If You'd Put $1,000 Into Oracle Stock 20 Years Ago, Here's What You'd Have Today

Oracle stock has been an outstanding buy-and-hold bet for decades.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Oracle (ORCL) is the latest mega-cap tech name putting up truly outstanding returns on the promise of artificial intelligence (AI), but long-time shareholders know ORCL stock has been a market-beating machine for ages.

Founded in the late 1970s, Oracle really hit its stride during the dot-com boom when it became dominant in database management systems. After the bubble burst, the company pursued an aggressive policy of acquisitions, scooping up software and hardware firms such as PeopleSoft and Sun Microsystems.

Oracle's voracious appetite transformed the company into what's known as a full-stack provider, offering enterprise customers everything from software and middleware to databases and hardware. But the acquisitions were also very expensive, pressuring margins at a time when year-over-year revenue growth was hard to come by.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Happily for Oracle shareholders, the company pivoted toward cloud computing. Undaunted by competition from the likes of Amazon.com's (AMZN) Amazon Web Services, Microsoft's (MSFT) Azure and Alphabet's (GOOGL) Google Cloud, Oracle launched Oracle Cloud Infrastructure (OCI) to provide cloud-based services for a range of enterprise needs.

When AI exploded on the scene at the end of 2022, Oracle was well positioned to take advantage of the industry's insatiable demand for computing power.

Today, Oracle has a $455 billion pipeline of contracts to supply computing power for AI. Indeed, the tech stock practically went vertical in September 2025 after the enterprise database and cloud-services provider signed a massive deal with OpenAI. The latter, which is best known for ChatGPT, agreed to buy $300 billion in computing power from Oracle over five years.

"Oracle has now partnered with the big three hyperscale cloud providers," writes Argus Research analyst Joseph Bonner, who rates shares at Buy. "It is realizing its vision of meeting its customers wherever they choose, with fully optimized performance, operability and connectivity among any and all compute surfaces."

Joining the AI gold rush allowed ORCL stock to gain 70% through the first nine months of 2025, adding about $400 billion in market cap in the process. By comparison, Buy-rated Dow Jones stocks Cisco Systems (CSCO) and International Business Machines (IBM) have market caps of about $265 billion apiece.

Thanks to ORCL's surging stock price, Executive Chairman Larry Ellison is now estimated to be the second richest person in the world after Elon Musk.

The bottom line on Oracle stock?

Oracle kind of found itself out of the conversation over the past few years. Legacy tech companies couldn't really compete for attention when the Magnificent 7 got all the glory as AI plays.

And yet ORCL stock has done very well by shareholders for a very long time.

Over its entire life as a publicly traded company, ORCL generated an annualized total return (price change plus dividends) of 19.6%. That clobbers the S&P 500's return of 10.8% over the same time frame.

Even better, ORCL stock leads the broader market by wide margins over the past one-, three-, five-, 10- and 15-year periods too.

And as for the past two decades? Oracle stock has been a big-time buy-and-hold winner.

