Kiplinger Q&A: Hill Harper

The veteran Hollywood actor embraces many of the get-rich-slowly tactics that Kiplinger champions: paying yourself first, dollar-cost averaging, investing in low-fee index funds and teaching financial literacy to children.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

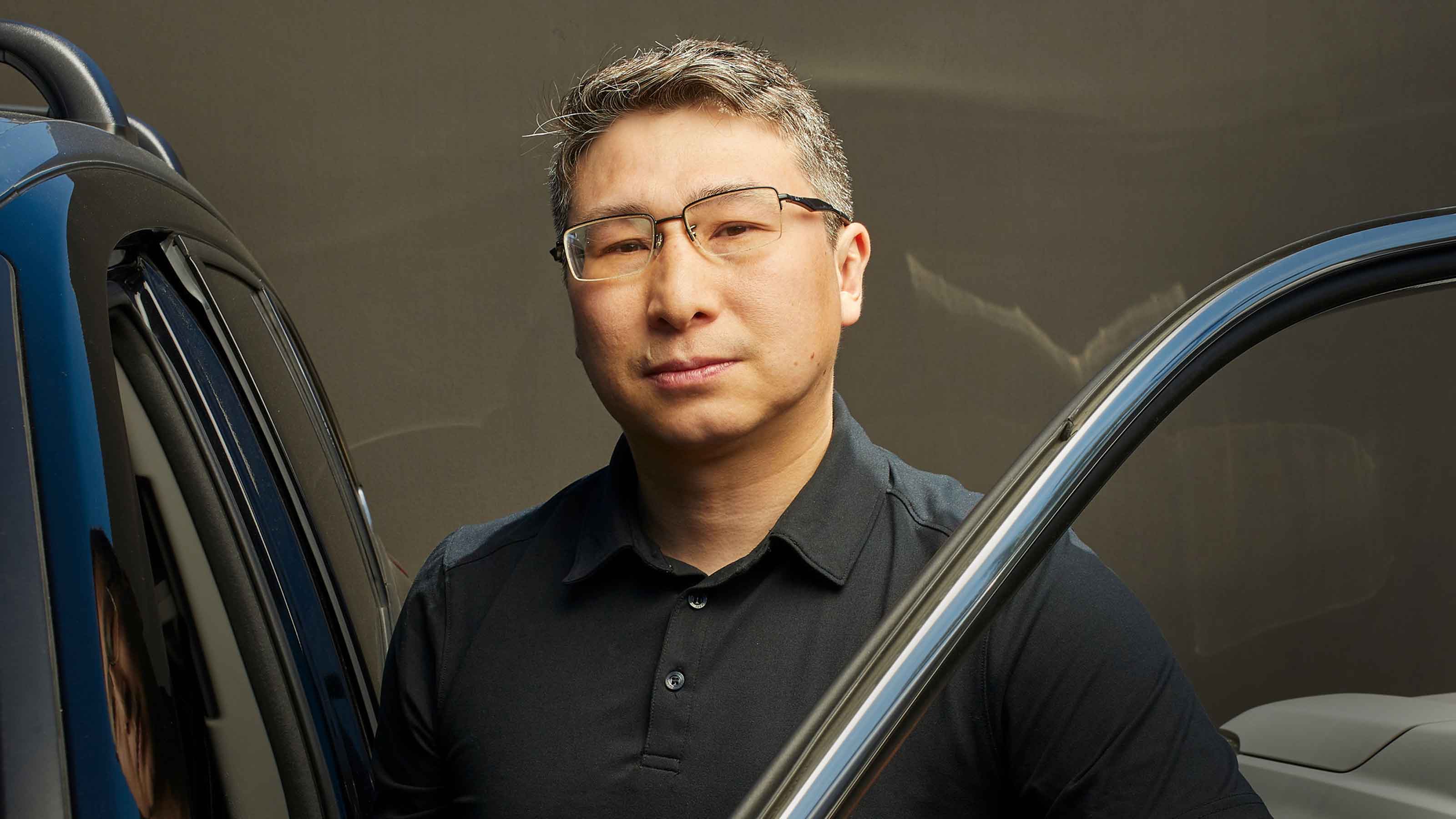

TV and film actor (ABC's "The Good Doctor," CBS's "CSI: NY" and Columbia Pictures' "Concussion") and author Hill Harper sees a void in the lesson plans for today's students ("We don't teach money," he laments) and believes celebrity influencers like himself should fill the gaps. That's a big reason he started his nonprofit organization Manifest Your Destiny, which works with youth in underserved communities in the Los Angeles area. Recently, this personal mission led Harper to partner with Experian's Boost America program, which encourages consumers with little or no credit history to input positive payment information into their Experian credit report using current utility or phone bills. This information is then factored into their overall FICO score, which helps increase their credit scores in real time.

