How to Get the Most Out of Your Pension Plan

Should you take a lump-sum payout? Do you think your employer is in danger of going bankrupt? These are only two of the issues to consider.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

The good news is you have a pension. According to the Bureau of Labor Statistics, only 15% of private industry workers had access to a defined benefit (pension) plan in 2022. And if you are close to retirement, you may be considering at what age to start the income or to take a payout. There are many factors to consider in your decision. Here are a few tips from my 22 years of experience in guiding retirees and executives, adapted from an upcoming webinar (info below).

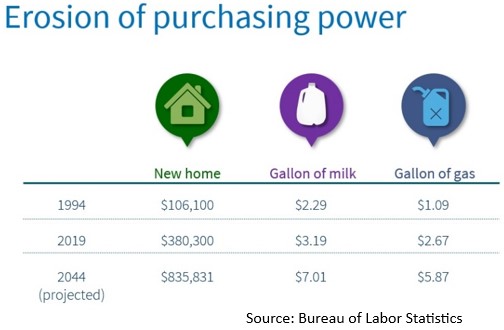

Inflation is a major concern

Pension income is usually level, meaning it doesn’t increase over time. Once you start the income stream at 65, that could be the same income at age 85, unless your plan offers an inflation adjustment. As comforting as it may sound to have a guaranteed stream of income for life, a dollar today will not be able to buy the same amount in 20 or 30 years.

Don’t underestimate inflation’s effect on your pension income. This may mean waiting longer to take the pension income so you have a larger payout or analyzing a lump-sum option that may have greater growth potential.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Pensioners should also consider their life expectancy and their spouse’s life expectancy when deciding how and when to take the income. The longer you or your spouse live, the more you may want to consider waiting to take the income for the higher payout.

Is there company/employer risk?

Ben Franklin once said, “The only thing guaranteed in life is death and taxes.” Notice how he left out pension income? The guarantee is only as good as the company or pension association backing the guarantee. Most large pensions are backed by the Pension Benefit Guaranty Corporation (PBGC). However, there are limits to how much income the PBGC guarantees, and who is to say those limits won’t change?

Buyer beware: Carefully consider the risk your pension may change, be bought out or, worst case, go bankrupt. If you are concerned about the financial viability of your company and don’t want to rely on the PBGC, then that’s a stronger case for taking a lump sum — a bird in hand, as they say.

What about your other assets?

No decision is made in isolation. A client of mine with ample money in a large stock portfolio decided to forgo taking the lump sum and opted for the pension income. She reasoned that she had enough of her portfolio at risk and wanted some guarantees in life. On the flip side, another client decided to take the lump sum — and move the asset tax-free to an IRA — because he wanted to ensure his two children would get the asset if he passed away. Pension income generally stops at the first death if a single-life payout is selected and second death if the joint-life income option is selected.

Of course, there is much more to know, like how does the pension income compare to an annuity? Knowing your pension income ratio helps. Something else to consider: Rising or falling interest rates can impact a pension.

The thing is, while all pensions share some basic similarities, you don’t want to rely too much on generalities, blog posts or an AI chatbot to guide you. There can be subtle differences between each plan.

And, lastly, the decision is generally irrevocable, so you want to get it right. It’s best to have an experienced financial adviser review your pension terms and conditions and develop a customized game plan that takes into consideration your other assets, sources of income and financial goals and risk tolerance.

For more, tune in to our upcoming webinar How to Maximize a Pension – A Planner’s Guide.

Investment advisory and financial planning services are offered through Summit Financial LLC, an SEC Registered Investment Adviser, 4 Campus Drive, Parsippany, NJ 07054. Tel. 973-285-3600 Fax. 973-285-3666. This material is for your information and guidance and is not intended as legal or tax advice. Clients should make all decisions regarding the tax and legal implications of their investments and plans after consulting with their independent tax or legal advisers. Individual investor portfolios must be constructed based on the individual’s financial resources, investment goals, risk tolerance, investment time horizon, tax situation and other relevant factors. Past performance is not a guarantee of future results. The views and opinions expressed in this article are solely those of the author and should not be attributed to Summit Financial LLC. Links to third-party websites are provided for your convenience and informational purposes only. Summit is not responsible for the information contained on third-party websites. The Summit financial planning design team admitted attorneys and/or CPAs, who act exclusively in a non-representative capacity with respect to Summit’s clients. Neither they nor Summit provide tax or legal advice to clients. Any tax statements contained herein were not intended or written to be used, and cannot be used, for the purpose of avoiding U.S. federal, state or local taxes.

related content

- Four Tips to Help You Conquer the Retirement Mountain

- Don’t Have a Pension? The SECURE Act Could Help

- Retirees with a Guaranteed Income Are Happier, Live Longer

- Pension Lump Sum Option vs. Annuity Payment: Which Is Better?

