Think You Know How to Be Happy in Retirement? These 9 Stats Might Surprise You

When it comes to your retirement happiness, don't believe everything you hear. We've turned to solid research for the facts on finding your bliss in retirement.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

The average person might celebrate retirement with a vacation. John Glenn, on the other hand, celebrated his with a trip to outer space.

At 77, after announcing his retirement from the U.S. Senate, Glenn joined the space shuttle Discovery, returning to orbit 36 years after becoming the first American to circle the Earth. His late-life mission wasn’t a stunt. It was an expression of who he was and what he believed about meaning in the later chapters of life.

“If there is one thing I've learned in my years on this planet,” he once said, “it's that the happiest people are ones who pursue meaning.”

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

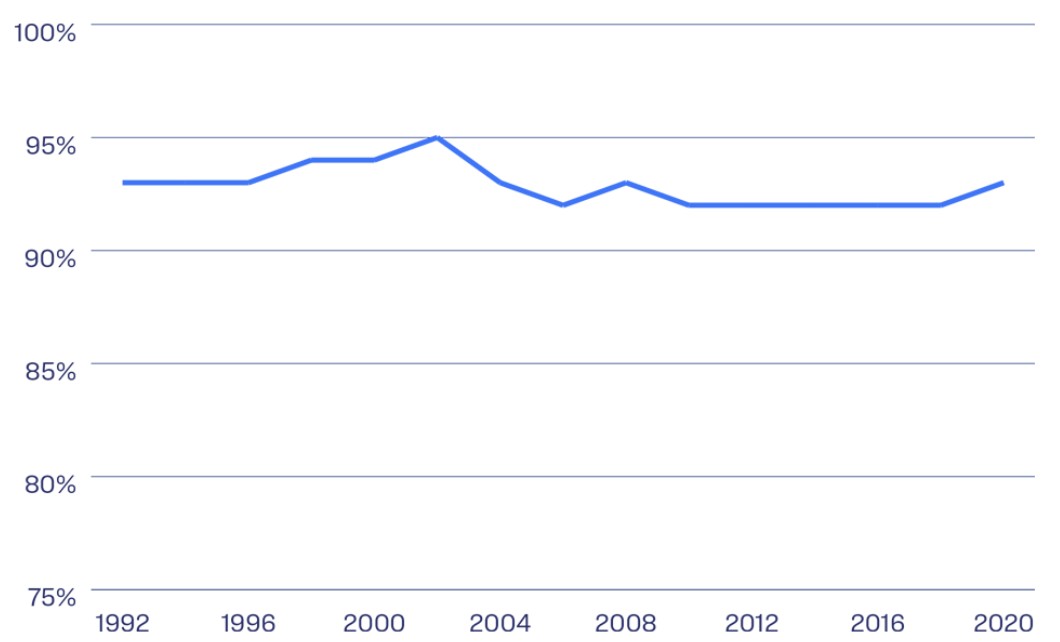

You don’t need to go to space to pursue a happy retirement. Most retirees are already happy. A 2025 TIAA Institute review of retirement well-being found that more than 90% of retirees report being “quite satisfied” or happy with their lives overall, despite common worries about money.

Percentage of respondents moderately or very satisfied with retirement, 1992 - 2020.

But when you dig deeper, the picture becomes far more nuanced. Not all happy retirees are happy in the same way. These statistics reveal why.

1. Retiring early isn't always better

It’s easy to assume that the earlier the retirement, the happier the retiree. But the data suggests there’s a “sweet spot,” and missing it by retiring too early can lead to lower satisfaction if it wasn't planned.

According to the 2024 MassMutual Retirement Happiness Study (PDF), Americans overwhelmingly view 63 as the ideal retirement age, even though the average American actually retires at 62.

That one-year difference matters. Retiring earlier than planned is often linked to involuntary reasons such as layoffs or health issues, and MassMutual found that while 67% of retirees say they’re happier, those who retired earlier than planned were significantly more likely to report feeling lonely or stressed.