We recently spoke with Harper about the partnership, the importance of proper money management, his personal finance book and his passion for giving back to the community.

Here's an edited transcript of our interview.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Why did you decide to partner with Experian for their Boost America campaign?

Hill Harper: With my foundation, financial literacy and financial empowerment are two of the biggest issues we have been working on consistently. When I was made aware of the Boost America program and what it represents -- the fact that for the first time individuals could take control of their credit and load positive payment history information into their credit report to get a better credit score -- I was very excited about it. It's not like the credit rating area is known for innovation, so to speak.

Why is financial literacy so important to you?

When I started my foundation [in 2005], I was working with young men, women and families in the most challenged neighborhoods. Everything that I would talk to them about -- whether it was education, job or relationship goals, or family cohesion -- came back to money.

The number-one thing couples argue about is money. The number-one thing students or young people talk about as the reason they can't do certain things is money. For people who want to start a business, it's money.

I started saying, 'Okay, if I want to really try to foundationally help people and not just put Band-Aids on problems, I've got to deal with this money piece. I have to really help people understand that money is a tool to be used to help achieve your goals.' [How to manage money] isn't what most of us have been taught . . . Money and your relationship to money could be disastrous, if you end up being saddled with debt.

At what point in your career did you realize that properly managing your money should be a priority?

I realized this when my father passed away in 2000. He worked very hard his entire life and passed from cancer. It was unexpected. The difficulty we had with taking care of the many things he worked so hard for . . . I realized that putting things in place to help build cross-generational wealth is key.

[My father] was a super-smart guy, but he hadn't put certain things in place that could have helped myself and my brother in the transition. I found that if I wanted to be able to help my loved ones after I'm gone, I needed to think more strategically about putting things in place that can help them better navigate the situation. That way, the work I'm doing now can last beyond my lifetime.

I didn't have kids then, but I thought about my family and friends who I'd like to see be helped. Now that I have a son, I've ratcheted that up even more to make sure that in my absence he is set up for success in his life.

What are some things you're doing to help ensure that happens?

My father taught me to do this before he passed away, which was set up an automatic investment account as well as an automatic savings account. By doing this automatically, the money never actually hits your hand. That's important.

[For the investments], my father recommended Vanguard 500 (VFIAX), and I added Vanguard BRIC [Vanguard's Emerging Markets Stock Index Fund (VEMAX) includes stocks from Brazil, Russia, India and China]. Those are two index funds. One is international, and the other is domestic. I selected two different dates each month when an automatic deposit goes into both accounts from my bank account. They'll grow on their own. It's called dollar-cost averaging. The fees are extremely low, and it's simple to execute. You forget that the money is there. Over the course of time, you're building savings, and you're letting the time value of money and compounded interest work on your behalf.

Do you work with a financial team to help manage your money?

Yes, and I do a couple of things that are a little different. I don't work with one financial person or company because I believe every person and every company has their own slant. I like to spread it out. I do certain things on my own that are just me being an individual operative, making certain choices and executing them myself. I also work with an entity for some of my retirement accounts and another entity for some of my direct investment accounts.

Your book, "The Wealth Cure: Putting Money in Its Place," offers an unconventional take on financial wellness. What inspired you to write it?

I was working on a book about finances and money because I wanted to create some measure of empowerment. Then I was diagnosed with [thyroid] cancer [in 2010]. My father had been diagnosed with cancer at a similar age. It really made me realize that at the end of the day, we have to live a truly wealthy life and look at it from a holistic perspective.

Money -- and our relationship to money -- is just one wealth factor. Another wealth factor that's even more important is our health. Then there's our connection with family and loved ones. The last component is working toward our goals, dreams and things that fulfill us. Every person has a different index of what creates the happiest version of themselves. If you're in chronic pain or if you're unhealthy, no matter how much money or or how many friends you have, it's difficult to be happy. So your health has to be a major wealth factor.

Being able to look at all of these things as pieces of a puzzle that build the happiest version of your life is what happened with the book . . . curing things that may be holding you back, which leads to living the wealthiest life possible -- but it's your version of wealth, not something that someone else projects on you.

What's the biggest money lesson you've learned so far?

The biggest money lesson I've learned is that it's not about how much money you earn. People always want to focus on income. It's about how much of it you keep, and how you make what you keep grow. That's critical.

What's the biggest money mistake you've ever made?

I've made so many. Most of mine have to do with betting on people and investing in start-up type of businesses. I've lost a lot by high-risk investments having to do with small businesses and start-ups because usually I'm investing in the person and not necessarily the fundamental underlying business.

You have a 3-year-old son, Pierce. Have you started teaching him any money lessons yet?

