Kip ETF 20: What's In, What's Out and Why

The broad market has taken a major hit so far in 2022, sparking some tactical changes to Kiplinger's lineup of the best low-cost ETFs.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

These days, checking on how your investments are doing feels a little like asking for a hard punch in the gut. Nearly every major asset class has suffered losses in recent months. It has been a total disaster.

Over the past six months, the S&P 500 Index surpassed the 20%-loss threshold that typically defines a bear market, though it recovered some. The bond market, which is supposed to provide ballast in a portfolio in times like these, is suffering its own rout. The Bloomberg U.S. Aggregate Bond Index is down 9.2%. Foreign stocks have spiraled down, too. The MSCI EAFE Index, the traditional benchmark for foreign stocks in developed countries, slipped 19.2%; the MSCI Emerging Markets Index fell 17.1%.

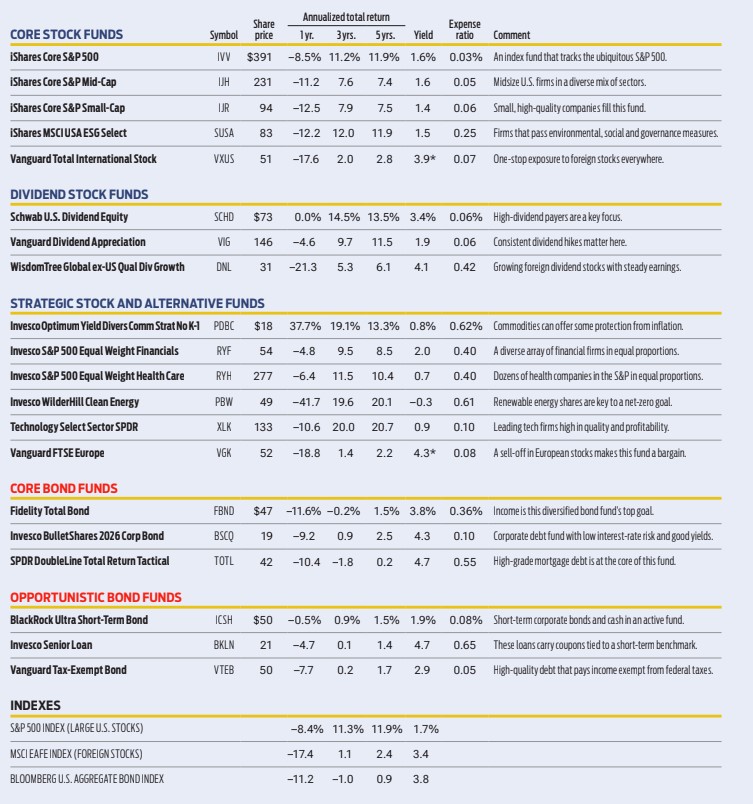

It's in this environment that we conduct our annual review of the Kiplinger ETF 20, our favorite exchange-traded funds, and the ETF industry as a whole. As you can imagine, there's little green – as in positive gains – to be found among our Kip ETF 20. It's a sea of red. But losses are an inevitable fact of investing. "This is part of the price of admission," says Ben Johnson, head of global ETF research at Morningstar, the financial data firm. "If it's too hard to watch, then step out and look at the trees, which at this time of year are mostly green, unlike the markets."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

We don't make changes to our Kiplinger ETF 20 roster lightly. But in order to make room for tactical strategies, something had to come out. This year, we made three such changes; a fourth change was related to an underperforming fund.

What's In, What's Out and Why

We're removing the Fidelity MSCI Industrials Index ETF (FIDU). Stocks in this sector thrive in the early-to-mid part of the economic cycle, but we're now firmly in the late stage, likely heading toward a recession. That said, if you own shares in this fund, stick with it. In a well-diversified portfolio, some parts will work when others do not.

However, we wanted to make room for a new strategy – a commodities fund, the Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF (PDBC). Commodities are in year three of a positive cycle, and such cycles typically last more than a dozen years, say strategists at Wells Fargo Investment Institute. Commodities are effective inflation foils and good portfolio diversifiers, too; when other assets are in decline, commodities tend to do well.

On the bond side, the value in municipal bonds was too good to overlook. Returns are down this year for all major muni-bond categories. But the selloff has created opportunities unseen in years, says a recent report from the Schwab Center for Financial Research. Most municipal bonds pay interest that is exempt from federal taxes. That benefit, coupled with rising yields, means that on a tax-equivalent basis, muni bonds currently yield as much or more than Treasuries and corporate debt.

For that reason, we are replacing the Vanguard Total International Bond ETF (BNDX), which currently yields 2.1%, with the Vanguard Tax-Exempt Bond ETF (VTEB), which pays a tax-equivalent yield of 3.8% for investors in the 24% federal income tax bracket.

