Nvidia (NVDA) reported fiscal 2026 third-quarter earnings report after the November 19 close. Nvidia earnings have become one of Wall Street's most anticipated events thanks to snowballing demand for all things artificial intelligence (AI).

The leader of the AI revolution reported earnings of $1.30 per share (+60.5% year over year) on revenue of $57.01 billion (+62.5% YoY). Gross margin was 73.6% vs 75.0% a year ago.

Jensen Huang's outfit expects to report fiscal fourth-quarter revenue of $65 billion, "plus or minus 2%," and gross margin of 75%, "plus or minus 50 basis points."

Analysts were calling for earnings of $1.25 per share on revenue of $54.9 billion.

"A great earnings report with higher guidance from Nvidia really shouldn't surprise anyone, but it may reinforce concerns over seemingly limitless AI capital budgets," says Dennis Follmer, chief investment officer at Montis Financial.

Follmer adds that several hyperscalers have already announced increased capital expenditures, so it will likely be another strong quarter for Nvidia. "And more importantly, we should expect the bigger hyperscaler spending to be reinforced by Nvidia raising future expectations for sales and earnings, given they are the chip of choice for such projects."

The Kiplinger team reported live on Nvidia's third-quarter earnings report, bringing you the news and our expert analysis of what the results could mean for you and your portfolio. Scroll for the latest updates.

Worried About an AI Bubble? Here's What You Need to Know | Amid Mounting Uncertainty: Five Forecasts About AI | If You'd Put $1,000 Into Nvidia Stock 20 Years Ago, Here's What You'd Have Today

Nvidia stock opens lower to start earnings week

Nvidia stock opened lower Monday morning, down 0.9% at last check. The chip stock is down more than 7% for the month to date, but has still gained nearly 42% since the start of the year.

This comes as the broader equities market trades cautiously higher at the start of the week, with the blue-chip Dow Jones Industrial Average up 0.04%, the broader S&P 500 0.1% higher and the tech-heavy Nasdaq Composite enjoying a 0.2% lead.

- Karee Venema

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021, and oversees a wide range of investing coverage, including content focused on equities, fixed income, mutual funds, ETFs, macroeconomics and more.

Can Nvidia earnings reignite the AI flame?

That's the question Matt Britzman, senior equity analyst at Hargreaves Lansdown, is asking.

"For the first time in several quarters, Nvidia enters earnings with sentiment under pressure. Shares have softened on concerns of an AI bubble and the reality that China sales are unlikely to rebound soon."

However, Britzman says the overarching picture for Nvidia "remains strong" and he believes third-quarter revenue will come in near the top end of guidance, "at around $55 billion – and scope for an upside surprise."

He believes market participants will be watching fourth-quarter guidance and any color for the year ahead.

"CEO Jensen Huang recently flagged $500 billion worth of orders on the books, and investors will be keen for clarity on timing, which could imply material upside to current forecasts. With plenty of nervousness in the air, strong results from Nvidia could be the perfect catalyst to reignite the AI flame," says Britzman.

- Karee Venema

Nvidia earnings: Harbinger of an AI bubble or proof the boom is real?

Ahead of Nvidia's earnings this week, Wall Street is worried that there's an AI bubble. In recent weeks, the sector has suffered from a spike in volatility.

According to Neil Azous, portfolio manager of Strategy Shares' Monopoly ETF (MPLY), the concerns may be overblown.

"For those worried about 'bubble' talk, the stock is already down heading into earnings, and historically every dip in Nvidia has proven profitable. The asymmetry — one day or seven days after earnings — has favored the upside. Betting against the most important company in the world, with the resources it has, has generally been a losing trade. Taken together, these factors could alleviate many current concerns," says Azous.

Brian Stutland, portfolio manager of the Rational Equity Armor Fund and the Catalyst Nasdaq-100 Hedged Equity Fund, agrees.

"The key is whether Nvidia continues hitting the targets analysts expect. Its forward price-to-earnings (P/E) ratio is around 31, which isn't extreme. This isn't like the late-'90s tech bubble, when major players traded at forward P/Es of 40 or 45," says Stutland.

He adds that Nvidia's valuation is reasonable and the company's growth helps justify it. "I'm not convinced we're at the tail end of a bubble. It would likely take a major catalyst to push the market significantly higher than expected, followed by a shakeout. As long as Nvidia delivers clarity through earnings and meets its growth targets, the higher multiples are justified, though there will still be volatility along the way."

Regardless, Nvidia is the clear bellwether. And even if there are a few small cracks in its growth story, it seems likely that the talk about the AI bubble will not go away.

- Tom Taulli

Tom Taulli has been developing software since the 1980s. He sold his applications to a variety of publications. In college, he started his first company, which focused on the development of e-learning systems. He would go on to create other companies as well, including Hypermart.net that was sold to InfoSpace in 1996. Along the way, Tom has written columns for online publications such as Bloomberg, Forbes, Barron's and Kiplinger. He has also written a variety of books, including Artificial Intelligence Basics: A Non-Technical Introduction.

What time is Nvidia's earnings release?

Nvidia will release its fiscal third-quarter earnings report after the stock market closes on Wednesday, November 19. The results typically come through around 4:20 pm to 4:30 pm Eastern Standard Time.

The release of Nvidia's earnings report will be followed by a conference call, which will begin at 5 pm EST.