- Can My Pension Trigger a Retirement Tax Bomb?

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Michael Aloi is a CERTIFIED FINANCIAL PLANNER™ Practitioner and Accredited Wealth Management Advisor℠ with Summit Financial, LLC. With 21 years of experience, Michael specializes in working with executives, professionals and retirees. Since he joined Summit Financial, LLC, Michael has built a process that emphasizes the integration of various facets of financial planning. Supported by a team of in-house estate and income tax specialists, Michael offers his clients coordinated solutions to scattered problems.

-

Is There Such a Thing As a Safe Stock? 17 Safe-Enough Ideas

Is There Such a Thing As a Safe Stock? 17 Safe-Enough IdeasNo stock is completely safe, but we can make educated guesses about which ones are likely to provide smooth sailing.

-

We're 64 with $4.3 million and can't agree on when to retire.

We're 64 with $4.3 million and can't agree on when to retire.I want to retire now and pay for health insurance until we get Medicare. My wife says we should work 10 more months. Who's right?

-

Missed an RMD? How to Avoid That (and the Penalty) Next Time

Missed an RMD? How to Avoid That (and the Penalty) Next TimeIf you miss your RMDs, you could face a hefty fine. Here are four ways to stay on top of your payments — and on the right side of the IRS.

-

Missed Your RMD? 4 Ways to Avoid Doing That Again (and Skip the IRS Penalties), From a Financial Planner

Missed Your RMD? 4 Ways to Avoid Doing That Again (and Skip the IRS Penalties), From a Financial PlannerIf you miss your RMDs, you could face a hefty fine. Here are four ways to stay on top of your payments — and on the right side of the IRS.

-

What Really Happens in the First 30 Days After Someone Dies (and Where Families Get Stuck)

What Really Happens in the First 30 Days After Someone Dies (and Where Families Get Stuck)The administrative requirements following a death move quickly. This is how to ensure your loved ones won't be plunged into chaos during a time of distress.

-

AI-Powered Investing in 2026: How Algorithms Will Shape Your Portfolio

AI-Powered Investing in 2026: How Algorithms Will Shape Your PortfolioAI is becoming a standard investing tool, as it helps cut through the noise, personalize portfolios and manage risk. That said, human oversight remains essential. Here's how it all works.

-

A Newly Retired Couple With a Portfolio Full of Winners Faced a $50,000 Tax Bill: This Is the Strategy That Helped Save Them

A Newly Retired Couple With a Portfolio Full of Winners Faced a $50,000 Tax Bill: This Is the Strategy That Helped Save ThemLarge unrealized capital gains can create a serious tax headache for retirees with a successful portfolio. A tax-aware long-short strategy can help.

-

5 Retirement Myths to Leave Behind (and How to Start Planning for the Reality)

5 Retirement Myths to Leave Behind (and How to Start Planning for the Reality)Separating facts from fiction is an important first step toward building a retirement plan that's grounded in reality and not based on incorrect assumptions.

-

I'm a Financial Adviser: Silence Is Golden, But It Hurts Your Heirs More Than You Think

I'm a Financial Adviser: Silence Is Golden, But It Hurts Your Heirs More Than You ThinkTalking to heirs about transferring wealth can be overwhelming, but avoiding it now can lead to conflict later. Here's how to start sharing your plans.

-

Will Your Children's Inheritance Set Them Free or Tie Them Up?

Will Your Children's Inheritance Set Them Free or Tie Them Up?An inheritance can mean extraordinary freedom for your loved ones, but could also cause more harm than good. How can you ensure your family gets it right?

-

I'm a Financial Adviser: This Is the Real Key to Enjoying Retirement With Confidence

I'm a Financial Adviser: This Is the Real Key to Enjoying Retirement With ConfidenceA resilient retirement plan is a flexible framework that addresses income, health care, taxes and investments. And that means you should review it regularly.