Stock Market Today: Stocks Wave Off Recession Worries

The latest gross domestic product data showed the U.S. economy contracted for a second straight quarter in Q2.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

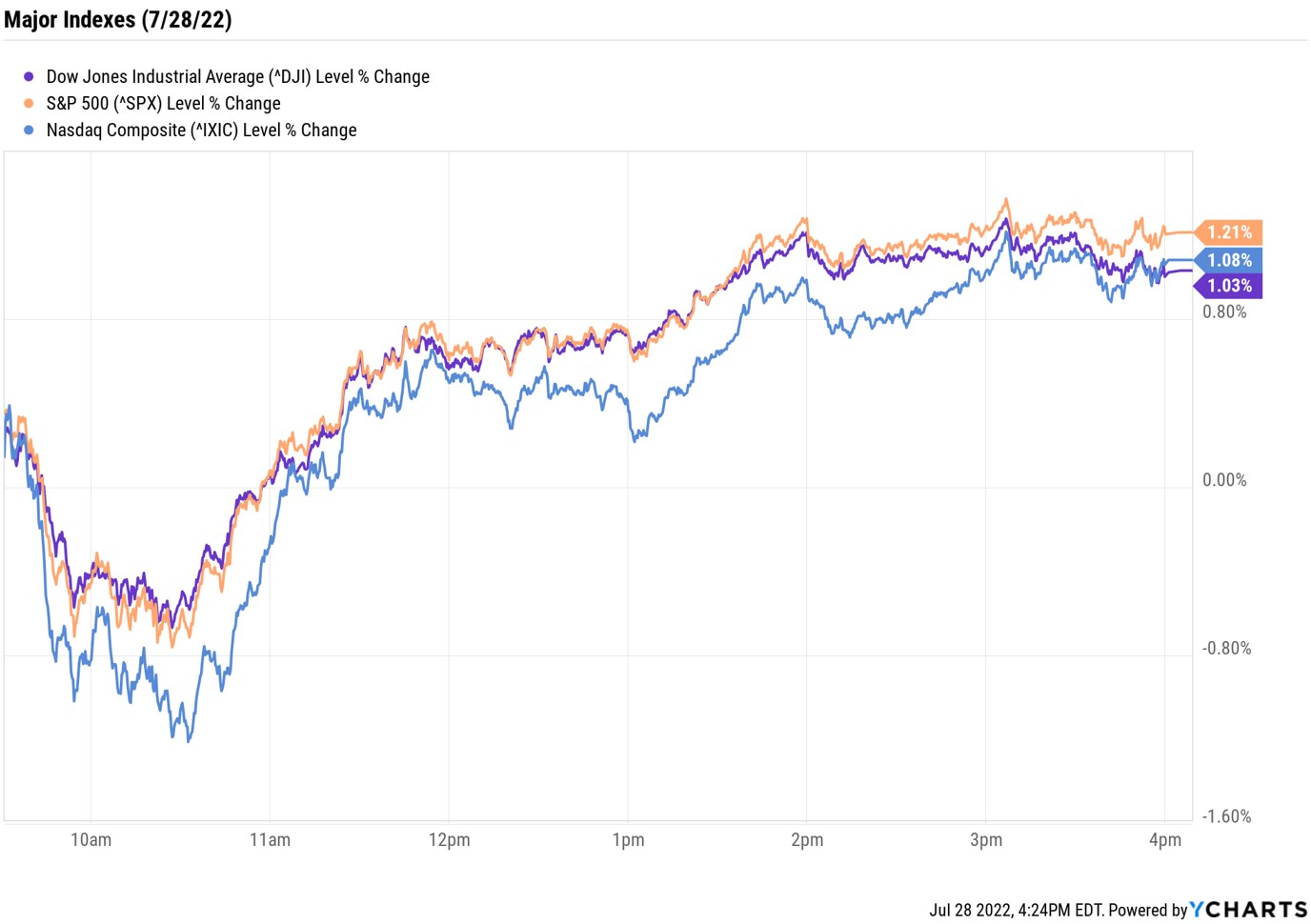

Stocks posted solid gains for a second straight day on Thursday, even as preliminary data showed the U.S. economy contracted 0.9% in the second quarter.

The latest report from the Commerce Department marks back-to-back quarterly declines in gross domestic product (GDP), and sparked a whirlwind of recession chatter on Wall Street.

"Two consecutive quarters of negative GDP meets our humble definition of a recession," says Dan Eye, chief investment officer at financial advisory firm Fort Pitt Capital Group. "But we agree with the view that labor market strength and a well-positioned consumer limits the severity of the economic contraction." Eye adds that the market sees lower odds of a third 75 basis-point rate hike (a basis point is one-one hundredth of a percentage point) at the Federal Reserve's September meeting and is beginning "to price in interest rate cuts as early as February 2023."

