These 8 States Have the Most Expensive Home Insurance in 2026

If you live in one of these eight states, you're probably paying $1,000 or more above the national average for home insurance.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Home insurance rates have skyrocketed over the past few years as natural disasters and extreme weather become more frequent and the costs of home repairs keep climbing.

While homeowners everywhere are feeling the pinch, some states have been hit harder than others. U.S. homeowners are paying an average of $2,424 per year for $300,000 in dwelling coverage, according to a recent Bankrate report. However, homeowners in eight states are paying significantly more than the national average.

That figure doesn't even include additional coverage for events like floods, earthquakes and other disasters that standard home insurance doesn't cover.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

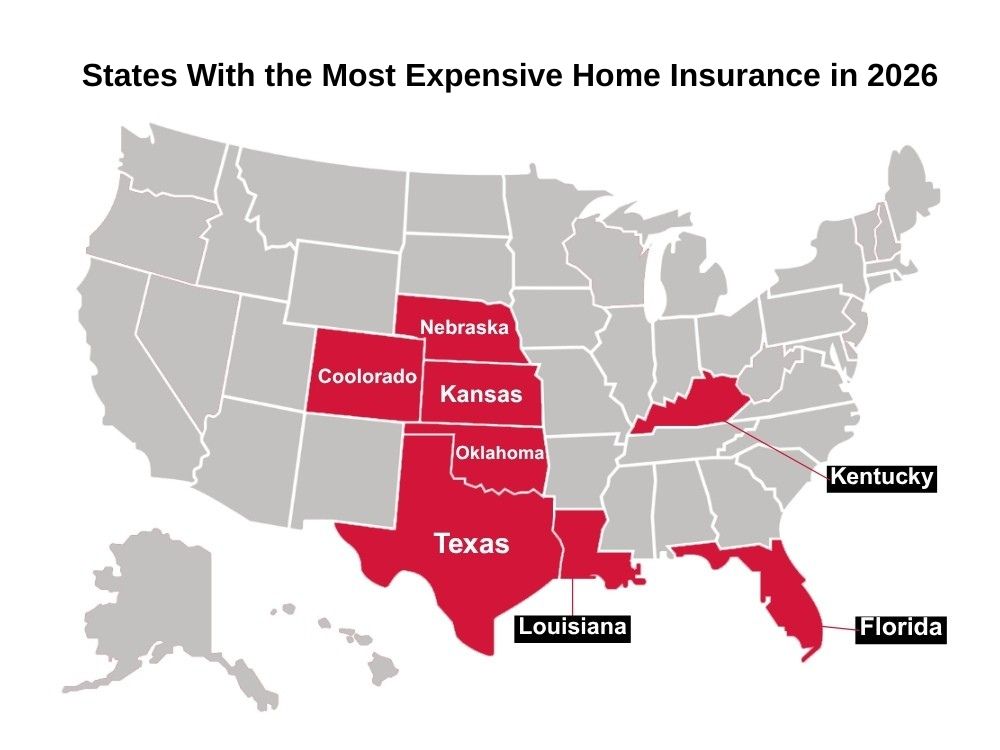

8 states with the most expensive home insurance in 2026

If you're looking to move to cut down on housing costs, you might want to check out the states with the cheapest home insurance, especially if you live in one of the states below.

Before seeing who's paying the most to protect their homes, use the tool below from Bankrate to see how the best rates for you compare to the national average:

8. Colorado

Coming in eighth place, Colorado homeowners are paying an average of $3,412 per year for standard home insurance. Nestled between tornado alley to the east and fire country to the west, the Rocky Mountain state faces an above-average risk of both natural disasters.

It's the growing wildfire risk that has driven the surge in home insurance prices in the state this year. To combat soaring rates, Colorado lawmakers recently passed legislation to make the wildfire risk scoring models used by insurers more transparent.

While it won't take effect until later this year, the new law also establishes clearer guidelines on fire-proofing steps homeowners can take to protect themselves (and earn discounts on their premiums). If you live here, the law in question is House Bill 1182, and you can keep an eye out for when the new law takes effect.

7. Kentucky

In Kentucky, homeowners pay an average of $3,540 annually for home insurance. This is actually down slightly from last year, when the average premium was $3,643. The state is too far inland for hurricanes, but it's still prone to strong summer storms.

Come winter, freezing temperatures and heavy snow can cause damage, too. Many counties in Kentucky also have a high flood risk. So, additional flood insurance is a good idea here.

6. Texas

Even insurance premiums are bigger in Texas. Homeowners in the state pay $3,899 per year on average. While that's almost $1,500 above the national average, it's about $200 less than $4,101, Texas's average premium in 2025.

Some areas see even higher costs, though. In Galveston, for example, home insurance premiums averaged $9,831.

The Lone Star state faces multiple threats, though the risks vary in different regions. In winter and spring tornadoes roll through the state on their way north. By summer, hot, dry conditions increase the risk of wildfires statewide. On the southern coast, hurricanes coming in from the Gulf can cause severe damage.

If you do live near the coast, double check your policy. In addition to excluding flood damage, standard policies in this region sometimes don't cover wind damage. Without flood or wind coverage, you'll be more or less on your own next hurricane season. So make sure you know what your policy covers and purchase any additional coverage you need to fully protect your home.

5. Kansas

Homeowners in Kansas pay $4,444 per year on average for standard homeowner's insurance. If you've seen The Wizard of Oz, you know exactly why Kansas made the list of states with the most expensive home insurance.

It's right in the middle of tornado alley, seeing an average of 96 tornadoes per year, according to the National Weather Service. The risk is highest in summer. While these are typically covered in a standard policy, it's important to track any damage and be ready with relevant documents before making a tornado-related claim.