Firstrade's Stephen Callahan: What investors will be watching in Nvidia's earnings

Nvidia reports earnings on November 19, and Wall Street is looking for a 17% quarter-over-quarter increase in revenue to $54.9 billion and earnings of $1.25 per share (+19% from Q2).

According to Stephen Callahan, trading behavior analyst at Firstrade Securities, those numbers look about right. "While many expect the chipmaker to beat these estimates, I agree with these numbers," he says.

Nvidia's Blackwell chips are likely to see strong demand, especially with the growth in spending on AI infrastructure for data centers. "Long-term contracts with big clients have given the chipmaker a predictable revenue pipeline," Callahan notes.

But risks remain. "The tense trade relations between the U.S. and China pose potential land mines for the company," the analyst warns. "These include stricter regulations that could affect sales."

And the growing chatter about an AI bubble could weigh on Nvidia stock.

As for what investors will watch most closely? "Strong revenue growth from the data center sector" tops the list, along with guidance on future demand, China sales, profit margins and supply chain stability.

- Tom Taulli

Does Nvidia pay a dividend?

Nvidia pays a small quarterly dividend of 1 cent per share, which works out to 4 cents per share annually.

Based on the chipmaker's current stock price, this works out to a dividend yield of 0.02%. By comparison, the S&P 500's current dividend yield is 1.2%.

In fiscal 2025, Nvidia paid roughly $834 billion in dividends. It also bought back $33.7 billion in stock.

- Karee Venema

Related: The Kiplinger Dividend 15: Our Favorite Dividend-Paying Stocks

Hedge funds bought Nvidia stock in Q3

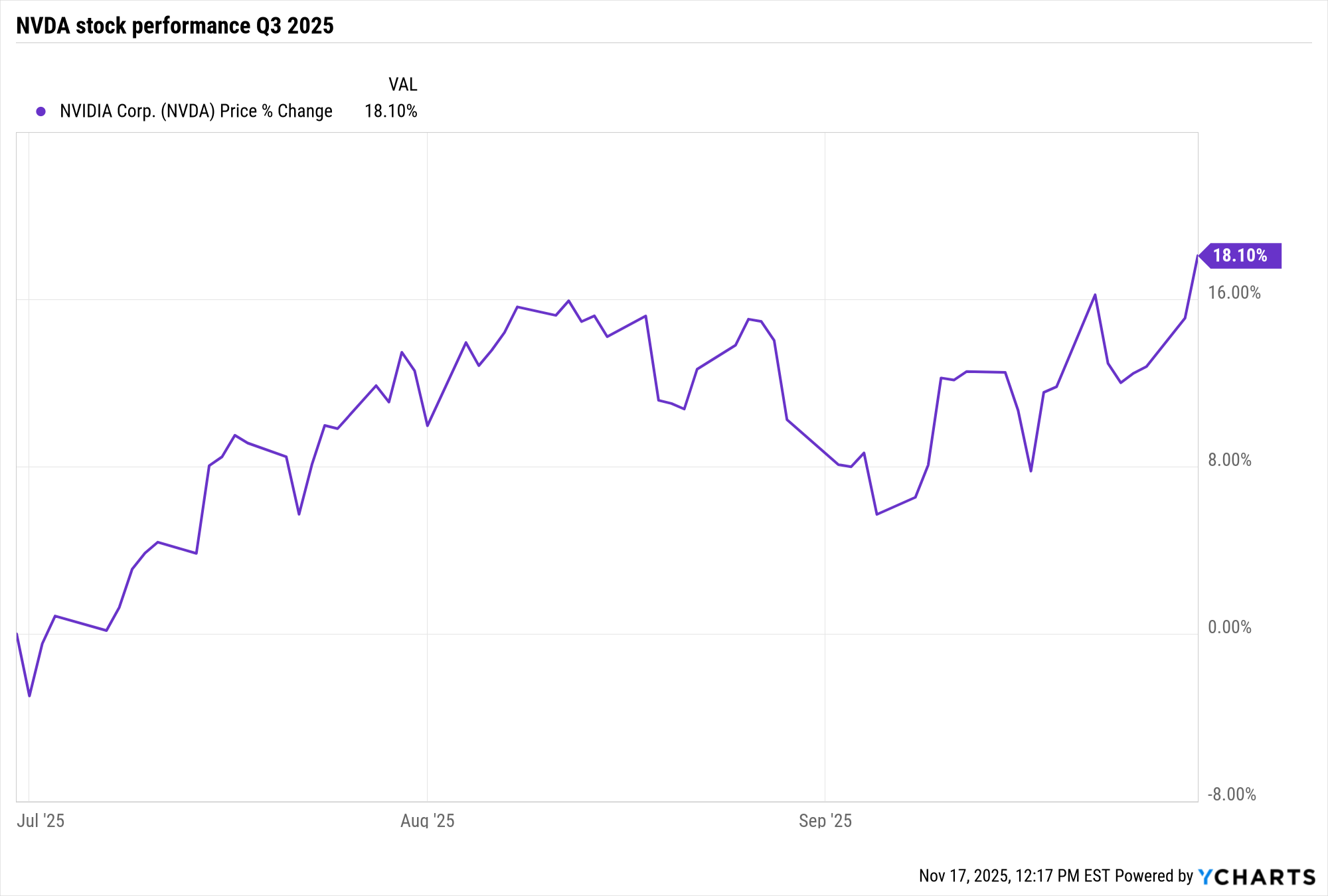

Nvidia shares outperformed the broader market in Q3, gaining 18.1% on a total return basis (price change plus dividends) vs the S&P 500's 8.1% total return.