2. Control matters more than age

A major reason early, unplanned retirees are less happy is that control over the exit is one of the strongest predictors of retirement well-being.

ProPublica research shows that 56% of workers age 50 and older experience at least one involuntary job separation before they plan to retire. Researchers have also found that voluntary retirees have significantly higher life satisfaction scores than involuntary retirees.

Essentially, a forced exit denies retirees the “mental runway” needed to build a new identity and routine, often leading to a dip rather than a bump in happiness.

In short, when you retire matters, but how you retire matters more.

3. The endless vacation myth

Many people dream of an endless vacation, but the happiest retirees aren’t the ones lounging around all day — they’re the ones doing something.

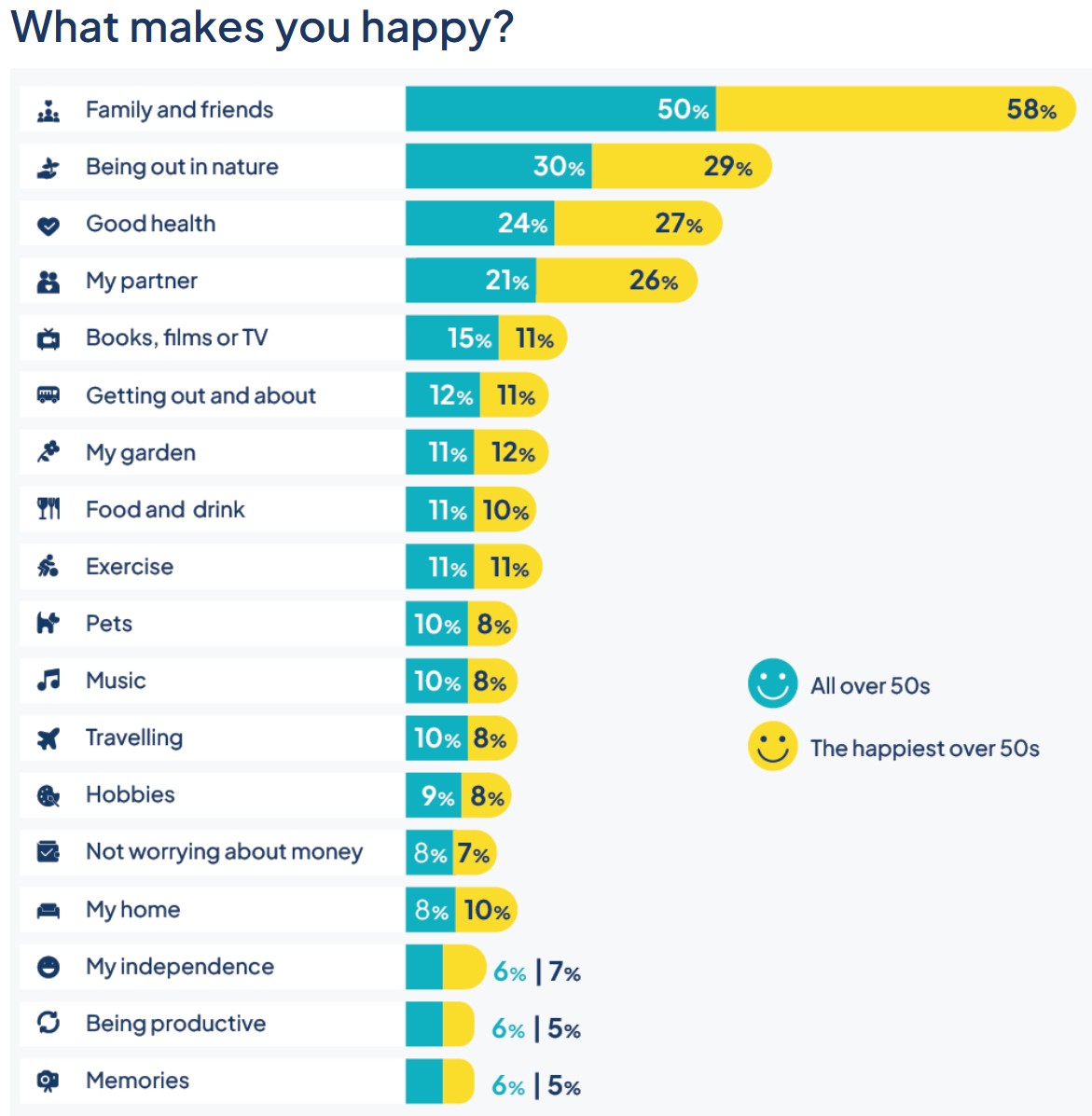

SunLife’s 2025 Life Well Spent report, which surveyed more than 2,000 adults age 50 and older, found that the happiest retirees spend 43 more minutes per week in nature and significantly less time watching TV than unhappy retirees.

Purpose also plays a powerful role. Retirees who volunteer are 64% more likely to report high levels of happiness. It’s not just altruism; it’s a hack for mental health, replacing the dopamine hit of “being needed” that work used to provide.

For some, the pursuit of purpose leads them back into the workforce. A T. Rowe Price study found that about 20% of retirees eventually “unretire,” and nearly 45% return for social or emotional reasons, rather than financial necessity.

As one Age Wave survey discovered, 93% of retirees believe it’s important to feel useful in retirement, and 92% believe purpose is key to a successful retirement.

Purpose doesn’t have to mean working. It correlates with “doing” vs “viewing.” Happier retirees tend to have more core pursuits (hobbies such as gardening, travel or pickleball) than unhappy retirees.

4. Who wins in retirement — men or women?

