Stock Market Today: Stocks Rally on Credit Suisse, First Republic Bank Rescue News

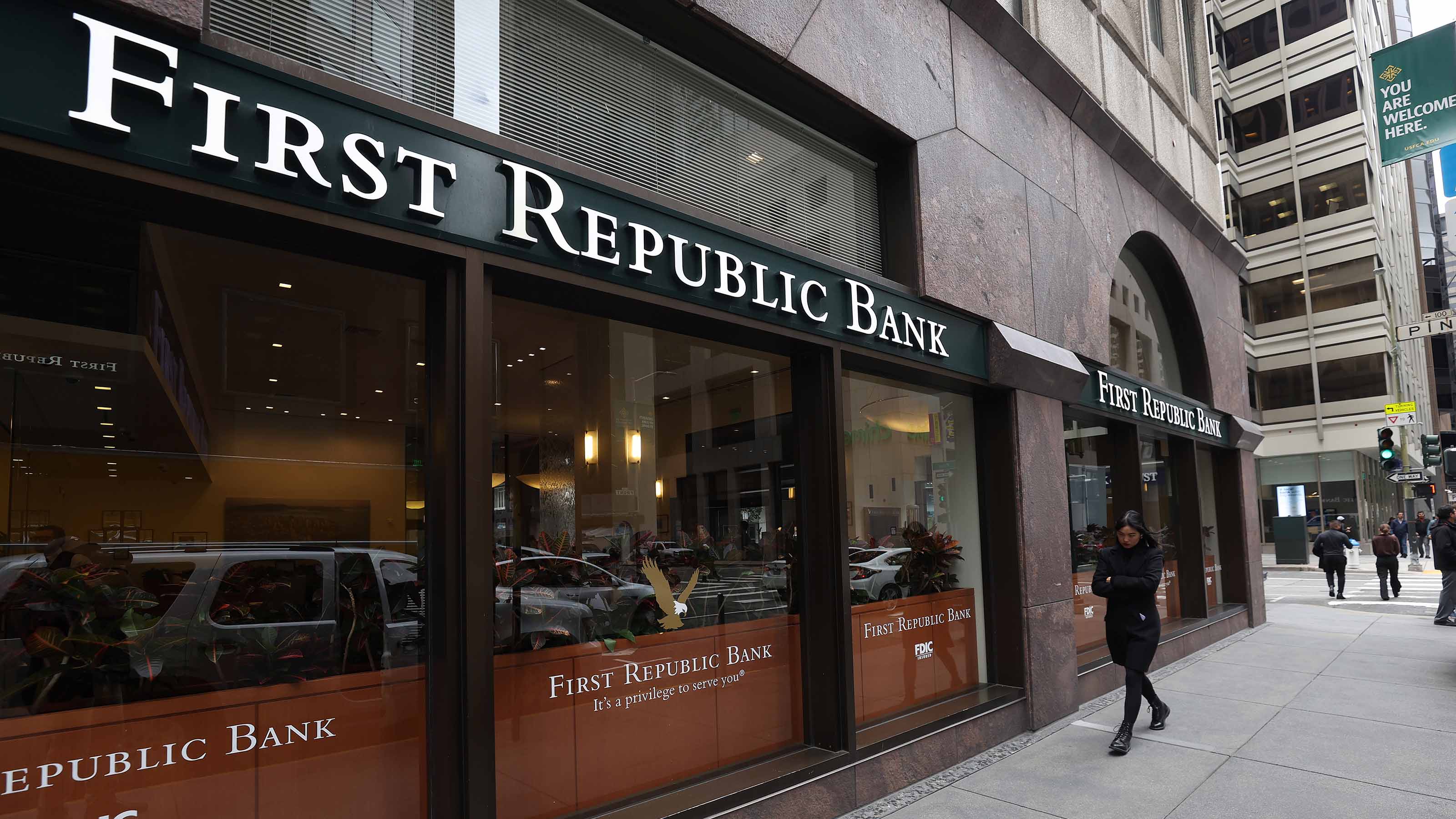

Reports that major U.S. banks would step in to help First Republic Bank helped stocks swing higher Thursday.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Stocks opened lower Thursday before reversing course mid-morning and rallying into the close.