During this July 1 through September 30 time frame, hedge funds were were net buyers of Nvidia stock.

According to WhaleWisdom, 48 hedge funds initiated new NVDA positions over the three-month period and 316 increased their stakes. This compares to 33 hedge funds that closed out of their Nvidia stakes entirely and 342 that reduced their positions.

The net change in hedge fund share ownership amounted to 4.6 million shares.

Peter Thiel's hedge fund sells Nvidia

As a group, hedge funds were net buyers of Nvidia in Q3, but one notable fund sold its stake in the chipmaker.

Thiel Macro, which is the namesake fund of Palantir Technologies (PLTR) board chair Peter Thiel, exited its stake in Nvidia in the third quarter. The fund first bought NVDA in Q4 2024 and the AI stock accounted for 40% of the portfolio at the end of Q2.

Regulatory filings reveal that Peter Thiel's hedge fund also sold off its entire stake in Vistra (VST), which provides energy for AI data centers, and slashed its stake in Tesla (TSLA) by 76%.

- Karee Venema

BofA Securities raises EPS estimates ahead of Nvidia's earnings report

BofA Securities analyst Vivek Arya raised his full-year earnings-per-share estimates for Nvidia ahead of the chipmaker's upcoming earnings report.

For fiscal year 2026, Arya now expects the company to report earnings of $4.56 per share, up from his previous estimate of $4.45 per share. He also increased his EPS guidance for fiscal 2027 (to $7.02 from $6.26) and fiscal 2028 (to $9.15 from $8.03).

The analyst reiterated his Buy rating and $275 price target, representing implied upside of nearly 50% to current levels.

"NVDA is the only merchant chip supplier with proven full-stack, rack-scale execution in large AI clusters, first with Blackwell (GB200), then with Blackwell Ultra (GB300) and next year in Vera Rubin (VR)," we'll likely have three generations of experience by the second half of calendar year 2026, says Arya.

He adds that cloud capex worries are often seasonal in nature – peaking in Q4 but easing at the start of the new year. And Nvidia is trading at an attractive valuation given its AI bellwether status and growth estimates.

Indeed, Nvidia CEO Jensen Huang said last month that the company has roughly $500 billion in total Blackwell and Rubin orders for this year and next – beating Wall Street's expectations by 10% to 15% – so most concerns will be more macro in nature, focusing on a tougher financing environment and increased competition.

- Karee Venema

Masayoshi Son and Peter Thiel unload Nvidia stock

Ahead of Nvidia's highly anticipated earnings report, some of the world's top tech investors have unloaded their positions in the stock. SoftBank, which Masayoshi Son operates, recently sold its remaining 32 million-share stake, netting $5.8 billion.

Then, as mentioned, there is Peter Thiel, who is the cofounder of PayPal and an early investor in Facebook. His hedge fund, Thiel Macro LLC, unloaded its position in Nvidia stock for about $100 million.

Granted, in light of the company’s massive market cap, these transactions are relatively small. Besides, Son has had a spotty track record with Nvidia stock. In 2019, he sold a $3.9 billion position. Had he held on, that stake would currently be worth about $150 billion.

Regardless, Son has become a billionaire because of his savvy, high-conviction investments. His move away from Nvidia may not signal bearishness on AI at all — but rather his belief that even bigger opportunities now exist within the category.

- Tom Taulli

The stock market closes lower to start Nvidia week

Stocks opened lower and recovered briefly but slid through the afternoon to begin a big week on the earnings front.

At Monday's closing bell, the blue-chip Dow Jones Industrial Average was down 1.2% at 46,590, the broad-based S&P 500 had fallen 0.9% to 6,672, and the tech-heavy Nasdaq Composite was off 0.8% at 22,708.

Nvidia, meanwhile, shed 1.9%.

"The key to a turnaround in the situation," says Louis Navellier of Navellier & Associates, "will be Nvidia's earnings this Wednesday. A positive surprise by NVDA and a recovery to new highs there, now down 12% from its all-time high, would re-energize the entire market."

Navellier notes that major investors such as Softbank and Peter Thiel have sold their entire NVDA positions and have "put a chill on the shares." He also cites "concerns about the circular financing agreements among the builders of the massive data center buildouts, which are the big buyers of Nvidia chips."

But, if CEO Jensen Huang and his company report "strong beats and, more importantly, strong guidance, these concerns will be mitigated and the AI theme will be reaffirmed, leading the market higher."

- David Dittman

Read more: Dow Falls 557 Points to Start NVDA Week: Stock Market Today

I am the former managing editor and chief investment strategist of Utility Forecaster and the former editorial director of Investing Daily, Charles Street Research, and Weiss Ratings. I am also a former stockbroker and have been working in financial media for more than 20 years.

Nvidia weakness creates a "lower bar" for the chip stock to overcome, says Main Street Research CIO

Nvidia stock is poised for a lower open Tuesday, with shares down 0.9% at last check. NVDA has pulled back in recent weeks amid broader risk-off trading on Wall Street and concerns that the AI trade has run too far, too fast.

But James Demmert, chief investment officer at Main Street Research, says this "brief reset ... means the stock now has a slightly lower bar to clear post-earnings." Demmert expects "Nvidia to exceed estimates and provide future earnings and revenue guidance that is higher than investors expect."

He adds that it is "unlikely that Nvidia has seen any slowdown in demand for its products, even with increased competition, given how early we are in the AI cycle."

