Stock Market Today: Stocks Struggle for Direction After Mixed Data

Existing home sales fell for a sixth straight month in July, while the latest jobs data pointed to a stable labor market.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

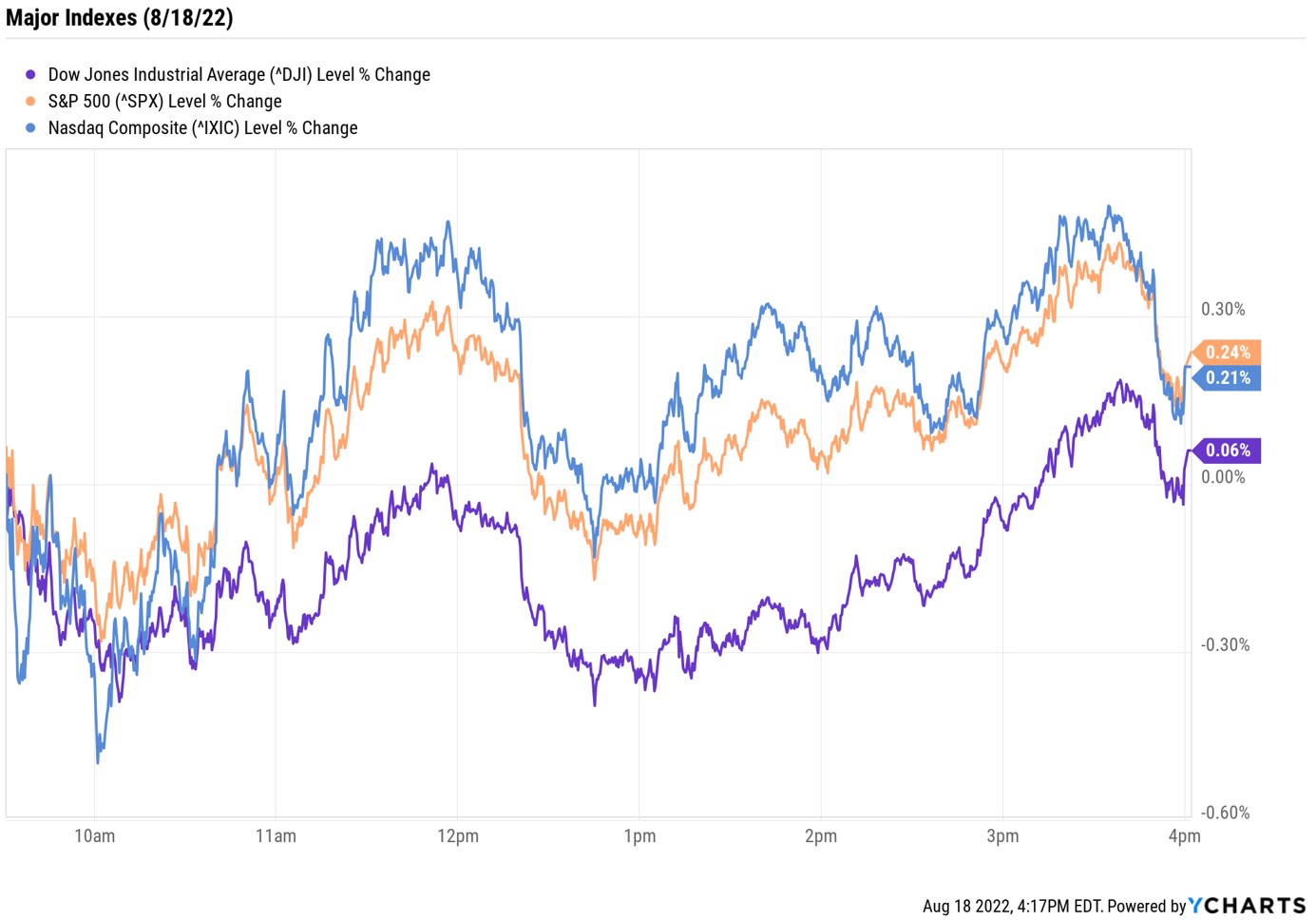

Choppy is the best word to describe how stocks behaved Thursday, with the major indexes spending the session bouncing between positive and negative territory.

In focus today was the release of several economic reports, with weak housing data drawing the most attention. The National Association of Realtors this morning said existing home sales fell for a sixth straight month in July – down 5.9% from June to a seasonally adjusted rate of 4.81 million homes. On a year-over-year basis, existing home sales were off 20.2%.

