a hefty $4.6 billion — still one of the biggest U.S. IPOs ever — most of which was used to pay down Tyco's massive debt load, which it accumulated because of an aggressive M&A spree.

The company eventually had to file for bankruptcy in late 2009 amid the financial crisis, and shareholders were wiped out. But CIT Group remained, albeit with a massive restructuring.

In January 2022, CIT Group merged with First Citizens BancShares in an all-stock deal worth roughly $2.2 billion.

Arm

- IPO date: September 13, 2023

- Amount raised in IPO: $4.6 billion

- Offer price: $51.00

The origins of Arm Holdings (ARM) go back to 1990. The company was a joint venture of Apple (AAPL), VLSI Technology and Acorn Computer, and its focus was to build cutting-edge semiconductors for computers with batteries. With the growth in mobile devices, Arm's strategy was spot on.

In 1998, the company would go public on the London Stock Exchange. Then, in 2016, Japanese conglomerate SoftBank agreed to shell out $32 billion for Arm. A few years later, Nvidia (NVDA) attempted to acquire the company for $40 billion, but regulators blocked the deal.

Arm's valuation would continue to rise. By the summer of 2023, SoftBank took the semiconductor stock public at a market capitalization of roughly $55 billion — making the Arm IPO one of the biggest on record.

Currently, the company's chips are inside nearly all smartphones. However, amid a maturing market, Arm is looking to expand into other categories like data centers and AI. In its most recently completed fiscal year, the company reported revenue of $3.2 billion.

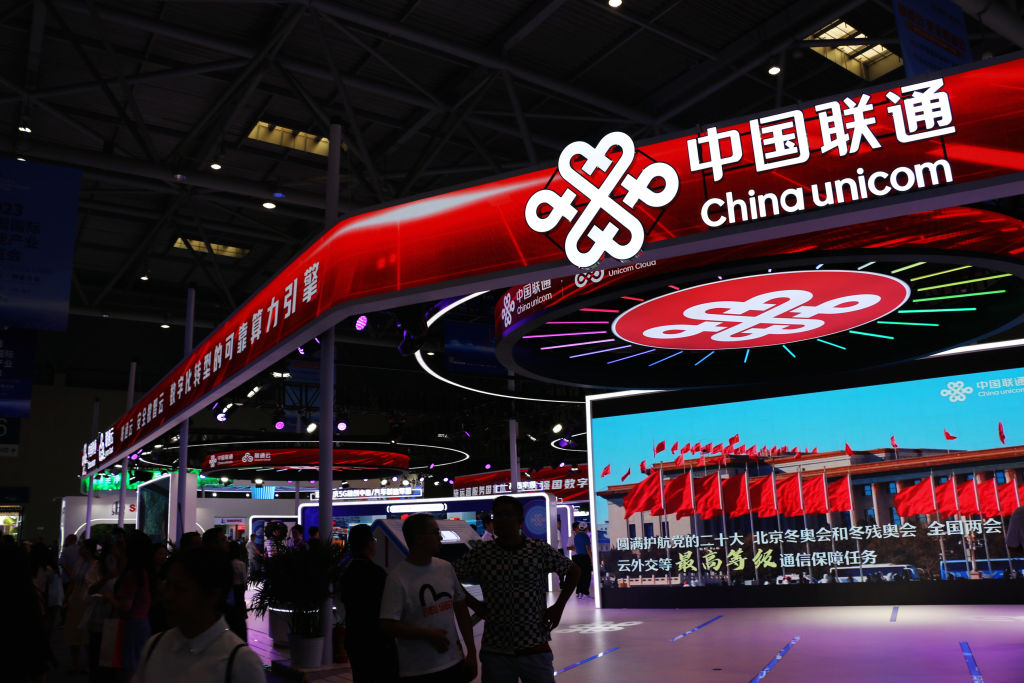

China Unicom

- IPO date: June 21, 2000

- Amount raised in IPO: $4.9 billion

- Offer price: $19.99

By summer 2000, American markets were under intense pressure from the dot-com bubble burst, but that didn't deter Chinese telecom company China Unicom. The firm pulled off a $4.9 billion deal — at the time, the biggest U.S. IPO ever by a Chinese company — to list on the New York Stock Exchange, and even managed to gain 12% on its first day. Shares also were offered in Hong Kong.