As for concerns over a potential AI bubble, the CIO reminds us that "all technology revolutions create bubble-like stock price performance," and excitement over all things artificial intelligence is currently expanding at a healthy pace.

While valuations are indeed lofty, Demmert says they're still trading at a discount to earnings growth rates, while sentiment has not yet reached the euphoric stage that signals a market top.

- Karee Venema

September jobs report release makes for a busy week on Wall Street

It's not only Nvidia earnings that Wall Street is waiting for this week. The highly anticipated September jobs report, whose release was delayed due to the record-long government shutdown, will be published ahead of Thursday's open.

Data released over the summer showed a concerning slowdown in the labor market, which prompted the Federal Reserve to cut interest rates by a quarter-percentage point at both its September and October meetings.

But expectations of a third straight rate cut at the next Fed meeting in December have declined in recent weeks amid a lack of concrete economic data.

"As of now, the odds of a rate cut in December have dropped to 45% after some caution and hawkish remarks from Fed officials," says Daniela Hathorn, senior market analyst at Capital.com. "The jobs data could skew this pricing if it confirms a further softening of the labor market, which would play into the narrative of a weakening U.S. economy, a key theme that has emerged in recent days and is driving some of the weakness in equities."

- Karee Venema

Related: When Is the Next Jobs Report?

Cloudflare outage resolved after temporary disruptions to ChatGPT, X and others

Cloudflare (NET) stock is tumbling today, down 3.5% at last check, after a major outage in the cloud services provider took down sections of the internet, including OpenAI's ChatGPT, X and DoorDash (DASH).

The issue has since been resolved, with Cloudflare noting that "the root cause of the outage was a configuration file that is automatically generated to manage threat traffic. The file grew beyond an expected size of entries and triggered a crash in the software system that handles traffic for a number of Cloudflare's services."

The company underscored that "there is no evidence that this was the result of an attack or caused by malicious activity."

On Monday, Cloudflare announced that it is buying Replicate, an AI platform used by developers to run artificial intelligence models. William Blair analyst Jonathan Ho says the acquisition will help NET advance "its vision of its Workers platform becoming a one-stop-shop for developers to build and run AI-powered applications by integrating Replicate and allowing users to easily deploy any AI model globally with just a single line of code."

Ho has an Outperform (Buy) rating on the tech stock, saying "investors should continue to own Cloudflare based on the potential for the company to execute near term as well as the central role it could play in the rapid shift toward an AI-centric internet."

- Karee Venema

AI bubble warnings grow louder ahead of Nvidia earnings

"No firm is immune if the AI bubble bursts." This is the warning from Alphabet (GOOGL) CEO Sundar Pichai, who told the BBC that the AI surge is "extraordinary," but shows "elements of irrationality."

He's not the only one raising concerns. Just look at Palantir Technologies (PLTR) CEO Alex Karp. While Karp says the market for AI is massive, he recently cautioned that the economic output may not match the cost of the infrastructure build out.

And then there's Michael Burry, of The Big Short fame. His recent warning suggests the Nasdaq-100 may have already peaked amid the AI spending boom, with Burry saying that "someone is going to lose a phenomenal amount of money."

With multiple heavyweights raising red flags, Nvidia's earnings this week won't just measure performance — they may gauge how much longer the AI boom can defy gravity.