"Outside of the initial months of the pandemic, existing home sales in July fell to the lowest level since 2015," says Jeffrey Roach, chief economist for independent broker-dealer LPL Financial. "A slowdown in housing has real economic impacts across the economy. For the demographic without home equity or a fixed-rate mortgage, inflationary pressures are acute and, unfortunately, rent prices are accelerating."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Also on the data front, the Labor Department this morning said weekly jobless claims edged down 2,000 last week to 250,000. The consensus estimate was for initial jobless claims to arrive at 265,000. "As long as the labor market remains stable, the Fed will continue increasing rates," Roach says. The economist expects the central bank to raise rates by half a percentage point in September, marking a slowdown from back-to-back 75 basis-point rate hikes in June and July. (A basis point is one-one hundredth of a percentage point).

Amid this mixed economic data, the major indexes failed to make any big moves. The Nasdaq Composite was up 0.5% at its session peak, before settling with a slimmer 0.2% gain at 12,965. The S&P 500 Index pared a portion of its earlier lead to end the day up 0.2% at 4,283. And the Dow Jones Industrial Average, which was lower for most of the day, eked out a 0.1% win to finish at 33,999.

Other news in the stock market today:

- The small-cap Russell 2000 tacked on 0.7% to end at 2,000.

- U.S. crude futures rose 2.7% to finish at $90.50 per barrel.

- Gold futures fell 0.3% to settle at $1,771.20 an ounce.

- Bitcoin gained 0.3% to $23,346.76. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Cisco Systems (CSCO) jumped 5.8% – making it the best Dow Jones stock today – after the maker of networking technology components reported earnings. In its fiscal fourth quarter, CSCO said earnings arrived at 83 cents per share and revenue came in at $13.1 billion, both figures higher than analysts were expecting. For its upcoming fiscal year, Cisco expects revenue growth of 5% at the midpoint, compared to the consensus estimate for 2.3% growth. "Given the weak results and negative commentary last quarter, we view these results as a strong end to what has been a very difficult year for CSCO," says CFRA Research analyst Keith Snyder (Strong Buy). "We believe the 4% to 6% revenue growth guidance for fiscal 2023 is on the conservative side given the record backlog levels and remaining performance obligations of $31 billion, $17 billion of which will be recognized in the next 12 months."

- It's been a wild month for Bed Bath & Beyond (BBBY), which soared nearly 273% from July 29 through last night's close. Today, though, the meme stock plummeted 19.6% (and is down another 19% in after-hours trading) after Ryan Cohen, GameStop (GME, -6.4%) chairman and founder of Chewy (CHWY, -4.7%), said he is selling his entire BBBY stake (9.45 million shares, according to an SEC filing) through his venture capital firm RC Ventures. "News that Ryan Cohen may be selling his stake in BBBY appears to have spooked the meme stock faithful," says David Jones, chief market strategist at Capital.com. "Unlike the frenzy of the past – with the likes of GME and AMC Entertainment Holdings (AMC, -9.7%) – BBBY traders seem more inclined to follow institutional wisdom than to blindly battle for companies with poor fundamentals. Could this be a turning point for meme stock traders? Perhaps traders have learnt from the past frenzies that while short term gains can be impressive, sentiment in short squeezes can reverse just as quickly, so this time around they may be being more cautious."

The Best Bond ETFs

Exchange-traded funds have been growing in popularity over the past two decades, and it's easy to see why. They provide investors flexibility to diversify their portfolios across dozens, hundreds or sometimes even thousands of assets – and often at attractive fees.

Here at Kiplinger, we offer a wide variety of coverage on the best ETFs to buy, including our favorite low-cost funds – perfect for those looking to build a core portfolio – and megatrend stock ETFS, which give investors exposure to disruptive technologies. Most recently, we updated our list of the best bond ETFs for investors.

Despite a rough year for the bond market, Lawrence Gillum, fixed-income strategist at LPL Financial, still believes "high-quality bonds play a pivotal role in portfolios as they have shown to be the best diversifier to equity risk." He adds that while he expects "further gains for stocks through year-end, unforeseen events happen. And it's best to have that portfolio protection in place before it's needed." These 10 funds provide a variety of ways for investors to gain exposure to the bond market. Check them out.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Big Change Coming to the Federal Reserve

Big Change Coming to the Federal ReserveThe Lette A new chairman of the Federal Reserve has been named. What will this mean for the economy?

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

Job Growth Sizzled to Start the Year. Here's Why It's Unlikely to Impact Interest Rates

Job Growth Sizzled to Start the Year. Here's Why It's Unlikely to Impact Interest RatesThe January jobs report came in much stronger than expected and the unemployment rate ticked lower to start 2026, easing worries about a slowing labor market.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.

-

Dow Hits New High Ahead of January Jobs Report: Stock Market Today

Dow Hits New High Ahead of January Jobs Report: Stock Market TodayA weak reading on December retail sales was in focus ahead of Wednesday's delayed labor market data.