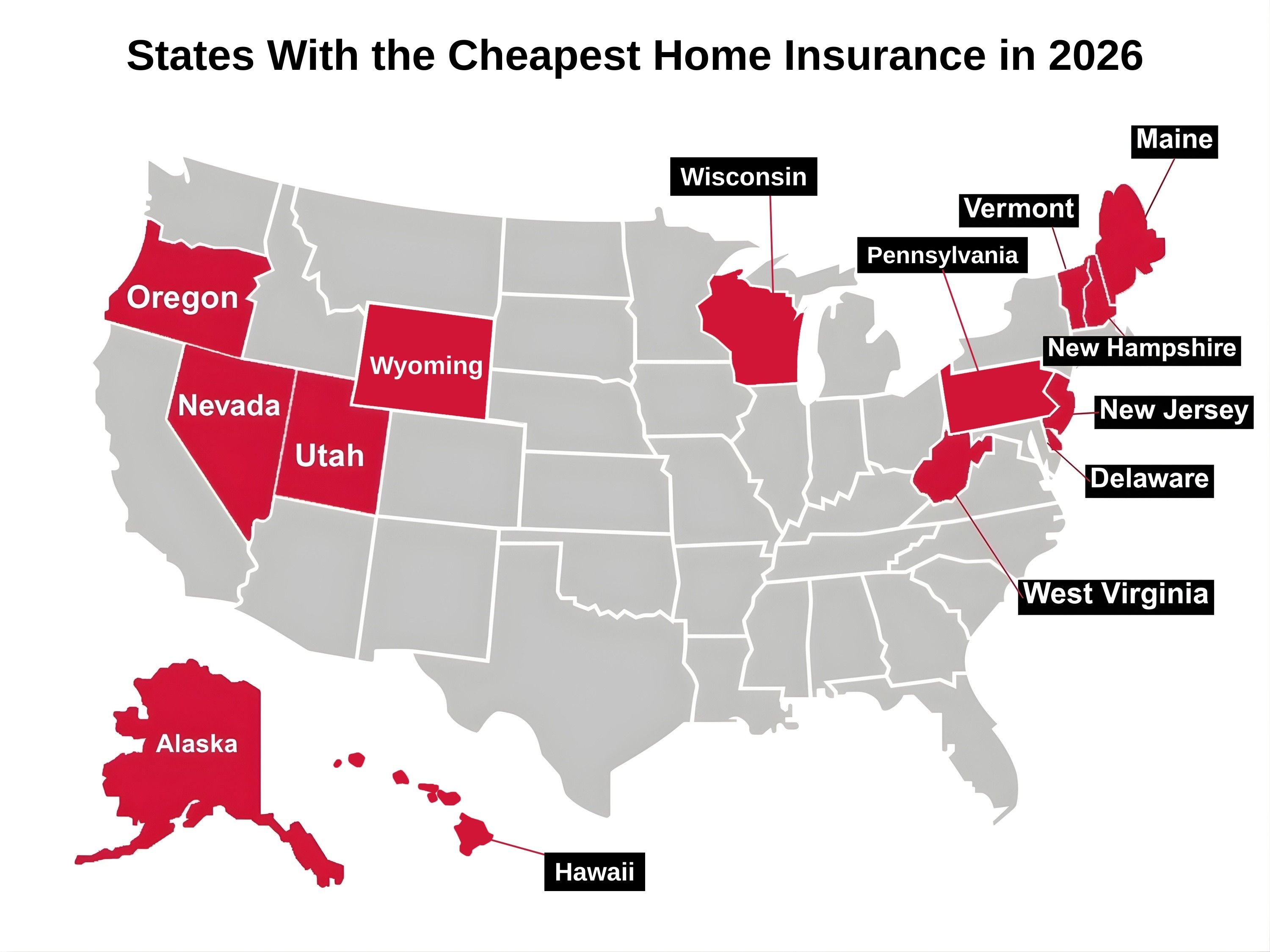

14 States with the Cheapest Home Insurance in 2026

Homeowners in these 14 states pay at least $1,100 less than the national average for home insurance.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

While home insurance rates have soared in the years since the pandemic, there are a few states where homeowners are paying well below average premiums to protect their homes.

According to the latest report from Bankrate, the national average home insurance premium in January was $2,424 per year for dwelling coverage of $300,000. But each state listed below pay rates that are at least $1,100 lower than that national average for the same coverage.

While the 14 states below are enjoying the lowest average home insurance rates in the country, it’s worth noting that this only applies to standard policies.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Standard insurance is important, but there are a few surprising things home insurance won’t cover. For those uncovered risks, homeowners need to buy additional coverage to make sure they’re fully covered against every threat their home faces.

14 States with the Cheapest Home Insurance in 2026

Here are the 14 cheapest states for home insurance and some of the reasons why.

14. Wyoming

Homeowners in Wyoming are paying just $1,306 per year on average for home insurance. That's $1,118 below the current national average. The cowboy state isn't immune to natural disasters, with the state experiencing a little bit of almost every risk, including wildfires, earthquakes and tornadoes.

