Stock Market Today: Nasdaq Rally Resumes After Amazon Earnings, Jobs Data

A positive reaction to Amazon earnings helped the Nasdaq easily outperform its peers.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

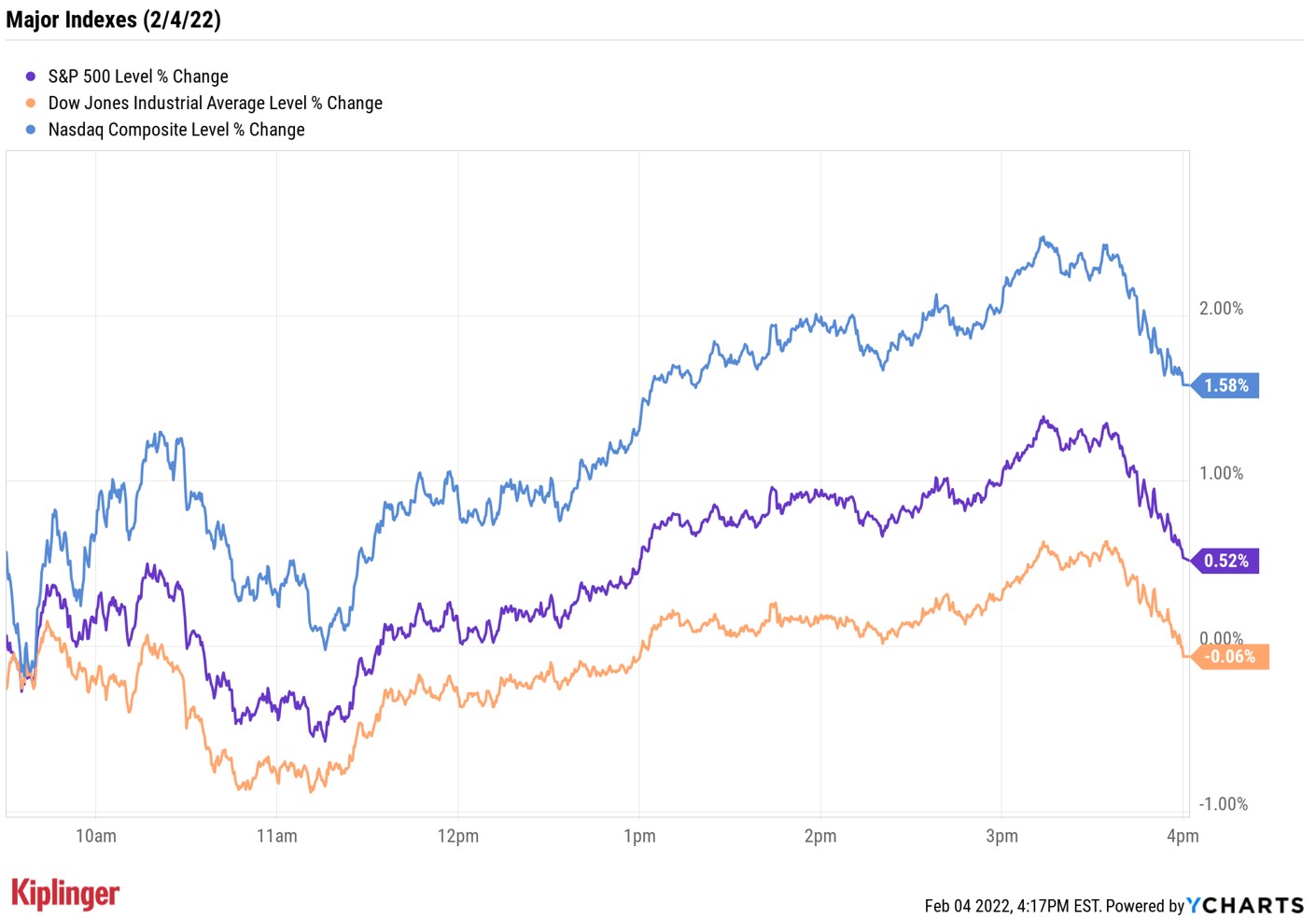

Two of the three major indexes closed higher on the final trading day of a volatile week thanks to a pair of well-received earnings and economic reports.

On the earnings front, Amazon.com (AMZN) surged 13.5% after the company last night reported top- and bottom-line beats. Strong year-over-year growth in Amazon Web Services and the company's investment in electric vehicle maker Rivian (RIVN) helped drive the better-than-expected results. AMZN also hiked the price of an Amazon Prime annual membership by 17%.

Amazon earnings shared the spotlight with the Labor Department's latest jobs report, which showed the U.S. added 467,000 new positions in January – much higher than the 150,000 gain expected by economists.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

"Fortunately, this jobs report exceeded expectations, suggesting that there has been some economic recovery following a poor performance in December," says Steve Rick, chief economist at Wisconsin-based financial services firm CUNA Mutual Group.

The report likely cements the Fed's plans to raise rates and end quantitative easing in the coming months, Rick adds.

