Stock Market Today: Stocks Retreat on Stimulus Stalemate

Investors rushed out of tech stocks Wednesday as continued gridlock on COVID stimulus measures weighed on Wall Street confidence.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

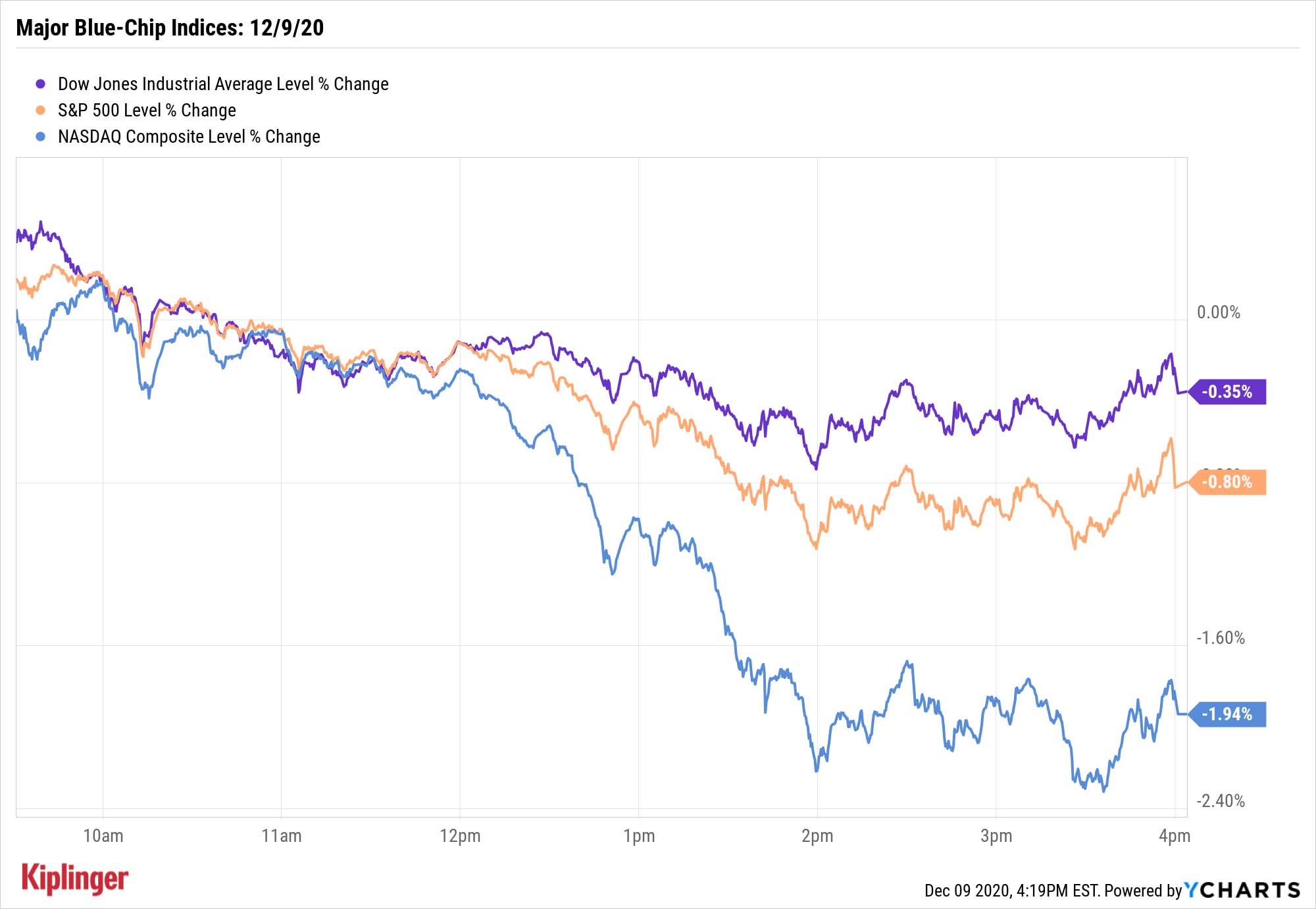

The major indices all retreated on Wednesday, with some of Wall Street's largest corporations bleeding the most.

Washington still can't get its act together on COVID relief: Democratic leaders shot down a $916 billion proposal from the White House, favoring instead a $908 billion bipartisan deal that's still not fully hammered out.

However, the "rotation" away from tech stocks was back on – sellers weren't overly aggressive with the many cyclical names of the Dow Jones Industrial Average, which dipped 0.4% to 30,068, but they sprinted away from mega-cap technology and tech-related firms.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Facebook (FB, -1.9%) helped lead the Nasdaq Composite (-1.9% to 12,338) lower after a group of 48 state attorneys general filed antitrust lawsuits against the social media firm; Apple (AAPL, -2.1%), Amazon.com (AMZN, -2.3%) and Google parent Alphabet (GOOGL, -1.9%) weighed heavily, too.

Where was that money flowing? Well, housing-related stocks Lowe's (LOW, +5.9%) and Home Depot (HD, +1.5%) attracted buyers Wednesday, as did the initial public offering (IPO) of food delivery service DoorDash (DASH), which rocketed 85.8% higher on its first day of trading.

Other action in the stock market today:

- The S&P 500 shed 0.8% to 3,672.

- The small-cap Russell 2000 closed 0.8% off its lows to 1,902.

- Gold futures joined stocks in their decline, falling 1.9% to $1,838.50 per ounce.

- U.S. crude oil futures slid, but by just 0.2% to settle at $45.52 per barrel.

How to Manage This Rotation

Investors should expect more of the same daily churn, analysts say, as Wall Street hangs on every stimulus-related headline. And they also continue to say that value stocks still have the edge.

"November was also a great month for Value with outperformance relative to Growth across all the size segments," write BofA Global Research analysts. "However, multiples actually expanded more in the Growth benchmarks than in the Value benchmarks across sizes. … This is one reason why we remain bullish on Value: the rally barely made a dent in relative valuations."

That continues to bode well for value stocks and value funds alike.

But investors who are fully allocated can't buy much of anything without raising a little cash, so unless you plan a massive contribution soon, you might need to do a little pruning. These 15 dividend-paying stocks continue to look problematic, according to analyst opinions and fundamental data.

Other stocks are coming up against difficult business environments and other obstacles that could hold them back in the year to come. Sell recommendations can always be dicey in a market as resilient as this one, but these five stocks are best sold or avoided as we turn the calendar to 2021.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Why Some Michigan Tax Refunds Are Taking Longer Than Usual This Year

Why Some Michigan Tax Refunds Are Taking Longer Than Usual This YearState Taxes If your Michigan tax refund hasn’t arrived, you’re not alone. Here’s what "pending manual review" means and how to verify your identity if needed.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

Good Stock Picking Gives This Primecap Odyssey Fund a Lift

Good Stock Picking Gives This Primecap Odyssey Fund a LiftOutsize exposure to an outperforming tech stock and a pair of drugmakers have boosted recent returns for the Primecap Odyssey Growth Fund.

-

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Caterpillar Stock 20 Years Ago, Here's What You'd Have TodayCaterpillar stock has been a remarkably resilient market beater for a very long time.

-

Dow Absorbs Disruptions, Adds 370 Points: Stock Market Today

Dow Absorbs Disruptions, Adds 370 Points: Stock Market TodayInvestors, traders and speculators will hear from President Donald Trump tonight, and then they'll listen to Nvidia CEO Jensen Huang tomorrow.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.