Medical Credit Cards Drive Up Cost of Care, Says CFPB

Medical credit card holders have accrued more than $1 billion in deferred interest.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

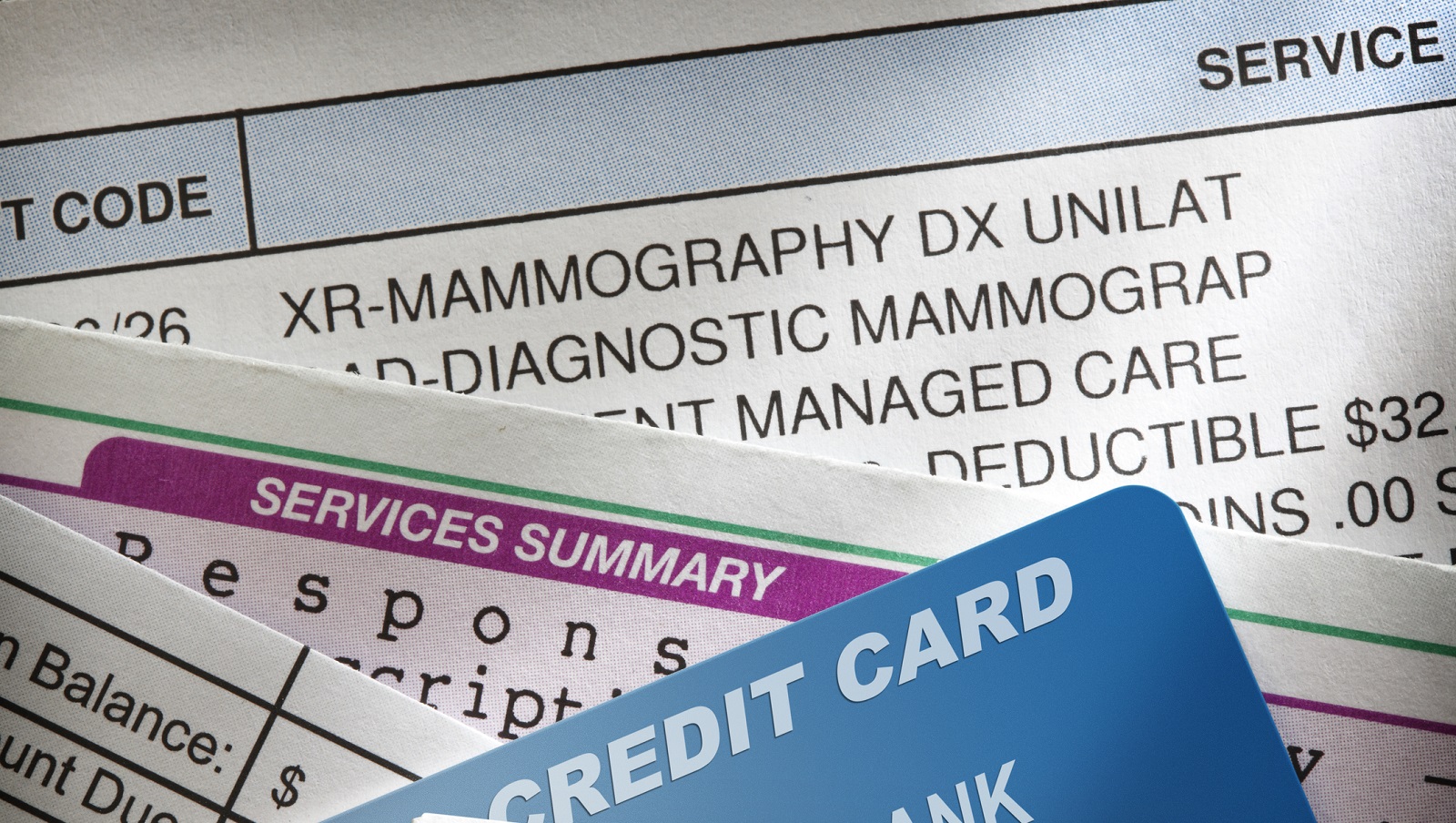

Specialist medical credit cards add to the financial stress facing hospital patients with medical debt, according to a newly published Consumer Financial Protection Bureau (CFPB) report.

It found that financial products sold to patients are typically more expensive than other forms of payment, including conventional credit cards, with card APR rates often reaching above 25%. The combined deferred interest bill on medical credit cards totals $1 billion, the CFPB noted.

