6 Cheap Blue-Chip Stocks to Buy Now

Volatile markets can be a blessing in disguise for bargain hunters of blue-chip stocks.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Volatile markets can be a blessing in disguise for bargain hunters of blue-chip stocks. After all, name-brand companies don’t go on sale every day. If it takes inflation fears, presumptive trade wars or a whiff of scandal to get good stocks at great prices, so be it.

But how do you find such blue-chip bargains? One way is to key on some fundamental valuation measures. Any time a big, quality name is trading at a price-earnings multiple that doesn’t adequately reflect it earnings growth prospects, you have a potentially cheap stock on your hands. Put another way: If a stocks trades at 15 times estimated earnings, but analysts forecast those same earnings to grow at an average of, say, 25% a year for the next five years, something’s up.

Now, it could be that whatever’s up is not good. Sometimes a stock is cheap for a reason. Perhaps it represents equity ownership in a virtual Dumpster fire, for example. When it comes to quality blue-chip stocks, however, there’s a chance the market is simply giving a patient, long-term investor a break on price.

Here are some big-name blue-chip stocks we found that aren’t quite trading up to their growth prospects. They might be cheap for now, but they probably won’t stay that way for long.

Data is as of March 13, 2018. Companies are listed in alphabetical order. Dividend yields are calculated by annualizing the most recent quarterly payout and dividing by the share price. Analysts’ ratings provided by Zacks Investment Research. Click on ticker-symbol links in each slide for current share prices and more.

Aflac

- Market value: $35.4 billion

- Dividend yield: 2.0%

- Analysts’ opinion: 3 strong buy, 0 buy, 6 hold, 1 sell, 1 strong sell

- Aflac (AFL, $90.75) started the year in horrific fashion after a report of alleged fraud sent shares into a dive. Memories of Wells Fargo’s (WFC) phony-accounts scandal likely exacerbated the selloff, but shares in AFL have quietly come back as fears of wrongdoing have died down. Indeed, they’re up about 3% in 2018, essentially matching the performance of the broader market.

Analysts at Janney Montgomery Scott have been steadfast throughout with a “Buy” rating on the stock. “We continue to believe that Aflac’s valuation is attractive and feel that, over time, investors will likely be rewarded from current levels,” they write. Even after recovering from the January swoon, Aflac stock trades at nearly 11 times expected earnings. That’s a bargain given that profits are projected to rise an average of nearly 14% annually over the next five years.

Then there’s the matter of the dividend, which has been as solid as they come. The supplemental insurance company has hiked its payout every year for 36 consecutive years.

Alphabet

- Market value: $792.6 billion

- Dividend yield: N/A

- Analysts’ opinion: 23 strong buy, 4 buy, 5 hold, 0 sell, 0 strong sell

Google parent Alphabet (GOOGL, $1,140.42) sure doesn’t look like a bargain at first glance. Not many stocks that go for more than $1,000 a pop do. But don’t let the four-figure share price fool you – the search giant is undervalued given its longer-term growth prospects.

GOOGL shares change hands at a bit less than 24 times expected earnings, according to data from Thomson Reuters. Yet earnings are expected to increase at an average annual rate of almost 25% a year for the next half-decade. That’s at least fair, and actually cheap by today’s market standards. Indeed, based on what investors are paying for earnings growth, Alphabet is cheaper than Standard & Poor’s 500-stock index.

William Blair equity research rates GOOGL at “Outperform” (equivalent of “Buy”), noting the increasing importance of non-advertising products like hardware and cloud-based services.

Apple

- Market value: $913.2 billion

- Dividend yield: 1.4%

- Analysts’ opinion: 13 strong buy, 1 buy, 13 hold, 0 sell, 1 strong sell

- Apple (AAPL, $179.96) is another mega-stock whose stock price doesn’t fully reflect the company’s earnings potential. As with Alphabet, this is partly a reflection of Apple’s massive size. It simply gets harder to grow rapidly off a bigger and bigger base.

But there’s no law that says Apple can’t be the first trillion-dollar company, even if shares are priced like they are. AAPL stock goes for less than 14 times expected earnings. Oh, and it’s also sitting on a massive cash pile – Chief Financial Officer Luca Maestri says the company’s “current net cash position is $163 billion,” and Apple plans on spending much of that to eventually become “approximately net-cash neutral.”

Warren Buffett’s Berkshire Hathaway (BRK.B) made Apple its most-bought stock over the last year. The world’s greatest value investor knows a cheap stock when he sees one.

One risk to watch out for with Apple, however, is a potential looming U.S. trade war – specifically with China. The fact that its products are even merely assembled in China could in theory come back to bite it, so investors should keep an eye on that developing situation.

Caterpillar

- Market value: $91.8 billion

- Dividend yield: 2.0%

- Analysts’ opinion: 8 strong buy, 2 buy, 10 hold, 0 sell, 0 strong sell

Shares in Caterpillar (CAT, $153.69) have stumbled lately. The threat of a global trade war will do that to the world’s largest maker of construction and mining equipment. Free trade is critical to CAT, to be sure, note analysts at William Blair, which is partly why they rate shares at “Market Perform” (equivalent of “Hold”). But they also note that Caterpillar, a component of the Dow Jones industrial average, is “probably (in) the best position it has ever been.”

