Stock Market Today: Powell Reins in Rate-Hike Prospects, Sets Stocks Loose

Fed chair's testimony that he is 'inclined to support a 25-basis-point rate hike' triggered a broad rebound in stocks Wednesday.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

After more than a week of international affairs monopolizing Wall Street's spotlight, attention shifted back to interest rates as Federal Reserve Chair Jerome Powell telegraphed the answer to one of investors' most pressing questions – and lit a fire under stocks.

In prepared testimony to the U.S. House Committee on Financial Services, Powell said he's "inclined to support a 25-basis-point rate hike" at the next Federal Open Market Committee meeting, set for March 15-16.

While Powell provided plenty of hedging language – saying the economic implications of Russia's invasion were "highly uncertain" and leaving the door open to a 50-basis-point increase in the Fed funds rate later in 2022 if rapid inflation persists – his comments largely shut down worries about a 50-basis-point hike in March that had contributed to recent equity selling.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"I think we should assume one hike at every meeting this year, or seven total," says Kiplinger Economist David Payne. That adds up to the same total increase of 1.75 points previously forecast, but with slightly different timing.

"With inflation at a multi-decade high, the Fed is anxious to get off of a crisis footing," adds Bill Adams, chief economist for Comerica Bank. "The Fed will try to cool demand enough to get inflation under control, but not choke off the recovery."

Investors also cheered a better-than-expected private-sector employer report, with ADP announcing that payrolls increased by 475,000 in February, easily topping estimates for 375,000 – and more shockingly, that January's 301,000 payroll losses were revised to 509,000 additions.

Peter Essele, head of portfolio management for Commonwealth Financial Network, noted that February's release showed small businesses (1-49 employees) experienced their first decline in jobs since April 2020, while large businesses (500+ employees) showed their third largest monthly job gain in 10 years.

"The dynamic in February is the extension of a trend that began in August 2021, where large business employment began to outpace small and medium business hiring in the recovery," he says. "The trend may reflect changing preferences in the labor force, with workers pivoting toward larger-scale businesses that potentially offer more benefits and higher wages."