These sorts of products are sold to patients as a way to reduce the growing costs of medical care, but the CFPB said they can actually result in decreased access to credit, costly and lengthy collection litigation, and an increased likelihood of bankruptcy.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

CFPB Director Rohit Chopra pointed to “fintechs and other lending outfits” designing “costly loan products” marketed specifically to hospitals and their patients.

From 2018 to 2020, patients used specialty medical credit cards or loans with deferred interest periods to pay for almost $23 billion in healthcare expenses - accrued over more than 17 million transactions.

The report comes as financial institutions and technology companies launch more products for medical patients and their families.

“These new forms of medical debt can create financial ruin for individuals who get sick,” Chopra said.

Why Are Medical Credit Cards a Problem for Patients?

According to available public information gathered by the CFPB, the financing terms for medical credit cards and medical installment loans include interest rates of around 26.99%, while standard consumer products charge a much lower average rate of 16%.

These products often have deferred interest plans, with all accrued interest potentially becoming due at the end of a defined period — a factor the CFPB said can prove especially expensive and unaffordable for patients.

The CFPB warned that companies are marketing their products directly to healthcare providers, potentially disincentivizing them to explain legally mandated financial assistance programs or zero-interest repayment options.

It added healthcare providers may be unable to adequately explain complex terms, such as deferred interest plans, to patients.

A 2022 poll by NPR and health policy research company KFF, found 41% of Americans have some form of healthcare debt. And in 2013, the CFPB ordered healthcare financing firm CareCredit to make a $34 million reimbursement fund after the agency found patients had been victims of "deceptive credit card enrollment tactics."

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Tom is a journalist and writer with an interest in sustainability, economic policy and pensions, looking into how personal finances can be used to make a positive impact. He graduated from Goldsmiths, University of London, with a BA in journalism before moving to a financial content agency. His work has appeared in titles Investment Week and Money Marketing, as well as social media copy for Reuters and Bloomberg in addition to corporate content for financial giants including Mercer, State Street Global Advisors and the PLSA. He has also written for the Financial Times Group.

When not working out of the Future’s Cardiff office, Tom can be found exploring the hills and coasts of South Wales but is sometimes east of the border supporting Bristol Rovers.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Mortgage Closing Costs and Fees Leapt 22% in 2022, Study Shows

Mortgage Closing Costs and Fees Leapt 22% in 2022, Study ShowsThe mortgage market was profoundly affected by high interest rates last year, a trend that is likely to continue given this year's rate increases, CFPB director says.

-

Leasing Firm 'Tricked' Shoppers, Ordered to Pay into Victims Relief Fund

Leasing Firm 'Tricked' Shoppers, Ordered to Pay into Victims Relief FundShoppers at stores including Sears and Kmart were ‘kept in the dark’ about contract terms, CFPB says.

-

Medical Credit Card Marketers Are Trying More Ways to Reach You

Medical Credit Card Marketers Are Trying More Ways to Reach YouMedical credit card promotions can now be found at physician offices, diagnostic centers and hospital websites, group says.

-

Loan Lender Sued for 'Trapping' Borrowers

Loan Lender Sued for 'Trapping' BorrowersHeights Finance was charged over a loan-churning scheme that aggressively pushed borrowers to refinance.

-

Your Credit Card Late Fees Could be Slashed, Thanks to CFPB Proposals

Your Credit Card Late Fees Could be Slashed, Thanks to CFPB ProposalsFederal bureau CFPB moves to rein in credit card late fees, which could save customers as much as $9 billion a year.

-

Borrowers Over 50 With Student Loan Debt

Borrowers Over 50 With Student Loan DebtPaying for College Millions of borrowers 50 and older are struggling to repay loans for themselves and their children, some delaying retirement. There’s a trick, though, to help with repayment.

-

Are Debt Collectors Overcharging You? How to Protect Yourself

Are Debt Collectors Overcharging You? How to Protect Yourselfdebt management "Convenience fees” on debt repayments are likely illegal.

-

Repo Risk: Beware Illegal Car Repossessions

Repo Risk: Beware Illegal Car Repossessionscars Used cars are worth more than ever before. The CFPB warns the hot market may tempt lenders to seize cars when they don’t have a legal right. What can you do if this happens to you?