Although trade-war rhetoric might be on the rise, it remains just that. Meanwhile, a synchronized global economic recovery remains very real. “Caterpillar (has) seen a major increase in demand for products with the resurgence of the global economy and tax reform in the United States,” William Blair notes.

Caterpillar’s stock fetches just less than 15 times expected earnings, and yet earnings are projected to rise an average of 20% a year for the next five years. Trade risks remains, but a good chunk appears already to be reflected in CAT’s price.

- Market value: $528.4 billion

- Dividend yield: N/A

- Analysts’ opinion: 23 strong buy, 4 buy, 2 hold, 0 sell, 0 strong sell

The valuation story on Facebook (FB, $181.88) is similar to that of Alphabet and Apple. Yes, it’s a giant company, but it still has the potential for outsized earnings growth that’s not adequately reflected in the stock.

Investors are willing to pay 21 times Facebook’s estimated earnings, and yet those selfsame earnings are projected to increase at an average rate of 27% a year. Put that way, Facebook is trading at a discount to the S&P 500 by their respective growth prospects.

Some investors worry that changes instituted by Facebook to its News Feed put revenue growth at risk. Analysts say those fears are overblown. “We continue to believe that any slowdown in time spent (on Facebook) will be compensated for by higher-quality time spent,” says Canaccord Genuity, which rates shares at “Buy.”

Visa

- Market value: $278.1 billion

- Dividend yield: 0.6%

- Analysts’ opinion: 24 strong buy, 2 buy, 1 hold, 0 sell, 0 strong sell

- Visa (V, $123.18), as we noted recently, is a favorite stock of hedge funds, and it’s easy to see why. As the world’s largest payments network, perhaps no company is as well-positioned to benefit from the growth of cashless transactions and digital mobile payments. Analysts at Credit Suisse, who rate shares at “Outperform” (equivalent of “Buy”), recently applauded the company’s new co-brand deals with Starbucks (SBUX) and Uber, as well as its renewed partnership with Marriott (MAR).

Visa stock is up about 37% over the past 52 weeks, but they still look like a good deal for patient investors. Shares go for less than 24 times forward earnings on expected average profit growth of more than 18% a year. No, that doesn’t make V stock a steal, but are you really going to argue with Buffett? Berkshire Hathaway, of which the famed value investor is chairman and CEO, owns nearly 11 million shares in Visa.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Dan Burrows is Kiplinger's senior investing writer, having joined the publication full time in 2016.

A long-time financial journalist, Dan is a veteran of MarketWatch, CBS MoneyWatch, SmartMoney, InvestorPlace, DailyFinance and other tier 1 national publications. He has written for The Wall Street Journal, Bloomberg and Consumer Reports and his stories have appeared in the New York Daily News, the San Jose Mercury News and Investor's Business Daily, among many other outlets. As a senior writer at AOL's DailyFinance, Dan reported market news from the floor of the New York Stock Exchange.

Once upon a time – before his days as a financial reporter and assistant financial editor at legendary fashion trade paper Women's Wear Daily – Dan worked for Spy magazine, scribbled away at Time Inc. and contributed to Maxim magazine back when lad mags were a thing. He's also written for Esquire magazine's Dubious Achievements Awards.

In his current role at Kiplinger, Dan writes about markets and macroeconomics.

Dan holds a bachelor's degree from Oberlin College and a master's degree from Columbia University.

Disclosure: Dan does not trade individual stocks or securities. He is eternally long the U.S equity market, primarily through tax-advantaged accounts.

-

Americans, Even With Higher Incomes, Are Feeling the Squeeze

Americans, Even With Higher Incomes, Are Feeling the SqueezeA 50-year mortgage probably isn’t the answer, but there are other ways to alleviate the continuing sting of high prices

-

Hiding the Truth From Your Financial Adviser Can Cost You

Hiding the Truth From Your Financial Adviser Can Cost YouHiding assets or debt from a financial adviser damages the relationship as well as your finances. If you're not being fully transparent, it's time to ask why.

-

How to Manage a Disagreement With Your Financial Adviser

How to Manage a Disagreement With Your Financial AdviserKnowing how to deal with a disagreement can improve both your finances and your relationship with your planner.

-

Stock Market Today: Nasdaq Hits a New High as Nvidia Soars

Stock Market Today: Nasdaq Hits a New High as Nvidia SoarsA big day for Nvidia boosted the Nasdaq, but bank stocks created headwinds for the S&P 500.

-

The 24 Cheapest Places To Retire in the US

The 24 Cheapest Places To Retire in the USWhen you're trying to balance a fixed income with an enjoyable retirement, the cost of living is a crucial factor to consider. Is your city the best?

-

Wells Fargo Stock Falls Despite Q2 Beat: Buy, Sell or Hold?

Wells Fargo Stock Falls Despite Q2 Beat: Buy, Sell or Hold?Wells Fargo stock is down despite reporting better-than-expected second-quarter earnings results. Here’s what you need to know.