- Tom Taulli

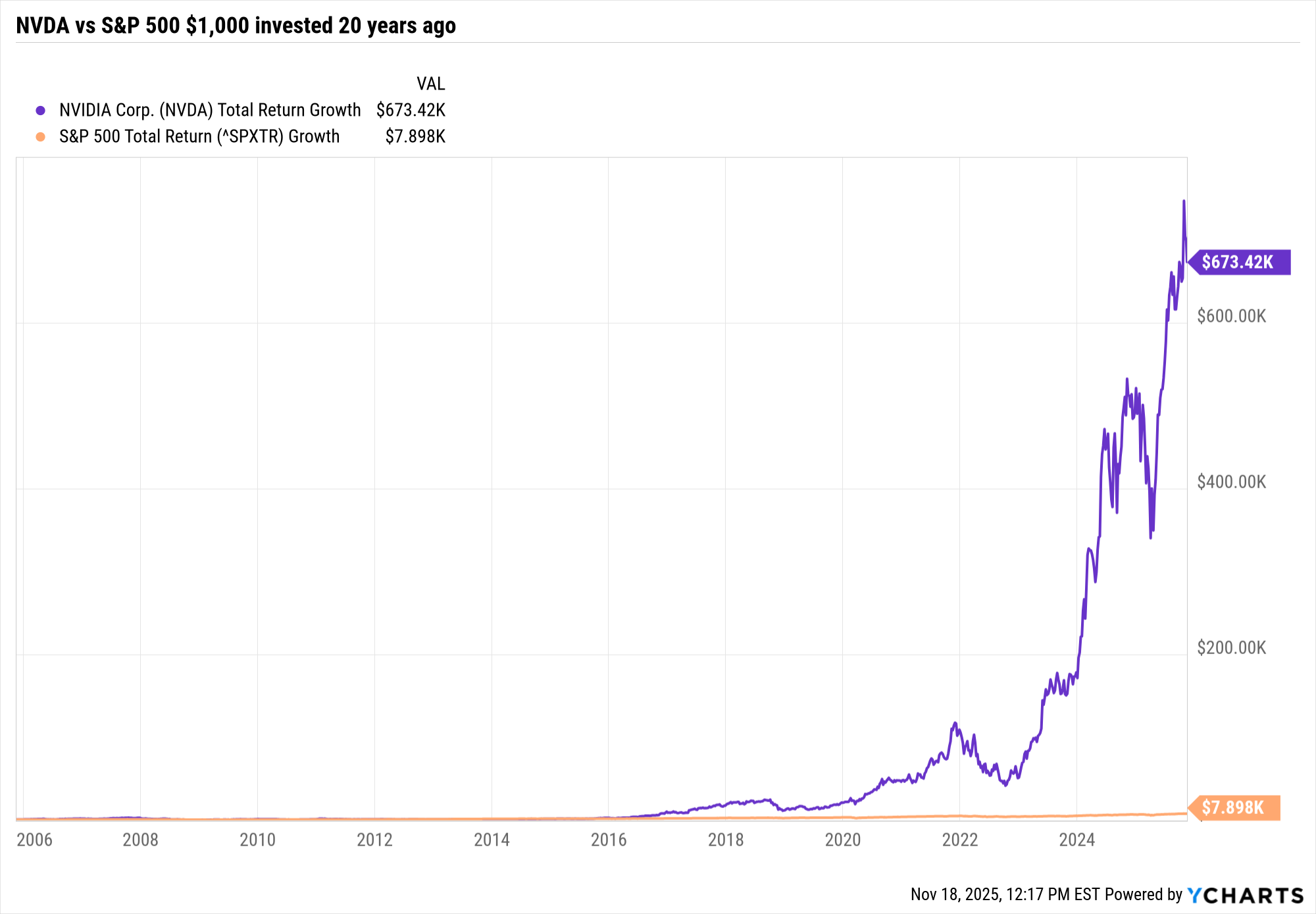

What would you have if you invested $1,000 in Nvidia 20 years ago?

Nvidia's share price has gone through some notable ups and downs over its 26 years as a publicly traded company, but its long-term trend has always been up and to the right.

Indeed, Nvidia has been one of the best stocks to own over that time frame and created more than $309 billion in shareholder value between January 1999 and December 2020, according to an analysis by Hendrik Bessembinder, a finance professor at the W.P. Carey School of Business at Arizona State University.

Over the past two decades, Nvidia stock generated an annualized total return of 38.5%. The S&P 500, with dividends reinvested, returned an annualized 10.9% over the same period.

In dollar terms, a $1,000 investment in Nvidia 20 years ago would be worth roughly $673,400 today. That same amount invested in the S&P 500 would theoretically be worth $7,900.

Microsoft, Nvidia and Anthropic go all in

On November 18, Microsoft (MSFT), Nvidia and Anthropic announced a massive strategic partnership. According to Microsoft's blog, Nvidia and Microsoft will invest up to $10 billion and $5 billion, respectively, in Anthropic.

At the same time, Anthropic committed to purchasing up to one gigawatt of compute capacity on Nvidia's future hardware, optimizing its models with the chipmaker, while scaling deployment across Microsoft Azure.

A report in The Wall Street Journal estimates that the total commitment from the artificial intelligence leaders is about $45 billion, making it one of the largest AI infrastructure deals ever.

This partnership signals more than just investment. It represents a deep intertwining of models, hardware and cloud infrastructure. For Microsoft, it means broadening its model ecosystem beyond one provider. For Nvidia, it means locking in demand for its next-gen chips. And for Anthropic, it means scale, capacity and market access.

Yet the timing — just ahead of Nvidia's earnings release — makes this a high-stakes moment for the entire AI sector. The question now: Can these billions translate into meaningful business outcomes, or will expectations outpace reality?

- Tom Taulli

What should you do with all that appreciated NVDA stock?

Even with its recent pullback, Nvidia stock is still up 40% for the year to date. And that's modest compared to its longer-term returns. Indeed, NVDA has generated an average annual return of almost 54% over the past 15 years, easily outpacing the S&P 500's 14.4% total return (price change plus dividends).

So what's an investor to do with all of their appreciated Nvidia stock? We turned to Charles Lewis Sizemore, CFA, chief investment officer and Kiplinger contributor, for advice.

One option is to take the money and run. "Having a disproportionate share of your portfolio in any single stock — even one as incredibly successful as Nvidia — is risky," says Sizemore. "Selling or at least trimming the position little by little could be smart risk management."

But selling isn't the only route you could take. In this article, Sizemore shares a few other potential scenarios for Nvidia investors who have capitalized on the stock's impressive run.

Stifel raises its price target on Nvidia ahead of earnings

Stifel analyst Ruben Roy raised his price target on Nvidia stock to $250 from $212 ahead of earnings, representing implied upside of nearly 38% to its November 18 close.

"CEO Jensen Huang's recent keynote at GTC Washington D.C., outlined the company's ongoing positioning as the backbone of AI infrastructure underpinned by more than $500 billion in cumulative order book for Blackwell and Rubin infrastructure spanning 2025-2026," Roy says.

The analyst expects near-term debate to remain focused on the sustainability of AI investments, even with several hyperscalers announcing increased spending in their recent earnings reports.

"We believe that concerns regarding vendor financing loops, financial sustainability of several key AI players, and recent supply side issues have increased as well," Roy adds, though he notes that recent conversations and industry data points "suggest that AI compute demand is likely to scale higher."

And the analyst continues to believe Nvidia is best-positioned to benefit from this rising demand.