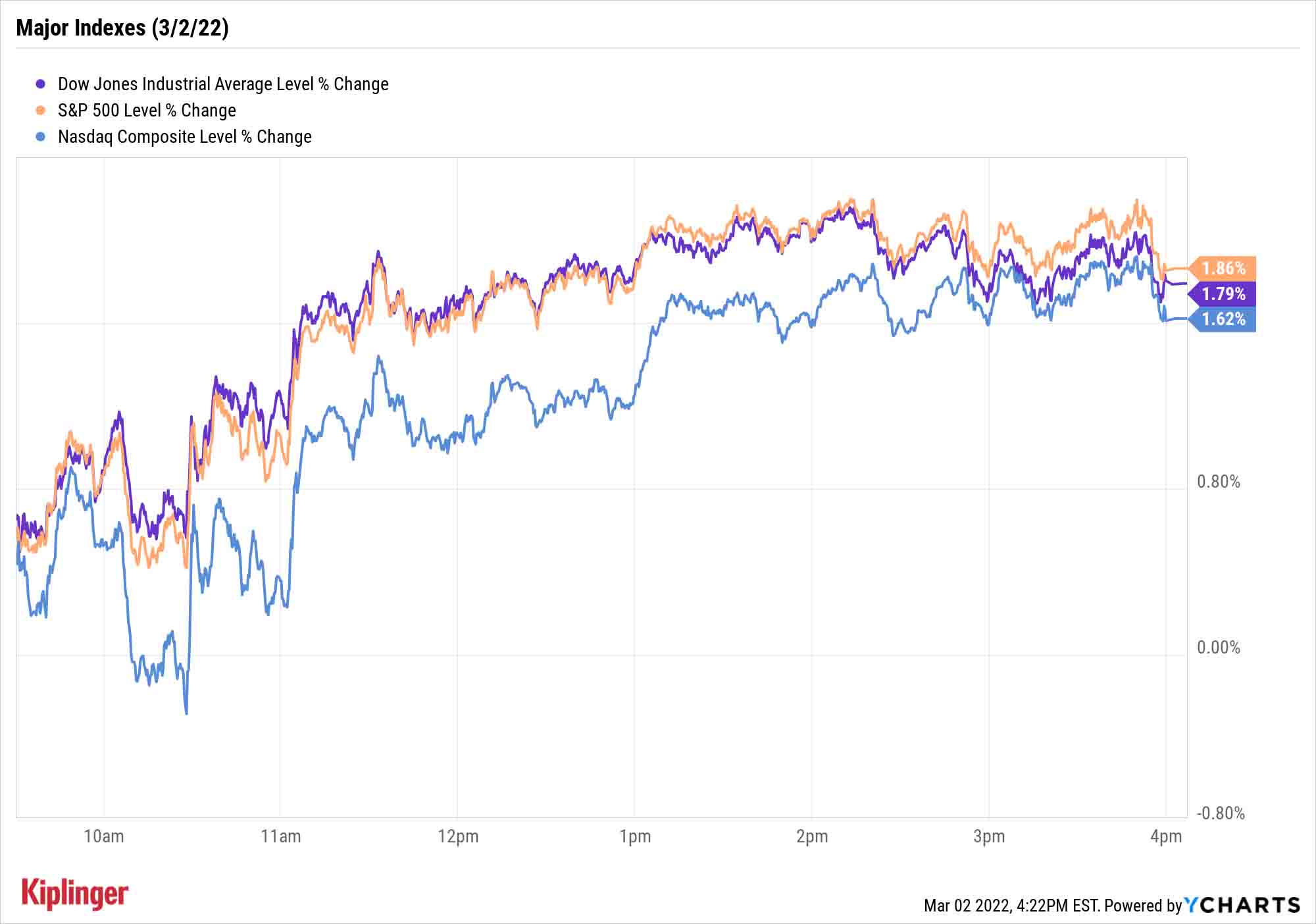

Ninety-two percent of the S&P 500's components, and every one of its 11 sectors, finished in the green, pushing the index 1.9% higher to 4,386. The Dow Jones Industrial Average (+1.8% to 33,891) and Nasdaq Composite (+1.6% to 13,752) also closed well in positive territory.

Other news in the stock market today:

- The small-cap Russell 2000 had itself another solid day, up 2.5% to 2,058 to post its fourth gain in five sessions.

- A weekly decline in domestic crude inventories and reports that the Organization of the Petroleum Exporting Countries (OPEC) will continue to gradually increase output sent U.S. crude oil futures spiking nearly 7% to $110.60 per barrel – their highest settlement since May 2011. "I would expect the run higher in oil prices to continue through the course of 2022," says David Keller, chief market strategist at StockCharts.com, though he adds that "many energy names appear overextended and due for at least a brief pullback before resuming their uptrends."

- Gold futures fell 1.1% to settle at $1,922.30 an ounce.

- Bitcoin slipped 1.0% to $43,826.77. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Nordstrom (JWN) stock shot up 37.8% after the department store reported fourth-quarter earnings of $1.23 per share on $4.5 billion in revenue – beating analysts' estimates for earnings of $1.02 per share on $4.4 billion in sales. The company also noted improving sequential sales in its off-price division, Nordstrom Rack, and gave higher-than-expected guidance for fiscal 2022. Still, CFRA Research analyst Zachary Warring maintained a Strong Sell rating on the retail stock. "We do not believe JWN can achieve numbers anywhere near their guidance for fiscal 2022 after earnings per share of just $1.10 in fiscal 2021 after massive government stimulus and unprecedented pent-up demand. We would steer clear of shares that trade at 8.0x JWN's earnings-per-share guidance for fiscal 2023."

