Stock Market Today: Nasdaq Outperforms as Mega-Cap Tech Stocks Soar

Meta Platforms led a rally in Big Tech, while Johnson & Johnson did well among blue chips on news the company will split in two.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Stocks ended a choppy week on a positive note but it wasn't enough to pull the major market indexes into the green on a weekly basis.

In focus today was the University of Michigan's consumer sentiment index, which fell to 66.8 in November from 71.7 in October – its lowest level in a decade and well below the 72.5 expected by economists.

Also on the economic front, the latest Job Openings and Labor Turnover Survey (JOLTS) showed the number of job openings eased slightly in September (to 10.4 million from August's 10.6 million), though the number of quits hit a record high of 4.4 million.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

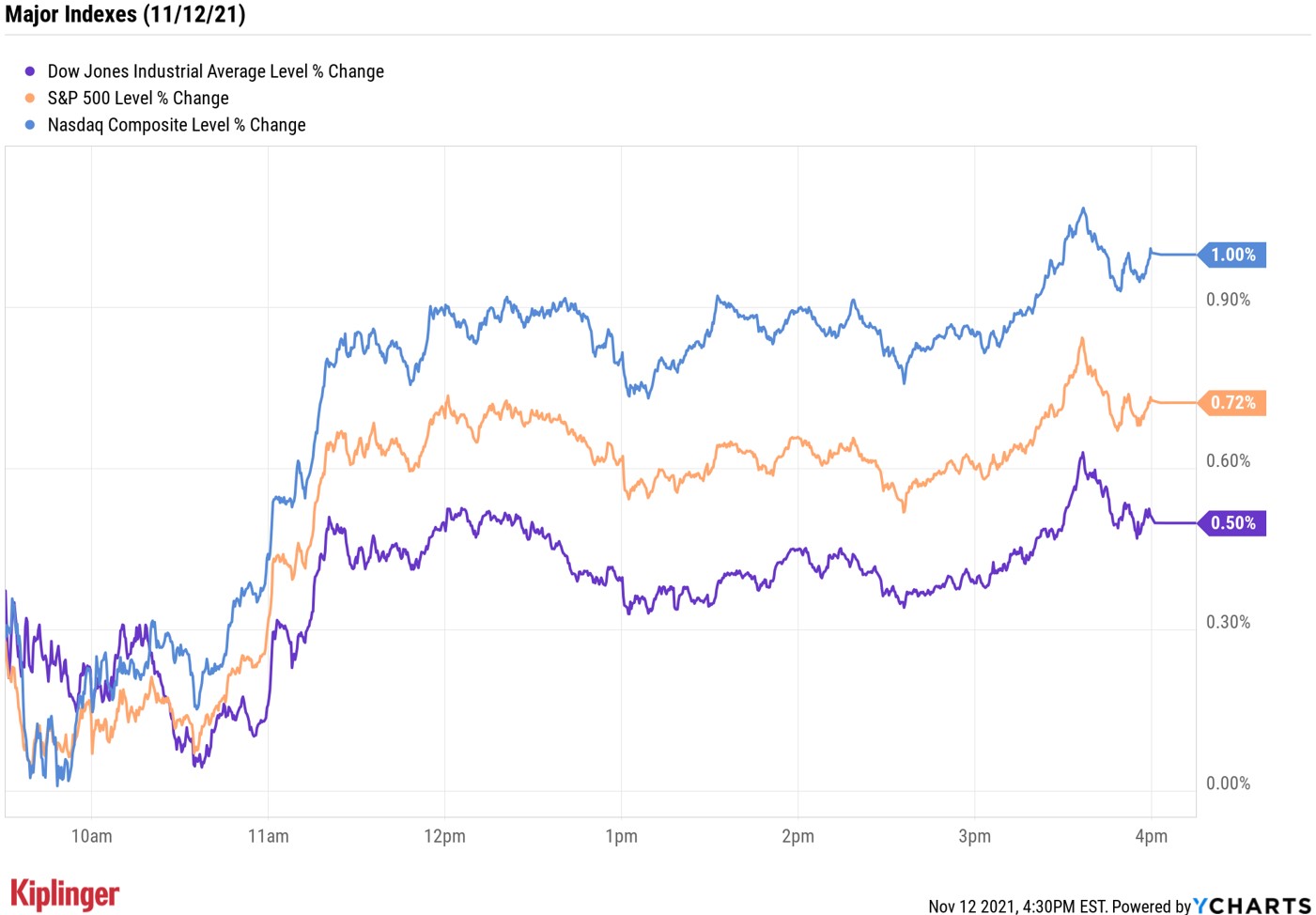

At the close, the Nasdaq Composite was up 1.0% at 15,860 as Meta Platforms (FB, +4.0%) led a rally in mega-cap tech stocks.