- Karee Venema

NVDA rises again in pre-market trading

Nvidia (NVDA) was down 2.8% on Tuesday to $181.36, extending its decline since hitting a new all-time high of $212.19 intraday on October 29 to 14.5%. The AI bellwether was rising again Wednesday morning in pre-market trading, ahead of its post-closing bell earnings announcement.

NVDA stock was up 1.7% about 15 minutes before the opening bell at the New York Stock Exchange – helped, perhaps, by another effusive note from Wedbush analyst Dan Ives.

Calling it a "foundational piece" of the AI revolution, Ives expects Nvidia to "handily exceed Street estimates given the plethora of positive data points we have picked up from our Asia supply chain checks." Ives also cites "monster Big Tech cap-ex numbers seen by the hyperscalers in late October earnings."

Wall Street expects earnings of $1.23 per share (+51.9% year over year) on revenue of $54.59 billion (+55.6% YoY). The consensus would also like to see fourth-quarter guidance for EPS of $1.37 on revenue of $59.60 billion.

"At a time with tech stocks volatile and investor worries around an 'AI Bubble'," Ives notes, "it all comes down to gauging the AI Revolution demand story which starts and ends with Nvidia."

The analyst says we'll "be able to hear a pin drop on Street trading desks as the entire global market will be carefully watching these results and commentary" from the "Godfather of AI," Nvidia CEO Jensen Huang, after the closing bell.

Ives has an Outperform, or Buy, rating on NVDA stock, with a $210 12-month target price.

– David Dittman

Gabelli PM: Why Nvidia's earnings could steer the entire market

With Nvidia set to report earnings later today, investor attention is sharper than ever — and for good reason.

As John Belton, portfolio manager at Gabelli Funds, notes, "Nvidia is the world's most valuable company and the largest constituent in the S&P 500, and its earnings are always closely followed by investors." He adds that this cycle carries even more weight given "the drawdown in U.S. stocks seen over the last few weeks."

Belton says Nvidia's results will offer a critical read on the health of AI spending: "Nvidia's earnings should provide an updated view of the demand environment for AI infrastructure, which we believe remains robust, supported by a broadening set of customers using the technology across a growing number of applications."

Looking beyond the quarter, Belton remains constructive on the broader tech landscape. "We think there is still runway for these companies to generate strong earnings growth over the coming years as AI adoption scales and use cases proliferate."

Nvidia's leadership remains key. The company "is the dominant player in AI semiconductors with a strong competitive position which looks defensible," Belton adds.

On valuations, he pushes back against bubble concerns: "The 'Magnificent 7' median forward P/E multiple has contracted roughly 10% … it is difficult to argue that we are in a valuation bubble currently."

- Tom Taulli

Big Tech, ROIC and NVDA

Jason Zweig writes a column for The Wall Street Journal called "The Intelligent Investor." He holds prime real estate at one of the world's premier financial publications.

His work is an homage to Charles Dow, who co-founded the WSJ and created the first stock market index, Benjamin Graham, who wrote the seminal book that lends his column its name, and Warren Buffett, Graham's most famous protege.

When Jason Zweig is writing about return on invested capital (ROIC) and Alphabet (GOOGL), Amazon.com (AMZN), Apple (AAPL), Meta Platforms (META), Microsoft (MSFT) and Nvidia (NVDA), as he did in his weekly newsletter on Tuesday, people are going to pay attention.

Zweig cites reporting in the WSJ by his colleagues Matt Wirz and Peter Rudegair: "Big tech companies are expected to spend nearly $3 trillion on AI through 2028 but only generate enough cash to cover half that tab."

And he adds his own color: "Between Sept. 1 and Nov. 13 – less than three months – big tech companies issued more bonds than they had in the previous three calendar years combined."

The problem, as Zweig sees it, is this: "Historically, software has been a 'capital-light' business whose own cash flows could finance most needs. Suddenly, however, the tech giants are becoming capital heavy."

Here's the bottom line: "What all this means is that AI had better turn out to be even more lucrative than the tech giants are projecting. Otherwise, these companies and their investors are going to be saddled with excess capital – and unsustainable valuations."

Investors, traders and speculators alike hope many questions about an AI bubble will be answered by Nvidia and CEO Jensen Huang after the closing bell.

– David Dittman

A quick correction

Writing with half an eye on big retail names joining Nvidia (NVDA) on the earnings calendar this week as well as the next Fed meeting in December, Louis Navellier of Navellier & Associates says, "The market correction appears to be over."

He adds, of course, "Nvidia's earnings tonight are pivotal."

Navellier notes that Lowe's (LOW) was up 5% after meeting revenue expectations and beating earnings forecasts but trimming its full-year profit forecast because of economic uncertainty.

"Interest rates remain flat," Navellier writes, adding that a rate cut by the Fed next month "will be bullish for stocks and would be very helpful for a year-end rally." He cautions that a 50-basis-point cut may generate recession fears.

"Nvidia is key because all the massive data center plans are wrapped around Nvidia chips," Navellier explains, "and the company has financial agreements with many of the AI players."

"A bullish report and forecast will invigorate Mega Tech, which very much steers the indexes, and index moves are what create the majority of buying and selling." NVDA stock was up 1.6% at last check.

– David Dittman

Jensen & Elon's Excellent Adventures

According to Reuters, Nvidia (NVDA) CEO Jensen Huang and Tesla (TSLA) CEO Elon Musk will discuss advances in AI and technology generally during a U.S.-Saudi Arabia investment forum in Washington on Wednesday.

