How to Create a Retirement Plan That Checks All Your Boxes

You might consider starting with a model retirement plan that has already been assembled and is ready to be refined to meet your objectives.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

If you like to oversee your own retirement planning, you have to do some homework. Most of you have gotten used to that and spend time on researching, sorting opinions and putting together the best approach for you and your family. Complicating the process is your need to address three key retirement objectives — lifetime income, liquidity for unplanned expenses and legacy for kids and grandkids. And, of course, you want to lower your taxes and have less market risk.

The product-by-product approach

Choosing among financial product options is sometimes fairly easy and is sometimes more challenging. When you’re comparing, for example, investments against guaranteed lifetime annuities, it’s not that difficult to measure market risk, tax effects and liquidity. It’s rarely an either/or decision, but rather a “how much.”

An advantage of this DIY approach is that you are in control of the decisions. The way to have confidence in your decisions, however, is to look at a plan with the options built in and then exclude those that don’t feel comfortable.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

A traditional plan is a start for most retirees

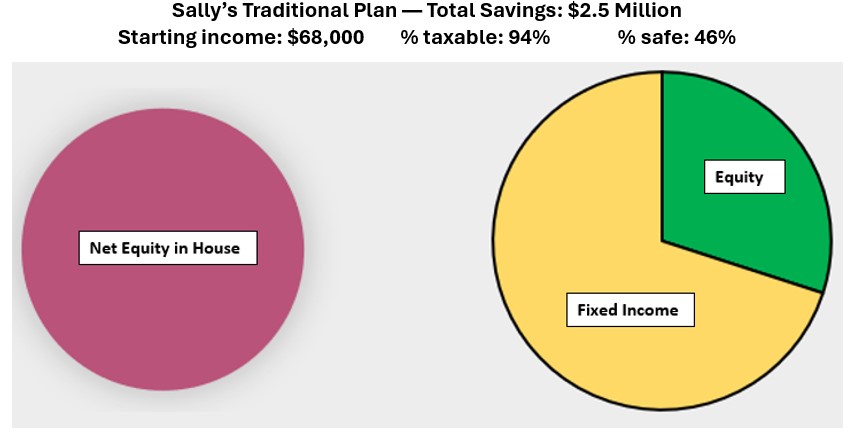

Here’s an example for Sally, the sample investor we often refer to, who at 70 years old looks at her financial situation in two distinct buckets:

- Retirement savings that total $1.5 million, with half in her rollover IRA and half in her personal (after-tax) accounts

- Her home, worth $1 million with no mortgage

She may have another bucket for short-term cash needs or higher-risk investments. These are excluded for this exercise when planning for the three key objectives.

As she developed her traditional plan below, Sally has followed conventional wisdom in at least two other respects:

- She invests her retirement savings 30% (100 less her age) in equities and 70% in fixed income

- She plans to own her home without any mortgage in retirement

That’s about as simple as you can get. However, Sally realized it produces too little starting income ($68,000) vs. her 6% income goal — or $90,000 per year from her savings. (This doesn’t consider Social Security payments or any pension.) Drawing down another $22,000 to start, and increasing that annually to account for inflation, creates the risk of her running out of savings. And the $90,000 income goal doesn’t even consider the costs of long-term care and other unplanned expenses. (For more on this, see my article How ‘Home-Based Planning’ Can Address Long-Term Care Costs.)

Sally’s DIY starter plan is easy to understand, but if spending down your savings is not the answer, then how do you find the right plan design for you?

Start with a plan with the three L’s, then find the products

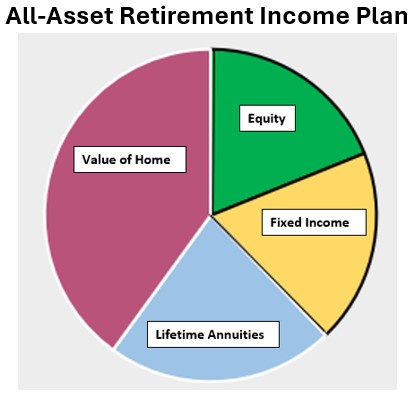

Begin with your goals, which for most retirees include lifetime income, liquidity for unplanned expenses and a legacy for heirs. To achieve those three L’s, your savings — including equity in your home — can be put to work in ways that Sally ignored in her plan above. Another part of the plan involves deciding which of your savings accounts you want to buy products from: tax-qualified or personal (after-tax) savings. Then, select single-purpose financial products that can be put together or eliminated to best serve your purposes.

For people who want to live in their own home as long as possible during retirement, access to home equity through a home equity conversion mortgage (HECM) is a consideration. And for lifetime income, which eases the fear of running out of money, converting some savings into lifetime income annuities provides a solution.

Those two (HECM and lifetime annuities) are not on every adviser or planner’s radar, but they should be on yours. Here’s a revised picture that shows how lifetime annuities and the value of the home add to a retirement plan. We call this an All-Asset Retirement Income Plan since it includes assets representing 90% of all asset classes.

