Medical Credit Card Marketers Are Trying More Ways to Reach You

Medical credit card promotions can now be found at physician offices, diagnostic centers and hospital websites, group says.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

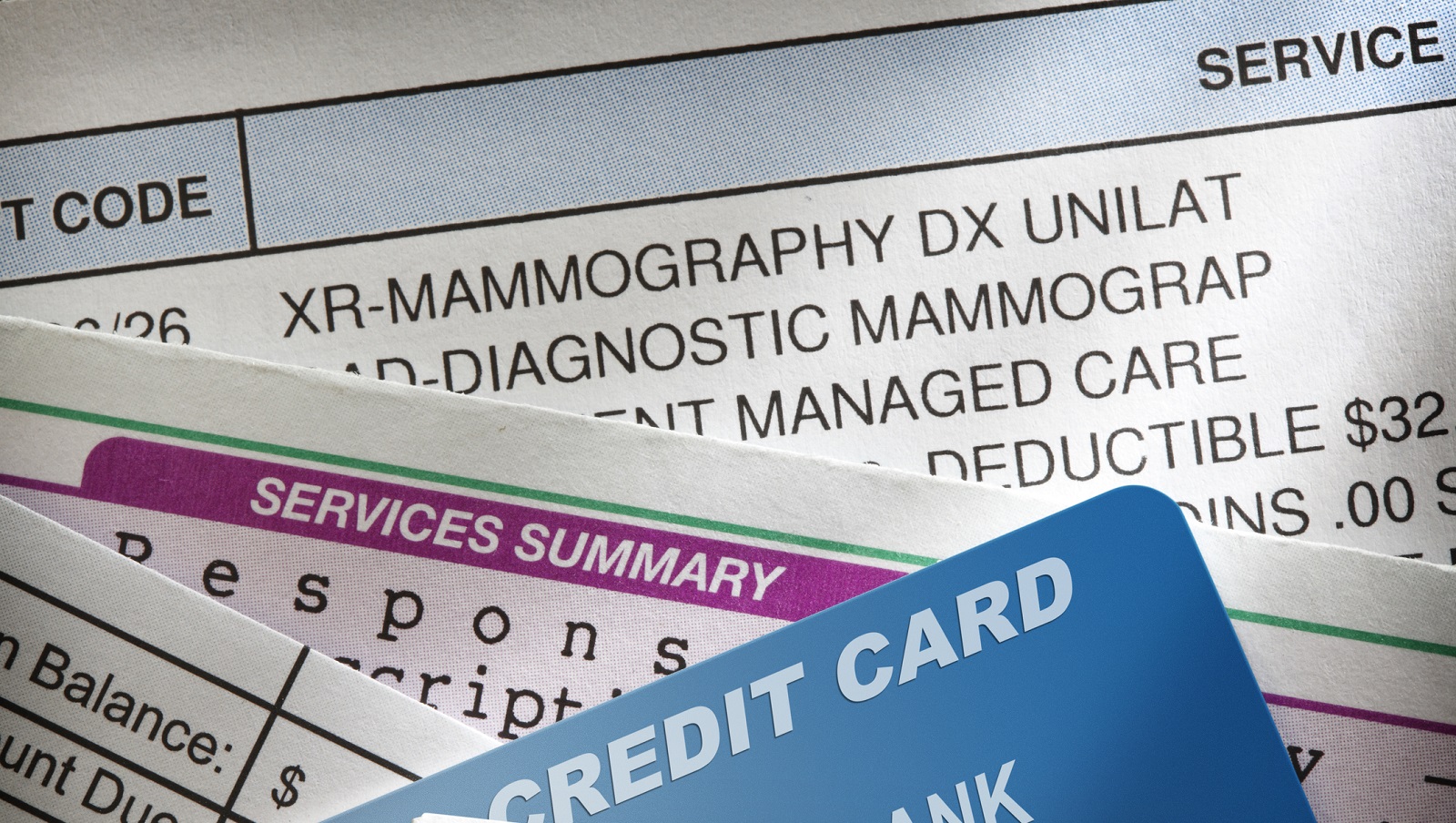

The marketing of medical credit cards – which were once offered mostly by health care providers to patients who had little or no coverage – is expanding into more health care sectors, adding to medical debt for patients and, in some cases, even contributing to bankruptcies, according to a new report.

