Stock Market Today: Stocks Slide to Start the Week

Global omicron-related restrictions and Fed anxieties took a toll on the major indexes Monday.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Equities took a step back Monday as investors reacted to weekend omicron developments and looked ahead to this week's Federal Reserve meeting.

While much of last week was spent cheering data indicating that omicron might be a milder version of the COVID coronavirus, the strain still might be able to hamper economic activity. Several European countries enacted restrictions to battle the omicron variant, including Norway and the U.K. – the latter of which announced its first death from omicron and said it's expected to be the country's dominant strain within days.

And in the U.S., average daily new COVID cases have eclipsed 100,000 for the first time in two months.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Meanwhile, some investors have their eyes trained on Wednesday, when the Federal Open Market Committee will announce its latest policy decisions. While most expect the benchmark Fed funds rate to stand pat, some believe the central bank will accelerate the timeline for tapering its $120 billion-per-month asset-purchasing program.

Michael Reinking, senior market strategist for the New York Stock Exchange, also pointed investors in the direction of the New York Fed's survey of Consumer Expectations. Near-term (one-year) inflation expectations increased to 6.0% in November from 5.7% in October, but three-year expectations actually declined to 4.0% from 4.2%, the first time that had happened since June.

"This is something the Fed will continue to watch as they continue to highlight that they want inflation expectations anchored around 2%," Reinking says. "While this is clearly above that level it is positive to see this tick lower though a single data point a trend does not make (spoken in my best Yoda impersonation)."

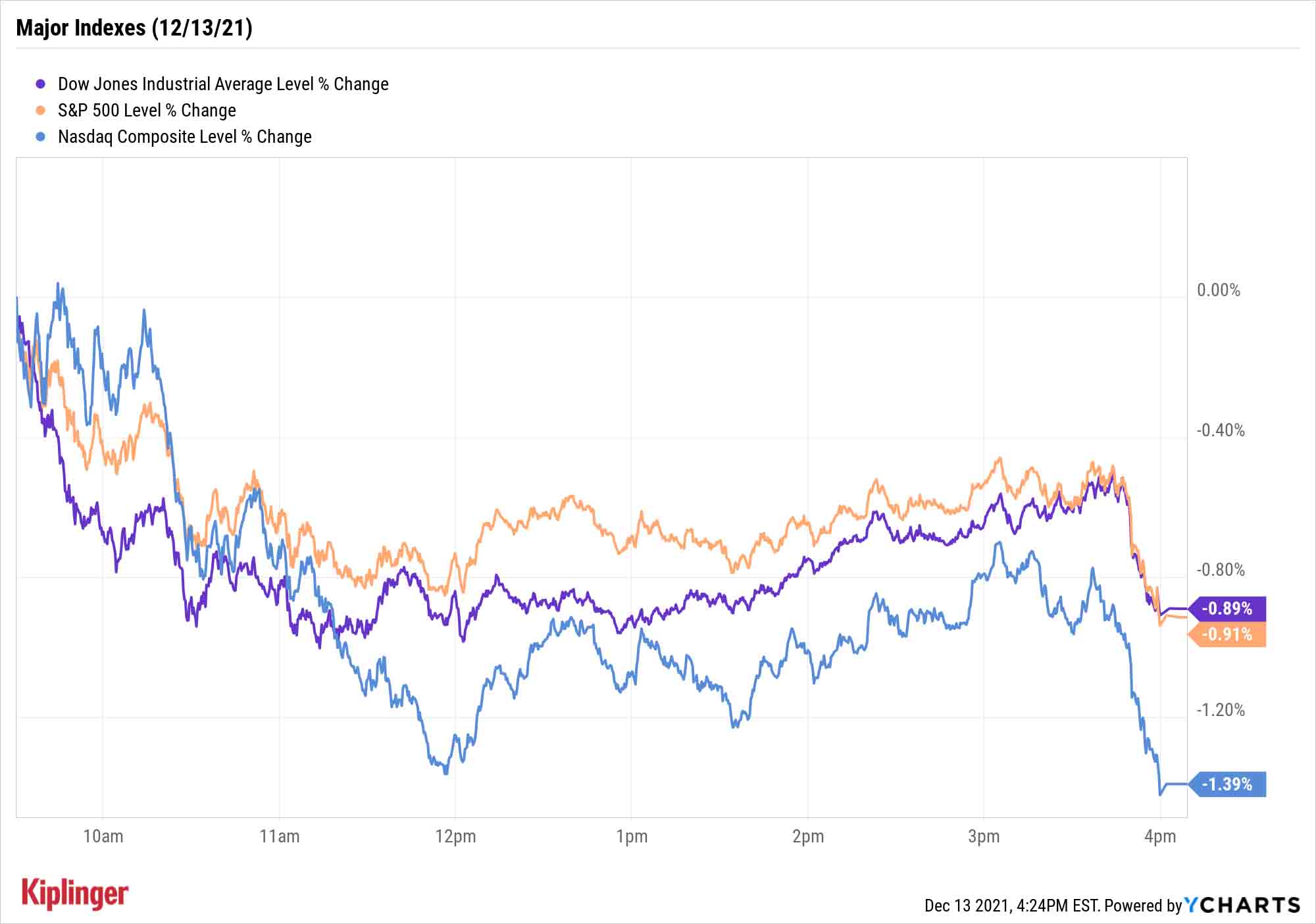

Every major index declined: The Dow was off 0.9% to 35,650, the S&P 500 declined 0.9% to 4,668 and the Nasdaq finished 1.4% lower to 15,413.

Other news in the stock market today:

- The small-cap Russell 2000 slumped 1.4% to 2,180.

- U.S. crude oil futures slipped 0.5% to settle at $71.29 per barrel.