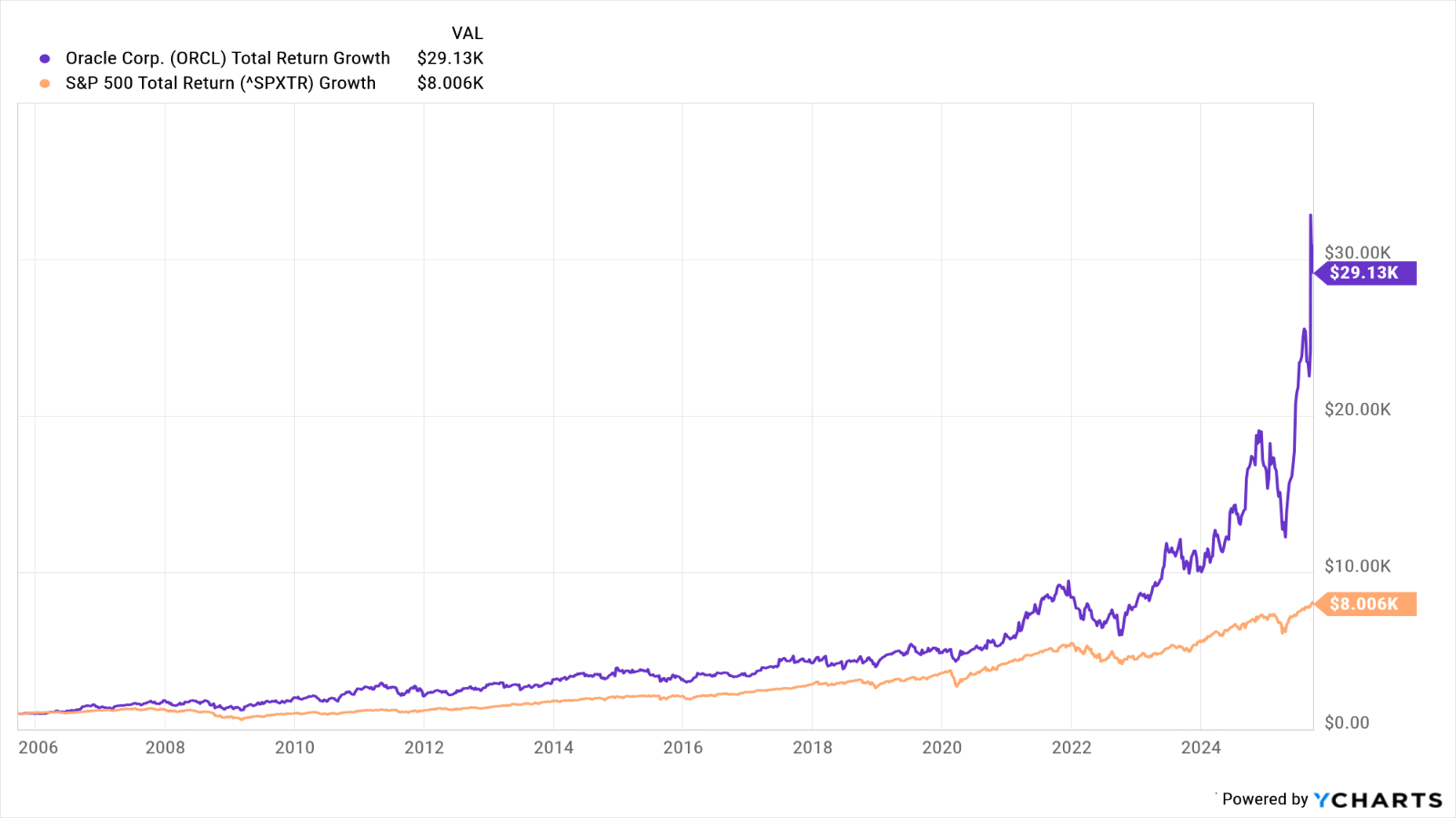

Have a look at the above chart and you'll see that if you invested $1,000 in Oracle stock 20 years ago, today your stake would be worth about $29,000 – good for an annualized total return of 18.2%.

The same amount invested in the S&P 500 would theoretically be worth about $8,000 today, or an annualized total return of 10.9%.

Wall Street likes Oracle's chance of maintaining its market-beating ways. Of the 40 analysts covering ORCL stock surveyed by S&P Global Market Intelligence, 22 call it a Strong Buy, five say Buy, 12 rate it at Hold and one says Strong Sell.

That works out to a consensus recommendation of Buy, with strong conviction to boot.

More Stocks of the Past 20 Years

- If You'd Put $1,000 Into Intel Stock 20 Years Ago, Here's What You'd Have Today

- If You'd Put $1,000 Into IBM Stock 20 Years Ago, Here's What You'd Have Today

- If You'd Put $1,000 Into Apple Stock 20 Years Ago, Here's What You'd Have Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dan Burrows is Kiplinger's senior investing writer, having joined the publication full time in 2016.

A long-time financial journalist, Dan is a veteran of MarketWatch, CBS MoneyWatch, SmartMoney, InvestorPlace, DailyFinance and other tier 1 national publications. He has written for The Wall Street Journal, Bloomberg and Consumer Reports and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among many other outlets. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange.

Once upon a time – before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily – Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing. He's also written for Esquire magazine's Dubious Achievements Awards.

In his current role at Kiplinger, Dan writes about markets and macroeconomics.

Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University.

Disclosure: Dan does not trade individual stocks or securities. He is eternally long the U.S equity market, primarily through tax-advantaged accounts.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Why Invest In Mutual Funds When ETFs Exist?

Why Invest In Mutual Funds When ETFs Exist?Exchange-traded funds are cheaper, more tax-efficient and more flexible. But don't put mutual funds out to pasture quite yet.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'"Wealth Your Way" by Cosmo DeStefano offers a highly accessible guide for young adults and their parents on building wealth through simple, consistent habits.