“This relatively new version of a credit card, marketed specifically for health care services and products, usually lures in applicants with promises of a promotional 0% APR for an introductory period of 6-18 months,” the U.S. Public Interest Research Group (PIRG) said in its response to a government request for information (RFI) on medical payment products. But more complex terms of the financial agreements are not always evident to applicants, and high interest rates and late fees can add to costs, the group said.

The list of health care settings now offering these cards includes physician offices, diagnostic centers and hospital websites, PIRG said.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

In July, the Consumer Financial Protection Bureau (CFPB), the Treasury and the Department of Health and Human Services (HHS) issued the RFI to see whether healthcare providers are promoting financial products that raise patient debt and lead to higher consumer costs.

From 2018 to 2020, patients used specialty medical credit cards or loans with deferred interest periods to pay for almost $23 billion in healthcare expenses, accrued over more than 17 million transactions, according to a CFPB report last May.

“Quick ‘fixes’ like medical credit cards may be tempting, but they are costly, further exacerbating the problem,” Patricia Kelmar, senior director of PIRG Health Care Campaigns, said in her group’s response. “We urge you to use your existing authorities to the greatest extent possible to protect consumers from high-cost medical credit cards. We urge you to move swiftly from this RFI to rule-making.”

Medical debt's role in bankruptcy filings

PIRG also referred to a study on bankruptcies in Oregon, a Medicaid-expansion state, which revealed that medical debt played a major role in bankruptcy filings in 2019.

“We were surprised that the single most frequently listed medical debt holder was not a hospital or other health care provider, but rather a medical credit card – CareCredit from Synchrony Bank,” PIRG said. This particular card was listed in 1,037 filings, totaling more than $2 million owed to CareCredit, with a median debt per bankruptcy filer of $1,443 - higher than any of the top 10 most cited health care systems in the study, PIRG said.

The CFPB, HHS and Treasury Department said that public input would improve their efforts to safeguard consumers against predatory medical debt and collections practices. Including PIRG’s comments, the agencies received 75 responses by today’s deadline.

According to the CFPB website, $88 billion of outstanding medical bills are currently in collections, affecting one out of five Americans. An infographic on the site provides various how-to answers to a series of questions to help you navigate the medical and collections systems.

RELATED CONTENT

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Joey Solitro is a freelance financial journalist at Kiplinger with more than a decade of experience. A longtime equity analyst, Joey has covered a range of industries for media outlets including The Motley Fool, Seeking Alpha, Market Realist, and TipRanks. Joey holds a bachelor's degree in business administration.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Mortgage Closing Costs and Fees Leapt 22% in 2022, Study Shows

Mortgage Closing Costs and Fees Leapt 22% in 2022, Study ShowsThe mortgage market was profoundly affected by high interest rates last year, a trend that is likely to continue given this year's rate increases, CFPB director says.

-

Leasing Firm 'Tricked' Shoppers, Ordered to Pay into Victims Relief Fund

Leasing Firm 'Tricked' Shoppers, Ordered to Pay into Victims Relief FundShoppers at stores including Sears and Kmart were ‘kept in the dark’ about contract terms, CFPB says.

-

Loan Lender Sued for 'Trapping' Borrowers

Loan Lender Sued for 'Trapping' BorrowersHeights Finance was charged over a loan-churning scheme that aggressively pushed borrowers to refinance.

-

Medical Credit Cards Drive Up Cost of Care, Says CFPB

Medical Credit Cards Drive Up Cost of Care, Says CFPBCFPB says medical credit cards are driving up the cost of care with more than $1 billion accrued in deferred interest.

-

Your Credit Card Late Fees Could be Slashed, Thanks to CFPB Proposals

Your Credit Card Late Fees Could be Slashed, Thanks to CFPB ProposalsFederal bureau CFPB moves to rein in credit card late fees, which could save customers as much as $9 billion a year.

-

Borrowers Over 50 With Student Loan Debt

Borrowers Over 50 With Student Loan DebtPaying for College Millions of borrowers 50 and older are struggling to repay loans for themselves and their children, some delaying retirement. There’s a trick, though, to help with repayment.

-

Are Debt Collectors Overcharging You? How to Protect Yourself

Are Debt Collectors Overcharging You? How to Protect Yourselfdebt management "Convenience fees” on debt repayments are likely illegal.

-

Repo Risk: Beware Illegal Car Repossessions

Repo Risk: Beware Illegal Car Repossessionscars Used cars are worth more than ever before. The CFPB warns the hot market may tempt lenders to seize cars when they don’t have a legal right. What can you do if this happens to you?