China Unicom, the second largest telecom company in China at the time, was a division of state-run China United Telecommunications. CHU held about 14% market share, including strong footprints in Beijing, Shanghai and Tianjin. Half of its revenue came from paging.

Currently, the company has 1.1 billion subscribers and has found growth in categories like cybersecurity, IoT and big data.

China Unicom delisted from the NYSE in 2021.

Infineon

- IPO date: March 13, 2000

- Amount raised in IPO: $5.2 billion

- Offer price: $33.92

In 2000, German chipmaker Infineon Technologies (IFNNY) wanted to get a piece of the dot-com action in the U.S. — and it worked. The deal was the second-biggest for a German company — second only to Deutsche Telekom (DTEGY) — and shares more than doubled, to $70 per share from a $33.92 offering price.

Infineon was a division of old-line industrial operator Siemens (SIEGY) and was ranked No. 10 in the world among chipmakers, in terms of total sales. Siemens, by the way, had enjoyed deal-making success a year earlier with an IPO of its Epcos division.

Infineon Technologies delisted from the New York Stock Exchange in 2007, but still trades on the Frankfurt Exchange, as well as over-the-counter in the U.S. It has a strong footprint in key markets such as self-driving vehicles and IoT. Its power and smart card ICs are No. 1 in market share. In fiscal 2024, revenue came to more than 15 billion euros and there were 58,000 employees worldwide.

United Parcel Service

- IPO date: November 10, 1999

- Amount raised in IPO: $5.5 billion

- Offer price: $50.00

In 1907, James Casey created the American Messenger Company, which offered parcel and special-mail service primarily by foot and bicycle. However, it upgraded its "fleet" with its first Ford Model T in 1913, and six years later, it took on the name we know it by now: United Parcel Service (UPS).

UPS built a massive business without much need for outside capital. In fact, UPS didn't go public until 1999 — compare that to rival FedEx (FDX), which was founded in 1971 and went public in 1978.

Demand for the UPS IPO was so robust that the deal had to be delayed by 45 minutes. Shares ended their first day of trading up 36%. And unlike many offerings, employees collected a nice windfall; they collectively owned about a third of the company's shares.

Since its massive IPO, UPS has continued to thrive. In fiscal year 2024, the company posted $91 billion in revenue and delivered 5.7 million packages per day across more than 200 countries and territories.

Swisscom

- IPO date: October 5, 1998

- Amount raised in IPO: $5.6 billion

- Offer price: $25.00

In 1851, Switzerland's government created a telegraph network to run through the country. This would later become the system for telephones across Switzerland. The organization would later come to be known as Swisscom (SCMWY), and it continues to adapt quickly to emerging technologies like the mobile networks.

In the 1990s, the Swiss government felt that the best strategy for growth and innovation was to privatize Swisscom. To do this, it held a public offering that raised $5.6 billion in the U.S. and a total of $7.1 billion on a global basis — securing its place on this list of the biggest IPOs ever.

The party didn't last long, though, and in 2007, Swisscom delisted its shares from the NYSE. The main reason was that the costs and regulations were too onerous given the low trading volume. The stock is still traded over-the-counter.

Today, Swisscom has 56% of market share in mobile communications in Switzerland and 50% of the broadband category.

Telstra

- IPO date: November 17, 1997

- Amount raised in IPO: $5.6 billion

- Offer price: $25.00

Similar to Swisscom's history, Telstra (TLGPY) originated from Australia's telecom system, which came under the Postmaster-General Department's watch back in 1901. In 1993, the system was renamed to Telstra, whose name is a mashup of "telecommunications" and "Australia."