We're also swapping out the Vanguard Intermediate-Term Bond ETF (BIV) for an investment-grade corporate bond fund with a target maturity, the Invesco BulletShares 2026 Corporate Bond ETF (BSCQ). The Vanguard ETF is solid, but BulletShares 2026 Corporate Bond offers better reward for the risk. Its duration (a measure of interest-rate sensitivity) is 3.8 years, but it yields 4.3%. By contrast, the Vanguard ETF has a duration of 6.5 years and yields 3.8%.

For the extra yield in the BulletShares fund, you give up a little in credit quality. The fund's bonds have an average credit rating of triple-B, the lowest rung of investment-grade credit. The Vanguard ETF, on the other hand, has an average credit quality of double-A. But over the past 12 months, the BulletShares ETF has lost 9.2%; the Vanguard fund, 12.1%.

A Few Words About Ark Innovation

The ARK Innovation ETF (ARKK), which invests in "innovation that's going to change lives," says manager Cathie Wood, is now the poster child for fizzled-out growth funds.

All of the fund's 35 stocks – which Wood had identified as the best ideas in an array of future trends, including DNA sequencing and gene therapies, energy storage, and robotic and artificial intelligence – are down since the start of the year. The ETF has plummeted 62% over the past 12 months. Readers who bought the fund when we added it to the Kip ETF 20 in 2019 were able to experience outsize gains in 2020, so their losses aren't quite as severe: The fund has posted a meager 0.8% cumulative gain since we added it to the Kip ETF 20 in mid 2019.

What went wrong? Investors spurned shares in fast-growing, nascent businesses as worries about inflation, rising interest rates and lofty valuations overran promises of future growth. "This is risk-off behavior," says manager Wood. Investors sought safety instead in well-known, profitable benchmark stocks, she says. "Most of the names in our portfolios are not in the broad-based Indexes. This is a continuation of fears around inflation and interest rates. It started a year ago, and it remains the case today."

Many of the companies in Ark Innovation's portfolio will likely survive a recession, if one arrives, including Exact Sciences (EXAS), the maker of at-home colon cancer tests; semiconductor leader Nvidia (NVDA); and Teladoc Health (TDOC). Indeed, most of the fund's top 10 holdings, which make up 61% of the portfolio, pull in billions of dollars in annual revenue; half are profitable, including Tesla (TSLA) and Zoom Video Communications (ZM).

But others may not survive an economic downturn. The fund has a good share of smaller positions in companies that are not profitable. Annual revenues at a handful of these companies come in under $100 million. That's a risk with a recession looming. And it's hard to see the market bottom from here; shares look likely to fall further.

So we're removing Ark Innovation from the Kip ETF 20. When we added the fund, we cautioned readers that this was a "shoot-the-moon investment, not a core holding." A long-term view and an iron stomach are necessary if you invest in this type of fund. Even Wood says she invests with a five-year time horizon in mind.

If you sized your investment appropriately with that in mind, the fund accounts for a tiny slice of your overall portfolio, and you could hang on to your shares. Eventually, growth stocks will come back, and by holding on you'd avoid locking in losses. "If you believe in the long-term growth of these trends, then this could be a blip," says Todd Rosenbluth, head of research at ETF data and analytics firm VettaFi, who adds he's not "for or against" the ETF. "If you don't believe in the long-term trends, then it's not the right fund for you."

But if you unload your Ark Innovation shares, it may pay to wait for a bear-market rally before you sell. These sharp, short-term stock-price rebounds that occur during a broader and longer market decline tend to be fast and ferocious, so be on the lookout.

We are replacing Ark Innovation with the Technology Select Sector SPDR Fund (XLK), a tech fund that invests in more-established companies.

The Kiplinger ETF 20 at a Glance

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Nellie joined Kiplinger in August 2011 after a seven-year stint in Hong Kong. There, she worked for the Wall Street Journal Asia, where as lifestyle editor, she launched and edited Scene Asia, an online guide to food, wine, entertainment and the arts in Asia. Prior to that, she was an editor at Weekend Journal, the Friday lifestyle section of the Wall Street Journal Asia. Kiplinger isn't Nellie's first foray into personal finance: She has also worked at SmartMoney (rising from fact-checker to senior writer), and she was a senior editor at Money.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Big Change Coming to the Federal Reserve

Big Change Coming to the Federal ReserveThe Lette A new chairman of the Federal Reserve has been named. What will this mean for the economy?

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

Dow Hits New High Ahead of January Jobs Report: Stock Market Today

Dow Hits New High Ahead of January Jobs Report: Stock Market TodayA weak reading on December retail sales was in focus ahead of Wednesday's delayed labor market data.

-

Tech Stocks Fuel Strong Start to the Week: Stock Market Today

Tech Stocks Fuel Strong Start to the Week: Stock Market TodayThe blue-chip Dow Jones Industrial Average extended its run above 50,000 on Monday and there are plenty of catalysts to keep the 30-stock index climbing.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.