Sparking the turnaround were reports that several of the country's largest banks – including blue chip stocks JPMorgan Chase (JPM) and Bank of America (BAC) – will provide beaten-down regional lender First Republic Bank (FRC) with a massive injection of deposits. Also lifting sentiment was news that Swiss National Bank offered a lifeline to Credit Suisse (CS).

It's been a chaotic week in the financial sector sparked by weekend headlines surrounding the failures of Silicon Valley Bank and Signature Bank. While this has created substantial volatility among bank stocks, the broader market has been fairly resilient. Still, today's positive headlines allowed investors to breathe a sigh of relief that the disruption could be contained.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

As a result, the Nasdaq Composite jumped 2.5% to 11,717, the S&P 500 soared 1.8% to 3,960, and the Dow Jones Industrial Average gained 1.2% to 32,246.

All but one sector – real estate (unchanged) – finished higher, with technology (+2.8%) and communications services (+2.2%) leading the way. Financials (+1.9%) were another solid gainer, thanks to strong price action seen across the sector.

FRC stock, for one, was down more than 36% at its session low before ending the day up 10.3%. Boosting the volatile bank stock was news that JPM, BAC, Wells Fargo (WFC) and Citigroup (C) will deposit $5 billion apiece into First Republic. Several other banks will reportedly commit smaller amounts to the rescue effort.

Elsewhere, CS stock was up 18% at its session high after the bank secured a $50 billion loan from Swiss National Bank in what it called "decisive action to pre-emptively strengthen its liquidity." Shares ended the day down 0.2%, though. Anxiety around the strength of the Swiss bank – sparked in part by the recent closures of SVB and Signature Bank – sent its shares tumbling on Wednesday.

Is tech the new safety play?

Are tech stocks the new safety plays? Tech and tech-related sectors like communications services have shown relative strength throughout the first quarter. Looking at the numbers, the tech-heavy Nasdaq is up more than 11% for the year-to-date vs a roughly 3% gain for the broader S&P 500 and a 3% decline for the blue-chip Dow.

There are two potential reasons for the outperformance, says Carrie King, global deputy chief investment officer of BlackRock Fundamental Equities. One is possible bargain hunting after a significant underperformance from tech and tech-related stocks last year. Another is the notable cost-cutting that's been underway, including massive layoffs.

For investors looking to play the hot hand of the market, there are plenty of ideas, including those found among the best tech stocks and the best communication services stocks. As for industry-specific opportunities, these are the best semiconductor stocks and the best AI stocks to buy now.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

5 Vince Lombardi Quotes Retirees Should Live By

5 Vince Lombardi Quotes Retirees Should Live ByThe iconic football coach's philosophy can help retirees win at the game of life.

-

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USA

The $200,000 Olympic 'Pension' is a Retirement Game-Changer for Team USAThe donation by financier Ross Stevens is meant to be a "retirement program" for Team USA Olympic and Paralympic athletes.

-

10 Cheapest Places to Live in Colorado

10 Cheapest Places to Live in ColoradoProperty Tax Looking for a cozy cabin near the slopes? These Colorado counties combine reasonable house prices with the state's lowest property tax bills.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Stocks Sink With Alphabet, Bitcoin: Stock Market Today

Stocks Sink With Alphabet, Bitcoin: Stock Market TodayA dismal round of jobs data did little to lift sentiment on Thursday.

-

Dow Leads in Mixed Session on Amgen Earnings: Stock Market Today

Dow Leads in Mixed Session on Amgen Earnings: Stock Market TodayThe rest of Wall Street struggled as Advanced Micro Devices earnings caused a chip-stock sell-off.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market Today

Fed Vibes Lift Stocks, Dow Up 515 Points: Stock Market TodayIncoming economic data, including the January jobs report, has been delayed again by another federal government shutdown.

-

Stocks Close Down as Gold, Silver Spiral: Stock Market Today

Stocks Close Down as Gold, Silver Spiral: Stock Market TodayA "long-overdue correction" temporarily halted a massive rally in gold and silver, while the Dow took a hit from negative reactions to blue-chip earnings.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market Today

Nasdaq Drops 172 Points on MSFT AI Spend: Stock Market TodayMicrosoft, Meta Platforms and a mid-cap energy stock have a lot to say about the state of the AI revolution today.