AI and Your Portfolio: How LLMs Can Boost Your Investments

Large language models (LLMs), such as OpenAI's GPT-4, can sift through massive datasets, identify patterns and generate insights about investment decisions.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

In recent years, the financial landscape has witnessed a technological revolution with the rise of artificial intelligence (AI), particularly large language models (LLMs). These advanced AI tools are changing the way investment strategies are developed and implemented, offering unprecedented opportunities for investors. Understanding how LLMs can be utilized in investment portfolios can help investors make more informed decisions and potentially enhance their financial outcomes.

Embracing LLM technology has the potential to significantly impact an investor's approach to portfolio management. LLMs can enable investors to uncover insights that might otherwise go unnoticed or help them find information faster. This can lead to more informed investment decisions, helping investors find new investment opportunities in a shorter timeframe. While tactical asset allocation might require advisory assistance, integrating LLMs into investment processes could provide investors with immediate access to valuable research.

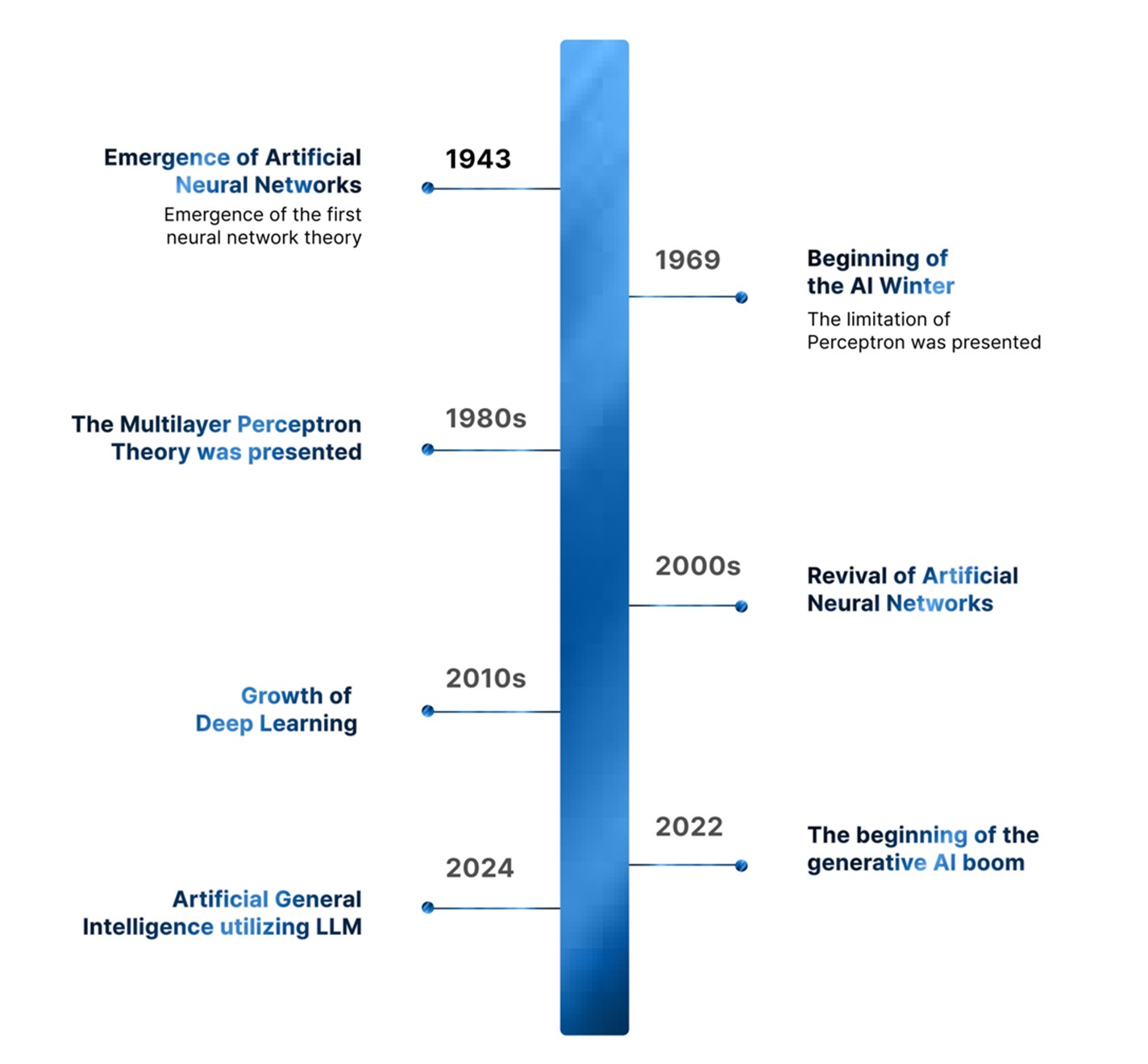

The advancement of AI technologies is leading to the development of large language models (LLMs).