I can barely get him to sit still for five seconds . . . but all joking aside, I bought one of these electronic banks that you can put a code in, it opens up and takes the money. He really enjoys just playing with it. He opens it and then puts coins in. That's as far as I've gotten.

I've tried to tell him when he wants something, 'Hey, we're going to have to go to your bank and get the money out to pay for this thing you want.' I'm slowly attempting to make the mental connection between buying something and using what's in your bank to do it.

Within the next few months, I'm going to take the entire bank with me to the toy store, and we're going to empty out the contents. There's probably only like $6 and a bunch of change in it, but we'll empty it out and he'll see the person take all that money. Then the bank will be empty, but he'll have this thing in his hand -- whatever toy he wanted -- and, hopefully, that'll begin to make the connection for him that things cost money and having to save money [to buy what you want].

What's the most frugal thing you do?

I am just like everybody else. I look for sales. I had to go to CVS recently and I was looking for the sale on laundry detergent. I was going through the aisles and using my CVS ExtraCare card, too.

What's the best money advice you've been given?

It's about the time value of money. I call it smart money versus dumb money. Most of us have been taught that a dollar's a dollar, but that's not true. There are smart dollars and there are dumb dollars. Ask yourself: ‘Is whatever you used your money for the previous day worth approximately the same or does it have a greater value?' If it's worth a lot less, then it's dumb money. If it's worth more or the same, it's smart money.

Investing in things that help you, such as eating healthy food or education, that's smart money. Spending on things that depreciate quickly, such as fancy cars, flashy jewelry or fancy sneakers, isn't wise and tends to result in credit card debt.

If you were starting out today, would you still pursue acting or something else?

I would follow my heart. I still love acting. I still love being able to play characters, the interaction with people on set or if you do a play with the cast when you're rehearsing. So I think that there's a high probability I would still be an actor, but acting is just a piece of what I do . . . I would also still pursue other endeavors.

Why is giving back to the community important to you?

My [maternal] grandfather was a pharmacist in a small town in South Carolina. I'm named after him. His name was Harold Hill. They called him Doc Hill. He had a pharmacy called Piedmont Pharmacy that served the black community during Jim Crow segregation. His whole point was, ‘If you have any blessing or the capacity, then the only reason you've been gifted it is to give back.'

With my Manifest Your Destiny foundation, I wanted to help young people in challenged communities be their best selves. I also recently started the Pierce and Hill Harper Arts Foundation in Detroit. It's all about bringing together artists and local residents, teaching people art, as well as art funding in schools.

[The schools] are something we haven't talked about. We teach math from first to 12th grade, but we don't teach money. I think that a young person's relationship to money will impact their life much more than their ability to do long division. Therefore, it's up to those of us who have the capability to create nonprofits and positive partnerships with companies, such as Experian, to fill in the financial literacy void. That's also what I'm trying to do that with the arts because arts funding is going out of schools. I want to fill in that void. Where can I serve? How can I help? And what am I passionate about? The answers to those questions guide my philanthropy.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Browne Taylor joined Kiplinger in 2011 and was a channel editor for Kiplinger.com covering living and family finance topics. She previously worked at the Washington Post as a Web producer in the Style section and prior to that covered the Jobs, Cars and Real Estate sections. She earned a BA in journalism from Howard University in Washington, D.C. She is Director of Member Services, at the National Association of Home Builders.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

How to Search For Foreclosures Near You: Best Websites for Listings

How to Search For Foreclosures Near You: Best Websites for ListingsMaking Your Money Last Searching for a foreclosed home? These top-rated foreclosure websites — including free, paid and government options — can help you find listings near you.

-

Four Tips for Renting Out Your Home on Airbnb

Four Tips for Renting Out Your Home on Airbnbreal estate Here's what you should know before listing your home on Airbnb.

-

Is Relief from Shipping Woes Finally in Sight?

Is Relief from Shipping Woes Finally in Sight?business After years of supply chain snags, freight shipping is finally returning to something more like normal.

-

Economic Pain at a Food Pantry

Economic Pain at a Food Pantrypersonal finance The manager of this Boston-area nonprofit has had to scramble to find affordable food.

-

The Golden Age of Cinema Endures

The Golden Age of Cinema Enduressmall business About as old as talkies, the Music Box Theater has had to find new ways to attract movie lovers.

-

Pricey Gas Derails This Uber Driver

Pricey Gas Derails This Uber Driversmall business With rising gas prices, one Uber driver struggles to maintain his livelihood.

-

Smart Strategies for Couples Who Run a Business Together

Smart Strategies for Couples Who Run a Business TogetherFinancial Planning Starting an enterprise with a spouse requires balancing two partnerships: the marriage and the business. And the stakes are never higher.

-

Fair Deals in a Tough Market

Fair Deals in a Tough Marketsmall business When you live and work in a small town, it’s not all about profit.