"This conversation will explore the emerging forces shaping the next wave of technological progress," reads a document cited by Reuters, "highlighting the architectures, models, and investments powering a more intelligent and interconnected future."

CEOs from Adobe (ADBE), Chevron (CVX), Cisco Systems (CSCO), General Dynamics (GD), Palantir Technologies (PLTR), Pfizer (PFE) and Qualcomm (QCOM) as well as Saudi Aramco are attending the meeting too.

Senior executives from Google parent Alphabet (GOOGL), Blackstone Group (BX), Boeing (BA), Haliburton (HAL), International Business Machines (IBM), Lockheed Martin (LMT), Parsons Group (PSN), Salesforce (CRM), State Street (STT) and Super Micro Computer (SMCI) as well as Andreesen Horowitz and Saudi Group will also attend the event at the John F. Kennedy Center for the Performing Arts.

NVDA stock was up 1.8% with a little more than an hour remaining in Wednesday's regular trading session. TSLA was down 0.1%.

– David Dittman

NVDA stock rallies into the close

Nvidia (NVDA) traded up as much as 3.6% before noon, sank some but stabilized around midday, and rallied into the close to post a 2.9% gain ahead of its fiscal 2026 third-quarter earnings announcement and CEO Jensen Huang's press conference.

In October, Huang said the leader of the AI revolution has $500 billion in calendar 2025 and 2026 orders for its Blackwell graphics processing unit and its Rubin GPU as well as related AI infrastructure equipment. NVDA stock hit a new 52-week high the next day, October 29. It's down 12.1% from there.

Analysts will be looking for tangible follow-through from the "Godfather of AI," as Dan Ives of Wedbush has dubbed Huang. “This is how much business is on the books: Half a trillion dollars worth so far,” Huang said at Nvidia's GTC conference in Washington.

Nvidia typically posts its quarterly earnings press releases around 4:20 pm ET. And the CEO's press conference usually gets going right around 5 pm.

– David Dittman

Nvidia's FY26 Q3 earnings and guidance are in

Nvidia (NVDA), the leader of the AI revolution, reported fiscal 2026 third-quarter earnings of $1.30 per share (+60.5% year over year) on revenue of $57.01 billion (+62.5% YoY). Gross margin was 73.6% vs 75.0% a year ago.

Jensen Huang's outfit expects to report fiscal fourth-quarter revenue of $65 billion, "plus or minus 2%," and gross margin of 75%, "plus or minus 50 basis points."

"Data Center revenue for the third quarter was a record $51.2 billion, up 66% from a year ago and up 25% sequentially, driven by three platform shifts - accelerated computing, powerful AI models, and agentic applications," CFO Colette Kress said in her quarterly commentary. "Blackwell Ultra is now our leading architecture across all customer categories while our prior Blackwell architecture saw continued strong demand."

Wall Street forecast EPS of $1.23 (+51.9% YoY) on revenue of $54.59 billion (+55.6% YoY). The consensus hoped to see fourth-quarter ;revenue guidance of $59.60 billion.

NVDA stock was up nearly 4% in after-market trading following the release.

– David Dittman

Nvidia is "going in style"

“Nvidia (NVDA) bears the weight of the world," observes Hargreaves Lansdown analyst Matt Britzman in the first commentary I've seen since the widely watched earnings and guidance release, "but like Atlas, it’s standing firm under that towering mountain of expectations. Third quarter results delivered the goods and then some.

The analyst notes a 4% beat on the top and bottom lines along with "a side of more good news in the form of a monster $65 billion revenue guide for the fourth quarter."

"While AI valuations are dominating the news feeds," Britzman writes, "Nvidia is going about its business in style." He cites a massive backlog of orders as well as its underrated breadth, including a full data center business offering chips, software, networking and other AI infrastructure.

"Even if rivals can offer parts of the stack," Britzman concludes, "Nvidia’s fully integrated solution will be hard to beat.”

– David Dittman

CFO Kress: It's "early innings" for Nvidia

Nvidia (NVDA) continued to climb as CFO Collette Kress explained how the chipmaker's position in the scaling process ensures its continued growth and confirmed the leader of the AI revolution has "visibility to half a trillion dollars" in sales of its equipment through the end of calendar 2026.

"We're still in the early innings of our work," Kress said, adding that Nvidia will remain the "superior choice" for the $3 trillion to $4 trillion in annual AI infrastructure spend through the end of the decade.

"Demand continues to exceed our expectations," the CFO said.

NVDA was up more than 6% about 10 minutes into Kress's prepared remarks.

– David Dittman

More notes from the Nvidia CFO

In addition to confirming CEO Jensen Huang's $500 billion forward orders assertions, CFO Collette Kress underscored the importance of U.S. government support for the AI revolution.

The CFO noted intense competition from China.

Kress also emphasized that production for Nvidia's next-generation Rubin AI GPU is ramping on schedule.

In addition to a recently announced collaboration with Anthropic, Nvidia is now considering an opportunity to invest in OpenAI.

– David Dittman

Nvidia's US expansion will continue

Nvidia (NVDA) CFO Collette Kress said the company will continue to invest strategically following its recent deal with Anthropic and amid discussions with OpenAI, emphasizing the importance of cash flow discipline.

Kress also said that Nvidia's expansion of U.S.-based production capacity will continue.

The CFO cited physical AI as the driver of the next leg of growth for Nvidia, and she also underscored its commitment to building resiliency and redundancy in its global supply chain.