- Gold futures ticked 0.2% higher to finish at $1,788.30 an ounce.

- Bitcoin tumbled over the weekend and into Monday, off 3.6% from Friday afternoon to $46,688.45. (Bitcoin trades 24 hours a day; prices reported here are as of 4 p.m.)

- Dollar Tree (DLTR, -0.5%) was in focus after the discount retailer yesterday replied to Mantle Ridge over its attempt last week to replace DLTR's entire board, calling the effort "unwarrantedly aggressive and hostile." The activist investor, which unveiled a 5.7% stake in Dollar Tree in mid-November, is also pushing for former Dollar General (DG) Chairman Richard Dreiling to take over the role as executive chairman of the board. UBS analyst Michael Lasser (Buy) called the back and forth between the two parties "typical of the process," and that Dollar Tree's response over the weekend "is probably a message that the board remains confident in the company's path forward." Additionally, Lasser believes "the clear path for this stock is higher," and DLTR "is one of the best ideas in the sector heading into 2022."

- Harley-Davidson (HOG) jumped 4.7% today after the motorcycle maker said its electric bike unit – LiveWire – is set to go public via a $1.77 billion merger deal with special purpose acquisition company (SPAC) AEA-Bridges Impact (IMPX, +3.6%). As part of the deal, which is expected to close in the second half of next year, HOG will retain a 74% stake in LiveWire. The new company will list on the New York Stock Exchange under the ticker "LVW."

- Lululemon Athletica (LULU, -1.4%) declined despite Argus Research analyst John Staszak reiterating a Buy rating on LULU shares.

The Best Dow Jones Stocks

It's another setback for the 139-year-old industrial average, which began the year 2021 with spring in its step. Despite that hot start through May of this year, the Dow, up 16.5% for the year-to-date, now trails both the S&P 500 (+24.3%) and Nasdaq (19.6%).

Wall Street spent most of the day huddling into defensive sectors such as real estate (+1.3%), consumer staples (+1.3%) and utilities (+1.2%), and bailing out of cyclical DJIA components such as Boeing (BA, -3.7%), Home Depot (HD, -2.5%) and Dow (DOW, -2.5%).

It's yet another reminder that while many investors consider the industrial average's blue chips to be a source of relative safety, they can ebb and flow just like the rest of the market – and some can absorb some mighty short-term bursts of pain.

If you find yourself looking to the Dow for new investment opportunities, you'll need to be tactical, sussing out which of the index's components are at their most appealing right now.

With 2022 nearing, we've looked at each of the Dow's 30 blue chips to determine which of its stocks analysts are hot on for the year ahead – and which ones they're turning a cold shoulder to.

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Kyle Woodley is the Editor-in-Chief of WealthUp, a site dedicated to improving the personal finances and financial literacy of people of all ages. He also writes the weekly The Weekend Tea newsletter, which covers both news and analysis about spending, saving, investing, the economy and more.

Kyle was previously the Senior Investing Editor for Kiplinger.com, and the Managing Editor for InvestorPlace.com before that. His work has appeared in several outlets, including Yahoo! Finance, MSN Money, Barchart, The Globe & Mail and the Nasdaq. He also has appeared as a guest on Fox Business Network and Money Radio, among other shows and podcasts, and he has been quoted in several outlets, including MarketWatch, Vice and Univision. He is a proud graduate of The Ohio State University, where he earned a BA in journalism.

You can check out his thoughts on the markets (and more) at @KyleWoodley.

-

Quiz: Do You Know How to Avoid the "Medigap Trap?"

Quiz: Do You Know How to Avoid the "Medigap Trap?"Quiz Test your basic knowledge of the "Medigap Trap" in our quick quiz.

-

5 Top Tax-Efficient Mutual Funds for Smarter Investing

5 Top Tax-Efficient Mutual Funds for Smarter InvestingMutual funds are many things, but "tax-friendly" usually isn't one of them. These are the exceptions.

-

AI Sparks Existential Crisis for Software Stocks

AI Sparks Existential Crisis for Software StocksThe Kiplinger Letter Fears that SaaS subscription software could be rendered obsolete by artificial intelligence make investors jittery.

-

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid Investment

I'm a 55-Year-Old Dad. Here’s How My 28-Year-Old Daughter Showed Me That AXP Is Still a Solid InvestmentAmerican Express stock is still a solid investment because management understands the value of its brand and is building a wide moat around it.

-

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into AMD Stock 20 Years Ago, Here's What You'd Have TodayAdvanced Micro Devices stock is soaring thanks to AI, but as a buy-and-hold bet, it's been a market laggard.

-

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into UPS Stock 20 Years Ago, Here's What You'd Have TodayUnited Parcel Service stock has been a massive long-term laggard.

-

How the Stock Market Performed in the First Year of Trump's Second Term

How the Stock Market Performed in the First Year of Trump's Second TermSix months after President Donald Trump's inauguration, take a look at how the stock market has performed.

-

Stocks Struggle for Gains to Start 2026: Stock Market Today

Stocks Struggle for Gains to Start 2026: Stock Market TodayIt's not quite the end of the world as we know it, but Warren Buffett is no longer the CEO of Berkshire Hathaway.

-

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into Lowe's Stock 20 Years Ago, Here's What You'd Have TodayLowe's stock has delivered disappointing returns recently, but it's been a great holding for truly patient investors.

-

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have Today

If You'd Put $1,000 Into 3M Stock 20 Years Ago, Here's What You'd Have TodayMMM stock has been a pit of despair for truly long-term shareholders.

-

AI Stocks Lead Nasdaq's 398-Point Nosedive: Stock Market Today

AI Stocks Lead Nasdaq's 398-Point Nosedive: Stock Market TodayThe major stock market indexes do not yet reflect the bullish tendencies of sector rotation and broadening participation.