-

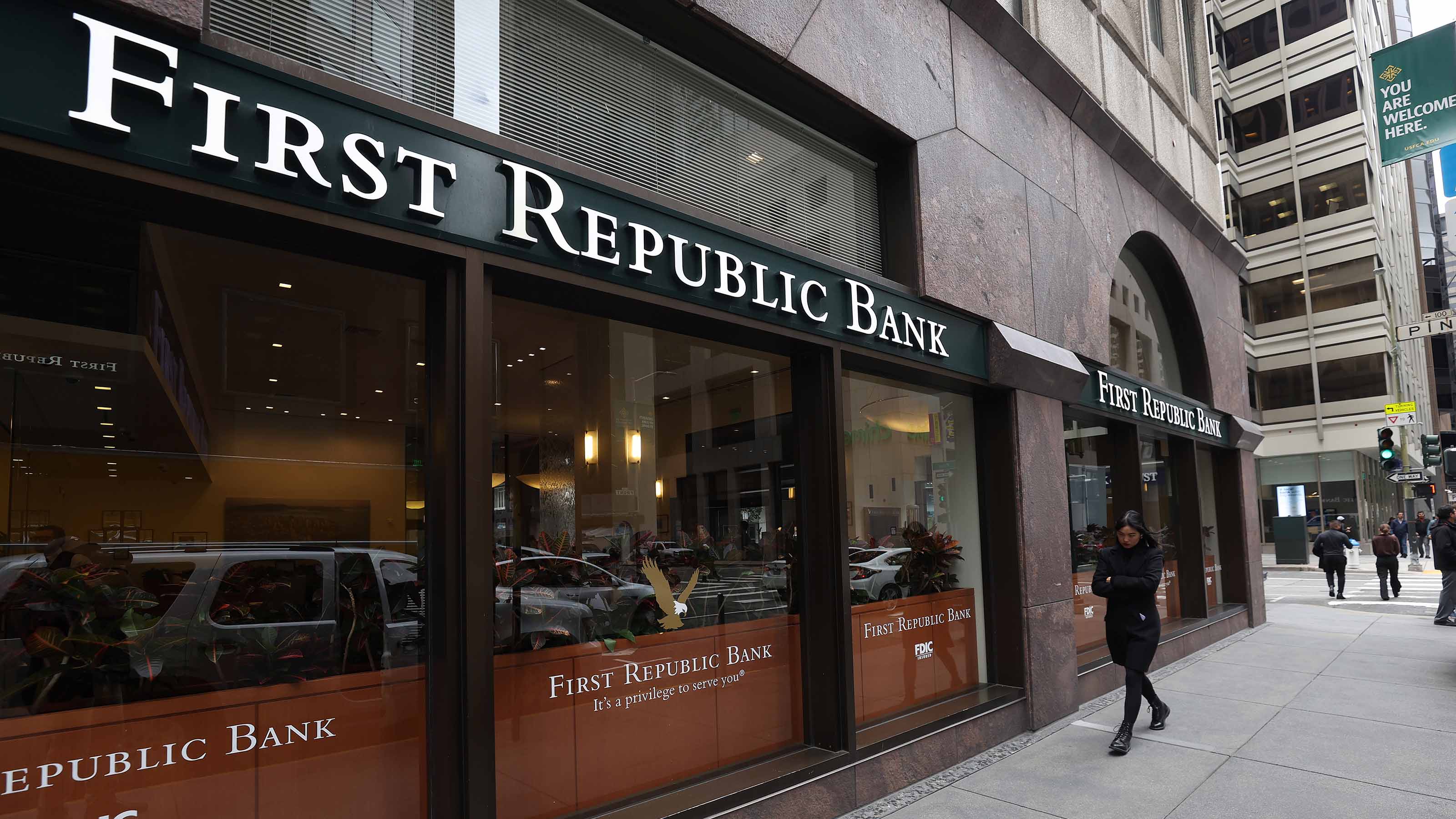

Stock Market Today: Stocks Rally on Credit Suisse, First Republic Bank Rescue News

Stock Market Today: Stocks Rally on Credit Suisse, First Republic Bank Rescue NewsReports that major U.S. banks would step in to help First Republic Bank helped stocks swing higher Thursday.

-

5 Stocks to Sell or Avoid Now

5 Stocks to Sell or Avoid Nowstocks to sell In a difficult market like this, weak positions can get even weaker. Wall Street analysts believe these five stocks should be near the front of your sell list.

-

Best Stocks for Rising Interest Rates

Best Stocks for Rising Interest Ratesstocks The Federal Reserve has been aggressive in its rate hiking, and there's a chance it's not done yet. Here are eight of the best stocks for rising interest rates.

-

The Five Safest Vanguard Funds to Own in a Volatile Market

The Five Safest Vanguard Funds to Own in a Volatile Marketrecession The safest Vanguard funds can help prepare investors for market tumult but without high fees.

-

Stock Market Today: Stocks Swing Higher After Consumer Sentiment Data

Stock Market Today: Stocks Swing Higher After Consumer Sentiment DataA rough start to Friday's session couldn't keep the major benchmarks from extending their daily winning streaks.