Your Parents' Retirement Plan Won’t Work for You (The Stats Are In)

Five stats show how you need to rethink retirement, because "the future ain’t what it used to be."

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The story of retirement is still a short one.

Before Social Security was enacted in 1935, most Americans simply worked until they physically couldn’t anymore. It was during the post-World War II boom that pensions became popular and retirement became a formal milestone, giving rise to the familiar narrative that you reach a certain number of years, collect your gold watch and head somewhere warm.

But retirement has never been static. As health, culture and society evolved, so did life’s chapters. Work shifted from farms to offices. Pensions faded. People became more mobile, more connected and more likely to live decades past their final paycheck.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

As a story still being written, retirement today looks little like the retirement your parents knew, which will look even less familiar to the next generation.

These statistics show how Americans are actually retiring now, and where retirement appears to be heading. Follow our tips for how you can modernize your own retirement plan.

1. The age of retirement is inching higher, but no one quite agrees where it should land

If there’s a gumbo-soup equivalent of retirement statistics — a number that reflects all the moving parts — it’s the retirement age. Longer life spans, shifting finances and changing ideas about work are all pushing retirement later.

The average retirement age has climbed to 62, up from 57 in 1991, according to MassMutual and Gallup surveys.

Policy is adding pressure, too. Social Security’s full retirement age is now 67 for those born in 1960 or later, which may quietly nudge more people to work well into their 60s.

Yet expectations lag behind reality. A 2025 Northwestern Mutual study finds that overall, working-age Americans still plan to retire at around 65. But Gen Zers say they aim to retire at 61, while Boomers say they aim to retire at 72. The goal post keeps moving, and no generation seems to agree on where it actually is.

Generation | Age started saving | Age plan to retire | Difference between starting age and target retirement age |

|---|---|---|---|

Gen Z | 24 | 61 | 37 years |

Millennials | 29 | 64 | 35 years |

Gen X | 33 | 67 | 34 years |

Baby boomers | 37 | 72 | 35 years |

Source: Northwestern Mutual's 2025 Planning & Progress Study

The reality is that most retirees don’t retire “on time.” They get pushed out.

The Transamerica Center for Retirement Studies reports that 52% of retirees stopped working sooner than planned. Only 7% retired later than they intended. The most common reasons aren’t wanderlust or financial independence. They’re job loss, organizational changes and health issues.

That means modern retirement risk may not be procrastination so much as it is unpredictability.

What you can do. Make sure you ask the right questions to help you decide whether to retire at 55, 60, 62, 65, 67, or 70.

2. You may need a much bigger nest egg than your parents did

The number of 401(k) millionaires in the U.S> is rising. That’s welcome news, because so is the price of admission to retirement.

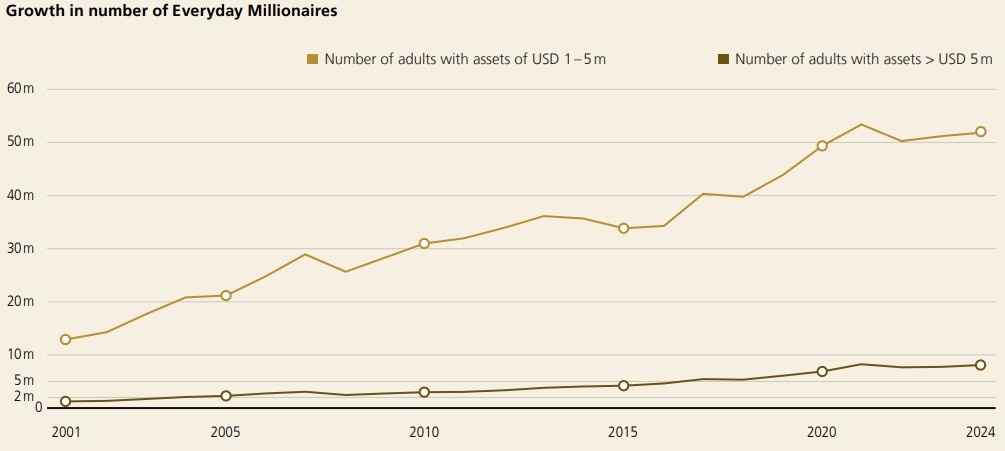

Fidelity recently reported 654,000 401(k) millionaires, the highest number in its history. The UBS Global Wealth Report 2025 estimates that so-called “moderate millionaires” — people with $1 million to $5 million — have quadrupled since 2000, adding roughly 1,000 new millionaires every day in 2024.

And yet, million-dollar balances may no longer feel so extravagant. Northwestern Mutual’s survey finds that Americans now believe they need $1.26 million to retire comfortably — up from $1.05 million just a few years ago.

The increase reflects rising prices and longer life spans, both of which are quietly pushing the cost of retirement higher and forcing savers to aim for bigger nest eggs.

So the good news is retirement is longer. The bad news? Retirement is longer.

What you can do. Stress-test your retirement plan to see if you will have enough money in different scenarios.

3. Americans expect far longer retirements than any generation before

About a third of U.S. adults expect their retirement to last more than a decade longer than the generation before them.