As competition became more intense, Australia's government set forth a program for privatization of Telstra in 1997. The first step was a partial IPO of Telstra. The offering resulted in a $5.6 billion haul from investors.

As of now, Telstra remains Australia's top telecom operator. The company has 22.5 million retail mobile customers.

Telstra delisted from the NYSE in 2006, but still trades over-the-counter in the U.S.

France Telecom

- IPO date: October 17, 1997

- Amount raised in IPO: $7.3 billion

- Offer price: $32.00

In 1878, the French government created the Ministry of Posts and Telegraphs. This would be the country's exclusive telecommunications organization that would eventually become France Telecom.

By the mid-1990s, the French government began the privatization of various state-owned businesses. One of its most prized assets was France Telecom. The timing of the public offering was also favorable, as it came during the dot-com bubble. Investors were optimistic that the platform could be leveraged as valuable internet infrastructure.

In 2007, France Telecom changed its name to Orange (ORAN). It was a recognition that the company had expanded its platform into different business segments. Orange was also a more memorable brand for consumers.

Currently, Orange has 287 million customers.

Uber Technologies

- IPO date: May 10, 2019

- Amount raised in IPO: $8.1 billion

- Offer price: $45.00

Garrett Camp and Travis Kalanick founded Uber Technologies (UBER) in 2009. They would create one of the killer apps for the smartphone era.

The founders were aggressive in their growth strategies. They raised huge amounts of capital and quickly built an extensive network.

But some of the moves were controversial. For one, Uber built software to circumvent the efforts of regulators. Then there were various sexual harassment and discrimination claims. There were also problems with the company's self-driving car efforts, namely in 2018, when a pedestrian was struck and killed. In 2017, Kalanick resigned as CEO.

When Uber went public, the company raised a hefty $8.1 billion — making it one of the biggest IPOs ever. The deal turned out to be a dud, though, with shares falling nearly 8% on their first day of trading. Within a year, they would lose more than half their value.

However, the stock has put in a solid performance on the price charts in recent years and is now up more than 61% from its offer price.

Kraft Foods

- IPO date: June 13, 2001

- Amount raised in IPO: $8.7 billion

- Offer price: $31.00

Philip Morris International (PM), which had purchased Nabisco in 2000, spun off Kraft Foods in 2001, using much of the offering's proceeds to pay down debt from the acquisition.

Kraft Foods at the time had a nice portfolio of brands, including Kraft Macaroni & Cheese, Maxwell House, Philadelphia Cream Cheese, Oreo and Oscar Mayer. It also had an interesting leadership structure that included co-CEOs, and Philip Morris' CEO was the chairman.

Nonetheless, even one of the biggest IPOs in U.S. history spurred little investor interest, with shares rising just 1% on their first day of trading.

In 2012, Kraft announced it would split off its North American grocery business as Kraft Foods Group, with the remaining snack-foods company to be renamed Mondelez International (MDLZ). Three years later, Kraft Foods Group merged with Heinz to become Kraft Heinz (KHC) in a deal facilitated by Warren Buffett's Berkshire Hathaway (BRK.B) and global investment firm 3G Capital.

AT&T Wireless Group

- IPO date: April 27, 2000

- Amount raised in IPO: $10.6 billion

- Offer price: $29.50

The AT&T Wireless IPO came at the peak of the dot-com boom, as parent company AT&T wanted to capitalize on the frenzy. The deal was done by issuing "tracking stock." This tracking stock essentially trades based on the performance of a company's division, but doesn't require the company to yield any control of the unit or spin off the division's actual operations.

AT&T Wireless was growing at a fast pace, as were other mobile companies including Sprint and Nextel. Revenue spiked by 41% year-over-year to $7.6 billion in 1999 and the firm boasted 12 million subscribers. So no one was surprised when AT&T raised a then-record $10.6 billion in one of the biggest U.S. IPOs ever, a year after UPS' $5.5 billion raise.