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

LLMs, like OpenAI's GPT-4, are able to process and analyze complex information quickly, making them valuable tools in various industries, including finance. For investors, LLMs provide a means to sift through massive datasets, identify patterns, and generate insights that were previously difficult to obtain.

One of the key advantages of LLMs is their ability to analyze complex financial data efficiently. They can identify trends and predict market movements with a level of accuracy and speed that surpasses traditional methods or human capabilities. This capability can allow investors to build more robust investment strategies, balancing risk and return effectively.

LLMs can personalize investment strategies to fit individual investor needs. By analyzing an investor’s financial goals and risk tolerance, coupled with the current market conditions, LLMs can help investors create tailored portfolios that align with their objectives. This personalized approach ensures that each investment plan is unique to the investor's specific circumstances, potentially leading to improved outcomes.

Who’s using LLMs

Investors can leverage LLMs in various ways to enhance their portfolios. Some of the largest global leaders in the financial industry are utilizing these technologies, including:

- Morgan Stanley. The investment bank has launched a generative AI assistant that helps financial advisers quickly extract relevant information from a vast database of financial data. This tool significantly speeds up the process of analyzing financial information and providing advice to clients.

- Robinhood. The popular trading app has integrated AI-powered features, including natural language processing, to provide personalized insights and recommendations to its users.

- Qraft Technologies. This fintech firm leverages AI for both predictive analytics and the development of LLM technologies. The firm has developed LLM technologies to summarize and translate corporate disclosures from different languages into the local language. The firm has also developed an LLM platform to assist an asset manager’s review of materials for compliance. It also built a fund chatbot that provides internal fund data to clients and makes it available for individual investors through the client's application. (Note: I am the APAC CEO at Qraft Technologies.)

Investors can use these technologies for in-depth market research and analysis, providing insights that inform better decision-making. LLMs can help optimize portfolios by suggesting asset allocations that maximize returns while minimizing risks.

Moreover, LLMs assist in risk management by identifying potential threats and helping investors develop strategies to mitigate them. This can help investors take a more proactive approach, potentially protecting investments against unforeseen market fluctuations.

The use of LLMs translates into several practical benefits. An enhanced understanding is one such benefit. Investors can use LLMs to explain complex investment strategies in simpler terms, ensuring they fully understand the rationale behind their financial decisions.

Potential challenges and considerations

While LLMs offer many benefits, it is important to recognize their limitations. They are powerful tools, but not infallible. Investors must combine AI insights with their knowledge and judgment to make sound investment decisions. Ethical considerations around data privacy and responsible AI use should also be addressed.

The integration of LLMs in investment portfolios represents a significant advancement in personal finance. By enhancing data analysis, market predictions and personalized investment strategies, LLMs offer valuable benefits to investors.

As the role of AI continues to evolve, it could prove beneficial for investors to seek out how these technologies can be harnessed to achieve their financial needs and goals. Staying informed about these advancements can give investors a competitive edge, enabling them to navigate the complexities of the financial markets with confidence and foresight, while paving the way for more informed, effective and personalized strategies.

Related Content

- How AI Can Help Take the Emotion Out of Investor Decisions

- AI Has Powerful Potential to Make Investing Decisions Easier

- Beyond the Hype: A Guide to Investing in AI

- Can Stocks Picked by Artificial Intelligence Beat the Market? 3 Stocks to Watch

- Don’t Hand Your Retirement Income Planning Over to AI Just Yet

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Francis Geeseok Oh is responsible for global sales and business development of Qraft's cutting-edge artificial intelligence technologies to financial institutions. He contributes to media such as Bloomberg, WSJ and Financial Times, discussing AI adoption in the asset management industry. Also, he has appeared as a guest speaker at AI lecture classes, including Oxford Said Business School, HKU and HKUST.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the 'Medigap Trap?'

Quiz: Do You Know How to Avoid the 'Medigap Trap?'Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Why Invest In Mutual Funds When ETFs Exist?

Why Invest In Mutual Funds When ETFs Exist?Exchange-traded funds are cheaper, more tax-efficient and more flexible. But don't put mutual funds out to pasture quite yet.

-

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.We are 62 and finally retired after decades of hard work. I see the lakehouse as an investment in our happiness.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.