That includes building its presence in the U.S. over the next four years.

– David Dittman

About this AI bubble

"There's been a lot of talk about an AI bubble," Nvidia (NVDA) CEO Jensen Huang said at the top of his prepared remarks for the chipmaker's conference call.

"We see something very different."

Huang identified three massive platform shifts underway, noting that Nvidia is addressing all three transitions "for the first time since the advent of Moore's Law."

This change is revolutionary, Huang explains, and Nvidia excels at every level of it, including pre- and post-training as well as inference.

"AI has reached a tipping point."

– David Dittman

About that $500 billion

"Yes, that's correct, we are working into our $500 billion forecast," CFO Collette Kress said in response to the first question during today's Nvidia (NVDA) fiscal 2026 third-quarter conference call.

"The number will grow," Kress added, noting that Nvidia shipped $50 billion this quarter. "We will probably be taking more orders."

– David Dittman

Nvidia will be efficient

"The world doesn't have an excess of anything to squander," Nvidia (NVDA) CEO Jensen Huang said during a response to a question during the company's fiscal 2026 third-quarter conference call.

"Energy efficiency is going to be extraordinary as we continue to grow," he said. "Nvidia GPU computing is the best way to do so."

Huang says Nvidia's hardware will also help drive revenue growth over time because of its efficiency.

Hundreds of billions of capex will be cash-flow generative, he explained, because new applications are the fastest-growing in history.

"Once people see what's happening under the surface" and engage beyond hyperscalers they'll appreciate what's happening.

– David Dittman

Nvidia seeks "extraordinary" returns

"We've secured a really resilient supply chain, and we have the balance sheet" to support its clients, Nvidia (NVDA) CEO Jensen Huang said in response to a question about future investment plans.

Huang said Nvidia will continue to use cash flow to support investments to expand the ecosystem and catalyze growth for partners and developers.

"They're all driving consumption, with a huge step-up in quality from a year ago," Huang said. Rather than give up a share in his company, the CEO likes to get a share of those companies and potential "extraordinary" returns.

– David Dittman

Nvidia's platform is the singular platform

"We run them all," Nvidia (NVDA) CEO Jensen Huang said about the AI platforms proliferating across sectors, industries and geographies.

And, he adds, "We are expanding the reach of our ecosystem" with its investments, with an eye on exponential growth.

– David Dittman

It ain't easy, even for Nvidia… especially for Nvidia

"When you're growing at the rate and the scale we are, how can anything be easy?" wondered Nvidia (NVDA) CEO Jensen Huang near the end of the company's quarterly conference call.

"We created a whole new industry."

Huang explained that Nvidia continues to solve its tractable supply-chain problems, with a lot of partners and a lot of routes to market.

And its architecture will drive the most revenues on an efficient, per-Watt basis.

"All the things that I've been telling you over the years are becoming evident," he said.

– David Dittman

'All of that has worked out well for us'

CFO Collette Kress confirmed Nvidia (NVDA) will hold gross margins in the mid-70s, noting that the chipmaker is "making sure we are innovating with our engineering and our business teams to create more architecture for this marketplace."

"Spot on," CEO Jensen Huang said of Kress's response. "We forecast, we plan, we negotiate with our supply chain well in advance," The CEO explained. "Our supply chain has known for quite a long time our requirements."

Huang added that Nvidia's suppliers have been "working with us" during a recent demand surge. "All of that has worked out well for us," he said. "There just aren't that many teams that are this skilled at building these incredibly complex things."

The Nvidia CEO cited five things that separate his company from other AI infrastructure providers. First, Nvidia can accelerate every phase of the ongoing computing transition.

And i's excellent at every phase of AI: pre-training, post-training and inference, which is "really, really hard."

Also, it's the only architecture that runs every frontier AI model: open source, science, biology, robotics… "We run everything, for every major platform," Huan said.

"We're in every cloud," he added as a fourth factor. "We're literally everywhere, every computer. One architecture, and it works."

Finally, he said, "Our offtake is so diverse," emphasizing that the versatility of its architecture is supported by the size of its ecosystem.

NVDA stock was higher by 5% in after-market trading at the conclusion of Huang's remarks.

– David Dittman

Nvidia's latest earnings signal the start of AI's "second wave": enterprise adoption

Nvidia's earnings report on Wednesday delivered more than another headline beat. It was a signal of how the AI market is entering the second wave.

For the past two years, hyperscalers and model labs have driven the bulk of GPU demand. This was about building the infrastructure to power the explosive growth of generative AI. But this quarter's guidance suggests something different is happening: enterprises are finally moving from pilot experiments to real deployment.

As CFO Colette Kress put it, "enterprises broadly are leveraging AI to boost productivity, increase efficiency and reduce cost." She cited examples from RBC, Lowe's, Unilever, and Salesforce's engineering team using Cursor.

Nvidia is now seeing demand "across every industry," not just from cloud providers and model builders. Jensen Huang doubled down on the message, calling AI "a brand-new category" that is transforming existing business models and powering agentic applications in health care, legal, supply chain, marketing and more.

Importantly, Nvidia said it has visibility into $500 billion in Blackwell and Rubin revenue through 2026. This is an astonishing figure that reflects both hyperscaler builds and a rising wave of enterprise AI factories.

If the first wave of AI was about building foundational compute, the second wave is about companies operationalizing it. Nvidia's guidance — and its customer examples — suggest that wave has now begun.

- Tom Taulli