- Salesforce.com (CRM, +0.7%) reported solid fourth-quarter results Tuesday night, bringing in adjusted earnings of 84 cents per share on $7.3 billion in revenue. This exceeded analysts' estimates for 75 cents per share and $7.2 billion, respectively. CRM also guided for higher-than-expected revenue in both the current quarter and the full fiscal year and expects to see $1.5 billion in sales from Slack in fiscal 2023. "Given how deep its relationships are with its customers, Salesforce will continue to do well in the current financial environment," says Chris Rothstein, CEO and founder of Groove, the leading sales engagement platform for enterprises using Salesforce. "As economic uncertainty and inflation continue to drive down multiples for tech companies around the world, Salesforce is uniquely positioned to be able to take advantage of the situation."

Buying and Holding? Consider These 7 Funds

We've mostly spent the past few weeks exploring ways to either defend yourself from recent volatility or take advantage of the market's bobbing and weaving.

But for many buy-and-holders, the name of the game during times of tumult is … well, business as usual: Hold on to what you believe in, sell what you don't, buy when opportunity (and value) strikes.

One aspect of maintaining this kind of a portfolio is ensuring you have a solid portfolio core of diversified exposure to the market's basic flavors. We've long touted our Kiplinger 25 mutual funds and Kip ETF 20 to get the job done, but investors with fund-provider loyalty can often find all the tools they need within the very same family. Take American Funds parent Capital Group, which recently made a splash in the ETF world with six actively managed core-portfolio offerings.

However, buy-and-holders also may want to add "satellite" holdings – smaller positions meant to generate outperformance, and again, some fund families have a wealth of options available.

State Street Global Advisors, for instance, is one of the top ETF providers in the game via its SPDR family of funds, with nearly 140 ETFs available in the U.S. alone. We've winnowed down its wide selection down to seven SPDR ETFs that are ideally suited for buy-and-hold portfolios.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

Should You Do Your Own Taxes This Year or Hire a Pro?

Should You Do Your Own Taxes This Year or Hire a Pro?Taxes Doing your own taxes isn’t easy, and hiring a tax pro isn’t cheap. Here’s a guide to help you figure out whether to tackle the job on your own or hire a professional.

-

Trump $10B IRS Lawsuit Hits an Already Chaotic 2026 Tax Season

Trump $10B IRS Lawsuit Hits an Already Chaotic 2026 Tax SeasonTax Law A new Trump lawsuit and warnings from a tax-industry watchdog point to an IRS under strain, just as millions of taxpayers begin filing their 2025 returns.

-

The New Fed Chair Was Announced: What You Need to Know

The New Fed Chair Was Announced: What You Need to KnowPresident Donald Trump announced Kevin Warsh as his selection for the next chair of the Federal Reserve, who will replace Jerome Powell.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

January Fed Meeting: Updates and Commentary

January Fed Meeting: Updates and CommentaryThe January Fed meeting marked the first central bank gathering of 2026, with Fed Chair Powell & Co. voting to keep interest rates unchanged.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

How the Stock Market Performed in the First Year of Trump's Second Term

How the Stock Market Performed in the First Year of Trump's Second TermSix months after President Donald Trump's inauguration, take a look at how the stock market has performed.

-

The December CPI Report Is Out. Here's What It Means for the Fed's Next Move

The December CPI Report Is Out. Here's What It Means for the Fed's Next MoveThe December CPI report came in lighter than expected, but housing costs remain an overhang.

-

How Worried Should Investors Be About a Jerome Powell Investigation?

How Worried Should Investors Be About a Jerome Powell Investigation?The Justice Department served subpoenas on the Fed about a project to remodel the central bank's historic buildings.

-

The December Jobs Report Is Out. Here's What It Means for the Next Fed Meeting

The December Jobs Report Is Out. Here's What It Means for the Next Fed MeetingThe December jobs report signaled a sluggish labor market, but it's not weak enough for the Fed to cut rates later this month.