But homeowners here are far less likely to experience catastrophic losses and Wyoming enjoys a below average rate of property crime. As a result of that relative safety, even the most expensive premiums in Wyoming are just $1,920 per year, a little over $500 below the national average.

13. Wisconsin

Homeowners in Wisconsin pay $1,303 per year on average for home insurance. The northern state isn’t exposed to some of the more destructive natural disasters like hurricanes and wildfires, which helps keep costs down.

The most common risks are related to Wisconsin’s harsh winters, including things like frozen pipes, ice dams and snow-related roof damage. While these issues are covered by a standard policy, Wisconsin homeowners still need to take proper precautions to prevent damage to avoid a denial on their insurance claim.

12. Hawaii

The average annual home insurance premium in Hawaii is just $1,296, according to Bankrate. While the promise of cheap insurance and island living might tempt you to move to the Aloha state, there’s an important exclusion homeowners need to consider first.

While standard policies in just about every other state cover wind-related damage, wind is an excluded peril in Hawaii. Homeowners living here need to buy supplemental hurricane insurance on top of flood insurance to be fully covered against storm damage.

11. Utah

The eleventh cheapest state for home insurance is Utah, with premiums averaging just $1,283 per year for $300,000 in dwelling coverage. And rates are relatively stable across the state, with residents in bigger cities like Salt Lake and Provo paying about the same as the statewide average.

There are a few reasons your home insurance bill is cheaper in Utah. The landlocked state is relatively safe from some of the most expensive threats like hurricanes, wildfires and other severe storms. It's low cost of living also means repair are cheaper when they are needed.

Still, Utah homeowners do have to brace for bad snowstorms and flooding is a risk in the southern half of the state.

10. Pennsylvania

In Pennsylvania, homeowners pay $1,278 per year on average for home insurance. In reality though, residents need to budget a few hundred more than that because they face two unique risks that aren't covered by home insurance.

Historically, the state has been home to extensive mining. Today, that's left much of the state vulnerable to both flooding and mine subsistence – both of which are usually excluded from standard home insurance.

9. Maine

At $1,219 per year, the average premium in Maine is well below the national average, but it is on the high side compared to its neighbors. You'll find even cheaper home insurance in New Hampshire and Vermont, for example.

One possible reason for this is that Maine is so heavily forested in much of the state, posing a higher wildfire risk than its neighbors face. It also makes home repairs a bit more expensive than average since many of the towns are fairly remote.

8. New Jersey

In New Jersey, homeowners pay $1,214 per year on average for a standard home insurance policy. While that is far below the national average, it’s important to note that most standard policies don’t cover flood damage.

Since more than half of the state’s total population lives on the coast, New Jersey is at high risk of flooding. It’s therefore essential for homeowners in the state to buy flood insurance to fully protect their homes. Even those living further inland can still be exposed to stormwater surges and other forms of flooding.

7. Oregon

Oregon homeowners saw average annual home insurance premiums of just $1,091 this year. While it’s one of the safer states to live in, the risk of wildfires has been increasing.

That risk isn’t as high as it is in California, its neighbor to the south, so Oregon hasn’t had to deal with the same issue of major insurers leaving the state.

Still, homeowners – especially those closest to the southern border – may want to take steps now to make their homes more fire ready.

Those on the west coast of the state might also want to consider buying earthquake insurance. Earthquake damage is usually excluded from standard policies and homeowners in the west have an above average risk of experiencing one.

6. Nevada

With little risk of hurricanes or other severe storms, Nevada homeowners pay just $1,074 per year on average for home insurance. The biggest weather-related issue in the state is the extreme heat it faces in the summer.

While heat is unlikely to cause any sudden damage the way storms or tornadoes do, the chronic exposure of your home to extreme heat can cause faster than usual wear and tear to things like your roof, siding and foundation. If you don’t stay on top of it, your insurer might deny your claim, citing neglect or lack of maintenance.

5. West Virginia

The average annual home insurance premium in West Virginia is just $1,047, with some areas paying less than $1,000 per year for a standard policy. However, that price doesn’t include flood insurance.

Most of the state has an above average risk of flooding, especially during hurricane season. Since flooding is typically excluded from standard home insurance policies, it’s important to buy additional coverage for flood damage.

4. New Hampshire

In New Hampshire, you can expect to pay an average of $1,039 per year for standard home insurance. The state is one of the safest places to live, as far as natural disasters go. Like other northern states, the biggest risks homeowners face are related to the snow and freezing damages experienced during New Hampshire’s harsh winters.

If you live here, make sure your pipes are insulated and you can provide proof that you’ve kept up with proper cold weather prep in your home to make your insurance claim process smoother.

Get more insurance tips and other personal finance insights straight to your inbox. Subscribe to Kiplinger's free daily newsletter, A Step Ahead.