Gen Z is even more optimistic, or cautious. Thirty-four percent believe they’ll live to 100.

Transamerica finds that today’s retirees plan for a median life expectancy of 90, and 11% are planning financially to live past 100. However, nearly half admit they’re unsure how long they’ll live, making longevity risk one of retirement’s biggest planning challenges.

What you can do. Take our quiz on healthy aging. See if you really know how to increase your healthspan (the total number of healthy years you live, relative to your total lifespan).

4. Retirement is less "full stop" and more "phase change"

The clean break from work is giving way to a softer landing.

The Employee Benefit Research Institute reports that about half of workers now expect to retire gradually rather than abruptly. Similarly, Northwestern Mutual finds that 40% of Americans plan to work in retirement, rising to nearly half of Gen X and Millennials.

Some do it for money. Others do it for a sense of purpose. Among those planning to work, 50% say they want to feel useful and stimulated, while 48% expect they’ll need the income.

Most won’t stay in their old jobs, either. Fifty-nine percent expect to switch to a different job, and 20% plan to pick up a flexible side gig.

For many, retirement no longer means leaving work; it means finding a meaningful role that fits their desired life.

It reflects a shift in the cultural meaning of retirement happiness. Consider that Northwestern Mutual reports that 80% of U.S. adults expect their retirement to be fundamentally different from the one their parents lived.

More than half say they expect to spend more time traveling, while nearly half anticipate devoting more energy to personally fulfilling activities. Many also expect to prioritize time with friends and family, and more than a third believe part-time or flexible work will be part of their retirement lives. Even volunteering is increasingly being woven into what people imagine their later years will look like.

What you can do. Spend some time getting to know yourself once more. If you love your job, you could dial down your time or responsibilities with a phased retirement. You could even try bargaining for a sabbatical if you just need a break. But if you want to retire fully, you'll need to apply the "second law" of retirement: establishing a clear structure for your time and purpose.

5. More retirees are choosing to "move on" rather than "settle down"

For a growing number of retirees, home is no longer a fixed address.

Transamerica finds that 37% of retirees move after leaving work, often to downsize, be closer to family, cut expenses or simply start a new chapter.

The pull isn’t just domestic. A 2025 Harris Poll found that 44% of Americans have seriously considered retiring abroad, and 14% are actively planning or contemplating a move overseas within two years. Lower costs, better healthcare and lifestyle flexibility are reshaping where retirement happens, not just when.

What you can do. If you are feeling antsy, check out the best places to retire in the U.S. If you are determined to stay put, develop a plan to age in place or evaluate retirement communities in your area.

Staying socially connected now takes more effort

The shape of American households is changing rapidly.

Census data shows that 29% of U.S. households — nearly 40 million — now consist of just one person, the highest share in history. By 2030, one in five Americans will be 65 or older, even as the population of children continues to shrink.

At the same time, "gray divorce" is surging. About 36% of divorces now involve adults over 50, up from less than 9% in 1990.

Together, these trends mean older adults are increasingly likely to live alone in retirement. And with smaller family networks, that also means fewer built-in caregivers. As a result, social planning has become just as important as financial planning in retirement.

The Yankees' great Yogi Berra once quipped, “The future ain’t what it used to be.” Retirement, it turns out, isn’t either.

And these numbers make one thing clear: the retirement you’re preparing for won’t be a carbon copy of the one that came before. Chances are it will be longer, more flexible, more mobile and far more personal.

What you can do. Try some of these winning techniques for combatting isolation and loneliness from around the globe.

Read More

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Jacob Schroeder is a financial writer covering topics related to personal finance and retirement. Over the course of a decade in the financial services industry, he has written materials to educate people on saving, investing and life in retirement.

With the love of telling a good story, his work has appeared in publications including Yahoo Finance, Wealth Management magazine, The Detroit News and, as a short-story writer, various literary journals. He is also the creator of the finance newsletter The Root of All (https://rootofall.substack.com/), exploring how money shapes the world around us. Drawing from research and personal experiences, he relates lessons that readers can apply to make more informed financial decisions and live happier lives.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Quiz: Do You Know How to Avoid the 'Medigap Trap?'

Quiz: Do You Know How to Avoid the 'Medigap Trap?'Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.We are 62 and finally retired after decades of hard work. I see the lakehouse as an investment in our happiness.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

5 Ronald Reagan Quotes Retirees Should Live By

5 Ronald Reagan Quotes Retirees Should Live ByThe Nation's 40th President's wit and wisdom can help retirees navigate their financial and personal journey with confidence.

-

We're 78 and Want to Use Our 2026 RMD to Treat Our Kids and Grandkids to a Vacation. How Should We Approach This?

We're 78 and Want to Use Our 2026 RMD to Treat Our Kids and Grandkids to a Vacation. How Should We Approach This?An extended family vacation can be a fun and bonding experience if planned well. Here are tips from travel experts.

-

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs In

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs InRoth conversions are all the rage, but what works well for one household can cause financial strain for another. This is what you should consider before moving ahead.