AT&T Wireless eventually sold out to Cingular Wireless — itself a joint venture between SBC Communications and BellSouth, which were broken off from the original AT&T — in 2004 for $41 billion. SBC eventually took on the AT&T brand as AT&T Inc. (T).

Rivian Automotive

- IPO date: November 10, 2021

- Amount raised in IPO: $11.9 billion

- Offer price: $78.00

From an early age, RJ Scaringe would restore cars in his neighbor's garage. But over time, he saw that there needed to be alternatives to fossil-fuel vehicles.

This led him to focus on getting an education in advanced mechanical engineering. He would eventually receive a doctorate from the Massachusetts Institute of Technology's (MIT) Sloan Automotive Lab. After this, he started his own company to build cars in 2009. It would become Rivian Automotive (RIVN) and the vision was to create electric-powered trucks and SUVs.

Pulling this off required more than innovation. Scaringe had to raise billions of dollars to build the infrastructure. Some of his backers were Amazon and Ford Motor (F).

When Scaringe took the company public in late 2021, he was able to raise a hefty $11.9 billion. This was even AS the company generated minimal revenue and had lost about $2 billion since 2020.

The IPO got a strong reception from Wall Street. On Rivian's first day of trading, shares shot up by nearly 30% and the market value of the company was over $100 billion.

But Rivian was not able to keep up the momentum. The stock is now down more than 85% from its IPO price.

Deutsche Telekom

- IPO date: November 17, 1997

- Amount raised in IPO: $13 billion

- Offer price: $17.00

The West German government created Deutsche Telekom (DTEGY) a few years after World War II. The organization has undergone several restructurings since then and the privatization process began in early 1995.

In late 1997, the government launched a massive IPO for Deutsche Telekom, raising roughly $13 billion in fresh capital.

The deal was challenging, though. For the most part, the growth started to slow down and competitive pressures took a toll. A key advantage for Deutsche Telekom, though, was that it had a monopoly in Germany for internet services.

Today, the company is one of the world's largest telecom operators, with 245 mobile customers and 21 million broadband lines. It has operations in over 50 countries.

While the communication services stock delisted from the NYSE in 2010, it is still traded over-the-counter.

General Motors

- IPO date: November 18, 2010

- Amount raised in IPO: $15.8 billion

- Offer price: $33.00

General Motors (GM) has a rich history dating back to 1908, spanning iconic brands (current and defunct) such as Chevrolet, Cadillac, GMC, Pontiac, Hummer, Saturn and Opel.

However, it was not immune to the financial crisis, and it in fact succumbed in June 2009, when it filed for bankruptcy. This included a $50 billion bailout from the federal government that sparked the nickname "Government Motors."

But GM was able to get its house in order. The company worked aggressively to cut costs, streamline operations, revamp the lineup and invest more in the Chinese market.

The result? General Motors was able to launch a successful IPO a couple years later. It reduced its obligations to the U.S. government by $22 billion (and fully paid off the government by 2015), and it made a $4.7 billion profit in 2011 — its first positive annual earnings since 2004.

The stock, on a price basis, has done well for investors, returning nearly 50% from its IPO price.

- IPO date: May 18, 2012

- Amount raised in IPO: $16.0 billion

- Offer price: $38.00

There was plenty of drama in the lead-up to the Facebook IPO. Facebook's prospectus noted that user-base growth likely would slow. The mobile side of the business was lagging. And CEO Mark Zuckerberg didn't win any friends when he wore a hoodie to his investor presentation, leading many to believe he had a lackadaisical attitude toward the process.

The day of the IPO was no better. Facebook's deal pricing was delayed because of a Nasdaq glitch that resulted in roughly $500 million in losses across numerous Facebook investors.

The situation got worse in the next few months, as Facebook plunged below $20 per share.

But Zuckerberg didn't flinch. He swiftly focused on investing in mobile, including upgrading the original Facebook app and also making deals for image-based social media company Instagram and messaging service WhatsApp. Facebook more than recovered. By August 2021, the shares fetched over $380.