Initial refinements to the All-Asset Retirement Income Plan

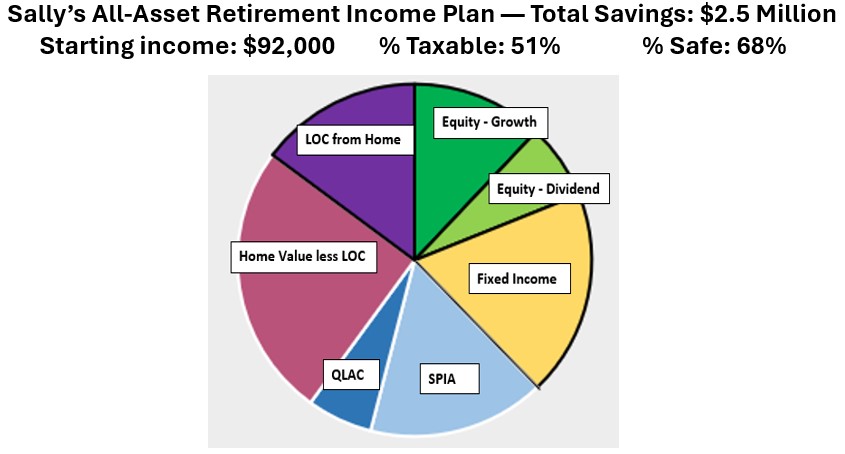

Now let’s apply these elements to Sally’s plan, which needs to be personalized for Sally’s age, gender and percentage of rollover IRA in her savings. Three important allocations are made in the refinement of this plan:

- Equity portfolios are allocated between high-dividend and growth portfolios

- The lifetime annuities are allocated between a SPIA (single premium immediate annuity) for current income and a QLAC (qualifying longevity annuity contract) for future income

- The value of the home is allocated between the HECM line of credit (with the amount determined by LOC percentages set by HUD) and the remaining equity

Sally’s All-Asset Retirement Income Plan delivers starting income of $92,000 that exceeds her objective of $90,000. She can add that extra $2,000 to her budget or reinvest it for future budgets.

Other deliverables under Sally’s All-Asset Retirement Income Plan

As you can see above, 68% of Sally’s income is “safe,” which means the income is not dependent on the liquidation or sale of investments. Even at a low market return, the plan will generate income from dividends, interest, annuity payments and drawdowns from HECM. (As part of the refinement process, planning software, such as that used by Go2Income, can test different investment returns and resulting plan outcomes.)

Her other objectives are also important, and the plan will help her achieve them:

- Liquidity. By adding the line of credit from HECM to her plan, more than 50% of her savings are liquid at the start, even with the addition of lifetime annuity payments.

- Legacy. Sally plans to live a long life, so the legacy, while delivered far in the future, equals or exceeds the original total value of savings.

- Lower taxes. Only 50% of her income is taxable through age 85. In turn, that will have a favorable impact on all of her taxable income, including Social Security and pension.

- Long-term care costs. Her liquidity is able to absorb, for example, substantial long-term care costs, with the impact felt on her legacy, not on income.

- Inflation protection. Under the starter plan with conservative return assumptions, her income grows by 1.4% per year until age 85. If inflation protection is a key objective, she can address it during the refinement process.

Of course, in order to achieve the best outcomes for Sally, she will need to speak with a financial adviser well-versed in all the elements of a diverse retirement plan. During that process, the plan can be attuned to Sally’s personal needs and desires.

You can order a Go2Income plan today based on the answers to three or four questions about your goals. Get started here with no obligation. Consult with your own qualified adviser, find an analytical tool to provide some guidance, or talk to a Go2Specialist.

Related Content

- A Different Way to Approach Your Mortgage in Retirement

- Transform Your Retirement Plan With This Powerful Combo

- Is Your Retirement Solution Hiding in Plain Sight?

- How Your Home Can Fill Gaps in Your Retirement Plan

- Annuities and Tax Planning Boost Retirement Income and More

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Jerry Golden is the founder and CEO of Golden Retirement Advisors Inc. He specializes in helping consumers create retirement plans that provide income that cannot be outlived. Find out more at Go2income.com, where consumers can explore all types of income annuity options, anonymously and at no cost.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the 'Medigap Trap?'

Quiz: Do You Know How to Avoid the 'Medigap Trap?'Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Why Invest In Mutual Funds When ETFs Exist?

Why Invest In Mutual Funds When ETFs Exist?Exchange-traded funds are cheaper, more tax-efficient and more flexible. But don't put mutual funds out to pasture quite yet.

-

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.

We Retired at 62 With $6.1 Million. My Wife Wants to Make Large Donations, but I Want to Travel and Buy a Lake House.We are 62 and finally retired after decades of hard work. I see the lakehouse as an investment in our happiness.

-

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll File

Social Security Break-Even Math Is Helpful, But Don't Let It Dictate When You'll FileYour Social Security break-even age tells you how long you'd need to live for delaying to pay off, but shouldn't be the sole basis for deciding when to claim.

-

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)

I'm an Opportunity Zone Pro: This Is How to Deliver Roth-Like Tax-Free Growth (Without Contribution Limits)Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

-

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer Pivot

One of the Most Powerful Wealth-Building Moves a Woman Can Make: A Midcareer PivotIf it feels like you can't sustain what you're doing for the next 20 years, it's time for an honest look at what's draining you and what energizes you.