At the close, the Nasdaq Composite was up 1.6% at 14,098 and the S&P 500 Index was 0.5% higher at 4,500. However, the Dow Jones Industrial Average turned lower in the final minutes of trading to end down 0.06% at 35,089.

Other news in the stock market today:

- The small-cap Russell 2000 added 0.6% to end at 2,002.

- U.S. crude oil futures climbed 2.3% to settle at $92.31 per barrel.

- Gold futures gained 0.2% to finish at $1,807.80 an ounce.

- Bitcoin shot up 11.6% to $40,567.40. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Ford Motor (F) fell 9.7% after the automaker reported adjusted earnings of 26 cents per share on $35.3 billion in revenue for its fourth quarter. The results fell short of analysts' consensus estimates for earnings of 45 cents per share and revenue of $35.3 billion. Still, BofA Securities analyst John Murphy reiterated his Buy rating on F. "Despite the tough finish to 2021, the 2022 financial outlook is strong, and we believe that under its Ford+ strategy outlined at its Capital Markets Day in 2021," Murphy says. "Simply, Ford is on the verge of executing something analogous to our Core to Future framework, by which it will strengthen its core business pillars to fund its future business. And despite the tough macroeconomic backdrop, we continue to believe Ford is just starting to hit a more sustainable inflection in earnings, driven by the combination of a favorable product cadence in the critical US/NA market; redesign efforts; and a real push into electrification, autonomy, connectivity, and other future businesses."

- Clorox (CLX) was another post-earnings loser, plunging 14.5%. In its fiscal second quarter, the Pine-Sol parent reported adjusted earnings of 66 cents per share on $1.69 billion in revenue, compared to analysts' calls for earnings per share of 84 cents on $1.66 billion in sales. Additionally, gross margin declined to 33% from 45% in the year-ago period. Clorox also forecast declining net sales and gross margin for its full fiscal year, citing higher-than-anticipated manufacturing, commodity and logistics costs. "CLX is 1) carrying elevated inventory, which is being recorded at a much higher cost; 2) isn't increasing prices at fast as we anticipated (likely because of market share losses last year); 3) is experiencing negative mix from the reintroduction of multi-pack products; and 4) continues to experience high input and transportation costs," says CFRA Research analyst Arun Sundaram. "Overall, we think CLX is facing some structural issues that could take a while to resolve." The analyst cut his rating on Clorox to Hold from Buy.

The "Sweet Spot" for Stocks

Mid-cap stocks were another winner in today's market, gaining 0.2% on the day and 1.7% on the week.

This group of equities (typically companies with market caps between $2 billion to $10 billion) are often overlooked by investors, who instead seek out large-cap names for stability or small-cap stocks for growth potential.

But mid-cap stocks can offer investors the best of both worlds – better growth prospects than their large-cap peers, and less volatility than smaller cap bets. Additionally, mid-cap stocks have historically provided a better risk/return profile for investors, according to Canadian fund provider Mackenzie Financial.

Here, we've compiled 15 of the best mid-cap stocks to buy for 2022. The names span a number of sectors, including technology, industrials and healthcare, but they all share one thing in common: top recommendations from Wall Street pros.

Karee Venema was long F as of this writing.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

With over a decade of experience writing about the stock market, Karee Venema is the senior investing editor at Kiplinger.com. She joined the publication in April 2021 after 10 years of working as an investing writer and columnist at a local investment research firm. In her previous role, Karee focused primarily on options trading, as well as technical, fundamental and sentiment analysis.

-

Nasdaq Leads a Rocky Risk-On Rally: Stock Market Today

Nasdaq Leads a Rocky Risk-On Rally: Stock Market TodayAnother worrying bout of late-session weakness couldn't take down the main equity indexes on Wednesday.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market TodayMarkets are paying more and more attention to hyperscalers' plans to spend more and more money on artificial intelligence.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.

-

Dow Adds 1,206 Points to Top 50,000: Stock Market Today

Dow Adds 1,206 Points to Top 50,000: Stock Market TodayThe S&P 500 and Nasdaq also had strong finishes to a volatile week, with beaten-down tech stocks outperforming.

-

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market Today

Nasdaq Slides 1.4% on Big Tech Questions: Stock Market TodayPalantir Technologies proves at least one publicly traded company can spend a lot of money on AI and make a lot of money on AI.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

Dow Rises 313 Points to Begin a Big Week: Stock Market Today

Dow Rises 313 Points to Begin a Big Week: Stock Market TodayThe S&P 500 is within 50 points of crossing 7,000 for the first time, and Papa Dow is lurking just below its own new all-time high.

-

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market Today

Nasdaq Leads Ahead of Big Tech Earnings: Stock Market TodayPresident Donald Trump is making markets move based on personal and political as well as financial and economic priorities.

-

11 Stock Picks Beyond the Magnificent 7

11 Stock Picks Beyond the Magnificent 7With my Mag-7-Plus strategy, you can own the mega caps individually or in ETFs and add in some smaller tech stocks to benefit from AI and other innovations.