3. Alaska

Homeowners in Alaska are paying an average of $1,035 per year for home insurance. As you can imagine, the biggest threats to homes in this state are related to the extreme and prolonged winter weather.

Winter-related damage is typically covered by standard home insurance, but it’s still the homeowner’s responsibility to take reasonable precautions to prevent damage.

2. Delaware

The small coastal state of Delaware pays an average annual home insurance premium of just $966. But like many states on the East Coast, the entire state is at high risk of flooding. So, homeowners here should use some of the savings on their regular insurance to purchase additional flood insurance.

1. Vermont

Coming in first place for the cheapest home insurance in the United States is Vermont. Homeowners in the northeastern state pay just $827 per year on average. That’s $1,597 less than the national average.

The low rates are because Vermont is one of the safest states in the country. Though some parts are at high risk of flooding. So, if you live here, doublecheck the FEMA Flood Map to find out if you’re in one of those high risk zones.

The bottom line

Insurance can be a financial lifesaver when disaster strikes. But until then, ever-increasing premiums can feel like a financial drain. That’s why it’s important to re-shop for home insurance regularly, whether you live in one of these states with cheaper than average home insurance or not.

When you do, compare both price and coverage to make sure you’re getting what you need at the best price. Don’t forget to factor in additional coverage like flood insurance or earthquake insurance, depending on which excluded risks are most prevalent in your area.

Get more insurance tips and other personal finance insights straight to your inbox. Subscribe to our daily newsletter, A Step Ahead.

Related content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Rachael Green is a personal finance eCommerce writer specializing in insurance, travel, and credit cards. Before joining Kiplinger in 2025, she wrote blogs and whitepapers for financial advisors and reported on everything from the latest business news and investing trends to the best shopping deals. Her bylines have appeared in Benzinga, CBS News, Travel + Leisure, Bustle, and numerous other publications. A former digital nomad, Rachael lived in Lund, Vienna, and New York before settling down in Atlanta. She’s eager to share her tips for finding the best travel deals and navigating the logistics of managing money while living abroad. When she’s not researching the latest insurance trends or sharing the best credit card reward hacks, Rachael can be found traveling or working in her garden.

-

4 High-End Experiences Worth the Splurge After 50

4 High-End Experiences Worth the Splurge After 50These curated date ideas provide the perfect backdrop for couples ready to enjoy the very best that the world has to offer.

-

Health Care Stocks Have Sagged. Can You Bet on a Recovery?

Health Care Stocks Have Sagged. Can You Bet on a Recovery?The flagging health care sector has perked up a bit lately. Is it time to invest?

-

Costco's Auto Program: Can Membership Pricing Really Save You Money on a Car?

Costco's Auto Program: Can Membership Pricing Really Save You Money on a Car?Costco's Auto Program can simplify the car-buying process with prearranged pricing and member perks. Here's what to know before you use it.

-

What Is an Assumable Mortgage and Could It Save You Thousands?

What Is an Assumable Mortgage and Could It Save You Thousands?With mortgage rates still elevated, taking over a seller’s existing home loan could lower monthly payments — if the numbers work.

-

Have You Fallen Into the High-Earning Trap? This Is How to Escape

Have You Fallen Into the High-Earning Trap? This Is How to EscapeHigh income is a gift, but it can pull you into higher spending, undisciplined investing and overreliance on future earnings. These actionable steps will help you escape the trap.

-

I'm a Financial Adviser: These 3 Questions Can Help You Navigate a Noisy Year With Financial Clarity

I'm a Financial Adviser: These 3 Questions Can Help You Navigate a Noisy Year With Financial ClarityThe key is to resist focusing only on the markets. Instead, when making financial decisions, think about your values and what matters the most to you.

-

Where Olympians Store Their Medals is a Great Lesson For Your Valuables and Cash

Where Olympians Store Their Medals is a Great Lesson For Your Valuables and CashWhat you can learn about protecting your cash and values from where Olympians store their medals.

-

An Executive's 'Idiotic' Idea: Skip Safety Class and Commit a Federal Crime

An Executive's 'Idiotic' Idea: Skip Safety Class and Commit a Federal CrimeSeveral medical professionals reached out to say that one of their bosses suggested committing a crime to fulfill OSHA requirements. What's an employee to do?

-

How You Can Use the Financial Resource Built Into Your Home to Help With Your Long-Term Goals

How You Can Use the Financial Resource Built Into Your Home to Help With Your Long-Term GoalsHomeowners are increasingly using their home equity, through products like HELOCs and home equity loans, as a financial resource for managing debt, funding renovations and more.

-

How to Find Free Money for Graduate School as Federal Loans Tighten in 2026

How to Find Free Money for Graduate School as Federal Loans Tighten in 2026Starting July 1, federal borrowing will be capped for new graduate students, making scholarships and other forms of "free money" vital. Here's what to know.

-

How to Choose the Best Internet Plan in Retirement

How to Choose the Best Internet Plan in RetirementYour internet needs can change dramatically after you stop working. Here's how to make sure you're not overpaying (or underpowered).