The S&P 500 Index gained 0.7% to 4,682 and the Dow Jones Industrial Average rose 0.5% to 36,100 on strength in Johnson & Johnson (JNJ, +1.2%). The healthcare giant gained on news it will split into two publicly traded companies, which you can read more about here.

Still, all three benchmarks notched their first down week since Oct. 1.

Other news in the stock market today:

- The small-cap Russell 2000 rose 0.1% to 2,411.

- U.S. crude futures shed 1% to settle at $80.79 per barrel.

- Gold futures edged up 0.3% to end at $1,868.50 an ounce.

- The CBOE Volatility Index (VIX) plunged 7.8% to 16.29.

- Bitcoin slipped 1% to $64,192.14. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m. each trading day.)

- A day after rocketing higher on the sale of its Ohio plant, Lordstown Motors (RIDE, -17.6%) pulled a 180 after its third-quarter earnings report. Results didn't repel investors – the company's 54-cent-per-share loss was actually better than the 62-cent deficit Wall Street expected. The bears were instead focused on the electric vehicle maker's announcement that the launch of its first vehicle – the Endurance pickup truck – was being pushed back to the second half of 2022.

- Kura Sushi USA (KRUS, +30.2%) exploded to new all-time highs after the conveyor-belt sushi chain reported a smaller operating loss and higher revenues for its fiscal fourth quarter. The company's 32 locations had returned to full indoor dining as of Aug. 31, helping to spur revenues by more than 400% year-over-year to $27.9 million. Meanwhile, its operating loss narrowed to $762,000 from $6.8 million in the year-ago period. KRUS shares are now up more than 260% year-to-date.

What's in Your 401(k)?

As the end of 2021 nears, we have four words for you: Don't neglect your 401(k).

If you're like many payrolled retirement savers, you have taken a "set it and forget it" approach to your 401(k) contributions and allocations. However, there are several reasons to check in on your retirement account. Perhaps your investment goals have changed or you'd like to reallocate funds to make sure you're getting the most bang for your buck.

We continue our annual look at the top mutual funds offered in 401(k) plans that so far has included options from Vanguard, Fidelity and T. Rowe Price. And we've now arrived at American Funds.

According to Kiplinger's Nellie Huang, "American Funds is a powerhouse in the 401(k) world, where investors of all sorts can access them. Six of its funds appear among the 100 most widely held funds in employer-sponsored retirement savings plans; another seven of its target-date funds, American Funds Target Date Retirement series, also rank among the top 100." Today, we delve into seven American Funds that are commonly found in 401(k) plans, rating each one a Buy, Hold or Sell.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

A Top Vanguard ETF Pick Outperforms on International Strength

A Top Vanguard ETF Pick Outperforms on International StrengthA weakening dollar and lower interest rates lifted international stocks, which was good news for one of our favorite exchange-traded funds.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

We're 64 with $4.3 million and can't agree on when to retire.

We're 64 with $4.3 million and can't agree on when to retire.I want to retire now and pay for health insurance until we get Medicare. My wife says we should work 10 more months. Who's right?

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

Dow Absorbs Disruptions, Adds 370 Points: Stock Market Today

Dow Absorbs Disruptions, Adds 370 Points: Stock Market TodayInvestors, traders and speculators will hear from President Donald Trump tonight, and then they'll listen to Nvidia CEO Jensen Huang tomorrow.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.

-

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market Today

S&P 500 Tops 7,000, Fed Pauses Rate Cuts: Stock Market TodayInvestors, traders and speculators will probably have to wait until after Jerome Powell steps down for the next Fed rate cut.

-

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market Today

S&P 500 Hits New High Before Big Tech Earnings, Fed: Stock Market TodayThe tech-heavy Nasdaq also shone in Tuesday's session, while UnitedHealth dragged on the blue-chip Dow Jones Industrial Average.