Research is mixed on whether men or women are ultimately happier in retirement. Overall, both experience a lift in life satisfaction upon entering retirement, and that satisfaction remains stable thereafter.

Some research finds that men tend to experience slightly higher gains in life satisfaction at retirement, especially when pension security and financial resources are strong.

Other studies show that women often do just as well or better when non-financial factors are the focus, such as strong social networks, meaningful routines, purpose-driven hobbies, volunteer work and stable health.

Ultimately, researchers tend to find that happiness in retirement is less about gender and more about circumstances (PDF).

5. More money, more happiness? Yes, but with diminishing returns

Are wealthier retirees happier? Generally, yes. But the relationship between money and happiness isn’t linear.

One research paper found that happiness continues to increase “well beyond” an annual income of $500,000, although the impact of each additional dollar diminishes at higher income levels. There is no strict plateau, but the slope becomes shallower.

Debt, however, is a much clearer villain. The Employee Benefit Research Institute (PDF) found that retirees with low assets, low savings and high levels of debt, including credit cards and medical bills, reported the lowest life-satisfaction scores, averaging 5.8 out of 10.

That suggests debt is a stronger predictor of unhappiness than wealth is of happiness.

6. Retirement doesn’t guarantee “happily ever after” for couples

People who marry tend to remain more satisfied at every stage of the relationship, from newlywed years through long-duration marriages (even after controlling for people’s happiness levels before marriage), according to a 2017 study in the Journal of Happiness Studies. The research also showed that married adults experience a less severe midlife dip in life satisfaction than unmarried adults, suggesting that marriage provides emotional stability and social support that can carry into retirement.