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Earnings were also in focus today. Meta Platforms (META) plummeted 5.2% after the Facebook parent said revenue declined 1% year-over-year in the second quarter to $28.8 billion – below what Wall Street was expecting. The company's earnings also came up short, as did its current-quarter revenue forecast.

"This is the first quarter ever that META is reporting declining revenue growth from a year ago," says David Wagner, portfolio manager at financial advisory firm Aptus Capital Advisors. "You couple this with the fact that guidance is substantially lighter than expected is why the stock is lower." Wagner adds that "given the market's focus on profitability, we like the fact the company has slowed down egregious spending in products that appear to be black holes."

Ford Motor (F), on the other hand, jumped 6.1% after the automaker said Q2 operating income nearly tripled on a year-over-year basis to $3.7 billion. F also hiked its quarterly dividend by 50% to 15 cents per share.

The major indexes managed to shake off some early morning weakness to finish near their session highs. The Dow Jones Industrial Average gained 1% to 32,529, the S&P 500 Index rose 1.2% to 4,072 and the Nasdaq Composite climbed 1.1% to 12,162.

Other news in the stock market today:

- The small-cap Russell 2000 gained 1.3% to 1,873.

- U.S. crude futures fell 0.9% to settle at $96.42 per barrel.

- Gold futures jumped 1.8% to $1,750.30 an ounce.

- Bitcoin soared 4.5% to $23,798.25. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Spirit Airlines (SAVE) rose 5.6% after the discount airline said it ended merger talks with Frontier Group Holdings (ULCC, +20.5%), instead accepting the $3.8 billion buyout offer from JetBlue Airways (JBLU, -0.4%). "The companies will have an uphill battle convincing regulators that this deal should be approved," says Chris Pultz, portfolio manager for alternative investment firm Kellner Capital. "The Biden administration has been vocal about competitiveness in the airline industry, and this will not be looked upon favorably."

- Qualcomm (QCOM) sank 4.5% after the wireless technology company gave current-quarter guidance that fell short of the consensus estimate, citing a "challenging macroeconomic environment." This overshadowed QCOM's higher-than-expected earnings of $2.96 per share and revenue of $10.9+ billion for its fiscal third quarter. Still, Argus Research analyst Jim Kelleher maintained a Buy rating on the tech stock. "QCOM has slightly outperformed peers during the tech sector selloff, reflecting the enduring strength of its silicon products and IP portfolio, and in our view continues to offer exceptional value," he says.

The Best Cheap ETFs We Can Find

Stock market gains from the past two days have brought some relief to investors, but worries over a potential recession will likely keep the roller-coaster ride going for the time being. Still, "investors should stay invested through the volatility and try to navigate into areas of the market that are more likely to provide downside protection in the volatile months ahead," says Gargi Chaudhuri, head of iShares investment strategy.

To weather the storm of a turbulent market, economic slowdown risks and high inflation, she says investors should gain exposure to "companies with strong balance sheets and the ability to pass on higher costs to consumers," which could help cushion a portfolio.

For that, there are plenty of single-stock plays for investors to choose from, like these companies with pricing power or these steady dividend growers. For those who want broad diversification, consider exchange-traded funds (ETFs) – which allow investors to build a core portfolio or make tactical moves across a basket of assets. But with thousands of ETFs to choose one, it can get overwhelming. Here, we've narrowed the list down to 20 of our favorite funds, which we call the Kip ETF 20. The exchange-traded funds featured here offer a variety of strategies for investors, at low costs to boot.

Karee Venema was long F as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market TodayThe impact of revolutionary technology has replaced world-changing trade policy as the major variable for markets, with mixed results for sectors and stocks.

-

Small Caps Step Up, Tech Is Still a Drag: Stock Market Today

Small Caps Step Up, Tech Is Still a Drag: Stock Market TodayEarly strength gave way to AI skepticism again as a volatile trading week ended on another mixed note.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

Big Change Coming to the Federal Reserve

Big Change Coming to the Federal ReserveThe Lette A new chairman of the Federal Reserve has been named. What will this mean for the economy?

-

Strong Jobs Report Leaves Markets Flat: Stock Market Today

Strong Jobs Report Leaves Markets Flat: Stock Market TodayInvestors, traders and speculators are taking time to weigh the latest labor market data against their hopes for lower interest rates.

-

Job Growth Sizzled to Start the Year. Here's Why It's Unlikely to Impact Interest Rates

Job Growth Sizzled to Start the Year. Here's Why It's Unlikely to Impact Interest RatesThe January jobs report came in much stronger than expected and the unemployment rate ticked lower to start 2026, easing worries about a slowing labor market.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.