4. Oklahoma

Like Kansas, Oklahoma residents face above average home insurance premiums due to the higher risk of tornadoes and wind-heavy thunderstorms. The average premium for the state is $4,695 per year, according to the Bankrate report. Tornadoes are most likely to happen in spring here.

Homeowners in the eastern half of the state also face higher risks of flooding, a disaster that typically isn't covered by standard insurance. So they need to pay even more to add flood coverage.

Get more insurance tips and other personal finance insights straight to your inbox. Subscribe to our daily newsletter, A Step Ahead.

3. Florida

Florida comes in at third place, with average home insurance premiums of $5,838. While that statewide average isn't the highest in the U.S., some Florida homeowners face even more exorbitant prices. In Tavernier, for example, home insurance averages an eyewatering $18,950 per year.

Florida is often in the path of powerful storms, which is a major reason why home insurance is so expensive in the state.

The state also has a very high risk of flooding, something that's excluded from standard coverage. So, if you are planning a move to the Sunshine State, make sure you budget for additional flood insurance as well as above-average home insurance premiums.

2. Louisiana

In Louisiana, you can expect to pay $6,274 per year on average for a standard policy. The state experiences more than its fair share of hurricanes each year, and many parts of the state also face an extremely high risk of flooding. This is not the place to skimp on flood insurance.

Likewise, it may also be worth checking your deductible for hurricane-related damage. The slight increase in premiums to lower your deductible could pay off next time you have to file a hurricane insurance claim.

1. Nebraska

You might be surprised to see this midwestern state beating out Florida for the highest average home insurance premiums. But Nebraskan homeowners are paying $6,587 annually for coverage, according to Bankrate.

The reason for the sky-high premiums largely comes down to Nebraska's harsh storm season – it's one of the worst states for hail damage and intense winds.

While there are certainly some parts of the state paying more than others, no one in Nebraska is paying nearly as much as the $18,950 premiums found in some parts of Florida.

The highest home insurance bill in Nebraska is found in Sidney, where homeowners pay "just" $8,215 per year. If you happen to live in Sidney, at least you know it could be about $10,000 worse.

Related Content

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Rachael Green is a personal finance eCommerce writer specializing in insurance, travel, and credit cards. Before joining Kiplinger in 2025, she wrote blogs and whitepapers for financial advisors and reported on everything from the latest business news and investing trends to the best shopping deals. Her bylines have appeared in Benzinga, CBS News, Travel + Leisure, Bustle, and numerous other publications. A former digital nomad, Rachael lived in Lund, Vienna, and New York before settling down in Atlanta. She’s eager to share her tips for finding the best travel deals and navigating the logistics of managing money while living abroad. When she’s not researching the latest insurance trends or sharing the best credit card reward hacks, Rachael can be found traveling or working in her garden.

-

4 High-End Experiences Worth the Splurge After 50

4 High-End Experiences Worth the Splurge After 50These curated date ideas provide the perfect backdrop for couples ready to enjoy the very best that the world has to offer.

-

Health Care Stocks Have Sagged. Can You Bet on a Recovery?

Health Care Stocks Have Sagged. Can You Bet on a Recovery?The flagging health care sector has perked up a bit lately. Is it time to invest?

-

Costco's Auto Program: Can Membership Pricing Really Save You Money on a Car?

Costco's Auto Program: Can Membership Pricing Really Save You Money on a Car?Costco's Auto Program can simplify the car-buying process with prearranged pricing and member perks. Here's what to know before you use it.

-

What Is an Assumable Mortgage and Could It Save You Thousands?

What Is an Assumable Mortgage and Could It Save You Thousands?With mortgage rates still elevated, taking over a seller’s existing home loan could lower monthly payments — if the numbers work.

-

Have You Fallen Into the High-Earning Trap? This Is How to Escape

Have You Fallen Into the High-Earning Trap? This Is How to EscapeHigh income is a gift, but it can pull you into higher spending, undisciplined investing and overreliance on future earnings. These actionable steps will help you escape the trap.

-

I'm a Financial Adviser: These 3 Questions Can Help You Navigate a Noisy Year With Financial Clarity

I'm a Financial Adviser: These 3 Questions Can Help You Navigate a Noisy Year With Financial ClarityThe key is to resist focusing only on the markets. Instead, when making financial decisions, think about your values and what matters the most to you.

-

Where Olympians Store Their Medals is a Great Lesson For Your Valuables and Cash

Where Olympians Store Their Medals is a Great Lesson For Your Valuables and CashWhat you can learn about protecting your cash and values from where Olympians store their medals.

-

An Executive's 'Idiotic' Idea: Skip Safety Class and Commit a Federal Crime

An Executive's 'Idiotic' Idea: Skip Safety Class and Commit a Federal CrimeSeveral medical professionals reached out to say that one of their bosses suggested committing a crime to fulfill OSHA requirements. What's an employee to do?

-

How You Can Use the Financial Resource Built Into Your Home to Help With Your Long-Term Goals

How You Can Use the Financial Resource Built Into Your Home to Help With Your Long-Term GoalsHomeowners are increasingly using their home equity, through products like HELOCs and home equity loans, as a financial resource for managing debt, funding renovations and more.

-

How to Find Free Money for Graduate School as Federal Loans Tighten in 2026

How to Find Free Money for Graduate School as Federal Loans Tighten in 2026Starting July 1, federal borrowing will be capped for new graduate students, making scholarships and other forms of "free money" vital. Here's what to know.

-

How to Choose the Best Internet Plan in Retirement

How to Choose the Best Internet Plan in RetirementYour internet needs can change dramatically after you stop working. Here's how to make sure you're not overpaying (or underpowered).