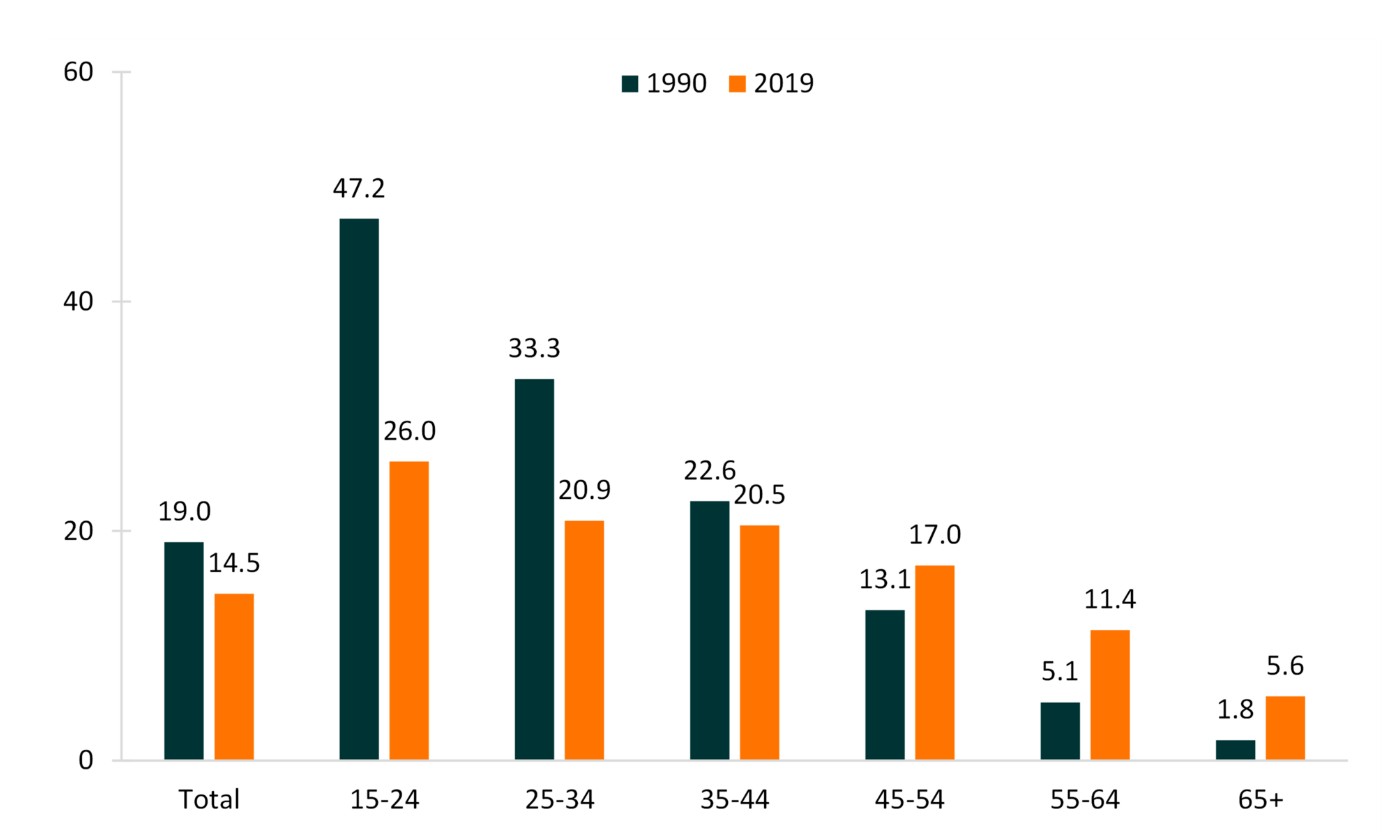

But retirement can strain relationships, too. The divorce rate for adults age 50 and older has tripled since 1990, and today 36% of all U.S. divorces involve couples age 50-plus. The graph below compares divorce rates by age in 1990 and 2019.