Later that year, Zuckerberg took a big bet on the metaverse and changed the name of the company to Meta Platforms (META). However, the results were mostly disappointing and expensive. Zuckerberg has since cut back on costs and invested heavily in AI, and the Magnificent 7 stock staged a nice comeback.

Enel SpA

- IPO date: November 2, 1999

- Amount raised in IPO: $16.5 billion

- Offer price: $45.23

Italian utility company Enel SpA (ENLAY) had a few things weigh on its IPO — namely, it was a utility (which doesn't tend to gin up excitement), and it was a foreign operation, which also tends to hurt interest.

Wall Street's reception was an unsurprising yawn. Yes, Enel became the largest publicly traded utility in the world, but the utility stock barely budged on their first day of trading, crawling ahead by just 0.33%.

Another interesting wrinkle: Enel was state-owned. The Italian government actually used the deal to bolster its treasury, as part of a wide-scale policy of privatization and attempting to adopt the euro.

But while the Enel IPO was the second-largest deal raise in U.S. market history, the stock never got much traction. By 2007, management chose to delist from the NYSE because of low trading volumes.

Visa

- IPO date: March 18, 2008

- Amount raised in IPO: $17.9 billion

- Offer price: $44.00

On March 16, 2008, JPMorgan Chase (JPM) agreed to buy Bear Stearns for a mere $2 per share — a 93% discount to the prior close (and a price that eventually would be moved up to $10 per share) — in a deal that involved a $30 billion loan from the Federal Reserve. It sent shockwaves across Wall Street, as investors started to worry about America's largest financial institutions.

This was the environment Visa (V) had to contend with when, a couple days later, it pulled off one of the biggest IPOs in U.S. history.

This was a gutsy move by management, who wanted to make a statement that Visa was in solid financial condition. Visa operated the world's largest payments system and was owned by about 13,000 financial institutions. At the time, it had about 1.5 billion cards in use, compared to 916 million for rival Mastercard (MA). And Wall Street cheered the offering, driving V shares up 28% on their opening day.

Anyone willing to invest in Visa during this time is doing cartwheels. A $1,000 investment on V's first day of trading would be worth nearly $24,000 today.

Alibaba Group Holding

- IPO date: September 19, 2014

- Amount raised in IPO: $21.8 billion

- Offer price: $68.00

Chinese e-commerce giant Alibaba Group Holding (BABA) launched in April 1999 by its 18 founders, including its charismatic leader Jack Ma.

Ma, a former English teacher, had little business or technology experience, but he did have a compelling vision: to create a massive marketplace where Chinese businesses could sell their wares in China as well as global markets.

Alibaba's early days were challenging. Funding was difficult to come by as tech companies were folding left and right in the dot-com bubble bust . Still, the company found traction and eventually built a powerful ecosystem. By the time it launched its 2014 IPO, the company was earning roughly $3.8 billion in annual net income from 279 million active buyers.

BABA's business has since spread to other areas such as cloud computing, digital media and even self-driving vehicles. However, the company has had to deal with challenges, including intense regulatory scrutiny. The result is that the shares have been under pressure during the past few years. In fact, since the IPO, the average annual return for investors has been only about 4%.

Related content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Tom Taulli has been developing software since the 1980s when he was in high school. He sold his applications to a variety of publications. In college, he started his first company, which focused on the development of e-learning systems. He would go on to create other companies as well, including Hypermart.net that was sold to InfoSpace in 1996. Along the way, Tom has written columns for online publications such as Bloomberg, Forbes, Barron's and Kiplinger. He has also written a variety of books, including Artificial Intelligence Basics: A Non-Technical Introduction. He can be reached on Twitter at @ttaulli.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Why Invest In Mutual Funds When ETFs Exist?

Why Invest In Mutual Funds When ETFs Exist?Exchange-traded funds are cheaper, more tax-efficient and more flexible. But don't put mutual funds out to pasture quite yet.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.