Divorce Rates by 10-Year Age Groups, 1990 and 2019

This “gray divorce” phenomenon can have severe financial implications. Women see their standard of living drop by 45% on average post-divorce, compared with 21% for men

7. The "U-curve" of happiness

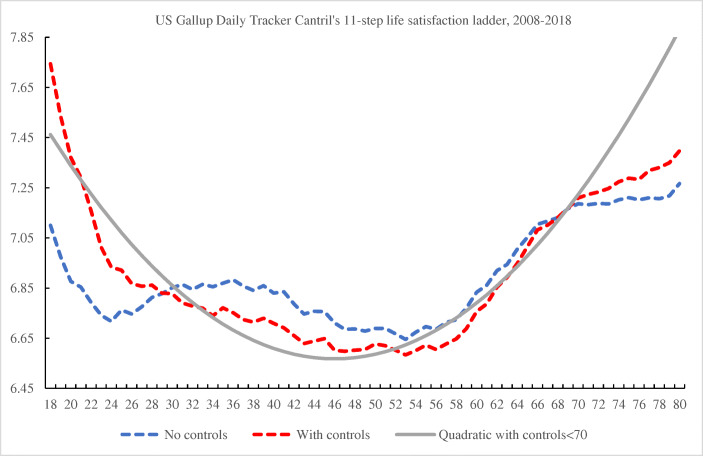

Happiness follows a widely documented U-shaped curve, hitting its lowest point in the late 40s (roughly age 47 to 48) and rising steadily through the 60s and 70s.

Retirees in their 60s and 70s consistently report higher satisfaction than people in their 30s and 40s. However, the curve can dip again after age 75 to 80 as health issues overtake financial freedom as the dominant driver of well-being.

8. Health is wealth … and happiness

Retirement happiness can also get a lift by hitting the gym. MassMutual’s Retirement Happiness Study also found that 49% of retirees who are “much happier” in retirement cited taking care of their health before they retired as a key reason.

Among that group, 70% rank exercise as a top activity, second only to spending time with loved ones.

9. A happy retirement is a work in progress

Research has found that happiness fluctuates; it’s a constant work in progress. One study concluded that happy people become more satisfied not simply because they feel better, but because they develop the resources to live well.

Retirement might offer more opportunities for finding happiness, but it doesn’t mean happiness becomes automatic.

It’s the kind of job you can’t simply retire from.

Read More

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Jacob Schroeder is a financial writer covering topics related to personal finance and retirement. Over the course of a decade in the financial services industry, he has written materials to educate people on saving, investing and life in retirement.

With the love of telling a good story, his work has appeared in publications including Yahoo Finance, Wealth Management magazine, The Detroit News and, as a short-story writer, various literary journals. He is also the creator of the finance newsletter The Root of All (https://rootofall.substack.com/), exploring how money shapes the world around us. Drawing from research and personal experiences, he relates lessons that readers can apply to make more informed financial decisions and live happier lives.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

Quiz: Do You Know How to Avoid the 'Medigap Trap?'

Quiz: Do You Know How to Avoid the 'Medigap Trap?'Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.We are 62 and finally retired after decades of hard work. I see the lakehouse as an investment in our happiness.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our Money

I'm a Wealth Adviser Obsessed With Mahjong: Here Are 8 Ways It Can Teach Us How to Manage Our MoneyThis increasingly popular Chinese game can teach us not only how to help manage our money but also how important it is to connect with other people.

-

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure ThemHow can advisers reassure clients nervous about their plans in an increasingly complex and rapidly changing world? This conversational framework provides the key.

-

5 Ronald Reagan Quotes Retirees Should Live By

5 Ronald Reagan Quotes Retirees Should Live ByThe Nation's 40th President's wit and wisdom can help retirees navigate their financial and personal journey with confidence.

-

We're 78 and Want to Use Our 2026 RMD to Treat Our Kids and Grandkids to a Vacation. How Should We Approach This?

We're 78 and Want to Use Our 2026 RMD to Treat Our Kids and Grandkids to a Vacation. How Should We Approach This?An extended family vacation can be a fun and bonding experience if planned well. Here are tips from travel experts.

-

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs In

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs InRoth conversions are all the rage, but what works well for one household can cause financial strain for another. This is what you should consider before moving ahead.